As filed with the Securities and Exchange

Commission on April 7, 2022

Registration No. 333-259619

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

PRE-EFFECTIVE AMENDMENT NO. 5

TO

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

ShiftPixy, Inc.

(Exact name of registrant as specified in its

charter)

| Wyoming |

47-4211438 |

(State or other jurisdiction

of

incorporation or organization) |

(I.R.S. Employer

Identification Number) |

501 Brickell Key Drive, Suite 300

Miami, FL 33131

(888) 798-9100

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Scott W. Absher

Chief Executive Officer

501 Brickell Key Drive. Suite 300

Miami, FL 33131

(888) 798-9100

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

Copies to:

Ivan K. Blumenthal, Esq.

Daniel A. Bagliebter, Esq.

Mintz, Levin, Cohn, Ferris, Glovsky and Popeo,

P.C.

666 Third Avenue

New York, New York 10017

(212) 935-3000

If

the only securities being registered on this form are being offered pursuant to dividend or interest reinvestment plans, please check

the following box. ¨

If

any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under

the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the

following box. x

If

this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please

check the following box and list the Securities Act registration statement number of the earlier effective registration statement for

the same offering. ¨

If

this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and

list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If

this form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective

upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ¨

If

this form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional

securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ¨

Indicate by check mark whether

the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging

growth company. See the definitions of “large accelerated filer,” “accelerated filer” “smaller reporting

company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| |

Large

accelerated filer ¨ |

Accelerated

filer ¨ |

| |

Non-accelerated

filter x |

Smaller

reporting company x |

| |

|

|

| |

Emerging

growth company x |

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨

The Registrant hereby amends this Registration

Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which

specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the

Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to

said Section 8(a), may determine.

The information in this prospectus

is not complete and may be changed. A registration statement relating to these securities has been filed with the Securities and

Exchange Commission. The selling shareholders may not sell these securities until the Securities and Exchange Commission declares

the registration statement effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to

buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED

APRIL 7, 2022

PROSPECTUS

15,423,200 Shares of Common Stock

The selling shareholders

of ShiftPixy, Inc. (“ShiftPixy,” “we,” “us” or the “Company”) listed beginning on

page 18 of this prospectus may offer and resell under this prospectus (i) up to 2,850,000 shares of our common stock, par value

$0.0001 per share (the “Common Stock”), and (ii) up to 12,573,200 shares of our Common Stock issuable upon exercise

of warrants, including pre-funded warrants and warrants issued by the Registrant to A.G.P./Alliance Global Partners and its affiliates

for compensation as placement agent in connection with the transactions described herein (collectively, the “Warrants”) acquired

by the selling shareholders under the Securities Purchase Agreement (the “Purchase Agreement”), dated August 31, 2021,

by and among the Company and the investor listed therein (the “Investor”) and the Placement Agent Agreement, dated August 31,

2021, by and between the Company and A.G.P./Alliance Global Partners (the “Placement Agent Agreement”).

We are registering the resale

of the shares of Common Stock covered by this prospectus as required by the Purchase Agreement and Placement Agent Agreement. The

selling shareholders will receive all of the proceePursuant to the requirements of the Securities Act of 1933, the registrant has duly

caused this registration statementds from any sales of the shares offered hereby. We will not receive any of the proceeds, but

we will incur expenses in connection with the offering. To the extent the Warrants are exercised for cash, if at all, we will receive

the exercise price of the Warrants.

The selling shareholders

may sell these shares through public or private transactions at market prices prevailing at the time of sale or at negotiated prices.

The timing and amount of any sale are within the sole discretion of the selling shareholders. Our registration of the shares of

Common Stock covered by this prospectus does not mean that the selling shareholders will offer or sell any of the shares. For further

information regarding the possible methods by which the shares may be distributed, see “Plan of Distribution” beginning on

page 22 of this prospectus.

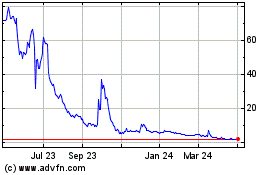

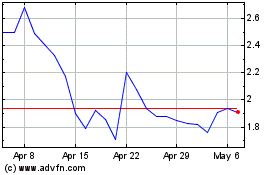

Our Common Stock is listed

on The Nasdaq Capital Market under the symbol “PIXY.” The last reported sale price of our Common Stock on April 6, 2022 was

$0.63 per share.

Investing in our Common

Stock is highly speculative and involves a significant degree of risk. Please consider carefully the specific factors set forth

under “Risk Factors” beginning on page 10 of this prospectus and in our filings with the Securities and Exchange

Commission.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy

or adequacy of the disclosures in this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is

, 2022

ABOUT THIS PROSPECTUS

This prospectus is part

of a registration statement that we have filed with the U.S. Securities and Exchange Commission (the “SEC”) pursuant to which

the selling shareholders named herein may, from time to time, offer and sell or otherwise dispose of the shares of our Common Stock covered

by this prospectus. You should not assume that the information contained in this prospectus is accurate on any date subsequent

to the date set forth on the front cover of this prospectus or that any information we have incorporated by reference is correct on any

date subsequent to the date of the document incorporated by reference, even though this prospectus is delivered or shares of Common Stock

are sold or otherwise disposed of on a later date. It is important for you to read and consider all information contained in this

prospectus, including the documents incorporated by reference therein, in making your investment decision. You should also read

and consider the information in the documents to which we have referred you under “Where You Can Find Additional Information”

and “Information Incorporated by Reference” in this prospectus.

We have not authorized anyone

to give any information or to make any representation to you other than those contained or incorporated by reference in this prospectus.

You must not rely upon any information or representation not contained or incorporated by reference in this prospectus. This prospectus

does not constitute an offer to sell or the solicitation of an offer to buy any of our shares of Common Stock other than the shares of

our Common Stock covered hereby, nor does this prospectus constitute an offer to sell or the solicitation of an offer to buy any securities

in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction. Persons who come

into possession of this prospectus in jurisdictions outside the United States are required to inform themselves about, and to observe,

any restrictions as to the offering and the distribution of this prospectus applicable to those jurisdictions.

Unless we have indicated

otherwise, or the context otherwise requires, references in this prospectus to “ShiftPixy,” the “Company,” “we,”

“us” and “our” refer to ShiftPixy, Inc.

PROSPECTUS

SUMMARY

This summary description

about us and our business highlights selected information contained elsewhere in this prospectus or incorporated by reference into this

prospectus. It does not contain all the information you should consider before investing in our securities. Important information

is incorporated by reference into this prospectus. To understand this offering fully, you should read carefully the entire prospectus,

including “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements,” together with the additional

information described under “Information Incorporated by Reference.”

Overview

We are a human capital

management (“HCM”) platform that provides real-time business intelligence along with HR services on a fee-based “software

as a service” (“SAAS”) business model. We provide human resources, employment compliance, insurance related, payroll,

and operational employment services solutions for our business clients (“clients” or “operators”) and shift work

or “gig” opportunities for worksite employees (“WSEs” or “shifters”). As consideration for providing

these services, we receive administrative or processing fees as a percentage of a client’s gross payroll, process and file payroll

taxes and payroll tax returns, provide workers’ compensation coverage and administration related services, and provide employee

benefits. The level of our administrative fees is dependent on the services provided to our clients which ranges from basic payroll processing

to a full suite of human resources information systems (“HRIS”) technology. Our primary operating business metric is gross

billings, consisting of our clients’ fully burdened payroll costs, which includes, in addition to payroll, workers’ compensation

insurance premiums, employer taxes, and benefits costs.

