Filed Pursuant to Rule 424(b)(3)

Registration No. 333-259069

Prospectus Supplement No. 15

(To Prospectus dated February 14, 2022)

QUALTEK SERVICES INC.

11,614,000 Shares

Class A Common Stock

This prospectus supplement is

being filed to update and supplement the information contained in the prospectus dated February 14, 2022 (the “Prospectus”),

related to the resale from time to time of up to 11,614,000 shares of Class A common stock, $0.0001 par value, of QualTek Services Inc.

(“Class A Common Stock”) including 6,937,500 shares of Class A Common Stock issuable upon the exchange of common

units of QualTek HoldCo, LLC and shares of our Class B common stock underlying the Pre-PIPE Notes issued to certain accredited investors

in the Pre-PIPE Investment and 4,676,500 shares of Class A Common Stock issued to certain accredited investors in the PIPE Investment

upon the closing of the Business Combination (all undefined capitalized terms are as defined in the Prospectus), with the information

contained in our Annual Report on Form 10-K, filed with the Securities and Exchange Commission (the “SEC”) on

April 28, 2023 (the “Annual Report”). Accordingly, we have attached the Annual Report to this prospectus supplement.

This prospectus supplement updates

and supplements the information in the Prospectus and is not complete without, and may not be delivered or utilized except in combination

with, the Prospectus, including any amendments or supplements thereto. This prospectus supplement should be read in conjunction with the

Prospectus and if there is any inconsistency between the information in the Prospectus and this prospectus supplement, you should rely

on the information in this prospectus supplement.

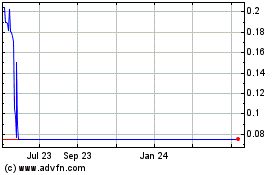

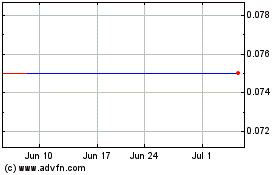

Our Class A Common Stock is traded

on The Nasdaq Capital Market under the symbol “QTEK.” On April 28, 2023, the closing price of our Class A Common Stock was

$0.261 per share.

We are an “emerging growth company”

as defined under the federal securities laws and, as such, have elected to comply with certain reduced public company reporting requirements.

Investing in our Class A Common Stock is highly

speculative and involves a high degree of risk. See “Risk Factors” beginning on page 9 of the Annual Report attached hereto,

page 20 of the Prospectus and appearing in any applicable prospectus supplement.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of Class A Common Stock or determined if this prospectus is truthful or

complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is April 28, 2023.

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 10-K

(Mark

One)

| x |

ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the fiscal year ended December 31, 2022

OR

| ¨ |

TRANSITION REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the transition period from _____ to _____

Commission

File Number 001-40147

QualTek

Services Inc.

(Exact

name of Registrant as specified in its Charter)

| Delaware |

|

83-3584928 |

| (State

or other jurisdiction of incorporation or organization) |

|

(I.R.S.

Employer Identification No.) |

| |

|

|

| 475

Sentry Parkway E, Suite 200 |

|

|

| Blue

Bell, PA |

|

19422 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (484) 804-4585

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

symbol(s) |

|

Name

of each exchange on which registered |

| Class A

Common Stock |

|

QTEK |

|

The

NASDAQ Stock Market LLC |

| Warrants |

|

QTEKW |

|

The

NASDAQ Stock Market LLC |

Securities

registered pursuant to Section 12(g) of the Act: None

Indicate

by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨

No x

Indicate

by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨

No x

Indicate

by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the

Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file

such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x

No ¨

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405

of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was

required to submit such files). Yes x No ¨

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated

filer |

¨ |

Accelerated filer |

¨ |

| Non-accelerated filer |

x |

Smaller reporting company |

x |

| Emerging

growth company |

x |

|

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act by the registered public accounting

firm that prepared or issued its audit report. ¨

If

securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of

the registrant included in the filing reflect the correction of an error to previously issued financial statements. x

Indicate

by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation

received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b).

¨

Indicate

by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨

No x

The

aggregate market value of the voting securities held by non-affiliates of the registrant as of the last business day of the registrant’s

most recently completed second fiscal quarter, July 2, 2022, was approximately $13,681,607 based upon the closing sale price of

$1.46 of our common stock on such date. As of April 21, 2023, there were 27,805,659 shares of Class A Common Stock, $0.0001

par value, issued and outstanding and 23,304,200 shares of our Class B Common Stock, $0.0001 par value, issued and outstanding.

Documents

Incorporated by Reference: None.

TABLE

OF CONTENTS

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

Annual Report on Form 10-K may contain forward-looking statements for purposes of the safe harbor provisions under the United States

Private Securities Litigation Reform Act of 1995. Forward-looking statements are typically identified by words such as “plan,”

“believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,”

“forecast,” “project,” “continue,” “could,” “may,” “might,” “possible,”

“potential,” “predict,” “should,” “would” and other similar words and expressions, but

the absence of these words does not mean that a statement is not forward-looking.

The

forward-looking statements are based on the current expectations of the management of QualTek Services Inc. (the "Company"

or "QualTek"), as applicable and are inherently subject to uncertainties and changes in circumstances and their potential effects

and speak only as of the date of such statement. There can be no assurance that future developments will be those that have been anticipated.

These forward-looking statements involve a number of risks, uncertainties or other assumptions that may cause actual results or performance

to be materially different from those expressed or implied by these forward-looking statements. Factors that may impact such forward-looking

statements include, but are not limited to the following:

| • | expectations

regarding the Company's liquidity, cash flows and uses of cash; |

| • | expectations

regarding the Company's ability to continue as a going concern; |

| • | expectations

regarding the Company’s strategies and future financial performance, including its

future business plans or objectives, prospective performance and opportunities and competitors,

revenues, products and services, pricing, operating expenses, market trends, capital expenditures,

and the Company’s ability to invest in growth initiatives and pursue acquisition opportunities; |

| • | the

Company likely choosing or needing to obtain alternative sources of capital or otherwise

meet its liquidity needs and/or restructure its existing indebtedness, which could force

the Company to liquidate and/or file for bankruptcy; |

| • | our

management team’s limited experience managing a public company; |

| • | the

highly competitive industries that the Company serves, which are also subject to rapid technological

and regulatory changes, as well as customer consolidation; |

| • | unfavorable

market conditions, inflation, rising interest rates, supply chain disruptions, market uncertainty,

public health outbreaks such as the COVID-19 pandemic and/or economic downturns; |

| • | failure

to properly manage projects, or project delays; |

| • | failure

to recover adequately on charges against project owners, subcontractors or suppliers for

payment or performance; |

| • | the

loss of one or more key customers, or a reduction in their demand for the Company’s

services; |

| • | our

ability to maintain an appropriately sized workforce; |

| • | our

ability to prevent or recover from the operational and physical hazards to which our business

is subject; |

| • | the

Company’s backlog being subject to cancellation and unexpected adjustments; |

| • | the

seasonality of the Company’s business, which is affected by the spending patterns of

