Overstock.com, Inc. (NASDAQ:OSTK) today reported financial results

for the quarter ended June 30, 2020.

Second Quarter Financial Highlights

- Total net revenue was $783 million, an increase of 109% year

over year

- Gross profit was $180 million or 23.0% of total net revenue, an

improvement of 321 basis points year over year

- Net income attributable to stockholders of Overstock.com, Inc.

was $36 million, an improvement of $61 million year over year

- Diluted earnings per share was $0.84, an improvement of $1.53

year over year

- Adjusted EBITDA (non-GAAP) was $42 million, an improvement of

$55 million year over year

- YTD net cash provided by operating activities was $170 million,

an improvement of $236 million year over year

- YTD free cash flow (non-GAAP) improved $237 million year over

year

- At the end of the second quarter, cash and cash equivalents

totaled $319 million

"In a rapidly shifting and challenging environment, Overstock

continues to perform exceptionally well," said Overstock CEO

Jonathan Johnson. "Second quarter gross sales in our Overstock

Retail business more than doubled year over year. The number of new

customers more than tripled year over year. Importantly, our

customers are buying our core products—home furnishings—from the

safety of their homes as part of the country's new normal. If

business continues as I expect, our Overstock Retail business will

achieve sustainable, profitable growth this year."

"tZERO and our other Medici Ventures blockchain-based businesses

continue to make progress, with several of those companies

attracting media attention for their solutions to problems the

country now faces," continued Johnson. "As an organization,

Overstock remains focused, disciplined, and resilient as our

employees execute against our strategic initiatives. I am proud of

the progress we have made, and I am confident that we can continue

along this profitable trajectory. I look forward to providing a

full update on our progress and performance during our earnings

call."

Other Second Quarter Financial Highlights

- Retail income before income taxes was $53 million, an

improvement of $62 million year over year

- Retail contribution (non-GAAP) was $99 million, or 12.9% of

Retail net revenue, an improvement of 239 basis points year over

year

- Retail Adjusted EBITDA (non-GAAP) was $53 million, an

improvement of $51 million year over year

- tZERO net revenue was $13 million, an increase of 129% year

over year, primarily due to SpeedRoute trading volume

- Consolidated G&A expenses decreased by $5 million primarily

due to the Delaware Supreme Court reversing an $8.6 million

judgment against the company, and improved by 506 basis points as a

percentage of total net revenue year over year

Second Quarter Operational Highlights

- Retail gross sales were $1 billion, an increase of 114% year

over year

- Newly acquired Retail customers increased 205% year over

year

- Gross sales from orders placed on a mobile device were 50.8% of

Retail gross sales in the second quarter of 2020, compared to 43.9%

in the second quarter of 2019

- tZERO ATS trading volume was a record 931,000 shares, a 231%

increase year over year

- Total number of tZERO Crypto app users increased 42% from March

31, 2020, and 100% YTD

COVID-19 Update

Overstock has responded effectively to the challenges and

opportunities created by the COVID-19 pandemic. In our Retail

business, customer demand increased significantly in the second

quarter, particularly in our key home furnishings categories. We

have seen a substantial year-over-year increase in our website

traffic and number of new customers, and our Retail gross sales

grew more than 100% year over year in Q2. Our online-only platform

and partner network with thousands of fulfillment centers has

enabled us to meet this increase in demand without significant

operational disruptions. Our warehouses have remained operational

based on our implementation of sound safety measures, including

staggered shifts and social distancing. We also are hiring in key

areas to support our current and expected growth. We have faced

challenges from the sharply increased volume throughout our

customer service channels and capacity issues from shipping

carriers and some suppliers, including out-of-stock positions on

some of our top performing products. We also have faced challenges

at tZERO and its subsidiaries, as market volatility has delayed

capital raises by potential issuers. Most of our Medici Ventures

blockchain companies have seen little disruption, and several are

working on solutions to problems arising from the global pandemic.

