UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of February 2021

Commission File Number: 001-38851

POWERBRIDGE TECHNOLOGIES CO., LTD.

(Translation of Registrant's name into English)

1st Floor, Building D2, Southern Software

Park

Tangjia Bay, Zhuhai, Guangdong 519080,

China

Tel: +86-756-339-5666

(Address of Principal Executive Office)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒

Form 40-F ☐

Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Note : Regulation

S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached

annual report to security holders.

Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Note: Regulation S-T Rule 101(b)(7) only

permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private

issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally

organized (the registrant’s “home country”), or under the rules of the home country exchange

on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required

to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already

been the subject of a Form 6-K submission or other Commission filing on EDGAR.

CONTENTS

Entry into a Material Definitive Agreement

Sales Agreement with A.G.P./Alliance

Global Partners

On February 23, 2021,

Powerbridge Technologies Co., Ltd. (the “Company”) entered into a Sales Agreement (the “Sales Agreement”)

with A.G.P./Alliance Global Partners, as sales agent (the “Agent”), pursuant to which the Company may offer and sell,

from time to time, through or to the Agent, as sales agent and/or principal (the “Offering”) up to $30,000,000 of its

ordinary shares, par value $0.00166667 per share (the “Shares”). Any Shares offered and sold in the Offering will be

issued pursuant to the Company’s Registration Statement on Form F-3 (the “Registration Statement”) filed with

the Securities and Exchange Commission (the “SEC”) on February 23, 2021, and the sales agreement prospectus that forms

a part of such Registration Statement, following such time as the Registration Statement is declared effective by the SEC, for

an aggregate offering price of up to $200 million.

The Company is not

obligated to sell any Shares under the Sales Agreement. Subject to the terms and conditions of the Sales Agreement, the Agent will

use commercially reasonable efforts consistent with its normal trading and sales practices, applicable state and federal law, rules

and regulations and the rules of The Nasdaq Capital Market (“Nasdaq”) to sell Shares from time to time based upon the

Company’s instructions, including any price, time or size limits specified by the Company. Upon delivery of a placement notice,

and subject to the Company’s instructions in that notice, and the terms and conditions of the Sales Agreement generally,

the Agent may sell the Shares by any method permitted by law deemed to be an “at the market offering” as defined by

Rule 415(a)(4) promulgated under the Securities Act of 1933, as amended. The Agent’s obligations to sell Shares under the

Sales Agreement are subject to satisfaction of certain conditions, including the effectiveness of the Registration Statement and

other customary closing conditions. The Company will pay the Agent a commission of 3.5% of the aggregate gross proceeds from each

sale of Shares and has agreed to provide the Agent with customary indemnification and contribution rights. The Company has also

agreed to reimburse the Agent for certain specified expenses.

The foregoing summary

of the Sales Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Sales

Agreement, which is attached as an exhibit to the Registration Statement and incorporated by reference into this Item 1.01.

Securities Purchase Agreement with Uptown

Capital, LLC

On January 8, 2021, the

Company entered into a securities purchase agreement (the “Purchase Agreement”) with Uptown Capital, LLC, a Utah limited

liability company (the “Investor”), pursuant to which the Company issued the Investor an unsecured promissory note

on January 8, 2021 in the original principal amount of $1,650,000 (the “Note”), convertible into ordinary shares, par

value $0.00166667 per share, of the Company (the “Ordinary Shares”), for $1,500,000 in gross proceeds. The transaction

contemplated by the Purchase Agreement closed on January 8, 2021.

The Note bears interest

at a rate of 9% per annum compounding daily. All outstanding principal and accrued interest on the Note will become due and payable

twelve months after the purchase price of the Note is delivered by Purchaser to the Company (the “Purchase Price Date”).

The Note includes an original issue discount of $150,000 along with $20,000 for Investor’s fees, costs and other transaction

expenses incurred in connection with the purchase and sale of the Note. The Company may prepay all or a portion of the Note at

any time by paying 120% of the outstanding balance elected for pre-payment.

