PART I

The following discussion should be read in conjunction with our audited consolidated financial statements and accompanying notes thereto included elsewhere in this Annual Report. The following discussion includes certain forward-looking statements. For a discussion of important factors, including the continuing development of our business and other factors which could cause actual results to differ materially from the results referred to in the historical information and the forward-looking statements presented herein, see “Item 1A, Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” contained in this Annual Report.

Unless the context requires otherwise, references to ‘‘PetIQ Inc.,’’ ‘‘PetIQ,’’ the ‘‘Company,’’ ‘‘we,’’ ‘‘our’’ or ‘‘us’’ refer collectively to PetIQ, Inc. and its consolidated subsidiaries, including PetIQ Holdings, LLC, a Delaware limited liability company, which we refer to as “HoldCo.”

Item 1 - Business

Our Initial Public Offering and Reorganization Transactions

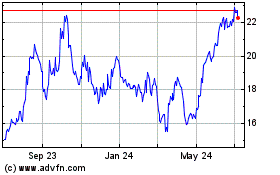

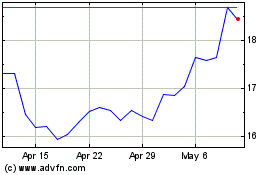

PetIQ, Inc. is a Delaware corporation formed in February 2016. PetIQ Class A common stock trades on the NASDAQ Global Select Market under the symbol “PETQ.”

On July 26, 2017, we closed an initial public offering (“IPO”) of 7,187,500 shares of our Class A common stock at a public offering price of $16.00 per share, which includes 937,500 shares issued pursuant to the underwriters’ over-allotment option. We received gross proceeds of approximately $115 million, part of which we used to purchase newly issued LLC interests from HoldCo (“LLC Interests”) at a price per interest equal to the initial public offering price of our Class A common stock of $16.00.

PetIQ is a holding company with no direct operations and our principal asset is the equity interest in PetIQ Holdings, LLC (“HoldCo”). In connection with the IPO, we completed a series of recapitalization transactions (collectively the “Reorganization Transactions”) including the following:

|

|

·

|

|

We entered into the 6th Amended and Restated LLC agreement for HoldCo (the “HoldCo LLC Agreement”), to, among other things, modifiy the capital structure of HoldCo to (i) create a new single class LLC Interests, (ii) exchange all of the then existing LLC Interests of the holders of HoldCo’s LLC interests (“Continuing LLC Owners”) for LLC Interests and (iii) appoint PetIQ as the sole managing member of HoldCo.

|

|

|

·

|

|

The PetIQ certificate of incorporation was amended and restated to, among other things, (i) provide for Class A common stock and Class B common stock and (ii) issue shares of Class B common stock to the Continung LLC Owners on a one-to-one basis with the number of LLC Interests they own.

|

|

|

·

|

|

Pursuant to a contribution agreement, each of ECP IV TS Investor Co., Eos TS Investor Co., and HCP-TS Blocker Corp (collectively, the “Sponsor Corps”) were contributed by their owners to PetIQ in exchange for 5,615,981 shares of Class A common stock and $30.5 million aggregate principal amount of preference notes payable by us. The contribution resulted in PetIQ acquiring 1,907,858 LLC Interests for the preference notes and 5,615,981 LLC Interests for the shares of Class A common stock. PetIQ also acquired the tax attributes of the Sponsor Corps, which were recorded generally as deferred tax assets at the time of the IPO. Following the contribution, each of the Sponsor Corps became a wholly owned subsidiary of PetIQ.

|

|

|

·

|

|

We exchanged 419,102 shares of Class A common stock on a one-for-one basis for 419,102 LLC Interests held by certain employee owners.

|

|

|

·

|

|

We purchased 1,589,643 LLC Interests from Continuing LLC Owners in exchange for $25.4 million in preference notes.

|

|

|

·

|

|

We purchased 133,334 LLC Interests from certain Continuing LLC Owners for $2.1 million.

|

All preference notes were paid in full upon the closing of the IPO. Following the completion of the Reorganization Transactions and IPO, PetIQ owned 61.5% of HoldCo. The remaining 38.5% of HoldCo was held by the Continuing LLC Owners, whom the Company defines as all remaining direct and indirect owners of HoldCo except for PetIQ. As the sole managing member of HoldCo, PetIQ and has the sole voting power in, and controls the management of, HoldCo. Accordingly, the Company consolidated the financial results of HoldCo and reported a non-controlling interest in its consolidated financial statements.

See Note 9 to the consolidated financial statements included in Part II, Item 8 for more information about the above-mentioned transactions as well as the other transactions completed in connection with the IPO.

Business Overview

PetIQ is a rapidly growing provider of veterinarian services and veterinarian-grade pet products, including prescription (“Rx”) medications, over-the-counter (“OTC”) flea and tick preventatives and health and wellness products for dogs and cats. We pioneered and are the leading seller to the retail channel of pet products that were previously available for purchase primarily from veterinary clinics. We enable our customers to offer pet owners choice, affordability and convenience in connection with products from leading national brands as well as our proprietary value-branded alternatives. Consumer behavior supports our continuing growth: pet owners are increasingly making purchases from the channels we serve. In addition, pet owners are shifting their retail purchases from non-veterinarian-grade products, previously the only products available in the retail channel, to the premium veterinarian-grade products that we sell. We believe we are well positioned to capitalize on these changes in consumer behavior because of our category leadership, broad product portfolio, value proposition and strong customer relationships. The end markets we serve are large and growing.

On January 17, 2018, we acquired Community Veterinary Clinics, LLC d/b/a VIP Petcare (“VIP,” and such acquisition, the “VIP Acquisition”). The aggregate consideration was comprised of $100 million of cash, 4,200,000 LLC Interests, 4,200,000 shares of our Class B common stock, a $10 million note payable due to sellers, and two $10 million earn-outs based on achievement of 2018 and 2019 combined company Adjusted EBITDA targets. VIP provides a comprehensive suite of services at community clinics and wellness centers hosted at pet retailers across 31 states, which includes diagnostic tests, vaccinations, prescription medications, microchipping and wellness checks. VIP’s veterinary services and products align with PetIQ’s corporate strategy and mission to improve pet health by providing consumers convenient access and affordable choices to a broad portfolio of pet health and wellness solutions. In 2017, VIP saw approximately one million pets through its network of community clinics. Today, PetIQ and VIP serve more than 40 retail partners representing more than 60,000 locations.

Our product portfolio spans a wide range of veterinarian-grade Rx medications and leading OTC medications as well as other health and wellness products. We offer our customers a comprehensive category management solution and sell products under multiple brands to address channel-specific requirements.

We rapidly develop, manufacture and introduce innovative new products to retailers and consumers. Our current product portfolio and pipeline of future products have been developed through a combination of in-house specialists and animal health research and development experts. In addition, we specialize in market analysis, product development, packaging, marketing, industry licensing and managing both the Environmental Protection Agency (“EPA”) and the Food and Drug Administration (“FDA”) regulated products. These internal and external resources enable us to expand our portfolio of proprietary value-branded products and develop next-generation versions of our existing products. We believe that our retail expertise and strong market position makes us an attractive partner for scientists and entrepreneurs developing new products in the pet health and wellness field. A combination of our internal expertise and strategic relationships has produced several of our top selling products and brands, including VetIQ, PetAction Plus, Advecta, PetLock Plus and TruProfen.

