SPECIAL CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement and the accompanying prospectus, including the documents that we incorporate by reference herein and therein, contain

"forward-looking statements" within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act.

Forward-looking statements are based on our current expectations of future events and many of these statements can be identified using terminology such as "believes," "expects," "anticipates,"

"plans," "may," "will," "projects," "continues," "estimates," "potential," "opportunity" and similar expressions.

Forward-looking

statements are only predictions based on management's current views and assumptions and involve risks and uncertainties, and actual results could differ materially from

those projected or implied. The most significant factors known to us that could materially adversely affect our business, operations, industry, financial position or future financial performance

include those discussed in this

prospectus supplement under the heading "Risk Factors" and elsewhere in this prospectus supplement, as well as other factors which may be identified from time to time in our other filings with the

Securities and Exchange Commission, or the SEC, including our most recent Quarterly Report on Form 10-Q filed with the SEC on July 29, 2019, or in the documents where such

forward-looking statements appear. You should carefully consider that information before you make an investment decision.

You

should not place undue reliance on these statements, which speak only as of the date that they were made. Our actual results or experience could differ significantly from those

anticipated in the forward-looking statements and from historical results, due to the risks and uncertainties described in this prospectus supplement and in our Annual Report on Form 10-K for

the year ended December 31, 2018, including in "Part I, Item 1A. Risk Factors," as well as others that we may consider immaterial or do not anticipate at this time. We do not

undertake any obligation to release publicly any revisions to these forward-looking statements after the date of this prospectus supplement to reflect later events or circumstances or to reflect the

occurrence of unanticipated events. All forward-looking statements attributable to us are expressly qualified in their entirety by these cautionary statements.

In

addition, with respect to all our forward-looking statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation

Reform Act of 1995.

S-iv

Table of Contents

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights selected information contained elsewhere or incorporated by reference in this prospectus

supplement and the accompanying prospectus. This summary does not contain all the information you should consider before investing in our ordinary shares. You should read and consider carefully the

more detailed information in this prospectus supplement and the accompanying prospectus, including the factors described under the heading "Risk Factors" in this prospectus supplement and the

financial and other information incorporated by reference in this prospectus supplement and the accompanying prospectus, as well as the information included in any free writing prospectus that we have

authorized for use in connection with this offering, before making an investment decision.

Overview

We are a leader in the field of gene therapy, seeking to develop single treatments with potentially curative results for patients suffering from

genetic and other devastating diseases. We are advancing a focused pipeline of innovative gene therapies. We have established clinical proof-of-concept in our lead indication, hemophilia B, and

achieved preclinical proof-of-concept in Huntington's disease. We believe our validated technology platform and manufacturing capabilities provide us distinct competitive advantages, including the

potential to reduce development risk, cost and time to market. We produce our adeno-associated virus, or AAV, based gene therapies in our own facilities with a proprietary, commercial-scale, current

good manufacturing practices compliant, manufacturing process. We believe our Lexington, Massachusetts-based facility is one of the world's leading, most versatile, gene therapy manufacturing

facilities.

Business Developments

Below is a summary of our recent significant business developments:

Hemophilia B program (AMT-061)

Etranacogene dezaparvovec, which we refer to as AMT-061 or EtranaDez, is our lead gene therapy candidate, and includes an AAV5 vector

incorporating the Factor IX-Padua variant for the treatment of patients with severe and moderately severe hemophilia B. In September 2019, we achieved our planned enrollment of 56 patients in our

Phase III HOPE-B pivotal trial of AMT-061, and we expect that we will over-enroll up to six additional patients before the end of September. AMT-061 has been granted Breakthrough Therapy

Designation by the U.S. Food and Drug Administration, or FDA, and access to the PRIME initiative by the European Medicines Agency, or EMA. We expect to receive topline data from the HOPE-B pivotal

trial in 2020 and to submit a Biologics License Application, or BLA, to the FDA in 2021.

In

February 2019, we announced the dosing of the first patient in our Phase III HOPE-B hemophilia B pivotal trial. The trial is a multinational, multi-center, open-label,

single-arm trial to evaluate the safety and efficacy of AMT-061. After the six-month lead-in period designed to establish a baseline control, patients will receive a single intravenous administration

of AMT-061. The primary endpoint of the trial will be based on the Factor IX, or FIX, activity level achieved following the administration of AMT-061, and the secondary endpoints will measure

annualized FIX replacement therapy usage, annualized bleed rates and safety. Patients enrolled in the HOPE-B trial will be tested for the presence of pre-existing neutralizing antibodies to AAV5 but

will not be excluded from the trial based on their titers.

In

February, May and July 2019, we presented updated data from our Phase IIb dose-confirmation trial of AMT-061. The Phase IIb trial is an open-label, single-dose,

single-arm, multi-center trial being conducted in the United States. The objective of the study was to evaluate the safety and tolerability of AMT-061 and confirm the dose for the HOPE-B trial

based on FIX activity at six weeks after

S-1

Table of Contents

administration.

Three patients with severe hemophilia were enrolled in this trial and received a single intravenous infusion of 2x1013 gc/kg.

Data

from the Phase IIb trial of AMT-061 show that all three patients experienced increasing and sustained FIX levels after a one-time administration of AMT-061. Mean FIX activity

was 45% of normal at 36 weeks of follow-up, exceeding threshold FIX levels generally considered sufficient to significantly reduce the risk of bleeding events. Specifically, the first patient

achieved FIX activity of 54% of normal, the second patient achieved FIX activity of 30% of normal, and the third patient achieved FIX activity of 51% of normal. Through 36 weeks of follow-up,

no patient experienced a material loss of FIX activity, reported any bleeding events or required any infusions of FIX replacement therapy for bleeds. One patient underwent hip surgery due to a

pre-existing condition and was treated perioperatively with short-acting factor replacement. This was reported by the investigator as a serious adverse event unrelated to AMT-061.

In

July 2019, we also presented three-and-a-half-year follow-up data related to our first-generation hemophilia B program, AMT-060, which incorporated a wild-type FIX gene. All 10

patients enrolled in the Phase I/II trial continue to show long-term meaningful clinical impact, including sustained increases in FIX activity and improvements in their disease state as

measured by reduced usage of FIX replacement therapy and decreased bleeding frequency. At up to 3.5 years of follow-up, AMT-060 continues to be safe and well-tolerated, with no new serious

adverse events and no development of inhibitors since the last reported data.

All

five patients in the second dose cohort of 2x1013 gc/kg continue to be free of routine FIX replacement therapy at up to three years after treatment. During the last

12 months of observation, the mean annualized bleeding rate was 0.7 bleeds, representing an 83% reduction compared with the year prior to treatment. During this same period, the usage of FIX

replacement therapy declined 96% compared with the year prior to treatment. Steady state mean yearly FIX activity at three years was 7.9%, compared with 7.1% in the first year and 8.4% in the second

year.

Huntington's disease program (AMT-130)

AMT-130 is our gene therapy candidate targeting Huntington's disease and utilizes an AAV vector carrying a microRNA, or miRNA, specifically

designed to silence the huntingtin gene. AMT-130 has received Orphan Drug Designation from the FDA and Orphan Medicinal Product Designation from the EMA.

In

January 2019, our Investigational New Drug, or IND, application for AMT-130 was cleared by the FDA, thereby enabling us to initiate our planned Phase I/II clinical trial. The

Phase I/II trial is expected

to be a randomized, double-arm, blinded, imitation surgery-controlled trial conducted at three surgical sites in the United States, and at least two non-surgical sites. The primary objective of

the trial is to evaluate the safety, tolerability and efficacy of AMT-130 at two doses. We expect to initiate dosing in our planned Phase I/II clinical trial before the end of 2019, with

preliminary biomarker data on initial patients expected in 2020.

