Maroussi, Greece, August 9, 2021 – Pyxis Tankers

Inc. (NASDAQ Cap Mkts: PXS) (the “Company” or “Pyxis Tankers”), an

international pure play product tanker company, today announced its

unaudited results for the three and six month periods ended June

30, 2021.

Summary

For the three months ended June 30, 2021, our

Revenues, net were $5.0 million. For the same period, our time

charter equivalent (“TCE”) revenues were $4.1 million, represented

a decrease of approximately $0.4 million or 8.8% over the

comparable period in 2020. Our net loss attributable to common

shareholders for the three months ended June 30, 2021 was $1.5

million, representing an increase of $0.3 million from the

comparable period of 2020. For the second quarter of 2021, the loss

per share (basic and diluted) was $0.04 compared to $0.06 for the

same period in 2020. Our Adjusted EBITDA was $0.4 million, which

represented a decrease of $0.8 million over the comparable period

in 2020. Please see “Non-GAAP Measures and Definitions” below.

Valentios Valentis, our Chairman and CEO

commented:

“The chartering environment for product tankers

in the second quarter of 2021 continued to be depressed, especially

the spot market in the Eastern hemisphere. The period market,

albeit more stable than the spot market, did encounter a decline in

activity during the quarter to levels below the prior 10 year

averages. The employment strategy for our Medium Range

tankers (“MRs”) of shorter-term, staggered time charters has

benefited the Company in a tough market. In the second quarter of

2021, the average TCE for our MR’s was approximately $12,700/day

which unfortunately was about $2,165 per day lower than the same

period in 2020. As of August 4, 2021, we had booked 47% of

available days for the third quarter of 2021 at an average TCE rate

of approximately $10,920 for our MRs.

Greater demand for refined petroleum products,

especially from OECD economies emerging from COVID-19 lockdowns,

have helped reduce global inventories to levels consistent with the

prior 5-year averages. Going forward higher refinery utilization

and increasing transportation activities are positive signs.

However, we have seen a movement of a fair number of long-range

tankers switching from the severely depressed dirty/crude trades

into clean products, thus adding capacity and hurting charter

rates. We expect this migration to be temporary as global oil

demand is forecasted by the IEA to increase by 4.6 million

barrels/day in the second half of 2021 and a further 3 million

barrels in 2022. Also, OPEC+ is scheduled in increase crude

production by 2 Mb/d starting this month. Nevertheless, we expect

the product tanker sector to continue to experience challenging

conditions until later this year with the impact of new variants of

COVID-19 and the path towards effective distribution of

vaccinations creating further uncertainty to the global

recovery.

Overall, we maintain a positive outlook about

the long-term prospects of the product tanker sector. Improving

global GDP growth and expanding personal and commercial mobility

should increase demand for seaborne transportation of a broad range

of petroleum products. The IMF just re-affirmed its global growth

forecast of 6% this year with a higher increase in 2022 to 4.9%. In

the meantime, the supply picture looks better due to the aging

global fleet, continued low ordering of new tankers and a

substantial increase in vessel demolition. For example, a leading

industry source stated that 22 MR2 tankers had been scrapped in

first half of 2021 and with 99 vessels at 20 years of age or more

as of June 30, 2021, the record pace may continue.

During this challenging period, we have

maintained our focus on the efficiencies of our operating platform,

as fleet-wide daily operating expenses were approximately $5,900

per vessel for the first half of 2021. We have continued to

strengthen our balance sheet and enhance our financial position for

upside opportunities. Recent equity offerings and bank loans have

resulted in lower leverage, better liquidity, interest rate

savings, longer debt maturities and capital for selective growth.

In July, we expanded our fleet with the acquisition of a 2013 built

eco-efficient MR which has been named the “Pyxis Karteria”. The

follow-on offering of additional Series A Convertible Preferred

Stock during July 2021 should provide us further flexibility and

capability to enhance shareholder value.”

Results for the three months ended June 30, 2020 and

2021

For the three months ended June 30, 2021, we

reported a net loss of $1.5 million, or $0.04 basic and diluted

loss per share, compared to a net loss of $1.2 million, or $0.06

basic and diluted loss per share, for the comparable period in

2020. The weighted average share count had increased by 15.9

million shares from the second quarter, 2020 to approximately 37.4

million common shares in the second quarter of 2021. The daily TCE

of $10,905 during the second quarter of 2021 was 7.3% lower than

the relevant period in 2020. The decrease was mainly due to lower

revenues, net of $0.5 million during the three months ended June

30, 2021 from $5.5 million in the same period of 2020. The decrease

was mostly attributed to lower charter rates for our MRs and lower

fleet utilization. Vessel operating expenses increased by $0.3

million or 13.4% for the three months ended June 30, 2021 compared

to the second quarter of 2020. However, lower interest and finance

costs of approximately $0.6 million, primarily as a result of the

refinancing of the previous $24 million loan facility secured by

the “Pyxis Epsilon” (the “Eighthone Loan”) with a $17 million loan

at a substantial lower interest rate, mitigated the loss for the

three months ended June 30, 2021. Our Adjusted EBITDA of $0.4

million, represented a decrease of $0.8 million from $1.1 million

for the same period in 2020.