Our Industry

Attractive Pet Industry Trends

. In 2016, approximately 63.4 million U.S. households (52% of total U.S. households) owned a dog or a cat, compared to 57.0 million households (50% of total U.S. households) in 2008, according to Packaged Facts. Demographic trends in pet ownership and changing attitudes toward pets support our continuing growth, through the following:

∎

Pet Humanization: According to Packaged Facts, in the United States, an estimated 79% of dog owners and 77% of cat owners view their pets as family members. With pets increasingly viewed as companions, friends and family members, pet owners behave like “pet parents” with a strong inclination for spending disposable income to meet all of their pets’ needs during all economic cycles. Pets have become a financial priority.

∎

Increasing Consumer Focus on Pet Health and Wellness: Consumers are exhibiting greater interest in improved health for their pets and, as a result, are increasing their spending on veterinary care as well as purchases of the most effective veterinarian-grade pet products and supplies. Pet owners of all demographic and income levels aspire to purchase leading veterinarian-grade treatments.

∎

Increasing Pet Age and Incidents of Pet Disease: Pets are living longer and, as a result, have increasing medical needs. In 2016, Packaged Facts reported that 53.9% of dogs and 58.9% of cats are overweight, and in 2015, Packaged Facts reported that approximately 75% of older dogs and predisposed breeds have heart disease.

∎

Increasing Market Size and Consumer Spending: Pet spending in the United States has steadily increased every year since 1994, with Americans spending approximately $80 billion on their pets in 2017. Forecasters expect this trend to contue into the future.

Strong Growth in Pet Products

. According to Packaged Facts and the American Pet Products Association (the “APPA”), Americans spent $81.4 billion on pet products and services in 2016, nearly triple their 2001 spending of $28.5 billion. U.S. sales of pet medications for dogs and cats have grown from $5.8 billion in 2011 to an estimated $7.4 billion in 2016 and are estimated to reach $8.9 billion by 2019, representing a CAGR of 6% between 2016 and 2019, according to Packaged Facts. Additionally, our innovative pet treats compete in the U.S. dog and cat treat market, which has grown every year since 2010. According to Packaged Facts, the U.S. dog and cat treat market has grown to an estimated $6.1 billion in 2016 and is estimated to reach $7.3 billion of retail sales by 2019, representing a CAGR of 6% between 2016 and 2019.

Growth of Pet Medication Purchases from Retail Channel

.

We believe the market for pet medication and health and wellness products in the retail channel is likely to outpace growth in the broader pet industry. The pet owner has increasingly purchased veterinarian grade pet products from the retail channel as the estimated mass market share of the U.S. pet medication industry increased from 12% in 2011 to 21% in 2015 while the estimated veterinarian share declined from 63% in 2011 to 59% in 2015. We believe that migration will continue in the future as more consumers take advantage of the convenience of their local retail store, become aware of the significant cost savings that retail channels can deliver, and our product penetration at retail increases. Additionally there is a significant segment of pet owners who have not sought pet health care for a variety of reasons. Our affordable high-quality products will help unlock demand and provide cost sensitive customers the leading treatments they want at prices they can afford. In addition, we believe our acquisition of VIP makes us uniquely positioned to provide veterinarian services within the retail channel, and continue to benefit from this channel expansion.

Our Business Strategy

There are significant opportunities to grow our brand awareness, increase our net sales and profitability and deliver shareholder value by executing on the following initiatives:

Grow Consumer Awareness of Our Products in the Retail Channel

. We are an established category creator in the pet health and wellness and medication market with strong penetration of the retail channel and high awareness among retailers. With our broad retail network that includes the top U.S. retailers, we are increasingly focused on building consumer awareness and converting more pet owners to use our products. As pet owners learn that our proprietary value-

branded products offer the same active ingredients as leading brands at lower prices, we believe they will shift their purchasing habits to our products and our share of the overall pet Rx and OTC medications and health and wellness products market will continue to grow.

Increase Volume of Products with Existing Retailers

.

We conduct business with the majority of leading U.S. retailers with our core product offerings. We believe our net sales will continue to grow as we expand the number of products we have available for sale at each retailer. We also plan to creatively expand SKU placement within existing accounts through our in-house merchandising capabilities. Additionally, following the VIP Acquisition, we believe we are positioned to expand our presence within leading retailers.

Provide Veterinarian Services in Conjunction with our Retail Partners

.

As a result of the VIP Acquisition, we now provide a comprehensive suite of services at community clinics and wellness centers hosted at pet retailers across 31 states, which includes diagnostic tests, vaccinations, prescription medications, microchipping and wellness checks. We believe we have the ability to expand those offerings within our existing retail footprint, which will provide an additional earnings stream, as well as drive pet parent traffic to our retail partners for the purchase of pet medication and health and wellness products, thereby expanding the sales of our product offerings through our retail partners.

Employees

As of December 31, 2017, we had 225 employees. Our employees are not represented by any labor union or any collective bargaining arrangement with respect to their employment with us. We have never experienced any work stoppages or strikes as a result of labor disputes. We believe that our employee relations are good.

We acquired an additional 1,087 full-time and part-time employees and an estimated 980 independent contractors as a result of the consummation of the VIP Acquisition.

Seasonality

While many of our products are sold consistently throughout the year, we do experience seasonality in the form of increased demand for our flea and tick product offerings in the first half of the year, both leading up to and throughout the spring and summer seasons. Additionally we may experience fluctuations in net sales related to the inventory management strategies of our retail customers.

The practice of veterinary medicine is subject to seasonal fluctuation. In particular, demand for veterinary services is significantly higher during the warmer months as there are more fleas, ticks, and mosquitos during these months and products and services sold to prevent or treat illness or diseases related to these insects.

Our Products

We are a manufacturer and distributor of pet medication and health and wellness products to the retail channel. We focus our product offerings on innovative, proprietary value-branded products, and leading third-party branded products for dogs and cats, including pet Rx medications, OTC medications, and wellness products. We offer and supply these products to customers primarily in the United States.

Rx Medications

Our Rx pet medications include heartworm preventatives, arthritis, thyroid, diabetes and pain treatments, antibiotics and other specialty medications, all of which require a prescription from a veterinarian. We co-develop and manufacture our own proprietary value-branded products and distribute well-known leading third-party branded medications.

Our proprietary value-branded Rx medications allow consumers to care for their pets with the same quality of branded medications at a much lower cost. Currently, we manufacture Heart Shield Plus, our proprietary value-branded version of Heartgard® Plus, which prevents heartworm infection in dogs. We also manufacture TruProfen, our proprietary value-branded version of Rimadyl®, which treats arthritis in dogs. We plan to develop, and bring to retail customers, proprietary value-branded versions of other popular pet Rx medications currently available only in branded versions at premium prices.

We also sell to retailers more than 240 SKUs of the most popular pet Rx medications that previously had been available primarily through the veterinarian channel. These retailers then sell these pet Rx medications to pet owners who have a prescription. We source these pet Rx medications directly from manufacturers or through licensed distributors. Several of the top-selling Rx medications that we distribute include Rimadyl®; Heartgard® Plus and Vetmedin®.