the Company’s customers and timing of governmental permitting, as well as weather conditions

and natural catastrophes; |

| • | system

and information technology interruptions and/or data security breaches; |

| • | failure

to comply with environmental laws; |

| • | the

Company’s significant amount of debt, which could adversely affect its business, financial

condition and results of operations or could affect its ability to access capital markets

in the future, and may prevent the Company from engaging in transactions that might be beneficial

due to restrictive debt covenants; and |

| • | the

Company’s status as a “controlled company” within the meaning of the Nasdaq

rules and, as a result, qualifying for exemptions from certain corporate governance

requirements, as a result of which you will not have the same protections afforded to stockholders

of companies that are subject to such requirements. |

Should

one or more of these risks or uncertainties materialize or should any of the assumptions made by the management of QualTek prove incorrect,

actual results may vary in material respects from those projected in these forward-looking statements. Except to the extent required

by applicable law or regulation, the Company undertakes no obligation to update these forward-looking statements to reflect events or

circumstances after the date of this Annual Report on Form 10-K to reflect the occurrence of unanticipated events.

PART I

Item

1. Business

Overview

We

are a technology-driven, leading provider of communications infrastructure services, power grid modernization, and renewables solutions

to the telecommunications and utilities industries across the United States. We provide a variety of mission-critical services across

the telecom and renewable energy value chain, including wireline and fiber optic terminations, wireless, fiber-to-the-home, or FTTH,

and customer fulfillment activities. Our experienced management team has leveraged our technical expertise, rigorous quality and safety

standards, and execution track record to establish and maintain long-standing relationships with blue-chip customers.

We

operate two business segments: (i) Telecommunications ("Telecom") and (ii) Renewables & Recovery Logistics.

Our Telecom segment provides engineering, construction, installation, network design, project management, site acquisition and maintenance

service to major telecommunication, utility and cable carriers in various locations in the United States. Our Renewables & Recovery

Logistics segment provides power utility, telecom and other businesses with continuity and disaster recovery operations, and provides

new fiber optic construction services to renewable energy, commercial and utilities customers across the United States.

Telecommunications

We

provide a full suite of services to the telecom sector across both wireless and wireline markets, from site acquisition and permitting

to initial engineering and design to installation, maintenance, program management and fulfillment. Our core offerings consist of:

| • | Engineering

and construction services including the design and construction of aerial and underground

fiber optic and coaxial systems for homes, businesses, cell towers, and small cells. |

| • | Installation

services including the placement and splicing of fiber and coaxial cable, in addition to

upgrades and new site builds for cellular towers. |

| • | Site

acquisition services to determine the location for new sites prior to new site builds. |

| • | We

also provide cable and satellite fulfillment services for residential and commercial customers.

These services are provided for telecom companies in connection with the maintenance or expansion

of new and existing networks. |

While

the telecommunications industry is naturally concentrated, we maintain customer diversification across our business segments. We have

numerous long-established relationships with telephone companies, wireless carriers, multiple cable system operators and electric utilities

companies, which have been built upon and cultivated through numerous Master Service Agreements ("MSA") that extend for periods

of one or more years (majority are for three or more years, some of which have auto-renewal provisions). Blue-chip, investment grade

customers including AT&T, Verizon, T-Mobile, and Comcast comprise a substantial portion of our revenue.

Within

our Telecom segment we also provide electrical contracting, and utility construction and maintenance services. We construct and maintain

overhead and underground distribution systems for municipalities, electric membership cooperatives, and electric-utility companies.

Renewables

and Recovery Logistics

We

entered the renewable infrastructure sector with our acquisition of Fiber Network Solutions, LLC ("FNS") in January 2021.

FNS is a full-service provider of fiber optic and electrical services, focusing primarily on renewable energy projects. Our capabilities

include expertise in wind and solar farm fiber, installation and testing, Optical Ground Wire ("OPGW") and all-dielectric self-supporting

("ADSS") aerial transmission line installation, and large-scale data communication solutions and installation.

We

also provide fiber optic terminations, Optical Time Domain Reflectometer ("OTDR") and power meter testing, fusion splicing,

fiber placement, extensive fiber optic and copper infrastructure installation, cable jetting, boring and trenching, industry specific

maintenance and material procurement.

Recovery

Logistics ("RLI") has been providing basecamp, catering, fueling, transport logistics, power restoration, and generator maintenance

services since 1999. Our basecamps house, feed and support thousands of linemen, first responders, and others when hurricanes and other

catastrophic events hit in the United States.

Industry

Overview

Telecommunications

Significant

advances in technology and rapid innovation in service offerings to data consumers have substantially increased demand for faster and

more reliable wireless and wireline/fiber communications network services.

With

the proliferation of mobile devices, advancements in the “internet of things,” or IoT, and segments of the workforce shifting

to remote work as a result of COVID-19, network traffic is growing and is expected to continue to grow, generating demand for both wired

and wireless connectivity. Increased data usage is driven by two key dynamics: (i) an increase in the number of internet-enabled

devices per capita and (ii) an increase in connection speed.

COVID-19

has further catalyzed network traffic growth by creating permanent shifts away from the office and into the home.

Low

levels of fiber penetration and the continuing growth of North American 5G deployment currently present significant opportunities for

sustained growth for businesses such as QualTek:

| • | Wireless:

Major carriers have continued to expand wireless network capacity and density with accelerated

development and planned implementation of 5G wireless technologies. The increased speed and

capacity that will result from deployment of 5G technology will require additional and improved

tower capacity with higher data frequencies, as well as deployment of numerous higher bandwidth

small cells to “densify” network performance. Wireless technology will need to

be supported by fiber backbone and as a result, many carriers have committed to investing

in the fiber infrastructure buildout. |

| • | Wired:

Telecommunication companies have also deployed capital and initiatives to improve fiber connectivity.

Importantly, with only about 60 million U.S. homes (about 43% as per the Fiber Broadband

Association) passed with fiber in 2022, over 100 million U.S. homes represent opportunities

for fiber passing over the next several years, indicating a massive investment cycle that

is still in early stages. |

Renewable

and Recovery Logistics

In

2017 and 2018, solar photovoltaic and onshore wind cemented their dominance in the renewable energy market, representing on average a

consolidated 77% of total finance commitments in renewable energy. The highly modular nature of these technologies, their short project

development lead times, increasing competitiveness driven by technology and manufacturing improvements, and government regulations play

an important role in explaining these technologies’ large share of global renewable energy investment.

The

Biden administration is expected to amplify this increase in spending for renewable power projects. For example, since his first day

in office, President Biden has rejoined the 2015 Paris Agreement, and set a goal to achieve a carbon pollution-free power sector by 2035.

