Earnings Call Webcast to Discuss 2019 Third

Quarter Financial Results to Post to Corporate Website on

Thursday, November 14, 2019

Reading International, Inc. (NASDAQ: RDI) today announced

results for the quarter ended September 30, 2019. Our Company

reported Basic Earnings per Share (“EPS”) of $0.04 and $0.05 for

the quarter and nine months ended September 30, 2019 respectively,

compared to $0.06 and $0.41 in the corresponding prior year

periods. At $70.5 million, our Consolidated Revenue for the third

quarter of 2019 decreased by 5%, or $3.8 million, compared to the

third quarter of 2018. Our revenue decrease was primarily impacted

by three factors:

(i) A decrease in cinema attendance due

primarily to (a) a weaker slate of film from arthouse/specialty

distributors in the U.S., (b) the outperformance during the third

quarter of 2018 of Crazy Rich Asians at our Consolidated Theatres

in Hawaii and (c) the 2019 closures due to the expiration of leases

underlying three of our cinemas in New York City, offset by our

acquisition of one cinema in Australia and the opening of one

cinema in New Zealand; (ii) The continuing closure (that began in

January 2019) of our Reading Cinema and certain retail areas at

Courtenay Central in Wellington, New Zealand as a result of seismic

concerns; and (iii) Adverse foreign exchange impact with a 6.2%

decline in the Australian dollar and a 3.0% decline in the New

Zealand dollar.

Throughout the quarter, we continued to execute on our strategic

priorities of upgrading our cinemas through the addition of

recliner seating, converting screens to TITAN LUXE or TITAN XC,

improving our Food & Beverage (“F&B”) programs and

expanding and improving our proprietary online ticketing programs

(generating service fee income). Our solid execution of these

strategic priorities mitigated the impact of our attendance

decline. Notwithstanding the media coverage about the popularity of

streaming, the overall exhibition industry enjoyed a box office

increase for the quarter demonstrating the continuing strength and

vitality of our industry. Our U.S. cinema circuit is unique in that

we are dependent on both strong art and specialty film and

commercial movies. Reflecting the content ebbs and flows, in 2019,

the arthouse/specialty distributors have delivered a particularly

weak film line-up.

During the first nine-months, we entered into or acquired leases

for two new cinemas in Australia and one new cinema in New Zealand.

Two of these cinemas (representing seven screens) are now

operational. The other cinema is anticipated to launch operations

during 2020. Subsequent to the end of the quarter, we entered into

an additional lease agreement with respect to a cinema under

development in Australia. In the U.S., we exercised our option to

acquire the ground lessee’s interest in the land and improvements

at our Village East Cinema in New York City. The exercise price

(payable upon the closing, currently contemplated for the second

quarter of 2020) is $5.9 million.

At our Tammany Hall/44 Union Square project in New York City, we

installed the last of the glass panels in the iconic dome. While no

assurances can be given, we anticipate filing for a core and shell

temporary certificate of occupancy for the building by the end of

2019. Lease negotiations continue with our anticipated principal

tenant that are expected to account for over 90% of the building,

and a variety of retail tenants continue to evaluate the remainder

of the space.

In addition, during the quarter, we made progress on the

planning of our re-development projects at Courtenay Central in

Wellington, New Zealand and Cannon Park in Townsville, Australia.

We also continued to work with various public and private

stakeholders on the infrastructure work for our 70.4 acre

industrial site in the Manukau/Wiri area of Auckland, New

Zealand.

Ellen Cotter, Chair, President and Chief Executive Officer said,

“During the third quarter, the Reading team delivered impressive

results at our Australian cinema and real estate and U.S. Live

Theatre divisions, each of which delivered quarterly revenues and

cash flow, in their respective functional currency, ranking first

or second best for any third quarter. In New Zealand, the

continuing closure of Courtenay Central due to seismic issues

caused declines in our overall cinema and real estate divisions in

that country. And, our U.S. Cinemas were negatively impacted, not

only by closures of three NYC theaters due to lease expirations,

but also a weaker slate of arthouse/specialty film and film of the

type appealing to our Consolidated Theatres audience in Hawaii.

Despite challenged attendance and box office result for our U.S.

Cinemas, we continued to execute well on our strategic initiatives,

including Food & Beverage and online ticketing. Looking

forward, we are excited not only about the highly anticipated

fourth quarter commercial line up, including Star Wars: The Rise of

Skywalker in December, but also specialty films like Little Women

by Greta Gerwig, Dark Waters by Todd Haynes and A Hidden Life by

Terrence Malick.”

Cotter continued, “We made good progress on our strategic value

creation projects, including 44 Union Square in New York City and

Courtenay Central in Wellington, New Zealand, each of which will

create long term value for our stockholders when the developments

are completed. Tammany Hall has turned out to be even more

impressive than we had hoped, and the views of Union Square from

our iconic glass dome are magnificent. I encourage people to look

at the photos posted @44UnionSquare on Instagram.”

Reading International, Inc. also announced today the appointment

of Gilbert Avanes as its Executive Vice President, Chief Financial

Officer and Treasurer effective November 5, 2019. Since January

2019, Mr. Avanes has held the role of Interim Chief Financial

Officer and Treasurer.

"We're delighted that Gilbert will take on the position of Chief

Financial Officer," said Ellen Cotter. "Gilbert has played a

critical role in the growth of Reading since joining in 2007. His

strategic financial, planning and analysis expertise, coupled with

his deep knowledge of our Company’s assets and their potential,

make Gilbert an ideal fit for this position. Margaret and I and the

rest of the Board and management team look forward to continue

working with Gilbert to continue to capitalize on our growth

opportunities ahead."

Over his 12 years with the Company, Mr. Avanes has held a

variety of positions of increasing responsibility on the Company’s

finance team, including: Senior Director of Financial Planning and

Analysis; Director of Financial Planning and Analysis; Senior

Finance Manager; and his current position of Vice President,

Financial Planning and Analysis. Prior to joining Reading, Mr.

Avanes served in various finance and accounting roles over the

course of a decade at Toronto-Dominion Bank Financial Group. Mr.

Avanes received his M.B.A. from Laurentian University and a

Bachelor of Commerce in Accounting from Ryerson University,

Toronto.