OTC Medications and Supplies

Our OTC medications are primarily comprised of flea and tick control products, which are available in multiple forms, such as spot on (topical) treatments, chewables, and collars.

We sell to the retail channel more than 110 SKUs of the most popular leading OTC-branded and value-branded medications consisting primarily of flea and tick control medications. We source OTC medications directly from manufacturers or through licensed distributors.

Health and Wellness Products

Our health and wellness products include specialty treats and other pet products such as dental treats and nutritional supplements (including hip and joint, vitamins and skin and coat products). We manufacture and distribute more than 219 SKUs of proprietary wellness products for dogs and cats, mainly under our VetIQ, Betsy Farms and Delightibles product lines.

Specific products in this category include dental treats, such as

Minties

dental treats; nutritional supplements, such as our VetIQ products, skin and coat chews, vitamin chews and treats that disguise medication to aid in pets’ pill ingestion; and treats, such as our

Betsy Farms

dog treats and

Delightibles

cat treats.

Product Innovation

We offer a broad portfolio of pet medications and health and wellness products to our retail customers, including an array of products that we develop, manufacture and distribute. To continue to grow our pet Rx medication, OTC medications and other health and wellness product offerings, we invest in research and development on an ongoing basis. We use a combination of in-house specialists, third-party consultants and animal health research and development experts to expand our proprietary value-branded portfolio and develop next-generation versions of our current pet products.

In addition, we have leveraged our market position to emerge as an attractive partner for outside research and development researchers and entrepreneurs developing new products and technologies in the strategic pet health and wellness field. We believe these scientists and entrepreneurs seek out our partnership on innovative products given our experience in proprietary value-branded manufacturing and relationships with key retail channel contacts. Our process of assessing partnerships with any outside research and development opportunity includes performing our own internal research and development review, testing and quality control procedures.

Channels

Traditional industry sales channels for pet Rx medications, OTC medications, and other health and wellness products include sales through the veterinarian, retail and e-commerce channels, depending primarily on the product involved.

Historically, pet Rx and flea and tick medications have been sold through veterinarian offices and, to a lesser extent, e-commerce. We have focused on making these products, as well as our proprietary value-branded products, available directly to consumers through retail outlets, which offer consumers access to these products at lower prices and in more convenient locations. Our retail channel sales are primarily concentrated in five sub-channels of retail: (i) food, drug and mass market sales (e.g., Walmart, Target and Kroger); (ii) club stores (e.g., Sam’s Club, Costco Wholesale and BJ’s Wholesale Club); (iii) pet specialty stores (e.g., PetSmart, Petco and independent pet stores); (iv) e-commerce; and (v) independent pharmacies. E-commerce grew by over 300% in 2017 when compared to 2016. The Company will continue

to grow its e-commerce business in line with total market growth in this channel by supporting its retail partners’ channel strategies and partnering with leading online retailers.

We believe we are a key participant in the sales growth of pet medication products to the retail channel.

Customers

As of December 31, 2017, approximately 98% of 2017 and 2016 net sales were generated from customers located in the United States and Canada, with the remaining 2% from foreign locations during each period. Our customers are primarily national superstore chains and national pet superstore chains, such as Walmart, Sam’s Club, Costco, PetSmart, Petco, Kroger, Target, and BJ’s Wholesale Club. We supply each of these customers on a national basis. Our largest retail customers are Walmart and Sam’s Club, which represented 30% and 16%, respectively of our net sales in 2017 and 33% and 21%, respectively, of our net sales in 2016. In addition, Anda Inc. (“Anda”), which distributes our products to pharmacies, accounted for 15% of our net sales in 2017 and 2016. Anda only purchases products that are actively being sold through to retailers. No other customer accounted for more than 10% of our net sales in 2017 or 2016.

At each of our top customers, we sell to several individual departments represented by different buying groups, such as pharmacy, treats, and pet supplies.

Additionally, we develop strong and lasting relationships with our pharmacy customers by leveraging our product breadth and expertise, superb customer care and support. Pharmacy customers have a higher barrier to entry than other retail customers as they are a highly regulated segment of the retail channel. We believe that, because of such regulation, our pharmacy customers appreciate our focus on integrating our systems with theirs, including interfacing delivery schedules and traceability, which is a key requirement for any major pharmacy retailer. In addition, we try to continually strengthen our pharmacy relationships by providing a variety of value-added services to the pharmacies. These services may include computer programs, training opportunities and web-based customer support.

Finally, we believe that our level of customer care is critical in retaining and expanding our relationships with our key customers. Our in-house customer care representatives participate in ongoing training programs under the supervision of our training managers. These training sessions include a variety of topics such as product knowledge, computer usage and customer service tips. Our customer care representatives promptly respond to customer inquiries related to products, order status, prices and shipping. We believe that our customer care representatives are a valuable source of feedback regarding customer satisfaction.

Supply Chain

Proprietary Value-Branded Products

None of our suppliers for proprietary value-branded products are individually significant. Our proprietary value-branded products are currently manufactured by us at our facilities in Daytona Beach, Florida and Springville, Utah and through a network of manufacturing facilities owned and operated by contract manufacturing partners across the United States and in Europe. We expect that the combined capacities of our facilities and those of our contract manufacturing partners will meet our forecasted needs for our proprietary value-branded products for the foreseeable future.

Distributed Products

We purchase branded and other products that we distribute, but do not manufacture, from a variety of sources in the United States and Europe, including certain manufacturers and licensed distributors. We believe that having strong relationships with our suppliers will ensure the availability of an adequate volume of products ordered by our retail customers and will enable us to provide more and better product information.

Fulfillment, Warehousing and Shipping

To accomplish efficient fulfillment for Rx medication products across the United States, we utilize our established medication distribution channels with our distribution partner, Anda. We have entered into a five-year contract with Anda, which automatically renews for successive two year terms.

For most products, our in-house fulfillment and distribution operations manage the entire supply chain, beginning with the placement of the order, continuing through order processing and then fulfilling and shipping of the product to the customer. All customer orders are processed by our customer service team. We inventory our products at, and fill most customer orders from, our distribution centers in Daytona Beach, Florida and Springville, Utah. We also use third-party warehouse providers to fulfill a small amount of our orders. We ship our products using common carriers.

For products sold into local and regional pet specialty retailers, we work with our distribution partner, Phillips Pet Food & Supplies (“Phillips”), one of the largest distributors to independent pet stores in the country. Phillips buys our products directly and resells them to independent pet specialty retailers.

Product Quality and Safety

We believe that product safety and quality are critical. We have developed, implemented and enforced a robust product safety and quality program. We have established critical control points throughout the entire supply chain from ingredient sourcing to finished goods to ensure compliance with our quality program.

The food safety program at our Utah plant, where our pet treats are made, is certified at Safe Quality Food Level II under the Global Food Safety Initiative Benchmarks. To achieve this qualification level, our Utah facility has been built to comply with particular food safety specifications and allows for correct airflow to prevent cross-contamination, among other things. This qualification level also requires us to have certain standard operating procedures in place written to Safe Quality Food code specifications, hold regular training seminars for manufacturing employees and maintain reporting documentation evidencing compliance with such standard operating procedures.

