Plug Power Inc. (“Plug Power”) (NASDAQ: PLUG) today announced its

intention to offer, subject to market conditions and other factors,

$200 million aggregate principal amount of Convertible Senior Notes

due 2025 (the “notes”) in a private offering (the “offering”) to

qualified institutional buyers pursuant to Rule 144A under the

Securities Act of 1933, as amended (the “Securities Act”). Plug

Power also expects to grant the initial purchasers of the notes a

13-day option to purchase up to an additional $30 million aggregate

principal amount of the notes.

The notes will be senior, unsecured obligations of Plug Power,

and interest will be payable semi-annually in arrears. The notes

will be convertible into cash, shares of Plug Power’s common stock

or a combination thereof, at Plug Power’s election. The interest

rate, conversion rate and other terms of the notes are to be

determined upon pricing of the offering.

Plug Power intends to use a portion of the net proceeds from the

offering of the notes to pay the cost of the capped call

transactions described below, and to fund the cash portion, if any,

of the repurchase of a portion of Plug Power’s existing 5.50%

Convertible Senior Notes due 2023 (the “2023 notes”) through

individually privately negotiated transactions (each, a “note

repurchase transaction”) concurrently with the offering of the

notes. The terms of each note repurchase transaction will depend on

several factors, including the market price of Plug Power’s common

stock and the trading price of the 2023 notes at the time of each

such note repurchase transaction. The consideration for any such

repurchases may include cash, shares of Plug Power’s common stock,

or a combination thereof. This activity could affect the market

price of Plug Power’s common stock and the initial conversion price

of the notes.

To the extent Plug Power effects the note repurchase

transactions, Plug Power intends to enter into agreements

concurrently with or shortly after the closing of the offering of

the notes to terminate a corresponding portion of the capped call

transactions it entered into in connection with the issuance of the

2023 notes.

In connection with the pricing of the notes, Plug Power expects

to enter into capped call transactions with one or more of the

initial purchasers of the notes or their respective affiliates

and/or other financial institutions (the “option counterparties”).

The capped call transactions are expected generally to reduce or

offset the potential dilution to Plug Power’s common stock upon any

conversion of the notes and/or to offset any cash payments Plug

Power is required to make in excess of the principal amount of

converted notes, as the case may be, with such reduction and/or

offset subject to a cap. If the initial purchasers of the notes

exercise their option to purchase additional notes, Plug Power

expects to enter into additional capped call transactions with the

option counterparties.

Plug Power expects that, in connection with establishing their

initial hedges of the capped call transactions, the option

counterparties or their respective affiliates will purchase shares

of Plug Power’s common stock and/or enter into various derivative

transactions with respect to Plug Power’s common stock concurrently

with or shortly after the pricing of the notes. This activity could

increase (or reduce the size of any decrease in) the market price

of the common stock or the notes at that time. In addition, Plug

Power expects that the option counterparties or their respective

affiliates may modify their hedge positions by entering into or

unwinding various derivatives with respect to the common stock

and/or by purchasing or selling shares of the common stock or other

securities of Plug Power in secondary market transactions following

the pricing of the notes and prior to the maturity of the notes

(and are likely to do so during any observation period related to a

conversion of the notes). This activity could also cause or avoid

an increase or a decrease in the market price of the common stock

or the notes, which could affect the ability of holders of notes to

convert the notes and, to the extent the activity occurs during any

observation period related to a conversion of the notes, it could

affect the number of shares of common stock and value of the

consideration that holders of notes will receive upon conversion of

the notes.

Plug Power expects to use the remainder of the net proceeds of

the offering of the notes to fund “eligible green projects,”

designed to contribute to selected sustainable development goals as

defined by the United Nations, and for working capital and other

general corporate purposes, which may include potential

acquisitions and strategic transactions.