In addition, the August 2022 Inflation Reduction Act (“IRA”) contains provisions that are designed to accelerate the

deployment of clean energy technologies, reduce carbon emissions, lower energy prices and support the development of a reliable and affordable

energy sector. The IRA provides almost $370 billion in clean energy funding to facilitate the clean energy transition, primarily in the

form of tax incentives, grants and loan guarantees. Among the clean energy and climate provisions is approximately $70 billion of incentives

over the next decade, including extensions of the renewable energy production tax credit and the investment tax credit for solar and

other energy technologies, as well as production tax credits and investment tax credits for the qualified production of clean hydrogen

and other clean fuels. As a result of the trends and factors discussed above, we expect a continuing increase in demand for construction

of renewable and other clean energy infrastructure in the coming years.

Power

utility companies, telecom carriers, and other entities rely on Recovery Logistics when disasters such as hurricanes hit the United States

Catastrophic events are inherently unpredictable, and may increase in frequency and severity. Power utilities have mutual assistance

agreements with each other that result in thousands of linemen mobilizing to impacted areas when power is out. Very few companies can

provide the basecamps needed to accommodate the tens of thousands of linemen that must be housed, fed, and supported as they restore

power. In addition, the expertise developed by Recovery Logistics to provide these basecamps translates well to other emergency response

markets. There are many opportunities to expand this business going forward.

Competitive

Strengths

Culture

of Operational Excellence that Resonates with Established Blue-Chip Customer Base

QualTek

analyzes and evaluates key performance metrics, such as customer satisfaction, technical issues in the field, hiring processes and working

capital management. We have fostered a culture of continuous improvement and our operational excellence. Our decentralized operations

create multiple points of contact with our customers, including Fortune 500 companies such as AT&T, Verizon, T-Mobile, and Comcast

thereby generating numerous individual relationships and contract opportunities per customer.

Highly

Scalable Shared Services Platform Driven by Technology-Enabled Capabilities

QualTek

provides full turnkey services to its customers. Our significant investment over the years to optimize our platform and technology has

created a highly scalable business ready to support continued growth. For example, a centralized shared services system provides us with

a competitive advantage for operational execution of customer services, process consistency and cross division sharing of “best

practices,” resulting in enhanced efficiency and scalability. To maintain this operational excellence, we conduct disciplined measuring

of KPIs with quality control for every division to ensure industry-leading execution capabilities.

Significant

Revenue and Backlog

Our

backlog consists of the estimated amount of revenue we expect to realize from future work on uncompleted contracts, including new contracts

under which work has not begun, as well as revenue from change orders and renewal options. A significant portion of our 24-month backlog

is attributable to MSAs and other service agreements, none of which require our customers to purchase minimum amounts of goods or services

and can be terminated at will or on short notice. Backlog amounts are determined based on estimates that incorporate historical trends,

anticipated seasonal impacts, experience from similar projects, and estimates of customer demand based on communications with our customers.

QualTek

maintains strong potential revenue visibility through its two-year estimated backlog. Consistent with standard practice across the industry,

QualTek calculates its estimated backlog for work under MSAs and other service agreements (including issued purchase orders) based on

historical trends, anticipated seasonal impacts, experience from similar projects, and estimates of customer demand based on communications

with our customers. Our long-standing relationships with blue-chip, investment grade customers enable us to understand our customers’

needs and expand our backlog. Our backlog provides long-term visibility into a recurring revenue base. QualTek has an estimated $1.6

billion two-year backlog of which $1.5 billion relates to our Telecom segment and $0.1 billion relates to our Renewables & Recovery

Logistics segment.

Backlog

is not a measure defined by accounting principles generally accepted in the United States of America ("GAAP") and should be

considered in addition to, but not as a substitute for, GAAP results. Participants in our industry often disclose a calculation of their

backlog; however, our methodology for determining backlog may not be comparable to the methodologies used by others. There can be no

assurance as to our customers’ requirements or if actual results will be consistent with the estimates included in our forecasts.

Furthermore, our ability to execute projects within our backlog may be adversely impacted by factors such as our liquidity and workforce,

including subcontractors. As a result, our backlog as of any particular date is an uncertain indicator of future revenue and earnings.

Management

Team

QualTek

is led by a highly experienced management team that is positioned to capitalize on sector momentum. Our senior management team has an

average of 21 years of individual industry experience. Our team is well suited to establish and maintain long-standing relationships

with blue-chip customers as a result of our technical expertise, rigorous quality and safety standards, and execution track record.

Strategic

Regional Presence across the U.S.

QualTek

has a national footprint with approximately 65 strategically located service locations across the United States in close proximity to

our major customers, allowing us to respond to customer demand swiftly and efficiently. Our presence in multiple regions gives us valuable

insight into local market drivers and customer demand, thereby enabling us to provide bespoke services in each market. Due to this presence,

QualTek has also built deep relationships with local customers that help drive business development, project execution, and cross-sell

opportunities.

Growth

Strategy

Expand

Service Offerings & Solutions while Leveraging Established Customer Relationships

QualTek’s

complementary service offering creates an opportunity for us to grow our business with customers in two fundamental ways: by winning

more contracts and cross-selling services. We anticipate growth in our Telecom business as spectrum continues to become available. Additionally,

we plan to cross-sell our full-suite of wireless services to our existing customer base.

In

our Renewables & Recovery Logistics segment, we see significant opportunity to leverage existing customers and footprint for

incremental projects. We also expect the Biden administration to promote more spending in renewables through government contracts and

also in other sectors and businesses that will in turn reinvest in renewable energy solutions.

Expansion

of our Recovery Logistics Business with Additional Deployments

We

believe that our Recovery Logistics business is currently underutilized and is poised to provide assistance to the telecom industry and

other industries for deployments beyond natural disasters such as hurricanes and winter storms. We intend to seek additional opportunities

for the business to deploy its assets in new opportunities.

Our

Services and Solutions

We

are a reputable, one-stop infrastructure solutions provider at the epicenter of the 5G and renewables buildout. To serve our customers,

we operate two distinct segments: Telecom, which includes our wireless and wireline engineering and construction services along with

our electrical construction and maintenance services, and Renewables & Recovery Logistics.

Telecommunications

Our

Telecom segment helps our clients build and maintain better, more reliable networks across the United States. We are able to provide

technology-driven, field-based critical services across every stage of the network life-cycle for the telecommunications industry and

power utility industry. This segment is composed of three sub-segments of services: wireless, wireline and power.

Wireless

This

sub-segment operates under the brand QualTek Wireless as a turnkey provider of installation, project management, maintenance, real estate,

and site acquisition to major wireless carriers. Some other services offered include:

| • | Program

and Construction Management |

| • | Construction

and Integration |

Wireline

This

sub-segment provides fiber optic aerial and underground installation, fiber optic splicing, termination & testing, new installation,

engineering, and fulfillment services to major telecommunication companies. Other wireline services include:

| • | OTDR

Testing / Certification |

| • | Multiple

Dwelling Units ("MDU") Retro-Fits |

| • | Maximum

Transition Unit ("MTU") Builds |

In

the Wireless and Wireline sub-segments, QualTek has long-standing relationships with AT&T, Verizon, T-Mobile, Dish, Comcast, Altice,

amongst many other blue-chip names.

Power

This

sub-segment provides electrical contracting, and utility construction and maintenance services to municipalities, electric membership

cooperatives, and electric-utility companies, including the construction and maintenance of overhead and underground distribution systems.