Our goal is to be the

best online fully-integrated workforce solution and employer services support platform for lower-wage workers and employment opportunities.

We have built an application and desktop capable marketplace solution that allows for workers to access and apply for job opportunities

created by our clients and to provide traditional back-office services to our clients as well as real-time business information for our

clients’ human capital needs and requirements.

We have designed our

business platform to evolve to meet the needs of a changing workforce and a changing work environment. We believe our approach and robust

technology will benefit from the observed demographic workplace shift away from traditional employee/employer relationships towards the

increasingly flexible work environment that is characteristic of the gig economy. We believe this change in approach began after the

2008 financial crisis and is currently being driven by the labor shortage created out of the COVID-19 economic crisis. We also believe

that a significant problem underpinning the lower wage labor crisis is the sourcing of workers and matching temporary or gig workers

to short-term job opportunities.

We have built our business

on a recurring revenue model since our inception in 2015. Our initial market focus has been to monetize a traditional staffing services

business model, coupled with developed technology, to address underserved markets containing predominately lower wage employees with

high turnover, including the light industrial, food service, restaurant, and hospitality markets.

Although we have recently

expanded into other industries, as noted below, for our fiscal year ended August 31, 2021 (“Fiscal 2021”), our primary focus

was on clients in the restaurant and hospitality industries, market segments traditionally characterized by high employee turnover and

low pay rates. We believe that these industries will be better served by our HRIS technology platform and related mobile smartphone application

that provides payroll and human resources tracking for our clients. The use of our HRIS platform should provide our clients with real-time

human capital business intelligence and we believe will result in lower operating costs, improved customer experience, and revenue growth.

All of our clients enter into service agreements with us or one of our wholly-owned subsidiaries to provide these services.

We believe that our

value proposition is to provide a combination of overall net cost savings to our clients, for which they are willing to pay increased

administrative fees that offset the costs of the services we provide, as follows:

| |

• |

Payroll

tax compliance and management services; |

| |

• |

Governmental

HR compliance such as for Patient Protection and Affordable Care Act (“ACA”) compliance requirements; |

| |

• |

Reduced

client workers’ compensation premiums or enhanced coverage; |

| |

• |

Access

to an employee pool of potential qualified applicants to reduce turnover costs; |

| |

• |

Ability

to fulfill temporary worker requirements in a “tight” labor market with our intermediation (“job matching”)

services; and |

| |

• |

Reduced

screening and onboarding costs due to access to an improved pool of qualified applicants who can be onboarded through a highly advanced,

efficient, and virtually paperless technology platform. |

We believe that providing

this baseline business, coupled with our technology solution, provides a unique, value-added solution to the HR compliance, staffing,

and scheduling problems that businesses face. Over the past eighteen months, in the face of the COVID-19 pandemic, we have instituted

various growth initiatives that are designed to accelerate our revenue growth. These initiatives include the matching of temporary job

opportunities between workers and employers under a fully compliant staffing solution through our HRIS platform. For this solution to

be effective, we need to obtain a significant number of WSEs in concentrated geographic areas to fulfill our clients’ unique staffing

needs and facilitate the client-WSE relationship.

The Private Placement

On August 31,

2021, we entered into a Securities Purchase Agreement with Armistice Capital Master Fund Ltd. (“Armistice”), pursuant to

which we issued and sold, in a private placement (the “Offering”), an aggregate of (i) 2,850,000 shares (the “Shares”)

of Common Stock, together with warrants (the “Common Warrants”) to purchase up to 2,850,000 shares of Common Stock, and (ii) 4,673,511

pre-funded warrants (the “Pre-funded Warrants”) with each Pre-funded Warrant exercisable for one share of Common Stock, together

with Common Warrants to purchase up to 4,673,511 shares of Common Stock (collectively, the “Offering”). Each share of Common

Stock and accompanying Common Warrant was sold together at a combined offering price of $1.595, and each Pre-funded Warrant and accompanying

Common Warrant was sold together at a combined offering price of $1.5949. The Pre-funded Warrants are immediately exercisable, at a nominal

exercise price of $0.0001, and may be exercised at any time until all of the Pre-funded Warrants are exercised in full. The Common Warrants

have an exercise price of $1.595 per share, are immediately exercisable and expire five years from the effective date of this registration

statement.

In connection with

the Offering, we entered into a Placement Agent Agreement with A.G.P./Alliance Global Partners (the “Placement Agent”), pursuant

to which the Placement Agent acted as the exclusive placement agent in connection with the Offering. Pursuant to the Placement Agent

Agreement, we agreed to pay the Placement Agent a fee equal to 7.0% of the aggregate gross proceeds from the Offering. In addition to

the cash fee, we agreed to issue to the Placement Agent warrants to purchase an aggregate of up to five percent (5%) of the aggregate

number of Shares and shares of Common Stock issuable upon exercise of the Pre-funded Warrants sold in the Offering (the “Placement

Agent Warrants” and, together with the Common Warrants and the Pre-funded Warrants, the “Warrants”). The Placement

Agent Warrants are exercisable for a period commencing six months from issuance and expiring four years from the effective date of this

registration statement, and have an initial exercise price of $1.7545 per share.

In connection with

the Offering, we are obligated, among other things, to (i) file a registration statement with the SEC within 15 days following the

closing of the Offering for purposes of registering the Shares and the shares of Common Stock issuable upon exercise of the Warrants,

including the Pre-funded Warrants and the Placement Agent Warrants, for resale by the selling shareholders, (ii) use our commercially

reasonable best efforts to have the registration statement declared effective within sixty (60) days after closing of the Offering (or

ninety (90) days after the closing of the Offering if the registration statement is reviewed by the SEC), and (iii) maintain the

registration until the selling shareholder no longer hold any Shares or Warrants, including Pre-funded Warrants and Placement Agent Warrants.

As described in detail

below, a portion of the proceeds of the Offering has been devoted to our funding activities in connection with our sponsorship, through

one of our wholly owned subsidiaries, of Industrial Human Capital, Inc. (“IHC”), our special purpose acquisition company,

or “SPAC,” which consummated its initial public offering on October 22, 2021. We expect to devote a portion of the proceeds

from the exercise of any warrants issued pursuant to the Offering to funding IHC’s initial business combination (“IBC”),

as detailed below. We believe that IHC, upon completing its IBC, will have a material positive impact on our results of operations. Nevertheless,

the failure of IHC to complete its IBC would likely have a material adverse effect on our results of operations and future results. For

further discussion, please refer to the “Risk Factors”, below, including the discussion under the heading “There

is no guarantee that our current cash position, expected revenue growth and anticipated financing transactions will be sufficient to

fund our operations for the next twelve months. Our sponsorship of IHC requires significant capital deployment, entails certain risks

and may not be successful, which would likely have a material adverse effect on our future expansion, revenues, and profits.”