In addition, our safety and quality program includes strict guidelines for incoming ingredients, batching, processing, packaging and finished goods. As part of our focus on safety and quality, we have implemented batch and lot traceability controls across our manufacturing network, including at our manufacturing facilities, where such controls have been implemented into our enterprise resource planning system. These controls allow us to track and tie discreet, inbound raw material components through the manufacturing process to the ultimate finished product, allowing us to maintain and control all finished product lot details and quickly access process manufacturing details.

At the Florida facility where our Rx and OTC medications are held for distribution, we maintain a Veterinary Prescription Drug Wholesale Distributor license with the State of Florida Department of Business and Professional Regulation, which is the same government entity that regulates distribution facilities for human medications. In connection with our maintenance of this license, the State of Florida conducts random inspections of our facility. To pass these inspections, we must demonstrate safety compliance at the highest standard, including maintaining correct plant temperatures and environmental controls.

As described above, we use contract manufacturers to produce certain of our proprietary value-branded products. To ensure product quality, consistency and safety standards, we actively monitor each contract manufacturer’s operations through the standard operating procedures and facility audits described above.

All of our contract manufacturing facilities are required to have quality control standard operating procedures in place. We require our contract manufacturing facilities to maintain third-party certifications and pass our own quality system and safety audits, and for FDA-regulated products, to comply with the Good Manufacturing Practices of the FDA. Third-party certifications provide an independent and external assessment that a product and/or process complies with applicable safety regulations and standards, though a regulatory authority may disagree with that assessment. In addition, our quality control

team conducts reviews of all aspects of our supply chain to ensure that ingredients, finished goods and manufacturing processes meet our strict safety and quality requirements and that all of our ingredients are rigorously tested prior to being used in our products.

Any consumer may call our customer service line, where we have trained representatives on staff. Any call reporting an adverse event relating to our products is further addressed by our third-party vendor, SafetyCall, through its own on-site veterinarians. On a quarterly basis, we submit filings in accordance with the EPA specifications reporting any adverse event associated with our flea and tick products.

Marketing and Advertising

Our marketing strategy largely focuses on building awareness and educating pet owners about our various brands and products. To accomplish this goal, we use a combination of television, digital marketing (e.g. digital coupons, display ads, pay per click, email), social media marketing and in-store displays and promotions. Our marketing message highlights the quality and cost-savings our products offer customers such as our proprietary, value-branded flea and tick products that contain the same active ingredients as leading brands at affordable prices.

Competition

The pet medication and health and wellness industry is highly competitive. We compete on the basis of product quality, product availability, quality, palatability, brand awareness, loyalty and trust, product variety and ingredients, product packaging and design, shelf space, reputation, price point and promotional efforts. We compete directly and indirectly with both manufacturers and distributors of pet medication and health and wellness products and online distributors, as well as with veterinarians. We directly face competition from companies that distribute various pet medications and pet health and wellness products to traditional retailers such as Perrigo, Unicharm Company and Central Garden and Pet Company, all of which are larger than we are and have greater financial resources. We also face competition in our other pet health and wellness products category from companies such as Nestlé S.A. (“Nestlè”), Mars, Inc (“Mars”), Perrigo Company plc (“Perrigo”), and The J.M. Smucker Company (“Smucker”), all of which are larger than we are and have greater financial resources.

Our retail customers compete with online retailers and veterinarians for the sale of Rx and OTC pet medications and other health and wellness products. Many pet owners may prefer the convenience of purchasing their pet medications or other health products during a veterinarian visit. In order to effectively compete with veterinarians, we and retail partners must continue to educate pet owners about the product availability, service and savings offered by purchasing pet medications and other health products in their retail stores.

With our acquisition of VIP, we will now compete directly with veterinarians. Our primary competitors for our veterinary clinics in most markets are individual practitioners or small, regional multi-clinic practices. In addition, some national companies such as Banfield Pet Hospitals, VCA Animal Hospitals, or Petco are developing or have developed networks of veterinary clinics in markets in which VIP currently operates.

Our Trademarks and Other Intellectual Property

We believe that our intellectual property has substantial value and has contributed significantly to the success of our business. Our primary trademarks include “PetIQ,” “PetAction,” “Advecta,” “PetLock,” “Heart Shield Plus,” “TruProfen,” “Betsy Farms,” “Minties,” “Vera,” “Delightibles” and “VetIQ,” all of which are registered with the U.S. Patent and Trademark Office. We also have numerous other trademark registrations and pending applications, in the U.S., Canada and Europe, for product names that are central to our branding. Our trademarks are valuable assets that reinforce our brand, our sub-brands and our consumers’ favorable perception of our products. The current registrations of these trademarks in the U.S. and foreign countries are effective for varying periods of time and may be renewed periodically, provided that we, as the registered owner, or our licensees where applicable, comply with all applicable renewal requirements including, where necessary, the continued use of the trademarks in connection with the goods or services identified in the applicable

registrations. In addition to trademark protection, we own numerous URL designations, including www.vetiq.com, www.advecta.com, www.delightibles.com and www.mintiestreats.com, that are important to the successful implementation of our marketing and advertising strategy. We also have patents and pending patent applications for products, formulas and packaging that we consider important to our business. We rely on and carefully protect unpatented proprietary expertise, recipes and formulations, continuing innovation and other trade secrets to develop and maintain our competitive position.

Government Regulation

Along with our contract manufacturers, ingredient and packaging suppliers and third-party shipping providers, we are subject to a broad range of laws and regulations, both in the U.S. and elsewhere, intended to protect public health and safety, natural resources and the environment. Our operations in the U.S. are subject to regulation by the FDA, the EPA, the Florida Department of Health and the USDA and by various other federal, state, local and foreign authorities regarding the manufacturing, processing, packaging, storage, distribution, advertising, labeling and export of our products, including drug and food safety standards.

All Rx animal drugs are required to be approved by the FDA through either a New Animal Drug Application or, in the case of generic Rx animal drugs, an Abbreviated New Animal Drug Application (“ANADA”). Two of our proprietary value-branded products, TruProfen and Heart Shield Plus, have been approved by the FDA under ANADAs submitted to the FDA by third parties. We have agreements with these third parties that hold approved ANADAs to private label or proprietary value-branded products under such ANADAs, However, the third parties that hold the ANADAs are ultimately responsible for compliance with regulatory obligations associated with these products.

In addition, our foreign subsidiaries are subject to the laws of the United Kingdom, the Republic of Ireland and the European Union, as well as provincial and local regulations.

Under various statutes and regulations, these agencies and authorities, among other things, (i) prescribe the requirements and establish the standards for quality and safety, (ii) regulate our marketing, advertising and sales to consumers and (iii) control the importing and exporting of our products. Certain of these agencies, in certain circumstances, must not only approve our products, but also review the manufacturing processes and facilities used to produce these products before they can be marketed in the United States and elsewhere. In particular, certain of our pet medication products require FDA approval prior to marketing. To market such an FDA-regulated pet medicine, the FDA must approve a new animal drug application, or NADA, supported by data from animal safety and effectiveness studies that adequately demonstrate the safety and efficacy of that product in the target animal for the intended indication; or, in the case of generic versions of previously approved reference-listed pet medicines, the FDA an ANADA, supported by data to demonstrate, among other things, that the proposed generic product has the same active ingredients in the same concentration as the reference-listed product and is bioequivalent to the reference listed product. After approval, manufacturers are required to collect reports of adverse events and submit them on a regular basis to the FDA. Some of the products we distribute are marketed pursuant to approved ANADAs held by third parties with whom we contract to distribute those ANADA-approved products under our own label.