The following table summarizes the results for the third quarter

and nine months of the year results for 2019 and 2018,

respectively:

Quarter Ended

Nine Months Ended

September 30,

% Change Favorable/

September 30,

% Change Favorable/

(Dollars in millions, except EPS)

2019

2018

(Unfavorable)

2019

2018

(Unfavorable)

Revenue

$

70.5

$

74.3

(5

)%

$

208.1

$

234.4

(11

)%

- US

37.8

40.8

(7

)%

112.7

124.9

(10

)%

- Australia

26.7

26.0

3

%

78.5

84.9

(8

)%

- New Zealand

6.0

7.5

(20

)%

16.9

24.6

(31

)%

Operating expense

$

(67.5

)

$

(69.7

)

3

%

$

(200.7

)

$

(215.5

)

7

%

Segment operating income (1)

$

7.5

$

9.5

(21

)%

$

21.9

$

35.9

(39

)%

Net income/(loss)(2)

$

0.9

$

1.3

(31

)%

$

1.2

$

9.4

(87

)%

EBITDA (1)

$

9.0

$

10.4

(13

)%

$

25.2

$

35.9

(30

)%

Adjusted EBITDA (1)

$

9.2

$

10.9

(16

)%

$

26.0

$

39.0

(33

)%

Basic EPS (2)

$

0.04

$

0.06

(33

)%

$

0.05

$

0.41

(88

)%

(1) Aggregate segment operating income, earnings before interest

expense (net of interest income), income tax expense, depreciation

and amortization expense (“EBITDA”) and adjusted EBITDA are

non-GAAP financial measures. See the discussion of non-GAAP

financial measures that follows. (2) Reflect amounts attributable

to stockholders of Reading International, Inc., i.e. after

deduction of noncontrolling interests.

COMPANY HIGHLIGHTS

- Operating Results: For the

quarter ended September 30, 2019, our worldwide revenue was $70.5

million, a decrease of 5%, or $3.8 million, from the same quarter

in the prior year. Our operating results were negatively impacted

by (i) a decrease in cinema attendance resulting primarily from the

U.S. where the third quarter 2019 slate of film proved to be less

attractive to movie goers in our specialized markets than that

available for the comparable period in 2018, (ii) the continuing

closure due to seismic concerns of a majority of the net rentable

area of Courtenay Central in Wellington (NZ), including our Reading

Cinema at that location, and (iii) the adverse foreign currency

exchange impact of the weakening Australian and New Zealand

dollars.

Our cinema results were supported by solid

execution on our strategic initiatives. Each of our cinema circuits

in the U.S., Australia and New Zealand, in their functional

currency, set records for the highest third quarter F&B spends

per patron (“SPP”).

We continue to improve and expand our

self-ticketing capabilities through our global cinema circuit. We

achieved a third quarter record for online ticket revenue, beating

the third quarter in 2018 by a combined 20% increase over the

previous record third quarter. Online sales consisted of 26.4% of

our global box office revenue, which is a record and represents an

increase of 6-percentage points from the prior year period. Our

continued improvements to our websites and apps and improved global

online sales infrastructure are enabling us to better serve high

sales volumes.

Due to the continued weakening of the

Australian and New Zealand currencies, the financial contributions

of our cinema circuits in Australia and New Zealand to our overall

results of operation have decreased.

- Capex program: During the

third quarter of 2019, we invested $10.0 million in capital

improvements, including our continued investment in the

redevelopment of 44 Union Square in New York City, as well as the

upgrading of certain of our cinemas:

(i) At our Reading Cinemas in West Lakes

(Australia), we converted two screens to TITAN LUXE and added a

Gold Lounge screen, each with recliner seating; (ii) At our Reading

Cinemas in Harbour Town (Australia), we converted two screens to

TITAN LUXE, each with recliner seating; and (iii) At our Reading

Cinemas in Rohnert Park (California), we converted an auditorium to

TITAN XC with Dolby ATMOS.

- Cinema Additions and

Pipeline: In early 2019, we purchased a well-established

four-screen cinema in Devonport, Tasmania. Also, to mitigate the

temporary closure of Reading Cinemas at Courtenay Central, we

leased a three-screen cinema space in Lower Hutt, adjacent to

Wellington, New Zealand. This cinema, which trades as The Hutt Pop

Up by Reading Cinemas, began operations in late June 2019. These

additions bring our operating global cinema count to 58 and global

screen count to 480, net of the three City Cinemas (Paris, Beekman,

and 86th Street) closed during the second and third quarter in the

U.S. as a result of lease expirations. But for the lease

expirations of these New York City cinemas, we would not have

closed these profitable cinemas.

We have five cinemas with 31 screens in the

pipeline. We expect our Reading Cinemas in Burwood (Melbourne, VIC)

to open in 2019 in time for Star Wars: The Rise of Skywalker. The

six-screen cinema will be the first all reclining cinema we have in

Melbourne and will feature a TITAN LUXE and an elevated F&B

program. Additionally, we have signed four lease agreements for new

build cinemas (comprising 25 screens) due to come online over the

next two years.

Real estate activities:

- Re-Development of 44 Union Square (New

York, U.S.) During July 2019, we topped out the steel dome

capping our redevelopment of historic Tammany Hall at 44 Union

Square and the last of the glass was installed last month. We

anticipate filing for our core and shell temporary certificate of

occupancy in December 2019 and are in final negotiations of a long

term lease for approximately 90% of the net rentable area of the

building. This lease would be for office use, and the remaining

7,200 square feet of ground floor space (facing onto Union Square)

continues to be marketed for retail use by Newmark.

- Minetta Lane Theatre (New York,

U.S.) In April 2019, we negotiated an extension through

March 2020 (with an option to extend our licensee for an additional

year through March 2021) of our Minetta Lane Theatre license

agreement with Audible, Inc., a subsidiary of Amazon. Audible will

continue to use our theatre as the location for its production of

various plays featuring one or two actors, to be recorded before a

live theatre audience, and offered on Audible.com.

- Village East Cinema (New York,

U.S.) In August 2019, we exercised our option to acquire the

lessee’s interest in the ground lease and improvements constituting

our Village East cinema in the East Village of New York City. The

exercise price (payable upon the closing, currently contemplated

for the second quarter of next year) is $5.9 million. The

acquisition clears the way for our renovation of this cinema, which

is currently planned for next year. As the transaction was a

related party transaction, the option exercise was reviewed and

approved by our Board’s Audit and Conflicts Committee and supported

by a third party valuation, which showed substantial value in the

option.

- Courtenay Central Re-Development

(Wellington, New Zealand) Located in the heart of Wellington

- New Zealand’s capital city, this center is comprised of 161,071

square feet of land situated proximate to the Te Papa Tongarewa

Museum (attracting over 1.5 million visitors annually), across the

street from the site of Wellington’s newly announced convention

center (estimated to open its doors in 2022) and at a major public

transit hub. Damage from the 2016 earthquake necessitated

demolition of our nine-story parking garage at the site. Further,

unrelated seismic issues have caused us to close the existing

cinema and significant portions of the retail structure while we

re-evaluate the property for redevelopment as an entertainment

themed urban center with a major food, beverage and grocery

component.