We provide comprehensive power line services including:

| • | New-build

Distribution Line Construction |

| • | Hardening

and Reliability Services |

| • | Greenfield

Residential Distribution |

QualTek

has the experience and the resources necessary to reliably deliver quality work for even the most complex and demanding overhead and

underground ventures.

Renewables &

Recovery Logistics

Our

Renewables & Recovery Logistics segment provides end-to-end services for clients in the renewable energy sector and supports

business continuity and disaster relief for clients in the telecommunications, power utility, and renewable energy industries, including

AT&T, Duke Energy, Entergy, and Blattner Energy.

Renewables

This

sub-segment operates under the brand QualTek Renewables and provides installation, testing and maintenance for wind farms, solar farms,

and fiber optic grids. Other QualTek Renewables services include:

| • | Fiber

Optic Terminations |

| • | OTDR

and Power Meter Testing |

| • | Fiber

Optic and Copper Infrastructure Installation |

| • | Wind

and Solar Farm fiber, installation, and testing |

| • | Large

scale data communications solutions and installation |

| • | OPGW &

ADSS Aerial transmission line installation |

Our

wind business comprises a majority of the revenue for our Renewables sub-segment for the fiscal year ended December 31, 2022. Advanced

wind turbines include a large number of sensors whose signals are prone to contamination from electrical interference from lightning

strikes. It is increasingly common to use fiber optics to galvanically isolate such interfaces, which is more difficult and costly with

copper wires. This not only limits the damage of any lightning strikes but also can help reduce the effects of power line noise on sensitive

sensor readings. Fiber optics are used for both galvanic isolation purposes and data communications. In addition, offshore turbines are

often situated five plus miles from the control center on land, making routine maintenance difficult and costly. As a result, wind turbine

operators increasingly rely on complex sensors to efficiently monitor and schedule routine maintenance. Fiber optic cables are the preferred

choice from a reliability and ease of maintenance perspective, especially at scale.

Our

solar business services help support solar power generation by ensuring that our clients’ farms are running safely and efficiently.

In a solar farm power generation system, large amounts of currents are generated from the heat of the sun. In order to protect the equipment

from current leakage, galvanic insulation becomes important to ensure the power system’s quality and reliability. Fiber optics

offer insulation protection from high-voltage/current glitches and unwanted signals into power equipment controls and communication.

In addition, fiber optic communication can cover longer link distance connections compared to copper wire. As the solar farms grow in

size, monitoring and controlling all the solar panels requires long link distance connections, which is only possible with fiber optic

cable.

Recovery

Logistics

This

sub-segment operates under the brand QualTek Recovery Logistics and provides business continuity, restoration, and disaster relief services

to its clients, including AT&T, Verizon, Duke Energy, Gulf Power, Florida Power and Light, and Entergy, among others. QualTek Recovery

Logistics has strategically staged basecamp assets in hurricane prone East and Gulf states to enable rapid deployment to any of these

areas. Some other services offered include:

Through

our 2018 acquisition of Recovery Logistics, LLC (“RLI”), we transformed our recovery logistics sub-segment from a regional

player with concentration in the Southeast to a fully national presence with a diversified customer base which can be served out of approximately

65 locations. RLI is a leading provider of business continuity and disaster recovery operations for the telecommunications and power

utility sectors. RLI helps businesses recover from unplanned events, including hurricanes, winter storms and floods.

QualTek’s

recent entry into the renewable energy space positions it to capitalize on sector tailwinds. Within Renewables, there is also significant

opportunity for the Company to leverage its existing customer relationships, as well as its footprint, to gain traction and win incremental

projects. This also applies to QualTek’s Recovery Logistics sub-segment, as the Company may be able to cross-sell recurring maintenance

and recovery services to capture incremental revenue and deepen penetration with existing customer relationships. Providing recovery

logistics capabilities offers another touchpoint for the Company to deliver high value-added services, underlining QualTek’s extensive

repertoire of end-to-end services.

We

believe that revenue will be propelled by the government’s focus and spending in the Renewables space, as well as QualTek’s

commitment to expanding its service offerings and customer base, specifically in its Recovery Logistics sub-segment.

Contract

Overview

QualTek

has numerous MSAs with blue-chip customers that extend for periods of one or more years, with a majority for three or more years, some

of which have automatic renewals, providing meaningful revenue visibility. Generally, the Company maintains multiple agreements with

each customer as different geographies and scopes of work are individually priced. Pricing is generally based on a fixed price per unit

basis with up to hundreds of units priced in a single contract. Many contracts specify discrete billing milestones for each job to be

performed. As an agreed-upon milestone is achieved, QualTek may bill for the work performed. Purchase orders for discrete projects are

generally issued under an MSA. This allows for quantity adjustments for the number of tasks/units that are performed with respect to

a project. There are also other adjustments such as “rock adders” that accommodate changes in scope versus original engineering

plans. MSAs have historically experienced high renewal rates.

QualTek

utilizes a disciplined approach when bidding on new contracts and will decline to bid if management believes QualTek cannot deliver the

quality that meets Company standards while achieving return targets. The Company’s approach in submitting a bid that meets target

returns is based on a number of factors, including, but not limited to its:

| • | Experience

in accurately understanding the scope of the work and associated margin |

| • | Knowledge

of local factors (i.e., resources, regional dynamics, work conditions, etc.) that will

impact work to be performed |

| • | Ability

to simultaneously “lock-in” labor rates with contracts for the work to be performed

on fixed price per unit basis (“back-to-back” agreements with contractors) |

| • | Pass-through

nature of material purchases |

Due

to the Company’s turnkey capabilities and high standard for quality control, QualTek often receives requests from customers to

bid on new contract opportunities.

Human

Capital Resources

Our

employees are critical to our success. In order to best service our customers, QualTek utilizes a hybrid in-house & contracted

labor model to flex our workforce. As of December 31, 2022, the Company had a combined workforce of approximately 803 in the Midwest,

1,159 in the West, 635 in the Southwest, 908 in the Southeast, and 1,770 in the Northeast. The Northeast workforce includes approximately

100 corporate employees that support all regions. Our combined workforce of approximately 5,275 includes 1,947 employees and 3,328 contracted

workers. Additionally, approximately 15% of our workforce is comprised of Veterans of the U.S. Armed Forces. Our

executive leadership team averages over 21 years of industry or functional experience. To date, we have not experienced any work stoppages and

consider our relationship with our employees to be in good standing.

Safety:

QualTek is committed to the safety and well-being of our employees and the communities in which we work. Our Health and Safety Program

complies with all applicable laws, rules, and regulations, as well as our own standards. Our objective is to surpass best practices while

eliminating or mitigating hazards that expose our personnel to injuries and illnesses. We hold our employees to the highest safety standards

while also identifying new hazards and effectiveness of our best-in-class safety program.

We

invest in highly effective, and thorough training. We go above and beyond for each individual to

ensure safety, efficiency, and consistency across our entire team. We have training facilities in New York, Minnesota, Virginia, California,

and Pennsylvania.

