Current Report Filing (8-k)

August 15 2019 - 4:12PM

Edgar (US Regulatory)

false0000910606REGENCY CENTERS LP 0000910606 2019-08-12 2019-08-13 0000910606 srt:PartnershipInterestMember 2019-08-12 2019-08-13

SECURITIES AND EXCHANGE COMMISSION

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) August 13, 2019

REGENCY CENTERS CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

Florida (Regency Centers Corporation)

Delaware (Regency Centers, L.P.)

|

|

1-12298

(Regency Centers Corporation)

0-24763

(Regency Centers, L.P.)

|

|

59-3191743

(Regency Centers Corporation)

59-3429602

(Regency Centers, L.P.)

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

One Independent Drive, Suite 114

|

|

|

|

Jacksonville, Florida

|

|

32202

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number including area code:

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form

8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230 .425)

|

|

|

☐

|

Soliciting material pursuant to Rule

14a-12

under the Exchange Act (17 CFR

240.14a-12)

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule

14d-2(b)

under the Exchange Act (17 CFR

240.14d-2(b))

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule

13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock, $.01 par value

|

|

REG

|

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule

12b-2

of the Securities Exchange Act of 1934

(§ 240.12b-2

of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(A) of the Exchange Act. ☐

Issuance of 2.950% Notes due 2029

On August 13, 2019, Regency Centers, L.P. (“RCLP”) and Regency Centers Corporation (“Regency”), the general partner of RCLP, entered into an Underwriting Agreement (the “Underwriting Agreement”) with U.S. Bancorp Investments, Inc., as representative of the several underwriters named therein, pursuant to which RCLP agreed to issue and sell an aggregate of $425,000,000 principal amount of its 2.950% Notes due 2029 (the “Notes”) priced to the public at 99.903% of principal amount. The Notes will be guaranteed as to the payment of principal and interest by Regency. The offering of the Notes is expected to close on August 20, 2019.

The Notes will bear interest at a rate of 2.950% per annum and mature on September 15, 2029. Interest on the Notes will be payable semi-annually in arrears on March 15 and September 15 of each year, commencing March 15, 2020, to holders of record on the immediately preceding March 1 and September 1.

The Notes will be issued pursuant to the terms of an Indenture dated as of December 5, 2001, as supplemented by the First Supplemental Indenture dated as of June 5, 2007, the Second Supplemental Indenture dated as of June 2, 2010, the Third Supplemental Indenture dated as of August 17, 2015, the Fourth Supplemental Indenture dated as of January 26, 2017 and the Fifth Supplemental Indenture dated as of March 6, 2019, each among RCLP, Regency, as guarantor, and U.S. Bank National Association, as trustee.

The foregoing is not a complete discussion of the Underwriting Agreement and is qualified in its entirety by reference to the full text of the Underwriting Agreement attached to this Current Report on Form

8-K

as Exhibit 1.1, which is incorporated herein by reference.

Prepayment and Termination of $300 Million Term Loan Maturing December 2, 2020

On August 14, 2019, RCLP notified Wells Fargo Bank, National Association that it will, on August 20, 2019, (i) prepay in full all Loans (as defined in the Loan Agreement) outstanding under that certain Term Loan Agreement, dated as of March 2, 2017 (as amended, modified and supplemented, the “Loan Agreement”), by and among RCLP, Regency, Wells Fargo Bank, National Association and each of the other financial institutions party thereto, including an interest rate swap breakage fee of approximately $1.1 million and (ii) pay and satisfy in full all other outstanding Obligations (as defined in the Loan Agreement), in each case in accordance with the terms of the Loan Agreement. Upon such payment and satisfaction, the Loan Agreement shall terminate.

|

Item 9.01

|

Financial Statements and Exhibits

|

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REGENCY CENTERS CORPORATION

|

|

|

|

|

|

|

August 15, 2019

|

|

|

|

|

|

/s/ J. Christian Leavitt

|

|

|

|

|

|

|

|

|

|

J. Christian Leavitt, Senior Vice President and Treasurer

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Regency Centers Corporation,

|

|

|

|

|

|

|

August 15, 2019

|

|

|

|

By:

|

|

/s/ J. Christian Leavitt

|

|

|

|

|

|

|

|

|

|

J. Christian Leavitt, Senior Vice President and Treasurer

|

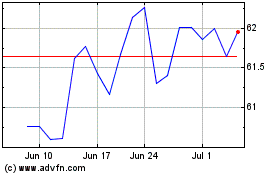

Regency Centers (NASDAQ:REG)

Historical Stock Chart

From Mar 2024 to Apr 2024

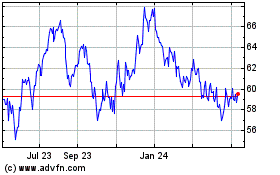

Regency Centers (NASDAQ:REG)

Historical Stock Chart

From Apr 2023 to Apr 2024