Predictive Oncology Announces $2.2 Million Registered Direct Offering Priced At-The-Market under Nasdaq Rules

May 07 2020 - 8:00AM

Predictive Oncology Inc. (NASDAQ: POAI) (“Predictive Oncology” or

“the Company”), a knowledge-driven company focused on applying

artificial intelligence (“AI”) to personalized medicine and drug

discovery, today announced that it has entered into definitive

agreements with several institutional and accredited investors for

the issuance and sale of an aggregate of 1,396,826 shares of its

common stock, at a purchase price of $1.575 per share, for

gross proceeds of approximately $2.2 million in a registered direct

offering priced at-the-market under Nasdaq rules. Predictive

Oncology has also agreed to issue to the investors unregistered

warrants to purchase up to an aggregate of 1,396,826 shares of

common stock. The closing of the offering is expected to occur on

or about May 8, 2020, subject to the satisfaction of customary

closing conditions.

H.C. Wainwright & Co. is acting as the exclusive placement

agent for the offering.

The warrants have an exercise price equal to $1.45 per share,

are exercisable immediately upon issuance and will expire five and

one-half years from the issuance date.

The Company currently intends to use up to $487,000 of the net

proceeds from the offering to repay certain indebtedness to Oasis

Capital, LLC, and the remainder for working capital purposes.

The shares of common stock described above are being offered and

sold by the Company in a registered direct offering pursuant to a

“shelf” registration statement on Form S-3 (Registration No.

333-234073), including a base prospectus previously filed with the

Securities and Exchange Commission (the “SEC”) on October 3, 2019

and became effective on December 19, 2019. The offering of the

shares of common stock will be made only by means of a prospectus

supplement that forms a part of the registration statement. A final

prospectus supplement and base prospectus relating to the

registered direct offering will be filed with the SEC and will be

available on the SEC's website located at http://www.sec.gov.

Electronic copies of the prospectus supplement and the accompanying

base prospectus may also be obtained by contacting H.C. Wainwright

& Co., LLC at 430 Park Avenue, 3rd Floor, New York, NY 10022,

by phone at 646-975-6996 or e-mail at

placements@hcwco.com.

The warrants described above were offered in a private placement

under Section 4(a)(2) of the Securities Act of 1933, as amended

(the "Act"), and Regulation D promulgated thereunder and, along

with the shares of common stock underlying the warrants, have not

been registered under the Act, or applicable state securities laws.

Accordingly, the warrants and the underlying shares of common stock

may not be offered or sold in the United States except pursuant to

an effective registration statement or an applicable exemption from

the registration requirements of the Act and such applicable state

securities laws.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy, nor shall there be any sale of

these securities in any state or jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such state or

jurisdiction.

About Predictive Oncology Inc.

Predictive Oncology (Nasdaq: POAI) operates through three

segments (Domestic, International and Helomics), which contain four

subsidiaries; Helomics, TumorGenesis, Skyline Medical and Skyline

Europe. Helomics applies artificial intelligence to its rich data

gathered from patient tumors to both personalize cancer therapies

for patients and drive the development of new targeted therapies in

collaborations with pharmaceutical companies. Helomics’

CLIA-certified lab provides clinical testing that assists

oncologists in individualizing patient treatment decisions, by

providing an evidence-based roadmap for therapy. In addition to its

proprietary precision oncology platform, Helomics offers boutique

CRO services that leverage its TruTumor™, patient-derived tumor

models coupled to a wide range of multi-omics assays (genomics,

proteomics and biochemical), and an AI-powered proprietary

bioinformatics platform to provide a tailored solution to its

clients’ specific needs. Predictive Oncology’s TumorGenesis

subsidiary is developing a new rapid approach to growing tumors in

the laboratory, which essentially “fools” cancer cells into

thinking they are still growing inside a patient. Its proprietary

Oncology Discovery Technology Platform kits will assist researchers

and clinicians to identify which cancer cells bind to specific

biomarkers. Once the biomarkers are identified they can be used in

TumorGenesis’ Oncology Capture Technology Platforms which isolate

and help categorize an individual patient’s heterogeneous tumor

samples to enable the development of patient specific treatment

options. Helomics and TumorGenesis are focused on ovarian cancer.