The foregoing descriptions

of the Purchase Agreement, the Placement Agent Agreement, the form of Warrant and the form of Pre-funded Warrant are not complete and

are subject to and qualified in their entirety by reference to the Purchase Agreement, the form of Warrant and the form of Pre-funded

Warrant, respectively, copies of which are attached as Exhibits 10.1, 10.2, 4.1 and 4.2, respectively, to the Current Report on Form 8-K

dated August 31, 2021, and are incorporated herein by reference

Recent Developments

Warrant Exercise

On January 26,

2022, we entered into a Warrant Exercise Agreement (the “Exercise Agreement”) with Armistice to cash exercise certain of

their warrants to purchase up to an aggregate of 4,948,453 shares of Common Stock (the “Existing Warrants”). The Existing

Warrants were initially issued on May 17, 2021 with an exercise price per share of $2.425,

were immediately exercisable and were set to expire on June 15, 2026.

Pursuant to the Exercise Agreement, to induce Armistice to cash exercise the Existing Warrants, (i) the exercise price per share of the

Existing Warrants was reduced to $1.20 and (ii) we issued Armistice a new warrant to purchase up to an aggregate of 9,896,906 shares

of Common Stock (the “New Warrant”), with such New Warrant to be issued on the basis of two New Warrant shares for each share

of the Existing Warrant that is exercised for cash (the “Warrant Exercise”). The New Warrant has an exercise price per share

of $1.55, is exercisable commencing July 28, 2022 and is set to expire on July 28, 2027. We received aggregate gross proceeds of approximately

$5.9 million from the cash exercise of the Existing Warrants. The Existing Warrants and the underlying shares of Common Stock were registered

pursuant to our Registration Statement on Form S-3 (File No. 333-256834), filed with the SEC under the Securities Act of 1933,

as amended (the “Securities Act”), on June 4, 2021, and declared effective on June 15, 2021.

Vensure Litigation

On September 7, 2021,

Shiftable HR Acquisition, LLC, a wholly-owned subsidiary of Vensure Employer Services, Inc. (collectively, “Vensure”), filed

a complaint (the “Complaint”) in the Court of Chancery of the State of Delaware asserting claims against us for breach of

contract and declaratory judgment arising from the January 2020 Asset Purchase Agreement (the “APA”) between Vensure and

us, pursuant to which Vensure purchased certain assets from us for total consideration of $19 million in cash, with $9.5 million to be

paid at closing, and the remainder to be paid in 48 equal monthly installments (the “Installment Sum”). The Complaint does

not specify the amount of damages sought and, in any event, we believe that, even if Vensure were to prevail, the amount recoverable

would be less than the Installment Sum due to us under the APA but unpaid to date after offsetting any such recovery. Nevertheless, we

deny Vensure’s claims and intend to defend the lawsuit vigorously while pursuing recovery of the unpaid Installment Sum from Vensure.

Accordingly, on November 4, 2021, the Company filed its Answer and Counterclaim to Vensure’s Complaint, in which it not only denied

Vensure’s claims, but also asserted counterclaims for breach of contract and tortious interference with contract.

May 2021 Private Placement

On May 13, 2021, we

entered into a Securities Purchase Agreement with Armistice, pursuant to which we issued and sold, in a private placement (the “May

Offering”), an aggregate of (i) 2,320,000 shares (the “May Shares”) of Common Stock, together with warrants (the “May

Common Warrants”) to purchase up to 2,320,000 shares of Common Stock, and (ii) 2,628,453 pre-funded warrants (the “May Pre-funded

Warrants”) with each May Pre-funded Warrant exercisable for one share of Common Stock, together with May Common Warrants to purchase

up to 2,628,453 shares of Common Stock. Each share of Common Stock and accompanying May Common Warrant was sold together at a combined

offering price of $2.425, and each May Pre-funded Warrant and accompanying May Common Warrant was sold together at a combined offering

price of $2.4249. The May Pre-funded Warrants were immediately exercisable, at a nominal exercise price of $0.0001, and may be exercised

at any time until all of the May Pre-funded Warrants are exercised in full. The May Common Warrants had an exercise price of $2.425 per

share, were immediately exercisable and were set to expire on June 15, 2026. The May Common Warrants were exercised in connection with

the Warrant Exercise.

In connection with

the May Offering, we entered into a Placement Agent Agreement (the “May Placement Agent Agreement”) with the Placement Agent,

pursuant to which the Placement Agent acted as the exclusive placement agent in connection with the May Offering. Pursuant to the May

Placement Agent Agreement, we agreed to pay the Placement Agent a fee equal to 7.0% of the aggregate gross proceeds from the May Offering.

In addition to the cash fee, we issued to the Placement Agent warrants to purchase an aggregate of up to five percent (5%) of the aggregate

number of the May Shares and shares of Common Stock issuable upon exercise of the May Pre-funded Warrants sold in the May Offering (the

“May Placement Agent Warrants”). The May Placement Agent Warrants are exercisable for a period commencing on November 17,

2021 and expiring June 15, 2025, and have an initial exercise price of $2.6675 per share.

Sponsorship of Special Purpose Acquisition

Companies

On April 29, 2021,

we announced our sponsorship, through our wholly-owned subsidiary, ShiftPixy Investments, Inc. (“Investments”), of four

SPAC IPOs but have since withdrawn the initial public offering registration statements related to three such SPACs in order to focus

on the growth and expansion of our Company and to completing IHC’s IBC. The registration statement and prospectus relating to the

IHC initial public offering (“IHC IPO”) was declared effective by the SEC on October 19, 2021, and IHC units (the “IHC

Units”), consisting of one share of common stock and an accompanying warrant to purchase one share of IHC common stock, began trading

on the New York Stock Exchange (“NYSE”) on October 20, 2021. The IHC IPO closed on October 22, 2021, raising gross proceeds

of $115 million for IHC. In connection with the IHC IPO, we purchased, through Investments, 4,639,102 private placement warrants at a

price of $1.00 per warrant, for an aggregate purchase price of $4,639,102. IHC currently intends to use the proceeds of the IHC IPO to

acquire companies in the light industrial segment of the staffing industry, and our goal is to enter into one or more CSAs with IHC following

its IBC. Immediately following the IHC IPO, IHC began to evaluate acquisition candidates. IHC has twelve months to complete its

IBC from the closing of the IHC IPO. We currently own, through Investments, approximately 15% of the issued and outstanding stock of

IHC.

We expect to invest

or otherwise extend capital, through Investments, totaling up to approximately $6,164,102 in connection with our sponsorship of IHC,

including $25,000 to purchase founder shares (the “Founder Shares”) (previously paid on February 18, 2021), $4,639,102 to

purchase private placement warrants (previously paid on October 22, 2021) and up to $1.5 million in working capital loans to IHC to finance

transaction costs in connection with IHC’s IBC. To date, we have not extended any such working capital loans, nor have we determined

the terms upon which any such working capital loans would be extended and/or repaid, though up to $1,500,000 of such working capital

loans extended to IHC may be convertible into private placement warrants of IHC’s post business combination entity, at a price

of $1.00 per warrant at our option. If we extend working capital loans to IHC and it does not consummate its IBC, such working capital

loans are unlikely to be repaid.

We expect IHC to operate

as a separately managed, publicly traded entity following the completion of its IBC, or “De-SPAC”. We anticipate entering

into service agreements with IHC’s post business combination staffing entities that will allow it to participate in our HRIS platform.

