Current Report Filing (8-k)

January 24 2020 - 4:34PM

Edgar (US Regulatory)

0000318300FALSE00003183002020-01-212020-01-21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 24, 2020 (January 21, 2020)

|

|

|

|

|

|

|

|

|

|

|

|

PEOPLES BANCORP INC.

|

|

|

|

(Exact name of Registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ohio

|

|

000-16772

|

|

31-0987416

|

|

(State or other jurisdiction

|

|

(Commission File

|

|

(I.R.S. Employer

|

|

of incorporation)

|

|

Number)

|

|

Identification Number)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

138 Putnam Street, PO Box 738

|

|

|

|

|

|

|

Marietta,

|

Ohio

|

|

45750-0738

|

|

|

|

(Address of principal executive offices)

|

|

|

(Zip Code)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Registrant's telephone number, including area code:

|

|

(740)

|

373-3155

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Not applicable

|

|

|

|

(Former name or former address, if changed since last report)

|

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common shares, without par value

|

PEBO

|

The Nasdaq Stock Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On January 21, 2020, management of Peoples Bancorp Inc. (“Peoples”) conducted a facilitated conference call at approximately 11:00 a.m., Eastern Standard Time, to discuss results of operations for the quarter and twelve months ended December 31, 2019. A replay of the conference call audio will be available on Peoples’ website, www.peoplesbancorp.com, in the “Investor Relations” section for one year. A copy of the transcript of the conference call is included as Exhibit 99.1 to this Current Report on Form 8-K.

The information contained in this Item 2.02 and Exhibit 99.1 included with this Current Report on Form 8-K, is being furnished pursuant to Item 2.02 and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, nor shall such information be deemed to be incorporated by reference in any registration statement or other document filed under the Securities Act of 1933, as amended, or the Exchange Act, except as otherwise stated in such filing.

During the conference call, management referred to non-Generally Accepted Accounting Principles ("US GAAP") financial measures that are used by management to provide information useful to investors in understanding Peoples' operating performance and trends, and to facilitate comparisons with the performance of Peoples' peers. The following tables show the differences between the non-US GAAP financial measures referred to during the conference call and the most directly comparable US GAAP-based financial measures.

NON-US GAAP FINANCIAL MEASURES (Unaudited)

The following non-US GAAP financial measures used by Peoples provide information useful to investors in understanding Peoples' operating performance and trends, and facilitate comparisons with the performance of Peoples' peers. The following tables summarize the non-US GAAP financial measures derived from amounts reported in Peoples' consolidated financial statements:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

|

|

|

|

|

|

Year Ended

|

|

|

|

|

December 31,

|

|

September 30,

|

|

December 31,

|

|

December 31,

|

|

|

|

(Dollars in thousands)

|

2019

|

|

2019

|

|

2018

|

|

2019

|

|

2018

|

|

|

|

|

|

|

|

|

|

|

|

|

Core non-interest expense:

|

|

|

|

|

|

|

|

|

|

|

Total non-interest expense

|

$

|

33,521

|

|

|

$

|

32,993

|

|

|

$

|

30,956

|

|

|

$

|

137,250

|

|

|

$

|

125,977

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Less: acquisition-related expenses

|

65

|

|

|

199

|

|

|

382

|

|

|

7,287

|

|

|

7,262

|

|

|

Less: pension settlement charges

|

—

|

|

|

—

|

|

|

91

|

|

|

—

|

|

|

267

|

|

|

Less: severance expenses

|

270

|

|

|

—

|

|

|

—

|

|

|

270

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Core non-interest expense

|

$

|

33,186

|

|

|

$

|

32,794

|

|

|

$

|

30,483

|

|

|

$

|

129,693

|

|

|

$

|

118,448

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

|

|

|

|

|

|

Year Ended

|

|

|

|

|

December 31,

|

|

September 30,

|

|

December 31,

|

|

December 31,

|

|

|

|

(Dollars in thousands)

|

2019

|

|

2019

|

|

2018

|

|

2019

|

|

2018

|

|

|

|

|

|

|

|

|

|

|

|

|

Efficiency ratio:

|

|

|

|

|

|

|

|

|

|

|

Total non-interest expense

|

$

|

33,521

|

|

|

$

|

32,993

|

|

|

$

|

30,956

|

|

|

$

|

137,250

|

|

|

$

|

125,977

|

|

|

Less: amortization of other intangible assets

|

888

|

|

|

953

|

|

|

861

|

|

|

3,359

|

|

|

3,338

|

|

|

Adjusted total non-interest expense

|

32,633

|

|

|

32,040

|

|

|

30,095

|

|

|

133,891

|

|

|

122,639

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total non-interest income

|

17,163

|

|

|

16,393

|

|

|

14,177

|

|

|

64,274

|

|

|

56,754

|

|

|

Less: net gain (loss) on investment securities

|

94

|

|

|

97

|

|

|

—

|

|

|

164

|

|

|

(146)

