Pyxis Tankers Announces Financial Results

for the Three Months and Year Ended December 31, 2021

Maroussi, Greece, March 18, 2022 – Pyxis Tankers

Inc. (NASDAQ Cap Mkts: PXS), (the “Company” or “Pyxis Tankers”), a

growth-oriented pure play product tanker company, today announced

unaudited results for the three months and year ended December 31,

2021.

Summary

For the three months ended December 31, 2021,

our Revenues, net were $8.1 million. For the same period, our time

charter equivalent (“TCE”) revenues were $3.9 million, an increase

of approximately $0.3 million or 8.7% from the comparable period in

2020. This increase was primarily due to 139 more operating days in

our fleet which resulted from the addition of one medium range

tanker (“MR”), higher fleet utilization counterbalanced by lower

charter rates for our MR’s. Our net loss to common shareholders

increased by $2.9 million to $5.6 million versus the comparable

period in 2020. This larger loss was primarily due to higher costs,

including the $2.4 million non-cash loss on vessels held-for-sale

in the fourth quarter of 2021, which represented the sale of our

two 2010 built 8,600 dwt product tankers, the “Northsea Alpha” and

“Northsea Beta”, that closed earlier this current quarter. For the

fourth quarter of 2021, loss per share (basic and diluted) was

$0.14. Our Adjusted EBITDA was negative $0.7 million, which

represented an increase of $0.5 million over the comparable period

in 2020. Please see “Non-GAAP Measures and Definitions” below.

Valentios Valentis, our Chairman and CEO,

commented:

“During the fourth quarter, 2021 we announced

the acquisition of the “Pyxis Lamda”, a 2017 built eco-efficient

MR, the debt refinancing of the “Pyxis Malou” and the non-core

sales of the two small tankers, which finalized our planned

operating and financial repositioning of the Company that commenced

in January, 2020. During this very challenging chartering period of

two years, we managed to raise over $36 million of equity capital,

source almost $75 million in bank loans at lower interest costs,

renew the fleet by selling three older vessels and acquiring two

eco-efficient MR’s as well as undertake four special surveys.

Moving forward, we have a modern fleet of five eco-MR’s, long-lived

bank debt and a reasonable balance sheet. We believe the Company is

situated to take advantage of better market conditions.

Historically depressed charter rates for the

product tanker sector continued into the beginning of the fourth

quarter, 2021. However, the traditional seasonal improvement of

better activity was cut short by the COVID-19 variant, Omicron,

which resulted in many adversities including the re-introduction of

travel restrictions worldwide. Personal mobility was reduced which

hurt demand for transportation fuels, a major portion of global

cargoes. Fortunately, the personal and economic impact from Omicron

has been considered mild. However, the delayed return to better

chartering conditions now faces the added unpredictability from the

effects of the hostilities in the Ukraine. We will do our best to

navigate the unchartered waters ahead.

During the three-month period ended December 31,

2021, we reported an average TCE of $8,706 for our MR’s,

substantially lower than the same period in the prior year.

However, charter rates have rebounded from historical lows, and as

of March 16th, our bookings for 83% of available days in the first

quarter, 2022 are approximately $14,775, exclusive of charterer’s

options. Over the balance of this year, we expect to continue our

mixed chartering strategy of shorter-term time charters and spot

employment, diversified by charterer and duration.

While we continue to be optimistic about the

long-term fundamentals of the product tanker sector, the

uncertainty surrounding demand growth is significant. Global

inventories of many refined products are well below the five year

averages, which is usually a positive indicator to rebuild stocks

in order to meet demand. However, the International Monetary Fund’s

forecast for global growth in GDP of 4.4% for 2022 is likely to be

revised downward due to recent geopolitical events. Given these

conditions, we expect increased charter rate volatility with an

expansion of ton miles for the balance of 2022, which could lead to

a wide range of spot charter rates worldwide. Nevertheless,

the vessel supply picture is much clearer, as the orderbook for

MR’s stood at 7.4% of the global fleet as of February 28, 2022,

according to a leading independent research firm. New ordering

continues to be very low as only two MR’s were ordered in the first

two months of the year. Delays in the delivery of new build MR’s

should continue given the overall size of ship yard backlogs and a

five year historical slippage rate of 13.4% per year. In 2021, 33

MR’s were scrapped and with 116 vessels at 20 years of age or more,

demolitions should continue at a brisk rate as 7 tankers have

already been scrapped in the first two months of 2022.

Consequently, we expect that net supply growth in 2022 and 2023

will run at approximately 2% per year.

We believe our experienced management team,

solid operating platform, disciplined use of capital and stronger

financial position should help us weather these uncertain times,

and potentially create further opportunities to enhance shareholder

value.”

Results for the three months ended December 31, 2020 and

2021

For the three months ended December 31, 2021, we

reported a net loss to common shareholders of $5.6 million,

approximately $2.9 million more than the loss in the comparable

period in 2020. This decline was primarily a result of the non-cash

loss on vessels held-for-sale of $2.4 million in the fourth quarter

of 2021, the sales of which subsequently closed in early 2022.

During the fourth quarter of 2021, our Revenues, net were $8.1

million or 79.6% higher compared to the same period in 2020,

primarily as a result of higher utilization and increased spot

employment for our MR tankers, which was offset from lower

fleet-wide daily TCE rate of $7,972, a $2,262 per day decline from

the comparable 2020 period due to poor charter rates and increased

voyage related costs and commissions that amounted to $4.2 million,

or $3.3 million higher compared with the same period in 2020.

Furthermore, the addition of one MR in July 2021 and the special

surveys of our small tankers completed during the fourth quarter of

2020, resulted in an aggregate increase of 139 operating days for

the period, from 350 days during the fourth quarter of 2020 to 489

days in 2021. Adjusted negative EBITDA of $0.7 million represented

an increase of $0.5 million from a negative $0.2 million in the

same period of

2020.

Results for the years ended December 31, 2020 and

2021

For the year ended December 31, 2021, we

reported a net loss to common shareholders of $12.9 million. Loss

per share basic and diluted for the year ended December 31, 2021

was $0.36. In 2020, our net loss was $7.0 million with a loss per

share basic and diluted of $0.32. In 2021, higher revenues, net of

$3.6 million or 16.7%, compared to 2020 were mainly due to higher

spot employment of our fleet and more available days due to the

addition of one MR tanker in July 2021. This revenue increase was

more than offset by an increase of $5.3 million in voyage related

costs and commissions as a result of higher spot market employment.

The aforementioned increase of voyage related costs as well as the

poor market conditions resulted to lower daily TCE rate of our

fleet with an average of $8,981 per day for the year ended December

31, 2021, compared to, $11,456 per day for the same period in 2020.

Furthermore, the increase in our revenues, net, was also impacted

by an aggregate net increase of approximately $2.5 million in

vessel operating expenses, general and administrative expenses,

management fees, depreciation and amortization which primarily

reflected the addition of one vessel, the “Pyxis Karteria”.

