Fourth Quarter Net Sales of $68.5 million, Up

19% Year-Over-Year

Fourth Quarter Continuing Operations - GAAP Net

Loss of $7.2 Million, $5.4 Million on an Adjusted Basis

Fourth Quarter Adjusted EBITDA from Continuing

Operations of $5.1 Million, A 53% Year-Over-Year Increase

Cash of $20.3 million, Available Revolver of

$20.0 million, Available Liquidity of $40.3 million at Year End

Call scheduled for Wednesday, March 6, 2019 at 9:00 a.m. Eastern

Time

CPI Card Group Inc. (Nasdaq: PMTS; TSX: PMTS.TO) (“CPI Card

Group” or the “Company”) today reported financial results for the

fourth quarter and full year ended December 31, 2018.

Scott Scheirman, President and Chief Executive Officer of CPI,

stated, “Fourth quarter financial results reflect the continued

progress we are making towards strengthening our business and

fostering changes that we believe will help us to achieve long-term

success. Our fourth quarter performance was highlighted by top-line

growth of 19% year over year, marking our fourth consecutive

quarter of year-over-year net sales growth. During the quarter, we

saw continued top line momentum across the business, particularly

in our emerging products and solutions.”

Scheirman continued, “As we enter 2019, we remain committed to

our strategy of deep customer focus, providing market-leading

quality products and customer service, developing a

market-competitive business model and continuous innovation.

Through continued thoughtful, disciplined execution of these highly

targeted initiatives, we believe we can achieve our vision of being

the partner of choice for our customers by providing market-leading

quality products and customer service with a market competitive

business model.”

Financial results, including non-GAAP measures, discussed in

this press release for all periods reflect continuing operations

unless otherwise noted. The sale of CPI U.K., which had

historically been reported as the U.K. Limited segment, has been

accounted for as discontinued operations, and comparative financial

information has been restated in accordance with U.S. GAAP (“GAAP”)

requirements. All earnings per share amounts reflect the

one-for-five reverse stock split, which occurred in December

2017.

Fourth Quarter and Full Year 2018 Consolidated Financial

Highlights from Continuing Operations

Net sales were $68.5 million in the fourth quarter of 2018, an

increase of 19.2% from the fourth quarter of 2017. For the full

year ended December 31, 2018, net sales were $255.8 million, an

increase of 14.3% over the prior year. Loss from operations was

$0.4 million in the fourth quarter of 2018 compared with a loss

from operations of $21.5 million in the fourth quarter of 2017. As

a reminder, the Company recorded a non-cash impairment charge of

$19.1 million in the fourth quarter of 2017, of which $17.2 million

related to the U.S. Debit and Credit segment, and the remaining

$1.9 million related to the Other segment. The Company generated

income from operations of $4.6 million during the full year 2018

compared with a loss from operations of $19.3 million during the

full year 2017. Net loss was $7.2 million, or $0.65 per diluted

share, and $14.8 million, or $1.33 per diluted share, for the

fourth quarter and full year 2018, respectively. This compares with

a net loss of $14.4 million, or $1.29 per diluted share, and $23.1

million, or $2.08 per diluted share, for the fourth quarter and

full year 2017, respectively. The Company’s net loss was impacted

by a reduction in the effective tax rate for the year ended 2018

compared to the prior year, which lowered the income tax benefit by

$12.2 million, due primarily to U.S. tax reform legislation.

Adjusted EBITDA for the fourth quarter of 2018 was $5.1 million,

up 52.7% compared with $3.3 million in the prior year fourth

quarter. For the full year 2018, adjusted EBITDA increased 16.6% to

$27.1 million compared to the full year 2017. These year-over-year

improvements are primarily the result of net sales growth and lower

costs resulting from cost optimization initiatives implemented

throughout 2018.

Fourth Quarter and Full Year 2018 Segment Information from

Continuing Operations

U.S. Debit and Credit:

Net sales increased 23.9% to $49.6 million in the fourth quarter

of 2018 compared with the fourth quarter of 2017. The increase in

U.S. Debit and Credit segment net sales was driven primarily by

increased sales from our emerging products and solutions, including

CPI Metals™, dual-interface EMV® cards, and Card@Once®. Full year

2018 segment net sales were $178.6 million, an increase of 10.1%

compared to 2017. EMV card volumes, excluding metal and dual

interface, were up 17% and 5% during the fourth quarter and full

year 2018, respectively, compared with the fourth quarter and full

year 2017, while average selling prices declined on a year over

year basis.

U.S. Prepaid Debit:

Net sales increased 6.0% to $17.1 million in the fourth quarter

of 2018 compared with the fourth quarter of 2017, driven by

additional sales volumes from our existing customer base. Full year

2018 segment net sales were $69.2 million, an increase of 21.4%

compared to 2017.

