Filed Pursuant to Rule 424(b)(3)

Registration No. 333-267477

Prospectus Supplement No. 2

(To Prospectus dated October 6, 2022)

QUALTEK SERVICES INC.

3,589,000

Shares of Class A Common Stock

306,000 warrants by the Selling Stockholders

Senior Convertible Notes due 2027 by the Selling

Noteholders

Up to 31,104,034 Shares of Class A Common Stock

Underlying 2027

Convertible

Notes

This

prospectus supplement is being filed to update and supplement the information contained in the prospectus dated October 6, 2022 (the

“Prospectus”), related to (a) the resale from time to time of (i) up to 3,589,000 shares of Class A common

stock, $0.0001 par value, of QualTek Services Inc. (“Class A Common Stock”) including 306,000 shares of Class

A Common Stock issuable upon the exercise of Private Placement Warrants, each exercisable for one share of Class A Common Stock at a

price of $11.50 per share (“warrants”) and (ii) 306,000 warrants by the selling security holders named

in this prospectus (each a “Selling Stockholder,” and, collectively, the “Selling Stockholders”),

(b) the resale from time to time of up to $124,685,000 in aggregate principal amount of senior convertible notes due 2027 (the “2027

Convertible Notes”) by the selling holders named in this prospectus (the “Selling Noteholders”

and, together with the Selling Stockholders, the “Selling Securityholders”) and (c) the resale from time to

time of up to 31,104,034 shares of our Class A Common Stock issuable upon conversion of the 2027 Convertible Notes by the Selling Noteholders

(all undefined capitalized terms are as defined in the Prospectus), with the information contained in our Current Report on Form 8-K,

filed with the Securities and Exchange Commission (the “SEC”) on December 7, 2022 (the “Current

Report”). Accordingly, we have attached the Current Report to this prospectus supplement.

This prospectus supplement updates

and supplements the information in the Prospectus and is not complete without, and may not be delivered or utilized except in combination

with, the Prospectus, including any amendments or supplements thereto. This prospectus supplement should be read in conjunction with

the Prospectus and if there is any inconsistency between the information in the Prospectus and this prospectus supplement, you should

rely on the information in this prospectus supplement.

Our Class A Common Stock and

warrants are traded on The Nasdaq Capital Market under the symbols “QTEK” and “QTEKW,” respectively. On December

7, 2022, the closing price of our Class A Common Stock and warrants were $0.5599 and $0.0851, respectively.

We are an “emerging growth company”

as defined under the federal securities laws and, as such, have elected to comply with certain reduced public company reporting requirements.

Investing in our Class A Common Stock, warrants

and 2027 Convertible Notes is highly speculative and involves a high degree of risk. See “Risk Factors” beginning on page

17 of the Prospectus and in any applicable prospectus supplement.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of the securities to be issued under this prospectus or determined if

this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is December 7,

2022.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

December 1, 2022

QUALTEK SERVICES INC.

(Exact name of registrant as specified in its

charter)

| Delaware |

001-40147 |

83-3584928 |

| (State or other jurisdiction |

(Commission |

(IRS Employer |

| of incorporation) |

File Number) |

Identification No.) |

475 Sentry Parkway E, Suite 200, Blue Bell,

PA 19422

(Address of principal executive offices) (Zip Code)

Registrant's telephone number, including area code

(484) 804-4585

Not Applicable

(Former name or former

address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.

below):

| |

¨ |

Written communications pursuant to Rule 425

under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to

Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to

Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

symbol(s) |

|

Name

of each exchange on which registered |

| Class A Common Stock |

|

QTEK |

|

The Nasdaq Stock Market LLC |

| Warrants |

|

QTEKW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934

(17 CFR §240.12b-2).