|

|

|

Less: net loss on asset disposals and other transactions

|

(229)

|

|

|

(78)

|

|

|

(15)

|

|

|

(782)

|

|

|

(334)

|

|

|

Total non-interest income, excluding net gains and losses

|

17,298

|

|

|

16,374

|

|

|

14,192

|

|

|

64,892

|

|

|

57,234

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net interest income

|

35,121

|

|

|

35,754

|

|

|

34,121

|

|

|

140,838

|

|

|

129,612

|

|

|

Add: fully tax-equivalent adjustment (a)

|

287

|

|

|

314

|

|

|

212

|

|

|

1,068

|

|

|

881

|

|

|

Net interest income on a fully tax-equivalent basis

|

35,408

|

|

|

36,068

|

|

|

34,333

|

|

|

141,906

|

|

|

130,493

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted revenue

|

$

|

52,706

|

|

|

$

|

52,442

|

|

|

$

|

48,525

|

|

|

$

|

206,798

|

|

|

$

|

187,727

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Efficiency ratio

|

61.92

|

%

|

|

61.10

|

%

|

|

62.02

|

%

|

|

64.74

|

%

|

|

65.33

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

Efficiency ratio adjusted for non-core items:

|

|

|

|

|

|

|

|

|

|

|

Core non-interest expense

|

$

|

33,186

|

|

|

$

|

32,794

|

|

|

$

|

30,483

|

|

|

$

|

129,693

|

|

|

$

|

118,448

|

|

|

Less: amortization of other intangible assets

|

888

|

|

|

953

|

|

|

861

|

|

|

3,359

|

|

|

3,338

|

|

|

Adjusted core non-interest expense

|

32,298

|

|

|

31,841

|

|

|

29,622

|

|

|

126,334

|

|

|

115,110

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted revenue

|

$

|

52,706

|

|

|

$

|

52,442

|

|

|

$

|

48,525

|

|

|

$

|

206,798

|

|

|

$

|

187,727

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Efficiency ratio adjusted for non-core items

|

61.28

|

%

|

|

60.72

|

%

|

|

61.04

|

%

|

|

61.09

|

%

|

|

61.32

|

%

|

|

|

|

|

|

|

|

|

|

|

|

(a) Tax effect is calculated using a 21% statutory federal corporate income tax rate.

NON-US GAAP FINANCIAL MEASURES (Unaudited) -- (Continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

At or For the Three Months Ended

|

|

|

|

|

|

|

|

|

|

|

December 31,

|

|

September 30,

|

|

June 30,

|

|

March 31,

|

|

December 31,

|

|

(Dollars in thousands, except per share data)

|

2019

|

|

2019

|

|

2019

|

|

2019

|

|

2018

|

|

|

|

|

|

|

|

|

|

|

|

|

Tangible equity:

|

|

|

|

|

|

|

|

|

|

|

Total stockholders' equity

|

$

|

594,393

|

|

|

$

|

588,533

|

|

|

$

|

579,022

|

|

|

$

|

535,121

|

|

|

$

|

520,140

|

|

|

Less: goodwill and other intangible assets

|

177,834

|

|

|

179,126

|

|

|

176,763

|

|

|

161,242

|

|

|

162,085

|

|

|

Tangible equity

|

$

|

416,559

|

|

|

$

|

409,407

|

|

|

$

|

402,259

|

|

|

$

|

373,879

|

|

|

$

|

358,055

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tangible assets:

|

|

|

|

|

|

|

|

|

|

|

Total assets

|

$

|

4,357,208

|

|

|

$

|

4,396,148

|

|

|

$

|

4,276,376

|

|

|

$

|

4,017,119

|

|

|

$

|

3,991,454

|

|

|

Less: goodwill and other intangible assets

|

177,834

|

|

|

179,126

|

|

|

176,763

|

|

|

161,242

|

|

|

162,085

|

|

|

Tangible assets

|

$

|

4,179,374

|

|

|

$

|

4,217,022

|

|

|

$

|

4,099,613

|

|

|

$

|

3,855,877

|

|

|

$

|

3,829,369

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tangible book value per common share:

|

|

|

|

|

|

|

|

|

|

|

Tangible equity

|

$

|

416,559

|

|

|

$

|

409,407

|

|

|

$

|

402,259

|

|

|

$

|

373,879

|

|

|

$

|

358,055

|

|

|

Common shares outstanding

|

20,698,941

|

|

|

20,700,630

|

|

|

20,696,041

|

|

|

19,681,692

|

|

|

19,565,029

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tangible book value per common share

|

$

|

20.12

|

|

|

$

|

19.78

|

|

|

$

|

19.44

|

|

|

$

|

19.00

|

|

|

$

|

18.30

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tangible equity to tangible assets ratio:

|

|

|

|

|

|

|

|

|

|

|

Tangible equity

|

$

|

416,559

|

|

|

$

|

409,407

|

|

|

$

|

402,259

|

|

|

$

|

373,879

|

|

|

$

|

358,055

|

|

|

Tangible assets

|

$

|

4,179,374

|

|

|

$

|

4,217,022

|

|

|

$

|

4,099,613

|

|

|

$

|

3,855,877

|

|

|

$

|

3,829,369

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tangible equity to tangible assets

|

9.97

|

%

|

|

9.71

|

%

|

|

9.81

|

%

|

|

9.70

|

%

|

|

9.35

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

|

|

|

|

|

|

Year Ended

|

|

|

|

|

December 31,

|

|

September 30,

|

|

December 31,

|

|

December 31,

|

|

|

|

(Dollars in thousands)

|

2019

|

|

2019

|

|

2018

|

|

2019

|

|

2018

|

|

|

|

|

|

|

|

|

|

|

|

|

Pre-provision net revenue:

|

|

|

|

|

|

|

|

|

|

|

Income before income taxes

|

$

|

17,627

|

|

|

$

|

18,149

|

|

|

$

|

16,367

|

|

|

$

|

65,358

|

|

|

$

|

54,941

|

|

|

Add: provision for loan losses

|

1,136

|

|

|

1,005

|

|

|

975

|

|

|

2,504

|

|

|

5,448

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Add: net loss on OREO

|

44

|

|

|

5

|

|

|

30

|

|

|

98

|

|

|

21

|

|

|

Add: net loss on investment securities

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

146

|

|

|

Add: net loss on other assets

|

188

|

|

|

73

|

|

|

—

|

|

|

692

|

|

|

224

|

|

|

Add: net loss on other transactions

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

76

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Less: net gain on investment securities

|

94

|

|

|

97

|

|

|

—

|

|

|

164

|

|

|

—

|

|

|

Less: net gain on other assets

|

3

|

|

|

—

|

|

|

15

|

|

|

8

|

|

|

—

|

|

|

Pre-provision net revenue

|

$

|

18,898

|

|

|

$

|

19,135

|

|

|

$

|

17,357

|

|

|

$

|

68,480

|

|

|

$

|

60,869

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total average assets

|

4,350,769

|

|

|

4,311,389

|

|

|

3,990,331

|

|

|

4,222,540

|

|

|

3,871,832

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pre-provision net revenue to total average assets (annualized)

|

1.72

|

%

|

|

1.76

|

%

|

|

1.73

|

%

|

|

1.62

|

%

|

|

1.57

|

%

|

NON-US GAAP FINANCIAL MEASURES (Unaudited) -- (Continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

|

|

|

|

|

|

Year Ended

|

|

|

|

|

December 31,

|

|

September 30,

|

|

December 31,

|

|

December 31,

|

|

|

|

(Dollars in thousands)

|

2019

|

|

2019

|

|

2018

|

|

2019

|

|

2018

|

|

|

|

|

|

|

|

|

|

|

|

|

Annualized net income adjusted for non-core items:

|

|

|

|

|

|

|

|

|

|

|

Net income

|

$

|

14,860

|

|

|

$

|

14,868

|

|

|

$

|

13,897

|

|

|

$

|

53,695

|

|

|

$

|

46,255

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Add: net loss on investment securities

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

146

|

|

|

Less: tax effect of loss on investment securities (a)