During the quarter, we continued to work

through the re-development details of the Courtenay Central

building, which we anticipate will feature a variety of uses to

complement and build upon the “destination quality” of this

location

Wellington continues to be rated as one of

the top cities in the world in which to live. Earlier this year,

UNESCO named Wellington as a UNESCO Creative City of Film. We

continue to believe that the Courtenay Central site is located in

one of the most vibrant and growing commercial and entertainment

precincts of New Zealand.

SEGMENT RESULTS

The following table summarizes the third quarter and nine months

segment operating results for 2019 and 2018, respectively:

Quarter Ended

Nine Months Ended

September 30,

% Change Favorable/

September 30,

% Change Favorable/

(Dollars in thousands)

2019

2018

(Unfavorable)

2019

2018

(Unfavorable)

Segment revenue

Cinema

United States

$

36,750

$

40,038

(8)

%

$

109,743

$

122,437

(10)

%

Australia

24,279

23,659

3

%

71,318

77,513

(8)

%

New Zealand

5,704

6,974

(18)

%

16,040

23,159

(31)

%

Total

$

66,733

$

70,671

(6)

%

$

197,101

$

223,109

(12)

%

Real

estate

United States

$

1,006

$

805

25

%

$

2,873

$

2,410

19

%

Australia

3,905

3,847

2

%

11,873

12,305

(4)

%

New Zealand

620

1,119

(45)

%

1,779

3,489

(49)

%

Total

$

5,531

$

5,771

(4)

%

$

16,525

$

18,204

(9)

%

Inter-segment elimination

(1,808)

(2,181)

17

%

(5,524)

(6,918)

20

%

Total segment revenue

$

70,456

$

74,261

(5)

%

$

208,102

$

234,395

(11)

%

Segment operating income

Cinema

United States

$

437

$

2,310

(81)

%

$

2,772

$

10,008

(72)

%

Australia

4,671

4,678

—

%

12,909

16,642

(22)

%

New Zealand

913

1,214

(25)

%

2,250

4,333

(48)

%

Total

$

6,021

$

8,202

(27)

%

$

17,931

$

30,983

(42)

%

Real

estate

United States

$

212

$

(154)

>100

%

$

163

$

(514)

>100

%

Australia

1,405

980

43

%

4,153

4,071

2

%

New Zealand

(132)

434

(>100)

%

(329)

1,339

(>100)

%

Total

$

1,485

$

1,260

18

%

$

3,987

$

4,896

(19)

%

Total segment operating income

(1)

$

7,506

$

9,462

(21)

%

$

21,918

$

35,879

(39)

%

(1) Aggregate segment operating income is a non-GAAP financial

measure. See the discussion of non-GAAP financial measures that

follows.

Cinema Exhibition

Third Quarter Results:

Cinema segment operating income decreased by $2.2 million, or

27%, to $6.0 million for the quarter ended September 30, 2019,

compared to September 30, 2018. The decrease was due to a decline

in attendance in all three circuits. However, such attendance

decreases were offset by increases in average ticket price (“ATP”)

and SPP (each in functional currency) in our U.S., Australia and

New Zealand circuits.

- Revenue in the U.S. decreased by 8%, or $3.3 million, to $36.8

million, due to a 14% decrease in attendance; offset by a 13%

increase in SPP, while ATP remained flat.

- Australia’s cinema revenue increased by 3%, or $0.6 million, to

$24.3 million, primarily due to a 4% increase in SPP and a 3%

increase in ATP, offset by a 2% decrease in attendance.

- New Zealand’s cinema revenue decreased by 18%, or $1.3 million,

to $5.7 million, due to a 24% decrease in attendance (principally

due to the closure of our Courtenay Central Cinema pending

redevelopment), offset by a 13% increase in SPP and a 10% increase

in ATP.

The top three grossing films for the third quarter of 2019 were

The Lion King, Spider-Man: Far From Home, and Toy Story 4,

representing approximately 37% of our worldwide admission revenues

for the quarter. The top three grossing films in the third quarter

of 2018 for our worldwide cinema circuits were Crazy Rich Asians,

Ant-Man and the Wasp, and Mission Impossible – Fallout, which

represented approximately 24% of our worldwide admission

revenues.

Nine Month Results:

Cinema segment operating income declined 42%, or $13.1 million,

to $17.9 million for the nine months ended September 30, 2019

compared to September 30, 2018, primarily driven by a 72% operating

income decline in the U.S. market, a decline in attendance

worldwide and adverse foreign exchange impacts. However, such

attendance decreases were offset to some extent by increases in ATP

and SPP:

- Revenue in the U.S. decreased by 10%, or $12.7 million, to

$109.7 million, primarily due to a 16% decrease in attendance

(principally due to a film slate that was less appealing to our

specialized audiences and the closure of three cinemas due to lease

expirations), offset by a 11% increase in SPP and a 2% increase in

ATP.

- Australia’s cinema revenue decreased by 8%, or $6.2 million, to

$71.3 million, primarily due to a 7% decrease in attendance and a

3% decrease in SPP, while ATP remained flat.

- New Zealand cinema revenue decreased by 31%, or $7.1 million,

to $16.0 million, primarily due to a 32% decrease in attendance,

(significantly due to the closure of our Courtenay Central Cinema

pending redevelopment); offset by a 5% increase in ATP and a 4%

increase in SPP.

The top three grossing films for the nine months of 2019 were

Avengers: Endgame, The Lion King, and Captain Marvel representing

approximately 20% of our worldwide admission revenues, compared to

the top three grossing films a year ago: Avengers: Infinity War,

Black Panther, and Incredibles 2, which represented approximately

18% of our admission revenues for the same period in 2018.

Real Estate

Third Quarter and Nine Month Results:

Real estate segment operating income increased by 18%, or $0.2

million, to $1.5 million for the quarter ended September 30, 2019,

compared to the third quarter ended September 30, 2018, primarily

due to a decrease in operating expenses in all three circuits,

offset by a decrease in revenue in the New Zealand operations, due

specifically to the ongoing closure of most of the net rentable

area of Courtenay Central. Real estate revenue for the third

quarter of 2019, decreased by 4%, or $0.2 million, to $5.5 million

compared to the third quarter of 2018, due also to a decrease in

revenues from our New Zealand segment related to the closure of a

majority of the rentable square footage at Courtenay Central.

For the nine months ended September 30, 2019, the real estate

segment operating income decreased by 19%, or $0.9 million, to $4.0

million compared to the nine months ended September 30, 2018

primarily attributable to an operating loss in the New Zealand

portfolio of $0.3 million for 2019, compared to an operating gain

of $1.3 million for the nine months ended September 30, 2018. Real

estate revenue decreased by 9%, or $1.7 million, to $16.5 million,

compared to the same period in 2018. This was primarily

attributable to the partial closure due to seismic concerns of a

majority of the net rentable area of Courtenay Central during the

first nine months of 2019, compared to same period in 2018.

