Registration No. 333-228031

As filed with the Securities and Exchange Commission on

September 14, 2020

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

POST-EFFECTIVE

AMENDMENT NO. 2

ON

FORM S-1

TO

FORM S-4 (FILE NO. 333-228031)

REGISTRATION STATEMENT UNDER THE SECURITIES

ACT OF 1933

________________________________

Predictive Oncology Inc.

(Exact name of registrant as specified in

its charter)

|

Delaware

|

3842

|

33-1007393

|

|

(State or jurisdiction

|

(Primary Standard Industrial

|

(I.R.S. Employer

|

|

of incorporation or organization)

|

Classification Code Number)

|

Identification No.)

|

|

2915 Commers Drive, Suite 900

Eagan, Minnesota 55121

(651) 389-4800

(Address and telephone number of registrant’s

principal executive offices and principal place of business)

|

|

Bob Myers

Chief Financial Officer

Predictive Oncology Inc.

2915 Commers Drive, Suite 900

Eagan, Minnesota 55121

(651) 389-4800

(Name, address and telephone

number of agent for service)

|

Copy to:

Martin R. Rosenbaum, Esq.

Maslon LLP

3300 Wells Fargo Center

90 South 7th Street

Minneapolis, Minnesota 55402

Telephone: (612) 672-8200

Facsimile: (612) 672-8397

|

Approximate date of commencement of proposed

sale to the public: From time to time on or after the effective date of this Registration Statement.

If any of the securities being registered

on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than

securities offered only in connection with dividend or interest reinvestment plans, check the following box: ☒

If this Form is filed to register additional

securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities

Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment

filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment

filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth

company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting

company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one)

|

Large accelerated filer ☐

|

Accelerated filer ☐

|

|

Non-accelerated filer ☒

|

Smaller reporting company ☒

|

|

Emerging growth company ☐

|

|

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. ☐

EXPLANATORY NOTE

This Post-Effective

Amendment No. 2 on Form S-1 (“Post-Effective Amendment No. 2”) is being filed pursuant to Section 10(a)(3) of the Securities

and Exchange Act of 1933, as amended, to update the Registration Statement on Form S-4 (File No. 333-228031), which became effective

in accordance with Section 8(a) of the Securities Act of 1933, as amended, on February 13, 2019. More specifically, this Post-Effective

Amendment No. 2 reflects an amendment to the terms of the Exchange Warrants (as defined below). No additional securities are being

registered under this Post-Effective Amendment No. 2. All applicable registration fees were paid at the time of the original filing

of the Registration Statement.

In connection

with its merger transaction (the “Merger”) with Helomics Holding Corporation (“Helomics”), which was completed

on April 4, 2019, Predictive Oncology Inc. (the “Company”) consummated an exchange offer with certain of Helomics’

existing investors that included, among other things, the exchange of warrants to purchase shares of Helomics common stock held

by such investors (the “Helomics Warrants”) for warrants (the “Exchange Warrants”) to purchase shares of

the Company’s common stock, par value $0.01 per share (“Common Stock”), at an exercise price of $10.00 per share

(as adjusted for a one-for-ten (1:10) reverse stock split that was effective on October 29, 2019 (the “2019 Reverse Split”)).

This Post-Effective Amendment No. 2 is being filed to reflect an amendment to the Exchange Warrants to reduce the exercise

price as provided in this Post-Effective Amendment No. 2. This Post-Effective Amendment No. 2 also updates the Registration Statement

on Form S-4 to incorporate by reference current financial information and other information required under Section 10(a)(3) of

the Securities Act of 1933, as amended.

Up to 1,424,506

shares of Common Stock, as adjusted for the 2019 Reverse Split, are issuable upon the exercise of the Exchange Warrants. Pursuant

to Rule 416 under the Securities Act of 1933, as amended, this Registration Statement also covers an indeterminate amount of additional

shares of Common Stock that may hereafter be offered or issued with respect to the shares registered hereby resulting from stock

splits, stock dividends, recapitalizations or certain other capital adjustments.

The Registrant hereby amends this Registration

Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment

which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of

the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange

Commission acting pursuant to said Section 8(a) may determine.

The information in this prospectus

is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities

and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to

buy these securities in any jurisdiction where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS, SUBJECT TO COMPLETION - DATED SEPTEMBER 14, 2020

PREDICTIVE ONCOLOGY INC.

Warrants to Purchase 1,424,506 Shares

of Common Stock

This prospectus relates to the issuance

by us of up to 1,424,506 shares of our common stock, par value $0.01 per share (“Common Stock”) issuable upon the exercise

of certain warrants (the “Exchange Warrants”) to purchase shares of Common Stock issued in connection with our merger

transaction (the “Merger”) with Helomics Holding Corporation, which was completed on April 4, 2019. In order to obtain

the shares of Common Stock, the Exchange Warrant holders must pay an exercise price equal to $0.845 per share, equal to last reported

per share price of Common Stock on the Nasdaq Capital Market on September 11, 2020, the last trading day before the date of this

prospectus.

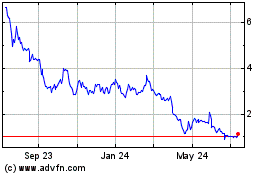

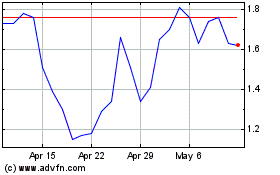

We will not receive

any proceeds from the sale of the shares of Common Stock covered by this prospectus other than proceeds from the exercise of the

Exchange Warrants. Our common stock is listed on the Nasdaq Capital Market under the symbol “POAI.” On September 11,

2020, the last reported per share price of our common stock on the Nasdaq Capital Market was $0.845 per share.

Investing in Common Stock involves

a high degree of risk. Before deciding whether to invest in our securities, you should consider carefully the risks that we

have described beginning on page 8 of this prospectus under the caption “Risk Factors” and in the documents

incorporated by reference into this prospectus.

Neither the Securities and Exchange

Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus

is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is [●],

2020.

Table of Contents

|

|

Page

|

|

About this Prospectus

|

1

|

|

Prospectus Summary

|

2

|

|

Risk Factors

|

8

|

|

Cautionary Note Regarding Forward Looking Statements

|

8

|

|

Use of Proceeds

|

9

|

|

Description of Capital Stock

|

10

|

|

The Offering

|

12

|

|

Plan of Distribution

|

13

|

|

Legal Matters

|

13

|

|

Experts

|

13

|

|

Where You Can Find More Information

|

13

|

|

Incorporation of Certain Documents by Reference

|

14

|

ABOUT THIS PROSPECTUS

This document,

which forms part of a post-effective amendment on Form S-1 to a registration statement on Form S-4 filed with the Securities and

Exchange Commission (the “SEC”) by Predictive Oncology Inc., formerly known as Precision Therapeutics Inc. (the “Company”)

(File No. 333-228031), constitutes a prospectus of the Company under Section 5 of the U.S. Securities Act of 1933, as amended (the

“Act”), with respect to the shares of Common Stock to be issued upon exercise of the Exchange Warrants. You should

not assume that the information contained in this prospectus is accurate on any date subsequent to the date set forth on the front

cover of this prospectus or that any information we have incorporated by reference is correct on any date subsequent to the date

of the document incorporated by reference, even though this prospectus is delivered or securities are sold or otherwise disposed

of on a later date. It is important for you to read and consider all information contained in this prospectus, including the Information

Incorporated by Reference herein, in making your investment decision. You should also read and consider the information in the

documents to which we have referred you under the captions “Where You Can Find More Information” and “Incorporation

of Information by Reference” in this prospectus.

