PAVmed Inc. (Nasdaq: PAVM, PAVMZ) (the “Company”

or “PAVmed”), a highly differentiated, multiproduct medical device

company, today reported preliminary financial results for the three

months ended March 31, 2020 and provided a business update.

“We have continued to aggressively advance our

strategic plan during the first quarter and recent weeks, including

securing marketing clearance for our CarpX™ device,” said Lishan

Aklog, M.D., PAVmed’s Chairman and Chief Executive Officer. “Our

team has successfully confronted the challenges of the Covid-19

pandemic with minimal short-term and no anticipated long-term

disruptions to our activities. We are encouraged that medical

facilities are beginning to re-open with elective procedures

restarting and look forward to achieving important milestones and

accelerating commercial activities in the coming months.”

RECENT ACCOMPLISHMENTS

- The Company received 510(k) marketing clearance from the U.S.

Food and Drug Administration (FDA) for its CarpX™ minimally

invasive carpal tunnel device.

- PAVmed successfully recruited and engaged a CarpX™ National

Sales Manager with over 20 years of commercial experience in the

orthopedic space.

- The Company’s majority-owned

subsidiary Lucid Diagnostics (“Lucid”) enrolled its first three

patients in its international multi-center IVD clinical trials

(ESOGUARD-BE-1 and 2) comparing EsoGuard™/EsoCheck™ to endoscopy.

These trials include over 60 sites in the U.S. and Europe. Nicholas

J. Shaheen MD, MPH, Professor and Chief of the Division of

Gastroenterology and Hepatology at UNC HealthCare, and lead author

of the most recent American College of Gastroenterology (ACG)

guidelines, serves as principal investigator of both trials.

- Lucid submitted its final insurance reimbursement payment

dossier to Medicare contractor Palmetto GBA and its molecular

diagnostics program Mol Dx.

- The Company successfully completed

an acute animal study of a working prototype of its EsoCure™

Esophageal Ablation Device, a disposable single-use thermal balloon

ablation catheter designed to use its patented Caldus Technology to

treat dysplastic Barrett’s Esophagus (BE) before it can progress to

highly lethal esophageal cancer and to do so without the need for

complex and expensive capital equipment. The EsoCure balloon

catheter inserted through the working channel of a standard

endoscope circumferentially ablated the esophageal lining

consistently and cleanly with ablation times far less than existing

radiofrequency and cryoablation devices.

- Both PAVmed and Lucid received firm

dates for the stage 1 audit of their quality systems by the EU

notified body, which will allow them to restart efforts to pursue

EU CE Mark clearance of EsoCheck, EsoGuard, CarpX and PortIO™ after

delays related to a regulatory backlog in Europe due to systematic

changes.

- PAVmed’s majority-owned subsidiary,

Solys Diagnostics (“Solys”), completed initial bench-top testing of

its NDIR laser based non-invasive blood glucose diagnostic device

demonstrating a linear response across a wide range of glucose

concentrations.

- The Company continued to expand and

advance its extensive intellectual property portfolio, which now

includes over 130 issued and pending, owned, assigned or licensed

patents across PAVmed and its subsidiaries.

UPCOMING KEY ACTIVITIES AND

MILESTONES

- Commercially launch CarpX and

assemble a world-class Medical Advisory Board of hand surgeons to

provide critical procedural development and professional education

support.

- Accelerate and expand EsoGuard and

EsoCheck commercial activities, including existing virtual sales

and professional education, as well as aggressive marketing until

clinical procedures can resume from Covid-19 limitations.

- Accelerate enrollment in ESOGUARD-BE-1 and 2 trials and

initiate two additional clinical trials involving EsoCheck when

clinical activities resume.

- Launch clinical trial of EsoCheck in Eosinophilic Esophagitis

at the University of Pennsylvania.

- Launch clinical trial of EsoCheck with BE progression markers

at Fred Hutchinson Cancer Research Center in Seattle.

