Tender Offer Statement by Issuer (sc To-i)

August 29 2022 - 9:02AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

TENDER OFFER STATEMENT UNDER SECTION 14(d)(1) or 13(e)(1) OF THE SECURITIES EXCHANGE ACT OF 1934

Playtika Holding Corp.

(Name of Subject Company (Issuer) and Filing Person (Offeror))

Common Stock, $0.01 par value

(Title of Class of Securities)

72815L 107

(CUSIP Number

of Class of Securities)

Robert Antokol

Chief Executive Officer

c/o Playtika Ltd.

HaChoshlim St 8

Herzliya

Pituach, Israel

972-73-316-3251

(Name, address and telephone number of person authorized to receive notices and communications on behalf of filing person)

Copies to:

|

|

|

| Michael A. Treska

Darren Guttenberg

Latham & Watkins LLP

650 Town Center Drive, 20th Floor

Costa Mesa, CA 92626 (714) 540-1235 |

|

Michael Cohen

Chief Legal Officer and

Secretary c/o Playtika Ltd.

HaChoshlim St 8 Herzliya

Pituach, Israel

972-73-316-3251

|

| ☐ |

Check the box if the filing relates solely to preliminary communications made before the commencement of a

tender offer. |

Check the appropriate boxes below to designate any transactions to which the statement relates:

| |

☐ |

third-party tender offer subject to Rule 14d-1. |

| |

☒ |

issuer tender offer subject to Rule 13e-4. |

| |

☐ |

going-private transaction subject to Rule 13e-3. |

| |

☐ |

amendment to Schedule 13D under Rule 13d-2. |

Check the following box if the filing is a final amendment reporting the results of the tender offer: ☐

If applicable, check the appropriate box(es) below to designate the appropriate rule provision(s) relied upon:

| |

☐ |

Rule 13e-4(i) (Cross-Border Issuer Tender Offer) |

| |

☐ |

Rule 14d-1(d) (Cross-Border Third Party Tender Offer)

|

SCHEDULE TO

This Tender Offer Statement on Schedule TO relates to the offer by Playtika Holding Corp., a Delaware corporation (“Playtika” or the

“Company”), to purchase up to 51,813,472 shares of its common stock, par value $0.01 per share (the “Shares”), at a price of $11.58 per Share, as defined in the Offer to Purchase (defined below), to the seller in cash, less any

applicable withholding taxes and without interest. The Company’s offer is being made upon the terms and subject to the conditions set forth in the Offer to Purchase, dated August 29, 2022 (together with any amendments or supplements

thereto, the “Offer to Purchase”), the related Letter of Transmittal (together with any amendments or supplements thereto, the “Letter of Transmittal”) and other related materials as may be amended or supplemented from time to

time (collectively, with the Offer to Purchase and the Letter of Transmittal, the “Tender Offer”). This Tender Offer Statement on Schedule TO is intended to satisfy the reporting requirements of Rule

13e-4(c)(2) under the Securities Exchange Act of 1934, as amended.

The information in the Offer to Purchase and

the Letter of Transmittal, copies of which are filed with this Schedule TO as Exhibits (a)(1)(A) and (a)(1)(B), respectively, are incorporated by reference in answer to Items 1 through 11 in this Tender Offer Statement on Schedule TO.

The information set forth under Item 8.01 of the Current Report on Form 8-K filed by the Company on August 24,

2022 (including all exhibits attached thereto and incorporated therein by reference) is incorporated herein by reference.

| ITEM 1. |

SUMMARY TERM SHEET. |

The information set forth in the section captioned “Summary Term Sheet” of the Offer to Purchase, a copy of which is filed with this Schedule TO as

Exhibit (a)(1)(A), is incorporated herein by reference.

| ITEM 2. |

SUBJECT COMPANY INFORMATION. |

(a) Name and Address: The name of the subject company is Playtika Holding Corp., a Delaware corporation. The address and telephone number of its

principal executive offices are: HaChoshlim St 8, Herzliya Pituach, Israel (972-73-316-3251149). The information set forth in

Section 9 (“Certain Information Concerning Us”) of the Offer to Purchase is incorporated herein by reference.

(b) Securities: The

information set forth in the section of the Offer to Purchase captioned “Introduction” and in Section 10 (“Interests of Directors and Executive Officers; Transactions and Arrangements Concerning the Shares”) of the Offer to

Purchase is incorporated herein by reference.

