AMMO, Inc. (Nasdaq: POWW ) (“AMMO” or the “Company”), a premier

American ammunition and munition components manufacturer and

technology leader, is pleased to announce it has reported financial

results for its fiscal third quarter ending December 31, 2020.

Financial Summary for Fiscal Third

Quarter 2021 vs. Fiscal Third Quarter 2020

- Sales for the quarter were $16.6

million - 500% increase in comparison to the

Fiscal 2020 quarter.

- Sales for the nine months increased

282% to $38.3 million.

- Gross Profit Margins increased to

approximately 20%, an increase of 163%.

- Operating expenses as a percentage

of sales decreased 28% from the prior year.

- Adjusted EBITDA has grown to $2.4

million for the quarter - 295% increase from the prior year.

AMMO is positioned for exceptional growth,

setting a new standard in Fiscal 2021. Demand fundamentals in the

US domestic ammunition market are exceedingly strong and we are

seeing no indication of slowing. Our fiscal third quarter delivered

the best quarterly performance in Company history, with even better

quarters expected throughout fiscal 2022.

AMMO’s sales for the quarter were $16.6 million,

a 500% increase in comparison to the Fiscal 2020

quarter. Sales for the nine-month period (year-over-year) increased

282% to $38.3 million.

Additionally, the Company experienced sales

growth of 38% quarter-over-quarter, a $4.6 million

increase.

The Company’s margins have also increased to

approximately 20% for our third fiscal quarter, an increase of 163%

or $4.2 million year-over-year. When depreciation and amortization

are added back to the cost of goods sold, our gross profit margin

increases to 25% for the quarter.

Our operating expenses as a percentage of sales

was 23% - 28% decrease from the

prior year quarter.

Net Loss for the quarter was approximately $1.9

million, which includes approximately $2.4 million of non-cash

expenses. Net Loss for the nine months was approximately $7.3

million, which also included non-cash expenses of $7.1 million.

Adjusted EBITDA has grown to $2.4 million for

the quarter - 295% increase from the prior year. For the nine-month

period, our Adjusted EBITDA was $3.3 million - 170% increase from

the prior year.

The adjusted EBITDA and margin improvement shows

the impact of the scaling we are beginning to see in our

operational costs. We expect our first half fiscal 2022 EBITDA to

be better than the second half of fiscal 2021 as a standalone.

The guidance for our fiscal 4th quarter as a

standalone company is $20M and $58M for our fiscal year ended March

31, 2021. We will be updating guidance if and as the previously

announced Gunbroker.com transaction comes into focus such that it

has an impact on our fourth quarter results.

Non-GAAP Financial Measures

We analyze operational and financial data to

evaluate our business, allocate our resources, and assess our

performance. In addition to total net sales, net loss, and other

results under generally accepted accounting principles (GAAP), the

following information includes key operating metrics and non-GAAP

financial measures we use to evaluate our business. We believe

these measures are useful for period-to-period comparisons of the

Company. We have included these non-GAAP financial measures in this

Quarterly Report on Form 10-Q because they are key measures we use

to evaluate our operational performance, produce future strategies

for our operations, and make strategic decisions, including those

relating to operating expenses and the allocation of our resources.

Accordingly, we believe these measures provide useful information

to investors and others in understanding and evaluating our

operating results in the same manner as our management and board of

directors.

Adjusted EBITDA

| |

|

For the Three Months Ended |

|

|

For the Nine Months Ended |

|

|

|

|

|

31-Dec-20 |

|

|

|

31-Dec-19 |

|

|

|

31-Dec-20 |

|

|

|

31-Dec-19 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reconciliation of GAAP

net income to Adjusted EBITDA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Loss |

|

$ |

(1,906,437 |

) |

|

$ |

(2,864,422 |

) |

|

$ |

(7,348,851 |

) |

|

$ |

(10,150,082 |

) |

| Depreciation and

amortization |

|

|

1,224,130 |

|

|

|

883,692 |

|

|

|

3,588,966 |

|

|

|

2,957,337 |

|

| Loss on Jagemann Munition

Components |

|

|

- |

|

|

|

- |

|

|

|

1,000,000 |

|

|

|

- |

|

| Excise Taxes |

|

|

1,201,841 |

|

|

|

138,529 |

|

|

|

2,707,534 |

|

|

|

374,132 |

|

| Interest expense, net |

|

|

1,938,630 |

|

|

|

214,326 |

|

|

|

2,704,315 |

|

|

|

607,710 |

|

| Employee stock awards |

|

|

240,853 |

|

|

|

182,250 |

|

|

|

716,589 |

|

|

|

688,750 |

|

| Stock grants |

|

|

65,455 |

|

|

|

168,363 |

|

|

|

213,130 |

|

|

|

548,057 |

|

| Stock for services |

|

|

87,500 |

|

|

|

72,000 |

|

|

|

87,500 |

|

|

|

272,000 |

|

| Other income, net |

|

|

(461,000 |

) |

|

|

- |

|

|

|

(274,400 |

) |

|

|

- |

|

| Contingent consideration fair

value |

|

|

(30,748 |

) |

|

|

- |

|

|

|

(88,106 |

) |

|

|

- |

|

| Adjusted EBITDA |

|

$ |

2,360,224 |

|

|

$ |

(1,205,262 |

) |

|

$ |

3,306,677 |

|

|

$ |

(4,702,096 |

) |

Adjusted EBITDA is a non-GAAP financial measures that

displays our net loss, adjusted to eliminate the effect of certain

items as described below.