We have

not authorized any dealer, salesman or other person to give any information or to make any representation other than those contained

or incorporated by reference in this prospectus. You should not rely upon any information or representation not contained or incorporated

by reference in this prospectus. This prospectus does not constitute an offer to sell or the solicitation of an offer to buy any

of our securities other than the securities covered hereby, nor does this prospectus constitute an offer to sell or the solicitation

of an offer to buy any securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in

such jurisdiction. Persons who come into possession of this prospectus in jurisdictions outside the United States are required

to inform themselves about, and to observe, any restrictions as to the offering and the distribution of this prospectus applicable

to those jurisdictions.

We further

note that the representations, warranties and covenants made in any agreement that is filed as an exhibit to any document that

is incorporated by reference in the prospectus were made solely for the benefit of the parties to such agreement, including, in

some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation,

warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made.

Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state

of our affairs.

Unless

the context otherwise requires, references in this prospectus to “Predictive,” the “Company,” “we,”

“us,” and “our” refer to Predictive Oncology Inc.

You should rely only on the information

contained or incorporated by reference, as applicable, in this prospectus, any prospectus supplement, or other offering materials

related to an offering of securities described in this prospectus. We have not authorized anyone to provide you with different

or additional information. If anyone provides you with different or additional information, you should not rely on it.

You should not assume that the information

contained or incorporated by reference, as applicable, in this prospectus, any prospectus supplement, or other offering materials

related to an offering of securities described in this prospectus is accurate as of any date other than the date of that document.

Neither the delivery of this prospectus, any prospectus supplement or other offering materials related to an offering of securities

described in this prospectus, nor any distribution of securities pursuant to this prospectus, any such prospectus supplement, or

other offering materials shall, under any circumstances, create any implication that there has been no change in the information

set forth or incorporated by reference, as applicable, in this prospectus, any such prospectus supplement or other offering materials

since the date of each such document. Our business, financial condition, results of operations and prospects may have changed since

those dates.

This prospectus does not constitute,

and any prospectus supplement or other offering materials related to an offering of securities described in this prospectus will

not constitute, an offer to sell, or a solicitation of an offer to purchase, the offered securities in any jurisdiction to or from

any person to whom or from whom it is unlawful to make such offer or solicitation in such jurisdiction.

PROSPECTUS SUMMARY

This summary contains basic information

about us. You should read the entire prospectus carefully, especially the risks of investing in our securities discussed under

“Risk Factors.” Some of the statements contained in this prospectus supplement, including statements under this summary

and “Risk Factors” are forward-looking statements and may involve a number of risks and uncertainties. We note that

our actual results and future events may differ significantly based upon a number of factors. You should not put undue reliance

on the forward-looking statements in this document, which speak only as of the date on the cover of this prospectus. For a more

complete understanding of the Company and this offering, we encourage you to read and consider carefully the more detailed information

in this prospectus supplement and the accompanying prospectus, including the information incorporated by reference in this prospectus

supplement and the accompanying prospectus, and the information included in any free writing prospectus that we have authorized

for use in connection with this offering. References to “we,” “our,” “us,” the “Company,”

or “Predictive” refer to Predictive Oncology Inc., a Delaware corporation.

Company Overview

Predictive Oncology Inc. (NASDAQ: POAI)

operates in two primary business areas: first, application of artificial intelligence (“AI”) in our precision medicine

business, to provide AI-driven predictive models of tumor drug response to improve clinical outcomes for patients and to assist

pharmaceutical, diagnostic, and biotech industries in the development of new personalized drugs and diagnostics; and second, production

of the United States Food and Drug Administration (“FDA”)-cleared STREAMWAY® System for automated, direct-to-drain

medical fluid disposal and associated products.

We have three operating segments: domestic,

international, and Helomics. Domestic and international consist of the STREAMWAY System product sales. The Helomics segment consists

of clinical testing and contract research. Our TumorGenesis subsidiary is included within corporate. Going forward, we have determined

that we will focus our resources on the Helomics segment and our primary mission of applying AI to precision medicine and drug

discovery. Our recent acquisitions of substantially all of the assets of Soluble Therapeutics, Inc., BioDtech, Inc., and Quantitative

Medicine LLC, as described in greater detail below, align with this mission.

Precision Medicine Business

Our precision medicine business, conducted

in our Helomics division, is committed to improving the effectiveness of cancer therapy using our proprietary, multi-omic tumor

profiling platform, one-of-a-kind database of historical tumor data, and the power of AI to build predictive models of tumor drug

response.

Helomics’ mission is to improve clinical

outcomes for patients by partnering with pharmaceutical, diagnostic, and academic organizations to bring innovative clinical products

and technologies to the marketplace. In addition to our proprietary patient-derived (“PDx”) tumor profiling platform

for oncology, Helomics offers: 1) data and AI driven contract research organization (“CRO”) services for clinical and

translational research that leverage PDx tumor models, 2) a wide range of multi-omics assays (genomics, proteomics, and biochemical),

and 3) AI driven predictive models to drive the discovery of targeted therapies.

Contract Research Organization (CRO)

and AI-Driven Business

We believe leveraging our unique, historical

database of the drug responses of over 150,000 patient tumors to build AI and data-driven multi-omic predictive models of tumor

drug response and outcome will provide actionable insights critical to both new drug development and individualizing patient treatment.

Our large historical database of tumors and related data, plus our ability to obtain the associated patient outcome data is a significant

competitive advantage. Cancer treatments require at least 5 years of testing to provide sufficient information on progression-free

survival rates. While competitors must wait for this data, we can leverage it today. These AI-driven predictive models, coupled

with the PDx platform will create a unique service to drive revenue generating projects with pharma, diagnostic and biotech companies

in areas such as biomarker discovery, drug screening, drug repurposing, and clinical trials. The AI-driven models will, once validated,

also provide clinical decision support to help oncologists individualize treatment.

Our CRO/AI business is committed to improving

the process of targeted therapy discovery. Our proprietary, TruTumorTM multi-omic PDx profiling and AI platform coupled

to our vast multi-omic database of biochemical and clinical information on patients with cancer, uses deep learning to understand

the association between the mutational profile of a patient’s tumor and the drug response profile of the tumor that is grown

in the lab. This approach is used to build an AI-driven predictive model that offers actionable insights of which mutations in

the tumor are associated with drugs to which the tumor is sensitive and which will lead to the optimal outcome for the patient.

