Report of Foreign Issuer (6-k)

June 29 2020 - 8:41AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF

FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR

15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of June 2020

Commission File Number: 001-38712

Pintec Technology Holdings Limited

9/F Heng An

Building

No. 17, East 3rd Ring Road

Chaoyang District, Beijing

People’s Republic of China

(Address of principal executive offices)

Indicate by check mark whether

the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form

40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Partial corrections to the Form 6-Ks furnished on

September 24, 2019 and December 13, 2019

In connection with the preparation of the Company’s consolidated financial

statements as of and for the year ended December 31, 2019, the Company determined that, due to inadvertent errors, certain adjustments needed to be made to the unreviewed and unaudited condensed consolidated financial statements for the six

months ended June 30, 2019 and the nine months ended September 30, 2019 furnished on Form 6-K to the United States Securities and Exchange Commission (the “SEC”) on

September 24, 2019 and December 13, 2019.

The Company corrected the use of net basis rather than gross basis to record revenue

earned from certain technical service fees for the six months ended June 30, 2018 and 2019 and the nine months ended September 30, 2018 and 2019.

The Company corrected the recognition of financial guarantee liabilities, financial guarantee assets, revenue recognized related to releasing

of guarantee liabilities and cost on guarantee for the six months ended June 30, 2019 and the nine months ended September 30, 2019.

The Company furnishes this Form 6-K in order to correct the errors.

Although the impact of the corrections on its six months ended June 30, 2019 and nine months ended September 30, 2019 unreviewed and

unaudited condensed consolidated financial statements were affected, the Company’s full year unreviewed and unaudited condensed consolidated financial statements of 2018 and 2019, which were included in the Form

6-K furnished to the SEC on June 16, 2020, were not affected.

2

The tables below illustrate the effects of adjustments made to the unreviewed and unaudited

condensed consolidated statements of operations and comprehensive income (loss) data for the six months ended June 30, 2018 and 2019 and nine months ended September 30, 2018 and 2019:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As previously reported

|

|

|

Revised

|

|

|

|

|

For the Six Months Ended

|

|

|

For the Nine Months Ended

|

|

|

For the Six Months Ended

|

|

|

For the Nine Months Ended

|

|

|

(In RMB thousands, except for share

and per share data)

|

|

June 30, 2018

|

|

|

June 30, 2019

|

|

|

September 30,

2018

|

|

|

September 30,

2019

|

|

|

June 30,

2018

|

|

|

June 30,

2019

|

|

|

September 30,

2018

|

|

|

September 30,

2019

|

|

|

Revenues:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Technical service fees

|

|

|

399,703

|

|

|

|

383,759

|

|

|

|

586,037

|

|

|

|

643,251

|

|

|

|

645,052

|

|

|

|

623,965

|

|

|

|

977,462

|

|

|

|

854,910

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total revenues

|

|

|

577,664

|

|

|

|

479,454

|

|

|

|

837,392

|

|

|

|

776,278

|

|

|

|

823,013

|

|

|

|

719,660

|

|

|

|

1,228,817

|

|

|

|

987,937

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenues:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost on guarantee

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

(48,733

|

)

|

|

|

—

|

|

|

|

(105,704

|

)

|

|

Service cost charged by Jimu Group-related party

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

(245,349

|

)

|

|

|

(169,180

|

)

|

|

|

(391,425

|

)

|

|

|

(209,118

|

)

|

|

Cost of revenues

|

|

|

(341,520

|

)

|

|

|

(204,877

|

)

|

|

|

(462,453

|

)

|

|

|

(302,598

|

)

|

|

|

(586,869

|

)

|

|

|

(422,790

|

)

|

|

|

(853,878

|

)

|

|

|

(617,420

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit

|

|

|

236,144

|

|

|

|

274,577

|

|

|

|

374,939

|

|

|

|

473,680

|

|

|

|

236,144

|

|

|

|

296,870

|

|

|

|

374,939

|

|

|

|

370,517

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative expenses

|

|

|

(96,589

|

)

|

|

|

(131,232

|

)

