Current Report Filing (8-k)

August 18 2021 - 4:06PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

August 12, 2021

|

SHIFTPIXY, INC.

|

|

(Exact name of registrant as specified in its charter)

|

|

Wyoming

|

|

47-4211438

|

|

(State of incorporation or organization)

|

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

|

501 Brickell Key Drive, Suite 300, Miami, FL

|

|

33131

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(888) 798-9100

(Registrant's telephone number, including area

code)

Commission File No. 001-37954

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.

below):

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered

under Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on

which registered

|

|

Common Stock, par value $0.0001 per share

|

|

PIXY

|

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934

(17 CFR §240.12b-2).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act.

|

Item 1.01

|

Entry into a Material Definitive Agreement.

|

On August 12, 2021, ShiftPixy, Inc., a Wyoming corporation (the “Company”),

entered into a letter agreement (the “Letter Agreement”) with a large institutional investor (the “Purchaser”)

to amend the securities purchase agreement (the “Purchase Agreement”), dated May 13, 2021, the form of which was previously

filed as Exhibit 10.1 to the Company’s Form 8-K filed with the Securities and Exchange Commission (the “SEC”) on May

17, 2021, to (i) permit the issuance of the Preferred Options described below, (ii) extend the Company’s restriction to issue common

stock or common stock equivalents to 180 days following the Effective Date (as defined in the Purchase Agreement), subject to certain

exceptions, and (iii) grant the Purchaser the right to purchase up to 50% of the Company’s securities offered pursuant to any private

placement transaction or public offering registered with the SEC that is announced or consummated during the eighteen month period commencing

May 13, 2021. The Letter Agreement also amends the lock-up agreement, dated as of May 13, 2021 (the “Lock-Up Agreement”),

with Scott W. Absher, the Company’s Chief Executive Officer, which restricts the ability of Mr. Absher to sell or transfer any shares

of the Company’s common stock, par value $0.0001 per share (the “Common Stock”), for 90 days following the Effective

Date, subject to certain exceptions, to permit certain pledge transactions involving the Common Stock.

The foregoing description of the Letter Agreement is not complete and

is qualified in its entirety by reference to the full text of the form of Letter Agreement, a copy of which is attached to this Current

Report on Form 8-K as Exhibit 10.1.

|

Item 3.02

|

Unregistered Sales of Equity Securities.

|

On August 13, 2021, the Company granted 12,500,000 options (the “Preferred

Options”) to purchase shares of the Company’s preferred stock, par value $0.0001 per share (the “Preferred Stock”),

for $0.0001 per share to Mr. Absher. Each Preferred Option is exercisable for a period of twenty-four months upon (i) the acquisition

of a Controlling Interest (as defined below) in the Company by any single shareholder or group of shareholders acting in concert, other

than Mr. Absher or J. Stephen Holmes, a co-founder of the Company, or (ii) the announcement of (x) any proposed merger, consolidation,

or business combination in which the Common Stock is changed or exchanged, or (y) any sale or distribution of at least 50% of the Company’s

assets or earning power, other than through a reincorporation. Each share of Preferred Stock is convertible into Common Stock on a one-for-one

basis. “Controlling Interest” means the ownership or control of outstanding voting shares of the Company sufficient to enable

the acquiring person, directly or indirectly and individually or in concert with others, to exercise one-fifth or more of all the voting

power of the Company in the election of directors or any other business matter on which shareholders have the right to vote under the

Wyoming Business Corporation Act. As previously disclosed, the Company intended to make an additional grant to Mr. Absher based on

the number of shares of Common Stock held by Mr. Absher in September 2016.

The Preferred Options were issued pursuant to an exemption from registration

under the Securities Act of 1933, as amended (the “Securities Act”) provided by Section 4(a)(2) and/or Section 3(a)(9) of

the Securities Act.

|

Item 9.01

|

Financial Statements and Exhibits.

|

The following exhibits are filed as part of this

report:

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

SHIFTPIXY, INC.

|

|

|

|

|

|

Date: August 18, 2021

|

By:

|

/s/ Scott W. Absher

|

|

|

|

|

|

|

|

Scott W. Absher

|

|

|

|

|

|

|

|

Chief Executive Officer and Director

|

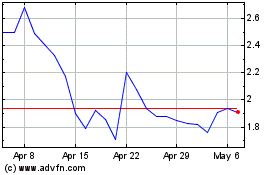

ShiftPixy (NASDAQ:PIXY)

Historical Stock Chart

From Mar 2024 to Apr 2024

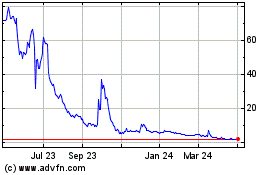

ShiftPixy (NASDAQ:PIXY)

Historical Stock Chart

From Apr 2023 to Apr 2024