We have evaluated and implemented a phased re-entry plan for our

offices while most of our corporate employees continue to work from

home without incident. We cannot predict how the COVID-19 pandemic

will unfold in the coming months. Nevertheless, the challenges

arising from the pandemic have not adversely affected our

liquidity, revenues, or capacity to service our debt, nor have

these conditions forced us to reduce our capital expenditures.

Digital Dividend

On May 19, 2020, we completed the distribution of our announced

digital dividend (the "Dividend") payable in shares of our Series

A-1 preferred stock. The Dividend was paid out at a ratio of 1:10,

so that one share of Series A-1 preferred stock was issued for

every ten shares of OSTK common stock, for every ten shares of

Series A-1 preferred stock, and for every ten shares of Series B

preferred stock held by all holders of such shares as of April 27,

2020, the record date for the Dividend.

Earnings Webcast Information

The company will hold a conference call and webcast to discuss

its Q2 2020 financial results on Thursday, July 30, 2020, at 8:30

a.m. ET. To access the live webcast and presentation slides, go to

http://investors.overstock.com. To listen to the conference call

via telephone, dial (877) 673-5346 and enter conference ID 9798319

when prompted. Participants outside the U.S. or Canada who do not

have Internet access should dial +1 (724) 498-4326 then enter the

conference ID provided above.

A replay of the conference call will be available at

http://investors.overstock.com starting two hours after the

live call has ended. An audio replay of the webcast will be

available via telephone starting at 11:30 a.m. ET on Thursday,

July 30, 2020, through 11:30 a.m. ET on Thursday,

August 13, 2020. To listen to the recorded webcast by phone,

dial (855) 859-2056 then enter the conference ID provided above.

Outside the U.S. or Canada dial +1 (404) 537-3406 and enter the

conference ID provided above.

Please email questions in advance of the call to

ir@overstock.com.

About Overstock.com

Overstock.com, Inc. Common Shares (NASDAQ:OSTK) / Digital Voting

Series A-1 Preferred Stock (Medici Ventures’ tZERO platform:OSTKO)

/ Series B Preferred (OTCQX:OSTBP) is an online retailer and

technology company based in Salt Lake City, Utah. Its leading

e-commerce website sells a broad range of new home products at low

prices, including furniture, décor, rugs, bedding, home

improvement, and more. The online shopping site, which is visited

by tens of millions of customers a month, also features a

marketplace providing customers access to millions of products from

third-party sellers. Overstock was the first major retailer to

accept cryptocurrency in 2014, and in the same year founded Medici

Ventures, its wholly-owned subsidiary dedicated to the development

and acceleration of blockchain technologies to democratize capital,

eliminate middlemen, and re-humanize commerce. Overstock regularly

posts information about the Company and other related matters on

the Newsroom and Investor Relations pages on its website,

Overstock.com.

O, Overstock.com, O.com, Club O, and Worldstock are

registered trademarks of Overstock.com, Inc. Other

service marks, trademarks and trade names which may be referred to

herein are the property of their respective owners.

Cautionary Note Regarding Forward-Looking

Statements

This press release and the July 30, 2020 conference call and

webcast to discuss our financial results may contain

forward-looking statements within the meaning of the federal

securities laws. Such forward-looking statements include all

statements other than statements of historical fact, including

forecasts of trends. These forward-looking statements are

inherently difficult to predict. Actual results could differ

materially for a variety of reasons, including but not limited to,

the duration of the COVID-19 pandemic and its ultimate impact on

our business and results of operations, adverse tax, regulatory or

legal developments, and competition. Other risks and uncertainties

include, among others, the inherent risks associated with the

businesses that Medici Ventures and tZERO are pursuing, our

continually evolving business model, and difficulties we may have

with our infrastructure, our fulfillment partners or our payment

processors, including cyber-attacks or data breaches affecting us

or any of them, and difficulties we may have with our search engine

optimization results. More information about factors that could

potentially affect our financial results is included in our Form

10-K for the year ended December 31, 2019, which was filed with the

Securities and Exchange Commission on March 13, 2020, in our Form

10-Q for the quarter ended March 31, 2020, which was filed with the

Securities and Exchange Commission on May 7, 2020, and in our

subsequent filings with the Securities and Exchange Commission. The

Form 10-K, 10-Q, and our subsequent filings with the Securities and

Exchange Commission identify important factors that could cause our

actual results to differ materially from those contained in or

contemplated by our projections, estimates and other

forward-looking statements.