Moreover, in 2021, we recorded a loss from debt extinguishment of

$0.5 million, which primarily reflected prepayment fees and the

write-off of remaining unamortized balance of deferred financing

costs associated with the loan refinancing of “Pyxis Malou” and

“Pyxis Epsilon” during the year. Interest and finance costs, net in

2021 were reduced by $1.7 million due to the loan refinancing of

the Eighthone and lower LIBOR rates paid on all the floating rate

bank debt, despite the increase in the overall outstanding debt due

to the acquisitions of “Pyxis Karteria” and “Pyxis Lamda”. Lastly,

we recognized a $2.4 million non-cash loss on vessels held for sale

in fourth quarter of 2021. Our adjusted negative EBITDA of $0.8

million represented a decrease of $3.5 million from $2.7 million

for the same period in 2020.

| |

|

Three months ended December 31, |

|

Year ended December 31, |

|

(Thousands of U.S. dollars, except for daily TCE rates) |

|

2020 |

|

2021 |

|

2020 |

|

2021 |

| |

|

|

|

|

|

|

|

|

| Revenues, net |

$ |

4,512 |

$ |

8,104 |

$ |

21,711 |

$ |

25,341 |

| Voyage related costs and commissions

1 |

|

(935) |

|

(4,205) |

|

(4,268) |

|

(9,579) |

| Time charter equivalent revenues 2 |

$ |

3,577 |

$ |

3,899 |

$ |

17,443 |

$ |

15,762 |

| |

|

|

|

|

|

|

|

|

| Total operating days |

|

350 |

|

489 |

|

1,523 |

|

1,755 |

| |

|

|

|

|

|

|

|

|

| Daily time charter equivalent rate 1,

2 |

|

10,234 |

|

7,972 |

|

11,456 |

|

8,981 |

1 “Pyxis Karteria”, a 46,652 dwt medium range

product tanker built in 2013 at Hyundai Mipo, was acquired on July

15, 2021 and commenced commercial operations at that time. On

December 20, 2021, we took delivery from a related party the “Pyxis

Lamda”, a 50,145 dwt MR product tanker built in 2017 at SPP

Shipbuilding in South Korea. After her first special survey, the

“Pyxis Lamda” launched commercial employment in early January,

2022. For 2021, the vessel contributed nil available days and,

consequently voyage and related costs of $10 have been excluded

from the above data.2 Subject to rounding; please see “Non-GAAP

Measures and Definitions” below.

Management’s Discussion and Analysis of

Financial Results for the Three Months ended December 31, 2020 and

2021

(Amounts are presented in U.S. dollars, rounded

to the nearest one hundred thousand, except as otherwise noted)

Revenues, net: Revenues, net of $8.1 million for

the three months ended December 31, 2021, represented an increase

of $3.6 million, or 79.6%, from $4.5 million in the comparable

period of 2020 as a result of higher spot employment for our MR’s,

a 94-day increase from 28 operating days in 2020 to 122 days during

the same period in 2021 and the improved utilization achieved by

the Company’s two small tankers of 99.5% compared to 65.1% in the

previous year, achieving a higher TCE rate of $6,744 per day for

the fourth quarter of 2021 compared with $4,722 in the same period

of 2020. This aforementioned Revenues, net increase was partially

counterbalanced by the decrease in the charter rates as a result of

the prevailing market conditions in the two comparative periods. In

Q4 2021, our daily TCE rate fleet-wide was $7,972, a $2,262 per day

decline from the comparable 2020 period as a result of poor charter

rates and the increase of $3.3 million of the voyage related costs

and commissions discussed below.

Voyage related costs and commissions: Voyage

related costs and commissions of $4.2 million in the fourth quarter

2021, represented an increase of $3.3 million, or 350.8%, from $0.9

million in the comparable period of 2020. This increase was

primarily a result of a 94-day increase in spot employment and a

decline in MR utilization to 83.2% for the three months ended

December 31, 2021 from 92.2% in the comparable period of 2020, as

well as substantially higher bunker fuel costs. Under spot

charters, all voyage expenses are typically borne by us rather than

the charterer and a decrease in time chartering results in

increased voyage related costs and commissions.

Vessel operating expenses: Vessel operating

expenses of $3.5 million for the three month period ended December

31, 2021, represented an increase of $0.6 million, or 21.3%, from

$2.9 million in the comparable period of 2020, which was mainly

attributed to the addition of the “Pyxis Karteria” as well as

higher crewing costs significantly due to COVID-19 related

measures.

General and administrative expenses: General and

administrative expenses of $0.6 million for the fourth quarter,

2021 remained stable compared to 2020.

Management fees: For the three months ended

December 31, 2021, management fees paid to our ship manager, Pyxis

Maritime Corp. (“Maritime”), an entity affiliated with our Chairman

and Chief Executive Officer, Mr. Valentis, and to

International Tanker Management Ltd. (“ITM”), our fleet’s technical

manager, increased by $0.1 million to $0.5 million as a result of

one more vessel, versus the comparable period in 2020.

Amortization of special survey costs:

Amortization of special survey costs of $0.1 million for the

quarter ended December 31, 2021, represented an increase of 11.1%,

compared to $90 thousand for the same period in 2020 primarily

attributed to the additional amortization costs from the “Pyxis

Epsilon”, “Northsea Alpha” and “Northsea Beta” special surveys in

2020.

Depreciation: Depreciation of $1.4 million for

the quarter ended December 31, 2021, increased of $0.3 million or

22.8% compared to $1.1 million in 2020. The increase was attributed

to the vessel additions during the year, mainly to the “Pyxis

Karteria”.

Loss on vessels held-for-sale: The non-cash loss

of $2.4 million for the quarter ended December 31, 2021, relates to

the sales of the two small tankers “Northsea Alpha” and “Northsea

Beta”, which met the criteria of being classified as held for sale

as of December 31, 2021, and were subsequently closed on January

28, 2022 and March 1, 2022, respectively. There was no comparable

amount in the year ended December 31, 2020.

Loss from debt extinguishment: On the fourth

quarter of 2021, we recorded a loss from debt extinguishment of

approximately $0.1 million reflecting a prepayment fee and the

write-off of remaining unamortized balance of deferred financing

costs, which are associated with the refinance of the “Pyxis Malou”

loan at the end of the year. No such loss was recorded for the

prior period.

Interest and finance costs, net: Interest and

finance costs, net, for the quarter ended December 31, 2021, was

$0.8 million, compared to $1.2 million in the comparable

period in 2020, a decrease of $0.4 million, or 32.3%. This decrease

was primarily attributable to lower interest costs derived from the

refinancing on March 29, 2021, of the Pyxis Epsilon (“Eighthone”)

loan. Additionally, despite the increase in the overall outstanding

debt due to the two vessels acquired, “Pyxis Karteria” and “Pyxis

Lamda”, the lower outstanding balance of the new Eighthone loan and

lower LIBOR rates paid on all the floating rate bank debt helped

reduce the overall interest expense compared to the same period in

2020.