Emerging

growth company x

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

Item 5.02 Departure of Directors or Certain Officers; Election of

Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Resignation of Directors

On December 1, 2022, Sam Chawla resigned as a

director on the Board of Directors (the “Board”) of QualTek Services Inc., a Delaware corporation (the “Company”)

and as a member of the Board’s Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee, on such

date, effective immediately. On the same date, Sam Totusek resigned as a director on the Board of the Company and as a member of the Nominating

and Corporate Governance Committee, on such date, effective immediately. Neither of Mr. Chawla’s nor Mr. Totusek’s decision

to resign was due to any disagreement with the Company on any matter relating to the Company’s operations, policies or practices

(financial or otherwise).

Appointment of Directors

On December 1, 2022, at the recommendation of

the Nominating and Corporate Governance Committee, the Board appointed Cielo Hernandez as a Class II director of the Company, effective

immediately, to fill the vacancy created by Sam Chawla’s resignation, with a term expiring at our annual meeting of stockholders

in 2023 or until her successor is duly elected and qualified or until her earlier resignation, removal or death. The Board also appointed

Ms. Hernandez to serve as a member of the Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee.

Ms. Hernandez will receive compensation for her

service as a director consistent with the Company’s independent non-employee director compensation program previously disclosed

in the Company’s definitive proxy statement for its 2022 annual meeting of shareholders, including pro-rated equity compensation.

There is no arrangement or understanding between Ms. Hernandez and any other person pursuant to which she was selected as a director.

Ms. Hernandez does not have any direct or indirect material interest in any transaction required to be disclosed pursuant to Item 404(a)

of Regulation S-K.

On December 1, 2022, at the recommendation of

the Nominating and Corporate Governance Committee, the Board appointed Bruce Roberson as a Class III director of the Company, effective

immediately, to fill the vacancy created by Sam Totusek’s resignation, with a term expiring at our annual meeting of stockholders

in 2024 or until his successor is duly elected and qualified or until earlier resignation, removal or death. The Board also appointed

Mr. Roberson to serve as a member of the Nominating and Corporate Governance Committee. Mr. Roberson is a Partner at Brightstar Capital

Partners (“BCP”), which, with its affiliates, owns a majority of the voting power of the Company’s Common Stock.

As Mr. Roberson is affiliated with BCP, he will not receive any compensation

for his service as a director. There is no arrangement or understanding between Mr. Roberson and any other person pursuant to which he

was selected as a director. Mr. Roberson does not have any direct or indirect material interest in any transaction required to be disclosed

pursuant to Item 404(a) of Regulation S-K.

On December 1, 2022, the shareholders of the Company voted to elect

John Kritzmacher to serve as a member of the Board of Directors, effective immediately. On December 1, 2022, the Board appointed Mr. Kritzmacher

to serve as the Chairman of the Audit Committee. Mr. Kritzmacher will receive compensation for his service as a director consistent with

the Company’s independent non-employee director compensation program, including pro-rated equity compensation.

Item 5.07 Submission of Matters to a Vote of Security Holders.

On December 1, 2022, the Company held its Annual

Meeting. A total of 37,023,473 shares of the Company’s Common Stock were present or represented by proxy at the Annual Meeting,

representing approximately eighty-two percent (82%) of the outstanding Common Stock as of October 31, 2022, the record date for the

Annual Meeting.

At the Annual Meeting, three (3) proposals were

submitted for a vote of the Company’s stockholders and the related results are as follows:

Proposal No. 1: The election of nominees,

Andrew Weinberg, Matthew Allard, and John Kritzmacher to the Board of Directors to hold office until the 2025 Annual Meeting of Stockholders

as Class I directors. The stockholders elected the three Class I directors by the following votes:

| Name | |

For | |

Withheld | |

Broker Non-Votes |

| Andrew Weinberg | |

34,463,691 | |

279,271 | |

2,280,511 |

| Matthew Allard | |

34,463,855 | |

279,107 | |

2,280,511 |

| John Kritzmacher | |

34,678,135 | |

64,827 | |

2,280,511 |

Proposal No. 2: The stockholders ratified

RSM US LLP as the Company’s independent registered accounting firm by the following votes:

| Votes For | |

36,980,151 |

| Votes Against | |

20,424 |

| Abstentions | |

22,898 |

Proposal

No. 3: The approval of a non-binding resolution regarding the frequency of future advisory votes on the compensation of the