Results for the six months ended June 30, 2020 and

2021

For the six months ended June 30, 2021, we

reported a net loss of $3.6 million, or $0.11 basic and diluted

loss per share, compared to a loss of $2.4 million, with the same

loss per share for the comparable period in 2020. The weighted

average share count had increased by 11.9 million shares to

approximately 33.3 million common shares for the most recent six

month period. Lower daily TCE of $10,885 and lower

utilization of 85.5% during the six-month period ended June 30,

2021 were the primary factors that contributed to an operating loss

of $1.2 million during the first half of 2021. For the comparable

period in 2020, the daily TCE was $11,844 and utilization was

89.3%, respectively, with operating income of $0.1 million. In

2021, lower revenues, net of $1.9 million or 15.6%, compared to

2020 were partially offset by a decrease of $0.8 million in voyage

related costs and commissions and an aggregate decrease of

approximately $0.8 million in management fees and interest and

finance costs, net. These differences were counterbalanced by

increased vessel operating expenses, general and administrative

expenses and amortization of special survey costs aggregating $0.3

million. These additional costs, along with the recognition of a

$0.5 million loss from debt extinguishment associated with the

Eighthone Loan refinancing and dividend payments of approximately

$0.2 million for the Series A Convertible Preferred Stock, resulted

in a $1.2 million increased net loss for the six months ended June

30, 2021.

Our Adjusted EBITDA of $1.2 million represented

a decrease of $1.2 million from $2.4 million for the same six month

period in 2020.

| |

Three Months ended June 30, |

|

Six

Monthsended June 30, |

| |

2020 |

|

2021 |

|

2020 |

|

2021 |

| |

(Thousands of U.S. dollars, except for daily TCE rates) |

| Revenues, net |

5,489 |

|

4,986 |

|

12,124 |

|

10,228 |

| Voyage related costs and

commissions |

(947) |

|

(843) |

|

(2,629) |

|

(1,804) |

| Time charter equivalent revenues 1 |

4,542 |

|

4,143 |

|

9,495 |

|

8,424 |

| |

|

|

|

|

|

|

|

| Total operating days 2 |

386 |

|

380 |

|

802 |

|

774 |

| |

|

|

|

|

|

|

|

| Daily time charter equivalent rate 1,

2 |

11,766 |

|

10,905 |

|

11,844 |

|

10,885 |

1 Subject to rounding; please see “Non-GAAP

Measures and Definitions” below2 “Pyxis Delta” was sold on January

13, 2020, and has been excluded from the calculation for the six

months ended June 30, 2020 (the vessel had been under TC employment

for approximately 2 days in January 2020 when it was redelivered

from charterers in order to be sold).

Management’s Discussion and Analysis of

Financial Results for the Three Months ended June 30, 2020 and

2021 (Amounts are presented in million U.S. dollars,

rounded to the nearest one hundred thousand, except as otherwise

noted)

Revenues, net: Revenues, net of $5.0 million for

the three months ended June 30, 2021, represented a decrease of

$0.5 million, or 9.2%, from $5.5 million in the comparable period

in 2020, substantially a result of lower charter rates for our MRs

and decrease in utilization level in the second quarter of

2021.

Voyage related costs and commissions: Voyage

related costs and commissions of $0.8 million for the three months

ended June 30, 2021 decreased by $0.1 million over the comparable

period in 2020 as a result of slightly lower spot charter activity.

Under spot charters, all voyage expenses are typically borne by us

rather than the charterer and a decrease in spot chartering results

in a decrease in voyage related costs and commissions.

Vessel operating expenses: Vessel operating

expenses of $2.8 million for the three months ended June 30, 2021,

represented an increase of $0.3 million, or 13.4%, from $2.5

million in the comparable period in 2020. This increase was due

primarily to timing differences of certain vessel costs.

General and administrative expenses: General and

administrative expenses of $0.6 million for the three months ended

June 30, 2021, remained relatively stable from the comparable

period in 2020.

Management fees: For the three months ended June

30, 2021, management fees paid to our ship manager, Pyxis Maritime

Corp. (“Maritime”), an entity affiliated with our Chairman and

Chief Executive Officer, Mr. Valentis, and to

International Tanker Management Ltd. (“ITM”), our fleet’s technical

manager, in the aggregate of $0.3 million remained flat as compared

to the 2020 period.

Amortization of special survey costs:

Amortization of special survey costs of $0.1 million for the three

months ended June 30, 2021, represented an increase of less than

$0.1 million over the same period in 2020. This increase was

primarily due to three vessel drydockings that were completed in

the second half of 2020.

Depreciation: Depreciation of $1.1 million for

the three months ended June 30, 2021, remained flat compared to the

same period in 2020.

Interest and finance costs, net: Interest and

finance costs, net, of $0.6 million for the three months ended June

30, 2021, represented a decrease of $0.6 million, or 49.2%, from

$1.2 million in the comparable period in 2020. This decrease was

primarily attributable to the refinancing of the Eighthone Loan,

which has helped to reduce our overall debt outstanding and average

interest rate, as well as lower LIBOR rates paid on floating rate

bank debt compared to the same period in 2020.

Management’s Discussion and Analysis of

Financial Results for the Six Months ended June 30, 2020 and

2021 (Amounts are presented in million U.S. dollars,

rounded to the nearest one hundred thousand, except as otherwise

noted)

Revenues, net: Revenues, net of $10.2 million

for the six months ended June 30, 2021, represented a decrease of

$1.9 million, or 15.6%, from $12.1 million in the comparable period

in 2020. The decrease in revenues, net during the six-month period

ended June 30, 2021 was mostly attributed to the lower charter

rates for our MRs compared to the first half of 2020 and lower

fleet utilization.

