Current Report Filing (8-k)

April 01 2021 - 5:11PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): March 26, 2021

AMMO,

INC.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

|

001-13101

|

|

83-1950534

|

|

(State

or other jurisdiction of

incorporation

or organization)

|

|

(Commission

File

Number)

|

|

(IRS

Employer

Identification

No.)

|

7681

E. Gray Rd.

Scottsdale,

Arizona 85260

(Address

of principal executive offices)

(480)

947-0001

(Registrant’s

telephone number, including area code)

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Trading

Symbol(s)

|

|

Name

of each exchange on which registered

|

|

Common

Stock, $0.001 par value

|

|

POWW

|

|

The

Nasdaq Stock Market LLC (Nasdaq Capital Market)

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company [ ]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Item

5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements

of Certain Officers.

On

March 26, 2021, Ammo, Inc. (the “Company”) appointed Mr. Robert J. Goodmanson, age 66, as President of the Company.

In

connection with Mr. Goodmanson’s appointment, Mr. Fred Wagenhals resigned as President of the Company. Mr. Wagenhals remains

Chief Executive Officer and Chairman of the Board of Directors.

In

addition to his role as President, Mr. Goodmanson will continue to serve on the Board of Directors.

Mr.

Goodmanson has been a Director of our company since May 2019. Mr. Goodmanson has more than 30 years of experience in the investment

industry. He was employed at Tealwood Asset Management, a fully Registered Investment Advisor in Minneapolis from January 2018

to March 2021. He founded and was CEO of Maxwell Simon, Inc. a FINRA registered full service Broker-Dealer and a licensed registered

Investment Advisory firm. Maxwell Simon’s focus was on institutional fixed income, advisory, private and public equity transactions.

Prior to founding Maxwell Simon, Mr. Goodmanson held senior positions at Tucker Anthony and Robert W Baird where he was a Divisional

Director. For three years he served on the FINRA Board of Governors for District 4 in Kansas City.

Family

Relationships

There

is no family relationship between Mr. Goodmanson and any of the Company’s directors or officers.

Related

Party Transactions

There

are no related party transactions reportable under Item 5.02 of Form 8-K and Item 404(a) of Regulation S-K.

Material

Plan, Contract, or Arrangement

In

connection with Mr. Goodmanson’s appointment as President, the Company entered into an employment agreement with Mr. Goodmanson

dated March 26, 2021 (the “Employment Agreement”). The Employment Agreement provides for an initial term ending March

26, 2024. Thereafter, either the Company or Mr. Goodmanson has the right to extend the Employment Agreement for three (3) additional

one-year terms. The Company and Mr. Goodmanson can mutually elect to terminate the Employment Agreement at any time upon ninety

(90) days written notice.

Mr.

Goodmanson is entitled to a base salary of $240,000 per year. Pursuant to the Employment Agreement, Mr. Goodmanson is entitled

to the grant of 130,000 shares of the Company’s common stock per year to be issued on a quarterly basis pursuant to the

Company’s 2017 Equity Incentive Plan. In the event Mr. Goodman’s employment is terminated

without Cause or Mr. Goodmanson resigns for Good Reason (as Cause and Good Reason are defined in the Employment Agreement) within

twelve (12) months of a Change in Control (as defined in the Employment Agreement), Mr. Goodmanson shall receive his salary for

the duration of the term of the Employment Agreement and 100% of the total number of shares due to Mr. Goodmanson for the duration

of the term of the Employment Agreement shall immediately become vested and issuable.

The foregoing description of the Employment

Agreement is not complete and is qualified in its entirety by reference to the full text of the Employment Agreement, which

will be filed as an exhibit to the Company’s Annual Report on Form 10-K for the fiscal year ended March 31, 2021.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

AMMO,

INC.

|

|

|

|

|

Dated:

April 1, 2021

|

By:

|

/s/

Robert D. Wiley

|

|

|

|

Robert

D. Wiley

|

|

|

|

Chief

Financial Officer

|

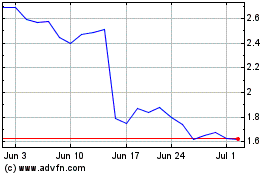

AMMO (NASDAQ:POWW)

Historical Stock Chart

From Mar 2024 to Apr 2024

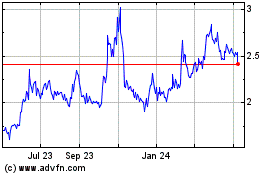

AMMO (NASDAQ:POWW)

Historical Stock Chart

From Apr 2023 to Apr 2024