Our CRO services business applies these

AI-driven predictive models coupled with our unique proprietary TruTumor PDx model to address a range of needs from discovery through

clinical and translational research, to clinical trials and diagnostic development and validation as noted below:

Research

Development

|

|

•

|

Patient enrichment & selection for trials

|

|

|

•

|

Clinical trial optimization

|

Clinical Decision Support

We believe this market segment has significant

growth potential and we believe we are differentiated from traditional CRO’s and other precision medicine and AI companies

through these unique assets:

|

•

|

|

clinically validated PDx platform;

|

|

•

|

|

database of over 150,000 tumor cases;

|

|

•

|

|

experienced AI team and AI platform;

|

|

•

|

|

ability to access outcome data going back over ten years for over 120,000 of the tumor cases in our database.

|

Industry and Market Background and Analysis

– Precision Medicine Business

Precision medicine is an emerging approach

for disease treatment and prevention that considers individual variability in genes, disease, environment, and lifestyle for each

case to develop effective therapies. This approach allows doctors and researchers to predict more accurately which treatment, dose,

and therapeutic regimen could provide the best possible outcome. The global precision medicine market is estimated to reach $141.7

billion by 2026, up from $43.6 billion in 2016. This growth is supported by the industry’s investment in precision medicine,

with leading biopharmaceutical companies doubling their investments in the technology over the last five years, with the potential

to increase by an additional 33% over the next five years (Source: BIS Research’s Global Precision Medicine Market to Reach

$141.70 Billion by 2026, December 2017).

Over the past several decades, researchers

have identified molecular patterns that are useful in defining the prognosis of a given cancer, determining the appropriate treatments,

and designing targeted treatments to address specific molecular alterations. The objective of precision medicine as directed towards

cancer therapy is to develop treatments tailored to the genetic changes in each person’s cancer, intended to improve the

effectiveness of the therapeutic regimen and minimize the treatment’s effects on healthy cells. However, for a majority of

patients the reality is that while many mutations in the patient’s tumor can be identified most are not actionable with current

protocols. As a result, the impact of targeted therapies is low, and uptake in clinical practice is inconsistent.

There is now a growing realization that

genomics alone will not be enough to achieve the promise of personalized therapeutics, especially for cancer. A multi-omic approach

(e.g. assessing the genome, transcriptome, epigenome, proteome, responseome, and microbiome) provides researchers and clinicians

the comprehensive information necessary for new drug development and individualized therapy. Comparatively, the multi-omic approach

provides a three-dimensional, 360-degree view of the cancer, while genomics alone is just a flat, one-dimensional view. However,

multi-omic data is difficult to access quickly as it is both costly and time consuming to initiate prospective data collection,

and few comprehensive, multi-omic datasets exist, especially specific to cancer.

Clinical Testing

Via our Helomics subsidiary, we offer a

group of clinically relevant, cancer-related tumor profiling and biomarker tests for gynecological cancers that determine how likely

the patient is to respond to various types of chemotherapy and which therapies might be indicated by relevant tumor biomarkers.

Clinical testing is comprised of ChemoFx

and BioSpeciFx tests. The ChemoFx test determines how a patient’s tumor specimen responds to a panel of various chemotherapy

drugs, while the BioSpeciFx test evaluates the expression of a specific genes, or biomarkers, in the patient’s tumor. Our

proprietary TruTumor™ PDx tumor platform provides us with the ability to work with actual live tumor cells to study the unique

biology of the patient’s tumor in order to understand how the patient responds to treatment.

Testing involves obtaining tumor tissue

during biopsy or surgery which is then sent to our Clinical Laboratory Improvement Amendments (“CLIA”) certified laboratory

using a special collection kit. Two samples of the tumor tissue are obtained, fixed and live. The fixed tumor tissue is tested

for a panel of biomarkers using a combination of Immunohistochemistry and Quantitative Polymerase Chain Reactions. The live tumor

tissue is grown in the lab and used to test the drug response of the tumor to a panel of standard-of-care drugs. When testing is

complete a report is provided back to the clinician with recommended therapies based on the drug response and biomarker profiles.

Helomics integrates the drug response with other genomic and molecular data and compares it with historical data in our database

to generate a roadmap that provides additional context to help the oncologist personalize patient treatment.

Recently Completed Acquisitions

In May 2020, the Company completed the

purchase of substantially all of the assets of Soluble Therapeutics, Inc. and BioDtech, Inc. The Company is operating the assets

acquired within its new direct subsidiary, Soluble Biotech, which offers services to pharmaceutical and biotech companies to screen

proteins for both solubility and stability, with possible applications to vaccines, antibodies and other proteins used in disease

treatment. The acquired technologies also specialize in removing, identifying, and isolating endotoxins from products that are

used by researchers to culture cells and to help identify endotoxins that maybe hidden within a protective matrix.

On July 1, 2020, the Company entered into

an Asset Purchase Agreement with Quantitative Medicine LLC, a Delaware limited liability company (“Quantitative”) and

its owners and simultaneously completed the acquisition of substantially all of the assets owned by Quantitative. Quantitative

is a biomedical analytics and computational biology company which has developed its novel, computational drug-discovery platform

CoRETM. CoRE is designed to dramatically reduce the time, cost, and financial risk of discovering new therapeutic drugs

by predicting the main effects of drugs on target molecules that mediate disease. By coupling CoRE, with Helomics’ TruTumor™

PDx tumor platform, Helomics multi-omic database of biochemical and clinical information on patients with cancer, and AI-driven

predictive models, we will offer a novel, one-of-a-kind capability for discovery of precision therapies that are expected to have

considerable value to the industry.. In the acquisition, the Company provided consideration in the form of 954,719 shares of common

stock (the “Transaction Shares”), which, when issued, had a market value of approximately $1,750,000. Half of the Transaction

Shares, representing 477,359 shares were deposited and held in escrow in connection with the sellers’ indemnification obligations,

while 207,144 of the remaining Transaction Shares were issued to Carnegie Mellon University (“CMU”) in satisfaction

of all pre-closing amounts owed to CMU by Seller under a technology licensing agreement between CMU and Seller that was assumed

by the Company on the Closing Date. The remaining Transaction Shares were issued to Quantitative, subject to certain restrictions.

Business Strategy for Precision Medicine

Business

We are a data and AI-driven discovery services

company that provides AI-driven predictive models of tumor drug response to improve clinical outcomes for patients by leveraging

our two primary unique assets:

|

•

|

|

A clinically validated PDx tumor profiling platform, TruTumor, that can generate drug response profiles and other multi-omic data. Over $200 million has been invested in this platform and was clinically validated in ovarian cancer.

|

|

•

|

|

Data on the drug response profiles of over 150,000 tumors across 137 cancer types tested using the PDx platform in over 10+ years of clinical testing. We call this database TumorSpace™.

|

Over 38,000 of the more than 150,000 clinically

validated cases in our TumorSpace™ database are specific to ovarian cancer. The data in TumorSpace is highly differentiated,

having both drug response data, biomarkers and access to historical outcome data from those patient samples. We intend to generate

additional data (genomics and transcriptomics) from these tumor samples to deliver a multi-omic approach to the pharmaceutical

industry. Through our Helomics subsidiary, we will utilize both this historical data and the PDx platform to build AI-driven predictive

models of tumor drug response and outcome through our CancerQuest 2020 (“CCQ2020”) initiative, which is still ongoing.

Once validated, we will commercialize these AI-driven predictive models in revenue generating service projects with pharmaceutical,

biotech, and diagnostic companies.

A key part of our commercialization strategy

for the CCQ2020 initiative is the understanding that our AI-driven models of tumor drug response serves a key unmet need of pharmaceutical,

diagnostic, and biotech industries for actionable multi-omic insights on cancer. In collaboration with these companies, using the

predictive models, we will accelerate the search for more individualized and effective cancer treatments, through revenue generating

projects in biomarker discovery, drug screening, drug repurposing, and clinical trials.