Voyage related costs and commissions: Voyage

related costs and commissions of $1.8 million for the six months

ended June 30, 2021, represented a decrease of $0.8 million, or

31.4%, from $2.6 million in the comparable period in 2020. For the

six months ended June 30, 2021, our MRs were on spot charters for 4

days in total, compared to 29 days for the respective period in

2020. This lower spot chartering activity for our MRs contribute

primarily to the less voyage costs as under spot charters, all

voyage expenses are typically borne by us rather than the

charterer. Furthermore, the decrease in revenues, net during the

six-months ended June 30, 2021, resulted in reduced charter

commissions compared to the same period in 2020, contributing

further to the decrease in voyage related costs and commissions.

Vessel operating expenses: Vessel operating expenses of $5.3

million for the six months ended June 30, 2021, represented a

slight $0.1 million increase compared to the six months ended June

30, 2020.

General and administrative expenses: General and

administrative expenses of $1.2 million for the six months ended

June 30, 2021, represented a slight increase of $0.1 million, or

10.2%, from the comparable period in 2020, due to timing of certain

incurred costs.

Management fees: For the six months ended June

30, 2021, management fees payable to Maritime and ITM of $0.7

million in the aggregate, represented a decrease of less than $0.1

million compared to the six months ended June 30, 2020, as a result

of the sale of Pyxis Delta that was completed in January 2020.

Amortization of special survey costs:

Amortization of special survey costs of $0.2 million for the six

months ended June 30, 2021, represented an increase of $0.1

million, compared to the same period in 2020 due to three vessel

drydockings that were completed in the second half of 2020.

Depreciation: Depreciation of $2.2 million for

the six months ended June 30, 2021, remained flat compared to the

same period in 2020.

Interest and finance costs, net: Interest and

finance costs, net, of $1.8 million for the six months ended June

30, 2021, represented a decrease of $0.8 million, or 30.4%, from

$2.5 million in the comparable period in 2020. The decrease was

primarily attributable to the refinancing of the Eighthone Loan,

which reduced our overall debt outstanding and average interest

rate, as well as lower LIBOR rates paid on floating rate bank debt

compared to the same period in 2020. This reduction to interest and

finance costs is partially off-set from the loss from debt

extinguishment of $0.5 million which primarily reflected a

prepayment fee and the write-off of remaining unamortized balance

of deferred financing costs, both of which were associated with the

aforementioned loan refinancing.

Unaudited Interim Consolidated

Statements of Comprehensive LossFor the three months ended

June 30, 2020 and 2021(Expressed in thousands of U.S. dollars,

except for share and per share data)

| |

|

|

Three months ended |

|

|

|

|

June 30, 2020 |

|

June 30, 2021 |

|

|

|

|

|

|

|

| Revenues,

net |

|

|

$

5,489 |

|

$

4,986 |

|

|

|

|

|

|

|

|

Expenses: |

|

|

|

|

|

| Voyage related

costs and commissions |

|

|

(947) |

|

(843) |

| Vessel operating

expenses |

|

|

(2,500) |

|

(2,834) |

| General and

administrative expenses |

|

|

(549) |

|

(584) |

| Management fees,

related parties |

|

|

(151) |

|

(151) |

| Management fees,

other |

|

|

(194) |

|

(193) |

| Amortization of

special survey costs |

|

|

(48) |

|

(102) |

| Depreciation |

|

|

(1,094) |

|

(1,103) |

| Allowance for

credit losses |

|

|

— |

|

(9) |

| Operating

income / (loss) |

|

|

6 |

|

(833) |

|

|

|

|

|

|

|

| Other

income / (expenses): |

|

|

|

|

|

| Loss from

financial derivative instrument |

|

|

(1) |

|

— |

| Interest and

finance costs, net |

|

|

(1,198) |

|

(609) |

| Total

other expenses, net |

|

|

(1,199) |

|

(609) |

|

|

|

|

|

|

|

| Net

loss |

|

|

$

(1,193) |

|

$

(1,442) |

| |

|

|

|

|

|

| Dividends Series A

Convertible Preferred Stock |

|

|

— |

|

(68) |

| |

|

|

|

|

|

| Net loss

attributable to common shareholders |

|

|

$

(1,193) |

|

$

(1,510) |

| |

|

|

|

|

|

| Loss per common

share, basic and diluted |

|

|

$

(0.06) |

|

$

(0.04) |

| |

|

|

|

|

|

| Weighted average

number of common shares, basic and diluted |

|

|

21,490,666 |

|

37,393,648 |

Unaudited Interim Consolidated Statements of

Comprehensive LossFor the six months ended June 30, 2020

and 2021(Expressed in thousands of U.S. dollars, except for share

and per share data)