(c) Trading Market and Price: The information set forth in the section of the Offer to Purchase

captioned “Introduction” and Section 7 (“Price Range of Shares; Dividends”) of the Offer to Purchase is incorporated herein by reference.

| ITEM 3. |

IDENTITY AND BACKGROUND OF FILING PERSON. |

(a) Name and Address: The name of the filing person is Playtika Holding Corp., a Delaware corporation. The address and telephone number of its principal

executive offices are: HaChoshlim St 8, Herzliya Pituach, Israel (972-73-316-3251149). The information set forth in

Section 9 (“Certain Information Concerning Us”) and Section 10 (“Interests of Directors and Executive Officers; Transactions and Arrangements Concerning the Shares”) of the Offer to Purchase and in Schedule I to the

Offer to Purchase is incorporated herein by reference.

| ITEM 4. |

TERMS OF THE TRANSACTION. |

(a) Material Terms: The information set forth in the sections of the Offer to Purchase captioned “Introduction” and “Summary Term

Sheet,” and in Section 1 (“Number of Shares; Price; Proration”), Section 2 (“Purpose of the Offer; Background of the Offer; Reasons for the Offer; Certain Effects of the Offer; Plans and Proposals”), Section 3

(“Procedures for Tendering Shares”), Section 4 (“Withdrawal Rights”), Section 5 (“Purchase of Shares

and Payment of Purchase Price”), Section 6 (“Conditions of the Offer”), Section 8 (“Source and Amount of Funds”), Section 10 (“Interests of Directors

and Executive Officers; Transactions and Arrangements Concerning the Shares”), Section 12 (“Certain U.S. Federal Income Tax and Israeli Income Tax Considerations”), Section 13 (“Extension of the Offer; Termination;

Amendment”) and Section 15 (“Miscellaneous”) of the Offer to Purchase is incorporated herein by reference.

(b) Purchases: The

information set forth in Section 10 (“Interests of Directors and Executive Officers; Transactions and Arrangements Concerning the Shares”) of the Offer to Purchase is incorporated herein by reference.

| ITEM 5. |

PAST CONTRACTS, TRANSACTIONS, NEGOTIATIONS AND AGREEMENTS. |

(a) Agreements Involving the Subject Company’s Securities: The information set forth in Section 10 (“Interests of Directors and Executive

Officers; Transactions and Arrangements Concerning the Shares”) of the Offer to Purchase is incorporated herein by reference.

| ITEM 6. |

PURPOSES OF THE TRANSACTION AND PLANS OR PROPOSALS. |

(a) Purposes: The information set forth in the section of the Offer to Purchase captioned “Summary Term Sheet” and in Section 2

(“Purpose of the Offer; Background of the Offer; Reasons for the Offer; Certain Effects of the Offer; Plans and Proposals”) of the Offer to Purchase is incorporated herein by reference.

(b) Use of the Securities Acquired: The information set forth in Section 2 (“Purpose of the Offer; Certain Effects of the Offer; Plans and

Proposals”) of the Offer to Purchase is incorporated herein by reference.

(c) Plans: The information set forth in Section 2

(“Purpose of the Offer; Background of the Offer; Reasons for the Offer; Certain Effects of the Offer; Plans and Proposals”) of the Offer to Purchase is incorporated herein by reference.

| ITEM 7. |

SOURCE AND AMOUNT OF FUNDS OR OTHER CONSIDERATION. |

(a) Source of Funds: The information set forth in the section of the Offer to Purchase captioned “Summary Term Sheet” and in Section 8

(“Source and Amount of Funds”) of the Offer to Purchase is incorporated herein by reference.

(b) Conditions: The information set forth

in the section of the Offer to Purchase captioned “Summary Term Sheet” and in Section 8 (“Source and Amount of Funds”) of the Offer to Purchase is incorporated herein by reference.

(c) Borrowed Funds: The information set forth in the section of the Offer to Purchase captioned “Summary Term Sheet” and in Section 8

(“Source and Amount of Funds”) of the Offer to Purchase is incorporated herein by reference.

| ITEM 8. |

INTEREST IN SECURITIES OF THE SUBJECT COMPANY. |

(a) Securities Ownership: The information set forth in Section 10 (“Interests of Directors and Executive Officers; Transactions and

Arrangements Concerning the Shares”) of the Offer to Purchase is incorporated herein by reference.

