Current Report Filing (8-k)

March 02 2020 - 5:26PM

Edgar (US Regulatory)

0001590560

false

00-0000000

0001590560

2020-03-01

2020-03-02

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

March 2, 2020

uniQure N.V.

(Exact Name of Registrant as Specified in

Charter)

|

The Netherlands

|

|

001-36294

|

|

N/A

|

(State or Other

Jurisdiction of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

Paasheuvelweg 25a,

1105 BP Amsterdam, The Netherlands

|

|

N/A

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including

area code: +31-20-566-7394

(Former Name or Former Address, if Changed

Since Last Report)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(see General Instruction A.2. below):

¨ Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material

pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class:

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered:

|

|

Ordinary Shares, par value €0.05 per share

|

|

QURE

|

|

The Nasdaq Global Select Market

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

|

|

Item 1.01

|

Entry Into a Material Definitive Agreement

|

On March 2, 2020, uniQure N.V. (the “Company”)

entered into a sales agreement (the “Sales Agreement”) with SVB Leerink LLC (“SVB Leerink”) with respect

to an at the market offering program, under which the Company may, from time to time in its sole discretion, offer and sell to

or through SVB Leerink, acting as agent, its ordinary shares, nominal value €0.05 per share, having an aggregate offering

price of up to $150,000,000 (the “Placement Shares”). Any Placement Shares to be offered and sold under the Sales Agreement

will be issued and sold pursuant to the Company’s previously filed and currently effective registration statement on Form

S-3 (File No. 333-225636) (the “Registration Statement”).

SVB Leerink may sell the Placement Shares

by any method permitted by law deemed to be an “at the market” offering as defined in Rule 415 of the Securities

Act of 1933, as amended, including, without limitation, sales made directly on or through The Nasdaq Global Select Market or any

other trading market for the Company’s ordinary shares in the United States, or sales to or through a market maker other

than on an exchange. SVB Leerink will use commercially reasonable efforts to sell the Placement Shares from

time to time, based upon instructions from the Company (including any price, time or size limits or other customary parameters

or conditions the Company may impose). SVB Leerink shall not purchase any Placement Shares on a principal basis pursuant to the

Sales Agreement, except as may otherwise be agreed in a separate written agreement.

The Company will pay SVB Leerink a commission

of 3% of the gross sales proceeds of any Placement Shares sold through SVB Leerink, acting as agent, under the Sales Agreement.

The Company is not obligated to make any

sales of Placement Shares under the Agreement. The offering of Placement Shares pursuant to the Sales Agreement will terminate

upon the earlier of (i) the sale of all Placement Shares subject to the Sales Agreement, or (ii) termination of the Sales

Agreement in accordance with its terms.

The Sales Agreement contains representations,

warranties and covenants that are customary for transactions of this type. In addition, the Company has agreed to indemnify SVB

Leerink against certain liabilities, including liabilities under the Securities Act.

The foregoing description of the Sales Agreement

is not complete and is qualified in its entirety by reference to the full text of the Sales Agreement, a copy of which is filed

herewith as Exhibit 1.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The legal opinion of Rutgers Posch Visée

Endedijk N.V. as to the legality of the Placement Shares is being filed as Exhibit 5.1 to this Current Report on Form 8-K.

This Current Report on Form 8-K shall

not constitute an offer to sell or the solicitation of an offer to buy the securities discussed herein, nor shall there be any

offer, solicitation, or sale of the securities in any state in which such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such state.

|

|

Item 9.01

|

Financial Statements and Exhibits

|

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly

authorized.

|

|

UNIQURE N.V.

|

|

|

|

|

|

|

|

|

Date: March 2, 2020

|

By:

|

/s/ MATTHEW KAPUSTA

|

|

|

|

Name:

|

Matthew Kapusta

|

|

|

|

Title:

|

Chief Executive Officer

|

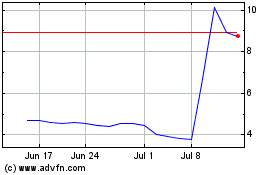

uniQure NV (NASDAQ:QURE)

Historical Stock Chart

From Mar 2024 to Apr 2024

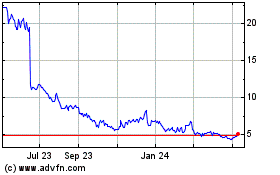

uniQure NV (NASDAQ:QURE)

Historical Stock Chart

From Apr 2023 to Apr 2024