Current Report Filing (8-k)

January 05 2021 - 7:54AM

Edgar (US Regulatory)

0001093691

false

0001093691

2020-12-31

2020-12-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

December 31, 2020

Plug Power Inc.

(Exact name of registrant as specified in

its charter)

|

Delaware

|

|

1-34392

|

|

22-3672377

|

|

(State or other jurisdiction

|

|

(Commission File

|

|

(IRS Employer

|

|

of incorporation)

|

|

Number)

|

|

Identification No.)

|

968 Albany Shaker Road,

Latham, New York

|

|

12110

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including

area code: (518) 782-7700

N/A

(Former name or former address, if changed

since last report.)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

¨ Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to

Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which

registered

|

|

Common Stock, par value $0.01 per share

|

|

PLUG

|

|

The Nasdaq Capital Market

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth

company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 8.01 Other Events.

As previously disclosed, in April

2017 Plug Power Inc. (the “Company”) issued a warrant to Amazon.com NV Investment Holdings LLC to acquire up to

55,286,696 shares of the Company’s common stock. The vesting of the warrant is linked to payments made by Amazon.com,

Inc. and its affiliates to the Company pursuant to existing commercial agreements. As of November 2, 2020, 34,917,912

shares had vested under the warrant at an exercise price of $1.1893 per share based on total cumulative spending with the

Company in excess of $200 million. Under the terms of the warrant, at the same time the exercise price for the unvested

20,368,784 shares was set at $13.81005 per share. On December 31, 2020, the Company waived the remaining vesting conditions

under the warrant, which resulted in the vesting of the remaining 20,368,784 unvested shares under the warrant. This

vesting is expected to result in a substantial one-time non-cash charge in the quarter ended December 31, 2020, to eliminate

the need to recognize future quarterly non-cash charges for this warrant and to simplify the Company’s financial

reporting going forward. The details of the warrant and vesting will be described in the Company’s annual report

on Form 10-K for the year ending December 31, 2020 to be filed by the Company with the Securities and Exchange Commission

(the “SEC”).

Forward-Looking

Statements

This Current

Report on Form 8-K contains forward-looking statements within the meaning of the federal securities laws. These statements

include, but are not limited to, statements regarding the expectation of a substantial one-time non-cash charge in the quarter

ended December 31, 2020 and the elimination of future quarterly non-cash charges. Although

the Company presently believes that the plans, expectations and anticipated results expressed in or suggested by the forward-looking

statements contained in this Form 8-K are reasonable, all forward-looking statements are inherently subjective, uncertain and subject

to change, as they involve substantial risks and uncertainties, including those beyond the Company’s control. New factors

emerge from time to time, and it is not possible for the Company to predict the nature, or assess the potential impact, of each

new factor on the Company’s business. These and other potential risks and uncertainties that

could cause actual results to differ from the results predicted are more fully detailed in the Company’s filings and reports

with the SEC, including the Annual Report on Form 10-K for the year ended December 31, 2019, as amended and supplemented by the

Quarterly Reports on Form 10-Q for the quarters ended March 31, 2020, June 30, 2020 and September 30, 2020, as well as other

filings and reports that are filed by the Company from time to time with the SEC. The

Company disclaims any obligation to update forward-looking statements.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

Plug Power Inc.

|

|

|

|

|

|

|

By:

|

/s/ Paul Middleton

|

|

|

|

Name: Paul Middleton

|

|

|

|

Title: Chief Financial Officer

|

Date: January 5, 2021

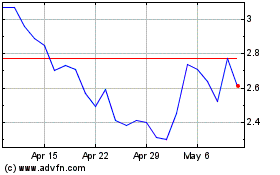

Plug Power (NASDAQ:PLUG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Plug Power (NASDAQ:PLUG)

Historical Stock Chart

From Apr 2023 to Apr 2024