(b) Securities Transactions: The

information set forth in Section 10 (“Interests of Directors and Executive Officers; Transactions and Arrangements Concerning the Shares”) of the Offer to Purchase is incorporated herein by reference.

| ITEM 9. |

PERSONS/ASSETS, RETAINED, EMPLOYED, COMPENSATED OR USED. |

(a) Solicitations or Recommendations: The information set forth in Section 14 (“Fees and Expenses”) of the Offer to Purchase is

incorporated herein by reference.

| ITEM 10. |

FINANCIAL STATEMENTS. |

(a) and (b) Not applicable.

| ITEM 11. |

ADDITIONAL INFORMATION. |

(a) Agreements, Regulatory Requirements and Legal Proceedings: The information set forth in Section 2 (“Purpose of the Offer; Background of

the Offer; Reasons for the Offer; Certain Effects of the Offer; Plans and Proposals”), Section 10 (“Interests of Directors and Executive Officers; Transactions and Arrangements Concerning the Shares”) and Section 11

(“Certain Legal Matters; Regulatory Approvals”) of the Offer to Purchase is incorporated herein by reference.

(b) Other Material

Information: The information in the Offer to Purchase and the Letter of Transmittal, copies of which are filed with this Schedule TO as Exhibits (a)(1)(A) and (a)(1)(B), respectively, is incorporated herein by reference.

|

|

|

| EXHIBIT NUMBER |

|

DESCRIPTION |

|

|

| (a)(1)(A) |

|

Offer to Purchase, dated August 29, 2022. |

|

|

| (a)(1)(B) |

|

Letter of Transmittal (including IRS Form W-9). |

|

|

| (a)(1)(C) |

|

Notice of Guaranteed Delivery. |

|

|

| (a)(1)(D) |

|

Letter to Brokers, Dealers, Banks, Trust Companies and Other Nominees, dated August 29, 2022. |

|

|

| (a)(1)(E) |

|

Letter to Clients for use by Brokers, Dealers, Banks, Trust Companies and Other Nominees, dated August 29, 2022. |

|

|

| (a)(1)(F) |

|

Summary Advertisement, dated August 29, 2022. |

|

|

| (a)(1)(G) |

|

Form of Notice of Withdrawal. |

|

|

| (a)(1)(H) |

|

Email Communication to Employees. |

|

|

| (a)(2) |

|

Not applicable. |

|

|

| (a)(3) |

|

Not applicable. |

|

|

| (a)(4) |

|

Not applicable. |

|

|

| (a)(5) |

|

Press Release, dated August 29, 2022. |

|

|

| (b) |

|

None. |

|

|

| (d)(1) |

|

Playtika Holding Corp. 2021-2024 Retention Plan (incorporated herein by reference to Exhibit 10.9 to the Company’s Registration Statement

on Form S-1, as filed with the SEC on December 18, 2020). |

|

|

| (d)(2) |

|

Form of Executive Retention Award Agreement under 2021-2024 Playtika Holding Corp. Retention Plan (incorporated herein by reference to Exhibit

10.11 to the Company’s Registration Statement on Form S-1, as filed with the SEC on December 18, 2020). |

|

|

| (d)(3) |

|

Form of Executive Appreciation Unit Award Agreement under 2021-2024 Playtika Holding Corp. Retention Plan (incorporated herein by reference to

Exhibit 10.13 to the Company’s Registration Statement on Form S-1, as filed with the SEC on December 18, 2020). |

|

|

| (d)(4) |

|

Form of Amendment to Playtika Holding Corp. 2021-2024 Retention Plan Agreements dated June

26, 2020 with U.S. Executives (incorporated herein by reference to Exhibit 10.15 to the Company’s Registration Statement on Form S-1, as filed with the SEC on December 18,

2020). |

|

|

|

| (d)(5) |

|

Amendment to Appreciation Unit Award Agreements under 2021-2024 Playtika Holding Corp. Retention Plan between Playtika Holding Corp. and Robert

Antokol (incorporated herein by reference to Exhibit 10.16 to the Company’s Registration Statement on Form S-1, as filed with the SEC on December 18, 2020). |

|

|

| (d)(6) |

|

2020 Incentive Award Plan, including Sub-Plan for Israeli Participants (incorporated herein by reference

to Exhibit 10.17 to the Company’s Registration Statement on Form S-1, as filed with the SEC on December 18, 2020). |

|

|

| (d)(7) |

|

Amendment No.