Subject to the adjustments

set forth in the Note, the conversion price for each Redemption Conversion (defined as below) shall be the Redemption Conversion

Price. Notwithstanding any provision in the Note, the Redemption Conversion Price shall not be less than $1.00 (as adjusted for

any share dividend, share split, share combination, reclassification or similar transaction occurring after the date of the Purchase

Agreement) (or such lower price as mutually determined by the Company and the Investor in writing, subject to the prior consent

of the principal market, if required) (the “Floor Price”).

The Investor has the

right to redeem the Note at any time six months after the Purchase Price Date (such amount, the “Redemption Amount”),

subject to maximum monthly redemption amount of $450,000, by providing the Company with a notice (each, a Redemption Notice”,

and each date on which Investor delivers a Redemption Notice, a “Redemption Date”). At any point after the six-month

anniversary of the Purchase Pried Date, redemptions may be satisfied in cash, unregistered Ordinary Share or registered Ordinary

Share (the “Redemption Conversion Shares”) at the Company's election (each,

a “Redemption Conversion”). However, the Company will be required to pay the redemption amount in cash, in the event

there is an Equity Conditions Failure (as defined in the Note). If Company chooses to satisfy a redemption in registered Ordinary

Share or unregistered Ordinary Share, such Ordinary Share shall be issued at 80% of the average of the lowest VWAP during the fifteen

(15) trading days immediately preceding the redemption notice is delivered. Notwithstanding the foregoing: (i) the Company will

not be entitled to elect a Redemption Conversion with respect to any portion of any applicable Redemption Amount and shall be required

to pay the Redemption Amount in cash, if on the applicable Redemption Date there is an Equity Conditions Failure, and such failure

is not waived in writing by the Investor; and (ii) in the event the Redemption Conversion Price is below the Floor Price on an

applicable Redemption Date, then the Company will be required to pay such Redemption Amount in cash.

If the Company fails

to deliver any Redemption Conversion Shares on or before the close of business on the third (3rd) Trading Day (as defined in the

Note) following each Redemption Date (the “Delivery Date”) on up to two (2) separate occasions, the Company shall have

another four (4) Trading Days to make such delivery without such delivery of Redemption Conversion Shares being considered late.

Under the Purchase

Agreement, while the Note is outstanding, the Company agreed to keep adequate public information available and maintain its Nasdaq

listing. Upon the occurrence of an Event of Default (as defined in the Note), the Investor shall have the right to increase the

balance of the Note by 15% for major defaults and 5% for minor defaults (as defined in the Note). In addition, the Note provides

that upon occurrence of an Event of Default, the interest rate shall accrue on the outstanding balance at the rate equal to the

lesser of 16% per annum or the maximum rate permitted under applicable law.

The Purchase

Agreement and the Note are filed as Exhibit 10.2 and 10.3 to this Current Report on Form 6-K and such documents are incorporated

herein by reference. The foregoing is only a brief description of the material terms of the Purchase Agreement and the Note, and

does not purport to be a complete description of the rights and obligations of the parties thereunder and is qualified in its entirety

by reference to such exhibits.

The information in

this Report shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934,

as amended, or otherwise subject to the liabilities of that Section. It shall not be deemed incorporated by reference in any filing

under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such a filing.

|

Item 9.01

|

Financial Statements and Exhibits.

|

SIGNATURE

Pursuant to the requirements of the Securities

and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly

authorized.

Date: February 23, 2021

|

|

POWERBRIDGE TECHNOLOGIES CO., LTD.

|

|

|

|

|

|

|

By:

|

/s/ Stewart Lor

|

|

|

|

Stewart Lor

Chief Financial Officer

|

|

|

|

3

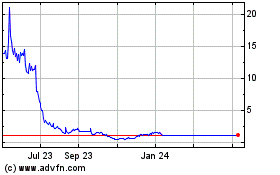

Powerbridge Technologies (NASDAQ:PBTS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Powerbridge Technologies (NASDAQ:PBTS)

Historical Stock Chart

From Apr 2023 to Apr 2024