Additional Proxy Soliciting Materials (definitive) (defa14a)

October 25 2019 - 5:26PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of

the Securities Exchange Act of 1934 (Amendment No. )

|

Filed by the Registrant ☒

|

|

|

|

Filed by a Party other than the Registrant ☐

|

|

|

|

Check the appropriate box:

|

|

☐

|

Preliminary Proxy Statement

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

☐

|

Definitive Proxy Statement

|

|

☒

|

Definitive Additional Materials

|

|

☐

|

Soliciting Material under §240.14a-12

|

|

|

|

Phio Pharmaceuticals Corp.

|

|

|

(Name of Registrant as Specified In Its Charter)

|

|

|

|

|

|

N/A

|

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

|

|

|

|

Payment of Filing Fee (Check the appropriate box):

|

|

☒

|

No fee required.

|

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

|

|

(5)

|

Total fee paid:

|

|

|

|

|

|

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

|

|

|

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

|

|

(3)

|

Filing Party:

|

|

|

|

|

|

|

|

|

(4)

|

Date Filed:

|

|

|

|

|

|

|

|

|

|

|

|

|

PHIO PHARMACEUTICALS CORP.

257 Simarano Drive, Suite 101

Marlborough, MA 01752

YOUR VOTE IS EXTREMELY IMPORTANT!

October 25, 2019

Dear Stockholder,

On October 24, 2019,

Phio Pharmaceuticals Corp. reconvened its 2019 Annual Meeting of Stockholders (originally scheduled for October 10, 2019) (the

“Annual Meeting”). At the reconvened meeting, stockholders voted on the proposals described in the Company's

definitive proxy statement filed with the U.S. Securities and Exchange Commission on August 30, 2019, other than the proposal

for a reverse split of the Company’s common stock (the “Reverse Split Proposal”). Although the

shares voted to date on the Reverse Split Proposal were overwhelmingly in favor (with approximately 78% of the shares cast voting

in favor of the proposal), there was not a sufficient number of shares voted in favor for this proposal to pass. Accordingly, no

vote was taken on the Reverse Split Proposal at the reconvened Annual Meeting. In order to allow additional time to solicit proxies

to vote on the Reverse Split Proposal, the Annual Meeting was further adjourned, solely with respect to voting on the Reverse Split

Proposal, to reconvene at 9:00 a.m. (Eastern Time) on November 7, 2019 at the executive offices of the Company, located at 257

Simarano Drive, Suite 101, Marlborough, Massachusetts.

The Company’s

Board of Directors unanimously recommends shareholders vote in favor of the Reverse Split Proposal in order to allow the Company

to implement a reverse split of the common stock as needed to satisfy the Nasdaq $1.00 minimum bid price requirement for continued

listing. If shareholders do not vote in favor of the Reverse Split Proposal, the Company expects that Nasdaq will commence delisting

proceedings the week of November 11, 2019. While the Company would expect to seek an appeal of any delisting notice and will

work to retain compliance with Nasdaq listing standards, the Company is at risk of losing its Nasdaq listing if shareholders do

not vote in favor of the Reverse Split Proposal. According to our latest records, we have not yet received your voting instructions

for the Annual Meeting of Stockholders. Your vote is extremely important.

Both leading independent

proxy advisory firms, Institutional Shareholder Services and Glass Lewis & Co., have recommended in favor of the Reverse Split

Proposal.

The Company encourages

any stockholder that has not received communications from their brokers or banks, or is uncertain if its shares have been voted,

to contact the Company's proxy specialists at the number listed below in order to help facilitate the voting of shares.

The Company's board

of directors and management respectfully request all such holders as of the record date to please vote their proxies as soon as

possible, but no later than November 6, 2019 at 11:59 p.m. (Eastern Time). The Company also reminds holders to inquire with their

voting institutions about any additional clearing time that may be required to forward voting instructions to the Company in advance

of the November 6, 2019 deadline. The record date for the Annual Meeting remains August 21, 2019. Company stockholders as

of the record date can vote, even if they have subsequently sold their shares. Stockholders who have previously submitted their

proxy or otherwise voted and who do not want to change their vote need not take any action.

For questions relating

to the voting of shares or to request additional or misplaced proxy voting materials, the Company's proxy solicitor, Georgeson,

may be reached at 1-866-695-6078. Representatives from Georgeson can also record and transmit votes over the phone as a convenience

to Company stockholders.

YOUR PARTICIPATION

IS IMPORTANT – PLEASE VOTE TODAY!

Sincerely,

Gerrit Dispersyn, Dr. Med. Sc.

President and Chief Executive Officer

ADDITIONAL INFORMATION

AND WHERE TO FIND IT

The

Company has filed a definitive proxy statement on Schedule 14A and associated proxy card (the “Proxy Statement”) with

the U.S. Securities and Exchange Commission (the “SEC”), which was filed on August 30, 2019. The Company, its directors,

its executive officers and certain other individuals set forth in the definitive proxy statement will be deemed participants in

the solicitation of proxies from shareholders in respect of the Annual Meeting. Information regarding the names of the Company’s

directors and executive officers and certain other individuals and their respective interests in the Company by security holdings

or otherwise is set forth in the Proxy Statement. BEFORE MAKING ANY VOTING DECISION, SHAREHOLDERS OF THE COMPANY ARE URGED TO READ

ALL RELEVANT DOCUMENTS FILED WITH OR FURNISHED TO THE SEC, INCLUDING THE PROXY STATEMENT AND ANY SUPPLEMENTS THERETO AND ACCOMPANYING

PROXY CARD. The Proxy Statement and a form of proxy have been mailed to shareholders of the Company. Investors and shareholders

can obtain a copy of the documents filed by the Company with the SEC, including the Proxy Statement, free of charge by visiting

the SEC’s website, www.sec.gov.

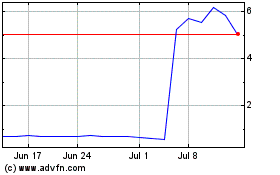

Phio Pharmaceuticals (NASDAQ:PHIO)

Historical Stock Chart

From Mar 2024 to Apr 2024

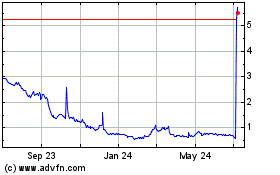

Phio Pharmaceuticals (NASDAQ:PHIO)

Historical Stock Chart

From Apr 2023 to Apr 2024