Management’s Discussion and Analysis of

Financial Results for the Years ended December 31, 2020 and

2021 (Amounts are presented in U.S. dollars, rounded to

the nearest one hundred thousand, except as otherwise noted)

Revenues, net: Revenues, net, of $25.3 million

for the year ended December 31, 2021, represented an increase of

$3.6 million, or 16.7%, from $21.7 million in the comparable

period in 2020, mainly as a result of higher spot employment for

our MR’s. Our small tankers operated solely in the spot market

during 2020 and 2021, whereas our MR tankers operated on spot and

time charters during both periods. Our MR’s perform 183-day more

days in spot market, from 58 operating days in 2020 to 241 days

during the year ended December 31, 2021. Moreover, the Company’s

two small tankers achieved improved utilization for 2021 of 81.5%

compared to 69.5% in the previous year. This overall increase

however, was counterbalanced by $5.3 million higher voyage related

costs and commissions that are discussed below. Revenue from spot

voyages in 2021 was $13.7 million, an increase of $6.7 million from

$7.0 million in 2020. Time charter revenue decreased by 20.8%, or

$3.1 million, to $11.6 million from $14.7 million in 2020. This

decrease was primarily attributable to lower charter rates, as well

as decreased time charter activity for our MR tankers at reduced

TCE rates offset by increased operating days due to the “Pyxis

Karteria” acquisition. Our total available days increased from

1,764 days in 2020 to 1,994 days in 2021, as a result of this

acquisition and 54 fewer dry-dock days from 66 in 2020 to 12 in

2021.

Voyage related costs and commissions: Voyage

related costs and commissions of $9.6 million for the year ended

December 31, 2021, represented an increase of $5.3 million, or

124.7%, from $4.3 million in the comparable period in 2020. This

increase was primarily a result of a 184-day increase in spot

employment for our MRs from 57 days during 2020 to 241 days during

2021, and higher utilization of the two small tankers from 69.5% to

81.5% providing 113 more voyage charter days, as well as

substantially higher bunker fuel costs. Under spot charters, all

voyage expenses are typically borne by us rather than the charterer

and a decrease in time chartering results in increased voyage

related costs and commissions.

Vessel operating expenses: Vessel operating

expenses of $12.5 million for the year ended December 31, 2021,

represented an increase of $1.6 million, or 14.5%, from $10.9

million in the comparable period in 2020. This increase was mainly

attributed to the addition of the “Pyxis Karteria” as well as

higher crewing costs significantly due to COVID-19 related

measures.

General and administrative expenses: General and

administrative expenses of $2.5 million for the year ended December

31, 2021 were $0.2 million higher, or 6.7%, from $2.4 million in

the comparable period 2020, primarily attributed to higher

professional fees.

Management fees, related parties: Management

fees to Maritime of $0.7 million for the year ended December 31,

2021, represented an increase of 12.4 % over the comparable period

in 2020 or $0.1 million due to the “Pyxis Karteria” acquisition in

July, 2021.

Management fees, other: Management fees, payable

to ITM of $0.9 million for the year ended December 31, 2021,

represented an increase of 4.0% which was attributed to the “Pyxis

Karteria” acquisition in July, 2021.

Amortization of special survey costs:

Amortization of special survey costs of $0.4 million for the year

ended December 31, 2021, represented an increase of 60.5%, compared

to $0.3 million for the same period in 2020 primarily attributed to

the additional amortization costs from the special surveys of the

“Pyxis Epsilon”, “Northsea Alpha” and “Northsea Beta” in 2020.

Depreciation: Depreciation of $4.9 million for

the year ended December 31, 2021, increased $0.5 million or 10.9%

compared to $4.4 million charged in 2020. The increase was due to

the vessel additions during the year, mainly to the “Pyxis

Karteria”.

Loss on vessels held-for-sale: The non-cash loss

of $2.4 million for the year ended December 31, 2021, relates to

the sales of the two small tankers “Northsea Alpha” and “Northsea

Beta”, which met the criteria of being classified as held for sale

as of December 31, 2021, and were subsequently closed on January

28, 2022 and March 1, 2022, respectively. There was no comparable

amount in the year ended December 31, 2020.

Loss from debt extinguishment: During 2021 we

recorded a loss from debt extinguishment of $0.5 million, which

primarily reflected a prepayment fee and the write-off of remaining

unamortized balance of deferred financing costs, of which $83

thousand was associated with the loan refinance of “Pyxis Malou” at

the end of the fourth fiscal quarter of 2021 and $458 thousand

associated with the “Pyxis Epsilon” that was refinanced at the end

of first quarter of 2021. No such loss was recorded in 2020.

Interest and finance costs, net: Interest and

finance costs, net, for the year ended December 31, 2021, was

$3.3 million, compared to $5.0 million in the comparable

period in 2020, a decrease of $1.7 million, or 33.8%. This decrease

was primarily attributable to lower interest costs derived from the

refinancing on March 29, 2021, of the Eighthone loan. Additionally,

despite the increase in the overall outstanding debt due to the two

vessels acquired, “Pyxis Karteria” and “Pyxis Lamda”, the lower

outstanding balance of the new Eighthone loan and lower LIBOR rates

paid on all the floating rate bank debt helped reduce the overall

interest expense compared to the same period in 2020.

Unaudited Consolidated Statements of Comprehensive

LossFor the three months ended December 31, 2020 and

2021(Expressed in thousands of U.S. dollars, except for share and

per share data)

| |

|

|

Three months ended December

31, |

|

|

|

|

2020(Unaudited) |

|

2021(Unaudited) |

|

|

|

|

|

|

|

| Revenues,

net |

|

|

$

4,512 |

|

$

8,104 |

|

|

|

|

|

|

|

|

Expenses: |

|

|

|

|

|

| Voyage related

costs and commissions |

|

|

(935) |

|

(4,215) |

| Vessel operating

expenses |

|

|

(2,856) |

|

(3,464) |

| General and

administrative expenses |

|

|

(610) |

|

(639) |

| Management fees,

related parties |

|

|

(153) |

|

(237) |

| Management fees,

other |

|

|

(193) |

|

(238) |

| Amortization of

special survey costs |

|

|

(90) |

|

(100) |

| Depreciation |

|

|

(1,116) |

|

(1,370) |

| Loss on vessels

held for sale |

|

|

— |

|

(2,389) |

| Allowance for

credit losses |

|

|

— |

|

(2) |

| Operating

loss |

|

|

(1,441) |

|

(4,550) |

|

|

|

|

|

|

|

| Other

expenses: |

|

|

|

|

|

| Loss from debt

extinguishment |

|

|

— |

|

(83) |

| Gain / (Loss)