We believe that our sponsorship of IHC focusing upon its IBC within the staffing industry has the potential to generate significant revenues

and earnings for us.

We may receive up to

approximately $12.66 million in aggregate gross proceeds from cash exercises of the Warrants, based on the per share exercise price of

the Warrants. The holders of the Warrants are not obligated to exercise their Warrants, and we cannot predict whether holders of the

Warrants will choose to exercise all or any of their Warrants. We do not currently have financing plans but we expect to obtain additional

financing in the form of public or private equity offerings over the next twelve months as described above to extend loans to IHC in

connection with its IBC if required.

Our board of directors

(the “Board”) recently passed a resolution determining that we should not pursue direct acquisition opportunities at this

time, but should instead use available capital that could be used for acquisitions to support our sponsorship of the SPACs, including

the acquisition activities being conducted by IHC. As a result, we are devoting a substantial portion of our working capital to supporting

the activities of IHC as it progresses toward its IBC, which includes time and expense devoted to evaluating acquisition candidates,

conducting due diligence, advancing legal and audit fees, and assisting in the recruitment of top management following De-SPAC. We anticipate

that certain of the gross proceeds of any Warrant exercises will support these activities, depending on their timing. Accordingly, we

do not believe at present that there is a substantial likelihood that IHC will compete with us for suitable acquisition targets. Further,

we do not anticipate that IHC will enter into an IBC with a target business that will be affiliated with us, Investments, or any of our

officers or directors. To the extent IHC proposes to enter into a business combination with such an affiliated person or related party,

such transaction would be negotiated on an arms’ length basis and be subject to Board and shareholder approvals, as appropriate.

Launch of ShiftPixy Labs

We also announced,

in July 2020, our “ShiftPixy Labs” initiative, which includes the development of ghost kitchens in conjunction with our wholly-owned

subsidiary, ShiftPixy Ghost Kitchens, Inc. Through this initiative, we intend to bring various food delivery concepts to market

that will combine with our HRIS platform to create an easily replicated, comprehensive food preparation and delivery solution. The initial

phase of this initiative is being implemented in our dedicated kitchen facility located in close proximity to our Miami headquarters,

which we are already showcasing through the distribution of video programming on social media produced and distributed by our wholly

-owned subsidiary, ShiftPixy Productions, Inc. If successful, we intend to replicate this initiative in similarly constructed facilities

throughout the United States and in selected international locations. We also intend to provide similar services via mobile kitchen concepts,

all of which will be heavily reliant on our HRIS platform and which we believe will capitalize on trends observed during the COVID-19

pandemic toward providing customers with a higher quality prepared food delivery product that is more responsive to their needs.

Impact of COVID-19

The COVID-19 pandemic

continues to provide both business setbacks and business opportunities. Our growth trajectory has been muted by the economic impacts

of the COVID-19 pandemic on our core business clients, primarily restaurants and nurse staffing organizations supplying health services

not related to COVID-19.

The COVID-19 pandemic

has significantly impacted and delayed our expected growth, which we saw initially through a decrease in our billed customers and WSEs

beginning in mid-March 2020, when the State of California first implemented “lockdown” measures. Substantially all of our

billed WSEs as of February 29, 2020 worked for clients located in Southern California, and were primarily in the QSR industry. Many of

these clients were required to furlough or lay off employees or, in some cases, completely shutter their operations. For our clients

serviced prior to the March 2020 pandemic lockdown, we experienced an approximate 30% reduction in business levels within six weeks after

the first lockdown commenced. Early in the pandemic, the combination of our sales efforts and the tools that our services provide to

businesses impacted by the COVID-19 pandemic resulted in additional business opportunities for new client location additions, as did

the fact that many of our clients received Payroll Protection Plan loans (“PPP Loans”) under the CARES Act, which supported

their businesses and payroll payments during in-store lockdowns. Nevertheless, during the quarter ended May 31, 2020, our WSE billings

per client location decreased as many of our clients were forced to cease operations or reduce staffing. On July 13, 2020, the Governor

of the State of California re-implemented certain COVID-19 related lockdown restrictions in most of the counties in the state, including

those located in Southern California where most of our clients were located. The mercurial nature of the pandemic led to recurring lockdowns

through the issuance of additional orders by state and county health authorities that yielded uneven patterns of business openings and

closings throughout our clients’ markets, which also experienced significant lockdowns beginning in late November 2020 and through

the year-end holiday season as a spike in COVID-19 cases was observed.

The negative impact

of these lockdowns on our business and operations continued through our third quarter of Fiscal 2021 in a see-saw pattern, with some

improvement observed after the removal of many restrictions in California and elsewhere from March through June 2021, only to be followed

by the reimplementation of restrictions in the face of the pandemic resurgence fueled by the spread of the Delta variant of the virus.

While the availability of PPP Loans to our clients mitigated the negative impact on our business during the initial stages of the pandemic,

we believe that the failure of the government to renew this program exacerbated the deleterious impact of subsequent restrictions and

lockdowns on our financial results for Fiscal 2021. We have observed some degree of business recovery as these lockdowns have relaxed

and vaccination efforts have accelerated, and we believe that, to the extent that COVID-19 infection rates continue to decrease, and

vaccination rates increase, governmental authorities will continue to remove restrictions, which will fuel our clients’ business

recoveries. Nevertheless, we remain concerned that the recent resurgence of the virus, in the form of the Omicron variant, could have

a material negative impact on our business and results of operations, as could the emergence of additional variants of the virus in the

future.

We have also experienced

increases in our workers’ compensation reserve requirements, and we expect additional workers’ compensation claims to be

made by furloughed employees. We also expect additional workers’ compensation claims to be made by WSEs required to work by their

employers during the COVID-19 pandemic. On May 4, 2020, the State of California indicated that workers who became ill with COVID-19 would

have a potential claim against workers’ compensation insurance for their illnesses. These additional claims, to the extent they

materialize, could have a material impact on our workers’ compensation liability estimates.

Going Concern

As of November 30,

2021, we had cash of $2.1 million and a working capital deficit of $11.9 million. We have incurred recurring losses, which has resulted

in an accumulated deficit of $158.1 million as of November 30, 2021. The recurring losses and cash used in operations are indicators

of substantial doubt as to our ability to continue as a going concern for at least one year from issuance of the audited financial statements

incorporated in our Annual Report on Form 10-K for the fiscal year ended August 31, 2021. Our plans to alleviate substantial

doubt are discussed below and elsewhere in our Annual Report on Form 10-K for the fiscal year ended August 31, 2021.

Historically, our principal

source of financing has come through the sale of our common stock and issuance of convertible notes. In May 2020, we successfully completed

an underwritten public offering, raising a total of $12 million ($10.3 million net of costs), and closed an additional $1.35 million

($1.24 million net of costs) between June 1, 2020 and July 7, 2020 pursuant to the underwriter’s overallotment. In October 2020,

we closed an additional $12 million equity offering ($10.7 million net of costs). In May 2021, we raised approximately $12 million ($11.1

million net of costs) in connection with the sale of common stock and warrants. More recently, in September 2021, we raised approximately

$12 million ($11.1 million net of costs) in connection with the sale of common stock and warrants. Our plans and expectations for the

next twelve months include raising additional capital to help fund expansion of our operations, including the continued development and

support of our information technology (“IT”) and HRIS platform, as well as our activities in connection with our sponsorship

of IHC described above. We expect to continue to invest in our HRIS platform, ShiftPixy Labs, our sponsorship of IHC and other growth

initiatives, all of which have required and will continue to require significant cash expenditures.

