By Yuka Hayashi

The growth of online lending has been a boon to hair salons,

bakeries and other small businesses that don't qualify for bank

credit. Yet this tech-enabled source of credit can mire some in

debt they can't repay, raising concern about inadequate

regulation.

Some are extending credit at sky-high rates with opaque terms

for costly fees and conditions, drawing comparisons with payday

lenders who target consumers in need of quick cash, according to

critics.

"There is a significant number of bad actors who are mostly

unregulated, " said Luz Urrutia, chief executive of Opportunity

Fund, a California nonprofit that lends in lower-income

communities. "They are really wreaking havoc across America's small

businesses."

Nearly a third of the small businesses surveyed applied for

online loans in 2018, up from 19% in 2018, according to a Federal

Reserve study. The market's growth is driven by loans of less than

$100,000, often as small as a few thousand dollars, according to

experts.

The biggest players in online business lending include major

names such as PayPal Holdings Inc., Amazon.com Inc. and Square

Inc., which use data collected through their e-commerce or payments

platforms to decide on offering small-business loans and at what

terms. Lending to small and medium-size businesses by the top five

digital platforms rose an estimated 39% in 2019 from the previous

year to $13.5 billion, according to S&P Global Market

Intelligence.

Most of the lenders don't make their fees public. An exception

is On Deck Capital Inc., one of the few that is publicly traded,

which charged annual rates ranging from 9% to 98.3% in the quarter

ended September, with an average of 45%. By contrast, long-term

bank loans guaranteed by the federal Small Business Administration

currently are offered to borrowers, with fairly good credit

histories, as low as 7%.

On Deck said it is "committed to providing fair and transparent

financing options," noting that it had led an effort to create a

standardized disclosure tool used by some large lenders.

But rates charged by smaller lenders can soar higher.

Opportunity Fund analyzed 150 online-loan contracts signed by

104 businesses in California before they came to the nonprofit

lender in 2016. It found the average rate for such loans was 94%

and the highest was 358%. Opportunity Fund charges 12% to 14% for

its loans.

Online lenders pepper business such as auto-body shops and

e-commerce stores with solicitations promising access to instant

cash with no credit checks.

But beyond the high interest rates, the complex structure of

some products and opaque disclosure make it difficult for borrowers

to understand costs.

Johnathon Bush, the owner of Not Just Cookies bakery in Chicago,

said he did a brisk business at farmers markets during the summer,

but he faced a cash crunch in November 2018, just as he was gearing

up for the holiday season.

After a bank rejected his loan application, he borrowed a total

of $38,000 from two online lenders, which required him to pay back

$56,000, including fees. The lenders immediately began withdrawing

$450 from his bank account every day, eating up most of his average

daily sales of about $600.

"I was able to eat and sleep, but there was nothing else left,"

said the 26-year-old Mr. Bush. "All the cash was going away fast."

After defaulting on his loans in January he was able to borrow from

family members, allowing him to keep his business.

He signed on to one of the murky products known as merchant cash

advances, which technically are advances on revenues, not loans.

Borrowers pay a fixed percentage of daily or weekly revenue rather

than interest. The costs of such products are sometimes in the

triple digits when converted into annual percentage rates for

loans. Giving access to the borrower's bank accounts is a common

practice in both payday lending and merchant cash advances.

In addition, many regulations to protect borrowers, such as

requirements to disclose interest rates and bans on discrimination,

apply to consumers, not businesses. Of the 30 million U.S. small

businesses, 24 million have no employees besides the owners,

according to the Small Business Administration.

"A vast majority of (borrowers) are consumers in every respect,"

said Glenn Christensen, associate professor of marketing at Brigham

Young University. "Yet the law treats them as sophisticated,

multimillion dollar companies."

Federal and state authorities are taking notice. California last

year passed legislation that requires online lenders to disclose

interest rates on small-business loans, just as they must for

credit card and auto loans. The Federal Trade Commission in May

said it planned to scrutinize unfair and deceptive practices in

small-business lending.

In some states online lenders must obtain licenses and follow

state interest-rate limits, sometimes set at 36% or lower, though

some states have no limits. Many lenders partner with nationally

chartered banks, which allow them to bypass state limits, a

practice that has been challenged in court.

However, online lenders have filled a void left by banks that

have limited small-business lending since the financial crisis

because it was risky or unprofitable. While they are increasingly

important sources of capital, online lenders' long-term prospects

remain uncertain, according to experts.

Unlike banks, which fund their loans from stable pools of

consumer deposits, online lenders mostly raise capital from hedge

funds and other investors -- money that could evaporate in times of

financial turbulence.

"The online lending industry is yet not old enough for two

things," said Adrienne Harris, a University of Michigan professor

and former Obama administration Treasury official. "One, to see how

it performs in a downturn or a credit crunch. Two, nobody has

really done the analytics to evaluate the trade off of increased

access to credit with potentially increased cost."

Write to Yuka Hayashi at yuka.hayashi@wsj.com

(END) Dow Jones Newswires

December 30, 2019 14:41 ET (19:41 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

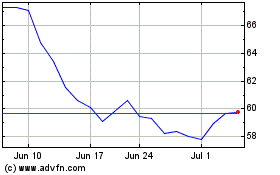

PayPal (NASDAQ:PYPL)

Historical Stock Chart

From Mar 2024 to Apr 2024

PayPal (NASDAQ:PYPL)

Historical Stock Chart

From Apr 2023 to Apr 2024