Also

in January 2019, the U.S. Patent and Trademark Office issued U.S. Patent 10,174,321 and in May 2019 the European Patent Office issued EP 3237618, both with granted claims that cover

the RNA constructs specifically designed to target exon1 and the embedding of these Huntington's disease RNA sequences into the miR451 scaffold, which we exclusively license from Cold Spring Harbor

Laboratory. The claims also cover certain expression cassettes comprising the RNA constructs and the use of gene therapy vectors including AAV vectors encompassing the described expression cassettes.

In

February 2019, we presented new preclinical data at the 14th Annual CHDI Huntington's disease Therapeutics Conference that illustrate the therapeutic potential of AMT-130 in

restoring

S-2

Table of Contents

function

of damaged brain cells in Huntington's disease and providing a safe and sustained reduction of mutant huntingtin protein.

In

April 2019, we announced that the FDA had granted Fast Track Designation for AMT-130.

Hemophilia A program (AMT-180)

In May 2019, we presented preclinical proof-of-concept data at the American Society of Gene and Cell Therapy, or ASGCT, Annual Meeting,

demonstrating that our gene therapy candidate AMT-180 for hemophilia A induced clinically relevant thrombin activation, and up to 29% of Factor VIII-independent activity, in FVIII-depleted

human plasma. The studies further demonstrated that a single intravenous administration of AMT-180 resulted in sustained, dose-dependent hemostatic effect as measured by one-stage clotting assay, and

that AMT-180 shows activation kinetics similar to native FIX and is not hyperactive. A pilot study in non-human primates demonstrated that administration of AMT-180 resulted in sufficient FIX protein

expression that translates to clinically relevant Factor VIII-independent activity in humans. No elevation of coagulation activation markers or signs of thrombi formation were observed. We

expect to submit an IND to the FDA for AMT-180 in 2020.

Spinocerebellar ataxia type 3 program (AMT-150)

At the 2019 American Academy of Neurology Annual Meeting, we presented preclinical data on AMT-150 for the treatment of spinocerebellar ataxia

type 3, or SCA3. The data featured at the conference demonstrated mechanistic proof-of-concept of the non-allele-specific ataxin-3 protein-silencing approach by using artificial miRNA

candidates engineered to target the ataxin-3 gene in a SCA3 knock-in mouse model. The proof-of-concept study demonstrated that a single AMT-150 injection in the cerebrospinal fluid resulted in strong

AAV transduction and significant mutant ataxin-3 lowering at the primary sites of disease neuropathology, the cerebellum (up to 53%) and the brainstem (up to 65%). We expect to initiate an

IND-enabling study of AMT-150 for the treatment of SCA3 in 2019.

Amyotrophic lateral sclerosis (ALS) and frontotemporal dementia (FTD) programs (AMT-160)

In February 2019, we published results from preclinical studies showing the potential for significant silencing, or knockdown, of the mutated

gene most commonly known to lead to onset of amyotrophic lateral sclerosis and frontotemporal dementia, two devastating neurodegenerative diseases. The proof-of-concept studies utilized our

proprietary, next-generation gene-silencing platform miQURE™.

Fabry program (AMT-190)

We also presented at the ASGCT conference preclinical data on AMT-190, our novel AAV5 gene therapy candidate for Fabry disease that comprises a

recombinant AAV5 vector incorporating a proprietary, exclusively licensed, modified NAGA (ModNAGA) variant. AMT-190 provides expression of ModNAGA, which shows a high structural resemblance to

á-gal. We believe that this approach may have several advantages over á-gal therapies, including higher stability in blood, better biodistribution in the target organs,

secondary toxic metabolite reduction and improved cross-correction of neighboring cells. ModNAGA might also be effective in the presence of á-gal antibodies. Data from in vitro and in

vivo studies show that AMT-190 has the potential to become a one-time treatment option that could be an improvement upon the enzyme replacement standard of care with more efficient uptake in the

kidney and heart and an improved immunogenicity profile.

We

anticipate targeting one new IND submission for our additional product candidates each year.

S-3

Table of Contents

BMS collaboration

In May 2015, we entered into a collaboration and license agreement and various related agreements with Bristol-Myers Squibb Company, or BMS,

that provided BMS with exclusive access to our gene therapy technology platform for the research, development and commercialization of therapeutics aimed at multiple targets in cardiovascular and

other diseases. The collaboration agreement provides that we may collaborate on up to ten collaboration targets in total. BMS has currently designated four collaboration targets. We agreed to certain

restrictions on our ability to work

independently of the collaboration, either directly or indirectly through any affiliate or third party, on certain programs that would be competitive with the collaboration programs. For any

collaboration targets that are advanced to clinical development, we would be responsible for manufacturing of clinical and commercial supplies. BMS has been reimbursing us for our research and

development costs in support of the collaboration during the initial research term and would lead development, regulatory and commercial activities for any collaboration targets that may be advanced.

During

the initial four-year research term, we supported BMS in discovery, non-clinical, analytical and process development efforts in respect of the designated collaboration targets. In

February 2019, BMS requested a one-year extension of the research term. In April 2019, following an assessment of the progress of this collaboration and our expanding proprietary programs, we notified

BMS that we did not intend to agree to an extension of the research term, but rather we preferred to restructure the collaboration to reduce or eliminate certain of our obligations under it.

Accordingly, the research term under the collaboration terminated on May 21, 2019, and we are currently in discussions with BMS potentially to restructure the collaboration and license

agreement and other related agreements following the expiration of the research term. Although such discussions are ongoing and may not result in any amendment to these arrangements, we believe that

the final resolution of these discussions may result in material changes to our collaboration with BMS. See "Risk Factors—Our ongoing discussions with BMS to restructure the terms of our

collaboration may not be successful, or may result in material changes to these arrangements, including less advantageous economic or other terms for us".

Our Patent Portfolio Related to Development Programs

Hemophilia B program (AMT-061)

We own a patent family, including patents and patent applications, directed to the use of the Padua mutation in human Factor IX, or hFIX,

for gene therapy in AMT-061. A patent cooperation treaty application was filed on September 15, 2009, and patents have been issued in the United States, Europe, and Canada. Further

applications are pending in the United States, Europe, and Hong Kong. The issued patents include claims directed to FIX protein with a leucine at the R338 position of the protein

sequence, nucleic acid sequences coding for this protein, and therapeutic applications, including gene therapy. The standard 20-year patent term of patents in this family will expire in 2029.

On

June 13, 2018, we were granted European Patent 2337849 directed to a FIX polypeptide protein. The opposition period with respect to such patent expired on March 13,

2019, by which time five parties had filed an opposition. On July 25, 2019, we submitted responses to such oppositions with the European Patent Office, or EPO, and expect that oral proceeding

with respect to such oppositions will take place in the first half of 2020. In addition, on May 15, 2019, a divisional European patent application in the FIX-Padua family, EP 3252157, was

refused. We intend to file a notice of appeal and a subsequent grounds of appeal with respect to such refusal in the third and fourth quarters of 2019, respectively. We are also currently

pursuing a European divisional patent application that was filed on May 14, 2019.