In connection with the pricing of the notes, Plug Power also

expects to extend the maturity of the prepaid forward stock

purchase transaction (the “prepaid forward”) that Plug Power

previously entered into with a financial institution in connection

with the issuance of the 2023 notes. The prepaid forward is

intended to allow investors to establish short positions that

generally correspond to (but may be greater than) commercially

reasonable initial hedges of their investment in the notes. In the

event of such greater initial hedges, investors may offset such

greater portion by purchasing the common stock on the day of

pricing of the notes. Facilitating investors’ hedge positions by

extending the maturity of the prepaid forward, particularly if

investors purchase the common stock on the pricing date, could

increase (or reduce the size of any decrease in) the market price

of the common stock and effectively raise the conversion price of

the notes. In addition, Plug Power expects that the forward

counterparty or its affiliates may modify their hedge position by

entering into or unwinding one or more derivative transactions with

respect to the common stock and/or purchasing or selling the common

stock or other securities of Plug Power in secondary market

transactions at any time following the pricing of the notes and

prior to the maturity of the notes. These activities could

also cause or avoid an increase or a decrease in the market price

of the common stock or the notes.

The notes will only be offered to qualified institutional buyers

pursuant to Rule 144A under the Securities Act. Neither the notes

nor the shares of Plug Power’s common stock potentially issuable

upon conversion of the notes, if any, have been, or will be,

registered under the Securities Act or the securities laws of any

other jurisdiction, and unless so registered, may not be offered or

sold in the United States except pursuant to an applicable

exemption from such registration requirements.

This announcement is neither an offer to sell nor a solicitation

of an offer to buy any of these securities and shall not constitute

an offer, solicitation or sale in any jurisdiction in which such

offer, solicitation or sale is unlawful.

Cautionary Language Concerning Forward-Looking

Statements

This press release contains “forward-looking statements” within

the meaning of the “safe harbor” provisions of the Private

Securities Litigation Reform Act of 1995, including but not limited

to, statements regarding the proposed terms of the notes, the size

of the offering, including the option to purchase additional notes

to the initial purchasers, the extent, and potential effects, of

the capped call transactions, the repurchases of the 2023 notes,

the extension of the prepaid forwards, the potential dilution to

Plug Power’s common stock, the conversion price for the notes and

the expected use of the proceeds from the sale of the notes, and

other statements contained in this press release that are not

historical facts. These forward-looking statements are made as of

the date they were first issued and were based on current

expectations, estimates, forecasts and projections as well as the

beliefs and assumptions of management. Words such as “expect,”

“anticipate,” “should,” “believe,” “hope,” “target,” “project,”

“goals,” “estimate,” “potential,” “predict,” “may,” “will,”

“might,” “could,” “intend,” “shall” and variations of these terms

or the negative of these terms and similar expressions are intended

to identify these forward-looking statements. Forward-looking

statements are subject to a number of risks and uncertainties, many

of which involve factors or circumstances that are beyond Plug

Power’s control. Plug Power’s actual results could differ

materially from those stated or implied in forward-looking

statements due to a number of factors, including but not limited

to, risks detailed in Plug Power’s filings and reports with

the Securities and Exchange Commission (“SEC”), including

its Annual Report on Form 10-K for the year ended December 31,

2019, Quarterly Report on Form 10-Q for the quarter

ended March 31, 2020 as well as other filings and reports that

may be filed by Plug Power from time to time with the SEC.

Plug Power anticipates that subsequent events and developments will

cause its views to change. Plug Power undertakes no

intention or obligation to update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise. These forward-looking statements should not be relied

upon as representing Plug Power’s views as of any date subsequent

to the date of this press release.

Media Contact Ian MartoranaThe Bulleit

Group(415) 237-3681plugpowerPR@bulleitgroup.com

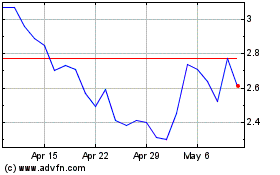

Plug Power (NASDAQ:PLUG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Plug Power (NASDAQ:PLUG)

Historical Stock Chart

From Apr 2023 to Apr 2024