QualTek

maintains a multi-disciplined and certified Safety team that both trains and reinforces QualTek’s safety culture to all employees.

QualTek’s Safety team has certified Occupational Safety and Health Administration (“OSHA”) outreach instructors, first

aid, cardiopulmonary resuscitation (“CPR”), radio frequency awareness, and National Safety Council Defensive Driver instructors.

Our team also has multiple National Wireless Safety Alliance (“NWSA”) practical examiners and Construction Industry Training &

Certification Academy (“CITCA”) rigging and climber training instructors.

Health &

Wellness: QualTek offers a comprehensive health and wellness benefits package that is designed to meet the individual needs of our

employees and their families. Current health offerings include medical, prescription, dental, and vision coverage. The QualTek wellness

program provides access to a variety of health and well-being resources to encourage employees to prioritize and maintain a healthy lifestyle.

To help employees manage their financial wellness, QualTek offers a 401k plan with a Company match, short-and long-term disability benefits,

life insurance, various flexible spending accounts, critical accident, critical illness, and hospital indemnity coverage. Through the

QualTek Employee Assistance Program (EAP), employees and their household members can seek support for health, financial, legal, and other

personal matters.

Additionally,

QualTek recognizes that employees have diverse needs for time away from work. To ensure a healthy work life balance, QualTek provides

employees with paid time off, paid sick time, paid holidays, and paid parental leave.

Diversity,

Equity, & Inclusion: At QualTek, we believe that our people are our greatest asset. We are committed to maintaining a workplace

that champions and values diversity. We strive to cultivate a dynamic and inclusive culture of collaboration and respect. Hiring, promoting,

and retaining a workforce with diverse backgrounds and perspectives enables us to best serve our customers and fulfill the Company’s

mission. Recognizing and valuing diversity is a responsibility of employees at all levels of the organization.

Government

Regulations

We

are subject to state and federal laws that apply to businesses generally, including laws and regulations related to labor relations,

wages, worker safety and environmental protection. While many of our customers operate in regulated industries (for example, utilities

regulated by the public service commission or communications companies regulated by the Federal Communications Commission (“FCC”)),

we are not generally subject to such regulation and oversight.

In

addition to environmental laws and regulations, as a contractor, our operations are subject to various laws, including:

| • | regulations

related to worker safety and health, including those established by the Occupational Safety

and Health Administration and state equivalents; |

| • | regulations

related to vehicle registrations, including those of the states and the U.S. Department of

Transportation; |

| • | contractor

licensing requirements; |

| • | permitting

and inspection requirements; and |

| • | building

and electrical codes. |

We

are subject to numerous environmental laws, regulations and programs, including the handling, transportation and disposal of non-hazardous

and hazardous substances and wastes, laws governing emissions and discharges into the environment, including discharges into air, surface

water, groundwater and soil, and programs related to the protection of endangered species and critical habitats.

We

are also subject to laws and regulations that impose liability and cleanup responsibility for releases of hazardous substances into the

environment. Under certain of these laws and regulations, liabilities can be imposed for cleanup of properties, regardless of whether

we directly caused the contamination or violated any law at the time of discharge or disposal. The presence of contamination from such

substances or wastes could interfere with ongoing operations or adversely affect our business.

In

addition, we could be held liable for significant penalties and damages under certain environmental laws and regulations. Our contracts

with customers may also impose liabilities on us regarding environmental issues that arise through the performance of our services. From

time to time, we may incur unanticipated and substantial costs and obligations related to environmental compliance and/or remediation

matters.

We

believe we have all material licenses and permits needed to conduct operations and that we are in material compliance with all applicable

regulatory and environmental requirements. We could, however, incur significant liabilities if we fail to comply with such requirements.

The

potential effects of climate change on our operations are highly uncertain. Climate change may result in, among other things, changes

in rainfall patterns, storm patterns and intensities and temperature levels. Our operating results are significantly influenced by weather.

Therefore, major changes in weather patterns could have a significant effect on our future operating results. For example, if climate

change results in significantly more adverse weather conditions in a given period, we could experience reduced productivity, which could

negatively affect our revenue and profitability. Climate change could also affect our customers and the projects that they award. Demand

for power projects or other projects could be negatively affected by significant changes in weather or from legislation or regulations

governing climate change. Conversely, increased catastrophic weather events could favorably impact the revenue and profitability of our

Recovery Logistics business.

Available

Information

Our

investor relations website address is https:investors.qualtekservices.com. We are required to file Annual Reports on Form 10-K

and Quarterly Reports on Form 10-Q with the SEC on a regular basis, and are required to disclose certain material events in a Current

Report on Form 8-K. The SEC also maintains a website that contains reports, proxy and information statements and other information

regarding issuers that file electronically with the SEC. The SEC’s website is located at http://www.sec.gov.

Item

1A. Risk Factors

You

should carefully consider the following risk factors, together with all of the other information included in this Form 10-K. We

may face additional risks and uncertainties that are not presently known to us, or that we currently deem immaterial. The following discussion

should be read in conjunction with the financial statements and notes to the financial statements included elsewhere in this Form 10-K.

These risk factors are not exhaustive. You should carefully consider the following risk factors in addition to the other information

included in this Form 10-K, including matters addressed in the

section

entitled “Cautionary Note Regarding Forward-Looking Statements.” QualTek may face additional risks and uncertainties that

are not presently known to it, or that QualTek currently deems immaterial, which may also impair QualTek’s business or financial

condition. The following discussion should be read in conjunction with the consolidated financial statements and notes to the financial

statements included herein. Additional risks, beyond those summarized below, may apply to our activities or operations as currently conducted,

or as we may conduct them in the future, or in the markets in which we operate or may in the future operate.

Summary

of Risk Factors

Our

business operations are subject to numerous risks and uncertainties, including those outside of our control, that could cause our business,

financial condition or operating results to be harmed, including, but not limited to, the following:

| • | Our

ability to continue as a going concern, including our belief that our current cash and cash

equivalents will not suffice to fund our business for more than 30 days; |

| • | The

possibility that our material indebtedness is accelerated and that we are unable to pay or

refinance such indebtedness, which could force us to liquidate and/or file for bankruptcy,

resulting in the holders of our Common Stock suffering a total loss on their investment; |

| • | The

risks and uncertainties related to a pre-arranged or pre-packaged bankruptcy reorganization,

which is currently under negotiation; |

| • | The

impact on our financial performance of losing key customers, decreased demand or contract

cancellation; |

| • | The

impact of our level of indebtedness on our ability to negotiate favorable terms with our

customers and vendors; |

| • | The

possibility that our estimation of costs under fixed priced contracts is inaccurate; |

| • | Our

ability to complete projects in a timely manner given the possibility of project delays; |

| • | Our

ability to adequately recover charges against project owners, subcontractors or suppliers; |

| • | Our

ability to convert our backlog into actual revenue and profits; |

| • | Risks

and hazards inherent in our business (including environmental and physical hazards on our

project sites, industrial accidents and weather or geologically related conditions); |