1 to Playtika Holding Corp. 2020 Incentive Award Plan (incorporated herein by reference to Exhibit 10.18 to the Company’s Registration Statement on Form S-1, as filed with the SEC on December

18, 2020). |

|

|

| (d)(8) |

|

Form of Restricted Stock Unit Agreement under 2020 Incentive Award Plan (incorporated herein by reference to Exhibit 10.19 to the Company’s

Registration Statement on Form S-1, as filed with the SEC on December 18, 2020). |

|

|

| (d)(9) |

|

Form of Restricted Stock Unit Agreement for Israeli Participants under 2020 Incentive Award Plan (incorporated by reference herein to Exhibit

10.20 to the Company’s Registration Statement on Form S-1, as filed with the SEC on December 18, 2020). |

|

|

| (d)(10) |

|

Form of Stock Option Agreement under 2020 Incentive Award Plan (incorporated herein by reference to Exhibit 10.21 to the Company’s Registration

Statement on Form S-1, as filed with the SEC on December 18, 2020). |

|

|

| (d)(11) |

|

Form of Stock Option Agreement for Israeli Participants under 2020 Incentive Award Plan (incorporated herein by reference to Exhibit 10.22 to

the Company’s Registration Statement on Form S-1, as filed with the SEC on December 18, 2020). |

|

|

| (d)(12) |

|

Employee Stock Purchase Plan (incorporated herein by reference to Exhibit 10.23 to Amendment No.

1 to the Company’s Registration Statement on Form S-1, as filed with the SEC on January 7, 2021). |

|

|

| (d)(13) |

|

Employment Agreement, dated as of December

20, 2011, by and between Playtika Ltd. and Robert Antokol (incorporated herein by reference to Exhibit 10.27 to the Company’s Registration Statement on Form S-1, as filed with the SEC on December

18, 2020). |

|

|

| (d)(14) |

|

Employment Agreement, dated as of March

15, 2017, by and between Playtika Ltd. and Nir Korczak (incorporated herein by reference to Exhibit 10.29 to the Company’s Registration Statement on Form S-1, as filed with the SEC on December

18, 2020). |

|

|

| (d)(15) |

|

Employment Agreement, dated as of April 2, 2018, by and between Playtika Ltd. and Yael

Yehudai (incorporated herein by reference to Exhibit 10.30 to the Company’s Registration Statement on Form S-1, as filed with the SEC on December 18, 2020). |

|

|

| (d)(16) |

|

Employment Agreement, dated as of December

4, 2011, by and between Playtika Ltd. and Shlomi Aizenberg (incorporated herein by reference to Exhibit 10.31 to the Company’s Registration Statement on Form S-1, as filed with the SEC on December

18, 2020). |

|

|

| (d)(17) |

|

Employment Agreement, dated as of May

25, 2011, by and between Playtika Ltd. and Ofer Kinberg (incorporated herein by reference to Exhibit 10.32 to the Company’s Registration Statement on Form S-1, as filed with the SEC on December

18, 2020). |

|

|

| (d)(18) |

|

Amendment to Employment Agreement, dated as of December

15, 2014, by and between Playtika Ltd. and Ofer Kinberg (incorporated herein by reference to Exhibit 10.32.1 to the Company’s Registration Statement on Form S-1, as filed with the SEC on December

18, 2020). |

|

|

| (d)(19) |

|

Employment Agreement, dated as of August

17, 2016, by and between Playtika Ltd. and Erez Rachmil (incorporated herein by reference to Exhibit 10.1# to the Company’s Quarter Report on Form 10-Q, as filed with the SEC on November 4,

2021). |

|

|

|

| (d)(20) |

|

Form of Performance Stock Unit Agreement under 2020 Incentive Award Plan (incorporated herein by reference to Exhibit 10.1 to the Company’s Current

Report on Form 8-K, as filed with the SEC on February 10, 2022). |

|

|

| (d)(21) |

|

Form of Performance Stock Unit Agreement for Israeli Participants under 2020 Incentive Award Plan (incorporated herein by reference to Exhibit 10.2 to

the Company’s Current Report on Form 8-K, as filed with the SEC on February 10, 2022). |

|

|

| (d)(22) |

|

Employment Agreement, dated as of December

6, 2016, by and between Playtika Ltd. and Eric Rapps (incorporated herein by reference to Exhibit 10.29 to the Company’s Annual Report on Form 10-K, as filed with the SEC on March 1, 2022). |

|

|

| (d)(23) |

|

Tender Agreement, dated August 26, 2022. |

|

|

| (g) |

|

None. |

|

|

| (h) |

|

None. |

|

|

| (107) |

|

Filing Fee Table. |

| ITEM 13. |

INFORMATION REQUIRED BY SCHEDULE 13E-3. |

Not applicable.