Balance Sheet, Liquidity, and Cash Flow from Continuing

Operations

Cash provided by operating activities for the fourth quarter of

2018 was $8.9 million and capital expenditures totaled $0.6

million, yielding free cash flow of $8.3 million during the fourth

quarter. For the full year ended December 31, 2018, cash provided

by operating activities was $7.0 million, capital expenditures

totaled $5.6 million and free cash flow was $1.4 million.

At December 31, 2018, the Company had $20.3 million of cash and

cash equivalents and a $40.0 million revolving credit facility, of

which $20.0 million was available for borrowing.

Total debt principal outstanding, comprised of the Company’s

First Lien Term Loan, was $312.5 million at December 31, 2018,

unchanged from December 31, 2017. Net of debt issuance costs and

discount, recorded debt was $305.8 million as of December 31, 2018.

The Company’s First Lien Term Loan matures on August 17, 2022 and

includes no financial covenants.

John Lowe, Chief Financial Officer, stated, “We continued to

deliver solid top-line performance in the fourth quarter of 2018,

which helped boost our fourth quarter adjusted EBITDA performance

by more than 50% compared with the fourth quarter of last year. Our

continued disciplined approach of driving revenue growth and

operational efficiency yielded positive free cash flow generation

from continuing operations for the full year 2018. We continue to

believe we have adequate cash and liquidity to support our business

plans.”

EMV® is a registered trademark or trademark of EMVCo LLC in the

United States and other countries.

Non-GAAP Financial Measures

In addition to financial results reported in accordance with

U.S. generally accepted accounting principles (GAAP), we have

provided the following non-GAAP financial measures in this release,

all reported on a continuing operations basis: Adjusted Net Income

(Loss), Adjusted Diluted Earnings (Loss) per Share, EBITDA,

reconciliation of US Debit and Credit segment EBITDA excluding

impairments, Adjusted EBITDA, and Free Cash Flow. These non-GAAP

financial measures are utilized by management in comparing our

operating performance on a consistent basis between fiscal periods.

We believe that these financial measures are appropriate to enhance

an overall understanding of our underlying operating performance

trends compared to historical and prospective periods and our

peers. Management also believes that these measures are useful to

investors in their analysis of our results of operations and

provide improved comparability between fiscal periods. Non-GAAP

financial measures should not be considered in isolation from, or

as a substitute for, financial information calculated in accordance

with GAAP. Our non-GAAP measures may be different from similarly

titled measures of other companies. Investors are encouraged to

review the reconciliation of these historical non-GAAP measures to

their most directly comparable GAAP financial measures included in

Exhibit E to this press release.

Adjusted Net Income (Loss) and Adjusted Diluted Earnings (Loss)

per Share

Adjusted Net Income (Loss) and Adjusted Diluted Earnings (Loss)

per Share are presented on a continuing operations basis and

exclude the impact of impairments, amortization of intangible

assets; litigation and related charges incurred in connection with

certain patent and shareholder litigation; stock-based compensation

expense; restructuring and other charges; and other

non-operational, non-cash or non-recurring items, net of their

income tax impact. In 2017, an income tax rate of 35% was used to

calculate the related tax impact on adjustments noted above.

Beginning in the first quarter of 2018, a 21% tax rate is used to

calculate Adjusted Net Income (Loss) and Adjusted Diluted Earnings

(Loss) per Share. In conjunction with U.S. government comprehensive

tax reform, there was a reduction of the U.S. federal tax rate from

35.0% to 21.0% effective in 2018. We believe that Adjusted Net

Income (Loss) and Adjusted Diluted Earnings (Loss) per Share are

useful in assessing our financial performance by excluding items

that are not indicative of our core operating performance or that

may obscure trends useful in evaluating our results of

operations.

EBITDA

EBITDA represents earnings before interest, taxes, depreciation

and amortization, all on a continuing operations basis. EBITDA is

presented because it is an important supplemental measure of

performance, and it is frequently used by analysts, investors and

other interested parties in the evaluation of companies in our

industry. EBITDA is also presented and compared by analysts and

investors in evaluating our ability to meet debt service

obligations. Other companies in our industry may calculate EBITDA

differently. EBITDA is not a measurement of financial performance

under GAAP and should not be considered as an alternative to cash

flow from operating activities or as a measure of liquidity or an

alternative to net (loss) income or net (loss) income from

continuing operations as indicators of operating performance or any

other measures of performance derived in accordance with GAAP.

Because EBITDA is calculated before recurring cash charges,

including interest expense and taxes, and is not adjusted for

capital expenditures or other recurring cash requirements of the

business, it should not be considered as a measure of discretionary

cash available to invest in the growth of the business.