Company’s named executive officers which could be held every year, every two (2) years or every three (3) years. The stockholders

approved the non-binding advisory resolution regarding the frequency of future votes on executive compensation every three (3) years as

follows:

| 1 Year | |

2,621,022 |

| 2 Years | |

10,980 |

| 3 Years | |

32,086,204 |

| Abstentions | |

24,756 |

| Broker Non-Vote | |

2,280,511 |

Item 7.01. Regulation FD Disclosure.

On December 7, 2022, the Company

issued a press release, which is attached to this Current Report on Form 8-K as Exhibit 99.1 and incorporated herein by reference.

This information shall not

be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

or otherwise subject to the liabilities of that section, and it shall not be deemed incorporated by reference in any filing under the

Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

QUALTEK SERVICES INC. |

| |

|

| |

|

| |

/s/ Christopher S. Hisey |

| |

Name: Christopher S. Hisey |

| |

Title: Chief Executive Officer |

| |

|

| Date: December 7, 2022 |

|

Exhibit 99.1

QualTek Appoints New Independent Members to its Board of Directors

BLUE BELL, Pa., December 7, 2022 - QualTek Services Inc. (“QualTek”

or the “Company”) (NASDAQ: QTEK), a leading turnkey provider of infrastructure services to the North American 5G wireless,

telecom, power grid modernization and renewable energy sectors, announced today the appointment of John Kritzmacher, Bruce Roberson and

Cielo Hernandez to QualTek’s Board of Directors. They will replace Jigisha Desai, Sam Totusek, and Sam Chawla.

“We are excited to welcome John, Bruce and Cielo to QualTek’s

Board of Directors and believe their extensive experience and expertise, both as board members and operators, will benefit QualTek as

we execute on future growth,” said QualTek CEO Scott Hisey. “We also would like to thank Jigisha, Sam, and Sam for their service

to the board.”

John

Kritzmacher joins the board with decades of experience as a board director, CFO and C-level operations executive across the Technology,

Media & Telecom sector. Mr. Kritzmacher’s leadership perspective is derived from a combination of senior finance and operations

roles in fast-paced markets disrupted by new technology and business model innovations. Mr. Kritzmacher has served as board director for

InterDigital (NASDAQ: IDCC) for 13 years, including eight years as Audit Committee Chair. Previously, he served on Duff & Phelps’

board prior to the firm being taken private. In his senior executive roles, Mr. Kritzmacher most recently served as Executive Vice

President and Chief Financial Officer of Wiley (NYSE: JWA) from 2013-2021, developing and executing strategies to drive revenue growth

and achieve the highest earnings performance in the company’s 215+-year history. Mr. Kritzmacher’s Telecom experience includes

serving as CFO at Lucent Technologies, leading into its merger with Alcatel, and as CFO at Global Crossing, leading into its combination

with Level 3. Mr. Kritzmacher earned an undergraduate degree in mathematics and economics from Dartmouth College. He also holds an MBA

with a specialization in accounting from New York University Stern School of Business. John will serve as Audit Committee Chairman.

Bruce Roberson joins the Board with more than 35 years’ experience

as a CEO, investor, and consultant. Mr. Roberson is a Partner at Brightstar Capital Partners. Prior to joining Brightstar Capital Partners,

he was a Partner with Sun Capital Partners, responsible for leading the firm’s operations team in North America. In that role Mr.

Roberson was responsible for the performance of more than thirty portfolio companies and served as a board member for 22 of those companies.

Previously, Mr. Roberson served for ten years as President and CEO of PSC Industrial Services under two different private equity owners.

At PSC, Mr. Roberson led four separate sale processes. Prior to PSC, Mr. Roberson was an executive with Safety-Kleen Systems as well as

a Senior Partner at McKinsey & Company where he worked for twenty years. Bruce received an economics degree from Stanford University

and a Master of Business Administration from Harvard Business School.