| |

|

|

Six months ended |

| |

|

|

June 30, 2020 |

|

June 30, 2021 |

| |

|

|

|

|

|

| Revenues,

net |

|

|

$

12,124 |

|

$

10,228 |

| |

|

|

|

|

|

|

Expenses: |

|

|

|

|

|

| Voyage related costs and

commissions |

|

|

(2,629) |

|

(1,804) |

| Vessel operating expenses |

|

|

(5,228) |

|

(5,342) |

| General and administrative

expenses |

|

|

(1,113) |

|

(1,226) |

| Management fees, related

parties |

|

|

(332) |

|

(300) |

| Management fees, other |

|

|

(432) |

|

(387) |

| Amortization of special survey

costs |

|

|

(97) |

|

(203) |

| Depreciation |

|

|

(2,189) |

|

(2,194) |

| Allowance for credit

losses |

|

|

— |

|

(9) |

| Gain from the sale of vessel,

net |

|

|

7 |

|

— |

| Operating income /

(loss) |

|

|

111 |

|

(1,237) |

| |

|

|

|

|

|

| Other income /

(expenses): |

|

|

|

|

|

| Loss from debt

extinguishment |

|

|

— |

|

(458) |

| Gain from financial derivative

instrument |

|

|

2 |

|

— |

| Interest and finance costs,

net |

|

|

(2,516) |

|

(1,750) |

| Total other expenses,

net |

|

|

(2,514) |

|

(2,208) |

| |

|

|

|

|

|

| Net loss |

|

|

$

(2,403) |

|

$

(3,445) |

| |

|

|

|

|

|

| Dividends Series A Convertible

Preferred Stock |

|

|

— |

|

(153) |

| |

|

|

|

|

|

| Net loss attributable

to common shareholders |

|

|

$

(2,403) |

|

$

(3,598) |

| |

|

|

|

|

|

| Loss per common share, basic

and diluted |

|

|

$

(0.11) |

|

$

(0.11) |

| |

|

|

|

|

|

| Weighted average number of

common shares, basic and diluted |

|

|

21,455,291 |

|

33,328,132 |

Consolidated Balance SheetsAs of December 31,

2020 and June 30, 2021 (unaudited)(Expressed in thousands of U.S.

dollars, except for share and per share data)

| |

|

|

December 31, |

|

June 30, |

| |

|

|

2020 |

|

2021 (unaudited) |

| ASSETS |

|

|

|

|

|

| |

|

|

|

|

|

| CURRENT

ASSETS: |

|

|

|

|

|

| Cash and cash equivalents |

|

|

$

1,620 |

|

$

10,199 |

| Inventories |

|

|

681 |

|

1,488 |

|

Trade accounts receivable |

|

|

672 |

|

512 |

|

Less: Allowance for credit losses |

|

|

(9) |

|

(9) |

| Trade accounts receivable,

net |

|

|

663 |

|

503 |

| Due from related parties |

|

|

2,308 |

|

598 |

| Prepayments and other current

assets |

|

|

133 |

|

172 |

| Total current

assets |

|

|

5,405 |

|

12,960 |

| |

|

|

|

|

|

| FIXED ASSETS,

NET: |

|

|

|

|

|

| Vessels, net |

|

|

83,774 |

|

81,580 |

| Prepayments for vessel

acquisition |

|

|

— |

|

3,008 |

| Total fixed assets,

net |

|

|

83,774 |

|

84,588 |

| |

|

|

|

|

|

| OTHER NON-CURRENT

ASSETS: |

|

|

|

|

|

| Restricted cash |

|

|

2,417 |

|

2,450 |

| Deferred charges, net |

|

|

1,594 |

|

1,391 |

| Total other

non-current assets |

|

|

4,011 |

|

3,841 |

| Total

assets |

|

|

$

93,190 |

|

$

101,389 |

| |

|

|

|

|

|

| LIABILITIES AND

STOCKHOLDERS’

EQUITY |

|

|

|

|

|

| |

|

|

|

|

|

| CURRENT

LIABILITIES: |

|

|

|

|

|

| Current portion of long-term

debt, net of deferred financing costs |

|

|

$

3,255 |

|

$

4,488 |

| Trade accounts payable |

|

|

3,642 |

|

2,252 |

| Hire collected in advance |

|

|

726 |

|

— |

| Accrued and other

liabilities |

|

|

677 |

|

950 |

| Total current

liabilities |

|

|

8,300 |

|

7,690 |

| |

|

|

|

|

|

| NON-CURRENT

LIABILITIES: |

|

|

|

|

|

| Long-term debt, net of current

portion and deferred financing costs |

|

|

50,331 |

|

40,279 |

| Promissory note |

|

|

5,000 |

|

3,000 |

| Total non-current

liabilities |

|

|

55,331 |

|

43,279 |

| |

|

|

|

|

|

| COMMITMENTS AND

CONTINGENCIES |

|

|

— |

|

— |

| |

|

|

|

|

|

|

STOCKHOLDERS’

EQUITY: |

|

|

|

|

|

| Preferred stock ($0.001 par

value; 50,000,000 shares authorized: of which 1,000,000 authorized

Series A Convertible Preferred Shares; 181,475 and 141,186 Series A

Convertible Preferred Shares issued and outstanding as at December

31, 2020 and June 30, 2021) |

|

|

— |

|

— |

| Common stock ($0.001 par

value; 450,000,000 shares authorized: 21,962,881 and 38,316,854

shares issued and outstanding as at December 31, 2020 and

June 30, 2021, respectively) |

|

|

22 |

|

38 |

| Additional paid-in

capital |

|

|

79,692 |

|

104,133 |

| Accumulated deficit |

|

|

(50,155) |

|

(53,751) |

| Total stockholders'

equity |

|

|

29,559 |

|

50,420 |

| Total liabilities and

stockholders' equity |

|

|

$

93,190 |

|

$

101,389 |

Unaudited Consolidated Statements of Cash

FlowsFor the six months ended June 30, 2020 and

2021(Expressed in thousands of U.S. dollars)