|

Contacts Investor Relations:Alexis

Callahan801-947-5126ir@overstock.com |

Media:Overstock Media

Relations801-947-3564pr@overstock.com |

Overstock.com, Inc.Consolidated

Balance Sheets (Unaudited)(in thousands, except

per share data)

| |

June 30, 2020 |

|

December 31, 2019 |

|

Assets |

|

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

318,573 |

|

|

$ |

112,266 |

|

|

Restricted cash |

2,637 |

|

|

2,632 |

|

|

Marketable securities at fair value |

2,122 |

|

|

10,308 |

|

|

Accounts receivable, net of allowance for credit losses of $1,534

and $2,474 at June 30, 2020 and December 31, 2019,

respectively |

47,765 |

|

|

24,728 |

|

|

Inventories |

6,340 |

|

|

5,840 |

|

|

Prepaids and other current assets |

22,769 |

|

|

21,589 |

|

|

Total current assets |

400,206 |

|

|

177,363 |

|

| Property and equipment,

net |

126,795 |

|

|

130,028 |

|

| Intangible assets, net |

9,919 |

|

|

11,756 |

|

| Goodwill |

27,120 |

|

|

27,120 |

|

| Equity securities |

50,542 |

|

|

42,043 |

|

| Operating lease right-of-use

assets |

23,387 |

|

|

25,384 |

|

| Other long-term assets,

net |

7,173 |

|

|

4,033 |

|

|

Total assets |

$ |

645,142 |

|

|

$ |

417,727 |

|

|

Liabilities and Stockholders’ Equity |

|

|

|

| Current liabilities: |

|

|

|

|

Accounts payable |

$ |

131,101 |

|

|

$ |

75,416 |

|

|

Accrued liabilities |

144,110 |

|

|

88,197 |

|

|

Unearned revenue |

89,705 |

|

|

41,821 |

|

|

Operating lease liabilities, current |

4,785 |

|

|

6,603 |

|

|

Other current liabilities |

4,332 |

|

|

3,962 |

|

|

Total current liabilities |

374,033 |

|

|

215,999 |

|

| Long-term debt, net |

42,948 |

|

|

— |

|

| Operating lease liabilities,

non-current |

20,791 |

|

|

21,554 |

|

| Other long-term

liabilities |

4,022 |

|

|

2,319 |

|

|

Total liabilities |

441,794 |

|

|

239,872 |

|

| Commitments and

contingencies |

|

|

|

| Stockholders' equity: |

|

|

|

|

Preferred stock, $0.0001 par value, authorized shares - 5,000 |

|

|

|

|

Series A-1, issued and outstanding - 4,204 and 4,210 |

— |

|

|

— |

|

|

Series B, issued and outstanding - 357 and 357 |

— |

|

|

— |

|

|

Common stock, $0.0001 par value, authorized shares - 100,000 |

|

|

|

|

Issued shares - 43,885 and 42,790 |

|

|

|

|

Outstanding shares - 40,332 and 39,464 |

4 |

|

|

4 |

|

|

Additional paid-in capital |

770,984 |

|

|

764,845 |

|

|

Accumulated deficit |

(560,480 |

) |

|

(580,390 |

) |

|

Accumulated other comprehensive loss |

(560 |

) |

|

(568 |

) |

|

Treasury stock at cost - 3,553 and 3,326 |

(70,537 |

) |

|

(68,807 |

) |

|

Equity attributable to stockholders of Overstock.com, Inc. |

139,411 |

|

|

115,084 |

|

|

Equity attributable to noncontrolling interests |

63,937 |

|

|

62,771 |

|

|

Total stockholders' equity |

203,348 |

|

|

177,855 |

|

|

Total liabilities and stockholders' equity |

$ |

645,142 |

|

|

$ |

417,727 |

|

|

Overstock.com, Inc.Consolidated