Reconciliation of US Debit and Credit segment EBITDA excluding

impairments are presented to show EBITDA without the effects of

impairment charges. We feel this measurement is important to show

the comparison for periods with and without impairment charges to

better reflect comparability between periods.

Adjusted EBITDA

Adjusted EBITDA is presented on a continuing operations basis

and is defined as EBITDA adjusted for impairments, litigation and

related charges incurred in connection with certain patent and

shareholder litigation; stock-based compensation expense;

restructuring and other charges; foreign currency gain or loss; and

other items that are unusual in nature, infrequently occurring or

not considered part of our core operations, as set forth in the

reconciliation on Exhibit E. Adjusted EBITDA is also a defined term

in our existing credit agreement, which generally conforms to the

definition above, and impacts certain credit measures and

compliance targets within the credit agreement. Adjusted EBITDA is

intended to show our unleveraged, pre-tax operating results and

therefore reflects our financial performance based on operational

factors, excluding non-operational, non-cash or non-recurring

losses or gains. Adjusted EBITDA has important limitations as an

analytical tool, and you should not consider it in isolation, or as

a substitute for, analysis of our results as reported under GAAP.

For example, Adjusted EBITDA does not reflect: (a) our capital

expenditures, future requirements for capital expenditures or

contractual commitments; (b) changes in, or cash requirements for,

our working capital needs; (c) the significant interest expenses or

the cash requirements necessary to service interest or principal

payments on our debt; (d) tax payments that represent a reduction

in cash available to us; (e) any cash requirements for the assets

being depreciated and amortized that may have to be replaced in the

future; (f) the impact of earnings or charges resulting from

matters that we and the lenders under our credit agreement may not

consider indicative of our ongoing operations; or (g) the impact of

any discontinued operations. In particular, our definition of

Adjusted EBITDA allows us to add back certain non-cash,

non-operating or non-recurring charges that are deducted in

calculating net (loss) income, even though these are expenses that

may recur, vary greatly and are difficult to predict and can

represent the effect of long-term strategies as opposed to

short-term results.

In addition, certain of these expenses can represent the

reduction of cash that could be used for other purposes. Further,

although not included in the calculation of Adjusted EBITDA, the

measure may at times allow us to add estimated cost savings and

operating synergies related to operational changes ranging from

acquisitions to dispositions to restructurings and/or exclude

one-time transition expenditures that we anticipate we will need to

incur to realize cost savings before such savings have occurred.

Further, management and various investors use the ratio of total

debt less cash to Adjusted EBITDA, or "net debt leverage," as a

measure of our financial strength and ability to incur incremental

indebtedness when making key investment decisions and evaluating us

against peers. The metric “total debt less cash” includes borrowed

long term debt and capital lease obligations, less cash. Adjusted

EBITDA margin percentage as shown in Exhibit E is computed as

Adjusted EBITDA divided by total net sales.

Free Cash Flow

We define Free Cash Flow as cash flow from continuing operations

less capital expenditures from continuing operations. We use this

metric in analyzing our ability to service and repay our debt.

However, this measure does not represent funds available for

investment or other discretionary uses since it does not deduct

cash used to service our debt, nor does it reflect the cash impacts

of our discontinued operations.

About CPI Card Group Inc.

CPI Card Group is a leading provider in payment card production

and related services, offering a single source for credit, debit

and prepaid debit cards including EMV® chip and dual interface,

personalization, instant issuance, fulfillment and digital payment

services. With more than 20 years of experience in the payments

market and as a trusted partner to financial institutions, CPI’s

solid reputation of product consistency, quality and outstanding

customer service supports our position as a leader in the market.

Serving our customers from locations throughout the United States

and Canada, we have a large network of high security facilities in

North America, each of which is certified by one or more of the

payment brands: Visa, Mastercard®, American Express, Discover and

Interac in Canada. Learn more at www.cpicardgroup.com.

Conference Call and Webcast

CPI Card Group Inc. will hold a conference call on March 6, 2019

at 9:00 a.m. ET to review its fourth quarter and full year 2018

results. To participate in the Company's conference call via

telephone or online:

Participant Toll-Free Dial-In Number: (800)

860-2442Participant International Dial-In Number: (412)

858-4600Webcast Link:

https://services.choruscall.com/links/pmts190306.html

Participants are advised to login for the live webcast 10

minutes prior to the scheduled start time.