from financial derivative instrument |

|

|

(1) |

|

18 |

| Interest and

finance costs, net |

|

|

(1,182) |

|

(800) |

| Total

other expenses, net |

|

|

(1,183) |

|

(865) |

|

|

|

|

|

|

|

| Net

loss |

|

|

$

(2,624) |

|

$

(5,415) |

| |

|

|

|

|

|

| Dividend Series A

Convertible Preferred Stock |

|

|

(82) |

|

(174) |

| |

|

|

|

|

|

| Net loss

attributable to common shareholders |

|

|

$

(2,706) |

|

$

(5,589) |

| |

|

|

|

|

|

| Loss per common

share, basic |

|

|

$

(0.12) |

|

$

(0.14) |

| |

|

|

|

|

|

| Weighted average

number of common shares, basic |

|

|

21,720,761 |

|

38,856,724 |

Consolidated Statements of Comprehensive

LossFor the years ended December 31, 2020 and

2021(Expressed in thousands of U.S. dollars, except for share and

per share data)

| |

|

|

Year ended December 31, |

| |

|

|

2020 |

|

2021(Unaudited) |

| Revenues, net |

|

$ |

21,711 |

$ |

25,341

|

| |

|

|

|

|

|

| Expenses: |

|

|

|

|

|

| Voyage related costs and commissions |

|

|

(4,268) |

|

(9,589) |

| Vessel operating expenses |

|

|

(10,880) |

|

(12,454) |

| General and administrative expenses |

|

|

(2,378) |

|

(2,538) |

| Management fees, related parties |

|

|

(637) |

|

(716) |

| Management fees, other |

|

|

(819) |

|

(852) |

| Amortization of special survey costs |

|

|

(253) |

|

(406) |

| Depreciation |

|

|

(4,418) |

|

(4,898) |

| Loss on vessels held for sale |

|

|

— |

|

(2,389) |

| Gain from the sale of vessel, net |

|

|

7 |

|

— |

| Allowance for credit losses |

|

|

— |

|

(11) |

|

Operating loss |

|

$ |

(1,935) |

$ |

(8,512) |

|

|

|

|

|

|

|

| Other

expenses: |

|

|

|

|

|

| Loss from debt extinguishment |

|

|

— |

|

(541) |

| Loss from financial derivative

instrument |

|

|

(1) |

|

— |

| Interest and finance costs, net |

|

|

(4,964) |

|

(3,285) |

| Total

other expenses, net |

|

$ |

(4,965) |

$ |

(3,826) |

| |

|

|

|

|

|

| Net loss |

|

$ |

(6,900) |

$ |

(12,338) |

| |

|

|

|

|

|

| Dividend Series A Convertible Preferred

Stock |

|

|

(82) |

|

(555) |

| |

|

|

|

|

|

| Net loss attributable to common

shareholders |

|

$ |

(6,982) |

$ |

(12,893) |

| |

|

|

|

|

|

| Loss per common share,

basic |

|

$ |

(0.32) |

$ |

(0.36) |

| |

|

|

|

|

|

| Weighted average number of

shares, basic |

|

|

21,548,126 |

|

35,979,071 |

Consolidated Balance SheetsAs of December 31,

2020 and 2021(Expressed in thousands of U.S. dollars, except for

share and per share data)

| |

|

|

|

|

December 31, |

|

December 31, |

| |

|

|

|

|

2020 |

|

2021 (Unaudited) |

| ASSETS |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| CURRENT ASSETS: |

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

|

|

$ |

1,620 |

$ |

6,180 |

| Restricted cash, current portion |

|

|

|

|

— |

|

944 |

| Inventories |

|

|

|

|

681 |

|

1,567 |

| Trade accounts receivable |

|

|

|

|

672 |

|

1,736 |

| Less: Allowance for credit losses |

|

|

|

|

(9) |

|

(20) |

| Trade accounts receivable, net |

|

|

|

|

663 |

|

1,716 |

| Due from related parties |

|

|

|

|

2,308 |

|

— |

| Vessel held-for-sale |

|

|

|

|

— |

|

8,509 |

| Prepayments and other current assets |

|

|

|

|

133 |

|

186 |

| Total current

assets |

|

|

|

|

5,405 |

|

19,102 |

| |

|

|

|

|

|

|

|

| FIXED ASSETS, NET: |

|

|

|

|

|

|

|

| Vessels, net |

|

|

|

|

83,774 |

|

119,724 |

| Total fixed assets,

net |

|

|

|

|

83,774 |

|

119,724 |

| |

|

|

|

|

|

|

|

| OTHER NON-CURRENT

ASSETS: |

|

|

|

|

|

|

|

| Restricted cash, net of current

portion |

|

|

|

|

2,417 |

|

2,750 |

| Financial derivative instrument |

|

|

|

|

— |

|

74 |

| Deferred dry dock and special survey

costs, net |

|

|

|

|

1,594 |

|

912 |

| Total other non-current

assets |

|

|

|

|

4,011 |

|

3,736 |

| Total assets |

|

|

|

$ |

93,190 |

$ |

142,562 |

| |

|

|

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS'

EQUITY |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| CURRENT

LIABILITIES: |

|

|

|

|

|

|

|

| Current portion of long-term debt, net of

deferred financing costs |

|

|

|

$ |

3,255 |

$ |

11,695 |

| Trade accounts payable |

|

|

|

|

3,642 |

|

3,084 |

| Due to related parties |

|

|

|

|

— |

|

6,962 |

| Hire collected in advance |

|

|

|

|

726 |

|

— |

| Accrued and other liabilities |

|

|

|

|

677 |

|

1,089 |

| Total current

liabilities |

|

|

|

|

8,300 |

|

22,830 |

| |

|

|

|

|

|

|

|

| NON-CURRENT

LIABILITIES: |

|

|

|

|

|

|

|

| Long-term debt, net of current portion

and deferred financing costs |

|

|

|

|

50,331 |

|

64,880 |

| Promissory note |

|

|

|

|

5,000 |

|

6,000 |

| Total non-current

liabilities |

|

|

|

|

55,331 |

|

70,880 |

| |

|

|

|

|

|

|

|

| COMMITMENTS AND

CONTINGENCIES |

|

|

|

|

— |

|

— |

| |

|

|

|

|

|

|

|

| STOCKHOLDERS'

EQUITY: |

|

|

|

|

|

|

|

| Preferred stock ($0.001 par value;

50,000,000 shares authorized; of which 1,000,000 authorized Series

A Convertible Preferred Shares; 181,475 and 449,673 Series A

Convertible Preferred Shares issued and outstanding as at

December 31, 2020 and December 31, 2021) |

|

|

|

|

— |

|

— |

| Common stock ($0.001 par value;