On

July 31, 2019 we received a notice of allowance from the U.S. Patent and Trademark Office for U.S. application number 15/989,665, a third U.S. family member in the

FIX-Padua patent family. The

S-4

Table of Contents

claims

as allowed cover any AAV comprising a nucleic acid encoding a FIX-Padua protein, and promoter sequences, transcription termination and control elements. The claims also cover FIX-Padua variants

with at least 70% sequence identity to FIX-R338L.

Huntington's disease program (AMT-130)

We own a patent family directed to gene therapy treatment of Huntington's disease within AMT-130. This family includes an issued patent in the

United States and pending patent applications in the United States, Europe and other jurisdictions. The standard 20-year term of patents in this family will expire in 2035.

Hemophilia A program (AMT-180) and spinocerebellar ataxia type 3 program (AMT-150)

We own a patent family directed to AAV-based gene therapies for treatment of hemophilia A and SCA3. This family includes a provisional

application in the United States, which was filed in 2018. The standard 20-year term of patents in these families, if filed and issued, will expire in 2039.

Corporate Information

uniQure was incorporated on January 9, 2012 as a private company with limited liability (besloten vennootschap

met beperkte aansprakelijkheid) under the laws of the Netherlands. Our business was founded in 1998 and was initially operated through our predecessor company, Amsterdam

Molecular Therapeutics (AMT) Holding N.V, or AMT. In 2012, AMT undertook a corporate reorganization, pursuant to which uniQure B.V. acquired the entire business and assets of AMT and completed

a share-for-share exchange with the shareholders of AMT. Effective February 10, 2014, in connection with our initial public offering, we converted into a public company with limited liability

(naamloze vennootschap) and changed our legal name from uniQure B.V. to uniQure N.V.

Our

Company is registered in the trade register of the Chamber of Commerce (Kamer van Koophandel) in Amsterdam, the Netherlands under

number 54385229. Our headquarters are in Amsterdam, the Netherlands, and our registered office is located at Paasheuvelweg 25a, Amsterdam 1105 BP, the Netherlands and our

telephone number is +31 20 240 6000.

Our

website address is www.uniqure.com. The information contained in, and that can be accessed through, our website is not incorporated into and does not form a part of this

prospectus supplement, the accompanying prospectus or any of the documents incorporated by reference herein or therein.

S-5

Table of Contents

THE OFFERING

|

|

|

|

|

Ordinary shares offered by us

|

|

$200,000,000 of ordinary shares.

|

|

Option to purchase additional ordinary shares

|

|

We have granted the underwriters an option for a period of up to 30 days from the date of this prospectus supplement to

purchase up to an additional $30,000,000 of ordinary shares at the public offering price less the underwriting discounts and commissions.

|

|

Ordinary shares to be outstanding immediately after this offering

|

|

41,452,550 ordinary shares (41,994,458 ordinary shares assuming the underwriters exercise in full their option to purchase

additional shares), based on the assumed public offering price of $55.36, which was the last reported sale price of our ordinary shares on The Nasdaq Global Select Market on September 3, 2019.

|

|

Use of proceeds

|

|

We estimate that the net proceeds to us from this offering, based on the assumed public offering price of $55.36, which was

the last reported sale price of our ordinary shares on The Nasdaq Global Select Market on September 3, 2019, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us, will be approximately

$187.6 million, or $215.8 million if the underwriters exercise their option to purchase additional shares from us in full. We intend to use the net proceeds from this offering to complete the clinical development of AMT-061, to fund the

continued clinical development of AMT-130, including our planned Phase I/II clinical trial, to fund further development of our other pipeline candidates and for working capital and general corporate purposes. See "Use of Proceeds".

|

|

Risk factors

|

|

An investment in our ordinary shares involves a high degree of risk. See the information contained in or incorporated by

reference under "Risk Factors" on page S-8 of this prospectus supplement, Item 1A of our Quarterly Report on Form 10-Q for the quarter ended June 30, 2019, and under similar headings in the other documents that are incorporated by

reference herein and therein, as well as the other information included in or incorporated by reference in this prospectus supplement and the accompanying prospectus.

|

|

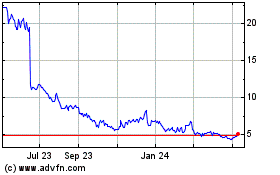

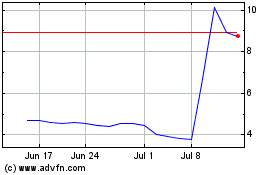

Market for the ordinary shares

|

|

Our ordinary shares are quoted and traded on The Nasdaq Global Select Market under the symbol "QURE."

|

The

number of ordinary shares expected to be outstanding after this offering and, unless otherwise indicated, the information in this prospectus supplement are based on 37,839,833

ordinary shares outstanding as of June 30, 2019, and excludes:

-

•

-

2,957,756 ordinary shares issuable upon the exercise of options outstanding as of June 30, 2019 at a weighted average exercise price of

$19.11 per ordinary share;

S-6

Table of Contents

-

•

-

356,392 ordinary shares issuable upon the vesting of restricted stock units outstanding as of June 30, 2019;

-

•

-

486,467 ordinary shares issuable upon the vesting of performance stock units outstanding as of June 30, 2019;

-

•

-

3,056,637 ordinary shares reserved for issuance under our 2014 Amended and Restated Share Option Plan, or the 2014 Plan as of June 30,

2019; and

-

•

-

142,539 ordinary shares reserved for issuance under our Employee Share Purchase Plan, or the ESPP, as of June 30, 2019.

Except

as otherwise indicated, we have presented the information in this prospectus supplement assuming:

-

•

-

no exercise by the underwriters in this offering of their option to purchase additional ordinary shares; and

-

•

-

no exercise or settlement of outstanding equity awards described above.

S-7

Table of Contents

RISK FACTORS

Investing in our ordinary shares involves a high degree of risk. Our business, prospects, financial condition or

operating results could be materially adversely affected by the risks identified below, as well as other risks not currently known to us or that we currently consider immaterial. The trading price of

our ordinary shares could decline due to any of these risks, and you may lose all or part of your investment. Before deciding whether to invest in our ordinary shares, you should consider carefully

the risk factors discussed below and those contained in the section entitled "Risk Factors" contained in our Quarterly Report on Form 10-Q for the quarter ended June 30, 2019, as filed

with the Securities and Exchange Commission, or SEC, which is incorporated herein by reference in its entirety, as well as any amendment or update to our risk factors reflected in subsequent filings

with the SEC. Please also read carefully the section entitled "Special Cautionary Note Regarding Forward-Looking Statements."

Management will have broad discretion as to the use of the net proceeds from this offering, and we may not

use the proceeds effectively.

Our management will have broad discretion in the application of the net proceeds from this offering and could spend the proceeds in ways that do

not improve our results of operations or enhance the value of our ordinary shares. Our failure to apply these funds effectively could have a material adverse effect on our business, delay the

development of our product candidates, and cause the price of our ordinary shares to decline.

You will experience immediate and substantial dilution in the book value per ordinary share you purchase in

this offering and may experience further dilution in the future.

The public offering price of the ordinary shares offered pursuant to this prospectus supplement is substantially higher than the net tangible

book value per ordinary share. Therefore, you will incur immediate and substantial dilution in the net tangible book value per ordinary share from the assumed public offering price per ordinary share

of $55.36, which was the last reported sale price of our ordinary shares on The Nasdaq Global Select Market on September 3, 2019. See the section titled "Dilution" on page S-15 below for

a more detailed discussion of the dilution investors in this offering will incur if they purchase ordinary shares in this offering.

You may experience future dilution as a result of future equity offerings.