We have been and expect

to continue to be impacted by the COVID-19 pandemic, from which we have experienced both positive and negative impacts. Our current business

focus is providing human capital and payroll services for the restaurant and hospitality industries, which have seen a reduction in payroll

and consequently a reduction in payroll processing fees on a per WSE and per location basis. However, we believe that we provide the

means for current and potential clients to adapt to many of the obstacles posed by COVID-19 by offering additional services such as delivery,

which have facilitated an increase in our client and client location counts, resulting in recovery of billings lost during the first

months of the pandemic. Beginning in June 2020, our billings per WSE and per location improved as lockdowns in its primary Southern

California market were lifted. Although the State of California re-implemented lockdowns in November 2020, we believe that many

of our clients have modified their businesses after the initial lockdowns to adapt somewhat to these adverse circumstances. Further,

the recent acceleration in the roll-out of COVID-19 vaccines throughout California and the entire country has resulted in an easing of

business operating restrictions. Nevertheless, if lockdowns resume, our client’s delay hiring or rehiring employees, or if our

clients shut down operations, our ability to generate operational cash flows may be significantly impaired.

Risks Associated with Our Business

Our business and our

ability to implement our business strategy are subject to numerous risks, as more fully described in the section entitled “Risk

Factors” in this prospectus and in our Annual

Report on Form 10-K for the fiscal year ended August 31, 2021 (the “Annual Report”), incorporated herein by

reference. You should read these risks before you invest in our securities. We may be unable, for many reasons, including those that

are beyond our control, to implement our business strategy.

Corporate Information

We were incorporated

under the laws of the State of Wyoming on June 3, 2015. Our principal executive office is located at 501 Brickell Key Drive, Suite 300,

Miami, FL 33131, and our telephone number is (888) 798-9100. Our website address is www.shiftpixy.com. Our website does not form a part

of this prospectus and listing of our website address is for informational purposes only.

THE OFFERING

| Shares

of Common Stock |

Up

to 15,423,200 shares of Common Stock. |

| that May be Offered

by the |

|

| Selling Shareholders |

|

| |

|

| Use of Proceeds |

We will not receive any

proceeds from the sale of the Common Stock by the selling shareholders. However, if all of the Warrants were exercised

for cash, we would receive gross proceeds of approximately $12.66 million. We intend to use the proceeds we receive from

the exercise of the Warrants to fund approximately $1.5 million working capital loans to IHC to finance transaction costs in

connection with IHC’s IBC and for general corporate purposes, including working capital, operating expenses and capital

expenditures.

|

| Use of

Proceeds |

See the

section titled “Use of Proceeds” for additional information. |

| |

|

| Offering Price |

The

selling shareholders may sell all or a portion of their shares through public or private transactions at prevailing market prices

or at privately negotiated prices. |

| |

|

| Nasdaq Capital Market

Symbol |

“PIXY” |

| |

|

| Risk Factors |

Investing

in our Common Stock involves a high degree of risk. See “Risk Factors” included in this prospectus and beginning

on page 19 of the Annual Report, incorporated by reference herein, and any other risk factors described in the documents incorporated

by reference herein, for a discussion of certain factors to consider carefully before deciding to invest in our Common Stock. |

Throughout this prospectus,

when we refer to the shares of our Common Stock being registered on behalf of the selling shareholders for offer and sale, we are referring

to the shares of Common Stock sold to the selling shareholders, as well as the shares of Common Stock issuable upon exercise of the Warrants,

each as described under “The Offering” and “Selling Shareholders.” When we refer to the selling shareholders

in this prospectus, we are referring to the selling shareholders identified in this prospectus and, as applicable, their donees, pledgees,

transferees or other successors-in-interest selling shares of Common Stock or interests in shares of Common Stock received after the

date of this prospectus from a selling shareholder as a gift, pledge, partnership distribution or other transfer.

RISK FACTORS

Investing in our securities

involves a high degree of risk. You should carefully consider and evaluate all of the information contained in this prospectus

and in the documents we incorporate by reference into this prospectus before you decide to purchase our securities. In particular,

you should carefully consider and evaluate the risks and uncertainties described below and under the heading “Risk Factors”

in the Annual Report. Any of the risks and uncertainties set forth below and in the Annual Report, as updated by annual, quarterly

and other reports and documents that we file with the SEC and incorporate by reference into this prospectus, or any prospectus, could

materially and adversely affect our business, results of operations and financial condition, which in turn could materially and adversely

affect the value of any securities offered by this prospectus. As a result, you could lose all or part of your investment.

Risks Relating to Our Business

There is no guarantee that our current

cash position, expected revenue growth and anticipated financing transactions will be sufficient to fund our operations for the next

twelve months. Our sponsorship of IHC requires significant capital deployment, entails certain risks and may not be successful, which

would likely have a material adverse effect on our future expansion, revenues, and profits.

As of November 30, 2021,

we had cash of $2.1 million and a working capital deficit of $11.9 million. We have incurred recurring losses, which has resulted in

an accumulated deficit of $158.1 million as of November 30, 2021. The recurring losses and cash used in operations are indicators of

substantial doubt as to our ability to continue as a going concern for at least one year from issuance of the audited financial statements

incorporated in our Annual Report on Form 10-K for the fiscal year ended August 31, 2021. Our plans to alleviate substantial

doubt are discussed below and elsewhere in our Annual Report on Form 10-K for the fiscal year ended August 31, 2021.

Historically, our principal

source of financing has come through the sale of our common stock and issuance of convertible notes. In May 2020, we successfully completed

an underwritten public offering, raising a total of $12 million ($10.3 million net of costs), and closed an additional $1.35 million

($1.24 million net of costs) between June 1, 2020 and July 7, 2020 pursuant to the underwriter’s overallotment. In October 2020,

we closed an additional $12 million equity offering ($10.7 million net of costs). In May 2021, we raised approximately $12 million ($11.1

million net of costs) in connection with the sale of common stock and warrants. More recently, in September 2021, we raised approximately

$12 million ($11.1 million net of costs) in connection with the sale of common stock and warrants. Our plans and expectations for the

next twelve months include raising additional capital to help fund expansion of our operations, including the continued development and

support of our IT and HRIS platform, as well as our activities in connection with our sponsorship of IHC described above. We expect to

continue to invest in our HRIS platform, ShiftPixy Labs, our sponsorship of IHC and other growth initiatives, all of which have required

and will continue to require significant cash expenditures.

We do not currently have

financing plans but we expect to obtain additional financing in the form of public or private equity offerings over the next twelve months

as described above to extend loans to IHC in connection with its IBC if required. There is no assurance that IHC will be able to

consummate its IBC within twelve months from the closing of the IHC IPO, in which case IHC would cease all operations except for the

purpose of winding up. While we believe that IHC, after completing its IBC, will generate significant revenues for us by virtue of entering

into CSAs and/or other contractual relationships with us after completing the De-SPAC process, we are unable to rely with certainty on

IHC to generate revenue in the future.

