Report of Foreign Issuer (6-k)

October 17 2019 - 4:26PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

October 17, 2019

PROQR THERAPEUTICS N.V.

Zernikedreef 9

2333 CK Leiden

The Netherlands

Tel: +31 88 166 7000

(Address, Including ZIP Code, and Telephone Number,

Including Area Code, of Registrant’s Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): o

Entry into a Material Definitive Agreement

Underwriting Agreement

On October 15, 2019, ProQR Therapeutics N.V. (the “Company”) entered into an underwriting agreement (the “Underwriting Agreement”) with Citigroup Global Markets Inc. and Evercore Group L.L.C., as representatives of the several underwriters named therein (collectively, the “Underwriters”), relating to an underwritten public offering of 9,090,909 ordinary shares (the “Shares”) of the Company (the “Offering”). All of the Shares were being sold by the Company. The offering price to the public of the Shares is $5.50 per share, and the Underwriters have agreed to purchase the Shares from the Company pursuant to the Underwriting Agreement at the public offering price, less underwriting discounts and commissions. Under the terms of the Underwriting Agreement, the Company granted the Underwriters an option, exercisable for 30 days, to purchase up to additional 1,363,636 ordinary shares (the “Option Shares”) on the same terms as the Shares.

The Shares will be issued pursuant to the Company’s shelf registration statement (the “Registration Statement”) on Form F-3 (Registration Statement No. 333- 228251) previously filed with the Securities and Exchange Commission (the “Commission”) and declared effective by the Commission on November 19, 2018. A preliminary prospectus supplement and prospectus supplement and the accompanying prospectus relating to the Offering have been filed with the Commission. The Offering is expected to close on or about October 18, 2019, subject to satisfaction of customary closing conditions.

The Company estimates that the aggregate net proceeds from the Offering will be approximately $46.6 million, after deducting the underwriting discounts and commissions and estimated offering expenses payable by the Company, without giving effect to any sales of the Option Shares.

A copy of the legal opinion of Allen & Overy LLP, the Company’s Netherlands counsel, relating to the legality and validity of the Shares and the Option Shares is filed as Exhibit 5.1 to this Report on Form 6-K, which is filed with reference to, and is hereby incorporated by reference into, the Registration Statement.

The Underwriting Agreement contains customary representations and warranties, agreements and obligations, conditions to closing and termination provisions. The Underwriting Agreement provides for indemnification by the Underwriters of the Company, its directors and certain of its executive officers, and by the Company of the Underwriters, for certain liabilities, including liabilities arising under the Securities Act of 1933, as amended, and affords certain rights of contribution with respect thereto. The foregoing description of the Underwriting Agreement is qualified in its entirety by reference to the Underwriting Agreement, which is attached as Exhibit 1.1 hereto and incorporated by reference herein. The representations, warranties and covenants contained in the Underwriting Agreement were made only for purposes of such agreements and as of specific dates, were solely for the benefit of the parties to such agreement, and may be subject to limitations agreed upon by the contracting parties.

On October 15, 2019, the Company issued a press release announcing the pricing of the Offering. A copy of the press release is attached as Exhibit 99.1 hereto and is hereby incorporated by reference herein.

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

ProQR Therapeutics N.V.

|

|

|

|

|

|

Date: October 17, 2019

|

By:

|

/s/ Smital Shah

|

|

|

|

Smital Shah

|

|

|

|

Chief Financial Officer

|

3

INDEX TO EXHIBITS

|

Number

|

|

Description

|

|

|

|

|

|

1.1

|

|

Underwriting Agreement, dated October 15, 2019, between the Company and Citigroup Global Markets Inc. and Evercore Group L.L.C.

|

|

|

|

|

|

5.1

|

|

Opinion of Allen & Overy LLP.

|

|

|

|

|

|

23.1

|

|

Consent of Allen & Overy LLP (included in Exhibit 5.1).

|

|

|

|

|

|

99.1

|

|

Press Release dated October 15, 2019.

|

4

ProQR Therapeutics NV (NASDAQ:PRQR)

Historical Stock Chart

From Mar 2024 to Apr 2024

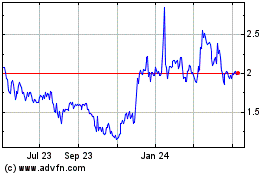

ProQR Therapeutics NV (NASDAQ:PRQR)

Historical Stock Chart

From Apr 2023 to Apr 2024