In order to raise additional capital, we may in the future offer additional ordinary shares or other securities convertible into or exchangeable

for our ordinary shares at prices that may not be the same as the prices per ordinary share in this offering. We may sell ordinary shares or other securities in any other offering at a price per

ordinary share that is less than the prices per ordinary share paid by investors in this offering, and investors purchasing ordinary shares or other securities in the future could have rights superior

to existing shareholders. The price per ordinary share at which we sell additional ordinary shares, or securities convertible or exchangeable into ordinary shares, in future transactions may be higher

or lower than the prices per ordinary share paid by investors in this offering.

Sales of a substantial number of our ordinary shares by our existing shareholders in the public market could

cause our stock price to fall.

If our existing shareholders sell, or indicate an intention to sell, substantial numbers of our ordinary shares in the public market, the

trading price of our ordinary shares could decline. In addition a substantial number of ordinary shares are subject to outstanding equity awards that are or will become eligible for sale in the public

market to the extent permitted by the provisions of various

S-8

Table of Contents

vesting

schedules. If these additional ordinary shares are sold, or if it is perceived that they will be sold, in the public market, the trading price of our ordinary shares could decline.

We,

the members of our Board, our senior management team and certain of our existing shareholders have agreed that, subject to certain exceptions, during the period ending 90 days

after the date of this prospectus supplement, they will not offer, sell, contract to sell, pledge or otherwise dispose of, directly or indirectly, any of our ordinary shares or securities convertible

into or exchangeable or exercisable for any of our ordinary shares, enter into a transaction that would have the same effect, or enter into any swap, hedge or other arrangement that transfers, in

whole or in part, any of the economic consequences of ownership of our ordinary shares, whether any of these transactions are to be settled by delivery of our ordinary shares or other securities, in

cash or otherwise, or publicly disclose the intention to make any offer, sale, pledge or disposition, or to enter into any transaction, swap, hedge or other arrangement, without, in each case, the

prior written consent of Goldman Sachs & Co. LLC and SVB Leerink LLC, who may release any of the securities subject to these lock-up agreements at any time without notice.

These restrictions are subject to certain exceptions, including, among others, to sales made pursuant to a trading plan that complies with Rule 10b5-1 under the Exchange Act, existing as of the

date of this prospectus supplement, which sales may include up to 55,000 ordinary shares, in aggregate, by certain of our executive officers, including our chief executive officer, subject to certain

price and volume-based limitations. Furthermore, each of our executive officers and directors is permitted to sell up to 4,900 ordinary shares in order to cover tax liabilities resulting from the

vesting of restricted stock units during the 90-day restricted period. Exceptions to the lock-up restrictions are described in more detail in this prospectus supplement under the caption

"Underwriting."

We have in the past qualified, and may in the future qualify, as a passive foreign investment company, which

may result in adverse U.S. federal income tax consequence to U.S. holders.

Based on our average value of our gross assets, our cash and cash equivalents as well as the price of our ordinary shares, we believe we

qualified as a passive foreign investment company, or PFIC, for U.S. federal income tax purposes for 2016 but not for 2017 or 2018. As of the date of this prospectus supplement we expect that we will

not qualify as a PFIC in 2019. A corporation organized outside the United States generally will be classified as a PFIC for U.S. federal income tax purposes in any taxable year in which at least 75%

of its gross income is passive income or on average at least 50% of the gross value of its assets is attributable to assets that produce passive income or are held to produce passive income. Passive

income for this purpose generally includes dividends, interest, royalties, rents and gains from commodities and securities transactions. Our status as a PFIC in any taxable year will depend on our

assets and activities in that particular year, and because this is a factual determination made annually after the end of each taxable year, there can be no assurance that we will not qualify as a

PFIC in future taxable years. The market value of our assets may be determined in large part by reference to the market price of our ordinary shares, which is likely to fluctuate, and may fluctuate

considerably given that market prices of biotechnology companies have been especially volatile. If we were considered a PFIC for the current taxable year or any future taxable year during which a U.S.

holder holds ordinary shares, certain adverse U.S. federal income tax consequences may apply to U.S. holders and a U.S. holder would be required to file annual information returns for such year,

whether the U.S. holder disposed of any ordinary shares or received any distributions in respect of ordinary shares during such year. As discussed under "Material Dutch and U.S. Federal Income Tax

Considerations—Material U.S. Federal Income Tax Considerations", a U.S. holder may be able to make certain tax elections that would lessen the adverse impact of PFIC status; however, in

order to make such elections the U.S. holder will usually have to have been provided information about the company by us, and we do not intend to provide such information.

S-9

Table of Contents

The

U.S. federal income tax rules relating to PFICs are complex. U.S. holders are urged to consult their tax advisors with respect to the purchase, ownership and disposition of our

ordinary shares, the possible implications to them of our being treated as a PFIC (including the availability of applicable elections, and whether making any such election would be advisable in their

particular circumstances) as well as the U.S. federal, state, local and foreign tax considerations applicable to such holders in connection with the purchase, ownership and disposition of our ordinary

shares.

Our ongoing discussions with BMS to restructure the terms of our collaboration may not be successful, or may

result in material changes to these arrangements.

The research term of our collaboration and license agreement with BMS expired in May 2019, and we are currently in discussions with BMS

potentially to restructure that agreement and the other related agreements to eliminate, reduce or alter our obligations under the collaboration. Our discussions are ongoing and may or may not result

in any restructuring or changes to our collaboration. If a restructuring of our collaboration with BMS were to be concluded, we expect it would result in a termination or amendment of existing

agreements, or the execution of new agreements that collectively could include changes in the number of future collaboration targets that may be designated by BMS, the exclusivity provisions related

to collaboration targets, our obligations to provide manufacturing services for collaboration targets, as well as changes in or the elimination of our economic rights on collaboration targets,

milestone payments, and BMS's warrants to purchase shares in our company, among other potential matters. Any such restructuring, if concluded, may include additional or different provisions from those

described above, and may include economic or other terms that are less advantageous for us.

Because

the outcome of these discussions is unknown, we have not taken into account the impact of such restructuring, if any, on the timing of recognizing prepaid license revenue, or any

other potential financial metrics, in our consolidated financial statements. We will account for any potential changes if and when the agreements are restructured

S-10

Table of Contents

USE OF PROCEEDS

We estimate that the net proceeds to us from this offering, based on the assumed offering price of $55.36, which was the last reported sale

price of our ordinary shares on The Nasdaq Global Select Market on September 3, 2019, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by

us, will be approximately $187.6 million, or $215.8 million if the underwriters exercise their option to purchase additional ordinary shares from us in full.

We

intend to use the net proceeds we receive from this offering, together with our existing cash and cash equivalents, as follows:

-

•

-

to complete the clinical development of AMT-061 in hemophilia B, and to begin preparations for commercial launch, assuming marketing approval

is granted;

-

•

-

to fund the continued clinical development of AMT-130 in Huntington's disease, including completing our planned Phase I/II clinical

trial of AMT-130;

-

•

-

to fund the further development of our other preclinical product candidates focused on rare and orphan diseases; and

-

•

-

for general corporate and working capital purposes.

Based

on our current plans, we believe our cash and cash equivalents, together with the net proceeds from this offering and excluding net proceeds from any exercise of the underwriters'

option to purchase additional ordinary shares, will be sufficient to fund our operations into 2022. Our cash requirements, if any, beyond that time will depend on the timing of expenditures in

connection with the planned commercial launch of AMT-061, assuming marketing approval is granted, as well as the timing and amount of any revenues following commercial launch.