Our third quarter 2019 Australian real estate segment reported

its highest ever third quarter revenues, reflecting improved

leasing at our centers in Australia, including Newmarket Village

and Auburn Redyard, at $3.9 million.

CONSOLIDATED AND NON-SEGMENT RESULTS

The third quarter and nine month consolidated and non-segment

results for 2019 and 2018 are summarized as follows:

Quarter Ended

Nine Months Ended

September 30,

% Change Favorable/

September 30,

% Change Favorable/

(Dollars in thousands)

2019

2018

(Unfavorable)

2019

2018

(Unfavorable)

Segment operating income

$

7,506

$

9,462

(21)

%

$

21,918

$

35,879

(39)

%

Non-segment income and expenses:

General and administrative expense

(4,493)

(4,831)

7

%

(14,205)

(16,717)

15

%

Interest expense, net

(1,871)

(1,748)

(7)

%

(5,924)

(5,132)

(15)

%

Other

257

(142)

>100

%

483

81

>100

%

Total non-segment income and

expenses

$

(6,107)

$

(6,721)

9

%

$

(19,647)

$

(21,768)

10

%

Income before income taxes

1,399

2,741

(49)

%

2,271

14,111

(84)

%

Income tax benefit (expense)

(547)

(1,482)

63

%

(1,159)

(4,618)

75

%

Net income/(loss)

$

852

$

1,259

(32)

%

$

1,112

$

9,493

(88)

%

Less: net income (loss) attributable to

noncontrolling interests

(50)

(38)

(32)

%

(103)

88

(>100)

%

Net income (loss) attributable to RDI

common stockholders

$

902

$

1,297

(30)

%

$

1,215

$

9,405

(87)

%

Third Quarter and Nine Month

Results

Net income attributable to RDI common stockholders declined by

30%, or $0.4 million, to $0.9 million for the quarter ended

September 30, 2019, compared to the same period prior year. Basic

EPS for the quarter ended September 30, 2019 decreased by $0.02, to

$0.04 from $0.06 in the prior-year quarter, mainly attributable to

a significant decrease in revenue from our Cinema business

segment.

Net income attributable to RDI common stockholders decreased by

87%, or $8.2 million, to $1.2 million for the nine months ended

September 30, 2019, compared to the same period in the prior year.

Basic EPS for the first nine months of 2019 decreased by $0.36, to

$0.05 from $0.41 in the prior year period, mainly attributable to a

significant decrease in revenue from both our Cinema and Real

Estate business segments.

Non-Segment General &

Administrative Expenses

Our non-segment general and administrative expense for the

quarter ended September 30, 2019 compared to the same period in the

prior year decreased by 7%, or $0.3 million, to $4.5 million. The

quarterly decrease mainly relates to lower legal expenses,

consulting fees, and various compensation costs.

Non-segment general and administrative expense for the nine

months ended September 30, 2019, decreased by 15%, or $2.5 million,

to $14.2 million, compared to the nine-month period ending

September 30, 2018, primarily related to lower legal expenses.

Income Tax Expense

Income tax expense for the quarter and nine months ended

September 30, 2019, decreased by $0.9 million and $3.5 million,

respectively, compared to the equivalent prior-year period. The

change between 2019 and 2018 is primarily related to lower pretax

income for the quarter and first nine months of 2019.

OTHER FINANCIAL INFORMATION

Balance Sheet and Liquidity

Total assets increased by $218.8 million, to $657.8 million at

September 30, 2019, compared to $439.0 million at December 31,

2018. This was primarily driven by the implementation of the lease

accounting standard effective January 1, 2019, which also resulted

in a similar increase in our liabilities. Additionally, assets

increased due to the capital investments relating to major real

estate projects, primarily the redevelopment of 44 Union Square in

New York, and to cinema improvements in (i) the U.S. at our

Consolidated Theatres in Mililani (Hawaii), (ii) New Zealand at the

Reading Cinemas at The Palms, and (iii) Australia at the Reading

Cinemas at Maitland, Waurn Ponds, West Lakes and Harbour Town.

Cash and cash equivalents at September 30, 2019 were $8.7

million, including approximately $4.9 million in the U.S., $2.7

million in Australia, and $1.1 million in New Zealand. We manage

our cash, investments and capital structure so we are able to meet

short-term and long-term obligations for our business, while

maintaining financial flexibility and liquidity.

As part of our operating cycle, we utilize cash collected from

(i) our cinema business when selling tickets and F&B items, and

(ii) rental income typically received in advance to reduce our

long-term borrowings and realize savings on interest charges. We

then settle our operating expenses generally with a lag within

traditional trade terms. This generates a temporary working capital

deficit. We review the maturities of our borrowings and negotiate

for renewals and extensions, as necessary for liquidity purposes.

We believe the cash flow generated from our operations coupled with

our ability to renew and extend our credit facilities will provide

sufficient liquidity in the upcoming year.

OTHER INFORMATION

Stock Repurchase Program

At September 30, 2019, the Company had used $20.1 million of the

$25.0 million authorized by the Company’s Board of Directors in

2017 to repurchase Class A Non-Voting Common Stock. During the nine

months ended September 30, 2019, the Company invested $11.3 million

to repurchase 856,563 shares of Class A Non-Voting Common Stock, of

which $7.8 million was paid in cash and $3.5 million through the

issuance of a purchase money promissory note, accruing interest at

5%, payable in equal quarterly installments of principal plus

accrued interest, all due and payable on September 18, 2024. The

Stock Repurchase Program allows Reading to repurchase its Class A

Non-Voting Common Stock from time to time in accordance with the

requirements of the Securities and Exchange Commission on the open

market, in block trades and in privately negotiated transactions,

depending on market conditions and other factors.

Certain Potential Cotter Family Stock

Sales

We are advised that the Estate of James J. Cotter, Sr. (the

“Estate”), has entered into an

agreement with the Internal Revenue Service to pay its estate taxes

over the next ten years. That agreement has been collateralized

through the grant of a security interest in certain Class A

Non-Voting Common Stock currently owned by The James J. Cotter

Living Trust (the "Living Trust"). It

is anticipated that it may be necessary from time to time for the

Estate or the Living Trust to sell Class A Non-Voting Common Stock

to pay that debt.