A replay of the conference call and webcast will be available

until March 20, 2019 at:

Replay: (877) 344-7529 or (412)

317-0088;Conference ID: 10127909Webcast replay:

http://investor.cpicardgroup.com

Forward-Looking Statements

Certain statements and information in this earnings release may

constitute “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995, Section 27A of

the Securities Act of 1933, as amended (the “1933 Act”) and Section

21E of the Securities Exchange Act of 1934, as amended (the “1934

Act”). The words “believe,” “estimate,” “project,” “expect,”

“anticipate,” “plan,” “intend,” “foresee,” “should,” “would,”

“could” or other similar expressions are intended to identify

forward-looking statements, which are generally not historical in

nature. These forward-looking statements are based on our current

expectations and beliefs concerning future developments and their

potential effect on us, and other information currently available.

Such statements reflect our current views with respect to future

events and are subject to certain risks, uncertainties and

assumptions. Should one or more of these risks or uncertainties

materialize, or should underlying assumptions prove incorrect,

actual results may vary materially from those described herein as

anticipated, believed, estimated, expected or intended. We are

making investors aware that such forward-looking statements,

because they relate to future events, are by their very nature

subject to many important factors that could cause actual results

to differ materially from those contemplated. These risks and

uncertainties include, but are not limited to: our substantial

indebtedness, including inability to make debt service payments or

refinance such indebtedness; the restrictive terms of our credit

facility and covenants of future agreements governing indebtedness

and the resulting restraints on our ability to pursue our business

strategies; our limited ability to raise capital in the

future; system security risks, data protection breaches and

cyber-attacks and possible exposure to litigation and/or regulatory

penalties under applicable data privacy and other laws for failure

to prevent such incidents; interruptions in our operations,

including our IT systems, or in the operations of the third parties

that operate the data centers or computing infrastructure on which

we rely; our failure to maintain our listing on the NASDAQ Capital

Market; our inability to adequately protect our trade secrets and

intellectual property rights from misappropriation or infringement,

claims that our technology is infringing on the intellectual

property of others, and risks related to open source software;

defects in our software; problems in production quality and

process; our failure to retain our existing customers or identify

and attract new customers; a loss of market share or a decline in

profitability resulting from competition; our inability to recruit,

retain and develop qualified personnel, including key personnel;

our inability to sell, exit, reconfigure or consolidate businesses

or facilities that no longer meet with our strategy; our inability

to develop, introduce and commercialize new products; the effect of

legal and regulatory proceedings; developing technologies that make

our existing technology solutions and products less relevant or a

failure to introduce new products and services in a timely

manner; quarterly variation in our operating results;

infringement of our intellectual property rights, or claims that

our technology is infringing on third-party intellectual property;

our inability to realize the full value of our long-lived assets;

our failure to operate our business in accordance with the PCI

Security Standards Council (“PCI”) security standards or other

industry standards such as Payment Card Brand certification

standards; costs relating to the obligatory collection of sales tax

and claims for uncollected sales tax in states that impose sales

tax collection requirements on out-of-state companies; disruption

or delays in our manufacturing operations or supply chain; a

decline in U.S. and global market and economic conditions and

resulting decreases in consumer and business spending; costs

relating to product defects and any related product liability

and/or warranty claims; maintenance and further imposition of

tariffs and/or trade restrictions on goods imported into the United

States; our dependence on licensing arrangements; risks

associated with international operations; non-compliance with, and

changes in, laws in the United States and in foreign jurisdictions

in which we operate and sell our products; risks associated with

the controlling stockholders’ ownership of our stock; and other

risks that are described in Part I, Item 1A – Risk Factors of our

Form 10-K and our other reports filed from time to time with the

Securities and Exchange Commission (the “SEC”).

We caution and advise readers not to place undue reliance on

forward-looking statements, which speak only as of the date hereof.

These statements are based on assumptions that may not be realized

and involve risks and uncertainties that could cause actual results

to differ materially from the expectations and beliefs contained

herein. We undertake no obligation to publicly update or revise any

forward-looking statements after the date they are made, whether as

a result of new information, future events or otherwise.

For more information:

CPI encourages investors to use its investor relations website

as a way of easily finding information about the company. CPI

promptly makes available on this website, free of charge, the

reports that the company files or furnishes with the SEC, corporate

governance information and press releases. CPI uses its investor

relations site (http://investor.cpicardgroup.com) as a means of

disclosing material information and for complying with its

disclosure obligations under Regulation FD.