| |

|

|

Six months ended |

| |

|

|

June 30, 2020 |

|

June 30, 2021 |

| Cash

flows from operating activities: |

|

|

|

|

|

| Net loss |

|

|

(2,403) |

|

(3,445) |

|

Adjustments to reconcile net loss to net cash provided by

operating activities: |

|

|

|

|

|

Depreciation |

|

|

2,189 |

|

2,194 |

| Amortization

of special survey costs. |

|

|

97 |

|

203 |

| Allowance for

credit losses |

|

|

— |

|

9 |

| Amortization

of financing costs |

|

|

153 |

|

111 |

| Loss from debt

extinguishment |

|

|

— |

|

458 |

| Gain from

financial derivative instrument |

|

|

(2) |

|

— |

| Gain on sale

of vessel, net |

|

|

(7) |

|

— |

| Issuance of

common stock under the promissory note |

|

|

56 |

|

55 |

|

Changes in assets and liabilities: |

|

|

|

|

|

|

Inventories |

|

|

(1) |

|

(807) |

| Trade accounts

receivable, net |

|

|

780 |

|

151 |

| Due from

related parties |

|

|

(5,563) |

|

1,710 |

| Prepayments

and other assets |

|

|

96 |

|

(39) |

| Special survey

cost |

|

|

(155) |

|

— |

| Trade accounts

payable |

|

|

(1,088) |

|

(1,322) |

| Hire collected

in advance |

|

|

(1,388) |

|

(726) |

| Accrued and

other liabilities |

|

|

120 |

|

322 |

| Net

cash used in operating activities |

|

|

(7,116) |

|

(1,126) |

| |

|

|

|

|

|

| Cash

flow from investing activities: |

|

|

|

|

|

| Proceeds from

the sale of vessel, net |

|

|

13,197 |

|

— |

| Ballast water

treatment system installation |

|

|

(56) |

|

(153) |

| Prepayments

for vessel acquisition |

|

|

— |

|

(3,008) |

| Net

cash provided by / (used in) investing activities |

|

|

13,141 |

|

(3,161) |

| |

|

|

|

|

|

| Cash

flows from financing activities: |

|

|

|

|

|

| Proceeds from

long-term debt |

|

|

— |

|

17,000 |

| Repayment of

long-term debt |

|

|

(7,256) |

|

(25,990) |

| Gross proceeds

from issuance of common stock |

|

|

— |

|

25,000 |

| Common stock

offering costs |

|

|

(34) |

|

(1,774) |

| Proceeds from

conversion of warrants into common shares |

|

|

— |

|

202 |

| Repayment of

promissory note |

|

|

— |

|

(1,000) |

| Payment of

financing costs |

|

|

— |

|

(388) |

| Preferred

stock dividends paid |

|

|

— |

|

(151) |

| Net

cash provided by / (used in) financing activities |

|

|

(7,290) |

|

12,899 |

| |

|

|

|

|

|

| Net

(decrease)/increase in cash and cash equivalents and restricted

cash |

|

|

(1,265) |

|

8,612 |

| Cash and cash

equivalents and restricted cash at the beginning of the period |

|

|

5,176 |

|

4,037 |

| Cash

and cash equivalents and restricted cash at the end of the

period |

|

|

$

3,911 |

|

$

12,649 |

| |

|

|

|

|

|

| SUPPLEMENTAL

INFORMATION: |

|

|

|

|

|

| Cash paid for

interest |

|

|

2,198 |

|

1,781 |

| Non-cash

financing activities-issuance of common stock under the promissory

note |

|

|

112 |

|

1,112 |

| Unpaid portion

of common stock offering costs and financing costs |

|

|

— |

|

131 |

Liquidity, Debt and Capital Structure

Pursuant to our loan agreements, as of June 30,

2021, we were required to maintain minimum liquidity of $2.45

million. Total cash and cash equivalents, including restricted

cash, aggregated to $12.6 million as of June 30, 2021.

Total funded debt (in thousands of U.S.

dollars), net of deferred financing costs:

| |

|

As of December |

|

As of June |

|

|

|

31, 2020 |

|

30, 2021 |

| Funded debt, net

of deferred financing costs |

$ |

53,586 |

$ |

44,767 |

| Promissory Note -

related party |

|

5,000 |

|

3,000 |

| Total

funded debt |

$ |

58,586 |

$ |

47,767 |

Our weighted average interest rates on our total

funded debt for the three and six month periods ended June 30, 2021

were 4.6% and 5.9%, respectively.

Upon repayment of the previous loan facility of

the Pyxis Epsilon, the maturity date for the Amended & Restated

Promissory Note became March 30, 2022. Given the Company improved

cash position, on June 17, 2021, the existing Amended and

Restated Promissory Note was amended on the following basis: a)

repayment of $1 million in principal plus accrued interest, b)

conversion of $1 million of principal into 1,091,062 restricted

common shares of the Company computed on the volume weighted

average closing share price for the 10 day period commencing one

day after its public distribution of first quarter, 2021, financial

results press release (i.e. the period from June 3 to June 16, 2021

at $0.9165) and c) remaining balance of $3 million in

principal will be due on April 1, 2023, and interest shall accrue

at an annual rate of 7.5%, payable quarterly in cash.