Predictive Oncology’s Skyline Medical division markets its patented

and FDA cleared STREAMWAY System, which automates the collection,

measurement and disposal of waste fluid, including blood,

irrigation fluid and others, within a medical facility, through

both domestic and international divisions. The company has achieved

sales in five of the seven continents through both direct sales and

distributor partners. For more information, please

visit www.predictive-oncology.com.

Forward-looking Statements

Certain of the matters discussed in this press release contain

forward-looking statements that involve material risks to and

uncertainties in the Company’s business that may cause actual

results to differ materially from those anticipated by the

statements made herein. Such risks and uncertainties include:

market and other conditions, the completion of the registered

direct offering, the satisfaction of customary closing conditions

related to the registered direct offering and the intended use of

net proceeds from the registered direct offering, we may not be

able to continue operating without additional financing; current

negative operating cash flows; the terms of any further financing,

which may be highly dilutive and may include onerous terms; no

assurance that a vaccine will be successfully developed in

collaboration with Dr. Daniel Carter, or that definitive

documentation of all arrangements with Dr. Carter will be

completed, risks related to the 2019 merger with Helomics

including; 1) significant goodwill could result in further

impairment; 2) possible failure to realize anticipated benefits of

the merger; 3) costs associated with the merger may be higher than

expected; 4) the merger may result in the disruption of our

existing businesses; and 5) distraction of management and diversion

of resources; risks related to our partnerships with other

companies, including the need to negotiate the definitive

agreements; possible failure to realize anticipated benefits of

these partnerships; and costs of providing funding to our partner

companies, which may never be repaid or provide anticipated

returns; risks related to the transaction with Quantitative

Medicine including: 1) completion of the transaction; 2) possible

failure to realize anticipated benefits of the merger; 3) costs

associated with the merger may be higher than expected; 4) the

merger may result in the disruption of our existing businesses; and

5) distraction of management and diversion of resources; risk that

we will be unable to complete the transaction with InventaBioTech

to acquire Soluble Therapeutics and BioDtech; risk that we will be

unable to protect our intellectual property or claims that we are

infringing on others’ intellectual property; the impact of

competition; acquisition and maintenance of any necessary

regulatory clearances applicable to applications of our technology;

inability to attract or retain qualified senior management

personnel, including sales and marketing personnel; risk that we

never become profitable if our product is not accepted by potential

customers; possible impact of government regulation and scrutiny;

unexpected costs and operating deficits, and lower than expected

sales and revenues, if any; adverse results of any legal

proceedings; the volatility of our operating results and financial

condition; and management of growth. In addition, our business and

operations have been and will likely continue to be materially and

adversely affected by the COVD-19 pandemic, including impact on a

significant supplier; a reduction in on-site staff at several of

our facilities, resulting in delayed production and less

efficiency; impact on sales efforts; impact on accounts receivable

and terms demanded by suppliers; and possible impact on financing

transactions; resulting in a possible continued material adverse

effect on our business, financial condition and results of

operations. These and other risks and uncertainties may be detailed

from time to time in the Company’s reports filed with the SEC,

which are available for review at www.sec.gov.

Investor Relations Contact:

Hayden IRJames

Carbonara(646)-755-7412james@haydenir.com

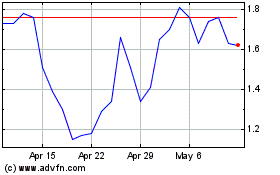

Predictive Oncology (NASDAQ:POAI)

Historical Stock Chart

From Mar 2024 to Apr 2024

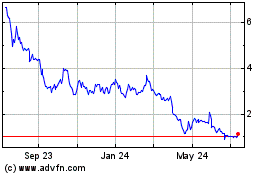

Predictive Oncology (NASDAQ:POAI)

Historical Stock Chart

From Apr 2023 to Apr 2024