Consistent with the agreement with the IRS, on September 23,

2019, Ellen Cotter, the President and Chief Executive Officer of

Reading International, Inc., and Margaret Cotter, the Executive

Vice President – Real Estate Management and Development of the

Company, in their capacity as co-trustees of the Living Trust,

entered into a 10b5-1 trading plan (the "10b5-1 Plan"). Under the 10b5-1 Plan, a

broker-dealer has been authorized to sell up to 40,000 shares of

the Class A Non-Voting Common Stock held by the Living Trust over a

period from December 9, 2019 through January 28, 2020, or such

earlier date as all such shares are sold, unless the 10b5-1 Plan is

terminated earlier pursuant to its terms. The Company is advised

that the purpose of the anticipated sales under the 10b5-1 Plan is

to provide liquidity to pay certain estate taxes of the Estate

pursuant to the terms of the Estate's agreement with the Internal

Revenue Service, as well as to pay other state taxes and

expenses.

Similarly, we are advised that Margaret Cotter is the Trustee of

an operational trust established by her father for the benefit of

her children, which is funded entirely with Class A Non-Voting

Common Stock. In her capacity as trustee of this trust, Margaret

Cotter has advised the Company that it will be necessary for that

trust to, from time to time, sell shares of Class A Non-Voting

Common Stock for her children’s educational, medical and other

expenses.

Ellen Cotter and Margaret Cotter have advised our Company that

as a consequence of the litigation between their brother (James J.

Cotter, Jr.) and themselves relating to matters concerning the

estate of their father (James J. Cotter, Sr.) and the Living Trust

and the Voting Trust established by their father, they have

incurred and continue to incur significant legal costs and expenses

and that they may find it necessary to sell Class A Shares held in

their personal capacity to fund the future costs of defending the

intention of their father to preserve control of our Company in the

Cotter Family.

Trust Litigation

In a matter potentially impacting the control of our Company,

but to which our Company is not a party (In re: James J. Cotter

Living Trust dated August 1, 2000 (Case No. BP159755) (the “Trust

Case”)), the California Court of Appeals on April 15, 2019, struck

down the California Trial Court’s order appointing a trustee ad

litem to solicit offers for the purchase of a controlling interest

in our Company. The basis for that disposition was the Appeals

Court’s determination that Mr. James J. Cotter, Jr. lacks standing

to seek the appointment of such a trustee ad litem. The Appeals

Court noted that Mr. Cotter, Jr. is neither a trustee of nor a

beneficiary of the trust established to hold such controlling

interest (the “Voting Trust”) and accordingly, determined that he

lacked any standing to bring before the trial court matters

relating to the internal affairs of that trust, such as the

appointment of a trustee ad litem. The Court of Appeals also noted,

in an observation not material to the specific grounds on which the

California Trial Court’s order was struck down, that “the plain

language [of the Trust Document] appears to show that the settlor

[Mr. Cotter, Sr.] instructed the Trustee [Margaret Cotter] not to

diversify [i.e. not to sell the voting shares held by the Voting

Trust].” The Trust Document directs the Trustee of the Voting Trust

that this voting stock is “to be retained for as long as

possible.”

On remand, Margaret Cotter and Ellen Cotter filed a peremptory

challenge to the original Los Angeles Superior Court judge

continuing to preside over the matter. That challenge was denied

and Margaret and Ellen petitioned the California Court of Appeal

for a writ of mandate. The California Court of Appeal declined to

hear that writ petition and Margaret Cotter and Ellen Cotter have

petitioned the California Supreme Court for review. That petition

remains pending.

The Guardian Ad Litem, appointed by the court to protect the

interests of Mr. Cotter Sr.’s grandchildren, has stated his view

that, notwithstanding the above referenced direction to retain the

Voting Stock as long as possible and the Court of Appeals statement

regarding that direction, diversification of the assets of the

Voting Trust would be in the best interests of the

grandchildren.

The Guardian Ad Litem has petitioned to split the Voting Trust

into two separate trusts and to diversify that portion of any

Voting Stock allocated to any separate trust set up for the

children of Mr. Cotter, Jr. and for authority to retain a valuation

expert. The Guardian Ad Litem has no authority over the Voting

Stock to be vested in the Voting Trust. This authority remains

vested with Margaret Cotter as the Sole Trustee of the Voting Trust

and, until the Voting Stock is transferred into the Voting Trust,

in Ellen Cotter and Margaret Cotter as the Co-Executors of the

Estate of James J. Cotter, Sr. and the Co-Trustees of the Living

Trust.

Ellen Cotter and Margaret Cotter, as Trustees of the James J.

Cotter, Sr. Living Trust, and Margaret Cotter, as Trustee of the

Voting Trust, oppose the Guardian Ad Litem’s petitions on various

grounds including the Guardian Ad Litem’s irreconcilable conflict

of interest. It is the Company’s understanding that no decision

will be made by the Superior Court to split the trust or to

diversify the Voting Trust (or any successor trusts) until there

has been discovery and a trial on the merits as to the intentions

of James J. Cotter, Sr. in this regard. No discovery or trial

schedule is currently in place and no hearing date has been set for

the Guardian Ad Litem’s petitions to retain a valuation expert or

to split the Voting Trust.

Ellen Cotter and Margaret Cotter have advised the Company that

while they oppose any sale of the Voting Stock as being

inconsistent with the intentions of Mr. Cotter, Sr., as set out in

the Trust Document, if there is such a sale, they intend to be the

buyers and to retain control of the Company in the Cotter Family.

They have further advised the Issuer that as the Estate is not yet

closed, it is uncertain that any shares of Voting Stock will be

transferred from the Estate to the Voting Trust in the near

term.

The table below presents the changes in our working capital

position and other relevant information addressing our liquidity as

of and for the nine months ended September 30, 2019 and the

preceding four years:

As of and for the 9-Months

Ended

Year Ended December 31

($ in thousands)

September 30, 2019

2018

2017

2016

2015 (2)

Total Resources (cash and

borrowings)

Cash and cash equivalents

(unrestricted)

$

8,708

$

13,127

$

13,668

$

19,017

$

19,702

Unused borrowing facility

84,149

85,886

137,231

117,599

70,134

Restricted for capital projects (1)

17,650

30,318

62,280

62,024

10,263

Unrestricted capacity

66,499

55,568

74,951

55,575

59,871

Total resources at period end

92,857

99,013

150,899

136,616

89,836

Total unrestricted resources at period

end

75,207

68,695

88,619

74,592

79,573

Debt-to-Equity Ratio

Total contractual facility

$

279,215

$

252,929

$

271,732

$

266,134

$

207,075

Total debt (gross of deferred financing

costs)

195,311

167,043

134,501

148,535

130,941

Current

34,374

30,393

8,109

567

15,000

Non-current

160,692

136,650

126,392

147,968

115,941

Finance lease liabilities

245

—

—

—

—

Total book equity

163,713

180,547

181,618

146,890

138,951

Debt-to-equity ratio

1.19

0.93

0.74

1.01

0.94

Changes in Working Capital

Working capital (deficit) (3)