On July 15, 2021, we took delivery of the Pyxis

Karteria, a medium range product tanker of 46,652 dwt built in 2013

at Hyundai Mipo shipyard in South Korea. The purchase was funded by

a combination of cash and a $13.5 million bank loan that is secured

by the vessel and amortizes over seven years.

On July 16, 2021, we announced the closing of

underwritten follow-on public offering (the “Offering”) of 308,487

shares of 7.75% Series A Cumulative Convertible Preferred Shares

(the “Preferred Shares” and each a “Preferred Share”) which trade

on the Nasdaq Capital Market under the symbol “PXSAP,” at a

purchase price of $20.00 per Preferred Share. The Company received

gross proceeds of approximately $6.17 million from the Offering,

prior to deducting underwriting discounts and estimated offering

expenses. The Company intends to use the net proceeds from the

Offering of $5.56 million for general corporate purposes, including

working capital and potential vessel acquisitions. Each Preferred

Share is convertible into the Company’s common shares at a

conversion price of $1.40 per common share, or 17.86 common shares,

at any time at the option of the holder, subject to certain

customary adjustments. If the trading price of Pyxis Tankers’

common stock equals or exceeds $2.38 per share for at least 20 days

in any 30 consecutive trading day period ending 5 days prior to

notice, the Company can call for mandatory conversion of the

Preferred Shares. Dividends on the Preferred Stock shall be

cumulative and paid monthly in arrears starting August 20, 2021, to

the extent declared by the board of directors of the Company.

The Preferred Shares will not be redeemable until after October 13,

2023, except upon change of control.

Monthly Series A Preferred Stock Dividend:

During the months of January through July 2021, we paid cash

dividends of $0.1615 per Series A Preferred Share, which aggregated

$0.15 million for the six month period ended June 30, 2021.

Update on Shares Issued and Outstanding: As of

August 4, 2021, we had 38,316,854 issued and outstanding common

shares, 449,673 Series A Preferred Shares and 1,590,540 warrants,

with exercise prices of $1.40 per common share (exclusive of

non-tradeable underwriter’s 444,571 common stock purchase warrants,

which have a weighted average exercise price of $2.16 per common

share, and 4,683 Series A Preferred Stock purchase warrants, which

have a weighted average exercise price of $24.97 per Series A

Preferred share). As of that date, Mr. Valentis beneficially owned

18,688,919 or approximately 48.8% of our outstanding shares.

Non-GAAP Measures and Definitions

Earnings before interest, taxes, depreciation

and amortization (“EBITDA”) represents the sum of net income /

(loss), interest and finance costs, depreciation and amortization

and, if any, income taxes during a period. Adjusted EBITDA

represents EBITDA before certain non-operating or non-recurring

charges, such as vessel impairment charges, gain from debt

extinguishment and stock compensation. EBITDA and Adjusted EBITDA

are not recognized measurements under U.S. GAAP.

EBITDA and Adjusted EBITDA are presented in this

press release as we believe that they provide investors with means

of evaluating and understanding how our management evaluates

operating performance. These non-GAAP measures have limitations as

analytical tools, and should not be considered in isolation from,

as a substitute for, or superior to financial measures prepared in

accordance with U.S. GAAP. EBITDA and Adjusted EBITDA do not

reflect:

- our cash expenditures, or future requirements for capital

expenditures or contractual commitments;

- changes in, or cash requirements for, our working capital

needs; and

- cash requirements necessary to service interest and

principal payments on our funded debt.

In addition, these non-GAAP measures do not have

standardized meanings and are therefore unlikely to be comparable

to similar measures presented by other companies. The following

table reconciles net loss, as reflected in the Unaudited

Consolidated Statements of Comprehensive Loss to EBITDA and

Adjusted EBITDA:

|

|

|

Three Months Ended |

|

Six Months Ended |

| (In

thousands of U.S. dollars) |

|

June 30, 2020 |

|

June 30, 2021 |

|

June 30, 2020 |

|

June 30, 2021 |

|

|

Reconciliation of Net loss to Adjusted EBITDA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

loss |

$ |

(1,193) |

$ |

(1,442) |

$ |

(2,403) |

$ |

(3,445) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation |

|

1,094 |

|

1,103 |

|

2,189 |

|

2,194 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Amortization of special survey costs |

|

48 |

|

102 |

|

97 |

|

203 |

|

|

|

|

|

|

|

|

|

|

|

|

| Interest

and finance costs, net |

|

1,198 |

|

609 |

|

2,516 |

|

1,750 |

|

|

|

|

|

|

|

|

|

|

|

|

|

EBITDA |

$ |

1,147 |

$ |

372 |

$ |

2,399 |

$ |

702 |

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from

debt extinguishment |

|

— |

|

— |

|

— |

|

458 |

|

|

|

|

|

|

|

|

|

|

|

|

| Loss /

(Gain) from financial derivative instrument |

|

1 |

|

— |

|

(2) |

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

| Gain from

the sale of vessel, net |

|

— |

|

— |

|

(7) |

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA |

$ |

1,148 |

$ |

372 |

$ |

2,390 |

$ |

1,160 |

|

| |

|

|

|

|

|

|

|

|

|

|

Daily TCE is a shipping industry performance

measure of the average daily revenue performance of a vessel on a

per voyage basis. Daily TCE is not calculated in accordance with

U.S. GAAP. We utilize daily TCE because we believe it is a

meaningful measure to compare period-to-period changes in our

performance despite changes in the mix of charter types (i.e. spot

charters, time charters and bareboat charters) under which our

vessels may be employed between the periods. Our management also

utilizes daily TCE to assist them in making decisions regarding

employment of the vessels. We calculate daily TCE by dividing

Revenues, net after deducting Voyage related costs and commissions,

by operating days for the relevant period. Voyage related costs and

commissions primarily consist of brokerage commissions, port, canal

and fuel costs that are unique to a particular voyage, which would

otherwise be paid by the charterer under a time charter

contract.

