Virus Brings Both Credits and Debits to PayPal and Square -- Heard on the Street

May 07 2020 - 6:29AM

Dow Jones News

By Telis Demos

Locked-down consumers are figuring out how to buy things online

that they used to get in stores. The question for the

digital-payments industry is how permanent that shift will be.

PayPal Holdings, the online payments giant, wasn't immune from

the slowdown seen across the consumer economy in March. Total

payment volume for the quarter grew 19% overall from a year earlier

in constant currency, slowing from a 26% pace through February to

7% in March, the company reported on Wednesday.

However, volumes are quickly rebounding: In April payment volume

was up 22%, and PayPal is seeing a record surge in net new active

user growth. Drivers of that rebound ranged from a jump in online

shopping to celebrities like Ellen DeGeneres making gifts to fans

through PayPal's Venmo platform.

PayPal is for now expecting the volume growth trend to slow in

May and June. For one thing, travel and events -- two categories of

spending that are unlikely to rebound anytime soon -- make up a

high-single-digit proportion of PayPal's transaction portfolio.

But there are some indications the shift to behaviors like

online grocery buying won't fully reverse. In Germany, where there

is some reopening, PayPal said it hasn't seen a meaningful change

in online behavior, with relevant activity still running at two to

three times the pre-virus level. PayPal also said it would

accelerate efforts to make itself an in-store player, as well as a

broader financial tool for direct deposit and things like paying

bills.

For example, Chief Executive Dan Schulman noted to analysts that

PayPal is speaking to the largest supermarket in France about doing

more contactless payments, and finding ways to mix the digital and

physical channels. Even if they are going to stores, consumers

"don't want to touch cash, they don't want to touch screens," Mr.

Schulman said. "There's going to be a new normal that emerges from

that."

In a poor economy, such efforts will be key to achieving the

level of growth assumed by PayPal's stock, which at over 36 times

forward earnings is near its highs as a public company, according

to FactSet.

Square, meanwhile, is suffering from having a base of in-store

terminals. Gross payment volume for its sellers was down 39% in the

last two weeks of the first quarter, a pace that continued through

April.

The company says it is beginning to find some offsets. Weekly

payment volume via Square's online store tool was up fivefold in

late April after launching new features like curbside pickup. It is

also seeing a jump in use of its consumer Cash App, a Venmo

competitor. Notably, as government stimulus payments went out,

April direct-deposit volumes into the Cash App were up threefold

from March. Direct deposit-eligible customers grew from 3 million

in February to 14 million by mid-April.

That's excellent for Square's long-term vision for digital

banking, a key support for its big multiple. After plunging in

March, the stock is now back to a sky-high 97 times forward

earnings, despite what is happening in stores.

This is potentially an epic moment for the emergence of digital

payments, but it's too soon for either of the biggest players to

declare victory.

Write to Telis Demos at telis.demos@wsj.com

(END) Dow Jones Newswires

May 07, 2020 06:14 ET (10:14 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

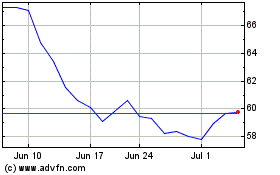

PayPal (NASDAQ:PYPL)

Historical Stock Chart

From Mar 2024 to Apr 2024

PayPal (NASDAQ:PYPL)

Historical Stock Chart

From Apr 2023 to Apr 2024