- Submit final coverage dossier to

Medicare contractor Palmetto GBA and its molecular diagnostics

program Mol Dx. Continue discussions to secure payment and coverage

decision for EsoGuard’s CPT code.

- Complete ongoing formal M&A

process seeking to secure a strategic partner or to license or

acquire the Company’s NextFlo™ technology for one or more clinical

applications while simultaneously advancing NextFlo toward an

initial FDA 510(k) submission later in 2020.

- Complete additional ongoing partnership discussions involving

EsoGuard, EsoCheck and DisappEAR.

- Submit response to FDA comments

following successful pre-submission meeting with the FDA on PortIO™

focused on the design of a clinical safety study in support of a de

novo application and the target population of its proposed label.

Submit PortIO Breakthrough Device application.

- Initiate a PortIO clinical safety

study to support its FDA de novo application and long-term clinical

study in Colombia, South America to demonstrate up to 60-day

maintenance free implant durations in humans.

- Complete benchtop, human and animal

testing seeking to achieve accuracy milestone based on established

FDA and ISO 15197 standards for Solys Diagnostics’ NDIR laser based

non-invasive blood glucose diagnostic device. Initiate commercial

development of inpatient device.

PRELIMINARY FINANCIAL

RESULTS

For the three months ended March 31, 2020,

research and development expenses were approximately $2.6 million

and general and administrative expenses were approximately $2.6

million. GAAP net loss attributable to common stockholders was

approximately $14.5 million, or $(0.33) per common share. As

illustrated below and for the purpose of helping the reader

understand the effect of derivative accounting and other non-cash

income and expenses on the Company’s financial results, the Company

reported a non-GAAP adjusted loss for the three months ended March

31, 2020 of $4.5 million, or $(0.10) per common share.

PAVmed had cash and cash equivalents of $8.7

million as of March 31, 2020, compared with $6.2 million as of

December 31, 2019. Subsequently, in late April 2020, the Company

received approximately $3.6 million in proceeds from a private

placement with an institutional investor for the sale of a Senior

Secured Convertible Note.

Non-GAAP Measures

To supplement our unaudited financial results

presented in accordance with U.S. generally accepted accounting

principles (GAAP), management provides certain non-GAAP financial

measures of the Company’s financial results. These non-GAAP

financial measures include net loss before interest, taxes,

depreciation and amortization (EBITDA) and non-GAAP adjusted loss,

which further adjusts EBITDA for stock-based compensation expense,

loss on the issuance or modification of convertible securities, the

periodic change in fair value of convertible securities, and loss

on debt extinguishment. The foregoing non-GAAP financial measures

of EBITDA and non-GAAP adjusted loss are not recognized terms under

U.S. GAAP.

Non-GAAP financial measures are presented with

the intent of providing greater transparency to information used by

us in our financial performance analysis and operational

decision-making. We believe these non-GAAP financial measures

provide meaningful information to assist investors, shareholders

and other readers of our unaudited financial statements in making

comparisons to our historical financial results and analyzing the

underlying performance of our results of operations. These non-GAAP

financial measures are not intended to be, and should not be, a

substitute for, considered superior to, considered separately from

or as an alternative to, the most directly comparable GAAP

financial measures.

Non-GAAP financial measures are provided to

enhance readers’ overall understanding of our current financial

results and to provide further information for comparative

purposes. Management believes the non-GAAP financial measures

provide useful information to management and investors by isolating

certain expenses, gains and losses that may not be indicative of

our core operating results and business outlook. Specifically, the

non-GAAP financial measures include non-GAAP adjusted loss and its

presentation is intended to help the reader understand the effect

of the loss on the issuance or modification of convertible

securities, the periodic change in fair value of convertible

securities, the loss on debt extinguishment and the corresponding

accounting for non-cash charges on financial performance. In

addition, management believes non-GAAP financial measures enhance

the comparability of results against prior periods.