We have excluded the following non-cash expenses

from our non-GAAP financial measures: depreciation and

amortization, loss on purchase, share-based compensation expenses,

and changes to the contingent consideration fair value. We believe

it is useful to exclude these non-cash expenses because the amount

of such expenses in any specific period may not directly correlate

to the underlying performance of our business operations.

Adjusted EBITDA as a non-GAAP financial measure

also excludes other cash interest income and expense, as these

items are not components of our core operations. We have not

included adjustment for any provision or benefit for income taxes

as we currently record a valuation allowance and have included

adjustment for excise taxes.

Non-GAAP financial measures have limitations,

should be considered as supplemental in nature, and are not meant

as a substitute for the related financial information prepared in

accordance with GAAP. These limitations include the

following:

- Employee stock awards and stock

grants expense has been, and will continue to be for the

foreseeable future, a significant recurring expense in the Company

and an important part of our compensation strategy;

- The assets being depreciated or

amortized may have to be replaced in the future, and the non-GAAP

financial measures do not reflect cash capital expenditure

requirements for such replacements or for new capital expenditures

or other capital commitments;

- Non-GAAP measures do not reflect

changes in, or cash requirements for our working capital needs;

and

- Other companies, including

companies in our industry, may calculate the non-GAAP financial

measures differently or not at all, which reduces their usefulness

as comparative measures.

Because of these limitations, you should

consider the non-GAAP financial measures alongside other financial

performance measures, including our net loss and other financial

results presented in accordance with GAAP.

About AMMO, Inc.

With its corporate offices headquartered in

Scottsdale, Arizona. AMMO designs and manufactures products for a

variety of aptitudes, including law enforcement, military, sport

shooting and self-defense. The Company was founded in 2016 with a

vision to change, innovate and invigorate the complacent munitions

industry. AMMO promotes branded munitions as well as its patented

STREAK™ Visual Ammunition, /stelTH/™ subsonic munitions, and armor

piercing rounds for military use. For more information, please

visit: www.ammo-inc.com.

Forward Looking Statements

This document contains certain “forward-looking

statements”. All statements other than statements of historical

fact are “forward-looking statements” for purposes of federal and

state securities laws, including, but not limited to, any

projections of earnings, revenue or other financial items; any

statements of the plans, strategies, goals and objectives of

management for future operations; any statements concerning

proposed new products and services or developments thereof; any

statements regarding future economic conditions or performance; any

statements or belief; and any statements of assumptions underlying

any of the foregoing.

Forward looking statements may include the words

“may,” “could,” “estimate,” “intend,” “continue,” “believe,”

“expect” or “anticipate” or other similar words, or the negative

thereof. These forward-looking statements present our estimates and

assumptions only as of the date of this report. Accordingly,

readers are cautioned not to place undue reliance on

forward-looking statements, which speak only as of the dates on

which they are made. We do not undertake to update forward-looking

statements to reflect the impact of circumstances or events that

arise after the dates they are made. You should, however, consult

further disclosures and risk factors we include in Annual Reports

on Form 10-K, Quarterly Reports on Form 10-Q, and Reports filed on

Form 8-K.

Reminder – Earnings Call

AMMO’s Fiscal Third Quarter 2021 Earnings Call

is scheduled for Tuesday, February 16th, 2021 (4:30 pm Eastern

Time). To participate in the conference call, please join by

dialing 1-877-407-0789 (domestic), 1-201-689-8562 (international),

or via webcast (http://public.viavid.com/index.php?id=143495) at

least 5-10 minutes prior to the scheduled start and follow the

operator’s instructions. When requested, please ask for “AMMO, Inc.

Fiscal Third Quarter 2021 Earnings Call.”

Investor Contact:Rob Wiley,

CFOAMMO, Inc.Phone: (480) 947-0001IR@ammo-inc.com

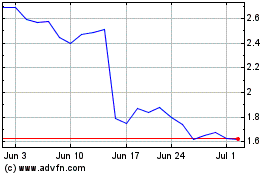

AMMO (NASDAQ:POWW)

Historical Stock Chart

From Mar 2024 to Apr 2024

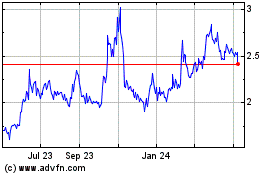

AMMO (NASDAQ:POWW)

Historical Stock Chart

From Apr 2023 to Apr 2024