450,000,000 shares authorized; 21,962,881 and 42,455,857 shares

issued and outstanding as at December 31, 2020 and December

31, 2021, respectively) |

|

|

|

|

22 |

|

42 |

| Additional paid-in capital |

|

|

|

|

79,692 |

|

111,840 |

| Accumulated deficit |

|

|

|

|

(50,155) |

|

(63,030) |

| Total stockholders'

equity |

|

|

|

|

29,559 |

|

48,852 |

| Total liabilities and

stockholders' equity |

|

|

|

$ |

93,190 |

$ |

142,562 |

Consolidated Statements of Cash FlowsFor the

years ended December 31, 2020 and 2021(Expressed in thousands of

U.S. dollars)

| |

|

|

Year ended December 31, |

| |

|

|

2020 |

|

2021 (Unaudited) |

| Cash

flows from operating activities: |

|

|

|

|

|

| Net loss |

|

$ |

(6,900) |

$ |

(12,338) |

|

Adjustments to reconcile net loss to net cash provided by

operating activities: |

|

|

|

|

|

|

Depreciation |

|

|

4,418 |

|

4,898 |

| Amortization and

write-off of special survey costs |

|

|

253 |

|

406 |

| Allowance for

credit losses |

|

|

— |

|

11 |

| Amortization and

write-off of financing costs |

|

|

328 |

|

247 |

| Loss from debt

extinguishment |

|

|

— |

|

541 |

| Loss / (gain)

from financial derivative instrument |

|

|

1 |

|

— |

| Loss on vessels

held for sale |

|

|

— |

|

2,389 |

| Gain on sale of

vessel, net |

|

|

(7) |

|

— |

| Issuance of

common stock under the promissory note |

|

|

169 |

|

55 |

| Changes

in assets and liabilities: |

|

|

|

|

|

| Inventories |

|

|

(180) |

|

(886) |

| Due from/to

related parties |

|

|

(9,157) |

|

6,276 |

| Trade accounts

receivable, net |

|

|

571 |

|

(1,064) |

| Prepayments and

other assets |

|

|

239 |

|

(53) |

| Special survey

cost |

|

|

(1,068) |

|

— |

| Trade accounts

payable |

|

|

(939) |

|

(618) |

| Hire collected

in advance |

|

|

(689) |

|

(726) |

| Accrued and

other liabilities |

|

|

(69) |

|

(34) |

| Net cash

used in operating activities |

|

$ |

(13,030) |

$ |

(896) |

| |

|

|

|

|

|

| Cash

flow from investing activities: |

|

|

|

|

|

| Proceeds from

the sale of vessel, net |

|

|

13,197 |

|

— |

| Vessel

acquisition |

|

|

— |

|

(43,005) |

| Vessel

additions |

|

|

(25) |

|

(14) |

| Ballast water

treatment system installation |

|

|

(542) |

|

(175) |

| Net cash

(used in) / provided by investing activities |

|

$ |

12,630 |

$ |

(43,194) |

| |

|

|

|

|

|

| Cash

flows from financing activities: |

|

|

|

|

|

| Proceeds from

long-term debt |

|

|

15,250 |

|

59,500 |

| Repayment of

long-term debt |

|

|

(19,909) |

|

(35,980) |

| Gross proceeds

from issuance of common stock |

|

|

— |

|

25,000 |

| Common stock

offering costs |

|

|

(57) |

|

(1,899) |

| Gross

proceeds from the issuance of Series A Convertible Preferred

units |

|

4,571 |

|

6,170 |

|

| Preferred shares

offering costs |

|

|

(260) |

|

(548) |

| Proceeds from

conversion of warrants into common shares |

|

|

— |

|

202 |

| Repayment of

promissory note |

|

|

— |

|

(1,000) |

| Financial

derivative instrument |

|

|

— |

|

(74) |

| Payment of

financing costs |

|

|

(265) |

|

(907) |

| Preferred stock

dividends paid |

|

|

(69) |

|

(537) |

| Net cash

provided by / (used in) financing activities |

|

$ |

(739) |

$ |

49,927 |

| |

|

|

|

|

|

| Net increase /

(decrease) in cash and cash equivalents and restricted cash |

|

|

(1,139) |

|

5,837 |

| Cash

and cash equivalents and restricted cash at the beginning of the

period |

|

5,176 |

|

4,037 |

|

| Cash and

cash equivalents and restricted cash at the end of the

period |

|

$ |

4,037 |

$ |

9,874 |

Liquidity, Debt and Capital Structure

Pursuant to our loan agreements, as of December

31, 2021, we were required to maintain total restricted cash of

$3.7 million. Total cash and cash equivalents, including restricted

cash, aggregated $9.9 million as of December 31, 2021, including

the retention account of $0.3 million for one of our loans.

Total funded debt (in thousands of U.S.

dollars), net of deferred financing costs:

|

|

|

|

December 31, 2020 |

|

December

31, 2021 |

| Funded debt, net of deferred financing

costs |

|

$ |

53,586 |

$ |

76,575 |

| Promissory Note - related party |

|

|

5,000 |

|

6,000 |

| Total funded debt |

|

$ |

58,586 |

$ |

82,575 |

Our weighted average interest rate on our total

funded debt for the year ended December 31, 2021 was 5.0% and 4.2%

in the fourth quarter, 2021.

On January 4, 2021 and April 2, 2021, following

the second amendment to the Amended & Restated Promissory Note

dated May 14, 2019, we issued to Maritime Investors Corp. (“MIC”),

an affiliate, 64,446 and 47,827, respectively, of our common shares

at the volume weighted average closing share price for the 10-day

period immediately prior to the quarter end to settle interest

payable under this obligation.

On June 17, 2021, following the exchange of $1

million in principal of the Amended & Restated Promissory Note,

we issued to MIC 1,091,062 common shares computed on the volume

weighted average closing share price for the 10-day period

commencing one day after publishing our first quarter, 2021

financial results press release.

On December 20, 2021, as part of the purchase

consideration for our acquisition of the “Pyxis Lamda”, we issued

to MIC 4,139,003 common shares, which was equivalent to $3 million

of the vessel’s purchase price, based on the average of a) the

volume weighted average closing share price for the five trading

day period immediately before the public announcement of such

acquisition dated November 15, 2021 and b) a similar 5-day period

after such announcement. On delivery date, these 4,139,003 Company

shares had a fair value of $2.2 million. On January 20, 2022 and

February 23, 2022, we paid cash dividends of $0.1615 per

Series A Convertible Preferred Share for each month.

At December 31, 2021, we had a total of

42,455,857 common shares issued and outstanding of which Mr.

Valentis beneficially owned 53.8%.

The recent outbreak of conflict between Russia

and the Ukraine has disrupted supply chains and caused instability

in the global economy, while the United States and the European

Union, among other countries, announced sanctions against Russia.

For example, on March 8, 2022, President Biden issued an executive

order prohibiting the import of certain Russian energy products

into the United States, including crude oil, petroleum, petroleum

fuels, oils, liquefied natural gas and coal. Additionally, the

executive order prohibits any investments in the Russian energy

sector by US persons, among other restrictions. The ongoing

conflict could result in the imposition of further economic

sanctions against Russia, and the Company’s business may be

adversely impacted. Currently, the Company’s charter contracts and

operations have not been negatively affected by the events in

Russia and Ukraine. However, it is possible that in the future

third parties with whom the Company has or will have charter

contracts may be impacted by such events. While in general much

uncertainty remains regarding the global impact of the conflict in

Ukraine, it is possible that such tensions could adversely affect

the Company’s business, financial condition, results of operation

and cash flows.