Vessel operating expenses (“Opex”) per day are

our vessel operating expenses for a vessel, which primarily consist

of crew wages and related costs, insurance, lube oils,

communications, spares and consumables, tonnage taxes as well as

repairs and maintenance, divided by the ownership days in the

applicable period.

We calculate utilization (“Utilization”) by

dividing the number of operating days during a period by the number

of available days during the same period. We use fleet utilization

to measure our efficiency in finding suitable employment for our

vessels and minimizing the amount of days that our vessels are

off-hire for reasons other than scheduled repairs or repairs under

guarantee, vessel upgrades, special surveys and intermediate

dry-dockings or vessel positioning. Ownership days are the total

number of days in a period during which we owned each of the

vessels in our fleet. Available days are the number of ownership

days in a period, less the aggregate number of days that our

vessels were off-hire due to scheduled repairs or repairs under

guarantee, vessel upgrades or special surveys and intermediate

dry-dockings and the aggregate number of days that we spent

positioning our vessels during the respective period for such

repairs, upgrades and surveys. Operating days are the number of

available days in a period, less the aggregate number of days that

our vessels were off-hire or out of service due to any reason,

including technical breakdowns and unforeseen circumstances.

EBITDA, Adjusted EBITDA and daily TCE are not

recognized measures under U.S. GAAP and should not be regarded as

substitutes for Revenues, net and Net income. Our presentation of

EBITDA, Adjusted EBITDA and daily TCE does not imply, and should

not be construed as an inference, that our future results will be

unaffected by unusual or non-recurring items and should not be

considered in isolation or as a substitute for a measure of

performance prepared in accordance with U.S. GAAP.

|

Recent Daily Fleet Data: |

|

|

|

|

|

|

|

|

|

(Amounts in U.S.$) |

|

Three Months Ended |

|

Six Months Ended |

| |

|

|

June 30, 2020* |

|

June 30, 2021 |

|

June 30, 2020* |

|

June 30, 2021 |

|

Eco-Efficient MR2: (2 of our vessels) |

|

|

|

|

|

|

|

|

| |

TCE |

|

14,410 |

|

13,280 |

|

15,060 |

|

13,481 |

| |

Opex |

|

6,017 |

|

6,697 |

|

5,966 |

|

6,511 |

| |

Utilization

% |

|

98.8% |

|

97.8% |

|

98.0% |

|

98.9% |

|

Eco-Modified MR2: (1 of our

vessels) |

|

|

|

|

|

|

|

|

| |

TCE |

|

15,697 |

|

11,555 |

|

15,286 |

|

11,207 |

| |

Opex |

|

5,493 |

|

6,604 |

|

6,078 |

|

6,632 |

| |

Utilization

% |

|

100.0% |

|

100.0% |

|

100.0% |

|

100.0% |

|

Small Tankers: (2 of our vessels) |

|

|

|

|

|

|

|

|

| |

TCE |

|

5,451 |

|

6,564 |

|

5,533 |

|

6,681 |

| |

Opex |

|

4,946 |

|

5,557 |

|

4,954 |

|

4,917 |

| |

Utilization

% |

|

69.8% |

|

61.0% |

|

75.5% |

|

64.9% |

|

Fleet: (5 vessels) * |

|

|

|

|

|

|

|

|

| |

TCE |

|

11,766 |

|

10,905 |

|

11,844 |

|

10,885 |

| |

Opex |

|

5,484 |

|

6,222 |

|

5,584 |

|

5,903 |

| |

Utilization

% |

|

87.1% |

|

83.5% |

|

89.3% |

|

85.5% |

* “Pyxis Delta”, a standard MR, was sold on

January 13, 2020, and has been excluded from the calculations for

the three and six months ended June 30, 2020 (the vessel had been

under TC employment for approximately 2 days in January when it was

re-delivered from charterers in order to be sold).

Conference Call and Webcast

We will host a conference call to discuss our

results at 8:30 a.m., Eastern Time, on Monday, August 9, 2021.

Participants should dial into the call 10

minutes before the scheduled time using the following numbers: 1

(877) 553-9962 (US Toll Free Dial In), 0(808) 238-0669 (UK Toll

Free Dial In) or +44 (0) 2071 928592 (Standard International Dial

In). Please quote "Pyxis Tankers".

A telephonic replay of the conference and

accompanying slides will be available following the completion of

the call and will remain available until Monday, August 16, 2021.

To listen to the archived audio file, visit our website

http://www.pyxistankers.com and click on Events& Presentations

under our Investor Relations page.

A live webcast of the conference call will be

available through our website (http://www.pyxistankers.com) under

our Events & Presentations page.

Webcast participants of the live conference call

should register on the website approximately 10 minutes prior to

the start of the webcast and can also access it through the

following link:

https://event.on24.com/wcc/r/3338967/AB5D981D9F585292A2B6B90A1ABE8551

An archived version of the webcast will be

available on the website within approximately two hours of the

completion of the call.