These

expected uses of the net proceeds from this offering represent our intentions based upon our present plans and business conditions. The amounts and timing of our actual

expenditures may vary significantly depending on numerous factors, including the progress of our research and development efforts, the status of and results from clinical trials, as well as any

collaborations that we may enter into with third parties for our product candidates and any unforeseen cash needs.

Pending

the use of the net proceeds from this offering, we intend to hold the net proceeds as cash.

A

$1.00 increase (decrease) in the assumed public offering price would increase (decrease) the net proceeds to us by approximately $3.4 million, assuming that the number of

ordinary shares offered by us (based on the assumed public offering price of $55.36 per ordinary share, which was the last reported sale price of our ordinary shares on The Nasdaq Global Select Market

on September 3, 2019) remains the same and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. We may also increase or decrease the

number of ordinary shares we are offering. An increase (decrease) of 1,000,000 ordinary shares in the number of ordinary shares offered by us would increase (decrease) the net proceeds to us from this

offering by approximately $52.0 million, assuming that the assumed public offering price of $55.36 per ordinary share remains the same and after deducting the estimated underwriting discounts

and commissions and estimated offering expenses payable by us.

DIVIDEND POLICY

We have never declared or paid any dividends on our ordinary shares, and we currently do not plan to declare dividends on our ordinary shares in

the foreseeable future. Under Dutch law, we may only pay dividends if our shareholders' equity exceeds the sum of the paid-up and called-up share capital plus the reserves required to be maintained by

Dutch law or by our articles of association. In addition, our Second Amended and Restated Loan and Security Agreement with Hercules Technology

S-11

Table of Contents

Growth

Capital, Inc., as amended, contains, and any other loan facilities that we may enter into may contain, restrictions on our ability, or that of our subsidiaries, to pay dividends. Subject

to such restrictions, a proposal for the payment of cash dividends in the future, if any, will be at the discretion of our board of directors, and will depend upon such factors as earnings levels,

capital requirements, contractual restrictions, our overall financial condition and any other factors deemed relevant by our board of directors.

S-12

Table of Contents

CAPITALIZATION

The following table sets forth our cash and cash equivalents and capitalization as of June 30,

2019:

-

•

-

on an actual basis; and

-

•

-

on an as adjusted basis to give effect to the issue and sale of 3,612,717 ordinary shares by us in this offering at the assumed public offering

price of $55.36, which was the last reported sale price of our ordinary shares on The Nasdaq Global Select Market on September 3, 2019, for aggregate net proceeds of $187.6 million after

deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us.

|

|

|

|

|

|

|

|

|

|

|

As of June 30, 2019

|

|

|

|

Actual

|

|

As Adjusted

|

|

|

|

($ in thousands, except

share and per

share data)

|

|

|

Cash and cash equivalents

|

|

$

|

184,095

|

|

$

|

371,715

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total debt:

|

|

|

|

|

|

|

|

|

Long-term debt(1)

|

|

|

35,784

|

|

|

35,784

|

|

|

Total debt

|

|

|

35,784

|

|

|

35,784

|

|

|

|

|

|

|

|

|

|

|

|

Shareholders' equity:

|

|

|

|

|

|

|

|

|

Ordinary shares

|

|

|

2,327

|

|

|

2,525

|

|

|

Additional paid-in-capital

|

|

|

732,924

|

|

|

920,346

|

|

|

Accumulated other comprehensive income

|

|

|

(8,518

|

)

|

|

(8,518

|

)

|

|

Accumulated deficit

|

|

|

(594,677

|

)

|

|

(594,677

|

)

|

|

|

|

|

|

|

|

|

|

|

Total shareholders' equity

|

|

|

132,056

|

|

|

319,676

|

|

|

|

|

|

|

|

|

|

|

|

Total capitalization

|

|

$

|

167,840

|

|

$

|

355,460

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-

(1)

-

Reflects

the amortized cost of our loan facility with Hercules as of June 30, 2019.

The

table above excludes:

-

•

-

2,957,756 ordinary shares issuable upon the exercise of options outstanding as of June 30, 2019 at a weighted average exercise price of

$19.11 per ordinary share;

-

•

-

356,392 ordinary shares issuable upon the vesting of restricted stock units outstanding as of June 30, 2019;

-

•

-

486,467 ordinary shares issuable upon the vesting of performance stock units outstanding as of June 30, 2019;

-

•

-

3,056,637 ordinary shares reserved for issuance under our 2014 Plan as of June 30, 2019; and

-

•

-

142,539 ordinary shares reserved for issuance under our ESPP as of June 30, 2019.

In

addition, the amounts in the table above assume no exercise by the underwriters of their option to purchase additional ordinary shares.

A

$1.00 increase (decrease) in the assumed public offering price would increase (decrease) the as adjusted amount of each of cash and cash equivalents, additional paid-in capital, total

shareholders' equity and total capitalization by approximately $3.4 million, assuming that the number of ordinary shares offered by us (based on the assumed public offering price of $55.36 per

ordinary share, which was the last reported sale price of our ordinary shares on The Nasdaq Global Select Market on September 3, 2019) remains the same and after deducting estimated

underwriting discounts and

S-13

Table of Contents

commissions

and estimated offering expenses payable by us. We may also increase or decrease the number of ordinary shares we are offering. An increase (decrease) of 1,000,000 ordinary shares in the

number of ordinary shares offered by us would increase (decrease) the as adjusted amount of each of cash and cash equivalents, additional paid-in capital, total shareholders' equity and total

capitalization by approximately $52.0 million, assuming that the assumed public offering price of $55.36 per ordinary share remains the same and after deducting the estimated underwriting

discounts and commissions and estimated offering expenses payable by us.

S-14

Table of Contents

DILUTION

If you invest in this offering, your ownership interest will be diluted to the extent of the difference between the offering price per ordinary

share and the as adjusted net tangible book value per ordinary share after giving effect to this offering. We calculate net tangible book value per ordinary share by dividing the net tangible book

value, which is tangible assets less total liabilities, by the number of our outstanding ordinary shares. Our net tangible book value as of June 30, 2019, was approximately

$98.5 million, or $2.60 per ordinary share.

After

giving effect to the sale by us of 3,612,717 ordinary shares in this offering at the assumed public offering price of $55.36 per ordinary share, which was the last reported sale

price of our ordinary shares on The Nasdaq Global Select Market on September 3, 2019, and after deducting estimated underwriting discounts and commissions and estimated offering expenses

payable by us, our adjusted net tangible book value as of June 30, 2019 would have been approximately $310.4 million, or $7.49 per ordinary share. This represents an immediate increase

in the net tangible book value of $4.89 per ordinary share to our existing shareholders and an immediate dilution in net tangible book value of $47.87 per ordinary share to new investors. The

following table illustrates this per share dilution:

|

|

|

|

|

|

|

|

|

|

Assumed public offering price per ordinary share

|

|

|

|

|

$

|

55.36

|

|

|

Net tangible book value per ordinary share as of June 30, 2019

|

|

$

|

2.60

|

|

|

|

|

|

Increase per share attributable to new investors

|

|

$

|

4.89

|

|

|

|

|

|

As adjusted net tangible book value per ordinary share as of June 30, 2019 after giving effect to this offering

|

|

|

|

|

$

|

7.49

|

|

|

|

|

|

|

|

|

|

|

|

Dilution per ordinary share to new investors purchasing ordinary shares in this offering

|

|

|

|

|

$

|

47.87

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If

the underwriters exercise their option to purchase additional ordinary shares in full at the assumed public offering price, the as adjusted net tangible book value after this offering

would be approximately $338.6 million, or $8.06 per ordinary share, representing an increase in net tangible book value per ordinary share to existing shareholders of approximately $5.46 per

ordinary share, and the dilution to new investors in this offering would be approximately $47.30 per ordinary share.