CPI Card Group Inc. Earnings Release Supplemental

Financial Information

Exhibit A Condensed Consolidated

Statements of Operations and Comprehensive Loss - Unaudited for the

three months and full years ended December 31, 2018 and 2017

Exhibit B Condensed Consolidated Balance Sheets – Unaudited as of

December 31, 2018 and 2017 Exhibit C Condensed Consolidated

Statements of Cash Flows - Unaudited for the years ended December

31, 2018 and 2017 Exhibit D Segment Summary Information –

Unaudited for the three months and full years ended December 31,

2018 and 2017 Exhibit E Supplemental GAAP to Non-GAAP

Reconciliations - Unaudited for the three months and full years

ended December 31, 2018 and 2017 EXHIBIT A

CPI

Card Group Inc. and Subsidiaries Condensed Consolidated

Statements of Operations and Comprehensive Loss (Dollars in

Thousands, Except Per Share Amounts) (Unaudited)

Three Months Ended December 31,

Year Ended December 31, 2018

2017 2018 2017 Net sales:

Products $ 34,158 $ 24,815 $ 125,069 $ 104,459 Services

34,358 32,674 130,745

119,285 Total net sales 68,516 57,489

255,814 223,744 Cost of sales:

Products (exclusive of depreciation and amortization shown below)

23,034 16,803 82,110 70,527 Services (exclusive of depreciation and

amortization shown below) 21,706 20,605 82,697 74,315 Depreciation

and amortization 2,797 2,634

12,417 10,697 Total cost of sales

47,537 40,042 177,224

155,539 Gross profit 20,979 17,447 78,590 68,205 Operating

expenses: Selling, general and administrative (exclusive of

depreciation and amortization shown below) 19,895 18,405 68,014

62,206 Impairments — 19,074 — 19,074 Depreciation and amortization

1,475 1,446 5,988

6,225 Total operating expenses 21,370

38,925 74,002 87,505 Income

(loss) from operations (391 ) (21,478 ) 4,588 (19,300 ) Other

expense, net: Interest, net (6,188 ) (5,318 ) (23,431 ) (20,850 )

Foreign currency (loss) gain (63 ) (3 ) (311 ) 517 Other income,

net 1 1 16 12

Total other expense, net (6,250 ) (5,320 )

(23,726 ) (20,321 ) Loss before income taxes

(6,641 ) (26,798 ) (19,138 ) (39,621 ) Income tax benefit (expense)

(594 ) 12,382 4,339

16,536 Net loss from continuing operations (7,235 ) (14,416

) (14,799 ) (23,085 ) Discontinued operations: Net (loss) income

from discontinued operation, net of taxes (112 ) (191

) (22,663 ) 1,075 Net loss $ (7,347 ) $

(14,607 ) $ (37,462 ) $ (22,010 ) Basic and Diluted Loss per

Share: Continuing operations $ (0.65 ) $ (1.29 ) $ (1.33 ) $ (2.08

) Discontinued operations (0.01 )

(0.02

)

(2.03

) 0.10

$

(0.66 ) $

(1.31

) $

(3.36

) $ (1.98 ) Weighted-average shares outstanding: Basic and

dilutive 11,160,377 11,134,633 11,149,554 11,117,454

Dividends declared per common share $ — $ — $ — $ 0.45

Comprehensive loss Net loss $ (7,347 ) $ (14,607 ) $ (37,462 ) $

(22,010 ) Reclassification adjustment from discontinued operations

— — 3,983 — Currency translation adjustment (118 ) 56

(205 ) 1,277 Total comprehensive loss $

(7,465 ) $ (14,551 ) $ (33,684 ) $ (20,733 )

EXHIBIT B

CPI Card Group Inc. and Subsidiaries Condensed

Consolidated Balance Sheets (Dollars in Thousands, Except

Share and Per Share Amounts) (Unaudited)

December 31,

December 31, 2018 2017 Assets

Current assets: Cash and cash equivalents $ 20,291 $ 23,205

Accounts receivable, net of allowances of $211 and $48,

respectively 43,794 32,531 Inventories 9,827 13,799 Prepaid

expenses and other current assets 4,997 3,681 Income taxes

receivable 5,564 8,208 Assets of discontinued operation —

20,651 Total current assets 84,473 102,075

Plant, equipment and leasehold improvements, net 39,110 44,436

Intangible assets, net 35,437 40,093 Goodwill 47,150 47,150 Other

assets 1,034 251 Total assets $ 207,204

$ 234,005

Liabilities and stockholders’

deficit Current liabilities: Accounts payable $ 16,511 $ 13,239

Accrued expenses 23,853 12,789 Deferred revenue and customer

deposits 912 3,342 Liabilities of discontinued operation —

5,669 Total current liabilities 41,276 35,039

Long-term debt 305,818 303,869 Deferred income taxes 5,749 12,168

Other long-term liabilities 3,937 2,503

Total liabilities 356,780 353,579 Commitments and

contingencies Stockholders’ deficit: Common Stock; $0.001

par value—100,000,000 shares authorized; 11,160,377 and 11,134,714

shares issued and outstanding as of December 31, 2018 and December

31, 2017, respectively 11 11 Capital deficiency (112,223 ) (113,081

) Accumulated loss (36,004 ) (1,366 ) Accumulated other

comprehensive loss (1,360 ) (5,138 ) Total

stockholders’ deficit (149,576 ) (119,574 ) Total

liabilities and stockholders’ deficit $ 207,204 $ 234,005

EXHIBIT C

CPI Card Group Inc. and

Subsidiaries Condensed Consolidated Statements of Cash

Flows (Dollars in Thousands) (Unaudited)

