Registration of Additional Securities (up to 20%) (s-1mef)

April 10 2019 - 6:12AM

Edgar (US Regulatory)

As filed with the Securities and Exchange

Commission on April 10, 2019

Registration

No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

____________________

Outlook

Therapeutics, Inc.

(Exact name of registrant as specified in

its charter)

____________________

|

Delaware

|

2836

|

38-3982704

|

(State or other jurisdiction of

incorporation or organization)

|

(Primary Standard Industrial

Classification Code Number)

|

(I.R.S. Employer

Identification No.)

|

____________________

7 Clarke Drive

Cranbury, New Jersey 08512

(609) 619-3990

(Address, including zip code, and telephone

number, including area code, of registrant’s principal executive offices)

____________________

Lawrence A. Kenyon

President, Chief Executive Officer and

Chief Financial Officer

Outlook Therapeutics, Inc.

7 Clarke Drive

Cranbury, New Jersey 08512

(609) 619-3990

(Name, address, including zip code, and

telephone number, including area code, of agent for service)

____________________

Copies to:

|

Yvan-Claude Pierre

Marianne C. Sarrazin

Pia Kaur

Cooley LLP

1114 Avenue of the Americas

New York, New York 10036

(212) 479-6000

|

Lawrence A. Kenyon

Outlook Therapeutics, Inc.

7 Clarke Drive

Cranbury, New Jersey 08512

(609) 619-3990

|

Jack Hogoboom

Lowenstein Sandler LLP

1251 Avenue of the Americas

New York, NY 10020

(212) 262-6700

|

____________________

Approximate date of commencement of

proposed sale to the public:

As soon as practicable after this Registration Statement is declared effective.

If any of the securities being registered

on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the

following box.

x

If this form is filed to register additional

securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act

registration statement number of the earlier effective registration statement for the same offering.

x

(File No. 333-229761)

If this form is a post-effective amendment

filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering.

¨

If this form is a post-effective amendment

filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering.

¨

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth

company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting

company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filter

o

|

Accelerated filer

o

|

Non-accelerated filer

o

|

Smaller reporting company

x

Emerging growth company

x

|

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised

financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☒

CALCULATION OF REGISTRATION

FEE

|

Title of Each Class of Securities to be Registered

|

Proposed Maximum

Aggregate Offering Price

(1)

|

Amount of Registration Fee

(3)

|

|

Common Stock, $0.01 par value per share

(2)

|

$3,435,000

|

$416.32

|

|

Common Stock Purchase Warrants and shares of Common Stock, $0.01 par value per share, underlying Common Stock Purchase Warrants

|

$9,972,000

|

$1,208.61

|

|

Total

|

$13,407,000

|

$1,624.93

|

|

(1)

|

Estimated solely for the purpose of computing the amount of registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended (the “Securities Act”).

|

|

(2)

|

Pursuant to Rule 416, under the Securities Act the securities being registered hereunder include such indeterminate number of additional shares of common stock as may be issued after the date hereof as a result of stock splits, stock dividends or similar transactions.

|

|

|

|

|

|

This Registration Statement shall become effective upon filing

with the Commission in accordance with Rule 462(b) under the Securities Act of 1933, as amended.

EXPLANATORY

NOTE AND

INCORPORATION

OF CERTAIN INFORMATION BY REFERENCE

Pursuant to Rule

462(b) under the Securities Act of 1933, as amended (“

Securities Act

”), Outlook Therapeutics, Inc. (the

“

Registrant

”) is filing this Registration Statement on Form S-1 (this “

Registration

Statement

”) with the Securities and Exchange Commission (the “

Commission

”). This Registration

Statement relates to the public offering of securities contemplated by the Registration Statement on Form S-1, as amended

(File No. 333-229761) (the “

Prior Registration Statement

”), which the Registrant originally

filed with the Commission on February 21, 2019, and which the Commission declared effective on April 9, 2019.

The Registrant

is filing this Registration Statement with respect to the registration of additional shares of common stock (the “

Shares

”)

and additional warrants to purchase shares of common stock (the “

Warrants

”) and shares of common stock

issuable upon exercise of the Warrants. The information set forth in the Prior Registration Statement and all exhibits to the Prior

Registration Statement are incorporated by reference into this Registration Statement.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements

of the Securities Act of 1933, the registrant has duly caused this registration statement on Form S-1 to be signed on its behalf

by the undersigned, thereunto duly authorized, in Cranbury, New Jersey, on April 10, 2019.

|

|

OUTLOOK THERAPEUTICS, INC.

|

|

|

|

|

|

By:

/s/ Lawrence A. Kenyon

|

|

|

Lawrence A. Kenyon

|

|

|

President, Chief Executive Officer and Chief Financial Officer

|

Pursuant to the requirements

of the Securities Act of 1933, this registration statement on Form S-1 has been signed by the following persons in the capacities

and on the dates indicated.

|

Signatures

|

|

Title

|

|

Date

|

|

|

|

|

|

|

|

*

Ralph H. Thurman

|

|

Executive Chairman

|

|

April 10, 2019

|

|

|

|

|

|

|

|

/s/ Lawrence

A. Kenyon

Lawrence A. Kenyon

|

|

President and Chief Executive Officer,

Chief Financial Officer, Treasurer, Secretary and Director

(Principal Executive, Financial and Accounting Officer)

|

|

April 10, 2019

|

|

|

|

|

|

|

|

*

Yezan Haddadin

|

|

Director

|

|

April 10, 2019

|

|

|

|

|

|

|

|

*

Kurt J. Hilzinger

|

|

Director

|

|

April 10, 2019

|

|

|

|

|

|

|

|

*

Pankaj Mohan, Ph.D.

|

|

Director

|

|

April 10, 2019

|

|

|

|

|

|

|

|

*

Faisal G. Sukhtian

|

|

Director

|

|

April 10, 2019

|

|

|

|

|

|

|

|

*

Joe Thomas

|

|

Director

|

|

April 10, 2019

|

|

|

|

|

|

|

|

*

Joerg Windisch, Ph.D.

|

|

Director

|

|

April 10, 2019

|

By:

/s/ Lawrence

A. Kenyon

Attorney-in-Fact

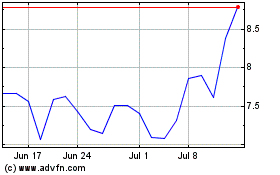

Outlook Therapeutics (NASDAQ:OTLK)

Historical Stock Chart

From Mar 2024 to Apr 2024

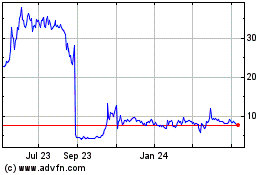

Outlook Therapeutics (NASDAQ:OTLK)

Historical Stock Chart

From Apr 2023 to Apr 2024