A

$1.00 increase in the assumed public offering price of $55.36 per ordinary share, the last reported sale price of our ordinary shares on The Nasdaq Global Select Market on

September 3, 2019, would increase the as adjusted net tangible book value by approximately $3.4 million, or approximately $0.08 per ordinary share, and increase the dilution per ordinary

share to new investors by approximately $0.92 per ordinary share, assuming that the number of ordinary shares offered by us remains the same and after deducting estimated underwriting discounts and

commissions and estimated offering expenses payable by us. A $1.00 decrease in the assumed public offering price of $55.36 per ordinary share, the last reported sale price of our ordinary shares on

The Nasdaq Global Select Market on September 3, 2019, would decrease the as adjusted net tangible book value by approximately $3.4 million, or approximately $0.08 per ordinary share, and

decrease the dilution per ordinary share to new investors by approximately $0.92 per ordinary share, assuming that the number of ordinary shares offered by us remains the same and after deducting

estimated underwriting discounts and commissions and estimated offering expenses payable by us. An increase of 1,000,000 ordinary shares in the number of ordinary shares offered by us would increase

the as adjusted net tangible book value by approximately $52.0 million, or $1.05 per ordinary share, and would decrease the dilution per ordinary share to new investors by $1.05 per ordinary

share, assuming that the assumed public offering price of $55.36 per ordinary share remains the same and after deducting the estimated underwriting discounts and commissions and estimated offering

expenses payable by us. A decrease of 1,000,000 ordinary shares in the number of ordinary shares offered by us would decrease the as adjusted net tangible book value by approximately

$52.0 million, or $1.10 per ordinary share, and would increase the dilution per

S-15

Table of Contents

ordinary

share to new investors by $1.10 per ordinary share, assuming that the assumed public offering price of $55.36 per ordinary share remains the same and after deducting the estimated

underwriting discounts and commissions and estimated offering expenses payable by us. The as-adjusted information discussed above is illustrative only and will adjust based on the actual public

offering price and other terms of this offering determined at pricing.

The

above discussion and table are based on 37,839,833 ordinary shares outstanding as of June 30, 2019, and excludes:

-

•

-

2,957,756 ordinary shares issuable upon the exercise of options outstanding as of June 30, 2019 at a weighted average exercise price of

$19.11 per ordinary share;

-

•

-

356,392 ordinary shares issuable upon the vesting of restricted stock units outstanding as of June 30, 2019;

-

•

-

486,467 ordinary shares issuable upon the vesting of performance stock units outstanding as of June 30, 2019;

-

•

-

3,056,637 ordinary shares reserved for issuance under our 2014 Plan as of June 30, 2019; and

-

•

-

142,539 ordinary shares reserved for issuance under our ESPP as of June 30, 2019.

To

the extent that equity awards outstanding as of June 30, 2019, have been or are exercised or settled, or other ordinary shares are issued, investors purchasing ordinary shares

in this offering could experience further dilution. In addition, we may choose to raise additional capital due to market conditions or strategic considerations, even if we believe we have sufficient

funds for our current or future operating plans. To the extent that additional capital is raised through the sale of equity or convertible debt securities, the issuance of these securities could

result in further dilution to our shareholders.

S-16

Table of Contents

MATERIAL DUTCH AND U.S. FEDERAL INCOME TAX CONSIDERATIONS

Material Dutch Tax Considerations

This summary solely addresses the principal Dutch tax consequences of the acquisition, ownership and disposal of our ordinary shares. It does

not purport to describe all the tax considerations that may be relevant to a particular holder of our ordinary shares (a "Shareholder"). Shareholders are advised to consult their own tax counsel with

respect to the tax consequences of acquiring, holding and/or disposing of our ordinary shares. Where in this summary English terms and expressions are used to refer to Dutch concepts, the meaning to

be attributed to such terms and

expressions shall be the meaning to be attributed to the equivalent Dutch concepts under Dutch tax law.

This summary does not address the tax consequences of:

-

•

-

A Shareholder who is an individual, either resident or non-resident in the Netherlands, and who has a (deemed) substantial interest

((fictief) aanmerkelijk belang) in us within the meaning of the Dutch Income Tax Act 2001

(Wet inkomstenbelasting 2001). Generally, if a person holds an interest in us, such interest forms part of a (deemed) substantial interest in us, if any

or more of the following circumstances is present:

-

1.

-

If

a Shareholder, either alone or, together with such Shareholder's partner (a statutorily defined term) owns or is deemed to own, directly or indirectly, either a

number of shares in us representing five percent or more of our total issued and outstanding capital (or the issued and outstanding capital of any class of our shares), or rights to acquire, directly

or indirectly, shares, whether or not already issued, representing five percent or more of our total issued and outstanding capital (or the issued and outstanding capital of any class of our shares),

or profit participating certificates (winstbewijzen), relating to five percent or more of our annual profit or to five percent of our liquidation

proceeds.

-

2.

-

If

the shares, profit participating certificates or rights to acquire shares in us are held or deemed to be held following the application of a non-recognition

provision.

-

3.

-

If

the partner of a Shareholder, or one of certain relatives of the Shareholder or of this partner has a substantial interest (as described under 1. and 2. above) in

us.

-

•

-

A Shareholder receiving income or realizing capital gains in their capacity as future, present or past employee

(werknemer) or member of a management board (bestuurder), or supervisory director

(commissaris); the income from which is taxable in the Netherlands.

-

•

-

Pension funds, investment institutions (fiscale beleggingsinstellingen), exempt investment

institutions (vrijgestelde beleggingsinstellingen) and other entities that are, in whole or in part, not subject to or exempt from corporate income tax

in the Netherlands, as well as entities that are exempt from corporate income tax in their country of residence, such country of residence being another state of the European Union, Norway,

Liechtenstein, Iceland or any other state with which the Netherlands have agreed to exchange information in line with international standards.

-

•

-

A Shareholder who is an individual and who is a qualifying non-resident taxpayer within the meaning of article 7.8, paragraph 6,

of the Dutch Income Tax Act 2001.

For

purposes of Dutch personal income tax and Dutch corporate income tax, ordinary shares legally owned by a third party, such as a trustee, foundation or similar entity or arrangement,

may under certain circumstances have to be allocated to the (deemed) settler, grantor or similar organizer (the "Settlor"), or, upon the death of the Settlor, such Settlor's beneficiaries in

proportion to their entitlement to the estate of the Settlor of such trust or similar arrangement.

This

summary is based on the tax laws and principles (unpublished case law not included) in the Netherlands as in effect on the date of this prospectus supplement, which are subject to

changes that

S-17

Table of Contents

could

prospectively or retroactively affect the stated tax consequences. Where in this summary the terms "the Netherlands" and "Dutch" are used, these refer solely to the European part of the Kingdom

of the Netherlands.