| • | The

seasonality of our business; |

| • | The

potential for us to incur substantial costs resulting from lawsuits or other claims against

us; |

| • | Our

reliance on the security and integrity of our information technology systems to effectively

operate our business; |

| • | The

possible impairment of our goodwill and other intangible assets; |

| • | Uncertainty

with respect to our insurance liabilities and potential costs; |

| • | Our

ability to retain and attract qualified managers, directors, key employees and qualified

personnel; |

| • | The

possibility that strategic investments will harm our operating results, cash flows and liquidity; |

| • | The

ability of our Recovery Logistics business to be profitable; |

| • | Possible

unionization activities among our personnel; |

| • | Our

dependence on the efforts of the Board and key personnel; |

| • | Our

significant amount of debt could adversely affect our business, financial condition and results

of our operations; |

| • | Our

ability to generate sufficient cash flows to satisfy our debt obligations or to refinance

our indebtedness; |

| • | Potential

harm to our results of operations, cash flows and liquidity due to, among other things, poor

subcontractor performance or loss of subcontractors; |

| • | Our

ability to obtain sufficient bonding capacity to support certain service offerings; |

| • | Our

ability to comply with our contractual covenants, including in respect of our debt; |

| • | Constraints

on us as a result of our indebtedness and cross-default provisions that could accelerate

all of our indebtedness; |

| • | Our

ability to repurchase our senior unsecured convertible notes due 2027 (the "2027 Convertible

Notes") upon a fundamental change; |

| • | The

effect of economic downturns, unfavorable market conditions, including from inflation, rising

interest rates or supply chain disruptions and political market uncertainty; |

| • | Our

ability to adjust to changes to laws, governmental regulations and policies; |

| • | Our

ability to compete in a rapidly developing industry with considerable customer consolidation; |

| • | Our

ability to affect the environment or cause exposure to hazardous substances; |

| • | Our

ability to comply with environmental laws related our underground work; |

| • | Our

failure to comply with the regulations of government agencies that oversee transportation

and safety compliance; |

| • | Our

failure to comply with various laws and regulations related to contractor licensing and business

licensing; |

| • | Challenges

presented by climate change and climate change regulations; |

| • | Our

potential failure to regain compliance with the requirements for continued listing on the

Nasdaq Capital Market, resulting in the delisting of our Class A Common Stock; |

| • | The

possibility that our actual financial results will differ materially from our estimates and

assumptions; |

| • | Potential

volatility of market price and market liquidity for shares of our Class A Common Stock; |

| • | The

limited market for our Class A Common stock; |

| • | Our

qualification as an emerging growth company under the JOBS Act and our reliance on certain

exemptions from disclosure and financial reporting requirements; |

| • | The

possibility that our warrants will be exercised and cause dilution to our stockholders; |

| • | Dilutive

effect of the possible conversion of the 2027 Convertible Notes; |

| • | Possible

harm to our business and operations resulting from shareholder activism and securities litigation; |

| • | Expectations

that we will not pay cash dividends in the foreseeable future; |

| • | Our

dependence on distributions from QualTek HoldCo to pay dividends, taxes, other expenses and

required payments under the Tax Receivable Agreement; |

| • | The

possibility that cash payments to TRA Holders under the Tax Receivable Agreement may be substantial

in amount, exceed actual realized tax benefits or be accelerated; |

| • | Our

status as a “controlled company” within the meaning of the Nasdaq listing standards

and, as a result, qualification for exemptions from certain corporate governance requirements; |

| • | The

right of QualTek Equity holders and the Sponsors to elect directors to our Board; |

| • | The

anti-takeover provisions in the Certificate of Incorporation and Amended and Restated Bylaws

and those present in Delaware law; and |

| • | Limitations

on our stockholders’ ability to obtain a favorable judicial forum for disputes with

the Company or its directors, officers or employees. |

Risks

Related to Our Business and Operations

The

Company believes its current cash and cash equivalents will not be sufficient to fund its business for the next twelve months from the

date of its consolidated financial statements, raising substantial doubt about the Company's ability to continue as a going concern.

As

of December 31, 2022, the Company had approximately $495 thousand of cash and cash equivalents. Based on the

Company’s current business plan, management believes that the Company’s available cash and cash equivalents will likely not

be sufficient to fund its operations for the next twelve months from the issuance of the consolidated financial statements that are included

elsewhere in this Annual Report on Form 10-K without generating positive cash flows and raising additional funds. These conditions

raise substantial doubt about the Company’s ability to continue as a going concern (see Note 1 - Nature of Business and Summary of Significant Accounting Policies). In addition, the Company’s current operating

plan is based on assumptions that may prove to be inaccurate, and the Company could use its available capital resources sooner than it

currently expects. The Company may be forced to curtail existing operations if it is unable to obtain additional funding to support its

current business plan.

In

addition, on March 15, 2023, we did not make an interest payment of approximately $3,700 thousand due on the 2027 Convertible Notes.

We had a 30-day grace period, or until April 14, 2023, to make the interest payment. We have not made the interest payment, and

as a result, an event of default has occurred under the indenture that governs our 2027 Convertible Notes (the "Indenture"),

the ABL Credit Agreement (as defined below) and the Term Loan Credit Agreement (as defined below). Pursuant to the Indenture, upon an

event of default, the trustee under the 2027 Convertible Notes or holders of 25% in aggregate principal amount of the outstanding 2027

Convertible Notes may declare the principal of, premium, if any, on and accrued and unpaid interest on, the 2027 Convertible Notes to

be due and payable immediately, which would require the Company to pay approximately $130,000 thousand immediately. In addition, pursuant

to each of the ABL Credit Agreement and the Term Loan Credit Agreement, upon an event of default, the lenders under such facilities can

accelerate the repayment of the outstanding borrowings thereunder and exercise other rights and remedies that they have under applicable

laws. The Company has not received any notices of acceleration as of the date hereof.

The

Company has entered into a forbearance agreement with holders of approximately 72% of the aggregate principal amount of the outstanding

2027 Convertible Notes (the “Forbearing Holders”), pursuant to which the Forbearing Holders have agreed to

(i) forbear from exercising any of their rights and remedies, including with respect to an acceleration, under the Indenture or

applicable law with respect to any default or any event of default arising under the Indenture relating to or as a proximate result of

the Company’s failure to pay interest on the 2027 Convertible Notes on March 15, 2023 or during the subsequent 30-day grace

period and (ii) exercise their rights pursuant to the Indenture to direct the trustee to forbear from exercising any remedy available

to the trustee or exercising any trust or power conferred upon the trustee with respect to such defaults or events of default, in each

case during the period commencing on April 24, 2023 and ending upon the earliest to occur of (a) 11:59 p.m. (New York

City time) on May 15, 2023, (b) the occurrence of any event of default other than the defaults and events of default specified

above, (c) payment of interest that was due March 15, 2023 to each Forbearing Holder, (d) the Company’s failure

to pay any amounts owed to certain of the Forbearing Holders’ advisors, (e) an event of default, acceleration, or similar

event in connection with any of the Company’s funded and/or revolving indebtedness, provided that the Company has not entered into

a forbearance or similar agreement with respect to the foregoing clause (e), and (f) any borrowing or further extension of credit

under the Company’s term loan facility, any provision of additional collateral to or for the benefit of the lenders under such

term loan facility or any other lenders, agents, trustees or other parties under any credit facility or any other financing or similar

instrument, or entry into any other non-ordinary course financing or similar transaction or any material asset disposition, in each case

without the express written consent of the Forbearing Holders.