A reconciliation to the most directly comparable

GAAP measure of all non-GAAP financial measures included in this

press release for the three months ended March 31, 2020 and 2019 is

as follows:

| |

|

Three Months Ended March 31, |

|

| (ooo's

except per-share amounts) |

|

2020 |

|

|

2019 |

|

| |

|

|

|

|

|

|

| Net income (loss) per

common share, basic and diluted |

|

|

$ |

(0.33 |

) |

|

|

$ |

(0.13 |

) |

| Net loss attributable

to common stockholders |

|

|

|

(14,545 |

) |

|

|

|

(3,600 |

) |

| Preferred Stock dividends and

deemed dividends |

|

|

|

70 |

|

|

|

|

65 |

|

|

Net income (loss) as reported |

|

|

|

(14,475 |

) |

|

|

|

(3,535 |

) |

| Adjustments: |

|

|

|

|

|

|

|

|

|

Depreciation expense1 |

|

|

|

4 |

|

|

|

|

3 |

|

|

Interest expense, net3 |

|

|

|

52 |

|

|

|

|

- |

|

| EBITDA |

|

|

|

(14,419 |

) |

|

|

|

(3,532 |

) |

| |

|

|

|

|

|

|

|

|

| Other non-cash or

financing related expenses: |

|

|

|

|

|

|

|

|

|

Stock-based compensation expense2 |

|

|

|

344 |

|

|

|

|

459 |

|

|

Debt extinguishment3 |

|

|

|

1,188 |

|

|

|

|

1 |

|

|

Change in FV convertible debt3 |

|

|

|

8,008 |

|

|

|

|

559 |

|

|

Offering costs convertible debt3 |

|

|

|

410 |

|

|

|

|

- |

|

| Non-GAAP adjusted

(loss) |

|

|

|

(4,469 |

) |

|

|

|

(2,513 |

) |

|

Basic and Diluted shares outstanding |

|

|

|

43,500 |

|

|

|

|

27,149 |

|

|

Non-GAAP adjusted (loss) income per share |

|

|

|

($0.10 |

) |

|

|

|

($0.09 |

) |

| 1 |

Included in general and administrative expenses in the financial

statements |

| |

|

| 2 |

For the three months ended March 31, 2020 includes $277 of stock

based compensation expense reported as general and administrative

expenses and $67 reported as research and development expense. For

the three months ended March 31, 2019 includes $285 of stock based

compensation expense reported as general and administrative

expenses and $174 reported as research and development

expense. |

| |

|

| 3 |

Included in other income and expenses |

Conference Call and Webcast

The Company will hold a conference call and

webcast today at 4:30 p.m. Eastern time. During the call, Lishan

Aklog, M.D., Chairman and Chief Executive Officer of the Company,

will provide a business update including an overview of the

Company’s near-term milestones and growth strategy. In addition,

Dennis McGrath, President and Chief Financial Officer, will review

first quarter 2020 financial results.

To access the conference call, U.S.-based

listeners should dial (877) 407-3982 and international listeners

should dial (201) 493-6780. All listeners should provide the

operator with the conference call name “PAVmed, Inc. Business

Update Conference Call” to join. Individuals interested in

listening to the live conference call via webcast may do so by

visiting the investor relations section of the Company’s website at

www.pavmed.com.

Following the conclusion of the conference call,

a replay will be available for one week and can be accessed by

dialing (844) 512-2921 from within the U.S. or (412) 317-6671 from

outside the U.S. To access the replay, all listeners should provide

the following pin number: 13703671. The webcast will be available

for replay on the investor relations section of the Company’s

website at www.pavmed.com.