Dividend Withholding Tax

We are generally required to withhold Dutch dividend withholding tax at a rate of 15% from dividends distributed by us: the dividend withholding

tax is for account of the Shareholder. The concept dividends "distributed by us" as used in this section includes, but is not limited to:

-

•

-

distributions of profits in cash or in kind, deemed and constructive distributions, and repayments of paid-in capital which are not recognized

for Dutch dividend withholding tax purposes;

-

•

-

liquidation proceeds, or proceeds from the repurchase or redemption of ordinary shares by us or one of our subsidiaries or other affiliated

entities in excess of the average paid-in capital of those shares recognized for Dutch dividend withholding tax purposes;

-

•

-

the par value of our ordinary shares issued to a Shareholder or an increase of the par value of our ordinary shares, to the extent that it does

not appear that a contribution, recognized for Dutch dividend withholding tax purposes, has been made or will be made; and

-

•

-

partial repayment of paid-in capital recognized for Dutch dividend withholding tax purposes, if and to the extent that there are net profits

(zuivere winst), unless (a) the general meeting of shareholders has resolved in advance to make such repayment and (b) the par value of

the ordinary shares concerned has been reduced by an equal amount by way of an amendment to our articles of association.

In general, we will be required to remit all amounts withheld as Dutch dividend withholding tax to the Dutch tax authorities. However, under

certain circumstances, we are allowed to reduce the amount to be remitted to the Dutch tax authorities by the lesser of:

-

•

-

3% of the portion of the distribution paid by us that is subject to Dutch dividend withholding tax; and

-

•

-

3% of the dividends and profit distributions, before deduction of foreign withholding taxes, received by us from qualifying foreign

subsidiaries in the current calendar year (up to the date of the distribution by us) and the two preceding calendar years, as far as such dividends and profit distributions have not yet been taken

into account for purposes of establishing the above mentioned reduction.

Although

this reduction reduces the amount of Dutch dividend withholding tax that we are required to remit to the Dutch tax authorities, it does not reduce the amount of tax that we are

required to withhold on dividends distributed.

A Shareholder which is resident or deemed resident in the Netherlands for Dutch tax purposes is generally entitled to a full credit of any Dutch

dividend withholding tax against the Dutch (corporate) income tax liability of such Shareholder, and is generally entitled to a refund in the form of a negative assessment of Dutch (corporate) income

tax, insofar such Dutch dividend withholding tax, together with any other creditable domestic and/or foreign taxes, exceeds such Shareholder's aggregate Dutch income tax or Dutch corporate income tax

liability.

S-18

Table of Contents

If

and to the extent that such a corporate Shareholder is eligible for the application of the participation exemption

(deelnemingsvrijstelling) with respect to the ordinary shares and the participation (deelneming) forms

part of the assets of the business enterprise of a Shareholder in the Netherlands, dividends distributed by us are in principle exempt from Dutch dividend withholding tax.

Pursuant

to domestic anti-dividend stripping rules, no exemption from Dutch dividend withholding tax, credit against Dutch (corporate) income tax, refund or reduction of Dutch dividend

withholding tax shall apply if the recipient of the dividend distributed by us is not considered to be the beneficial owner (uiteindelijk gerechtigde)

as meant in these rules, of such dividends.

A non-resident Shareholder, which is resident in the non-European part of the Kingdom of the Netherlands or in a country that has concluded a

tax treaty with the Netherlands, may be eligible for a full or partial relief or refund from Dutch dividend withholding tax, provided that (i) such relief or refund is timely and duly claimed,

and (ii) the entitlement to such relief or refund is not restricted pursuant to a provision for the prevention of fraud or abuse included in such tax treaty.

In

addition, pursuant to domestic law, a non-resident Shareholder that is not an individual, is entitled to an exemption from Dutch dividend withholding tax, provided that each of the

following tests are satisfied:

-

1.

-

the

non-resident Shareholder is, according to the tax law of:

-

a.

-

a

Member State of the European Union, or another state designated by a ministerial decree that is a party to the Agreement regarding the European Economic Area,

resident there and it is not transparent for tax purposes according to the tax law of such state; or

-

b.

-

a

state not being a Member State of the European Union or another state designated by a ministerial decree, that is a party to the Agreement regarding the European

Economic Area (a "Third State") that has concluded a tax treaty with the Netherlands containing a provision for dividends, resident there and it is not transparent for tax purposes according to the

tax law of such state; and

-

2.

-

the

non-resident Shareholder has an interest in us for which the participation exemption as referred to in article 13 Dutch Corporate Income Tax Act 1969

(Wet op de vennootschapsbelasting 1969, or CITA) or the participation credit under article 13aa CITA would apply if the Shareholder would be a

resident in the Netherlands; and

-

3.

-

the

non-resident Shareholder is, according to a tax treaty concluded by its state of residence with another state, not considered resident in a Third State that has

not concluded a tax treaty with the Netherlands containing a provision for dividends; and

-

4.

-

the

non-resident Shareholder does not carry out duties or activities comparable to an investment institution as described in article 6a or article 28

CITA respectively; and

-

5.

-

the

non-resident Shareholder does not hold the interest as mentioned under 2 here above with (one of) the main purpose(s) of the evasion of Dutch dividend withholding

tax in the hands of another person and there is not an artificial arrangement or transaction or series thereof in place whereby: (i) an arrangement or transaction may consist of several steps

or components; (ii) an arrangement or transaction or series thereof is regarded artificial to the extent it is not put in place for valid commercial reasons which reflect economic reality.

A

non-resident Shareholder which is resident in a Member State of the European Union with which the Netherlands has concluded a tax treaty that provides for a reduction of Dutch tax on

dividends based on the ownership of the number of voting rights, the test mentioned under 2 here

S-19

Table of Contents

above

is also satisfied if the non-resident Shareholder owns voting rights in us for which the participation exemption as referred to in article 13 CITA or a tax credit under

article 13aa CITA would apply if the shareholder would be a resident in the Netherlands.

Pursuant

to domestic anti-dividend stripping rules, no exemption from Dutch dividend withholding tax, refund or reduction of Dutch dividend withholding tax shall apply if the recipient

of the dividend paid by us is not considered the beneficial owner (uiteindelijk gerechtigde) as meant in these rules, of such dividends. The Dutch tax

authorities have taken the position that this beneficial ownership test can also be applied to deny relief from Dutch dividend withholding tax under tax treaties and the Tax Arrangement for the

Kingdom (Belastingregeling voor het Koninkrijk).

A

non-resident Shareholder which is subject to Dutch income tax or Dutch corporate income tax in respect of any benefits derived or deemed to be derived from our ordinary shares,

including any capital gain realized on the disposal thereof, can generally credit the Dutch dividend withholding tax against its Dutch income tax or its Dutch corporate income tax liability, as

applicable, and is generally entitled to a refund pursuant to a negative tax assessment if and to the extent the Dutch dividend withholding tax, together with any other creditable domestic and/or

foreign taxes, exceeds its aggregate Dutch income tax or its aggregate Dutch corporate income tax liability, respectively.

Taxes on Income and Capital Gains

Residents of the Netherlands

A Shareholder, who is an individual resident or deemed to be resident in the Netherlands for Dutch income tax purposes will be subject to Dutch

personal income tax at the progressive rates (up to a maximum rate of 51.75% (2019)) under the Dutch Income Tax Act 2001 on the income derived from the ordinary shares and gains realized on the

disposal thereof if:

-

•

-

such Shareholder derives any benefits from the ordinary shares, which are attributable to an enterprise of such Shareholder, whether as an

entrepreneur or pursuant to a co-entitlement to the net worth (medegerechtigd tot het vermogen) of an enterprise other than as a shareholder or an

entrepreneur; or

-

•

-

such income or gain is taxable in the hands of such Shareholder as benefits from miscellaneous activities (resultaat

uit overige werkzaamheden), including but not limited to activities with respect to the ordinary shares that are beyond the scope of regular active portfolio management

activities (normaal, actief vermogensbeheer).