The

Company has entered into a forbearance agreement with the administrative agent and lenders (the “ABL Forbearing Holders”)

under the ABL Credit Agreement, pursuant to which the ABL Forbearing Holders have agreed to forbear from exercising any of their rights

and remedies, including with respect to an acceleration, in respect of a cross-payment event of default arising under Section 8.1(b)(i) of

the ABL Credit Agreement and any event of default that may arise under Section 8.1(e)(ii) of the ABL Credit Agreement as a

result of our failure to deliver an unqualified audit report (a report not containing an explanatory paragraph regarding "going

concern") with respect to our financial statements for the fiscal year ended December 31, 2022, among other changes and forbearances,

including a reduction in the aggregate commitment from $105,000 thousand to $90,000 thousand. The forbearance period shall expire on

the earliest of: (i) May 15, 2023, (ii) the time at which any of the representations and warranties in the forbearance

agreement is inaccurate in any material respect or any covenant is breached in any material respect, (iii) the occurrence of any

other default or event of default under the ABL Credit Agreement or (iv) the trustee under the Convertible Notes exercises any remedy

under the Indenture.

The

Company has entered into a limited waiver agreement with the administrative agent and required lenders (the “Term Loan Waiving

Holders”) under the Term Loan Credit Agreement, pursuant to which the Term Loan Waiving Holders have agreed to waive certain

defaults, including with respect to an acceleration, in respect of a cross-payment event of default under Section 8.1(b)(i) of

the Term Loan Credit Agreement and any event of default that may arise under Section 8.1(e)(ii) of the Term Loan Credit Agreement

as a result of our failure to deliver an unqualified audit report (a report not containing an explanatory paragraph regarding "going

concern") with respect to our financial statements for the fiscal year ended December 31, 2022, among other changes and waivers,

including changes that will allow the Company to request additional borrowings in the form of new money incremental term loans in an

amount of up to $20,000 thousand, subject to the approval of the Required Lenders (as defined in the Term Loan Credit Agreement). The

waiver period shall expire on the earliest of: (i) May 15, 2023, (ii) the time at which any of the representations and

warranties in the limited waiver agreement is inaccurate in any material respect or any covenant is breached in any material respect,

(iii) the occurrence of any other default or event of default under the Term Loan Credit Agreement or (iv) the trustee under

the Convertible Notes exercises any remedy under the Indenture.

To

address near-term liquidity needs, the Company negotiated with its lenders for a new-money investment, which culminated in the Term Loan

Amendment. Pursuant to the Term Loan Amendment, the Company received a cash infusion totaling $55,000 thousand on March 16,

2023 and expects to receive a cash infusion totaling $5,000 thousand on April 28, 2023, and additional cash infusions totaling $5,000

thousand by May 12, 2023. The Company may also request $10,000 thousand of additional new money incremental term loans under the

Term Loan Credit Agreement, which will be subject to the approval of the Required Lenders. There can be no assurances that, if requested,

the Company will obtain such approval and subsequently be able to borrow the additional $10,000 thousand of new money incremental term

loans. Without additional cash infusions, the Company will likely not have sufficient cash to fund its operations for more than

30 days from the date of this report.

If

our indebtedness is accelerated, we cannot be certain that we will have sufficient funds available to pay the accelerated indebtedness

or that we will have the ability to refinance the accelerated indebtedness on terms favorable to us or at all, which could have a material

adverse effect on our business, results of operations and financial condition and could impact our ability to continue as a going concern.

Even if our creditors do not exercise all rights and remedies available to them in an event of default, such an event of default could

cause a significant decline in the value of our Class A Common Stock.

The

inclusion of the explanatory language around going concern in our consolidated financial statements, any event of default under the agreements

governing our indebtedness and any strategic transactions that we undertake to improve our liquidity position could also have an adverse

impact on our reputation and relationship with third parties with whom we do business, including our customers, vendors and employees.

We will likely choose or need to obtain alternative sources of capital or otherwise meet our liquidity

needs and/or restructure our existing indebtedness through the protections available under applicable bankruptcy or insolvency laws,

including Chapter 11 of the U.S. Bankruptcy Code. Holders of our Class A Common Stock will likely not receive any value or payments

in a restructuring or similar scenario.

In

the event we were to pursue a bankruptcy reorganization under the U.S. Bankruptcy Code, we would be subject to the risks and uncertainties

associated with bankruptcy proceedings, including the potential delisting of our Class A Common Stock from trading on Nasdaq.

We

continue to experience significant financial and operating challenges that present substantial doubt as to our ability to continue as

a going concern. If we continue to experience financial and operating challenges and are unsuccessful or unable to raise additional capital,

it will be necessary for us to commence reorganization proceedings. In the event we were to pursue such a restructuring, our operations,

our ability to develop and execute our business plan and our continuation as a going concern would be subject to the risks and uncertainties

associated with bankruptcy proceedings, including, among others: the high costs of bankruptcy proceedings and related fees; our ability

to maintain the listing of our Class A Common Stock on the Nasdaq Capital Market; our ability to obtain sufficient financing to

allow us to emerge from bankruptcy and execute our business plan post-emergence, and our ability to comply with terms and conditions

of that financing; our ability to maintain our relationships with our lenders, counterparties, vendors, suppliers, employees and other

third parties; our ability to maintain contracts that are critical to our operations on reasonably acceptable terms and conditions; the

ability of third parties to use certain limited safe harbor provisions of the U.S. Bankruptcy Code to terminate contracts without first

seeking bankruptcy court approval; and the actions and decisions of third parties who have claims and/or interests in our bankruptcy

proceedings that may be inconsistent with our operational and strategic plans. In addition, we may be subject to litigation or other

claims related to a bankruptcy or dissolution and liquidation. Any reorganization effected under the U.S. Bankruptcy Code will result

in a total loss of investments in our Class A Common Stock.

In

addition, if we were to commence bankruptcy proceedings, our shares of Class A Common Stock would likely be delisted from trading

on Nasdaq. Nasdaq rules provide that securities of a company that trades on Nasdaq may be delisted in the event that such company

seeks bankruptcy protection. In response to a Chapter 11 filing, Nasdaq would likely issue a delisting letter immediately following such

a filing. If Nasdaq were to issue such a letter, we would have the opportunity to appeal the determination during which time the delisting

would be stayed, but if we did not appeal or otherwise were not successful in our appeal, our Class A Common Stock would soon thereafter

be delisted and our Class A Common Stock could be traded in the over-the-counter markets. Any delisting of our Class A Common

Stock could result in a substantial decline in the value of our Class A Common Stock including, among other reasons, for the reduced

liquidity of our Class A Common Stock.