Our commercial strategy has identified

a portfolio of revenue generating project types that leverage the predictive models, our AI expertise, PDx tumor profiling, and

CLIA laboratory to provide custom solutions utilizing our full array of assets and expertise.

The CCQ2020 initiative will focus initially

on ovarian cancer, which is where we have the most expertise, samples, data, and access to outcomes. However, we intend to expand

the initiative to include cancers of the lung, breast, colon, and prostate, and will actively seek partners to assist in that effort.

Within the clinical sector, we will utilize

these predictive models (once validated) for new clinical decision support tools for individualizing therapy for patients with

cancer. These clinical decision support tools are a longer revenue horizon than the research projects with pharmaceutical companies

but, importantly, will provide a steady stream of additional data generation to refine the predictive models for both clinical

and research applications.

Skyline Medical – The STREAMWAY

System

Sold through our subsidiary, Skyline Medical,

Inc (“Skyline Medical”), the STREAMWAY System virtually eliminates staff exposure to blood, irrigation fluid and other

potentially infectious fluids found in the healthcare environment. Antiquated manual fluid handling methods that require hand carrying

and emptying filled fluid canisters present both an exposure risk and potential liability. Skyline Medical’s STREAMWAY System

fully automates the collection, measurement, and disposal of waste fluids and is designed to: 1) reduce overhead costs to hospitals

and surgical centers; 2) improve compliance with the Occupational Safety and Health Administration (“OSHA”) and other

regulatory agency safety guidelines; 3) improve efficiency in the operating room and radiology and endoscopy departments, thereby

leading to greater profitability; and 4) provide greater environmental stewardship by helping to eliminate the approximately 50

million potentially disease-infected canisters that go into landfills each year in the United States.

In December 2019, we announced that we

had received indications of interest from several parties for the possible acquisition of our Skyline Medical division, and we

reaffirmed that we are focusing our resources on our precision medicine business. We continue to operate the Skyline Medical business

with a focus on maximizing our strategic opportunities with respect to this division. As of the date of this Registration Statement,

we have no definitive agreement in place.

Industry and Market Background and Analysis

- Infectious and Bio-hazardous Waste Management

There has long been recognition of the

collective potential for ill effects to healthcare workers from exposure to infectious/bio-hazardous materials. Federal and state

regulatory agencies have issued mandatory guidelines for the control of such materials, and in particular, bloodborne pathogens.

OSHA’s Bloodborne Pathogens Standard (29 CFR 1910.1030) requires employers to adopt engineering and work practice controls

that would eliminate or minimize employee exposure from hazards associated with bloodborne pathogens. In 2001, in response to the

Needlestick Safety and Prevention Act, OSHA revised the Bloodborne Pathogens Standard. The revised standard clarifies and emphasizes

the need for employers to select safer needle devices and to involve employees in identifying and choosing these devices. The revised

standard also calls for the use of “automated controls” as it pertains to the minimization of healthcare exposure to

bloodborne pathogens.

Most surgical procedures produce potentially

infectious materials that must be disposed with the lowest possible risk of cross-contamination to healthcare workers. Current

standards of care allow for these fluids to be retained in canisters and located in the operating room where they can be monitored

throughout the surgical procedure. Once the procedure is complete these canisters and their contents are disposed using a variety

of methods, all of which include manual handling and result in a heightened risk to healthcare workers for exposure to their contents.

Canisters are the most prevalent means of collecting and disposing of infectious fluids in hospitals today. Traditional, non-powered

canisters and related suction and fluid disposable products are exempt and do not require FDA clearance.

We believe that our virtually hands free

direct-to-drain technology (1) significantly reduces the risk of healthcare worker exposure to these infectious fluids by replacing

canisters, (2) further reduces the risk of worker exposure when compared to powered canister technology that requires transport

to and from the operating room, (3) reduces the cost per procedure for handling these fluids, and (4) enhances the surgical team’s

ability to collect data to accurately assess the patient’s status during and after procedures. In addition to the traditional

canister method of waste fluid disposal, several other powered medical devices have been developed that address some of the deficiencies

described above. Most of these competing products continue to utilize some variation on the existing canister technology, and while

not directly addressing the canister, most have been successful in eliminating the need for an expensive gel and its associated

handling and disposal costs. Our existing competitors with products already on the market have a clear competitive advantage over

us in terms of brand recognition and market exposure. In addition, many of our competitors have extensive marketing and development

budgets that could overpower an emerging growth company like ours.

We expect the hospital surgery market to

continue to increase due to population growth, the aging of the population, and expansion of surgical procedures to new areas (for

example, use of the endoscope) which requires more fluid management and new medical technology.

STREAMWAY System Product Sales

Our domestic and international segments

consist primarily of sales of the STREAMWAY System, as well as sales of the proprietary cleaning fluid and filters for use with

the STREAMWAY System. We manufacture an environmentally conscious system for the collection and disposal of infectious fluids resulting

from surgical and other medical procedures. We have been granted patents for the STREAMWAY System in the United States, Canada,

and Europe. We distribute our products to medical facilities where bodily and irrigation fluids produced during medical procedures

must be contained, measured, documented, and disposed. Our products minimize the exposure potential to the healthcare workers who

handle such fluids. In addition to simplifying the handling of these fluids, our goal is to create products that dramatically reduce

staff exposure without significant changes to established operative procedures, historically a major industry stumbling block to

innovation and product introduction.

The STREAMWAY System is a wall-mounted

fully automated system that disposes of an unlimited amount of suction fluid providing uninterrupted performance for physicians

while virtually eliminating healthcare workers’ exposure to potentially infectious fluids collected during surgical and other

patient procedures. The STREAMWAY System also provides an innovative way to dispose of ascites and pleural fluid with no evac bottles,

suction canisters, transport, or risk of exposure. We also manufacture and sell two disposable products required for the operation

of the STREAMWAY System: a bifurcated dual port procedure filter with tissue trap and a single use bottle of cleaning solution.

Both items are utilized on a single procedure basis and must be discarded after use. The STREAMWAY disposables are a critical component

of our business model. Recurring revenues from the sale of the disposables are expected to be significantly higher over time than

the revenues from the initial sale of the unit. We have exclusive distribution rights to the disposable solution.

We sell our medical device products directly

to hospitals and other medical facilities using employed sales representatives, independent contractors and distributors.

TumorGenesis Division

Our subsidiary, TumorGenesis, is pursuing

a new rapid approach to growing tumors in the laboratory, which essentially “fools” the cancer cells into thinking

they are still growing inside the patient. We have also announced a proposed joint venture with GLG Pharma focused on using their

combined technologies to bring personalized medicines and testing to ovarian and breast cancer patients, especially those who present

with ascites fluid (over one-third of patients).

Ability to Continue as a Going Concern

We have suffered recurring losses from

operations, and we have significant debt repayment obligations that are due within the current year. Although we have been able

to fund our current working capital requirements, principally through debt and equity financing, there is no assurance that we

will be able to do so in the future. As a result of our capital needs for operations and debt repayment, we need to raise significant

capital, and there is no assurance that we will be successful in raising sufficient capital. As a result management has substantial

doubt about our ability to continue as a going concern.

