By Allison Prang

PepsiCo Inc.'s new Chief Executive Ramon Laguarta said he has no

plans to break up the snacks and drinks giant, nor divest the

company's bottling operations, after completing a four-month review

of the global business.

"We believe our product and geographic portfolios make sense.

And we do not currently see the need to shed or acquire businesses

in any significant way," Mr. Laguarta said on a conference call

Friday after PepsiCo reported quarterly results.

Last year, PepsiCo agreed to buy seltzer-machine maker

SodaStream International Ltd., while rival Coca-Cola Co. bought the

Costa Coffee chain. PepsiCo has also faced questions from Wall

Street about whether it would keep its food business, which sells

Doritos, Sabra hummus and Quaker Oats, together with its drinks

business, which includes Gatorade, Aquafina and Mountain Dew.

The PepsiCo veteran, who took over as CEO in October, laid out

his plans Friday: ramp up investments in advertising, technology

and supply chains to boost growth and capture market share. The

company also started a new restructuring program that will shed an

undisclosed number of jobs and factories over several years.

The Purchase, N.Y., firm said Friday it expects to incur about

$2.5 billion in pretax restructuring charges through 2023, with

most of the charges coming from severance and other employee costs.

The company's 2018 results included $138 million of restructuring

costs, and it expects to incur $800 million in the current

year.

PepsiCo didn't elaborate on the extent of job cuts or plant

closures.

The maker of Mountain Dew, Quaker Oats oatmeal and Tropicana

orange juice also said it expects organic revenue -- which excludes

currency fluctuations, acquisitions and divestitures -- to rise 4%

this year, compared with 3.7% in the recently ended year. Core

earnings excluding currency fluctuations are expected to fall by

about 1%, driven by items including a higher tax rate and

investments being made this year.

In 2019, PepsiCo plans to make substantial investments in areas

such as adding manufacturing capacity and advertising and

marketing, Chief Financial Officer Hugh Johnston said on the

earnings call. The company is fresh off sponsoring the Super Bowl

LIII halftime show and airing commercials during the National

Football League championship game. The company has been working to

increase investments in Pepsi and Mountain Dew beverages to lift

sales in North America.

PepsiCo expects to spend about $4.5 billion on capital

expenditures in 2019, an increase of more than $1 billion from the

previous year. Mr. Laguarta said the company is "investing in brand

building, selling capacity and supply chain capacity."

The company will also be hiring more personnel to market and

deliver products to retail customers, Mr. Johnston told The Wall

Street Journal in an interview Friday. He didn't say how many.

Mr. Laguarta, who took over as CEO from Indra Nooyi, has been

working to focus the company on priorities including accelerating

organic revenue growth and managing costs, and using the resulting

savings to reinvest in the business. To push sales growth, PepsiCo

has looked at increasing advertising, broadening product lines and

making changes to packaging.

"There is further growth and further opportunities for us to

grow share" in PepsiCo's categories, the CEO told analysts on the

call. "And the process started with, let's see how we can refocus

the discretionary funds that we have in each one of our

business[es] against the growth opportunities."

When asked by an analyst about potentially separating the

company's snacks and drinks business, Mr. Laguarta underscored the

benefits of keeping the operations together. He said the company is

able to show its strength, like around the Super Bowl, when it is

able to create displays with products from each category.

Mr. Laguarta also told analysts the company can compete without

selling off or refranchising its North American bottling and

distribution operations, a move that Coca-Cola completed in 2017.

He said the North American drinks business "will play a very

important role in the future of PepsiCo, and we're convinced it

will drive very good results for us."

The company will be integrating its bottling business into its

five new regional divisions under its North America beverages

business, the company told employees Friday. Trade publication

Beverage-Digest earlier reported the bottling changes.

Shares of PepsiCo rose 3% to $115.91 in Friday trading after the

company forecast higher growth for this year. It said

fourth-quarter revenue was flat from a year earlier though it

benefited from higher prices in its North America units. Because of

higher transportation costs, the beverage maker had planned to

raise prices on some of its Frito-Lay products in October.

Earlier this week, Coca-Cola Co. said it expects sales to slow

in 2019. In the latest quarter, Coca-Cola said tea and coffee sales

volume rose while soda sales volume fell. Shares in the company

fell 8.4% to $45.59 on Thursday.

PepsiCo said revenue was $19.52 billion in the fourth quarter,

in line with estimates from analysts polled by Refinitiv. Organic

revenue rose 4.6%.

Among PepsiCo segments, Frito-Lay North America saw the biggest

increase in the quarter, with revenue climbing 3.6%. Revenue rose

1.8% in the company's North American beverages division.

PepsiCo reported a fourth-quarter profit of $6.85 billion, or

$4.83 a share, which included a $4.93 billion income-tax benefit.

For the comparable quarter a year prior, the company posted a loss

of $710 million, or 50 cents a share.

Excluding one-time items, earnings were $1.49 a share, which met

analysts' estimates.

Write to Allison Prang at allison.prang@wsj.com

(END) Dow Jones Newswires

February 15, 2019 18:13 ET (23:13 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

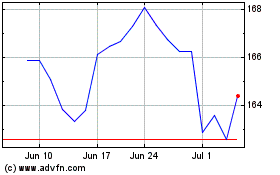

PepsiCo (NASDAQ:PEP)

Historical Stock Chart

From Mar 2024 to Apr 2024

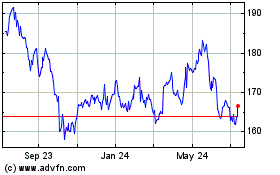

PepsiCo (NASDAQ:PEP)

Historical Stock Chart

From Apr 2023 to Apr 2024