Year Ended December 31, 2018

2017 Operating activities Net loss $ (37,462 )

$ (22,010 ) Adjustments to reconcile net loss to net cash provided

by operating activities: Loss (income) from discontinued operations

22,663 (1,075 ) Impairments — 19,074 Depreciation and amortization

expense 18,405 16,922 Stock-based compensation expense 961 1,989

Amortization of debt issuance costs and debt discount 1,949 1,947

Deferred income taxes (6,897 ) (9,167 ) Other, net 302 (165 )

Changes in operating assets and liabilities: Accounts receivable

(5,523 ) (6,396 ) Inventories (1,998 ) 2,826 Prepaid expenses and

other assets (2,108 ) 619 Income taxes 2,644 (8,581 ) Accounts

payable 2,411 5,655 Accrued expenses 10,436 (456 ) Deferred revenue

and customer deposits 632 599 Other liabilities 655

1,671 Cash provided by operating activities -

continuing operations 7,070 3,452 Cash used in operating activities

- discontinued operations (3,550 ) (1,025 )

Investing

activities Acquisitions of plant, equipment and leasehold

improvements (5,634 ) (7,263 ) Cash used in investing

activities - continuing operations (5,634 ) (7,263 ) Cash used in

investing activities - discontinued operations (220 ) (1,527 )

Financing activities Dividends paid on common stock — (7,540

) Payments on capital leases (519 ) — Taxes withheld and paid on

stock-based compensation awards — (341 ) Cash

used in financing activities (519 ) (7,881 ) Effect of exchange

rates on cash (61 ) 494 Net decrease in cash

and cash equivalents (2,914 ) (13,750 ) Cash and cash equivalents,

beginning of period 23,205 36,955 Cash

and cash equivalents, end of period $ 20,291 $ 23,205

EXHIBIT D

CPI Card Group Inc. and Subsidiaries

Segment Summary Information For the Three Months and Year

Ended December 31, 2018 and 2017 (Dollars in Thousands)

(Unaudited) Net Sales (1) and (2)

Three Months Ended December 31, 2018

2017 $ Change

% Change Net sales by segment:

U.S. Debit and Credit

$ 49,605 $ 40,042 $ 9,563 23.9 % U.S. Prepaid Debit 17,071 16,104

967 6.0 % Other 2,292 2,658 (366 )

(13.8

)%

Eliminations (452 ) (1,315 ) 863 * %

Total $ 68,516 $ 57,489 $ 11,027 19.2 %

* Calculation not meaningful

Year Ended December 31, 2018

2017 $ Change %

Change Net sales by segment:

U.S. Debit and Credit

$ 178,597 $ 162,216 $ 16,381 10.1 % U.S. Prepaid Debit 69,199

57,005 12,194 21.4 % Other 9,891 11,049 (1,158 )

(10.5

)%

Eliminations (1,873 ) (6,526 ) 4,653 *

% Total $ 255,814 $ 223,744 $ 32,070 14.3 %

* Calculation not meaningful

Gross Profit (1) and (2)

Three Months Ended December 31, 2018

% of NetSales 2017

% of NetSales $ Change

% Change Gross profit by segment:

U.S. Debit and Credit

$ 14,145 28.5 % $ 10,944 27.2 % $ 3,201 29.2 % U.S. Prepaid Debit

6,311 37.0 % 5,941 36.9 % 370 6.2 % Other 523 * % 562

* % (39 )

(6.9

)%

Total $ 20,979 30.6 % $ 17,447 30.3 % $ 3,532 20.2 %

* Calculation not meaningful

Year Ended December 31, 2018

% of NetSales 2017

% of NetSales $ Change

% Change Gross profit by segment:

U.S. Debit and Credit

$ 50,036 28.0 % $ 45,179 27.8 % $ 4,857 10.8 % U.S. Prepaid Debit

26,422 38.2 % 20,358 35.7 % 6,064 29.8 % Other 2,132 * %

2,668 * % (536 )

(20.1

)%

Total $ 78,590 30.7 % $ 68,205 30.5 % $ 10,385 15.2 %

* Calculation not meaningful

Income (loss) from Operations (1) and (2)