We are subject to labor and employment laws, safety and health regulations and other laws, including those promulgated by the EPA and the National Labor Relations Board. Our operations, and those of our contract manufacturers, ingredient and packaging suppliers and third-party shipping providers, are subject to various laws and regulations relating to worker health and safety matters as well as environmental and natural resource protection, including the availability and use of pesticides, emissions and discharges to the environment, and the treatment, handling, storage and disposal of materials and wastes. We monitor changes in these laws and believe that we are in material compliance with applicable laws and regulations. No assurance can be given, however, that material costs and liabilities will not arise in the future, such as due to a change in the law or the discovery of currently unknown conditions.

Certain states have laws, rules and regulations which require that veterinary medical practices be either wholly-owned or majority-owned by licensed veterinarians and that corporations which are not wholly-owned or majority-owned by licensed veterinarians refrain from providing, or holding themselves out as providers of, veterinary medical care. In these states and provinces, we provide management and other administrative services to veterinary practices rather than

owning such practices or providing such care. In some cases, in addition to providing management and administrative services we may lease the veterinary facility and equipment to the veterinary practice. Although we have structured our operations to comply with our understanding of the veterinary medicine laws of each state and province in which we operate, interpretive legal precedent and regulatory guidance varies by jurisdiction and is often sparse and not fully developed.

In addition, all of the states in which we operate impose various registration permit and/or licensing requirements. To fulfill these requirements, we have registered each of our facilities with appropriate governmental agencies and, where required, have appointed a licensed veterinarian to act on behalf of each facility. All veterinarians practicing in our animal wellness centers are required to maintain valid state licenses to practice.

Our Corporate Information

PetIQ, Inc., a Delaware corporation, was incorporated in February 2016 for the purpose of completing our IPO and has had no business activities or transactions prior to July 20, 2017. PetIQ is a holding company and the sole managing member of HoldCo, a Delaware limited liability company, founded in 2012. HoldCo is the sole member of PetIQ, LLC (“Opco”), an Idaho limited liability company and our predecessor for financial reporting purposes, and has no operations and no assets other than the equity interests of Opco. We are incorporated in Delaware and currently exist as a Delaware corporation. Our principal executive offices are located at 500 E. Shore Dr., Eagle, Idaho 83616. Our telephone number is 208-939-8900. The address of our corporate website is

www.petiq.com

, and our investor relations website is located at

http://ir.petiq.com

. The contents of our website are not intended to be incorporated by reference into this Annual Report on Form 10-K or in any other report or document we file with the SEC, and any references to our websites are intended to be inactive textual references only.

Available Information

Our Annual Reports on Form 10-K, annual proxy statements and related proxy cards are made available on our website at the same time they are mailed to stockholders. Our quarterly reports on Form 10-Q, periodic reports on Form 8-K and amendments to those reports that we file or furnish pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), are available through our website, free of charge, as soon as reasonably practicable after they have been electronically filed or furnished to the SEC. Our website also provides access to reports filed by our directors, executive officers and certain significant shareholders pursuant to Section 16 of the Exchange Act. In addition, General Code of Ethics and charters for the committees of our board of directors are available on our website as well as other shareholder communications. The information contained in or that can be accessed through our website does not constitute a part of, and is not incorporated by reference into, this report. You may read and copy any materials we file with the Securities and Exchang Commission (“SEC”) at the SEC's Public Reference Room at 100 F Street, NE, Washington, DC 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC also maintains a website, www.sec.gov, which contains reports, proxy and information statements and other information that we file electronically with the SEC.

Item 1A – Risk Factors

Our business, results of operations and financial condition may be materially adversely affected by a number of factors, including the following:

Risks Related to Our Business and Industry

We may seek to grow our business through acquisitions of or investments in new or complementary businesses, facilities, technologies or products, or through strategic alliances, and the failure to manage acquisitions, investments or strategic alliances, or the failure to integrate them with our existing business, could have a material adverse effect on us.

From time to time we may consider opportunities to acquire or make investments in new or complementary businesses, facilities, technologies or products, or enter into strategic alliances, that may enhance our capabilities, expand our manufacturing network,

complement our current products or expand the breadth of our markets, such as the recent VIP Acquisition. Potential and completed acquisitions and investments and other strategic alliances involve numerous risks, including:

|

|

∎

|

|

problems integrating the purchased business, facilities, technologies or products;

|

|

|

∎

|

|

issues maintaining uniform standards, procedures, controls and policies;

|

|

|

∎

|

|

unanticipated costs associated with acquisitions, investments or strategic alliances;

|

|

|

∎

|

|

diversion of management’s attention from our existing business;

|

|

|

∎

|

|

adverse effects on existing business relationships with suppliers, contract manufacturers, and retail customers;

|

|

|

∎

|

|

risks associated with entering new markets in which we have limited or no experience;

|

|

|

∎

|

|

potential loss of key employees of acquired businesses; and

|

|

|

∎

|

|

increased legal and accounting compliance costs.

|

We do not know if we will be able to identify acquisitions or strategic relationships we deem suitable, whether we will be able to successfully complete any such transactions on favorable terms or at all or whether we will be able to successfully integrate any acquired business, facilities, technologies or products into our business or retain any key personnel, suppliers or customers. Our ability to successfully grow through strategic transactions depends upon our ability to identify, negotiate, complete and integrate suitable target businesses, facilities, technologies and products and to obtain any necessary financing. These efforts could be expensive and time-consuming and may disrupt our ongoing business and prevent management from focusing on our operations. If we are unable to integrate any acquired businesses, facilities, technologies and products effectively, our business, results of operations and financial condition could be materially adversely affected.

Completed acquisitions may result in additional goodwill and/or an increase in other intangible assets on our balance sheet. We are required annually, or as facts and circumstances exist, to test goodwill and other intangible assets to determine if impairment has occurred. If the testing performed indicates that impairment has occurred, we are required to record a non-cash impairment charge for the difference between the carrying value of the goodwill or other intangible assets and the implied fair value of the goodwill or the fair value of other intangible assets in the period the determination is made. We determined there was no impairment in 2017, 2016 and 2015; however, we cannot accurately predict the amount and timing of any impairment of assets. Should the value of goodwill or other intangible assets become impaired, there could be a material adverse effect on our financial condition and results of operations.

We may not be able to successfully integrate, manage and expand VIP’s business and operations.

As a result of the VIP Acquisition, the size of our business has expanded significantly and we have entered into a new line of business providing veterinary services. This will pose substantial challenges for our management, including the management of significantly expanded operations and associated increased cost and complexity. In addition, the provision of veterinary services is a regulated industry subject to numerous governmental regulations. Any failure to manage our expanded business or to realize the anticipated benefits of the VIP Acquisition could have a material adverse effect on our business, operating results and financial condition.

We are dependent on a relatively limited number of customers for a significant portion of our net sales.

