By Peter Rudegeair

The lending machines of Silicon Valley are running at

half-speed.

Financial-technology companies including PayPal Holdings Inc.

and Square Inc. were eager to participate in the government's $350

billion lending program designed to keep small businesses afloat

during the coronavirus pandemic. But some aspects of the government

programs render much of the industry less effective.

The stakes are high for small businesses desperate for cash,

especially since the program is close to running out of money.

A new Federal Reserve facility that will finance billions of

dollars of the loans excludes lenders that aren't banks. What's

more, fintech lenders got a late start compared with banks. The

Treasury Department and Small Business Administration didn't start

letting the fintech companies into the first-come, first-served

lending program until after roughly half of the funds had already

been claimed.

And the SBA's loan portal is ill-equipped to plug into the

automated lending software developed by startups and tech

companies. The portal, for example, often requires lenders to

insert applicants' information manually.

"It's kind of like they built a maglev train and had to

reverse-engineer it into a handcar, because that's the track

they've been given," said Brian Peters, executive director of

Financial Innovation Now, an industry association whose members

include Intuit Inc., PayPal and Square.

Fintech companies have ramped up their lending to small

businesses over the past five years, filling a void left by banks

that backed away from the sector following heavy losses during the

financial crisis. For many small businesses, they are the only way

to get a loan. But with the pot of money reserved for payroll loans

running out as soon as this week and with no agreement in Congress

to add more funding, many small businesses, especially those that

were turned away by banks, could be left behind.

"We're doing our best, but the timelines are tight and the

demand is high," said Luke Voiles, vice president and business

leader of Intuit's lending arm, QuickBooks Capital.

The $350 billion recovery effort, called the Paycheck Protection

Program, allows small businesses to apply for forgivable loans that

can be used to cover eight weeks of payroll and other expenses.

Businesses apply to lenders, and the SBA guarantees the loans.

From the start, policy makers wanted to expand the pool of

approved SBA lenders to reach more small businesses, and fintech

companies spotted an opportunity. In mid-March, Square Chief

Executive Jack Dorsey reached out to Treasury Secretary Steven

Mnuchin to express interest in joining the program, according to

people familiar with the matter.

Among the companies that received the go-ahead in recent days to

start making payroll loans were Intuit, PayPal and Square, as well

as the specialized online lenders Funding Circle USA Inc. and On

Deck Capital Inc. But the first of them only got approval a week

after banks started accepting loan applications on April 3.

Fintech companies bring vast customer networks to the table. In

the U.S., PayPal serves more than 10 million small businesses while

Intuit's QuickBooks accounting software counts about six million

users.

Many small businesses have complained that big banks won't even

consider applications from businesses that aren't existing

customers. The ability to apply for a loan through a tech vendor

they use gives them more options.

It also helps that many fintech companies already have vast

amounts of information on their clients, which they say lets them

make lending decisions quickly. Square and Intuit, for example,

also make payroll software for businesses, so they can produce the

documentation themselves for the government-backed loans without

applicants having to calculate anything.

The volume of small loans to businesses on big banks' books fell

more than one-fifth from mid-2015 until mid-2019, according to data

from the Federal Deposit Insurance Corp. During that span, PayPal

expanded its holdings of loans it made to businesses by more than

10-fold, to $2.4 billion.

To receive the government guarantee, loan applications are

submitted through an SBA portal called E-Tran. The bulk of those

often require loan officers to enter applicants' information

manually, according to lenders.

Last fiscal year, about 52,000 loan requests for the SBA's

flagship program were approved through E-Tran, according to the

agency. In just the past two weeks, the SBA has approved more than

one million payroll loans.

Banks resorted to assigning thousands of employees to the task

of filling in fields in E-Tran by hand to handle the flood of

interest in the payroll-loan program. Fintech companies, which

operate with fewer people and more automation, can't easily do the

same.

The SBA is developing an application-programming interface, a

way for two pieces of software to exchange data without human

involvement, for payroll loans that would allow lenders to upload

applications in batches, according to people familiar with the

matter. Certain lenders are testing that interface, but it was

unknown when the SBA would start accepting actual applications

through it, the people said.

How to fund the loans is another challenge for fintech lenders.

Banks can choose to make the loans using their depositors' money or

use the loans as collateral to borrow from the Fed. Fintech

companies, because they aren't banks, can't avail themselves of

either option.

Many fintech lenders rely on outside investment managers to

purchase the loans they do make. But the government-set interest

rate on the payroll loans -- 1% -- is too low to appeal to many

investors.

Some fintechs, including PayPal, work with a bank to make their

loans, and the bank can access the Fed funding.

Fed officials have discussed opening its payroll lending

facility to nonbanks but haven't released details or a

timeline.

--Coulter Jones contributed to this article.

Write to Peter Rudegeair at Peter.Rudegeair@wsj.com

(END) Dow Jones Newswires

April 16, 2020 08:14 ET (12:14 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

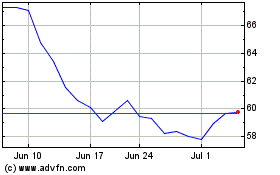

PayPal (NASDAQ:PYPL)

Historical Stock Chart

From Mar 2024 to Apr 2024

PayPal (NASDAQ:PYPL)

Historical Stock Chart

From Apr 2023 to Apr 2024