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

31

|

|

|

Less: net gain on investment securities

|

94

|

|

|

97

|

|

|

—

|

|

|

164

|

|

|

—

|

|

|

Add: tax effect of net gain on investment securities (a)

|

20

|

|

|

20

|

|

|

—

|

|

|

34

|

|

|

—

|

|

|

Add: net loss on asset disposals and other transactions

|

229

|

|

|

78

|

|

|

15

|

|

|

782

|

|

|

334

|

|

|

Less: tax effect of net loss on asset disposals and other transactions (a)

|

48

|

|

|

16

|

|

|

3

|

|

|

164

|

|

|

70

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Add: acquisition-related expenses

|

65

|

|

|

199

|

|

|

382

|

|

|

7,287

|

|

|

7,262

|

|

|

Less: tax effect of acquisition-related expenses (a)

|

14

|

|

|

42

|

|

|

80

|

|

|

1,530

|

|

|

1,525

|

|

|

Add: severance expenses

|

270

|

|

|

—

|

|

|

—

|

|

|

270

|

|

|

—

|

|

|

Less: tax effect of severance expenses (a)

|

57

|

|

|

—

|

|

|

—

|

|

|

57

|

|

|

—

|

|

|

Add: pension settlement charges

|

—

|

|

|

—

|

|

|

91

|

|

|

—

|

|

|

267

|

|

|

Less: tax effect of pension settlement charges (a)

|

—

|

|

|

—

|

|

|

19

|

|

|

—

|

|

|

56

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Less: release of deferred tax asset valuation allowance

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

805

|

|

|

Less: impact of Tax Cuts and Jobs Act on remeasurement of deferred tax assets and deferred tax liabilities

|

—

|

|

|

—

|

|

|

705

|

|

|

—

|

|

|

705

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income adjusted for non-core items

|

$

|

15,231

|

|

|

$

|

15,010

|

|

|

$

|

13,578

|

|

|

$

|

60,153

|

|

|

$

|

51,072

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Days in the period

|

92

|

|

|

92

|

|

|

92

|

|

|

365

|

|

|

365

|

|

|

Days in the year

|

365

|

|

|

365

|

|

|

365

|

|

|

365

|

|

|

365

|

|

|

Annualized net income

|

$

|

58,955

|

|

|

$

|

58,987

|

|

|

$

|

55,135

|

|

|

$

|

53,695

|

|

|

$

|

46,255

|

|

|

Annualized net income adjusted for non-core items

|

$

|

60,427

|

|

|

$

|

59,551

|

|

|

$

|

53,869

|

|

|

$

|

60,153

|

|

|

$

|

51,072

|

|

|

Return on average assets:

|

|

|

|

|

|

|

|

|

|

|

Annualized net income

|

$

|

58,955

|

|

|

$

|

58,987

|

|

|

$

|

55,135

|

|

|

$

|

53,695

|

|

|

$

|

46,255

|

|

|

Total average assets

|

$

|

4,350,769

|

|

|

$

|

4,311,389

|

|

|

$

|

3,990,331

|

|

|

$

|

4,222,540

|

|

|

$

|

3,871,832

|

|

|

Return on average assets

|

1.36

|

%

|

|

1.37

|

%

|

|

1.38

|

%

|

|

1.27

|

%

|

|

1.19

|

%

|

|

Return on average assets adjusted for non-core items:

|

|

|

|

|

|

|

|

|

|

|

Annualized net income adjusted for non-core items

|

$

|

60,427

|

|

|

$

|

59,551

|

|

|

$

|

53,869

|

|

|

$

|

60,153

|

|

|

$

|

51,072

|

|

|

Total average assets

|

$

|

4,350,769

|

|

|

$

|

4,311,389

|

|

|

$

|

3,990,331

|

|

|

$

|

4,222,540

|

|

|

$

|

3,871,832

|

|

|

Return on average assets adjusted for non-core items

|

1.39

|

%

|

|

1.38

|

%

|

|

1.35

|

%

|

|

1.42

|

%

|

|

1.32

|

%

|

(a) Tax effect is calculated using a 21% statutory federal corporate income tax rate.

NON-US GAAP FINANCIAL MEASURES (Unaudited) -- (Continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended

|

|

|

|

|

|

|

|

|

|

For the Year Ended

|

|

|

|

|

December 31,

|

|

September 30,

|

|

|

|

|

|

December 31,

|

|

December 31,

|

|

|

|

(Dollars in thousands)

|

2019

|

|

2019

|

|

|

|

|

|

2018

|

|

2019

|

|

2018

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Annualized net income excluding amortization of other intangible assets:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income

|

$

|

14,860

|

|

|

$

|

14,868

|

|

|

|

|

|

|

$

|

13,897

|

|

|

$

|

53,695

|

|

|

$

|

46,255

|

|

|

Add: amortization of other intangible assets

|

888

|

|

|

953

|

|

|

|

|

|

|

861

|

|

|

3,359

|

|

|

3,338

|

|

|

Less: tax effect of amortization of other intangible assets (a)