$

(76,065)

$

(55,270)

$

(46,971)

$

6,655

$

(35,581)

Current ratio

0.25

0.35

0.42

1.10

0.51

Capital Expenditures (including

acquisitions)

$

34,585

$

56,827

$

76,708

$

49,166

$

53,119

(1) This relates to the construction facilities specifically

negotiated for: (i) 44 Union Square redevelopment project, obtained

in December 2016, and (ii) New Zealand construction projects,

obtained in May 2015. The New Zealand construction loan expired

December 31, 2018. (2) Certain 2015 balances included the

restatement impact as a result of a change in accounting principle

(see Note 2 – Summary of Significant Accounting Policies –

Accounting Changes). Certain 2017 and 2016 balances included the

restatement impact as a result of a prior period financial

statement correction of immaterial errors (see Note 2 – Summary of

Significant Accounting Policies – Prior Period Financial Statement

Correction of Immaterial Errors). (3) Typically our working capital

(deficit) is negative as we receive revenue from our cinema

business ahead of the time that we have to pay our associated

liabilities. We use the money we receive to pay down our borrowings

in the first instance.

Below is a summary of the available credit facilities as of

September 30, 2019:

As of September 30,

2019

(Dollars in thousands)

Available Contractual

Capacity

Capacity Used

Unused Capacity

Restricted for Capital

Projects

Unrestricted Capacity

Bank of America Credit Facility (USA)

$

55,000

$

27,000

$

28,000

$

—

$

28,000

Bank of America Line of Credit (USA)

5,000

5,000

—

—

—

Union Square Construction Financing

(USA)

50,000

32,350

17,650

17,650

—

NAB Corporate Term Loan (AU) (1)

80,952

54,977

25,975

—

25,975

Westpac Bank Corporate (NZ) (1)

20,038

7,514

12,524

—

12,524

Total

$

210,990

$

126,841

$

84,149

$

17,650

$

66,499

(1) The borrowings are denominated in foreign currency. The

contractual capacity and capacity used were translated into U.S.

dollars based on the applicable exchange rates as of September 30,

2019.

The $17.7 million representing borrowings restricted for capital

projects is wholly composed of the $17.7 million of unused capacity

for our 44 Union Square development and construction.

Our overall global operating strategy is to conduct business

mostly on a self-funding basis by country (except for funds used to

pay an appropriate share of our U.S. corporate overhead). However,

we may, from time to time, move funds between jurisdictions where

circumstances merit such action as part of our goal to minimize our

cost of capital.

Non-GAAP Financial Measures

This earnings release presents aggregate segment operating

income, and EBITDA, which are important financial measures for the

Company, but are not financial measures defined by U.S. GAAP.

These measures should be reviewed in conjunction with the

relevant U.S. GAAP financial measures and are not presented as

alternative measures of EPS, cash flows or net income as determined

in accordance with U.S. GAAP. Aggregate segment operating income

and EBITDA, as we have calculated them, may not be comparable to

similarly titled measures reported by other companies.

Aggregate segment operating income – We evaluate the

performance of our business segments based on segment operating

income, and management uses aggregate segment operating income as a

measure of the performance of operating businesses separate from

non-operating factors. We believe that information about aggregate

segment operating income assists investors by allowing them to

evaluate changes in the operating results of the Company’s business

separate from non-operational factors that affect net income, thus

providing separate insight into both operations and the other

factors that affect reported results. Refer to “Consolidated and

Non-Segment Results” for a reconciliation of segment operating

income to net income.

EBITDA – We use EBITDA in the evaluation of our Company’s

performance since we believe that EBITDA provides a useful measure

of financial performance and value. We believe this principally for

the following reasons:

We believe that EBITDA is an accepted industry-wide comparative

measure of financial performance. It is, in our experience, a

measure commonly adopted by analysts and financial commentators who

report upon the cinema exhibition and real estate industries, and

it is also a measure used by financial institutions in underwriting

the creditworthiness of companies in these industries. Accordingly,

our management monitors this calculation as a method of judging our

performance against our peers, market expectations and our

creditworthiness. It is widely accepted that analysts, financial

commentators and persons active in the cinema exhibition and real

estate industries typically value enterprises engaged in these

businesses at various multiples of EBITDA. Accordingly, we find

EBITDA valuable as an indicator of the underlying value of our

businesses. We expect that investors may use EBITDA to judge our

ability to generate cash, as a basis of comparison to other

companies engaged in the cinema exhibition and real estate

businesses and as a basis to value our company against such other

companies.

EBITDA is not a measurement of financial performance under

generally accepted accounting principles in the United States of

America and it should not be considered in isolation or construed

as a substitute for net income or other operations data or cash

flow data prepared in accordance with generally accepted accounting

principles in the United States for purposes of analyzing our

profitability. The exclusion of various components, such as

interest, taxes, depreciation and amortization, limits the

usefulness of these measures when assessing our financial

performance, as not all funds depicted by EBITDA are available for

management’s discretionary use. For example, a substantial portion

of such funds may be subject to contractual restrictions and

functional requirements to service debt, to fund necessary capital

expenditures and to meet other commitments from time to time.

EBIT and EBITDA also fail to take into account the cost of

interest and taxes. Interest is clearly a real cost that for us is

paid periodically as accrued. Taxes may or may not be a current

cash item but are nevertheless real costs that, in most situations,

must eventually be paid. A company that realizes taxable earnings

in high tax jurisdictions may, ultimately, be less valuable than a

company that realizes the same amount of taxable earnings in a low

tax jurisdiction. EBITDA fails to take into account the cost of

depreciation and amortization and the fact that assets will

eventually wear out and have to be replaced.

Adjusted EBITDA – using the principles we consistently

apply to determine our EBIDTA, we further adjusted the EBIDTA for

certain items we believe to be external to our business and not

reflective of our costs of doing business or results of operation.

Specifically, we have adjusted for (i) gains on insurance

recoveries, (ii) legal expenses relating to extraordinary

litigation, (iii) adjustments for gains/losses relating to property

sales, and (iv) any other items that can be considered

non-recurring in accordance with the 2-year SEC requirement for

determining an item is non-recurring, infrequent or unusual in

nature.