Our two largest retail customers, Walmart and Sam’s Club, accounted for 30% and 16% of our net sales in 2017, 33% and 21% of our net sales in 2016, and 39% and 21% of our net sales in 2015, respectively. No other retail customer has accounted for 10% or more of our net sales for these periods. In addition, Anda, which distributes our products to pharmacies, accounted for 15% of our net sales in 2017 and 2016 and 14% of our net sales in 2015. If we were to lose any of our key customers, if any of our key customers reduce the amount of their orders or if any of our key customers consolidate, reduce their store footprint and/or gain greater market power, our business, financial condition and results of operations may be materially adversely affected. We may be similarly adversely impacted if any of our key customers experience any financial or operational difficulties or generate less traffic.

In addition, we generally do not enter into long-term contracts with our retail customers. As a result, we rely on consumers’ continuing demand for our products and our position in the market for all purchase orders. If our retail customers change their pricing, margin expectations or business terms (including through the imposition of warehouse and other fees), change their business strategies as a result of industry consolidation or otherwise, reduce the number of brands or product lines they carry, decrease their advertising or promotional efforts for, or the amount of shelf space they allocate to, our products or allocate greater

shelf space to other products, our net sales could decrease and our business, financial condition and results of operations may be materially adversely affected.

We may not be able to successfully implement our growth strategy on a timely basis or at all.

Our future success depends, in large part, on our ability to implement our growth strategy, including introducing products and expanding into new markets, attracting new consumers to our brand and sub-brands, improving placement of our products in the stores of our retail customers and expanding our distribution. In particular, we recently began to expand our sales plan to include online sales through our retail partners. Our ability to implement this growth strategy depends, among other things, on our ability to:

|

|

∎

|

|

develop new proprietary value-branded products and product line extensions that appeal to consumers;

|

|

|

∎

|

|

continue to effectively compete in our industry;

|

|

|

|

|

|

|

|

∎

|

|

increase our brand and sub-brand recognition by effectively implementing our marketing strategy and advertising initiatives;

|

|

|

∎

|

|

maintain and, to the extent necessary, improve our high standards for product quality, safety and integrity;

|

|

|

|

|

|

|

|

∎

|

|

expand and maintain brand and sub-brand loyalty;

|

|

|

∎

|

|

secure shelf space in the stores of our retail customers; and

|

|

|

∎

|

|

enter into distribution and other strategic arrangements with traditional retailers and other potential distributors of our products.

|

We may not be able to successfully implement our growth strategy and may need to change our strategy in order to maintain our growth. If we fail to implement our growth strategy or if we invest resources in a growth strategy that ultimately proves unsuccessful, our business, financial condition and results of operations may be materially adversely affected.

We have incurred net losses in the past and may be unable to sustain profitability in the future.

We incurred net losses of $3.4 million and $1.3 million for the years ended December 31, 2016 and 2015, respectively. As of December 31, 2017, we had an accumulated deficit of $22.4 million including the operations of HoldCo prior to our IPO. We expect to continue to incur significant product commercialization and regulatory, sales and marketing and other expenses. In addition, our general and administrative expenses increased following our IPO due to the additional costs associated with being a public company. The net income we earn may fluctuate significantly from quarter to quarter. We will need to generate additional net sales or increased gross margin to sustain profitability, and we cannot be sure that we will remain profitable for any substantial period of time. Our failure to maintain profitability could negatively impact the value of our Class A common stock.

If we continue to grow rapidly, we may not be able to manage our growth effectively.

Our historical rapid growth has placed and, if continued, may continue to place significant demands on our management and our operational and financial resources. Our organizational structure may become more complex as we add additional staff, and we would likely require more resources to grow and continue to improve our operational, management and financial controls. If we are not able to manage our growth effectively, our business, financial condition and results of operations may be materially adversely affected.

We operate in a highly competitive industry and may lose market share or experience margin erosion if we are unable to compete effectively.

The pet health and wellness industry is highly competitive. We compete on the basis of product and ingredient quality, product availability, palatability, brand awareness, loyalty and trust, product variety and innovation, product packaging and design, shelf space, reputation, price and convenience and promotional efforts. We compete directly and indirectly with both manufacturers and distributors of pet health and wellness products, including online distributors and veterinarians. We face direct competition from companies that distribute various pet medications and pet health and wellness products to traditional retailers, such as Perrigo, Unicharm Company and Central Garden and Pet Company, all of which are larger than we are and have greater financial resources. We also face competition in our other pet health and wellness products category from companies such as Nestlé, Mars, and Smucker, all of which are larger than we are and have greater financial resources.

Although we do not compete with various human drug distributors today, we have no way to guarantee that they will not enter into the market in the future. These distributors, such as McKesson Corporation, AmerisourceBergen Corporation and Cardinal Health, Inc., are larger than we are and have greater financial resources than we do.

These competitors may be able to identify and adapt to changes in consumer preferences more quickly than us due to their resources and scale. They may also be more successful in marketing and selling their products, better able to increase prices to reflect cost pressures and better able to increase their promotional activity, which may impact us and the entire pet health and wellness industry. If these or other competitive pressures cause our products to lose market share or experience margin erosion, our business, financial condition and results of operations may be materially adversely affected.

We face significant competition from veterinarians and may not be able to compete profitably with them.

We compete indirectly with veterinarians for the sale of pet medications and other health and wellness products. Veterinarians hold a competitive advantage over us because many pet owners may find it more convenient or preferable to purchase these products directly from their veterinarians at the time of an office visit. In addition, with the completion of the VIP Acquisition, we now manage a significant number of veterinarians, both as employees and as independent contractors, and now compete directly with the veterinarians for the provision of veterinarian services. In order to effectively compete with veterinarians in the future, we may be required to incur additional costs for marketing, promotions and other incentives, which may result in lower operating margins and adversely affect the results of operations.

Resistance from veterinarians to authorize prescriptions, or attempts/efforts on their part to discourage pet owners to purchase from retailers and pharmacies could cause our net sales to decrease and could materially adversely affect our financial condition and results of operations.

Since we began our operations some veterinarians have resisted providing, or simply refuse to provide, pet owners with a copy of their pet’s prescription or authorizing the prescription to an outside pharmacy, thereby effectively preventing outside pharmacies from filling such prescriptions under state law. We have also been informed by customers and consumers that veterinarians on certain occasions have tried to discourage pet owners from purchasing from the retail channel. If the number of veterinarians who refuse to authorize prescriptions should increase, or if veterinarians are successful in discouraging pet owners from purchasing from outside retailers and pharmacies, our net sales could decrease and our financial condition and results of operations may be materially adversely affected.

Any damage to our reputation or our brand or sub-brands may materially adversely affect our business, financial condition and results of operations.

Maintaining, developing and expanding our reputation with consumers, our retail customers and our suppliers is critical to our success. Our brand and sub-brands may suffer if our marketing plans or product initiatives are not successful. The importance of our brand and sub-brands may decrease if competitors offer more products with formulations similar to the products that we manufacture. Further, our brand and sub-brands may be negatively impacted due to real or perceived quality issues or if consumers perceive us as being untruthful in our marketing and advertising, even if such perceptions are not accurate. Product contamination, the failure to maintain high standards for product quality, safety and integrity, including raw materials and ingredients obtained from suppliers, or allegations of product quality issues, mislabeling or contamination, even if untrue or caused by our contract manufacturing partners or raw material suppliers, may reduce demand for our products or cause production and delivery disruptions. We maintain guidelines and procedures to ensure the quality, safety and integrity of our products. However, we may be unable to detect or prevent product and/or ingredient quality issues, mislabeling or contamination, particularly in instances of fraud or attempts to cover up or obscure deviations from our guidelines and procedures. If any of our products become unfit for consumption, cause injury or are mislabeled, we may have to engage in a product recall and/or be subject to liability. Damage to our reputation or our brand or sub-brands or loss of consumer confidence in our products for any of these or other reasons could result in decreased demand for our products and our business, financial condition and results of operations may be materially adversely affected.

