PayPal Sues U.S. Regulator Over Prepaid-Card Rule

December 12 2019 - 3:56PM

Dow Jones News

By Yuka Hayashi

WASHINGTON -- PayPal Holdings Inc. sued a federal banking

regulator Wednesday, alleging that its new rule has hampered the

company's ability to offer credit products and has created

confusion among users of its popular digital-payment services

PayPal and Venmo.

The lawsuit challenges the regulation on prepaid accounts rolled

out by the Consumer Financial Protection Bureau in April. While the

rule's primary aim is to improve consumer protection for prepaid

payment cards, it also extends to "digital wallets," any financial

products capable of holding cash balances directly on cards or

electronic devices.

As a result, the rule brought under its coverage digital-payment

tools such as PayPal, Venmo, Alphabet Inc.'s Google Pay, and Square

Inc.'s Cash App, despite the industry's claim that digital wallets

are fundamentally different from prepaid cards, which are often

sold at grocery and drugstores.

The regulation imposes complex requirements on issuers to

disclose fees and other terms of services, while placing limits on

their ability to offer credit products to customers.

"The Bureau's most basic error was ignoring the critical

differences between digital wallets and prepaid products," PayPal

said in its complaint filed with the U.S. District Court for the

District of Columbia. "The resulting regulatory regime is

fundamentally ill-suited to PayPal digital wallets and is likely to

mislead or confuse consumers."

A CFPB spokeswoman didn't respond to requests for comment.

The legal fight underscores the challenge of regulating a

financial product at a time when technology accelerates the

developments of products and services that defy traditional product

definitions. And as industry competition intensifies, expanding

functions of payment products into areas such as consumer loans and

investments becomes essential for companies, industry experts say.

It follows years of intense lobbying by PayPal and other

digital-wallet providers before the rule's issuance to exclude

their products.

"Having exhausted other options, PayPal is filing suit to end

the unsuitable application of the Prepaid Rule and its negative

impact on digital-wallet consumers and our business," PayPal said

in a statement. The rule creates hurdles for marketing of credit

products as it bans consumers from linking credit products to

digital wallets for the first 30 days after they acquire such

products.

"This is a case that could have an impact on our members, their

business partners and most importantly the customers they serve,"

said Brian Tate, chief executive of Innovative Payments

Association, a trade group of prepaid-card issuers, while calling

for its members to fully comply with the rule until a final court

decision is made. The group has also opposed the CFPB rule's

disclosure requirements, but supports its coverage of digital

wallets.

General-purpose reloadable prepaid cards allow users to load

funds directly to a card without having a bank account. Popular

among consumers who don't have full access to financial products,

such cards usually carry a card-network logo such as Visa or

Mastercard.

(END) Dow Jones Newswires

December 12, 2019 15:41 ET (20:41 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

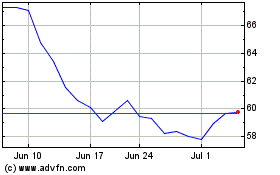

PayPal (NASDAQ:PYPL)

Historical Stock Chart

From Mar 2024 to Apr 2024

PayPal (NASDAQ:PYPL)

Historical Stock Chart

From Apr 2023 to Apr 2024