Three Months Ended December 31, 2018

% of NetSales 2017

% of NetSales $

Change % Change Income (loss) from

Operations by segment:

U.S. Debit and Credit

$ 6,764 13.6 % $ (12,645 )

(31.6

)%

$ 19,409 * % U.S. Prepaid Debit 4,996 29.3 % 5,084 31.6 % (88 )

(1.7

)%

Other (12,151 ) * % (13,917 ) * % 1,766

12.7 % Total $ (391 )

(0.6

)%

$ (21,478 )

(37.4

)%

$ 21,087 98.2 %

* Calculation not meaningful

Year Ended December 31, 2018

% of NetSales 2017

% of NetSales $ Change

% Change Income (loss) from Operations by

segment:

U.S. Debit and Credit

$ 22,414 12.6 % $ 2,121 1.3 % $ 20,293 956.8 % U.S. Prepaid Debit

21,928 31.7 % 16,679 29.3 % 5,249 31.5 % Other (39,754 ) * %

(38,100 ) * % (1,654 )

(4.3

)%

Total $ 4,588 1.8 % $ (19,300 )

(8.6

)%

$ 23,888 * %

* Calculation not meaningful

EBITDA (1), (2) and (3) Three

Months Ended December 31, 2018 % of

NetSales 2017 % of

NetSales $ Change

% Change EBITDA by segment

U.S. Debit and Credit

$ 9,425 19.0 % $ (10,255 )

(25.6

)%

$ 19,680 * % U.S. Prepaid Debit 5,445 31.9 % 5,592 34.7 % (147 )

(2.6

)%

Other (11,051 ) * % (12,737 ) * % 1,686

13.2 % Total $ 3,819 5.6 % $ (17,400 )

(30.3

)%

$ 21,219 121.9 % * Calculation not meaningful

Year Ended December 31, 2018 % of

NetSales 2017 % of

NetSales $ Change

% Change EBITDA by segment (1)

U.S. Debit and Credit

$ 34,213 19.2 % $ 11,618 7.2 % $ 22,595 194.5 % U.S. Prepaid Debit

23,782 34.4 % 18,847 33.1 % 4,935 26.2 % Other (35,297 ) * %

(32,314 ) * % (2,983 )

(9.2

)%

Total $ 22,698 8.9 % $ (1,849 )

(0.8

)%

$ 24,547 * % * Calculation not meaningful

____________________

Note the tables in this exhibit are presented on a continuing

operations basis. (1) On August 3, 2018, we completed the

sale of the U.K. Limited segment. During the second quarter of

2018, we met the criteria to report the U.K. Limited segment as a

discontinued operation. The financial position, results of

operations and cash flows have been restated for all periods to

conform with discontinued operations presentation. (2) During the

first quarter of 2018, we reorganized our United States business

operations and realigned our United States reporting segments to

correspond with the manner with which our chief decision maker

evaluates operating performance and makes decisions as to the

allocation of resources. As a result of this realignment, our CPI

on Demand business operations were moved from U.S. Prepaid Debit

into the U.S. Debit and Credit reporting segment, consistent with

the other related personalization operations. Segment information

for previous periods has been restated to conform with this

realignment and current period presentation. The restatement of

2017 segment information was not material. (3)

EBITDA is the primary measure used by

management to evaluate segment operating performance. The principal

difference between Income from operations and EBITDA is that EBITDA

is adjusted to exclude Depreciation and amortization expense of

$2,658 and $2,390 in U.S. Debit and Credit; $454 and $507 in U.S.

Prepaid Debit and $1,160 and $1,183 in Other for the three months

ended December 31, 2018 and 2017, respectively, and $11,801 and

$9,497 in U.S. Debit and Credit; $1,859 and $2,168 in U.S. Prepaid

Debit and $4,745 and $5,257 in Other for the years ended December

31, 2018 and 2017, respectively.

EXHIBIT E

CPI Card Group Inc. and Subsidiaries

Supplemental GAAP to Non-GAAP Reconciliation (Dollars in

Thousands, Except Shares and Per Share Amounts)

(Unaudited) Three

Months Ended December 31, Year Ended December

31, 2018 2017 2018

2017 EBITDA and Adjusted EBITDA: Net loss from

continuing operations $ (7,235 ) $ (14,416 ) $ (14,799 ) $ (23,085

) Interest expense, net 6,188 5,318 23,431 20,850 Income tax

(benefit) expense 594 (12,382 ) (4,339 ) (16,536 ) Depreciation and

amortization 4,272 4,080 18,405

16,922

EBITDA $ 3,819 $ (17,400 ) $

22,698 $ (1,849 )

Adjustments to EBITDA

Impairments(1) — 19,074 — 19,074 Litigation and related charges (2)