Corporate Information

We were originally incorporated on April

23, 2002 and reincorporated in Delaware in 2013. We changed our name from Skyline Medical, Inc. to Precision Therapeutics, Inc.

on February 1, 2018 and to Predictive Oncology, Inc. on June 13, 2019.

Our address is 2915 Commers Drive, Suite

900, Eagan, Minnesota 55121. Our telephone number is (651) 389-4800, and our website address is www.predictive-oncology.com. The

information contained on, or that can be accessed through, our website is not part of this prospectus.

Recent Developments

On July 8, 2020, Andrew P. Reding resigned

from the Board of Directors of the Company, effective immediately. Effective July 9, 2020, the Board elected Chuck Nuzum, Nancy

Chung-Welch, Ph.D., and Gregory S. St.Clair to the Board. They were chosen to fill the vacancies created by the resignations of

Pam Prior, Gerald J. Vardzel, Jr. and Andrew P. Reding, respectively. Mr. Nuzum was also chosen to chair the Board’s Audit

Committee. As a Class I director, his term will expire at the 2022 annual meeting of the Company’s stockholders, while Dr.

Chung-Welch’s and Mr. St.Clair’s terms will expire at the 2020 annual meeting of the Company’s stockholders (as

with the other Class II directors).

The annual meeting of the Company’s stockholders

was held on September 3, 2020. At the Annual Meeting, among other matters, the stockholders took the following actions: elected

three directors – J. Melville Engle, Gregory S. St.Clair, Sr., and Dr. Nancy Chung-Welch; approved the repricing of outstanding

stock options issued under the Company’s Amended and Restated 2012 Stock Incentive Plan and held by current officers or employees

of the Company which had an exercise price higher than $1.54 per share, to an exercise price of $1.54; and approved an Amended

and Restated 2012 Stock Incentive Plan, including an increase in the reserve of shares of common stock authorized for issuance

thereunder by 750,000, to 1,750,000.

Risk Factors

Our business is subject to numerous risks.

For a discussion of the risks you should consider before purchasing our securities, see “Risk Factors” on page

8 of this prospectus.

Description of the Offering

Pursuant to that certain Amended and Restated

Agreement and Plan of Merger, dated as of October 26, 2018 by and among the Company, Helomics Acquisition, Inc. (“Merger

Sub”), a wholly owned subsidiary of the Company, and Helomics Holding Corporation (“Helomics”), Helomics merged

with and into Merger Sub, with Merger Sub, which was subsequently renamed Helomics Holding Corporation, surviving as a wholly-owned

subsidiary of the Company (the “Merger”).

In connection with the Merger, which was

completed on April 4, 2019, the Company consummated an exchange offer with certain of Helomics’ existing investors that included,

among other things, the exchange of warrants to purchase shares of Helomics common stock held by such investors (the “Helomics

Warrants”) for warrants (the “Exchange Warrants”) to purchase shares of Common Stock at an exercise price of

$10.00 per share (as adjusted for a one-for-ten (1:10) reverse stock split that was effective on October 29, 2019). Up to 1,424,506

shares of Common Stock are issuable upon the exercise of the Exchange Warrants.

Effective on the date of this prospectus,

the Company is notifying the holders of the Exchange Warrants that the Company will accept an exercise price therefor of $0.845,

equal to the last reported per share price of Common Stock on the Nasdaq Capital Market on September 11, 2020.

RISK FACTORS

An investment in our securities involves

a number of risks. Before deciding to invest in our securities, you should carefully consider the risks described below and discussed

under the section captioned “Risk Factors” contained in our Annual Report on Form 10-K for the year ended December

31, 2019, and our Quarterly Report on Form 10-Q for the quarter ended June 30, 2020, which are incorporated by reference in this

prospectus, the information and documents incorporated by reference herein, and in any prospectus supplement or free writing prospectus

that we have authorized for use in connection with an offering. If any of these risks actually occurs, our business, financial

condition, results of operations or cash flow could be harmed. This could cause the trading price of our common stock to decline,

resulting in a loss of all or part of your investment. The risks described in the documents referenced above are not the only ones

that we face. Additional risks not presently known to us or that we currently deem immaterial may also affect our business.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING

STATEMENTS

Some of the statements made in this prospectus

are “forward-looking statements” that indicate certain risks and uncertainties related to the Company, many of which

are beyond the Company’s control. The Company’s actual results could differ materially and adversely from those anticipated

in such forward-looking statements as a result of certain factors, including those set forth below and elsewhere in this report.

Important factors that may cause actual results to differ from projections include:

|

|

•

|

We may not be able to continue operating without additional financing;

|

|

|

•

|

Current negative operating cash flows;

|

|

|

•

|

Our capital needs to accomplish our goals, including any further financing, which may be highly dilutive and may include onerous terms;

|

|

|

•

|

Significant debt repayments due in September 2020, which the Company will likely need to extend or restructure, with no assurance that this will be possible;

|

|

|

•

|

Risks related to the recent and future acquisitions, including;

|

|

|

|

1)

|

significant goodwill could result in further impairment;

|

|

|

|

2)

|

possible failure to realize anticipated benefits of the transactions;

|

|

|

|

3)

|

costs associated with the transactions may be higher than expected;

|

|

|

|

4)

|

the transactions may result in the disruption of our existing businesses; and

|

|

|

|

5)

|

distraction of management and diversion of resources;

|

|

|

•

|

Risks related to our partnerships with other companies, including the need to negotiate the definitive agreements; possible failure to realize anticipated benefits of these partnerships; and costs of providing funding to our partner companies, which may never be repaid or provide anticipated returns;

|

|

|

•

|

Risk that we will be unable to protect our intellectual property or claims that we are infringing on others’ intellectual property;

|

|

|

•

|

The impact of competition;

|

|

|

•

|

Acquisition and maintenance of any necessary regulatory clearances applicable to applications of our technology;

|

|

|

•

|

Inability to attract or retain qualified senior management personnel, including sales and marketing personnel;

|

|

|

•

|

Risk that we never become profitable if our product is not accepted by potential customers;

|

|

|

•

|

Possible impact of government regulation and scrutiny;

|

|

|

•

|

Unexpected costs and operating deficits, and lower than expected sales and revenues, if any;

|

|

|

•

|

Adverse results of any legal proceedings;

|

|

|

•

|

The volatility of our operating results and financial condition;

|

|

|

•

|

Management of growth;

|

|

|

•

|

Material and adverse effects of the COVID-19 pandemic, including impact on a significant supplier; a reduction in on-site staff at several of our facilities, resulting in delayed production and less efficiency; impact on sales efforts; impact on accounts receivable and terms demanded by suppliers; and possible impact on financing transactions; and

|

|

|

•

|

Other specific risks that may be detailed from time to time in the Company’s reports filed with the SEC.

|

|

|

|

|

|

In some cases, you can identify

forward-looking statements by terms such as “may”, “will”, “should”, “could”,

“would”, “expects”, “plans”, “anticipates”, “believes”,

“estimates”, “projects”, “predicts”, “potential” and similar expressions

intended to identify forward-looking statements. These statements reflect our current views with respect to future events and

are based on assumptions and subject to risks and uncertainties. Given these uncertainties, you should not place undue

reliance on these forward-looking statements. We discuss many of these risks in greater detail under the heading “Risk

Factors” beginning on page 8 of this prospectus and in our SEC filings. Also, these forward-looking statements

represent our estimates and assumptions only as of the date of the document containing the applicable statement.