About PAVmed

PAVmed Inc. is a highly differentiated,

multiproduct commercial stage medical device company employing a

unique business model designed to advance innovative products to

commercialization rapidly and with less capital than the typical

medical device company. This proprietary model enables PAVmed to

pursue an expanding pipeline strategy with a view to enhancing and

accelerating value creation while seeking to further expand its

pipeline through relationships with its network of clinician

innovators at leading academic centers. PAVmed’s diversified

product pipeline addresses unmet clinical needs encompassing a

broad spectrum of clinical areas with attractive regulatory

pathways and market opportunities. Its four operating divisions

include GI Health (EsoGuard™ Esophageal DNA Test, EsoCheck™

Esophageal Cell Collection Device, and EsoCure™ Esophageal Ablation

Device with Caldus™ Technology), Minimally Invasive Interventions

(CarpX™ Minimally Invasive Device for Carpal Tunnel Syndrome),

Infusion Therapy (PortIO™ Implantable Intraosseus Vascular Access

Device and NextFlo™ Highly Accurate Infusion Platform Technology),

and Emerging Innovations (non-invasive laser-based glucose

monitoring, pediatric ear tubes, and mechanical circulatory

support). For more information, please visit www.pavmed.com,

follow us on Twitter, connect with us on LinkedIn, and watch our

videos on YouTube. For more information on our majority owned

subsidiary, Lucid Diagnostics Inc., please visit www.luciddx.com,

follow Lucid on Twitter, and connect with Lucid on LinkedIn.

Forward-Looking Statements

This press release includes forward-looking

statements that involve risks and uncertainties. Forward-looking

statements are statements that are not historical facts. Such

forward-looking statements, based upon the current beliefs and

expectations of PAVmed’s management, are subject to risks and

uncertainties, which could cause actual results to differ from the

forward-looking statements. Risks and uncertainties that may cause

such differences include, among other things, volatility in the

price of PAVmed’s common stock, Series W Warrants and Series Z

Warrants; general economic and market conditions; the uncertainties

inherent in research and development, including the cost and time

required advance PAVmed’s products to regulatory submission;

whether regulatory authorities will be satisfied with the design of

and results from PAVmed’s preclinical studies; whether and when

PAVmed’s products are cleared by regulatory authorities; market

acceptance of PAVmed’s products once cleared and commercialized;

our ability to raise additional funding and other competitive

developments. PAVmed has not yet received clearance from the FDA or

other regulatory body to market many of its products. The Company

has been monitoring the COVID-19 pandemic and its impact on our

business. The Company expects the significance of the COVID-19

pandemic, including the extent of its effect on the Company’s

financial and operational results, to be dictated by, among other

things, the success of efforts to contain it and the impact of

actions taken in response. New risks and uncertainties may arise

from time to time and are difficult to predict. All of these

factors are difficult or impossible to predict accurately and many

of them are beyond PAVmed’s control. For a further list and

description of these and other important risks and uncertainties

that may affect PAVmed’s future operations, see Part I, Item IA,

“Risk Factors,” in PAVmed’s most recent Annual Report on Form 10-K

filed with the Securities and Exchange Commission, as the same may

be updated in Part II, Item 1A, “Risk Factors” in any Quarterly

Reports on Form 10-Q filed by PAVmed after its most recent Annual

Report. PAVmed disclaims any intention or obligation to publicly

update or revise any forward-looking statement to reflect any

change in its expectations or in events, conditions, or

circumstances on which those expectations may be based, or that may

affect the likelihood that actual results will differ from those

contained in the forward-looking statements.

Contacts:

InvestorsMike HavrillaDirector of Investor

Relations(814) 241-4138JMH@PAVmed.com

MediaShaun O’NeilChief Commercial Officer(518)

812-3087SMO@PAVmed.com

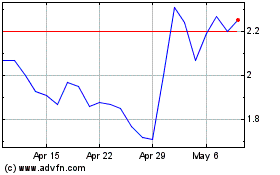

PAVmed (NASDAQ:PAVM)

Historical Stock Chart

From Mar 2024 to Apr 2024

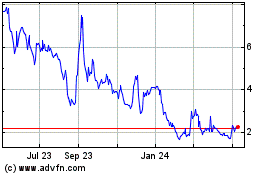

PAVmed (NASDAQ:PAVM)

Historical Stock Chart

From Apr 2023 to Apr 2024