3 1,015 1,042 4,514 Stock-based compensation expense 219 622 961

1,989 Restructuring and other charges (3) 955 — 2,051 — Foreign

currency loss (gain) 63 3 311

(517 ) Subtotal of adjustments to EBITDA 1,240

20,714 4,365 25,060

Adjusted EBITDA $ 5,059 $ 3,314 $

27,063 $ 23,211

Adjusted EBITDA Margin (%

of Net Sales) 7.4 % 5.8 % 10.6 %

10.4 %

% increase period over period 52.7 % —

16.6 % —

Three Months

Ended December 31, Year Ended December 31, 2018

2017 2018 2017 Adjusted net loss from

continuing operations and loss per share - continuing

operations: Net loss from continuing operations $ (7,235 ) $

(14,416 ) $ (14,799 ) $ (23,085 ) Impairments(1) — 19,074 — 19,074

Amortization of intangible assets 1,164 1,140 4,655 4,655

Litigation and related charges (2) 3 1,015 1,042 4,514 Stock-based

compensation expense 219 622 961 1,989 Restructuring and other

charges (3) 955 — 2,051 — Tax effect of above items (492 )

(7,648 ) (1,829 ) (10,581 )

Adjusted net

loss from continuing operations $ (5,386 ) $ (213 ) $ (7,919 )

$ (3,434 )

Three Months Ended December 31,

Year Ended December 31, 2018 2017 2018

2017 Weighted-average number of shares outstanding:

Basic 11,160,377 11,134,633 11,149,554 11,117,454 Effect of

dilutive equity awards — — —

— Weighted-average diluted shares outstanding

11,160,377 11,134,633 11,149,554

11,117,454

Three Months Ended December

31, Year Ended December 31, 2018 2017

2018 2017 Reconciliation of loss per share -

continuing operations (GAAP) to adjusted diluted loss per share -

continuing operations: Diluted (loss) per share (GAAP) -

continuing operations $ (0.65 ) $ (1.29 ) $ (1.33 ) $ (2.08 )

Impact of net (loss) income adjustments 0.17

1.27

0.62 1.77

Adjusted diluted

loss per share - continuing operations $ (0.48 ) $

(0.02

) $ (0.71 ) $ (0.31 )

Three Months Ended December

31, Year Ended December 31, 2018 2017

2018 2017 Reconciliation of cash provided by

operating activities - continuing operations (GAAP) to free cash

flow: Cash provided by operating activities - continuing

operations $ 8,914 $ 7,546 $ 7,070 $ 3,452 Acquisitions of plant,

equipment and leasehold improvements (606 ) (974 )

(5,634 ) (7,263 ) Free cash flow - continuing

operations $ 8,308 $ 6,572 $ 1,436 $ (3,811 )

Three Months Ended December 31, Year Ended

December 31, 2018 2017 2018 2017

Reconciliation of US Debit and Credit Segment EBITDA excluding

impairments EBITDA $ 9,425 $ (10,255 ) $ 34,213 $ 11,618

Impairment (1)

— 17,181 — 17,181

US Debit and Credit Segment EBITDA excluding goodwill

impairment $ 9,425 $ 6,926 $ 34,213 $ 28,799

EBITDA Margin (% of Net Sales) 19.0 %

17.3 % 19.2 % 17.8 %

% increase period over

period 36.1 % — 18.8 % —

____________________

Note that tables in this exhibit are presented on a continuing

operations basis.

(1)

Impairment charges of goodwill and intangibles in 2017 of

$19.1 million includes $17.2 million related to U.S. Debit and

Credit and $1.9 million related to Other.

(2)

Represents net legal costs incurred with certain patent and

shareholder litigation.

(3)

Represents primarily employee and lease termination costs incurred

in connection with the decision to consolidate three

personalization operations in the United States to two facilities,

and employee termination costs incurred in the fourth quarter of

2018 in connection with the sale of our Canadian operations.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190306005201/en/

CPI Card Group Inc. Investor Relations:Jennifer

Almquist(877) 369-9016InvestorRelations@cpicardgroup.comCPI Card

Group Inc. Media Relations:Media@cpicardgroup.com

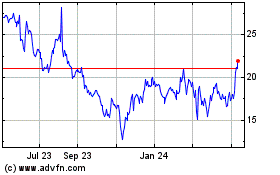

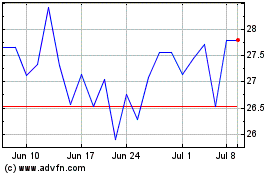

CPI Card (NASDAQ:PMTS)

Historical Stock Chart

From Mar 2024 to Apr 2024

CPI Card (NASDAQ:PMTS)

Historical Stock Chart

From Apr 2023 to Apr 2024