You should read this prospectus, the documents

we have filed with the SEC that are incorporated by reference and any free writing prospectus that we have authorized for use in

connection with this offering completely and with the understanding that our actual future results may be materially different

from what we expect. We qualify all of the forward-looking statements in the foregoing documents by these cautionary statements.

Information regarding market and industry

statistics contained in this prospectus is included based on information available to the Company that it believes is accurate.

It is generally based on academic and other publications that are not produced for purposes of securities offerings or economic

analysis. The Company has not reviewed or included data from all sources, and the Company cannot assure potential investors of

the accuracy or completeness of the data included in this prospectus. Forecasts and other forward-looking information obtained

from these sources are subject to the same qualifications and the additional uncertainties accompanying any estimates of future

market size, revenue and market acceptance of products and services. The Company has no obligation to update forward-looking information

to reflect actual results or changes in assumptions or other factors that could affect those statements.

USE OF PROCEEDS

We will receive the proceeds from the exercise

of the Exchange Warrants, but not from the sale of the underlying shares of Common Stock by the holders of Exchange Warrants. We

intend to use the proceeds from the exercise of the Exchange Warrants for general corporate purposes, including working capital,

sales and marketing activities, general and administrative matters, repayment of indebtedness and capital expenditures. We may

also use a portion of the proceeds to acquire or invest in complementary products or businesses. Our management will have broad

discretion over the uses of the proceeds from the exercise of the Exchange Warrants. Pending these uses, we intend to invest the

net proceeds from the exercise of the Exchange Warrants in short-term, investment-grade, interest-bearing securities such as money

market accounts, certificates of deposit, commercial paper and guaranteed obligations of the U.S. government.

DESCRIPTION OF CAPITAL STOCK

The following description summarizes the

material terms of our capital stock. This summary is, however, subject to the provisions of our certificate of incorporation and

bylaws. For greater detail about our capital stock, please refer to our certificate of incorporation and bylaws.

General

Our authorized capital stock

consists of 100,000,000 shares of Common Stock, and 20,000,000 shares of preferred stock, $0.01 par value per share (“Preferred

Stock”). Out of the Preferred Stock, as of September 4, 2020, 2,300,000 shares have been designated Series B Convertible

Preferred Stock, of which 79,246 shares were outstanding.

The outstanding shares of our Common Stock

and Preferred Stock are fully paid and nonassessable.

The Series B Convertible Preferred Stock

is convertible into Common Stock at the option of its holders on a 1:1 basis, subject to a 4.99% beneficial ownership blocker.

Our Board of Directors is authorized, subject

to any limitations prescribed by law, to provide for the issuance of the shares of Preferred Stock in series and, by filing a certificate

pursuant to the applicable law of the State of Delaware, to establish from time to time the number of shares to be included in

each such series, and to fix the designation, powers, preferences and rights of the shares of each such series and any qualifications,

limitations or restrictions thereon. The number of authorized shares of Preferred Stock may be increased or decreased (but not

below the number of shares thereof then outstanding) by the affirmative vote of the holders of a majority of the outstanding shares

of Common Stock without a vote of the holders of the Preferred Stock, or of any series thereof, unless a vote of any such holders

is required pursuant to the certificate or certificates establishing the series of Preferred Stock.

Common Stock

As of September 4, 2020, we had

15,421,006 shares of common stock outstanding held by approximately 152 stockholders of record.

Voting Rights. The holders of our

Common Stock are entitled to one vote for each outstanding share of Common Stock owned by that shareholder on every matter properly

submitted to the shareholders for their vote. Shareholders are not entitled to vote cumulatively for the election of directors.

Dividend Rights. Subject to the

dividend rights of the holders of any outstanding series of preferred stock, holders of our Common Stock are entitled to receive

ratably such dividends and other distributions of cash or any other right or property as may be declared by our Board of Directors

out of our assets or funds legally available for such dividends or distributions.

Liquidation Rights. In the event

of any voluntary or involuntary liquidation, dissolution or winding up of our affairs, holders of our Common Stock would be entitled

to share ratably in our assets that are legally available for distribution to shareholders after payment of liabilities and after

the satisfaction of any liquidation preference owed to the holders of any Preferred Stock.

Conversion, Redemption and Preemptive

Rights. Holders of our Common Stock have no conversion, redemption, preemptive, subscription or similar rights.

Anti-Takeover Provisions

Bylaws. Certain provisions of our

Bylaws could have anti-takeover effects. These provisions are intended to enhance the likelihood of continuity and stability in

the composition of our corporate policies formulated by our Board of Directors. In addition, these provisions also are intended

to ensure that our Board of Directors will have sufficient time to act in what our Board of Directors believes to be in the best

interests of our Company and our shareholders. Nevertheless, these provisions could delay or frustrate the removal of incumbent

directors or the assumption of control of us by the holder of a large block of Common Stock, and could also discourage or make

more difficult a merger, tender offer, or proxy contest, even if such event would be favorable to the interest of our shareholders.

These provisions are summarized below.

Advance Notice Provisions for Raising

Business or Nominating Directors. Sections 2.09 and 2.10 of our Bylaws contain advance-notice provisions relating to the ability

of shareholders to raise business at a shareholder meeting and make nominations for directors to serve on our Board of Directors.

These advance-notice provisions generally require shareholders to raise business within a specified period of time prior to a meeting

in order for the business to be properly brought before the meeting.

Number of Directors and Vacancies.

Our Bylaws provide that the exact number of directors shall be determined from time to time solely by resolution adopted by the

affirmative vote of a majority of the entire Board of Directors. The Board of Directors is divided into three classes, as nearly

equal in number as possible, designated: Class I, Class II and Class III (each, a “Class”). In the case of any

increase or decrease, from time to time, in the number of directors, the number of directors in each class shall be apportioned

as nearly equal as possible. Except as otherwise provided in the Certificate of Incorporation, each director serves for a term

ending on the date of the third annual meeting of the Company’s stockholders following the annual meeting at which such director

was elected; provided, that the term of each director shall continue until the election and qualification of a successor and be

subject to such director’s earlier death, resignation or removal. Vacancies on the Board of Directors resulting from death,

resignation, removal or otherwise and newly created directorships resulting from any increase in the number of directors may be

filled solely by a majority of the directors then in office (although less than a quorum) or by the sole remaining director.