Cielo Hernandez joins the board as an accomplished leader with more

than 25 years of experience leading global teams across various industries including logistics, energy, manufacturing, retail and technology.

Currently, Ms. Hernandez is the Chief Financial Officer and Chief Human Resources Officer of ProTrans Holdings, Inc. in Austin, TX. Ms.

Hernandez is a strategic leader responsible for all financial activities with a focus on driving financial performance management, profitability

analysis, long-term financing plan, and compliance. Ms. Hernandez also has extensive experience in HR strategy and transformation that

drive company growth and profitability. Ms. Hernandez currently serves as a Board member for KVH Industries (NYSE: KVHI) as a Chairman

of the Audit Committee and Board Member of the Rowan University Foundation. Ms. Hernandez also served as a Board Member for the Chamber

of Commerce Southern NJ, a Board Member for SJI subsidiaries, President and Board Member of Maersk Inc and Maersk Services and Board Member

for APM Terminals and MSC Joint Venture. Ms. Hernandez earned an undergraduate degree in accounting from Universidad Santiago de Cali,

Colombia. She also holds an MBA with specialization in international business from the University of Miami.

About QualTek

Founded in 2012, QualTek is a leading technology-driven provider of

infrastructure services to the 5G wireless, telecom, power grid modernization and renewable energy sectors across North America. QualTek

has a national footprint with more than 80 operation centers across the U.S. and a workforce of over 5,000 people. QualTek has established

a nationwide operating network to enable quick responses to customer demands as well as proprietary technology infrastructure for advanced

reporting and invoicing. The Company reports within two operating segments: Telecommunications, and Renewables and Recovery and has already

become a leader in providing disaster recovery logistics and services for electric utilities. For more information, please visit https://www.qualtekservices.com.

Forward Looking Statements

This

communication contains forward-looking statements for purposes of the safe harbor provisions under the United States Private Securities

Litigation Reform Act of 1995, including statements about the financial condition, results of operations, earnings outlook and prospects

of QualTek. Forward-looking statements are typically identified by words such as “plan,” “believe,” “expect,”

“anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,”

“continue,” “could,” “may,” “might,” “possible,” “potential,”

“predict,” “should,” “would” and other similar words and expressions, but the absence of these words

does not mean that a statement is not forward-looking.

The forward-looking statements

are based on the current expectations of the management of QualTek and are inherently subject to uncertainties and changes in circumstances

and their potential effects and speak only as of the date of such statement. There can be no assurance that future developments will be

those that have been anticipated. These forward-looking statements involve a number of risks, uncertainties or other assumptions that

may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements.

These risks and uncertainties include, but are not limited to, those discussed and identified in public filings made with the SEC by QualTek.

Should one or more of the risks or uncertainties materialize or should

any of the assumptions made by the management of QualTek prove incorrect, actual results may vary in material respects from those projected

in these forward-looking statements.

All subsequent written and oral

forward-looking statements concerning the matters addressed in this communication and attributable to QualTek or any person acting on

its behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this communication. Except

to the extent required by applicable law or regulation, QualTek undertakes no obligation to update these forward-looking statements to

reflect events or circumstances after the date of this communication to reflect the occurrence of unanticipated events

Media Contact:

QualTek IR/Communications

Madison Leonard

PR@qualtekservices.com

(484) 804 - 4585

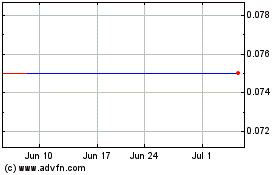

QualTek Services (NASDAQ:QTEK)

Historical Stock Chart

From Mar 2024 to Apr 2024

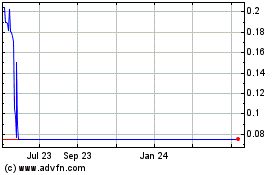

QualTek Services (NASDAQ:QTEK)

Historical Stock Chart

From Apr 2023 to Apr 2024