Current Report Filing (8-k)

March 30 2020 - 4:47PM

Edgar (US Regulatory)

false

0000910606

0001066247

0000910606

2020-03-27

2020-03-27

0000910606

srt:PartnershipInterestMember

2020-03-27

2020-03-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

March 27, 2020

Date of Report (Date of earliest event reported)

REGENCY CENTERS CORPORATION

REGENCY CENTERS, L.P.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Florida (Regency Centers Corporation)

Delaware (Regency Centers, L.P.)

|

|

001-12298 (Regency Centers Corporation)

0-24763 (Regency Centers, L.P.)

|

|

59-3191743 (Regency Centers Corporation)

59-3429602 (Regency Centers, L.P.)

|

|

(State or other jurisdiction of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

One Independent Drive, Suite 114

Jacksonville, Florida 32202

(Address of principal executive offices) (Zip Code)

(904) 598-7000

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

Regency Centers Corporation

|

Title of each class

|

|

Trading Symbol

|

|

Name of each exchange on which registered

|

|

Common Stock, $.01 par value

|

|

REG

|

|

The Nasdaq Stock Market LLC

|

Regency Centers, L.P.

|

Title of each class

|

|

Trading Symbol

|

|

Name of each exchange on which registered

|

|

None

|

|

N/A

|

|

N/A

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230 .425)

|

|

☐

|

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 2.03

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

|

$500 Million Facility Draw-down

On March 27, 2020, Regency Centers, L.P. (“RCLP”) borrowed $500 million under the revolving credit facility described in that certain Fourth Amended and Restated Credit Agreement dated as of March 23, 2018, by and among RCLP, as borrower, Regency Centers Corporation (“Regency”), as guarantor, Wells Fargo Bank, National Association, as administrative agent, and the other lenders party thereto (the “Credit Agreement”) to further strengthen its financial position and balance sheet, to enhance its financial liquidity and to provide financial flexibility to continue its business initiatives as the effects of the COVID-19 pandemic continue to evolve. The proceeds will be available to be used for working capital and general corporate purposes. After giving effect to such borrowing and other borrowings made under the Credit Agreement, there is approximately $545 million available for additional borrowing under the revolving credit facility under the Credit Agreement.

A copy of the Credit Agreement is filed as Exhibit 4.1 to the Company’s Current Report on Form 8-K on March 26, 2018. The material terms of the Credit Agreement are also described in Note 9 of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2019.

|

Item 7.01

|

Regulation FD Disclosures

|

Withdrawal of Guidance

On March 30, 2020, Regency issued a press release announcing, among other things, the withdrawal of its fiscal 2020 guidance provided on February 12, 2020 due to the complex and rapidly evolving circumstances around the COVID-19 pandemic. Regency is not providing an updated outlook at this time. A copy of the press release is filed as Exhibit 99.1 to this report and is incorporated herein by reference. In addition, Regency has posted to its website a presentation deck which is filed as Exhibit 99.2 to this report and is incorporated herein by reference.

Settlement of Forward Master Confirmations

During March 2020, Regency physically settled its forward master confirmations, each dated May 17, 2017 and amended on November 13, 2018 and supplemented on September 11, 2019, by and between Regency and each of JPMorgan Chase Bank, National Association and Bank of America, N.A. (the “Forward Master Confirmations”) by delivering an aggregate of 1,894,845 shares of Regency’s common stock. Upon physical settlement of the Forward Master Confirmations, Regency received net proceeds of approximately $125 million, after deducting the underwriters’ discount and before deducting estimated offering expenses.

Under the Forward Master Confirmations, Regency agreed to sell to JPMorgan Chase Bank, National Association and Bank of America, N.A. (each, a “Forward Purchaser”) the same number of shares of Regency’s common stock sold by an affiliate of the Forward Purchaser in the underwritten public offering. In connection with the Forward Master Confirmations, the Forward Purchaser (or its affiliate) borrowed from third-party lenders and sold in the underwritten public offering shares of the Company’s common stock having an aggregate offering price of up to approximately $128.8 million.

The foregoing description of the Forward Master Confirmations does not purport to be complete and is qualified in its entirety by reference to the terms and conditions of the Forward Master Confirmations which are filed as Exhibits 1.3 and 1.4 to the Company’s Current Report on Form 8-K filed on May 17, 2017, each of which are incorporated herein by reference, and the Forward Master Confirmation Amendments which are filed as Exhibits 1.3 and 1.4 to the Company’s Current Report on Form 8-K filed on November 14, 2018, each of which are incorporated herein by reference. The shares of common stock issued upon the physical settlement of the Forward Master Confirmations were previously registered pursuant to a Prospectus Supplement dated May 17, 2017 under Regency’s prior Registration Statement on Form S-3 ASR (Registration No. 333-217081) filed with the Securities and Exchange Commission on March 31, 2017 (the “Prior Registration Statement”). Pursuant to Rule 429(b), Regency’s Registration Statement on Form S-3 ASR (Registration No. 333-237145) filed with the Securities and Exchange Commission on March 13, 2020 (the “Registration Statement”) also constitutes the Prior Registration Statement, which post-effective amendment to the Prior Registration Statement became effective concurrently with the effectiveness of the Registration Statement.

On March 30, 2020, Regency issued a press release announcing the final settlement. A copy of the press release is filed as Exhibit 99.1 to this report and is incorporated herein by reference.

The information in this item shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, nor shall it be deemed incorporated by reference into any disclosure document relating to Regency, except to the extent, if any, expressly set forth by specific reference in such filing.

On March 30, 2020, Regency issued a press release announcing notice of a change in location of its Annual Meeting of Shareholders to be held on Wednesday, April 29, 2020 at 9:00 a.m. Eastern Time (the “Annual Meeting”). In light of public health concerns regarding COVID-19, the Annual Meeting has been changed to be held in a virtual meeting format only.

Further information regarding this change to the location of the Annual Meeting can be found in the Notice of Change of Location filed by Regency on Schedule 14A on March 30, 2020.

A copy of the press release is filed as Exhibit 99.1 to this report and is incorporated herein by reference.

|

Item 9.01(d)

|

Financial Statements and Exhibits

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

REGENCY CENTERS CORPORATION

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

March 30, 2020

|

|

By:

|

|

/s/ Barbara C. Johnston

|

|

|

|

|

|

Barbara C. Johnston, Senior Vice President and General Counsel

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REGENCY CENTERS, L.P.

|

|

|

|

|

|

|

|

|

|

By: Regency Centers Corporation, its general partner

|

|

|

|

|

|

|

|

|

|

|

|

|

March 30, 2020

|

|

By:

|

|

/s/ Barbara C. Johnston

|

|

|

|

|

|

Barbara C. Johnston, Senior Vice President and General Counsel

|

|

|

|

|

|

|

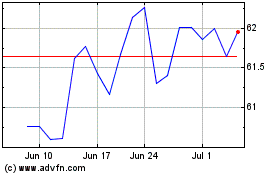

Regency Centers (NASDAQ:REG)

Historical Stock Chart

From Mar 2024 to Apr 2024

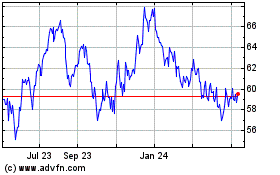

Regency Centers (NASDAQ:REG)

Historical Stock Chart

From Apr 2023 to Apr 2024