Impact of COVID-19 on the Company’s

Business

In response to the outbreak of COVID-19 in late

2019, governments and governmental agencies around the world took

numerous actions, including travel bans, quarantines, and other

emergency public health measures, and a number of countries

implemented lockdown measures, which resulted in a significant

reduction in global economic activity and extreme volatility in the

global financial markets. By 2021, however many of these measures

were relaxed. Nonetheless, we cannot predict whether and to what

degree emergency public health and other measures will be

reinstituted in the event of any resurgence in the COVID-19 virus

or any variants thereof. If the COVID-19 pandemic continues on a

prolonged basis or becomes more severe, the adverse impact on the

global economy and the charter rate environment for product tankers

may deteriorate further and our operations and cash flows may be

negatively impacted. Relatively weak global economic conditions

during periods of volatility have and may continue to have a number

of adverse consequences for product tankers and other shipping

sectors, as we experienced in most of 2020 and 2021 and we may

experience in the future, including, among other things:

•

low charter rates, particularly for vessels employed on short-term

time charters or in the spot market;

•

decreases in the market value of product tankers and limited

second-hand market for the sale of vessels;

•

limited financing for vessels;

•

loan covenant defaults; and

•

declaration of bankruptcy by certain vessel operators, vessel

owners, shipyards and charterers.

The COVID-19 pandemic and measures to contain

its spread have negatively impacted regional and global economies

and trade patterns in markets in which we operate, the way we

operate our business, and the businesses of our charterers and

suppliers. These negative impacts could continue or worsen, even

after the pandemic itself diminishes or ends. Companies, including

us, have also taken precautions, such as requiring employees to

work remotely and imposing travel restrictions, while some other

businesses have been required to close entirely. Moreover, we face

significant risks to our personnel and operations due to the

COVID-19 pandemic. The crews on our vessels face risk of exposure

to COVID-19 as a result of travel to ports in which cases of

COVID-19 have been reported. Our shore-based personnel likewise

face risk of such exposure, as we maintain offices in areas that

have been impacted by the spread of COVID-19.

Measures against COVID-19 in a number of

countries have restricted crew rotations on our vessels, which may

continue or become more severe. As a result, in 2021, we

experienced and may continue to experience disruptions to our

normal vessel operations caused by increased deviation time

associated with positioning our vessels to countries in which we

can undertake a crew rotation in compliance with such measures. We

have had and expect to continue to have increased expenses due to

incremental fuel consumption and days in which our vessels are

unable to earn revenue in order to deviate to certain ports on

which we would ordinarily not call during a typical voyage. We may

also incur additional expenses associated with testing, personal

protective equipment, quarantines, and travel expenses such as

airfare costs in order to perform crew rotations in the current

environment. In 2021, delays in crew rotations have also caused us

to incur additional costs related to crew bonuses paid to retain

the existing crew members on board and may continue to do so.

Moreover, COVID-19 and governmental and other

measures related to it have led to a highly difficult environment

in which to acquire and dispose of vessels given difficulty to

physically inspect vessels. The impact of COVID-19 has also

resulted in reduced industrial activity globally, and more

specifically, in China with temporary closures of factories and

other facilities, labor shortages and restrictions on travel. In

addition, the effects of COVID-19 has resulted in changes to vessel

drydocking locations and higher related costs.

This and future epidemics may affect personnel

operating payment systems through which we receive revenues from

the chartering of our vessels or pay for our expenses, resulting in

delays in payments. We continue to focus on our employees'

well-being, while making sure that our operations continue

undisrupted and at the same time, adapting to the new ways of

operating. As such employees are encouraged and in certain cases

required to operate remotely which significantly increases the risk

of cyber security attacks.

The occurrence or continued occurrence of any of

the foregoing events or other epidemics or an increase in the

severity or duration of the COVID-19 or other epidemics could have

a material adverse effect on our business, results of operations,

cash flows, financial condition, value of our vessels and ability

to pay dividends on our Series A Convertible Preferred Stock.

Non-GAAP Measures and Definitions

Earnings before interest, taxes, depreciation

and amortization (“EBITDA”) represents the sum of net income /

(loss), interest and finance costs, depreciation and amortization

and, if any, income taxes during a period. Adjusted EBITDA

represents EBITDA before certain non-operating or non-recurring

charges, such as loss on vessel held for sale, loss from debt

extinguishment, loss or gain from financial derivative instrument

and gain from sale of vessel. EBITDA and Adjusted EBITDA are not

recognized measurements under U.S. GAAP.

EBITDA and Adjusted EBITDA are presented in this

press release as we believe that they provide investors with means

of evaluating and understanding how our management evaluates

operating performance. These non-GAAP measures have limitations as

analytical tools, and should not be considered in isolation from,

as a substitute for, or superior to financial measures prepared in

accordance with U.S. GAAP. EBITDA and Adjusted EBITDA do not

reflect:

- our cash expenditures, or future requirements for capital

expenditures or contractual commitments;

- changes in, or cash requirements for, our working capital

needs; and

- cash requirements necessary to service interest and

principal payments on our funded debt.

In addition, these non-GAAP measures do not have

standardized meanings and are therefore unlikely to be comparable

to similar measures presented by other companies. The following

table reconciles net loss, as reflected in the Unaudited

Consolidated Statements of Comprehensive Loss to EBITDA and

Adjusted EBITDA:

| |

|

Three months ended December 31, |

|

Year ended December 31, |

| (In thousands of U.S. dollars) |

|

2020 |

|

2021 |

|

2020 |

|

2021 |

| Reconciliation of Net loss to Adjusted

EBITDA |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Net loss |

$ |

(2,624) |

$ |

(5,415) |

$ |

(6,900) |

$ |

(12,338) |

| |

|

|

|

|

|

|

|

|

| Depreciation |

|

1,116 |

|

1,370 |

|

4,418 |

|

4,898 |

| |

|

|

|

|

|

|

|

|

| Amortization of special survey costs |

|

90 |

|

100 |

|

253 |

|

406 |

| |

|

|

|

|

|

|

|

|

| Interest and finance costs, net |

|

1,182 |

|

800 |

|

4,964 |

|

3,285 |

| |

|

|

|

|

|

|

|

|

| EBITDA |

$ |

(236) |

$ |

(3,145) |

$ |

2,735 |

$ |

(3,749) |

| |

|

|

|

|

|

|

|

|

| Loss on vessels held for sale |

|

— |

|

2,389 |

|

— |

|

2,389 |

| |

|

|

|

|

|

|

|

|

| Loss from debt extinguishment |

|

— |

|

83 |

|

— |

|

541 |

| |

|

|

|

|

|

|

|

|

| Loss / (Gain) from financial derivative

instrument |

|

1 |

|

(18) |

|

1 |

|

— |

| |

|

|

|

|

|

|

|

|

| Gain from the sale of vessel, net |

|

— |

|

— |

|

(7) |

|

— |

| |

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

$ |

(235) |

$ |

(691) |

$ |

2,729 |

$ |

(819) |

Daily TCE is a shipping industry performance

measure of the average daily revenue performance of a vessel on a

per voyage basis. Daily TCE is not calculated in accordance with

U.S. GAAP. We utilize daily TCE because we believe it is a

meaningful measure to compare period-to-period changes in our

performance despite changes in the mix of charter types (i.e., spot

charters, time charters and bareboat charters) under which our

vessels may be employed between the periods. Our management also

utilizes daily TCE to assist them in making decisions regarding

employment of the vessels. We calculate daily TCE by dividing

Revenues, net after deducting Voyage related costs and commissions,

by operating days for the relevant period. Voyage related costs and

commissions primarily consist of brokerage commissions, port, canal

and fuel costs that are unique to a particular voyage, which would

otherwise be paid by the charterer under a time charter

contract.

Vessel operating expenses (“Opex”) per day are

our vessel operating expenses for a vessel, which primarily consist

of crew wages and related costs, insurance, lube oils,

communications, spares and consumables, tonnage taxes as well as

repairs and maintenance, divided by the ownership days in the

applicable period.

We calculate utilization (“Utilization”) by

dividing the number of operating days during a period by the number

of available days during the same period. We use fleet utilization

to measure our efficiency in finding suitable employment for our

vessels and minimizing the amount of days that our vessels are

off-hire for reasons other than scheduled repairs or repairs under

guarantee, vessel upgrades, special surveys and intermediate

dry-dockings or vessel positioning. Ownership days are the total

number of days in a period during which we owned each of the

vessels in our fleet. Available days are the number of ownership

days in a period, less the aggregate number of days that our

vessels were off-hire due to scheduled repairs or repairs under

guarantee, vessel upgrades or special surveys and intermediate

dry-dockings and the aggregate number of days that we spent

positioning our vessels during the respective period for such

repairs, upgrades and surveys. Operating days are the number of

available days in a period, less the aggregate number of days that

our vessels were off-hire or out of service due to any reason,

including technical breakdowns and unforeseen circumstances.

EBITDA, Adjusted EBITDA, Opex and daily TCE are

not recognized measures under U.S. GAAP and should not be regarded

as substitutes for Revenues, net and Net income. Our presentation

of EBITDA, Adjusted EBITDA, Opex and daily TCE does not imply, and

should not be construed as an inference, that our future results

will be unaffected by unusual or non-recurring items and should not

be considered in isolation or as a substitute for a measure of

performance prepared in accordance with U.S. GAAP.

| (Amounts in U.S. Dollars per day) |

|

|

Three months ended December

31, |

|

Year ended December 31, |

| |

|

|

2020 |

|

2021 |

|

2020 |

|

2021 |

| Eco-Efficient MR2: (2021: 3

of our vessels*) |

|

|

|

|

|

|

|

|

|

|

(2020: 2 of our vessels) |

TCE : |

|

$13,104 |

|

$10,763 |

|

$14,377 |

|

$10,855 |

| |

Opex : |

|

6,232 |

|

6,785 |

|

6,107 |

|

6,993 |

| |

Utilization % : |

|

93.3% |

|

87.7% |

|

97.2% |

|

93.1% |

| Eco-Modified MR2: (1 of our

vessels) |

|

|

|

|

|

|

|

|

|

| |

TCE : |

|

10,611 |

|

927 |

|

14,130 |

|

8,486 |

| |

Opex : |

|

7,714 |

|

6,613 |

|

6,612 |

|

6,724 |

| |

Utilization % : |

|

90.2% |

|

69.6% |

|

97.5% |

|

88.5% |

| Small Tankers: (2 of our

vessels) |

|

|

|

|

|

|

|

|

|

| |

TCE : |

|

4,722 |

|

6,744 |

|

5,331 |

|

6,612 |

| |

Opex : |

|

5,476 |

|

4,828 |

|

5,204 |

|

4,956 |

| |

Utilization % : |

|

65.1% |

|

99.5% |

|

69.5% |

|

81.5% |

| Fleet: (2021: 6

vessels*) |

|

|

|

|

|

|

|

|

|

|

(2020: 5 vessels) |

TCE : |

|

10,234 |

|

7,972 |

|

11,456 |

|

8,981 |

| |

Opex : |

|

6,226 |

|

6,104 |

|

5,847 |

|

6,198 |

| |

Utilization % : |

|

82.8% |

|

88.6% |

|

86.3% |

|

88.0% |

As at December 31, 2021 our fleet consisted of

four eco-efficient MR2 tankers, “Pyxis Lamda”, “Pyxis Theta”,

“Pyxis Karteria” and “Pyxis Epsilon”, one eco-modified MR2, “Pyxis

Malou”, and two handysize tankers, “Northsea Alpha” and “Northsea

Beta”. During 2020 and 2021, the vessels in our fleet were employed

under time and spot charters.

* a) On December 20, 2021, we took

delivery from a related party the “Pyxis Lamda”, a

50,145 dwt medium range product tanker built in 2017 at SPP

Shipbuilding in South Korea. After her first special survey,

the “Pyxis Lamda” launched commercial employment in

early January, 2022. For 2021, the vessel contributed nil available

days, and, consequently voyage and related costs of $10 have been

excluded from the above data. b) “Pyxis Karteria” was acquired on

July 15, 2021 and commenced commercial activities at that time.

2022 Annual Shareholder Meeting Date and

Deadline for Submitting Shareholder Proposals

We will host our annual shareholder meeting (the

“ASM”) for 2022 in London, United Kingdom on May 11, 2022. The

board of directors of the Company (the “Board”) has set a record

date for the 2022 ASM of April 14, 2020. Shareholders of record

will be asked to vote on the following proposals, which will be

described in more detail in the proxy materials for the 2022 ASM

that are expected to be available on or around April 21, 2022: a)

to re-elect Mr. Aristides Pittas, as a Class II director, to serve

until the 2025 ASM; b) to approve one or more amendments to the

Company’s articles of incorporation (the “Articles”) to effect one

or more reverse stock splits of the Company’s issued common shares

at any time and from time to time until the 2023 ASM at a ratio of

not less than 1 for 4 and not more than 1 for 10 and in the

aggregate of not more than 1 for 10, inclusive, with the exact

ratio to be set at a whole number within this range determined by

the Board, or any duly constituted committee thereof, in its

discretion, and to authorize the Board to implement any such

reverse stock split by filing any such amendment to the Articles

with the Registrar of Corporations of the Republic of the Marshall

Islands at any time following such approval and prior to the 2023

ASM, provided that fractional share interests are expected to

settled in cash; and c) to transact such other business that

may properly come before the 2022 ASM or any adjournment

thereof.