We expect to invest or

otherwise extend capital, through Investments, totaling up to approximately $6,164,102 in connection with our sponsorship of IHC, including

$25,000 to purchase Founder Shares (previously paid on February 18, 2021), $4,639,102 to purchase private placement warrants (previously

paid on October 22, 2021) and up to $1.5 million in working capital loans to IHC to finance transaction costs in connection with IHC’s

IBC. To date, we have not extended any such working capital loans, nor have we determined the terms upon which any such working capital

loans would be extended and/or repaid, though up to $1,500,000 of such working capital loans extended to IHC may be convertible into

private placement warrants of IHC’s post business combination entity, at a price of $1.00 per warrant at our option. If we extend

working capital loans to IHC and it does not consummate its IBC, such working capital loans are unlikely to be repaid.

We will lose our entire

investment in IHC if it is unable to consummate its IBC. We have withdrawn the initial public offering registration statements of Vital,

TechStackery and Firemark in order to focus on the growth and expansion of our Company and to completing IHC’s IBC. The combined

value of our equity investment in our sponsored SPACs, as carried on the consolidated balance sheet included in the financial statements

accompanying our Annual Report on Form 10-K, filed with the SEC on December 3, 2021, is $47,472,000, which we have computed in accordance

with accounting principles generally accepted in the United States, and which constitutes the majority of the carrying value of our total

assets as reflected on our consolidated balance sheet; however, we expect our forfeiture of Founder Shares of Vital, TechStackery and

Firemark to significantly decrease the value of our equity investment described above. Further, if IHC is unable to consummate its IBC,

then our Founder Shares and private placement warrants in IHC will be worthless. Even if IHC is able to consummate its IBC, we can provide

no assurance that the value of our equity investment in IHC will not decline significantly based upon a variety of factors, including,

without limitation, stockholder and general market reaction to IHC’s IBC, redemption requests received from IHC stockholders in

connection with any proposed IBC, and IHC stockholder dilution resulting from additional capital raises or other financing transactions

undertaken by IHC in connection with its IBC.

We expect our investment

in our HRIS platform to continue over the next twelve months regardless of whether we enter into client services agreements with IHC’s

post business combination entity, and regardless of whether IHC is able to complete successfully the De-SPAC process, as we believe such

investments will be necessary to support our existing clients as well as our future organic growth. While we anticipate that these investments

will yield benefits to us in the future in the form of increased revenues and earnings, it is likely that such improved financial results

will be delayed or otherwise materially impacted if we are unable to enter successfully into client services agreements with IHC’s

post business combination entity on terms that are beneficial to us, or if IHC is unable to complete its IBC.

We believe that our current

cash position, along with our cost controls, projected revenue growth and anticipated financing from potential institutional investors,

will be sufficient to alleviate substantial doubt and fund our operations for at least a year from the date of this Form 10-K. If these

sources do not provide the capital necessary during the next twelve months, we may need to curtail certain aspects of our operations

or expansion activities, consider the sale of additional assets, or consider other means of financing. We can give no assurance that

we will be successful in implementing our business plan and obtaining financing on terms that are advantageous to us, or that any such

additional financing will be available.

We will lose our entire investment in IHC

if IHC does not complete its initial business combination and our officers may have a conflict of interest in determining whether a particular

business combination target is appropriate for IHC.

On April 29, 2021, we

announced our sponsorship, through Investments, of four SPAC IPOs, but have since withdrawn the initial public offering registration

statements of three such SPACs in order to focus on the growth and expansion of our company and to completing IHC’s IBC. We purchased

Founder Shares in each SPAC, through Investments, for an aggregate purchase price of $100,000, or $25,000 per SPAC. The number of Founder

Shares issued to us was determined based on the expectation that such Founder Shares would represent 15% of the outstanding shares of

each SPAC after its initial public offering (excluding the private placement warrants described below and their underlying securities).

We are likely to be able to make a substantial profit on our nominal investment in the Founder Shares of IHC even at a time when IHC’s

public shares have lost significant value. On the other hand, the IHC Founder Shares will be worthless if it does not complete its IBC.

Accordingly, Investments will benefit from the completion of IHC’s IBC and may be incentivized to complete an IBC of a less favorable

target company or on terms less favorable to stockholders rather than liquidate.

The registration statement

and prospectus relating to IHC’s IPO was declared effective by the SEC on October 19, 2021, and IHC units (the “IHC Units”),

consisting of one share of common stock and an accompanying warrant to purchase one share of IHC common stock, began trading on the NYSE

on October 20, 2021. The IHC IPO closed on October 22, 2021, raising gross proceeds for IHC of $115 million. In connection with the IHC

IPO, we purchased, through our wholly-owned subsidiary, 4,639,102 placement warrants at a price of $1.00 per warrant, for an aggregate

purchase price of $4,639,102. The IHC private placement warrants will be worthless if IHC does not complete an IBC. Each whole private

placement warrant is exercisable to purchase one whole share of common stock in each SPAC at $11.50 per share. Also, as previously disclosed,

on February 18, 2021, we invested an aggregate of $100,000 to purchase Founder Shares in all four of our sponsored SPACs through Investments,

though we now intend to forfeit the Founder Shares of Vital, TechStackery and Firemark.

The investment amounts set

forth above do not include loans that Investments has extended to our four SPACs. As of the date of this prospectus, Investments has

been fully repaid by IHC; however, Investments previously extended loans to Vital, TechStackery and Firemark in an aggregate amount of

$550,000 to cover IPO-related and organizational expenses of each SPAC, including SEC registration, legal and auditing fees, which we

do not expect to be repaid.

In addition, we may extend

working capital loans to IHC to finance transaction costs in connection with IHC’s IBC. To date, we have not extended any such

working capital loans, nor have we determined the terms upon which any such working capital loans would be extended and/or repaid. Up

to $1,500,000 of such working capital loans may be convertible into private placement warrants of IHC’s post business combination

entity, at a price of $1.00 per warrant at our option. If we extend working capital loans to IHC and IHC does not consummate its IBC,

such working capital loans are unlikely to be repaid.

We do not currently have

financing plans but we expect to obtain additional financing in the form of public or private equity offerings over the next twelve months

as described above to purchase private placement warrants and to extend loans to IHC in connection with its IBC.

The interests of our officers

who also serve as officers of IHC, and Mr. Absher, our Chairman and Chief Executive Officer who also serves as Chairman of the Board

of Directors of IHC, may influence their motivation in identifying and selecting a target business combination for IHC, completing IHC’s

IBC and influencing the operation of the business following IHC’s IBC.

There is no assurance that

IHC will be able to complete its IBC within the next twelve months. While we believe that IHC, after completing its IBC, will generate

significant revenues for us by virtue of entering into CSAs and/or other contractual relationships with us after completing the De-SPAC

process, we are unable to rely with certainty on IHC to generate revenue in the future.

We expect our investment

in our HRIS platform to continue over the next twelve months regardless of whether we enter into CSAs with the SPACs, and regardless

of whether IHC is able to complete successfully the De-SPAC process, as we believe such investments will be necessary to support our

existing clients as well as our future organic growth. While we anticipate that these investments will yield benefits to us in the future

in the form of increased revenues and earnings, it is likely that such improved financial results will be delayed or otherwise materially

impacted if we are unable to enter successfully into CSAs with IHC’s post business combination entity on terms that are beneficial

to us, or if IHC is unable to complete its IBC.