The information discussed on the conference

call, or that can be accessed through, Pyxis Tankers Inc.’s website

is not incorporated into, and does not constitute part of this

report.

About Pyxis Tankers Inc.

We own a modern fleet of six tankers, including

the recent delivery of the Pyxis Karteria, engaged in seaborne

transportation of refined petroleum products and other bulk

liquids. We are focused on growing our fleet of medium range

product tankers, which provide operational flexibility and enhanced

earnings potential due to their “eco” features and modifications.

Pyxis Tankers is positioned to opportunistically expand and

maximize the value of its fleet due to competitive cost structure,

strong customer relationships and an experienced management team,

whose interests are aligned with those of its shareholders. For

more information, visit: http://www.pyxistankers.com. The

information discussed contained in, or that can be accessed

through, Pyxis Tankers Inc.’s website, is not incorporated into,

and does not constitute part of this report.

Pyxis Tankers Fleet (as of August 4, 2021)

| |

|

|

Carrying |

|

|

Charter |

Earliest |

| |

|

|

Capacity |

Year |

Type of |

Rate |

Redelivery |

|

Vessel Name |

Shipyard |

Vessel Type |

(dwt) |

Built |

Charter |

per day (1) |

Date |

| Pyxis Epsilon |

SPP / S. Korea |

MR |

50,295 |

2015 |

Spot |

n/a |

n/a |

| Pyxis Theta 2 |

SPP / S. Korea |

MR |

51,795 |

2013 |

Time |

$13,250 |

December 2021 |

| Pyxis Malou |

SPP / S. Korea |

MR |

50,667 |

2009 |

Spot |

n/a |

n/a |

| Pyxis Karteria |

Hyundai Mipo/ S. Korea |

MR |

46,652 |

2013 |

Time |

$10,800 |

August 2021 |

| Northsea Alpha |

Kejin / China |

Small Tanker |

8,615 |

2010 |

Spot |

n/a |

n/a |

| Northsea Beta |

Kejin / China |

Small Tanker |

8,647 |

2010 |

Spot |

n/a |

n/a |

| |

|

|

216,671 |

|

|

|

|

- Charter rates are gross and do not reflect any commissions

payable.

- “Pyxis Theta” is contracted with a charterer’s option to extend

the charter at $15,000 per day for an additional six months,

plus/minus 15 days

Forward Looking Statements

This press release contains forward-looking

statements and forward-looking information within the meaning of

the Private Securities Litigation Reform Act of 1995 applicable

securities laws. The words “expected'', “estimated”, “scheduled”,

“could”, “should”, “anticipated”, “long-term”, “opportunities”,

“potential”, “continue”, “likely”, “may”, “will”, “positioned”,

“possible”, “believe”, “expand” and variations of these terms and

similar expressions, or the negative of these terms or similar

expressions, are intended to identify forward-looking information

or statements. But the absence of such words does not mean that a

statement is not forward-looking. All statements that are not

statements of either historical or current facts, including among

other things, our expected financial performance, expectations or

objectives regarding future and market charter rate expectations

and, in particular, the effects of COVID-19 on our financial

condition and operations and the product tanker industry in

general, are forward-looking statements. Forward-looking

information is based on the opinions, expectations and estimates of

management of Pyxis Tankers Inc. (“we”, “our” or “Pyxis”) at the

date the information is made, and is based on a number of

assumptions and subject to a variety of risks and uncertainties and

other factors that could cause actual events or results to differ

materially from those projected in the forward-looking information.

Although we believe that the expectations and assumptions on which

such forward-looking statements and information are based are

reasonable, those are not guarantees of our future performance and

you should not place undue reliance on the forward-looking

statements and information because we cannot give any assurance

that they will prove to be correct. Since forward-looking

statements and information address future events and conditions, by

their very nature they involve inherent risks and uncertainties and

actual results and future events could differ materially from those

anticipated or implied in such information. Factors that might

cause or contribute to such discrepancy include, but are not

limited to, the risk factors described in our Annual Report on Form

20-F for the year ended December 31, 2020 and our other filings

with the Securities and Exchange Commission (the “SEC”). The

forward-looking statements and information contained in this

presentation are made as of the date hereof. We do not undertake

any obligation to update publicly or revise any forward-looking

statements or information, whether as a result of new information,

future events or otherwise, except in accordance with U.S. federal

securities laws and other applicable securities laws.

Company

Pyxis Tankers Inc.59 K. Karamanli StreetMaroussi 15125

Greeceinfo@pyxistankers.com

Visit our website at www.pyxistankers.com

Company Contact

Henry WilliamsChief Financial OfficerTel: +30 (210) 638 0200 /

+1 (516) 455-0106Email: hwilliams@pyxistankers.com

Source: Pyxis Tankers Inc.

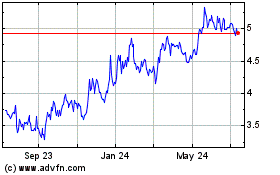

Pyxis Tankers (NASDAQ:PXS)

Historical Stock Chart

From Mar 2024 to Apr 2024

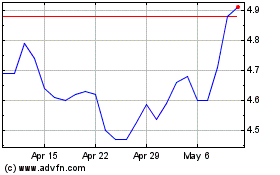

Pyxis Tankers (NASDAQ:PXS)

Historical Stock Chart

From Apr 2023 to Apr 2024