Delaware Law. We are subject to

Section 203 of the Delaware General Corporation Law. This provision generally prohibits a Delaware corporation from engaging in

any business combination with any interested stockholder for a period of three years following the date the stockholder became

an interested stockholder, unless:

|

|

•

|

prior to such date, the board of directors approved either the business combination or the transaction that resulted in the stockholder becoming an interested stockholder;

|

|

|

•

|

upon consummation of the transaction that resulted in the stockholder becoming an interested stockholder, the interested stockholder owned at least 85% of the voting stock of the corporation outstanding at the time the transaction commenced, excluding for purposes of determining the number of shares outstanding those shares owned by persons who are directors and also officers and by employee stock plans in which employee participants do not have the right to determine confidentially whether shares held subject to the plan will be tendered in a tender or exchange offer; or

|

|

|

•

|

on or subsequent to such date, the business combination is approved by the board of directors and authorized at an annual meeting or special meeting of stockholders and not by written consent, by the affirmative vote of at least 66 2/3% of the outstanding voting stock that is not owned by the interested stockholder.

|

Section 203 defines

a business combination to include:

|

|

•

|

any merger or consolidation involving the corporation and the interested stockholder;

|

|

|

•

|

any sale, transfer, pledge or other disposition of 10% or more of the assets of the corporation involving the interested stockholder;

|

|

|

•

|

subject to certain exceptions, any transaction that results in the issuance or transfer by the corporation of any stock of the corporation to the interested stockholder;

|

|

|

•

|

any transaction involving the corporation that has the effect of increasing the proportionate share of the stock of any class or series of the corporation beneficially owned by the interested stockholder; or

|

|

|

•

|

the receipt by the interested stockholder of the benefit of any loans, advances, guarantees, pledges or other financial benefits provided by or through the corporation.

|

In general, Section 203 defines an “interested

stockholder” as any entity or person beneficially owning 15% or more of the outstanding voting stock of a corporation, or

an affiliate or associate of the corporation and was the owner of 15% or more of the outstanding voting stock of a corporation

at any time within three years prior to the time of determination of interested stockholder status; and any entity or person affiliated

with or controlling or controlled by such entity or person.

These statutory provisions could delay

or frustrate the removal of incumbent directors or a change in control of our company. They could also discourage, impede, or prevent

a merger, tender offer, or proxy contest, even if such event would be favorable to the interests of stockholders. In addition,

note that while Delaware law permits companies to opt out of its business combination statute, our Certificate of Incorporation

does not include this opt-out provision.

Transfer Agent and Registrar

The transfer agent and registrar for our

common stock is Corporate Stock Transfer, Inc.

Listing

The shares of our common stock are listed

on The Nasdaq Capital Market under the symbol “POAI.” On September 11, 2020, the last reported sale price per share

for our common stock as reported by The Nasdaq Capital Market was $0.845.

THE OFFERING

Issuance of Exchange Warrants

On April 4, 2019 (the “Effective

Date”), the Company completed the business combination of Helomics Acquisition, Inc., a wholly-owned subsidiary of the Company

(“Merger Sub”), with Helomics Holding Corporation (“Helomics”) in accordance with the terms of the Amended

and Restated Agreement and Plan of Merger, dated as of October 26, 2018 (as amended, the “Merger Agreement”). Pursuant

to the terms of the Merger Agreement, the parties to the Merger Agreement consummated a forward-triangular merger, whereby Helomics

merged with and into Merger Sub, with Merger Sub surviving the merger as a wholly-owned subsidiary of the Company (the “Merger”).

In accordance with the Merger Agreement,

and pursuant to an Offer to Exchange dated February 13, 2019 and included in the Company’s Registration Statement on Form

S-4 (File No. 333-228031), which became effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, on

February 13, 2019 (the “Registration Statement”), the Company made an offer to issue (the “Exchange Offer”)

to holders of certain promissory notes of Helomics (the “Helomics Notes Payable”) and accompanying warrants to purchase

Helomics common stock (the “Helomics Warrants”) (a) shares of Common Stock in exchange for the tendered Helomics Notes

Payable and (b) warrants to purchase shares of Common Stock (the “Exchange Warrants”) at an exercise price of $10.00

per share (as adjusted for a one-for-ten (1:10) reverse stock split that was effective on October 29, 2019 (the “2019 Reverse

Split”)) in exchange for the Helomics Warrants held by such holders. The issuance occurred on the Effective Date and at the

effective time of the Merger. With respect to the Exchange Warrants specifically, Predictive issued Exchange Warrants to purchase

up to 1,424,506 shares of Common Stock (as adjusted for the 2019 Reverse Split) to (a) all holders of Helomics Notes Payable who

accepted the Exchange Offer and (b) three holders of Helomics Notes Payable who did not accept the Exchange Offer, but executed

a note extension agreement with Predictive, pursuant to which such holders agreed to accept the terms of the Exchange Offer with

respect to their Helomics Warrants. The amount of the Exchange Warrants issued was determined according to a formula based on the

number of Helomics Warrants held by a tendering holder.

The Exchange Warrants expire five years

after the Effective Date, and require the payment of cash to exercise such warrants unless there is no effective registration statement

covering the exercise of the Exchange Warrants or the resale of the shares that may be purchased thereunder. The Exchange Warrants,

and the shares issuable upon conversion or exercise thereof, were registered with the United States Securities and Exchange Commission

on the Registration Statement.

Upon a “fundamental transaction,”

the Exchange Warrants will continue to exist and be converted into a right to receive alternative consideration upon exercise.

The Exchange Warrants entitle the holders of the Exchange Warrants to participate in any distributions of common stock as though

the Exchange Warrant were exercised in full in advance of the record date of the distribution. The Exchange Warrants contain a

beneficial ownership limitation, which prohibits a holder from obtaining greater than 4.99% (or at the holder’s election,

9.99%) of the outstanding Common Stock immediately after the exercise of the Exchange Warrant.

Amended Exercise Price of the Exchange

Warrants

On ___________, 2020, the date of this

prospectus, the Company notified the holders of the Exchange Warrants that the Company would accept an exercise price therefor

of $0.845 (the “Amended Exercise Price”), equal to the last reported per share price of Common Stock on the Nasdaq

Capital Market on September 11, 2020, the last trading day before the date of this prospectus.

PLAN OF DISTRIBUTION

The shares of Common Stock offered and

sold by us pursuant to this prospectus will be issued directly to the holders of Exchange Warrants upon payment of the exercise

price therefore to us. We will pay all fees and expenses incident to the registration of the offer and sale of shares of Common

Stock by such holders of Exchange Warrants pursuant to this prospectus.

LEGAL MATTERS

The validity of any securities offered

from time to time by this prospectus and any related prospectus supplement will be passed upon by Maslon LLP, Minneapolis, Minnesota.

EXPERTS

The financial statements incorporated in

this prospectus by reference from the Company’s Annual Report on Form 10-K for the year ended December 31, 2019 have been

audited by Deloitte & Touche LLP, an independent registered public accounting firm, as stated in their report, which is incorporated

herein by reference (which report expresses an unqualified opinion and includes an explanatory paragraph relating to the substantial

doubt about the Company’s ability to continue as a going concern as described in Note 1 to the financial statements). Such

financial statements have been so incorporated in reliance upon the report of such firm given upon their authority as experts in

accounting and auditing.

The financial statements of Helomics Holding

Corporation for the fiscal year ended December 31, 2018, as restated, incorporated by reference in this prospectus have been so

incorporated in reliance on the report of Schneider Downs & Co., Inc., certified public accountants registered with the Public

Company Accounting Oversight Board, as auditor for Helomics Holding Corporation prior to the acquisition by the Company.

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the SEC a registration

statement on Form S-4 (File No. 333-228031) under the Securities Act with respect to the securities we are offering under this

prospectus. This prospectus does not contain all of the information set forth in the registration statement and the exhibits to

the registration statement. For further information with respect to us and the securities we are offering under this prospectus,

we refer you to the registration statement and the exhibits and schedules filed as a part of the registration statement.

