Current Report Filing (8-k)

September 18 2020 - 8:05AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of

The

Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): September 15, 2020

PROPHASE

LABS, INC.

(Exact

name of Company as specified in its charter)

|

Delaware

|

|

0-21617

|

|

23-2577138

|

|

(State

or other jurisdiction

of incorporation)

|

|

(Commission

File

Number)

|

|

(I.R.S.

Employer

Identification

No.)

|

|

621

N. Shady Retreat Road

Doylestown,

PA

|

|

18901

|

|

(Address

of principal executive offices)

|

|

(Zip

Code)

|

Registrant’s

telephone number, including area code: (215) 345-0919

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Company under

any of the following provisions (see General Instruction A.2. below):

|

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities

Registered Pursuant to Section 12(b) of the Act:

|

Title

of Each Class

|

|

Trading

Symbol(s)

|

|

Name

of each exchange on which registered

|

|

Common

Stock, par value $0.0005

|

|

PRPH

|

|

Nasdaq

Capital Market

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company [ ]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Item

1.01 Entry into a Material Definitive Agreement.

On September 15, 2020,

ProPhase Labs, Inc. (the “Company”) issued an unsecured, partially convertible, promissory note for an aggregate

principal amount of $8 million to JXVII Trust (“JXVII”) and an unsecured, partially convertible, promissory

note for an aggregate principal amount of $2 million to Justin J. Leonard (“Leonard,” and together with JXVII, the

“Lenders”).

Each of the two

unsecured, partially convertible, promissory notes (collectively, the “Notes”) is due and payable

on the third anniversary of the date on which the Note was funded (for each Note, the “Closing Date”)

and accrues interest at a rate of 10% per year from the Closing Date, payable on a quarterly basis, until the Note is

repaid in full. The Company has the right to prepay the Notes at any time after the

13 month anniversary of the Closing Date upon providing written notice to the Lenders, and may prepay the Notes prior to such

time with the consent of the Lenders. The Lenders have the right, at any time, and from time to time, on and after the

13 month anniversary of the Closing Date to convert up to an aggregate of $3 million of the Notes into common stock of the Company

at a conversion price of $3.00 per share. Repayment of the Notes has been guaranteed by the Company’s wholly-owned subsidiary,

Pharmaloz Manufacturing, Inc.

The

Notes contain customary events of default. If a default occurs and is not cured within the applicable cure period or is not waived,

any outstanding obligations under the Notes may be accelerated. The Notes also contain certain restrictive covenants which, among

other things, restrict the Company’s ability to create, incur, assume or permit to exist, directly or indirectly, any lien

(other than certain permitted liens described in the Notes) securing any indebtedness of the Company, and prohibits the Company

from distributing or reinvesting the proceeds from any divestment of assets (other than in the ordinary course) without the prior

approval of the Lenders.

The

Company intends to use the proceeds from the Notes for working capital and general corporate purposes, which may include capital

expenditures, product development and commercialization expenditures, and acquisitions of companies, businesses, technologies

and products within and outside the consumer products industry.

The

foregoing description of the Notes does not purport to be complete and is subject to, and is qualified in its entirety by reference

to, the full text of the Notes, which are attached as Exhibits 10.1 and 10.2 to this Current Report on Form 8-K, and are incorporated

herein by reference.

Item

2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement

of a Registrant.

The

disclosure provided in Item 1.01 of this Current Report on Form 8-K is hereby incorporated by reference into this Item 2.03.

Item

7.01 Regulation FD Disclosure.

On

September 18, 2020, the Company issued a press release announcing the transaction described in Item 1.01 of this Current

Report on Form 8-K. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The

information in this Item 7.01 and Exhibit 99.1 shall not be deemed “filed” for purposes of Section 18 of the Securities

Exchange Act of 1934, as amended, nor shall it be incorporated by reference in any registration statement filed under the Securities

Act of 1933, as amended, unless specifically identified therein as being incorporated by reference therein.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

ProPhase

Labs, Inc.

|

|

|

|

|

|

|

By:

|

/s/

Monica Brady

|

|

|

|

Monica

Brady

|

|

|

|

Chief

Financial Officer

|

Date:

September 18, 2020

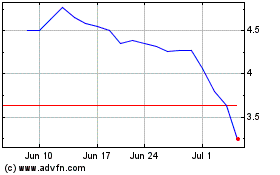

ProPhase Labs (NASDAQ:PRPH)

Historical Stock Chart

From Mar 2024 to Apr 2024

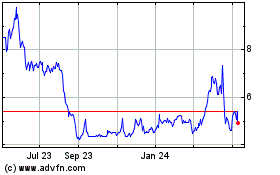

ProPhase Labs (NASDAQ:PRPH)

Historical Stock Chart

From Apr 2023 to Apr 2024