|

186

|

|

|

200

|

|

|

|

|

|

|

181

|

|

|

705

|

|

|

701

|

|

|

Net income excluding amortization of other intangible assets

|

$

|

15,562

|

|

|

$

|

15,621

|

|

|

|

|

|

|

$

|

14,577

|

|

|

$

|

56,349

|

|

|

$

|

48,892

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Days in the period

|

92

|

|

|

92

|

|

|

|

|

|

|

92

|

|

|

365

|

|

|

365

|

|

|

Days in the year

|

365

|

|

|

365

|

|

|

|

|

|

|

365

|

|

|

365

|

|

|

365

|

|

|

Annualized net income

|

$

|

58,955

|

|

|

$

|

58,987

|

|

|

|

|

|

|

$

|

55,135

|

|

|

$

|

53,695

|

|

|

$

|

46,255

|

|

|

Annualized net income excluding amortization of other intangible assets

|

$

|

61,741

|

|

|

$

|

61,975

|

|

|

|

|

|

|

$

|

57,833

|

|

|

$

|

56,349

|

|

|

$

|

48,892

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average tangible equity:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total average stockholders' equity

|

$

|

591,112

|

|

|

$

|

583,269

|

|

|

|

|

|

|

$

|

507,890

|

|

|

$

|

566,123

|

|

|

$

|

488,139

|

|

|

Less: average goodwill and other intangible assets

|

178,494

|

|

|

179,487

|

|

|

|

|

|

|

162,790

|

|

|

173,768

|

|

|

158,115

|

|

|

Average tangible equity

|

$

|

412,618

|

|

|

$

|

403,782

|

|

|

|

|

|

|

$

|

345,100

|

|

|

$

|

392,355

|

|

|

$

|

330,024

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Return on average stockholders' equity ratio:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Annualized net income

|

$

|

58,955

|

|

|

$

|

58,987

|

|

|

|

|

|

|

$

|

55,135

|

|

|

$

|

53,695

|

|

|

$

|

46,255

|

|

|

Average stockholders' equity

|

$

|

591,112

|

|

|

$

|

583,269

|

|

|

|

|

|

|

$

|

507,890

|

|

|

$

|

566,123

|

|

|

$

|

488,139

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Return on average stockholders' equity

|

9.97

|

%

|

|

10.11

|

%

|

|

|

|

|

|

10.86

|

%

|

|

9.48

|

%

|

|

9.48

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Return on average tangible equity ratio:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Annualized net income excluding amortization of other intangible assets

|

$

|

61,741

|

|

|

$

|

61,975

|

|

|

|

|

|

|

$

|

57,833

|

|

|

$

|

56,349

|

|

|

$

|

48,892

|

|

|

Average tangible equity

|

$

|

412,618

|

|

|

$

|

403,782

|

|

|

|

|

|

|

$

|

345,100

|

|

|

$

|

392,355

|

|

|

$

|

330,024

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Return on average tangible equity

|

14.96

|

%

|

|

15.35

|

%

|

|

|

|

|

|

16.76

|

%

|

|

14.36

|

%

|

|

14.81

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a) Tax effect is calculated using a 21% statutory federal corporate income tax rate.

Item 9.01 Financial Statements and Exhibits

a) - c)

Not applicable

d) Exhibits

See Index to Exhibits below.

INDEX TO EXHIBITS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exhibit Number

|

|

Description

|

|

|

|

|

Transcript of conference call conducted by management of Peoples Bancorp Inc. on January 21, 2020 to discuss results of operations for the quarter and twelve months ended December 31, 2019

|

|

* Schedules and exhibits have been omitted pursuant to Item 601(b)(2) of Regulation S-K. A copy of any omitted schedules or exhibits will be furnished supplementally to the SEC upon its request.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PEOPLES BANCORP INC.

|

|

|

|

|

|

|

|

|

Date:

|

January 24, 2020

|

By:/s/

|

JOHN C. ROGERS

|

|

|

|

|

|

John C. Rogers

|

|

|

|

|

|

|

|

|

|

|

|

Executive Vice President,

Chief Financial Officer and Treasurer

|

|

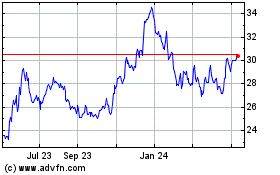

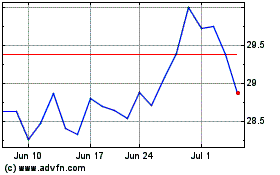

Peoples Bancorp (NASDAQ:PEBO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Peoples Bancorp (NASDAQ:PEBO)

Historical Stock Chart

From Apr 2023 to Apr 2024