We

derive a significant portion of our revenue from a few customers, and the loss of one or more of these customers, or a reduction in their

demand for our services, could impair our financial performance. In addition, many of our contracts, including our service agreements,

do not obligate our customers to undertake any infrastructure projects or other work with us, and most of our contracts may be terminated

at will or on short notice.

Our

business is concentrated among relatively few customers, and a substantial portion of our services are provided on a non-recurring, project-by-project

basis. Our revenue could significantly decline if we were to lose one or more of our significant customers, or if one or more of our

customers reduce the amount of business they provide to us. Our customers may choose to reduce the amount of business they provide to

us for, among other reasons, concerns regarding our liquidity. For the fiscal year ended December 31, 2022, our top three customers

accounted for approximately 66% of our total revenues, respectively. In addition, our results of operations, cash flows and liquidity

could be negatively affected if we complete the required work on non-recurring projects and cannot replace them with similar projects.

See Note 1. Nature of Business and Summary of Significant

Accounting Policies, in the notes to our audited consolidated financial statements included herein for revenue concentration

information.

We

derive a significant portion of our revenue from multi-year MSAs and other service agreements. Under these agreements, our customers

have no obligation to undertake any infrastructure projects or other work with us. In addition, most of our contracts can be terminated

at will or on short notice. This makes it difficult to estimate our customers’ demand for our services. A significant decline in

the volume of work our customers request us to perform under these service agreements could negatively affect our results of operations,

cash flows and liquidity.

Some

of our contracts, including our service agreements, are periodically open to public bid. We may not be the successful bidder on existing

contracts that are re-bid. We could experience a reduction in revenue, profitability and liquidity if we fail to win a significant number

of existing contracts upon re-bid, or, for services that are provided on a non-recurring basis, if we complete the required work under

a significant number of projects and cannot replace them with similar projects. Additionally, from time to time, we enter into contracts

that contain financing or other conditions that must be satisfied before we can begin work. Certain of these contracts may not result

in revenue or profits if our customers are unable to obtain financing or to satisfy other conditions associated with such projects.

Our

level of indebtedness may hinder our ability to negotiate favorable terms with our customers and vendors, which could negatively impact

our operating performance and, thus, could make it more difficult for us to generate cash flow sufficient to satisfy all of our obligations

under our indebtedness.

Our

success is partially attributable to our ability to negotiate attractive pricing and terms with our customers, vendors and suppliers.

Our level of indebtedness may adversely affect our credit profile or rating. Our customers consider our credit profile when negotiating

contract terms, and if they were to change the terms on which they demand payment from us, or refuse to do business with us altogether,

it could have a material adverse effect on our business, results of operations, cash flows and financial condition.

Our

credit profile or rating may also adversely affect our ability to negotiate favorable trade terms from our current or future vendors,

including pricing, payment, delivery, inventory, transportation, and other terms, and may increase our need to support purchases with

letters of credit or to procure goods or services on a cash-in-advance basis. This could negatively impact the profitability and liquidity

of our business and our ability to effectively compete. Thus, our level of indebtedness could adversely affect the profitability of our

business, which could make it more difficult for us to generate cash flow sufficient to satisfy our obligations under our indebtedness.

We

may not accurately estimate the costs associated with services provided under fixed price contracts, which could impair our financial

performance. Additionally, we recognize revenue for certain projects using the cost-to-cost method of accounting; therefore, variations

of actual results from our assumptions could reduce our profitability.

We

derive a significant portion of our revenue from fixed price MSAs and other service agreements. Under these contracts, we typically set

the price of our services on a per unit or aggregate basis and assume the risk that costs associated with our performance may be greater

than what we estimated.

We

also enter into contracts for specific projects or jobs that require the installation or construction of an entire infrastructure system

or specified units within an infrastructure system, many of which are priced on a fixed price or per unit basis. Our profitability will

be reduced if actual costs to complete a project exceed our original estimates. Our profitability is therefore dependent upon our ability

to accurately estimate the costs associated with our services and our ability to execute in accordance with our plans. A variety of factors

could negatively affect these estimates, including delays resulting from weather, changes in expected productivity levels, conditions

at work sites differing materially from those anticipated at the time we bid on the contract and higher than expected costs of labor

and/or materials. These variations, along with other risks inherent in performing fixed price contracts, could cause actual project results

to differ materially from our original estimates, which could result in lower margins than anticipated, or losses, which could reduce

our profitability, cash flows and liquidity.

In

addition, we recognize revenue from fixed price contracts, as well as for certain projects pursuant to MSAs and other service agreements,

over time utilizing the cost-to-cost measure of progress, or the “cost-to-cost” method of accounting, under which the percentage

of revenue to be recognized in a given period is measured by the percentage of costs incurred to date on the contract to the total estimated

costs for the contract. The cost-to-cost method, therefore, relies on estimates of total expected contract costs. Contract revenue and

total contract cost estimates are reviewed and revised on an ongoing basis as the work progresses. Adjustments arising from changes in

the estimates of contract revenue or costs are reflected in the fiscal period in which such estimates are revised. Estimates are based

on management’s reasonable assumptions, judgment and experience, but are subject to the risks inherent in estimates, including

unanticipated delays or technical complications, changes in job performance, job conditions and management’s assessment of expected

variable consideration. Variances in actual results from related estimates on a large project, or on several smaller projects, could

be material. The full amount of an estimated loss on a contract is recognized in the period such losses are determined. Any such adjustments

could result in reduced profitability and negatively affect our results of operations.

Our

failure to properly manage projects, or project delays, including those resulting from difficult work sites and environments or delays,

could result in additional costs or claims or failure to achieve actual revenue or profits when anticipated or at all, which could have

a material adverse effect on our operating results, cash flows and liquidity.

Certain

of our engagements involve large-scale, complex projects that may occur over extended time periods. The quality of our performance on

such a project depends in large part upon our ability to manage our client relationships and the project itself, such as the timely deployment

of appropriate resources, including third-party contractors and our own personnel. Our results of operations, cash flows and liquidity

could be adversely affected if we miscalculate the resources or time needed to complete a project with capped or fixed fees, or the resources

or time needed to meet contractual milestones.

We

perform work under a variety of conditions, including, but not limited to, challenging and hard to reach terrain and difficult site conditions.

Performing work under such conditions can result in project delays or cancellations, potentially causing us to incur unanticipated costs,

reductions in revenue or the payment of liquidated damages. In addition, some of our agreements require that we assume the risk should

actual site conditions vary from those expected. Some of our projects involve challenging engineering, procurement and construction phases,

which may occur over extended time periods. We may encounter difficulties in engineering, delays in designs or materials provided by

the customer or a third party, equipment and material delivery delays, permitting delays, schedule changes, delays from customer failure

to timely obtain rights-of-way, weather-related delays, delays by subcontractors in completing their portion of projects and governmental,

market and political or other factors, some of which are beyond our control and could affect our ability to complete a project as originally