Our growth and business are dependent on trends that may change, and our historical growth may not be indicative of our future growth.

The growth of our business depends primarily on the continued shift from consumers purchasing pet health and wellness products from veterinarians to purchasing such products through traditional retail channels, growth of the pet health and wellness products market and popularity of pet ownership, as well as on general economic conditions. These trends may not continue or may change. In the event of a decline in consumers purchasing pet health and wellness products through traditional retail channels, a change in pet health and wellness trends or a decrease in the overall number of pets, or during challenging economic times, we

may be unable to persuade our retail customers and consumers to purchase our products, and our business, financial condition and results of operations may be materially adversely affected and our growth rate may slow or stop.

There may be decreased spending on pets in a challenging economic climate.

The United States has from time to time experienced challenging economic conditions, and the global financial markets have recently undergone and may continue to experience significant volatility and disruption. Our business, financial condition and results of operations may be materially adversely affected by a challenging economic climate, including adverse changes in interest rates, volatile commodity markets and inflation, contraction in the availability of credit in the market and reductions in consumer spending. The keeping of pets and the purchase of pet-related products may constitute discretionary spending for some consumers and any material decline in the amount of consumer discretionary spending may reduce overall levels of pet ownership or spending on pets. As a result, a slow-down in the general economy may cause a decline in demand for our products. In addition, we cannot predict how worsening economic conditions would affect our retail customers and suppliers, generally. If economic conditions result in decreased spending on pets and have a negative impact on our retail customers and suppliers, our business, financial condition and results of operations may be materially adversely affected.

Our business depends, in part, on the sufficiency and effectiveness of our marketing and trade promotion programs and incentives.

Due to the highly competitive nature of our industry, we must effectively and efficiently promote and market our products through television, internet and print advertisements as well as through trade promotions and incentives to sustain and improve our competitive position in our market. Marketing investments may be costly. In addition, we may, from time to time, change our marketing strategies and spending, including the timing or nature of our trade promotions and incentives. We may also change our marketing strategies and spending in response to actions by our customers, competitors and other companies that manufacture and/or distribute pet health and wellness products. The sufficiency and effectiveness of our marketing and trade promotions and incentives are important to our ability to retain and improve our market share and margins. If our marketing and trade promotions and incentives are not successful or if we fail to implement sufficient and effective marketing and trade promotions and incentives or adequately respond to changes in industry marketing strategies, our business, financial condition and results of operations may be adversely affected.

If our products are alleged to cause injury or illness or fail to comply with governmental regulations, we may need to recall our products and may experience product liability claims.

Our products may be subject to product recalls, including voluntary recalls or withdrawals, if they are alleged to pose a risk of injury or illness, or if they are alleged to have been mislabeled, misbranded or adulterated or to otherwise be in violation of governmental regulations. We may also voluntarily recall or withdraw products in order to protect our brand or reputation if we determine that they do not meet our standards, whether for quality, palatability, appearance or otherwise. If there is any future product recall or withdrawal, it could result in substantial and unexpected expenditures, destruction of product inventory, damage to our reputation and lost sales due to the unavailability of the product for a period of time, and our business, financial condition and results of operations may be materially adversely affected. In addition, a product recall or withdrawal may require significant management attention and could result in enforcement action by regulatory authorities.

We also may be subject to product liability claims if the consumption or use of our products is alleged to cause injury or illness. Although we carry product liability insurance, our insurance may not be adequate to cover all liabilities that we may incur in connection with product liability claims. For example, punitive damages are generally not covered by insurance. If we are subject to substantial product liability claims in the future, we may not be able to continue to maintain our existing insurance, obtain comparable insurance at a reasonable cost, if at all, or secure additional coverage. This could result in future product liability claims being uninsured. If there is a product liability judgment against us or a settlement agreement related to a product liability claim, our business, financial condition and results of operations may be materially adversely affected. In addition, even if product liability claims against us are not successful or are not fully pursued, these claims could be costly and time-consuming and may require management to spend time defending claims rather than operating our business.

To the extent our retail customers purchase products in excess of consumer consumption in any period, our net sales in a subsequent period may be adversely affected as our retail customers seek to reduce their inventory levels.

From time to time, our retail customers may purchase more products than they expect to sell to consumers during a particular time period. Our retail customers may grow their inventory in anticipation of, or during, our promotional events, which typically provide for reduced prices during a specified time or other incentives. Our retail customers may also increase inventory in anticipation of a price increase for our products, or otherwise over-order our products as a result of overestimating demand for

our products. If a retail customer increases its inventory during a particular reporting period as a result of a promotional event, anticipated price increase or otherwise, then our net sales during the subsequent reporting period may be adversely impacted as our retail customers seek to reduce their inventory to customary levels. This effect may be particularly pronounced when the promotional event, price increase or other event occurs near the end or beginning of a reporting period or when there are changes in the timing of a promotional event, price increase or similar event, as compared to the prior year. To the extent our retail customers seek to reduce their usual or customary inventory levels or change their practices regarding purchases in excess of consumer consumption, our net sales and results of operations may be materially adversely affected in that or subsequent periods.

We may not be able to manage our manufacturing and supply chain effectively, which may adversely affect our results of operations.

We must accurately forecast demand for all of our products in order to ensure that we have enough products available to meet the needs of our retail customers. Our forecasts are based on multiple assumptions that may cause our estimates to be inaccurate and affect our ability to obtain adequate manufacturing capacity (whether our own manufacturing capacity or contract manufacturing capacity) in order to meet the demand for our proprietary value-branded products, which could prevent us from meeting increased retail customer or consumer demand and harm our brand, our sub-brands and our business. If we do not accurately align our manufacturing capabilities with demand, our business, financial condition and results of operations may be materially adversely affected.

If for any reason we were to change any one of our contract manufacturers, we could face difficulties that might adversely affect our ability to maintain an adequate supply of our proprietary value-branded products, and we would incur costs and expend resources in the course of making the change. Moreover, we might not be able to obtain terms as favorable as those received from our current contract manufacturers, which in turn would increase our costs.

In addition, we must continuously monitor our inventory and product mix against forecasted demand. If we underestimate demand, we risk having inadequate supplies. We also face the risk of having too much inventory on hand that may reach its expiration date and become unsalable, and we may be forced to rely on markdowns or promotional sales to dispose of excess or slow-moving inventory. If we are unable to manage our supply chain effectively, our operating costs could increase and our profit margins could decrease.

We rely on our contract manufacturing partners to produce a portion of our products and disruptions in our contract manufacturers’ systems or events outside our control could increase our cost of sales, adversely affect our net sales and injure our reputation and customer relationships, thereby harming our business.

