Statement of Changes in Beneficial Ownership (4)

September 15 2021 - 5:24PM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

BVF PARTNERS L P/IL |

2. Issuer Name and Ticker or Trading Symbol

Rain Therapeutics Inc.

[

RAIN

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

__X__ Director __X__ 10% Owner

_____ Officer (give title below) __X__ Other (specify below)

See Remarks |

|

(Last)

(First)

(Middle)

44 MONTGOMERY STREET, 40TH FLOOR |

3. Date of Earliest Transaction

(MM/DD/YYYY)

9/13/2021 |

|

(Street)

SAN FRANCISCO, CA 94104

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

___ Form filed by One Reporting Person

_

X

_ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

| Common Stock, $0.001 par value (1) | 9/13/2021 | | P | | 213246 | A | $16.49 | 1473119 | D (2) | |

| Non-Voting Common Stock, $0.001 par value (1)(5) | | | | | | | | 1900815 | D (2) | |

| Common Stock, $0.001 par value (1) | 9/13/2021 | | P | | 158511 | A | $16.49 | 1076314 | D (3) | |

| Non-Voting Common Stock, $0.001 par value (1)(5) | | | | | | | | 1390756 | D (3) | |

| Common Stock, $0.001 par value (1) | 9/13/2021 | | P | | 20512 | A | $16.49 | 169992 | D (4) | |

| Non-Voting Common Stock, $0.001 par value (1)(5) | | | | | | | | 286691 | D (4) | |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Explanation of Responses: |

| (1) | This Form 4 is filed jointly by Biotechnology Value Fund, L.P. ("BVF"), Biotechnology Value Fund II, L.P. ("BVF2"), Biotechnology Value Trading Fund OS LP ("Trading Fund OS"), BVF Partners OS Ltd. ("Partners OS"), BVF I GP LLC ("BVF GP"), BVF II GP LLC ("BVF2 GP"), BVF GP Holdings LLC ("BVF GPH"), BVF Partners L.P. ("Partners"), BVF Inc. and Mark N. Lampert (collectively, the "Reporting Persons"). Each of the Reporting Persons is a member of a Section 13(d) group. Each of the Reporting Persons disclaims beneficial ownership of the securities reported herein except to the extent of his or its pecuniary interest therein. |

| (2) | Securities owned directly by BVF. As the general partner of BVF, BVF GP may be deemed to beneficially own the securities owned directly by BVF. As the sole member of BVF GP, BVF GPH may be deemed to beneficially own securities owned directly by BVF. As the investment manager of BVF, Partners may be deemed to beneficially own the securities owned directly by BVF. As the investment adviser and general partner of Partners, BVF Inc. may be deemed to beneficially own the securities owned directly by BVF. As a director and officer of BVF Inc., Mr. Lampert may be deemed to beneficially own the securities owned directly by BVF. |

| (3) | Securities owned directly by BVF2. As the general partner of BVF2, BVF2 GP may be deemed to beneficially own the securities owned directly by BVF2. As the sole member of BVF2 GP, BVF GPH may be deemed to beneficially own securities owned directly by BVF2. As the investment manager of BVF2, Partners may be deemed to beneficially own the securities owned directly by BVF2. As the investment adviser and general partner of Partners, BVF Inc. may be deemed to beneficially own the securities owned directly by BVF2. As a director and officer of BVF Inc., Mr. Lampert may be deemed to beneficially own the securities owned directly by BVF2. |

| (4) | Securities owned directly by Trading Fund OS. As the general partner of Trading Fund OS, Partners OS may be deemed to beneficially own the securities owned directly by Trading Fund OS. As the investment manager of Trading Fund OS and the sole member of Partners OS, Partners may be deemed to beneficially own the securities owned directly by Trading Fund OS. As the investment adviser and general partner of Partners, BVF Inc. may be deemed to beneficially own the securities owned directly by Trading Fund OS. As a director and officer of BVF Inc., Mr. Lampert may be deemed to beneficially own the securities owned directly by Trading Fund OS. |

| (5) | Each share of Non-Voting Common Stock may be converted at any time into one share of Common Stock at the option of its holder, subject to the beneficial ownership limitations provided for in the Issuer's amended and restated certificate of incorporation. Each share of Non-Voting Common Stock is convertible into 1 share of Common Stock. The Non-Voting Common Stock may not be converted if, after such conversion, the Reporting Persons would beneficially own, as determined in accordance with Section 13(d) of the Securities Exchange Act of 1934, as amended, more than 9.99% of the shares of Common Stock outstanding immediately after giving effect to such conversion. |

Remarks:

