Report of Foreign Issuer (6-k)

September 30 2019 - 4:31PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of September 2019

Commission File Number: 001-38206

TDH HOLDINGS, INC.

(Translation of registrant’s name into

English)

c/o Qingdao Tiandihui Foodstuffs Co. Ltd., Room

1809,

Financial Square, 197 Shuangzhu Road, Huangdao

District, Qingdao, Shandong Province

People’s Republic of China

Tel: +86-532-8591-9267

(Address of Principal Executive Office)

Indicate by check mark

whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form

40-F ☐

Indicate by check mark

if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark

if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Indicate by check mark

whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission

pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934. Yes ☐ No ☒

If “Yes” is

marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): -.

Other Information

2019

Annual Meeting of Shareholders

On

September 16, 2019, TDH Holdings, Inc. (the “Company”) held its 2019 Annual Shareholders Meeting at 9AM local China

time (or 8PM Eastern Standard Time), in Beijing, China. At the close of business on August 12, 2019, the record date to vote at

the meeting, there were 12,516,662 shares issued and outstanding. The following is a list of matters considered and voted upon

at the Annual Meeting:

|

|

1.

|

Election of Class B Directors

|

|

|

|

Name

|

Voted For

|

Withheld

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Qiu Li

|

7,030,130

|

6,007

|

|

|

|

|

|

|

|

Caifen Zou

|

7,034,137

|

6,000

|

|

|

|

|

|

|

2.

|

Ratification of appointment of Malone Bailey LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2019.

|

|

|

|

|

|

|

|

Voted For

|

Voted Against

|

Abstain

|

|

|

|

|

|

|

7,035,137

|

1,000

|

0

|

|

|

|

|

|

3.

|

Approval of the issuance of more than 20% of the Company’s issued and outstanding common stock in connection with the August 2019 private placement of the Company’s securities (the “Private Placement”) in accordance with Nasdaq Marketplace Rule 5635(d).

|

|

|

|

|

|

|

|

Voted For

|

Voted Against

|

Abstain

|

|

|

|

|

|

|

7,030,292

|

1,295

|

2,550

|

|

|

|

|

4.

|

Approval of the Company’s officer and director participation in the Private Placement as referenced in Proposal 3 in accordance with Nasdaq Marketplace Rule 5635(c).

|

|

|

|

|

|

|

|

Voted For

|

Voted Against

|

Abstain

|

|

|

|

|

|

|

7,027,977

|

1,120

|

5,040

|

|

|

|

|

5.

|

Approval of any change of control that could result from the potential issuance of the Company’s securities in the Private Placement as referenced in Proposal 3 in accordance with Nasdaq Marketplace Rule 5635(b).

|

|

|

|

|

|

|

|

Voted For

|

Voted Against

|

Abstain

|

|

|

|

|

|

|

7,032,551

|

1,546

|

40

|

|

|

Closing

of the Private Placement; Updates on the Nasdaq Compliance Matters

Following

the Annual Meeting and upon receipt of the requisite shareholder vote, on September 27, 2019, the Company closed a private

placement of its securities pursuant to subscription agreements with several individual accredited investors, including with

the Company’s Chief Executive Officer and a Board member (together, the “Investors”), under which such

Investors have agreed to purchase from the Company up to an aggregate of $10 million worth of the Company’s common

shares, at the per share price of $0.30, or a total of 33,333,333 of the Company’s common shares (the “Private

Placement”). The Company’s intends to use the net proceeds from the sale of its securities in this Private

Placement to pay off certain debt, complete the first phase of the Lingang production plant and for working capital and

general corporate purposes. The closing of this Private Placement was subject to certain conditions, including the

stockholder approval requirement pursuant to Nasdaq Marketplace Rule 5635(d). The Company sold the securities in this Private

Placement in reliance upon an exemption from registration under the Securities Act. There were no discounts or brokerage fees

associated with this offering.

Following

an oral hearing before the Nasdaq Hearings Panel to address the Company’s inability to meet Nasdaq minimum $2.5 million in

shareholders’ equity requirement set forth in Listing Rule 5550(b)(1), the Company received the Panel’s determination

to continue the listing of the Company’s securities on Nasdaq provided:

|

|

·

|

On or before September 30, 2019, the Company shall have closed its private placement and issued public disclosures that it has over $2.5 million in stockholders’ equity, and

|

|

|

·

|

On or before October 20, 2019, the Company shall report to the Panel regarding the status of its closing bid price and its plan for a reverse stock split.

|

In compliance

with the terms of the Panel’s determination, the Company reports that following the closing of the Private placement referenced

above, the Company’s shareholders’ equity, as shown on a pro forma basis reflecting the effect of such capital infusion,

is $5.36 million:

Unaudited Pro

Forma Condensed Combined Balance Sheet as of June 30, 2019

|

|

|

|

|

As of June 30, 2019

|

Pro Forma

|

|

|

|

|

|

|

Stockholders’ Equity

|

|

($4.64 million)

|

$5.36 million

|

|

|

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

Dated: September 30, 2019

|

TDH Holdings, Inc.

|

|

|

|

|

|

|

By

|

/s/ Dandan Liu

|

|

|

Name: Dandan Liu

Title: Chief Executive Officer

|

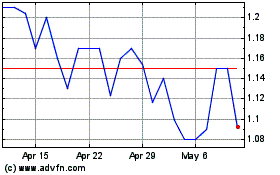

TDH (NASDAQ:PETZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

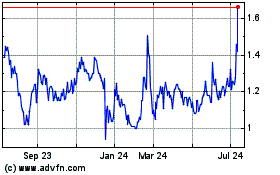

TDH (NASDAQ:PETZ)

Historical Stock Chart

From Apr 2023 to Apr 2024