Reconciliation of EBITDA to net income is presented below:

Quarter Ended

Nine Months Ended

September 30,

September 30,

(Dollars in thousands)

2019

2018

2019

2018

Net Income/(loss)

$

902

$

1,297

$

1,215

$

9,405

Add: Interest expense, net

1,871

1,748

5,924

5,132

Add: Income tax expense

547

1,482

1,159

4,618

Add: Depreciation and amortization

5,704

5,829

16,870

16,705

EBITDA

$

9,024

$

10,356

$

25,168

$

35,860

Adjustments for:

Legal expenses relating to the derivative

litigation, the Cotter employment arbitration and other Cotter

litigation matters

184

505

782

3,146

Adjusted EBITDA

$

9,208

$

10,861

$

25,950

$

39,006

Conference Call and Webcast

We plan to post our pre-recorded conference call and audio

webcast on our corporate website on November 14, 2019, that will

feature prepared remarks from Ellen Cotter, Chief Executive

Officer; Gilbert Avanes, Chief Financial Officer; and Andrzej

Matyczynski, Executive Vice President - Global Operations.

A pre-recorded question and answer session will follow our

formal remarks. Questions and topics for consideration should be

submitted to InvestorRelations@readingrdi.com by November 13,

2019, 5:00 p.m. Eastern Standard Time. The audio webcast can be

accessed by visiting http://www.readingrdi.com/about/#earnings-call.

About Reading International,

Inc.

Reading International, Inc. (NASDAQ: RDI) is a leading

entertainment and real estate company, engaging in the development,

ownership and operation of multiplex cinemas and retail and

commercial real estate in the United States, Australia, and New

Zealand.

The family of Reading brands includes cinema brands: Reading

Cinemas, Angelika Film Centers, Consolidated Theatres, and City

Cinemas; live theatres operated by Liberty Theatres in the United

States; and signature property developments, including Newmarket

Village, Auburn Redyard, and Cannon Park in Australia, Courtenay

Central in New Zealand and 44 Union Square in New York City.

Additional information about Reading can be obtained from the

Company's website: http://www.readingrdi.com.

Forward-Looking

Statements

Our statements in this press release contain a variety of

forward-looking statements as defined by the Securities Litigation

Reform Act of 1995. Forward-looking statements reflect only our

expectations regarding future events and operating performance and

necessarily speak only as of the date the information was prepared.

No guarantees can be given that our expectation will in fact be

realized, in whole or in part. You can recognize these statements

by our use of words such as, by way of example, “may,” “will,”

“expect,” “believe,” and “anticipate” or other similar

terminology.

These forward-looking statements reflect our expectation after

having considered a variety of risks and uncertainties. However,

they are necessarily the product of internal discussion and do not

necessarily completely reflect the views of individual members of

our Board of Directors or of our management team. Individual Board

members and individual members of our management team may have

different views as to the risks and uncertainties involved, and may

have different views as to future events or our operating

performance.

Among the factors that could cause actual results to differ

materially from those expressed in or underlying our

forward-looking statements are the following:

- with respect to our cinema operations:

- the number and attractiveness to moviegoers of the films

released in future periods;

- the amount of money spent by film distributors to promote their

motion pictures;

- the licensing fees and terms required by film distributors from

motion picture exhibitors in order to exhibit their films;

- the comparative attractiveness of motion pictures as a source

of entertainment and willingness and/or ability of consumers (i) to

spend their dollars on entertainment and (ii) to spend their

entertainment dollars on movies in and outside the home

environment;

- the extent to which we encounter competition from other cinema

exhibitors, from other sources of outside-the-home entertainment,

and from inside-the-home entertainment options, such as “home

theaters” and competitive film product distribution technology,

such as, by way of example, cable, satellite broadcast and

Blu-ray/DVD rentals and sales, and so called “movies on

demand”;

- the impact of certain competitors’ subscription or advance pay

programs;

- the cost and impact of improvements to our cinemas, such as

improved seating, enhanced food and beverage offerings and other

improvements;

- disruptions during theater improvements;

- the extent to and the efficiency with which we are able to

integrate acquisitions of cinema circuits with our existing

operations; and

- certain of our activities are in geologically active areas,

creating a risk of damage and/or disruption of real estate and/or

cinema businesses from earthquakes.

- with respect to our real estate development and operation

activities:

- the rental rates and capitalization rates applicable to the

markets in which we operate and the quality of properties that we

own;

- the ability to negotiate and execute lease agreements with

material tenants;

- the extent to which we can obtain on a timely basis the various

land use approvals and entitlements needed to develop our

properties;

- the risks and uncertainties associated with real estate

development;

- the availability and cost of labor and materials;

- the ability to obtain all permits to construct

improvements;

- the ability to finance improvements;

- the disruptions from construction;

- the possibility of construction delays, work stoppage and

material shortage;

- competition for development sites and tenants;

- environmental remediation issues;

- the extent to which our cinemas can continue to serve as an

anchor tenant that will, in turn, be influenced by the same factors

as will influence generally the results of our cinema

operations;

- the increased depreciation and amortization expense as

construction projects transition to leased real property;

- the ability to negotiate and execute joint venture

opportunities and relationships; and

- certain of our activities are in geologically active areas,

creating a risk of damage and/or disruption of real estate and/or

cinema businesses from earthquakes.

- with respect to our operations generally as an international

company involved in both the development and operation of cinemas

and the development and operation of real estate; and previously

engaged for many years in the railroad business in the United

States:

- our ability to renew, extend or renegotiate our loans that

mature in 2020;

- our ability to grow our Company and provide value to our

stockholders;

- our ongoing access to borrowed funds and capital and the

interest that must be paid on that debt and the returns that must

be paid on such capital;

- expenses, management and Board distraction and other effects of

the litigation efforts mounted by James Cotter, Jr. against the

Company, including his efforts to cause a sale of voting control of

the Company;

- the relative values of the currency used in the countries in

which we operate;

- changes in government regulation, including by way of example,

the costs resulting from the implementation of the requirements of

Sarbanes-Oxley;

- our labor relations and costs of labor (including future

government requirements with respect to minimum wages, shift

scheduling, the use of consultants, pension liabilities, disability

insurance and health coverage, and vacations and leave);

- our exposure from time to time to legal claims and to

uninsurable risks such as those related to our historic railroad

operations, including potential environmental claims and

health-related claims relating to alleged exposure to asbestos or

other substances now or in the future recognized as being possible

causes of cancer or other health related problems, and class

actions and private attorney general wage and hour based

claims;

- our exposure to cyber-security risks, including

misappropriation of customer information or other breaches of

information security;

- changes in future effective tax rates and the results of

currently ongoing and future potential audits by taxing authorities

having jurisdiction over our various companies; and

- changes in applicable accounting policies and practices.

The above list is not necessarily exhaustive, as business is by

definition unpredictable and risky, and subject to influence by

numerous factors outside of our control, such as changes in

government regulation or policy, competition, interest rates,

supply, technological innovation, changes in consumer taste and

fancy, weather, and the extent to which consumers in our markets

have the economic wherewithal to spend money on beyond-the-home

entertainment.

