Current Report Filing (8-k)

July 07 2020 - 8:19AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

Form 8-K

_____________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event Reported): July 1, 2020

Predictive Oncology Inc.

(Exact Name of Registrant as Specified in Charter)

|

Delaware

|

001-36790

|

33-1007393

|

|

(State or Other Jurisdiction of Incorporation)

|

(Commission File Number)

|

(I.R.S. Employer Identification Number)

|

|

2915 Commers Drive, Suite 900, Eagan, Minnesota 55121

|

|

(Address of Principal Executive Offices) (Zip Code)

|

(651) 389-4800

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

[ ]

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

[ ]

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company [ ]

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading symbol(s)

|

Name of each exchange on which registered

|

|

Common stock, $0.01 par value

|

POAI

|

Nasdaq Capital Market

|

Item 1.01. Entry into a Material Definitive Agreement.

On July 1, 2020 (the “Closing Date”), Predictive Oncology Inc., a Delaware corporation (the “Company”), entered into an Asset Purchase Agreement (collectively with all attachments and exhibits thereto, the “Agreement”) with Quantitative Medicine LLC, a Delaware limited liability company (“Seller”) and its owners (collectively, the “Members” and jointly and severally with Seller, the “Selling Parties”) and simultaneously completed the acquisition of substantially all of the assets owned by Seller (the “Purchased Assets”) upon the terms and conditions contained therein (collectively, the “Transaction”). In exchange, the Company provided consideration in the form of 954,719 shares of common stock (the “Transaction Shares”), which, when issued, had a market value of approximately $1,750,000.

477,359 shares, representing half of the Transaction Shares (the “Escrow Shares”), were deposited and held in escrow upon issuance, while 207,144 of the remaining Transaction Shares were issued to Carnegie Mellon University (“CMU”) in satisfaction of all pre-closing amounts owed to CMU by Seller under a technology licensing agreement between CMU and Seller that was assumed by the Company on the Closing Date. The remaining Transaction Shares were issued to Seller. Half of the Escrow Shares will be released on the six month anniversary of the Closing Date, and the other half will be released on the one year anniversary of the Closing Date; provided, however, that all or some of the Escrow Shares may be released and returned to the Company for reimbursement in the event that the Company suffers a loss against which the Selling Parties have indemnified the Company pursuant to the Agreement.

In addition to restrictions arising under the Securities Act of 1933, as amended (the “Securities Act”) and the restrictions on the Escrow Shares, the Transaction Shares are subject to the following transfer restrictions: (i) no Transaction Shares may be sold or otherwise transferred within six months of the Closing Date; (ii) 20% of the Transaction Shares may be sold or otherwise transferred in accordance with applicable law after the sixth-month anniversary of the Closing Date, and shall, for the avoidance of doubt, be subject to the requirements of subsection (iv) below; (iii) the remainder of the Transaction Shares may be sold or otherwise transferred in accordance with applicable law on and after the one-year anniversary of the Closing Date; (iv) provided, further, that once the restriction in subsection (i) above lapses, for an additional 12 months thereafter, no Selling Party may sell in any three-month period shares representing more than 1% of the Company’s outstanding common stock, as determined in the most recently filed quarterly or annual report of the Company, which 1% amount may cumulate in each subsequent three-month period, to the extent not sold by such Selling Party in a prior three-month period.

The Agreement is attached to this report as Exhibit 10.1 and incorporated herein by reference. The forgoing description of the Agreement and the Transaction is not complete and is qualified in its entirety by the contents of the actual Agreement.

A press release announcing the Transaction is attached hereto as Exhibit 99.1.

Item 3.02. Unregistered Sales of Equity Securities.

The disclosure in Item 1.01 is incorporated herein by reference thereto. The Transaction Shares issued to Seller and Seller’s designees were not registered under the Securities Act at the time of sale, and therefore may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements. For these issuances, the Company relied on the exemption from federal registration under Section 4(a)(2) of the Securities Act and/or Rule 506 promulgated thereunder, based on the Company’s belief that the offer and sale of such securities has not and will not involve a public offering.

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On July 2, 2020, the Company’s Board of Directors (the “Board”) approved the repricing, subject to stockholder approval, of all (i) stock options outstanding under the Company’s Amended and Restated 2012 Stock Incentive Plan (the “Plan”) (ii) held by current officers or employees of the Company which (iii) have an exercise price higher than $1.54 per share. Following the repricing, subject to stockholder approval of the repricing, the exercise price of such stock options is $1.54 per share, equal to the closing sale price of the common stock on July 1, 2020. Stock options granted for service on the Board were not included in the repricing. There are currently 830,488 stock options outstanding under the Plan, and substantially all of such stock options have exercise prices in excess of the current fair market value of the Company’s common stock. In approving the repricing, the Board considered the impact of the current exercise prices of the stock options on the incentives provided to employees, the lack of retention value provided by the stock options, and the impact of such options on the capital structure of the Company. The Company intends to include a proposal for stockholders to approve the repricing in the proxy materials for the 2020 annual meeting of stockholders.

Item 8.01. Other Events.

On June 28, 2020, secured lenders of the Company agreed to extensions of the maturity date of the Company’s secured promissory notes that previously had a maturity date of June 28, 2020. The maturity dates of the notes were extended to July 15, 2020 with no consideration paid for such extensions. The aggregate principal amount of such notes is $2,702,109.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

(Signature page follows)

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

Predictive Oncology Inc.

|

|

|

|

|

|

|

|

|

|

Date: July 7, 2020

|

By:

|

/s/ Bob Myers

|

|

|

|

Bob Myers

|

|

|

|

Chief Financial Officer

|

|

|

|

|

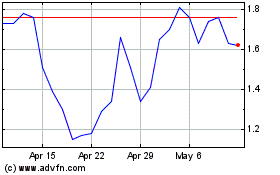

Predictive Oncology (NASDAQ:POAI)

Historical Stock Chart

From Mar 2024 to Apr 2024

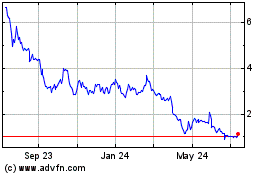

Predictive Oncology (NASDAQ:POAI)

Historical Stock Chart

From Apr 2023 to Apr 2024