Statements of Operations (Unaudited)(in thousands,

except per share data) |

| |

Three months endedJune 30, |

|

Six months ended June 30, |

| |

2020 |

|

2019 |

|

2020 |

|

2019 |

| Revenue, net |

|

|

|

|

|

|

|

|

Retail |

$ |

766,956 |

|

|

$ |

367,475 |

|

|

$ |

1,106,554 |

|

|

$ |

730,100 |

|

|

Other |

15,588 |

|

|

6,234 |

|

|

27,563 |

|

|

11,338 |

|

|

Total net revenue |

782,544 |

|

|

373,709 |

|

|

1,134,117 |

|

|

741,438 |

|

| Cost of goods sold |

|

|

|

|

|

|

|

|

Retail |

589,044 |

|

|

294,984 |

|

|

854,436 |

|

|

585,624 |

|

|

Other |

13,618 |

|

|

4,826 |

|

|

23,959 |

|

|

8,791 |

|

|

Total cost of goods sold |

602,662 |

|

|

299,810 |

|

|

878,395 |

|

|

594,415 |

|

|

Gross profit |

179,882 |

|

|

73,899 |

|

|

255,722 |

|

|

147,023 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

Sales and marketing |

79,790 |

|

|

34,560 |

|

|

116,552 |

|

|

68,037 |

|

|

Technology |

33,678 |

|

|

33,153 |

|

|

66,474 |

|

|

68,586 |

|

|

General and administrative |

27,371 |

|

|

31,964 |

|

|

59,797 |

|

|

72,196 |

|

|

Total operating expenses |

140,839 |

|

|

99,677 |

|

|

242,823 |

|

|

208,819 |

|

| Operating income (loss) |

39,043 |

|

|

(25,778 |

) |

|

12,899 |

|

|

(61,796 |

) |

| Interest income |

614 |

|

|

630 |

|

|

886 |

|

|

1,033 |

|

| Interest expense |

(588 |

) |

|

(105 |

) |

|

(788 |

) |

|

(232 |

) |

| Other income (expense),

net |

(4,171 |

) |

|

(2,995 |

) |

|

2,512 |

|

|

(9,267 |

) |

|

Income (loss) before income taxes |

34,898 |

|

|

(28,248 |

) |

|

15,509 |

|

|

(70,262 |

) |

| Provision (benefit) for income

taxes |

517 |

|

|

(622 |

) |

|

693 |

|

|

256 |

|

| Net income (loss) |

34,381 |

|

|

(27,626 |

) |

|

14,816 |

|

|

(70,518 |

) |

|

Less: Net loss attributable to noncontrolling interests |

(1,975 |

) |

|

(2,945 |

) |

|

(5,207 |

) |

|

(6,593 |

) |

| Net income (loss) attributable

to stockholders of Overstock.com, Inc. |

$ |

36,356 |

|

|

$ |

(24,681 |

) |

|

$ |

20,023 |

|

|

$ |

(63,925 |

) |

| Net income (loss) per common

share—basic: |

|

|

|

|

|

|

|

| Net income (loss) attributable

to common shares—basic |

$ |

0.85 |

|

|

$ |

(0.69 |

) |

|

$ |

0.48 |

|

|

$ |

(1.85 |

) |

| Weighted average common shares

outstanding—basic |

40,329 |

|

|

35,225 |

|

|

40,243 |

|

|

33,806 |

|

| Net income (loss) per common

share—diluted: |

|

|

|

|

|

|

|

| Net income (loss) attributable

to common shares—diluted |

$ |

0.84 |

|

|

$ |

(0.69 |

) |

|

$ |

0.47 |

|

|

$ |

(1.85 |

) |

| Weighted average common shares

outstanding—diluted |

40,590 |

|

|

35,225 |

|

|

40,440 |

|

|

33,806 |

|

|

Overstock.com, Inc.Consolidated

Statements of Cash Flows (Unaudited)(in

thousands) |

| |

Six months ended June 30, |

| |

2020 |

|

2019 |

|

Cash flows from operating activities: |

|

|

|

|