SIGNATURE

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

|

|

|

|

|

|

|

|

|

|

|

Playtika Holding Corp. |

|

|

|

| Date: August 29, 2022 |

|

|

|

By: /s/ Craig Abrahams |

|

|

|

|

Craig Abrahams |

|

|

|

|

President and Chief Financial Officer |

INDEX TO EXHIBITS

|

|

|

| EXHIBIT NUMBER |

|

DESCRIPTION |

|

|

| (a)(1)(A) |

|

Offer to Purchase, dated August 29, 2022. |

|

|

| (a)(1)(B) |

|

Letter of Transmittal (including IRS Form W-9). |

|

|

| (a)(1)(C) |

|

Notice of Guaranteed Delivery. |

|

|

| (a)(1)(D) |

|

Letter to Brokers, Dealers, Banks, Trust Companies and Other Nominees, dated August 29, 2022. |

|

|

| (a)(1)(E) |

|

Letter to Clients for use by Brokers, Dealers, Banks, Trust Companies and Other Nominees, dated August 29, 2022. |

|

|

| (a)(1)(F) |

|

Summary Advertisement, dated August 29, 2022. |

|

|

| (a)(1)(G) |

|

Form of Notice of Withdrawal. |

|

|

| (a)(1)(H) |

|

Email Communication to Employees. |

|

|

| (a)(2) |

|

Not applicable. |

|

|

| (a)(3) |

|

Not applicable. |

|

|

| (a)(4) |

|

Not applicable. |

|

|

| (a)(5) |

|

Press Release, dated August 29, 2022. |

|

|

| (b) |

|

None. |

|

|

| (d)(1) |

|

Playtika Holding Corp. 2021-2024 Retention Plan (incorporated herein by reference to Exhibit 10.9 to the Company’s Registration Statement on Form S-1, as filed with the SEC on

December 18, 2020). |

|

|

| (d)(2) |

|

Form of Executive Retention Award Agreement under 2021-2024 Playtika Holding Corp. Retention Plan (incorporated herein by reference to Exhibit 10.11 to the Company’s Registration Statement on Form

S-1, as filed with the SEC on December 18, 2020). |

|

|

| (d)(3) |

|

Form of Executive Appreciation Unit Award Agreement under 2021-2024 Playtika Holding Corp. Retention Plan (incorporated herein by reference to Exhibit 10.13 to the Company’s Registration Statement on Form S-1, as filed with the SEC on December 18, 2020). |

|

|

| (d)(4) |

|

Form of Amendment to Playtika Holding Corp. 2021-2024 Retention Plan Agreements dated June 26, 2020 with U.S. Executives (incorporated herein by reference to Exhibit 10.15 to the Company’s Registration Statement on Form S-1, as filed with the SEC on December 18, 2020). |

|

|

| (d)(5) |

|

Amendment to Appreciation Unit Award Agreements under 2021-2024 Playtika Holding Corp. Retention Plan between Playtika Holding Corp. and Robert Antokol (incorporated herein by reference to Exhibit 10.16 to the Company’s

Registration Statement on Form S-1, as filed with the SEC on December 18, 2020). |

|

|

| (d)(6) |

|

2020 Incentive Award Plan, including Sub-Plan for Israeli Participants (incorporated herein by reference to Exhibit 10.17 to the Company’s Registration Statement on Form S-1, as filed with the SEC on December 18, 2020). |

|

|

| (d)(7) |

|

Amendment No. 1 to Playtika Holding Corp. 2020 Incentive Award Plan (incorporated herein by reference to Exhibit 10.18 to the Company’s Registration Statement on Form S-1, as

filed with the SEC on December 18, 2020). |

|

|

| (d)(8) |

|

Form of Restricted Stock Unit Agreement under 2020 Incentive Award Plan (incorporated herein by reference to Exhibit 10.19 to the Company’s Registration Statement on Form S-1, as

filed with the SEC on December 18, 2020). |

|

|

|

| (d)(9) |

|

Form of Restricted Stock Unit Agreement for Israeli Participants under 2020 Incentive Award Plan (incorporated by reference herein to Exhibit 10.20 to the Company’s Registration Statement on Form