Since the 2022 ASM is expected to occur more

than 30 days prior to the anniversary of the Company’s 2021 ASM,

the Board has set a new deadline for the receipt of shareholder

proposals a reasonable time before the Company will begin to print

and send its proxy materials. For business to be properly

brought before the 2022 ASM by any shareholder, and for nomination

of directors to be made by a shareholder, notice must be received

by the Company in proper written form, in accordance with the

Company Amended and Restated Bylaws, no later than 5:00 p.m.

(Athens local time) on April 14, 2022.

Conference Call and Webcast

We will host a conference call to discuss our

results at 4:30 p.m., Eastern Time, on Friday, March 18, 2022.

Participants should dial into the call 10

minutes before the scheduled time using the following numbers: 1

(877) 553-9962 (US Toll Free Dial In), 0(808) 238-0669 (UK

Toll Free Dial In) or +44 (0) 2071 928592 (Standard International

Dial In). Please quote "Pyxis Tankers".

A telephonic replay of the conference and

accompanying slides will be available following the completion of

the call and will remain available until Friday, March 25, 2022. To

listen to the archived audio file, visit our website

http://www.pyxistankers.com and click on Events& Presentations

under our Investor Relations page.

Webcast:A webcast of the conference call will be

available through our website (http://www.pyxistankers.com) under

our Events & Presentations page.

Webcast participants of the live conference call

should register on the website approximately 10 minutes prior to

the start of the webcast and can also access it through the

following link:

https://events.q4inc.com/attendee/201614083

An archived version of the webcast will be

available on the website within approximately two hours of the

completion of the call.

The information discussed on the conference

call, or that can be accessed through, Pyxis Tankers Inc.’s website

is not incorporated into, and does not constitute part of this

report.

About Pyxis Tankers Inc.

We own a modern fleet of five tankers engaged in

seaborne transportation of refined petroleum products and other

bulk liquids. We are focused on growing our fleet of medium range

product tankers, which provide operational flexibility and enhanced

earnings potential due to their “eco” features and modifications.

Pyxis Tankers Inc. is positioned to opportunistically expand and

maximize the value of its fleet due to competitive cost structure,

strong customer relationships and an experienced management team,

whose interests are aligned with those of its shareholders. For

more information, visit: http://www.pyxistankers.com. The

information discussed contained in, or that can be accessed

through, Pyxis Tankers Inc.’s website, is not incorporated into,

and does not constitute part of this report.

Pyxis Tankers Fleet (as of March 18, 2022)

|

Vessel Name |

Shipyard |

Vessel type |

Carrying Capacity (dwt) |

Year Built |

Type of charter |

Charter(1) Rate (per day) |

Anticipated Earliest Redelivery Date |

|

| |

| |

|

|

|

|

|

|

|

|

|

|

| Pyxis

Lamda (2) |

SPP /

S. Korea |

MR |

50,145 |

2017 |

Time |

15,250 |

Mar

2022 |

|

| Pyxis

Epsilon |

SPP /

S. Korea |

MR |

50,295 |

2015 |

Spot |

n/a |

n/a |

|

| Pyxis

Theta |

SPP /

S. Korea |

MR |

51,795 |

2013 |

Spot |

n/a |

n/a |

|

| Pyxis

Karteria |

Hyundai

/ S. Korea |

MR |

46,652 |

2013 |

Time |

14,000 |

May

2022 |

|

| Pyxis

Malou |

SPP /

S. Korea |

MR |

50,667 |

2009 |

Spot |

n/a |

n/a |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

249,554 |

|

|

|

|

|

- Charter rates are gross and do not reflect any commissions

payable.

- “Pyxis Lamda” is fixed on a time charter for 70 days, +/- 15

days at $15,250 per day with charterer’s option of additional min

70 max 180 days +/- 15 days at $15,700 per day.

Forward Looking Statements

This press release contains forward-looking

statements and forward-looking information within the meaning of

the Private Securities Litigation Reform Act of 1995 applicable

securities laws. The words “expected'', “estimated”, “scheduled”,

“could”, “should”, “anticipated”, “long-term”, “opportunities”,

“potential”, “continue”, “likely”, “may”, “will”, “positioned”,

“possible”, “believe”, “expand” and variations of these terms and

similar expressions, or the negative of these terms or similar

expressions, are intended to identify forward-looking information

or statements. But the absence of such words does not mean that a

statement is not forward-looking. All statements that are not

statements of either historical or current facts, including among

other things, our expected financial performance, expectations or

objectives regarding future and market charter rate expectations

and, in particular, the effects of COVID-19 on our financial

condition and operations and the product tanker industry in

general, are forward-looking statements. Forward-looking

information is based on the opinions, expectations and estimates of

management of Pyxis Tankers Inc. (“we”, “our” or “Pyxis”) at the

date the information is made, and is based on a number of

assumptions and subject to a variety of risks and uncertainties and

other factors that could cause actual events or results to differ

materially from those projected in the forward-looking information.

Although we believe that the expectations and assumptions on which

such forward-looking statements and information are based are

reasonable, those are not guarantees of our future performance and

you should not place undue reliance on the forward-looking

statements and information because we cannot give any assurance

that they will prove to be correct. Since forward-looking

statements and information address future events and conditions, by

their very nature they involve inherent risks and uncertainties and

actual results and future events could differ materially from those

anticipated or implied in such information. Factors that might

cause or contribute to such discrepancy include, but are not

limited to, the risk factors described in our Annual Report on Form

20-F for the year ended December 31, 2020 and our other filings

with the Securities and Exchange Commission (the “SEC”). The

forward-looking statements and information contained in this

presentation are made as of the date hereof. We do not undertake

any obligation to update publicly or revise any forward-looking

statements or information, whether as a result of new information,

future events or otherwise, except in accordance with U.S. federal

securities laws and other applicable securities laws.

Company

Pyxis Tankers Inc.59 K. Karamanli StreetMaroussi 15125

Greeceinfo@pyxistankers.com

Visit our website at www.pyxistankers.com

Company Contact

Henry WilliamsChief Financial OfficerTel: +30 (210) 638 0200 /

+1 (516) 455-0106Email: hwilliams@pyxistankers.com

Source: Pyxis Tankers Inc.

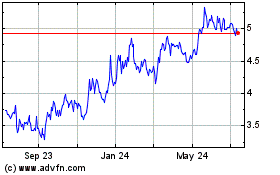

Pyxis Tankers (NASDAQ:PXS)

Historical Stock Chart

From Mar 2024 to Apr 2024

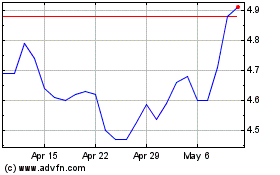

Pyxis Tankers (NASDAQ:PXS)

Historical Stock Chart

From Apr 2023 to Apr 2024