|

|

|

(159,591

|

)

|

|

|

(221,588

|

)

|

|

|

(96,589

|

)

|

|

|

(135,975

|

)

|

|

|

(159,591

|

)

|

|

|

(200,298

|

)

|

|

Total operating expenses

|

|

|

(186,916

|

)

|

|

|

(218,566

|

)

|

|

|

(288,726

|

)

|

|

|

(342,538

|

)

|

|

|

(186,916

|

)

|

|

|

(223,309

|

)

|

|

|

(288,726

|

)

|

|

|

(321,248

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating profit

|

|

|

49,228

|

|

|

|

56,011

|

|

|

|

86,213

|

|

|

|

131,142

|

|

|

|

49,228

|

|

|

|

73,561

|

|

|

|

86,213

|

|

|

|

49,269

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gain/(loss) on guarantee liabilities

|

|

|

—

|

|

|

|

9,678

|

|

|

|

(2,839

|

)

|

|

|

(44,382

|

)

|

|

|

—

|

|

|

|

—

|

|

|

|

(2,839

|

)

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income before income tax expense

|

|

|

44,053

|

|

|

|

93,950

|

|

|

|

75,662

|

|

|

|

111,142

|

|

|

|

44,053

|

|

|

|

101,822

|

|

|

|

75,662

|

|

|

|

73,651

|

|

|

Net income

|

|

|

12,386

|

|

|

|

73,335

|

|

|

|

15,760

|

|

|

|

115,226

|

|

|

|

12,386

|

|

|

|

81,207

|

|

|

|

15,760

|

|

|

|

77,735

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss)/income attributable to ordinary shareholders

|

|

|

(20,791

|

)

|

|

|

73,335

|

|

|

|

(51,617

|

)

|

|

|

115,226

|

|

|

|

(20,791

|

)

|

|

|

81,207

|

|

|

|

(51,617

|

)

|

|

|

77,735

|

|

|

Total comprehensive income

|

|

|

30,734

|

|

|

|

73,998

|

|

|

|

50,902

|

|

|

|

136,484

|

|

|

|

30,734

|

|

|

|

81,870

|

|

|

|

50,902

|

|

|

|

98,993

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive (loss)/income attributable to ordinary shareholders

|

|

|

(2,443

|

)

|

|

|

73,998

|

|

|

|

(16,475

|

)

|

|

|

136,484

|

|

|

|

(2,443

|

)

|

|

|

81,870

|

|

|

|

(16,475

|

)

|

|

|

98,993

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss)/income per ordinary share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

(0.31

|

)

|

|

|

0.27

|

|

|

|

(0.76

|

)

|

|

|

0.42

|

|

|

|

(0.31

|

)

|

|

|

0.30

|

|

|

|

(0.76

|

)

|

|

|

0.28

|

|

|

Diluted

|

|

|

(0.31

|

)

|

|

|

0.26

|

|

|

|

(0.76

|

)

|

|

|

0.38

|

|

|

|

(0.31

|

)

|

|

|

0.28

|

|

|

|

(0.76

|

)

|

|

|

0.26

|

|

3

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

Pintec Technology Holdings Limited

|

|

|

|

|

|

By

|

|

:

|

|

/s/ Steven Yuan Ning Sim

|

|

Name

|

|

:

|

|

Steven Yuan Ning Sim

|

|

Title

|

|

:

|

|

Chief Financial Officer

|

Date: June 29, 2020

4

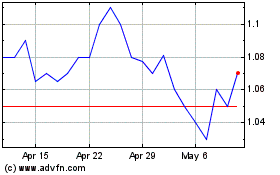

Pintec Technology (NASDAQ:PT)

Historical Stock Chart

From Mar 2024 to Apr 2024

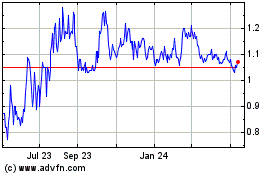

Pintec Technology (NASDAQ:PT)

Historical Stock Chart

From Apr 2023 to Apr 2024