We have agreements with contract manufacturers, who produce a portion of our proprietary value-branded products. The loss of any of these contract manufacturers or the failure for any reason of any of these contract manufacturers to fulfill their obligations under their agreements with us, including a failure to meet our quality controls and standards, may result in disruptions to our supply of products. We may be unable to locate an additional or alternate contract manufacturing arrangement in a timely manner or on commercially reasonable terms, if at all. Identifying a suitable manufacturer is an involved process that requires us to become satisfied with the prospective manufacturer’s level of expertise, quality control, responsiveness and service, financial stability and labor practices.

Moreover, in the event of a disruption in our contract manufacturers’ systems, we may be unable to locate alternative manufacturers of comparable quality at an acceptable price, or at all. The manufacture of our products may not be easily transferable to other sites in the event that any of our contract manufacturers experience breakdown, failure or substandard performance of equipment, disruption of supply or shortages of raw materials and other supplies, labor problems, power outages, adverse weather conditions and natural disasters or the need to comply with environmental and other directives of governmental agencies. From time to time, a contract manufacturer may experience financial difficulties, bankruptcy or other business disruptions, which could disrupt our supply of products or require that we incur additional expense by providing financial accommodations to the contract manufacturer or taking other steps to seek to minimize or avoid supply disruption, such as establishing a new contract manufacturing arrangement with another provider. Any delay, interruption or increased cost in the proprietary value-branded products that might occur for any reason could affect our ability to meet customer demand for our products, adversely affect our net sales, increase our cost of sales and hurt our results of operations. In addition, manufacturing disruption could injure our reputation and customer relationships, thereby harming our business.

We currently purchase our distributed Rx and OTC medications from manufacturers and licensed distributors. We do not have any guaranteed supply of medications at any pre-established prices.

We cannot guarantee that we will be able to purchase an adequate supply of Rx and OTC medications from manufacturers and licensed distributors to meet our customers’ demands, or that we will be able to purchase these medications at competitive prices. As these medications represent a significant portion of our net sales, our failure to fill customer orders for these medications could adversely impact our net sales. If we are forced to pay higher prices for these medications to ensure an adequate supply, we cannot guarantee that we will be able to pass along to our customers any increases in the prices we pay for these medications. Additionally, in the event that the manufacturers of these Rx and OTC medications take action to prohibit our licensed distributors from selling such medications to us entirely, or dictate the pricing at which our licensed distributors sell such medications to us or that our retail customers sell such medications to end consumers, our financial condition and results of operations could be materially and adversely affected.

If any of our independent transportation providers experience delays or disruptions, our business could be adversely affected.

We currently rely on independent transportation service providers both to ship products to our manufacturing and distribution warehouses from our third-party suppliers and contract manufacturers and to ship products from our manufacturing and distribution warehouses to our retail customers. Our utilization of these delivery services, or those of any other shipping companies that we may elect to use, is subject to risks, including increases in fuel prices, which would increase our shipping costs, and employee strikes and inclement weather, which may impact the shipping company’s ability to provide delivery services sufficient to meet our shipping needs. If any of the foregoing occurs, our business, financial condition and results of operations may be materially adversely affected.

The growth of our business depends in part on our ability to introduce new products and improve existing products, and our research and development and partnership efforts may fail to generate new product developments.

A key element of our growth strategy depends on both our existing product portfolio and our ability to develop and market new products and improvements to our existing products, including those that we may develop through partnerships. The success of our innovation and product development efforts is affected by the technical capability of our product development staff and third-party consultants in developing and testing new products, including complying with governmental regulations, our attractiveness as a partner for outside research and development scientists and entrepreneurs and the success of our management and sales team in introducing and marketing new products.

We may be unable to determine with accuracy when or whether any of our products now under development will be approved or launched, and we may be unable to develop or otherwise acquire product candidates or products. Additionally, we cannot predict whether any such products, once launched, will be commercially successful. Furthermore, the timing and cost of our R&D initiatives may increase as a result of additional government regulation or otherwise, making it more time-consuming and/or costly to research, test and develop new products. If we are unable to successfully develop or otherwise acquire new products, our financial condition and results of operations may be materially adversely affected.

Failure to protect our intellectual property could harm our competitive position or require us to incur significant expenses to enforce our rights.

Our success depends in part on our ability to protect our intellectual property rights. Our trademarks such as “

PetIQ,” “PetAction,” “Advecta,” “PetLock,” “HeartShield,” “TruProfen,” “Betsy Farms,” “Minties,” “Vera,” “Delightibiles,” “VetIQ”

and others are valuable assets that support our brand, sub-brands and consumers’ perception of our products. We rely on trademark, copyright, trade secret, patent and other intellectual property laws, as well as nondisclosure and confidentiality agreements and other methods, to protect our trademarks, trade names, proprietary information, technologies and/or processes. Our non-disclosure agreements and confidentiality agreements may not effectively prevent disclosure of our proprietary information, technologies and processes and may not provide an adequate remedy in the event of unauthorized disclosure of such information, which could harm our competitive position. In addition, effective patent, copyright, trademark and trade secret protection may be unavailable or limited for some of our intellectual property rights and trade secrets in foreign countries. We may need to engage in litigation or similar activities to enforce our intellectual property rights, to protect our trade secrets or to determine the validity and scope of proprietary rights of others. Any such litigation could require us to expend significant resources and divert the efforts and attention of our management and other personnel from our business operations. If we fail to protect our intellectual property, our business, financial condition and results of operations may be materially adversely affected.

We may be subject to intellectual property infringement claims or other allegations, which could result in substantial damages and diversion of management’s efforts and attention.

We have obligations to respect third-party intellectual property. The steps we take to prevent misappropriation, infringement or other violation of the intellectual property of others may not be successful. From time to time, third parties have asserted intellectual property infringement claims against us, our suppliers, or our retail customers and may continue to do so in the future. For example, Bayer Healthcare, Inc. filed suit against Cap IM Supply, Inc. (“Cap IM”), our supplier of Advecta 3 and PetLock MAX, alleging that these products infringed Bayer’s intellectual property and seeking damages and to enjoin Cap IM from selling Advecta 3 and PetLock MAX to us. See

“

Item 3—Legal Proceedings”. Although we believe that our products and manufacturing processes do not infringe in any material respect upon proprietary rights of other parties and/or that meritorious defenses would exist with respect to any assertions of infringement of other parties, we may from time to time be found to infringe on the proprietary rights. For example, patent applications in the United States and some foreign countries are generally not publicly disclosed until the patent application is published, and we may not be aware of currently filed patent applications that relate to our products or processes. If patents later issue on these applications, we may be found liable for subsequent infringement. Such claims that our products or processes infringe these rights, regardless of their merit or resolution, could be costly and may divert the efforts and attention of our management and technical personnel. In part due to the complex technical issues and inherent uncertainties in intellectual property litigation, we cannot predict whether we will prevail in such proceedings. If such proceedings result in an adverse outcome, we could, among other things, be required to:

|

|

·

|

|

Pay substantial damages (potentially treble damages in the United States);

|

|

|

·

|

|

cease the manufacture, use or sale of the infringing products;

|

|

|

·

|

|

discontinue the use of the infringing processes;

|

|

|

·

|

|

expend significant resources to develop non-infringing processes;