We file annual, quarterly and current reports,

proxy statements and other information with the SEC. The SEC maintains a website that contains reports, proxy statements and other

information regarding issuers that file electronically with the SEC, including us. The address of the SEC website is www.sec.gov.

We maintain a website at www.predictive-oncology.com.

Information contained in, or accessible through, our website is not part of this prospectus and you should not rely on that information

unless that information is also in this prospectus or incorporated by reference in this prospectus.

INCORPORATION OF CERTAIN DOCUMENTS BY

REFERENCE

The SEC allows us to “incorporate

by reference” information into this prospectus, which means that we can disclose important information to you by referring

you to another document filed separately with the SEC. The documents incorporated by reference into this prospectus contain important

information that you should read about us. The following documents are incorporated by reference into this prospectus:

We are allowed to incorporate by reference

information contained in documents that we file with the SEC. This means that we can disclose important information to you by referring

you to those documents and that the information in this prospectus is not complete and you should read the information incorporated

by reference for more detail. We incorporate by reference in two ways. First, we list certain documents that we have already filed

with the SEC. The information in these documents is considered part of this prospectus. Second, the information in documents that

we file in the future will update and supersede the current information in, and incorporated by reference in, this prospectus until

we file a post-effective amendment that indicates the termination of the offering of the common stock made by this prospectus.

We incorporate by reference the documents

listed below and any future filings we will make with the SEC under Section 13(a), 13(c), 14 or 15(d) of the Exchange Act (other

than information furnished in Current Reports on Form 8-K filed under Item 2.02 or 7.01 of such form unless such form expressly

provides to the contrary), including those made after the date of the initial filing of the registration statement of which this

prospectus is a part and prior to effectiveness of such registration statement:

|

|

•

|

Our Annual Report on Form 10-K for the fiscal year ended December 31, 2019;

|

|

|

•

|

Our Quarterly Reports on Form 10-Q for the quarters ended March

30, 2020 and June 30, 2020;

|

|

|

•

|

Current Reports on Form 8-K filed September 8, 2020, August 13,

2020, July 20, 2020, July 7, 2020, June 26, 2020, June 19, 2020, June 12, 2020, June 8, 2020, June 2, 2020, 2 reports filed

on May 8, 2020, May 1, 2020, April 30, 2020, April 24, 2020, April 22, 2020, April 1, 2020, March 23, 2020, March 16, 2020,

February 21, 2020, February 7, 2020, February 4, 2020, January 28, 2020, January 24, 2020, January 6, 2020; and April 10,

2019, as amended by Amendment No. 1 on June 18, 2019 and Amendment No. 2 on September 26, 2019; and

|

|

|

•

|

The description of the Company’s common stock filed as Exhibit 4.29 “Description of Registrant’s Securities” to the Company’s Annual Report on Form 10-K on April 1, 2020.

|

We will provide to each person, including

any beneficial owner, to whom a prospectus is delivered, a copy of any or all of the information that has been incorporated by

reference in this prospectus but not delivered with this prospectus. You may request a copy of this information at no cost, by

writing or telephoning us at the following address or telephone number:

Predictive Oncology Inc.

Attention: Corporate Secretary

2915 Commers Drive, Suite 900

Eagan, Minnesota 55121

(651) 389-4800

PREDICTIVE ONCOLOGY INC.

1,424,506 Shares

Warrants to Purchase Common Stock

______________________

PROSPECTUS

______________________

[•], 2020

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 13. Other Expenses Of Issuance And Distribution.

The following table sets forth the costs

and expenses, payable by the registrant in connection with the sale of common stock being registered. All amounts are estimates

except the SEC registration fee and the Nasdaq listing fee.

|

Securities and Exchange Commission registration fee

|

|

$

|

1,726.15

|

*

|

|

NASDAQ listing fee

|

|

$

|

5,055.00

|

|

|

Printing and engraving expenses

|

|

$

|

5,000.00

|

|

|

Legal fees and expenses

|

|

$

|

5,000.00

|

|

|

Accounting fees and expenses

|

|

$

|

5,000.00

|

|

|

Miscellaneous

|

|

$

|

218.85

|

|

|

Total

|

|

$

|

22,000.00

|

|

*Previously

paid in connection with the filing of the Company’s registration statement on Form S-4 (File No 333-228031), which is amended

hereby.

Item 14. Indemnification of Directors

and Officers.

We are a Delaware corporation and certain

provisions of the Delaware Statutes and our bylaws provide for indemnification of our officers and directors against liabilities

that they may incur in such capacities. A summary of the circumstances in which indemnification is provided is discussed below,

but this description is qualified in its entirety by reference to our bylaws and to the statutory provisions.

Section 145 of the Delaware General Corporation

Law provides for, under certain circumstances, the indemnification of our officers, directors, employees and agents against liabilities

that they may incur in such capacities. A summary of the circumstances in which such indemnification provided for is contained

herein, but that description is qualified in its entirety by reference to the relevant Section of the Delaware General Corporation

Law.

In general, the statute provides that any

director, officer, employee or agent of a corporation may be indemnified against expenses (including attorneys’ fees), judgments,

fines and amounts paid in settlement, actually and reasonably incurred in a proceeding (including any civil, criminal, administrative

or investigative proceeding) to which the individual was a party by reason of such status. Such indemnity may be provided if the

indemnified person’s actions resulting in the liabilities: (i) were taken in good faith; (ii) were reasonably believed to

have been in or not opposed to our best interest; and (iii) with respect to any criminal action, such person had no reasonable

cause to believe the actions were unlawful. Unless ordered by a court, indemnification generally may be awarded only after a determination

of independent members of the Board of Directors or a committee thereof, by independent legal counsel or by vote of the stockholders

that the applicable standard of conduct was met by the individual to be indemnified.

The statutory provisions further provide

that to the extent a director, officer, employee or agent is wholly successful on the merits or otherwise in defense of any proceeding

to which he was a party, he is entitled to receive indemnification against expenses, including attorneys’ fees, actually

and reasonably incurred in connection with the proceeding.

Indemnification in connection with a proceeding

by or in the right of the Company in which the director, officer, employee or agent is successful is permitted only with respect

to expenses, including attorneys’ fees actually and reasonably incurred in connection with the defense. In such actions,

the person to be indemnified must have acted in good faith, in a manner believed to have been in our best interest and must not

have been adjudged liable to us unless and only to the extent that the Court of Chancery or the court in which such action or suit

was brought shall determine upon application that, despite the adjudication of liability, in view of all the circumstances of the

case, such person is fairly and reasonably entitled to indemnity for such expense which the Court of Chancery or such other court

shall deem proper. Indemnification is otherwise prohibited in connection with a proceeding brought on behalf of the Company in

which a director is adjudged liable to us, or in connection with any proceeding charging improper personal benefit to the director

in which the director is adjudged liable for receipt of an improper personal benefit.

Delaware law authorizes us to reimburse

or pay reasonable expenses incurred by a director, officer, employee or agent in connection with a proceeding in advance of a final

disposition of the matter. Such advances of expenses are permitted if the person furnishes to us a written agreement to repay such