Given the variety and unpredictability of the factors that will

ultimately influence our businesses and our results of operation,

no guarantees can be given that any of our forward-looking

statements will ultimately prove to be correct. Actual results will

undoubtedly vary and there is no guarantee as to how our securities

will perform, either when considered in isolation or when compared

to other securities or investment opportunities.

In addition to the forward-looking factors set forth above, we

encourage you to review Item 1A. “Risk Factors,” from our Company’s

Annual Report on SEC Form 10-K for the Year Ended December 31,

2018, as well as the risk factors set forth in any other filings

made under the Securities Act of 1934, as amended, including any of

our Quarterly Report of Form 10-Q.

Finally, we undertake no obligation to publicly update or to

revise any of our forward-looking statements, whether as a result

of new information, future events or otherwise, except as may be

required under applicable law. Accordingly, you should always note

the date to which our forward-looking statements speak.

Additionally, certain of the presentations included in this

press release may contain “pro forma” information or “non-U.S. GAAP

financial measures.” In such case, a reconciliation of this

information to our U.S. GAAP financial statements will be made

available in connection with such statements.

Reading International, Inc. and

Subsidiaries

Unaudited Consolidated Statements of

Operations

(Unaudited; U.S. dollars in thousands,

except per share data)

Quarter Ended

Nine Months Ended

September 30,

September 30,

2019

2018

2019

2018

Revenue

Cinema

$

66,733

$

70,671

$

197,101

$

223,109

Real estate

3,723

3,590

11,001

11,286

Total revenue

70,456

74,261

208,102

234,395

Costs and expenses

Cinema

(53,709

)

(54,929

)

(158,273

)

(170,183

)

Real estate

(2,225

)

(2,475

)

(7,108

)

(7,408

)

Depreciation and amortization

(5,704

)

(5,829

)

(16,870

)

(16,705

)

General and administrative

(5,908

)

(6,489

)

(18,426

)

(21,250

)

Total costs and expenses

(67,546

)

(69,722

)

(200,677

)

(215,546

)

Operating income

2,910

4,539

7,425

18,849

Interest expense, net

(1,871

)

(1,748

)

(5,924

)

(5,132

)

Gain (loss) on sale of assets

(1

)

—

(1

)

—

Other income (expense)

141

(130

)

190

(273

)

Income (loss) before income tax expense

and equity earnings of unconsolidated joint ventures

1,179

2,661

1,690

13,444

Equity earnings of unconsolidated joint

ventures

220

80

581

667

Income (loss) before income

taxes

1,399

2,741

2,271

14,111

Income tax benefit (expense)

(547

)

(1,482

)

(1,159

)

(4,618

)

Net income (loss)

$

852

$

1,259

$

1,112

$

9,493

Less: net income (loss) attributable to

noncontrolling interests

(50

)

(38

)

(103

)

88

Net income (loss) attributable to

Reading International, Inc. common shareholders

$

902

$

1,297

$

1,215

$

9,405

Basic earnings (loss) per share

attributable to Reading International, Inc. shareholders

$

0.04

$

0.06

$

0.05

$

0.41

Diluted earnings (loss) per share

attributable to Reading International, Inc. shareholders

$

0.04

$

0.06

$

0.05

$

0.41

Weighted average number of shares

outstanding–basic

22,546,827

23,006,040

22,791,530

22,988,227

Weighted average number of shares

outstanding–diluted

22,688,230

23,197,924

22,952,838

23,185,021

Reading International, Inc. and

Subsidiaries

Consolidated Balance Sheets

(U.S. dollars in thousands, except share

information)

September 30,

December 31,

2019

2018

ASSETS

(unaudited)

Current Assets:

Cash and cash equivalents

$

8,708

$

13,127

Receivables

4,363

8,045

Inventory

1,195

1,419

Prepaid and other current assets

10,831

7,667

Total current assets

25,097

30,258

Operating property, net

248,100

257,667

Operating lease right-of-use assets

216,963

—

Investment and development property,

net

107,292

86,804

Investment in unconsolidated joint

ventures

4,721

5,121

Goodwill

19,913

19,445

Intangible assets, net

3,607

7,369

Deferred tax asset, net

25,959

26,235

Other assets

6,164

6,129

Total assets

$

657,816

$

439,028

LIABILITIES AND STOCKHOLDERS'

EQUITY

Current Liabilities:

Accounts payable and accrued

liabilities

$

24,318

$

26,154

Film rent payable

6,430

8,661

Debt - current portion

34,374

30,393

Derivative financial instruments - current

portion

105

41

Taxes payable - current

611

1,710

Deferred current revenue

6,406

9,264

Operating lease liabilities - current

portion

19,579

—

Other current liabilities

9,339

9,305

Total current liabilities

101,162

85,528

Debt - long-term portion

131,681

106,286

Derivative financial instruments -

non-current portion

291

145

Subordinated debt, net

26,255

26,061

Noncurrent tax liabilities

11,647

11,530

Operating lease liabilities - non-current

portion

210,737

—

Other liabilities

12,330

28,931

Total liabilities

494,103

258,481

Commitments and contingencies

Stockholders’ equity:

Class A non-voting common stock, par value

$0.01, 100,000,000 shares authorized,

32,963,489 issued and 20,404,573

outstanding at September 30, 2019 and

33,112,337 issued and 21,194,748

outstanding at December 31, 2018

231

232

Class B voting common stock, par value

$0.01, 20,000,000 shares authorized and

1,680,590 issued and outstanding at

September 30, 2019 and December 31, 2018

17

17

Nonvoting preferred stock, par value

$0.01, 12,000 shares authorized and no issued

or outstanding shares at September 30,

2019 and December 31, 2018

—

—

Additional paid-in capital

148,236

147,452

Retained earnings

48,859

47,616

Treasury shares

(36,541

)

(25,222)

Accumulated other comprehensive income

(1,288

)

6,115

Total Reading International, Inc.

stockholders’ equity

159,514

176,210

Noncontrolling interests

4,199

4,337

Total stockholders’ equity

163,713

180,547

Total liabilities and stockholders’

equity

$

657,816

$

439,028

View source

version on businesswire.com: https://www.businesswire.com/news/home/20191113005183/en/

Gilbert Avanes, Chief Financial Officer Andrzej Matyczynski,

Executive Vice President for Global Operations Reading

International, Inc. (213) 235-2240

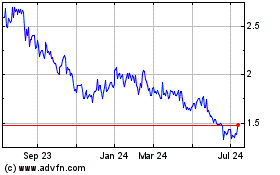

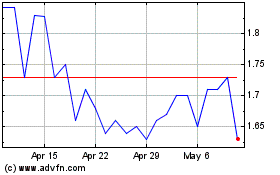

Reading (NASDAQ:RDI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Reading (NASDAQ:RDI)

Historical Stock Chart

From Apr 2023 to Apr 2024