If

neither of the two abovementioned conditions apply, the individual Shareholder will be taxed under the regime for savings and investments (inkomen uit sparen

en beleggen). Irrespective of the actual income and capital gains realized, the annual taxable benefit of all the assets and allowable liabilities of a Shareholder who is taxed

under this regime, including the ordinary shares, is set at a deemed return on the fair market value of the assets reduced by the allowable liabilities on January 1 of each year.

Depending

on the aggregate amount of the fair market value of the assets reduced by the allowable liabilities, the deemed return ranges from 1.935% up to 5.60% (2019). This deemed return

is subject to income tax at a flat rate of 30%. Taxation only occurs if and to the extent the fair market value of the assets reduced by the allowable liabilities exceeds a threshold

(heffingvrij vermogen) of €30,360 (2019). The deemed return will be adjusted annually based on historic market yields.

S-20

Table of Contents

Generally, a Shareholder that is a corporation, another entity with a capital divided into shares, a cooperative (association), or another legal

entity that has an enterprise to which the ordinary shares are attributable, that is resident or deemed to be resident in the Netherlands for Dutch corporate income tax purposes will be subject to

Dutch corporate income tax, levied at a rate of 25% (19% over profits up to €200,000) over income derived from the ordinary shares and gains realized upon the acquisition, redemption

and disposal of ordinary shares (rates and brackets for 2019).

If

and to the extent that such Shareholder is eligible for the application of the participation exemption with respect to income derived from the ordinary shares, any gains and losses

(with the exception of liquidation losses under strict conditions) realized on the ordinary shares are exempt from Dutch corporate income tax.

Non-residents of the Netherlands (including but not limited to U.S. Shareholders)

A Shareholder, who is an individual not resident or deemed to be resident in the Netherlands for Dutch income tax purposes will not be subject

to any Dutch taxes on income or capital gains in respect of dividends distributed by us or in respect of any gain realized on the disposal or deemed disposal of ordinary shares (other than dividend

withholding tax as described above), except if:

-

•

-

such holder has an enterprise or an interest in an enterprise that is, in whole or in part, carried on through a permanent establishment or a

permanent representative in the Netherlands and to which enterprise or part of an enterprise, as the case may be, the ordinary shares are attributable; or

-

•

-

such income or gain is taxable in the hands of such Shareholder as benefits from miscellaneous activities in the Netherlands, including but not

limited to activities with respect to the ordinary shares that are beyond the scope of regular active portfolio management activities.

If

one of the two abovementioned conditions apply, the income or gains in respect of dividends distributed by us or in respect of any capital gain realized on the disposal or deemed

disposal of ordinary shares will in general be subject to Dutch personal income tax at the progressive rates up to 51.75% (2019).

A Shareholder, that is not an individual, and is not resident or deemed to be resident in the Netherlands for Dutch corporate income tax

purposes, will not be subject to any Dutch taxes on income or capital gains in respect of dividends distributed by us, or in respect of any gain realized, on the disposal or deemed disposal of

ordinary shares (other than dividend withholding tax as described above), except if:

-

1.

-

such

Shareholder has an enterprise or an interest in an enterprise that is, in whole or in part, carried on through a permanent establishment or a permanent

representative in the Netherlands, to which the ordinary shares are attributable; or

-

2.

-

such

Shareholder has a substantial interest or a deemed substantial interest in us, which interest is held with (one of) the main purpose(s) of the evasion of income

tax in the hands of another person and there is an artificial arrangement or transaction or series thereof whereby: (i) an arrangement or transaction may consist of several steps or components;

(ii) an arrangement or transaction or series thereof is regarded artificial to the extent it is not put in place for valid commercial reasons which reflect economic reality; or

S-21

Table of Contents

-

3.

-

such

Shareholder is an entity resident of Aruba, Curaçao or Saint Martin with a permanent establishment or permanent representative in Bonaire, Saint

Eustatius or Saba to which such income or gain is attributable, and the permanent establishment or permanent representative would be deemed to be resident of the Netherlands for Dutch corporate income

tax purposes (i) had the permanent establishment been a corporate entity (lichaam), or (ii) had the activities of the permanent

representative been conducted by a corporate entity, respectively.

A

Shareholder as mentioned under 1 here above is not subject to Dutch corporate income tax for income and capital gains derived, if the ordinary shares are attributable to the permanent

establishment in the Netherlands and the participation exemption as referred to in article 13 CITA applies to those ordinary shares.

If

one of the abovementioned conditions applies, income derived from the ordinary shares and gains realized on ordinary shares will, in general, be subject to Dutch corporate income tax

levied at a rate of 25% (19% over profits up to €200,000) (rates and brackets for 2019).

Gift or Inheritance Taxes

No Dutch gift or Dutch inheritance tax is due in respect of any gift, in form or in substance, of the ordinary shares by, or inheritance of the

shares on the death of a Shareholder except if:

-

•

-

at the time of the gift or death of the Shareholder, the Shareholder is resident, or deemed to be resident, in the Netherlands for purposes of

Dutch gift tax or Dutch inheritance tax, as applicable; or

-

•

-

in the case of a gift of ordinary shares by an individual who at the date of the gift was neither resident nor deemed to be resident in the

Netherlands (i) such individual dies within 180 days after the date of the gift, while being resident or deemed to be resident in the Netherlands; or (ii) the gift of ordinary

shares is made under a condition precedent (opschortende voorwaarde) and the Shareholder is resident, or is deemed to be resident in the Netherlands at

the time the condition is fulfilled.

For

purposes of the above, a gift of ordinary shares made under a condition precedent is deemed to be made at the time the condition precedent is satisfied.

For

purposes of Dutch gift or Dutch inheritance taxes, an individual not holding the Dutch nationality will be deemed to be resident in the Netherlands, inter

alia, if such individual has been resident in the Netherlands at any time during the ten years preceding the date of the gift or such individual's death. Additionally, for

purposes of Dutch gift tax, an individual not holding the Dutch nationality will be deemed to be resident in the Netherlands if such individual has been resident in the Netherlands at any time during

the twelve months preceding the date of the gift. Applicable tax treaties may override deemed residency in the Netherlands.

Value Added Tax

No Dutch value added tax will arise in respect of payments in consideration for the issue, acquisition, ownership and disposal of ordinary

shares, other than value added taxes on fees payable in respect of services not exempt from Dutch value added tax.

Other Taxes and Duties

No Dutch registration tax, capital tax, custom duty, transfer tax, stamp duty or any other similar tax or duty will be payable in the

Netherlands in respect of or in connection with the subscription, issue, placement, allotment, delivery or transfer of the ordinary shares.

Residence

A Shareholder will not become resident, or deemed resident in the Netherlands for Dutch tax purposes by reason only of holding the ordinary

shares.

S-22

Table of Contents

Material U.S. Federal Income Tax Considerations

The following general summary of the material U.S. federal income tax considerations applicable to the acquisition, ownership and disposition of

our ordinary shares is based upon current law and does not purport to be a comprehensive discussion of all the tax considerations that may be relevant to our ordinary shares.

This

summary is based on current provisions of the Internal Revenue Code of 1986, as amended (the "Code"), existing, final, temporary and proposed U.S. Treasury Regulations,

administrative rulings and judicial decisions, in each case as available on the date of this annual report. All of the foregoing are subject to change, which change could apply retroactively and could

affect the tax consequences described below.

This

section summarizes the material U.S. federal income tax considerations to U.S. holders, as defined below, of ordinary shares.

This

summary addresses only the U.S. federal income tax considerations for U.S. holders that acquire the ordinary shares at their original issuance and hold the ordinary shares as