Certain of our

officers and directors have potential conflicts of interest arising from our sponsorship activities of IHC.

Our officers may not commit

their full time to our affairs, which may result in a conflict of interest in allocating their time between our operations and IHC.

All of our officers are engaged with IHC and our officers are not obligated to contribute any specific number of hours per week to our

affairs. All of our officers serve as officers of IHC and Mr. Absher, our Chairman and Chief Executive Officer, also serves as Chairman

of the Board of Directors of IHC. While we do not believe that the time devoted to IHC will undermine their ability to fulfill their

duties with respect to our Company, if the business affairs of IHC require them to devote substantial amounts of time to such affairs,

it could limit their ability to devote time to our affairs which may have a negative impact on our operations. The interests of each

of these individuals in our Company and IHC may influence their motivation in identifying and selecting a target business combination,

completing an IBC and influencing the operation of our business following IHC’s IBC.

None of our officers or

directors (i) hold any equity interest in IHC, (ii) receive any form of compensation from IHC, or (iii) have any pecuniary interest related

to IHC separate and apart from their pecuniary interest in our Company. While Messrs. Absher, Carney and Gans, as officers and/or directors

of both our Company and IHC, owe fiduciary duties to each entity, our Board has considered this matter and determined that no disabling

conflict of interest has arisen or is likely to arise that would prevent these individuals from discharging their fiduciary duties on

behalf of our Company. As a result, our Board has (i) approved our sponsorship of IHC through our subsidiary, Investments, (ii) approved

Messrs. Absher, Carney and Gans serving as officers and/or directors of IHC, and (iii) approved the allocation of additional ShiftPixy

resources, including financial backing and personnel, for the purpose of supporting the activities of IHC as it pursues its IBC. Further,

we do not anticipate that IHC will enter into an IBC with a target business affiliated with us, Investments, or any of our officers or

directors. To the extent IHC were to propose a business combination with such an affiliated person or related party, such transaction

would be negotiated on an arms’ length basis and be subject to Board and shareholder approvals, as appropriate.

If we are deemed to be an investment company

under the Investment Company Act of 1940, we may be required to institute burdensome compliance requirements and our activities may be

restricted, which may make it difficult for us to conduct our operating business and our IHC sponsorship activities.

Section

3(a)(1)(C) of the Investment Company Act 1940 (the “1940 Act”) defines as an investment company any issuer that is engaged

or proposes to engage in the business of investing, reinvesting, owning, holding or trading in securities and owns or proposes to acquire

investment securities having a value exceeding 40% of the value of the issuer’s total assets (exclusive of Government securities

(as defined in the 1940 Act) and cash items) on an unconsolidated basis (the “40% Threshold”). We acquired the Founder Shares

on April 22, 2021 and we believe that we exceeded the 40% Threshold on October 19, 2022 in connection with the pricing of IHC’s

IPO exclusive of Government securities and cash items. Investments acquired 4,312,500 Founder Shares on April 22, 2021 for an aggregate

purchase price of $25,000, or approximately $0.006 per share. Prior to the pricing of IHC’s IPO on October 19, 2021, there was

substantial doubt as to whether the IPO would be completed on the proposed terms, or at all, and therefore, the fair market value of

the Founder Shares owned by us had significantly less value than $10.00 per unit, the IPO price. On October 19, 2022, upon pricing of

IHC’s IPO, the Founder Shares had a market value of $21,100,000 based on the $10.00 per unit offering price. Accordingly, we believe

that October 19, 2022 is the beginning of the one-year temporary safe harbor under Rule 3a-2 promulgated under the 1940 Act, as described

below.

Rule 3a-2 provides a temporary

safe harbor from application of the 1940 Act’s provisions to certain issuers that are in transition to a non-investment company

business. Specifically, Rule 3a-2 deems an issuer that meets the definition of “investment company” in Section 3(a)(1)(A)

or 3(a)(1)(C) of the 1940 Act not to be an investment company for a period not to exceed one year, provided that the conditions of the

rule are satisfied. Pursuant to Rule 3a-2, the one-year period begins on the earlier of: (i) the date on which an issuer owns securities

and/or cash having a value exceeding 50% of the value of such issuer’s total assets on either a consolidated or unconsolidated

basis; or (ii) the date on which an issuer owns or proposes to acquire investment securities having a value exceeding the 40% Threshold.

Accordingly, we believe that our IHC sponsorship activities fall within the safe harbor under Rule 3a-2 of the 1940 Act, which allows

a 3(a)(1)(C) investment company (as a “transient investment company”) a grace period of one year from the date of classification,

to avoid registration under the 1940 Act. The SEC’s IM Guidance Update No. 2017-03 (March 2017) specifically states that the “purpose

of Rule 3a-2 is to temporarily relieve certain issuers that are in transition to a non-investment company business from the registration

and other requirements of the 1940 Act.” In that guidance, the Staff of the SEC also acknowledged that the “one-year period

for transient investment companies should be available to issuers that have a bona fide intent to be engaged primarily in a non-investment

company business.” As provided in Rule 3a-2, during the one-year period, the issuer must undertake activities that are consistent

with an objective to no longer be an “investment company” by the end of this period. In addition, the issuer’s board

of directors must adopt a resolution that commits the issuer to undertake activities in order to achieve this objective.

We have withdrawn the

initial public offering registration statements of Vital, TechStackery and Firemark in order to focus on the growth and expansion of

our company and on the completion of IHC’s IBC. We believe that these actions, together with our ongoing operations, evidence our

bona fide intent to be engaged primarily in a non-investment company business as soon as is reasonably possible in accordance with the

safe harbor provided by Rule 3a-2. Our board of directors has adopted a resolution committing our company to our historical operating

business to provide human capital outsourcing solutions, which does not include the business of investing, reinvesting, owning, holding,

or trading in securities, and owning or proposing to acquire investment securities. The IHC IPO registration statement and related prospectus

include an exception permitting Investments to transfer its ownership in the Founder Shares at any time to the extent that Investments

determines, in good faith, that such transfer is necessary to ensure that it and/or any of its parents, subsidiaries or affiliates are

in compliance with the 1940 Act. To comply with Rule 3a-2, we intend to sell the Founder Shares or dividend the Founder Shares to our

shareholders by October 19, 2022, the end of the one-year period afforded by the safe harbor for transient investment companies under

Rule 3a-2. To this end, we have also forfeited our Founder Shares of Vital, TechStackery and Firemark. As a result, we believe that we

will not be required to register as an investment company under the 1940 Act.

Notwithstanding the foregoing,

the acquisition of additional investment securities, including potentially as a result of making working capital loans to IHC, could

be viewed as business activities inconsistent with this requirement.

We expect IHC to operate

as a separately managed, publicly traded entity following the completion of its IBC. We anticipate entering into one or more service

agreements with IHC post business combination that will allow its clients to participate in our HRIS platform. We believe that focusing

upon the successful completion of IHC’s IBC within the staffing industry has the potential to generate significant revenues and

earnings for us.