S-1, as filed with the SEC on December 18, 2020). |

|

|

| (d)(10) |

|

Form of Stock Option Agreement under 2020 Incentive Award Plan (incorporated herein by reference to Exhibit 10.21 to the Company’s Registration Statement on Form S-1, as filed with the

SEC on December 18, 2020). |

|

|

| (d)(11) |

|

Form of Stock Option Agreement for Israeli Participants under 2020 Incentive Award Plan (incorporated herein by reference to Exhibit 10.22 to the Company’s Registration Statement on Form

S-1, as filed with the SEC on December 18, 2020). |

|

|

| (d)(12) |

|

Employee Stock Purchase Plan (incorporated herein by reference to Exhibit 10.23 to Amendment No. 1 to the Company’s Registration Statement on Form S-1, as filed with the SEC on

January 7, 2021). |

|

|

| (d)(13) |

|

Employment Agreement, dated as of December 20, 2011, by and between Playtika Ltd. and Robert Antokol (incorporated herein by reference to Exhibit 10.27 to the Company’s Registration Statement on Form S-1, as filed with the SEC on December 18, 2020). |

|

|

| (d)(14) |

|

Employment Agreement, dated as of March 15, 2017, by and between Playtika Ltd. and Nir Korczak (incorporated herein by reference to Exhibit 10.29 to the Company’s Registration Statement on Form S-1, as filed with the SEC on December 18, 2020). |

|

|

| (d)(15) |

|

Employment Agreement, dated as of April 2, 2018, by and between Playtika Ltd. and Yael Yehudai (incorporated herein by reference to Exhibit 10.30 to the Company’s Registration Statement on Form S-1, as filed with the SEC on December 18, 2020). |

|

|

| (d)(16) |

|

Employment Agreement, dated as of December 4, 2011, by and between Playtika Ltd. and Shlomi Aizenberg (incorporated herein by reference to Exhibit 10.31 to the Company’s Registration Statement on Form S-1, as filed with the SEC on December 18, 2020). |

|

|

| (d)(17) |

|

Employment Agreement, dated as of May 25, 2011, by and between Playtika Ltd. and Ofer Kinberg (incorporated herein by reference to Exhibit 10.32 to the Company’s Registration Statement on Form S-1, as filed with the SEC on December 18, 2020). |

|

|

| (d)(18) |

|

Amendment to Employment Agreement, dated as of December 15, 2014, by and between Playtika Ltd. and Ofer Kinberg (incorporated herein by reference to Exhibit 10.32.1 to the Company’s Registration Statement on Form S-1, as filed with the SEC on December 18, 2020). |

|

|

| (d)(19) |

|

Employment Agreement, dated as of August 17, 2016, by and between Playtika Ltd. and Erez Rachmil (incorporated herein by reference to Exhibit 10.1# to the Company’s Quarter Report on Form

10-Q, as filed with the SEC on November 4, 2021). |

|

|

| (d)(20) |

|

Form of Performance Stock Unit Agreement under 2020 Incentive Award Plan (incorporated herein by reference to Exhibit 10.1 to the Company’s Current Report on Form 8-K, as filed with the

SEC on February 10, 2022). |

|

|

| (d)(21) |

|

Form of Performance Stock Unit Agreement for Israeli Participants under 2020 Incentive Award Plan (incorporated herein by reference to Exhibit 10.2 to the Company’s Current Report on Form

8-K, as filed with the SEC on February 10, 2022). |

|

|

| (d)(22) |

|

Employment Agreement, dated as of December 6, 2016, by and between Playtika Ltd. and Eric Rapps (incorporated herein by reference to Exhibit 10.29 to the Company’s Annual Report on Form 10-K, as filed with the SEC on March

1, 2022). |

|

|

| (d)(23) |

|

Tender Agreement, dated August 26, 2022. |

|

|

| (g) |

|

None. |

|

|

| (h) |

|

None. |

|

|

| (107) |

|

Filing Fee Table. |

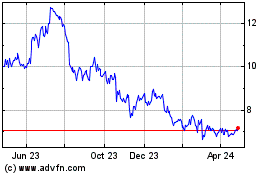

Playtika (NASDAQ:PLTK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Playtika (NASDAQ:PLTK)

Historical Stock Chart

From Apr 2023 to Apr 2024