For purposes of Section 16 of the Securities Exchange Act of 1934, as amended, Partners may be deemed to be a director by deputization of the Issuer due to a member of Partners, Gorjan Hrustanovic, serving on the Board of Directors of the Issuer, and his agreement to transfer the economic benefit, if any, received upon the sale of any shares issuable upon exercise of any options to Partners. As of the date hereof, Dr. Hrustanovic does not beneficially own any options or Shares. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

BVF PARTNERS L P/IL

44 MONTGOMERY STREET

40TH FLOOR

SAN FRANCISCO, CA 94104 | X | X |

| See Remarks |

BIOTECHNOLOGY VALUE FUND L P

44 MONTGOMERY STREET

40TH FLOOR

SAN FRANCISCO, CA 94104 |

|

|

| See Explanation of Responses |

BVF I GP LLC

44 MONTGOMERY ST., 40TH FLOOR

SAN FRANCISCO, CA 94104 |

|

|

| See Explanation of Responses |

BIOTECHNOLOGY VALUE FUND II LP

44 MONTGOMERY STREET

40TH FLOOR

SAN FRANCISCO, CA 94104 |

|

|

| See Explanation of Responses |

BVF II GP LLC

44 MONTGOMERY ST., 40TH FLOOR

SAN FRANCISCO, CA 94104 |

|

|

| See Explanation of Responses |

Biotechnology Value Trading Fund OS LP

P.O. BOX 309 UGLAND HOUSE

GRAND CAYMAN, E9 KY1-1104 |

|

|

| See Explanation of Responses |

BVF Partners OS Ltd.

P.O. BOX 309 UGLAND HOUSE

GRAND CAYMAN, E9 KY1-1104 |

|

|

| See Explanation of Responses |

BVF GP HOLDINGS LLC

44 MONTGOMERY ST., 40TH FLOOR

SAN FRANCISCO, CA 94104 |

| X |

|

|

BVF INC/IL

44 MONTGOMERY STREET

40TH FLOOR

SAN FRANCISCO, CA 94104 |

| X |

|

|

LAMPERT MARK N

44 MONTGOMERY STREET

40TH FLOOR

SAN FRANCISCO, CA 94104 |

| X |

|

|

Signatures

|

| BVF Partners L.P., By: BVF Inc., its general partner, By: /s/ Mark N. Lampert, President | | 9/15/2021 |

| **Signature of Reporting Person | Date |

| Biotechnology Value Fund, L.P., By: BVF Partners L.P., its investment manager, By: BVF Inc., its general partner, By: /s/ Mark N. Lampert, President | | 9/15/2021 |

| **Signature of Reporting Person | Date |

| BVF I GP LLC, By: BVF GP HOLDINGS LLC, its sole member, By: /s/ Mark N. Lampert, Chief Executive Officer | | 9/15/2021 |

| **Signature of Reporting Person | Date |

| Biotechnology Value Fund II, L.P., By: BVF Partners L.P., its investment manager, By: BVF Inc., its general partner, By: /s/ Mark N. Lampert, President | | 9/15/2021 |

| **Signature of Reporting Person | Date |

| BVF II GP LLC, By: BVF GP HOLDINGS LLC, its sole member, By: /s/ Mark N. Lampert, Chief Executive Officer | | 9/15/2021 |

| **Signature of Reporting Person | Date |

| BVF Partners OS Ltd., By: BVF Partners L.P., its sole member, By: BVF Inc., its general partner, By: /s/ Mark N. Lampert, President | | 9/15/2021 |

| **Signature of Reporting Person | Date |

| Biotechnology Value Trading Fund OS LP, By: BVF Partners L.P., its investment manager, BVF Inc., its general partner, By: /s/ Mark N. Lampert, President | | 9/15/2021 |

| **Signature of Reporting Person | Date |

| BVF GP Holdings LLC, By: /s/ Mark N. Lampert, Chief Executive Officer | | 9/15/2021 |

| **Signature of Reporting Person | Date |

| BVF Inc., By: /s/ Mark N. Lampert, President | | 9/15/2021 |

| **Signature of Reporting Person | Date |

| /s/ Mark N. Lampert | | 9/15/2021 |

| **Signature of Reporting Person | Date |

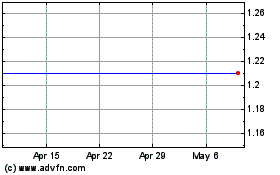

Rain Oncology (NASDAQ:RAIN)

Historical Stock Chart

From Mar 2024 to Apr 2024

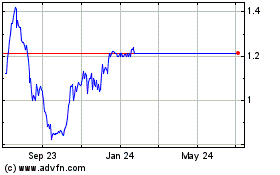

Rain Oncology (NASDAQ:RAIN)

Historical Stock Chart

From Apr 2023 to Apr 2024