If we are deemed to be

an investment company under the Investment Company Act of by virtue of our IHC sponsorship activities or based upon a determination that

we exceeded the 40% Threshold prior to October 19, 2021, our future activities may be restricted, including:

| · | restrictions

on the nature of our investments; and |

| · | restrictions

on the issuance of securities, each of which may make it difficult for us to conduct our

business and raise working capital. |

In addition, we may have imposed upon us burdensome

requirements, including:

| · | registration

as an investment company with the SEC; |

| · | adoption

of a specific form of corporate structure different from our current operating structure;

and |

| · | reporting,

record keeping, voting, proxy and disclosure requirements and other rules and regulations

that we are currently not subject to. |

If we were deemed to be subject to the 1940 Act, compliance with these additional regulatory

burdens would require additional expenses for which we have not allotted funds and may hinder our ability to operate our business.

Financial Market Risks

If we are unable to continue to meet the listing requirements

of Nasdaq, our common stock will be delisted.

Our common stock currently trades on Nasdaq,

where it is subject to various listing requirements including minimum per share prices. On April 4, 2022, we were notified by Nasdaq

that we are not in compliance with certain of these listing requirements, and that failure to correct these deficiencies could result

in delisting. We believe that we will be able to address Nasdaq’s concerns within the timeframe required for continued listing,

and that we will then return to being in full compliance with all of its listing requirements. Nevertheless, if we are not able to meet

Nasdaq’s listing standards in the future, we could be subject to suspension and delisting proceedings. A delisting of our common

stock and our inability to list on another national securities market could negatively impact us by: (i) reducing the liquidity

and market price of our common stock; (ii) reducing the number of investors willing to hold or acquire our common stock, which could

negatively impact our ability to raise equity financing; (iii) limiting our ability to use a registration statement to offer and

sell freely tradable securities, thereby preventing us from accessing the public capital markets; and (iv) impairing our ability

to provide equity incentives to our employees.

CAUTIONARY NOTE REGARDING

FORWARD-LOOKING STATEMENTS

This prospectus and the

documents incorporated by reference into this prospectus include forward-looking statements within the meaning of Section 27A of

the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, as amended, that relate to future events or our

future financial performance and involve known and unknown risks, uncertainties and other factors that may cause our actual results,

levels of activity, performance or achievements to differ materially from any future results, levels of activity, performance or achievements

expressed or implied by these forward-looking statements. Words such as, but not limited to, “anticipate,” “aim,”

“believe,” “contemplate,” “continue,” “could,” “design,” “estimate,”

“expect,” “intend,” “may,” “might,” “plan,” “predict,” “poise,”

“project,” “potential,” “suggest,” “should,” “strategy,” “target,”

“will,” “would,” and similar expressions or phrases, or the negative of those expressions or phrases, are intended

to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Although we believe

that we have a reasonable basis for each forward-looking statement contained in this prospectus and incorporated by reference into this

prospectus, we caution you that these statements are based on our projections of the future that are subject to known and unknown risks

and uncertainties and other factors that may cause our actual results, level of activity, performance or achievements expressed or implied

by these forward-looking statements, to differ. The section in this prospectus entitled “Risk Factors” and the sections in

our periodic reports, including our Annual Report entitled “Risk Factors” and “Description of Business,” and

our most recent quarterly report on Form 10-Q entitled “Management’s Discussion and Analysis of Financial Condition

and Results of Operations,” as well as other sections in this prospectus and the documents or reports incorporated by reference

into this prospectus, discuss some of the factors that could contribute to these differences. These forward-looking statements include,

among other things, statements about:

| |

· |

our

future financial performance, including our revenue, costs of revenue and operating expenses; |

| |

· |

our

ability to achieve and grow profitability; |

| |

· |

our

ability to continue as a going concern, and the sufficiency of our cash, cash equivalents and investments to meet our liquidity needs; |

| |

· |

our

ability to form ongoing, profitable relationships with IHC described above; |

| |

· |

our

predictions about industry and market trends; |

| |

· |

our

ability to successfully expand internationally; |

| |

· |

our

ability to effectively manage our growth and future expenses; |

| |

· |

our

estimated total addressable market; |

| |

· |

our

ability to maintain, protect and enhance our intellectual property; |

| |

· |

our

ability to comply with modified or new laws and regulations applying to our business; |

| |

· |

the

attraction and retention of qualified employees and key personnel; |

| |

· |

the

effect COVID-19 or other public health issues could have on our business and financial condition and the economy in general; |

| |

|

|

| |

· |

uncertainties regarding the effect of general economic and market conditions; |

| |

· |

the impact of geopolitical events, including Russia’s recent invasion

of Ukraine; |

| |

|

|

| |

· |

our

ability to successfully defend litigation brought against us; and |

| |

· |

our

use of the net proceeds from this offering, if any. |

We may not actually achieve

the plans, intentions or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking

statements. Forward-looking statements should be regarded solely as our current plans, estimates and beliefs. We have included important

factors in the cautionary statements included in this document and incorporated by reference, particularly in the section entitled “Risk

Factors” beginning on page 19 of our Annual Report that we believe could cause actual results or events to differ materially

from the forward-looking statements that we make. Moreover, we operate in a very competitive and rapidly changing environment. New risks

emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on

our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained

in any forward-looking statements we may make. Given these risks and uncertainties, readers are cautioned not to place undue reliance

on such forward-looking statements. All forward-looking statements are qualified in their entirety by this cautionary statement. Our

forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures or investments

we may make. You should read this prospectus and the documents that we have filed as exhibits to this prospectus and incorporated by

reference herein completely and with the understanding that our actual future results may be materially different from the plans, intentions

and expectations disclosed in the forward-looking statements we make. Although we believe that the expectations reflected in the forward-looking

statements are reasonable, we cannot guarantee future results, levels of activity or performance. The forward-looking statements contained

in this prospectus are made as of the date of this prospectus and we do not assume any obligation to update any forward-looking statements,

whether as a result of new information, future events or otherwise, except as required by applicable law.

You should also consider

carefully the statements set forth in the sections titled “Risk Factors” or elsewhere in this prospectus and in the documents

incorporated or deemed incorporated herein or therein by reference, which address various factors that could cause results or events

to differ from those described in the forward-looking statements. All subsequent written and oral forward-looking statements attributable

to us or to persons acting on our behalf are expressly qualified in their entirety by the applicable cautionary statements. We

have no plans to update these forward-looking statements.

USE OF PROCEEDS

We will not receive any

of the proceeds from the sale of Common Stock by the selling shareholders named in this prospectus, and the selling shareholders will

receive all of the proceeds from this offering.

We may receive up to approximately

$12.66 million in aggregate gross proceeds from cash exercises of the Warrants, based on the per share exercise price of the Warrants.

We

intend to use the proceeds we receive from the exercise of the Warrants to fund approximately $1.5 million working capital loans

to IHC to finance transaction costs in connection with IHC’s IBC and for general corporate purposes, including working capital,

operating expenses and capital expenditures.

The holders of the Warrants

are not obligated to exercise their Warrants, and we cannot predict whether holders of the Warrants will choose to exercise all or any

of their Warrants. Our expected use of the proceeds from the exercise of the Warrants represents our current intentions based upon our

present plans and business conditions. As a result, our management will have broad discretion in the application of the net proceeds,

and investors will be relying on our judgment regarding the application of the net proceeds of this offering. In addition, we might decide

to postpone or not pursue these certain of these activities if the net proceeds from this offering and the other sources of cash are