Consolidated net income (loss) |

$ |

14,816 |

|

|

$ |

(70,518 |

) |

|

Adjustments to reconcile consolidated net income (loss) to net cash

provided by (used in) operating activities: |

|

|

|

|

Depreciation and amortization |

15,117 |

|

|

15,518 |

|

|

Non-cash operating lease cost |

3,029 |

|

|

2,992 |

|

|

Stock-based compensation to employees and directors |

5,733 |

|

|

9,156 |

|

|

Impairment of equity securities |

— |

|

|

4,214 |

|

|

Losses on equity method securities |

6,013 |

|

|

3,058 |

|

|

Gain on disposal of business |

(10,705 |

) |

|

— |

|

|

Other non-cash adjustments |

1,960 |

|

|

1,360 |

|

|

Changes in operating assets and liabilities, net of

acquisitions: |

|

|

|

|

Accounts receivable, net |

(24,652 |

) |

|

12,295 |

|

|

Inventories |

(500 |

) |

|

2,231 |

|

|

Prepaids and other current assets |

(3,178 |

) |

|

3,311 |

|

|

Other long-term assets, net |

171 |

|

|

(547 |

) |

|

Accounts payable |

54,952 |

|

|

(31,722 |

) |

|

Accrued liabilities |

61,625 |

|

|

(5,317 |

) |

|

Unearned revenue |

48,109 |

|

|

(9,628 |

) |

|

Operating lease liabilities |

(3,612 |

) |

|

(2,340 |

) |

|

Other long-term liabilities |

1,565 |

|

|

85 |

|

|

Net cash provided by (used in) operating activities |

170,443 |

|

|

(65,852 |

) |

| Cash flows from investing activities: |

|

|

|

|

Purchase of equity securities |

(170 |

) |

|

(2,500 |

) |

|

Proceeds from sale of equity securities and marketable

securities |

6,306 |

|

|

7,082 |

|

|

Acquisitions of businesses, net of cash acquired |

— |

|

|

4,886 |

|

|

Expenditures for property and equipment |

(9,399 |

) |

|

(10,586 |

) |

|

Deconsolidation of cash of Medici Land Governance, Inc. |

(4,056 |

) |

|

— |

|

|

Other investing activities, net |

(659 |

) |

|

(1,997 |

) |

|

Net cash used in investing activities |

(7,978 |

) |

|

(3,115 |

) |

| Cash flows from financing activities: |

|

|

|

|

Payment on long-term debt |

(779 |

) |

|

— |

|

|

Proceeds from long-term debt |

47,500 |

|

|

— |

|

|

Proceeds from sale of common stock, net of offering costs |

2,848 |

|

|

52,112 |

|

|

Payments of taxes withheld upon vesting of restricted stock |

(1,730 |

) |

|

(1,346 |

) |

|

Other financing activities, net |

(3,992 |

) |

|

(1,006 |

) |

|

Net cash provided by financing activities |

43,847 |

|

|

49,760 |

|

| Net increase (decrease) in cash, cash equivalents and

restricted cash |

206,312 |

|

|

(19,207 |

) |

| Cash, cash equivalents and restricted cash, beginning of

period |

114,898 |

|

|

142,814 |

|

| Cash, cash equivalents and restricted cash, end of period |

$ |

321,210 |

|

|

$ |

123,607 |

|

Segment Financial Information

The following table summarizes information about reportable

segments and includes a reconciliation to consolidated net income

(loss) (in thousands):

| |

Three months ended June 30, |

| |

Retail |

|

tZERO |

|

MVI |

|

Other |

|

Total |

| 2020 |

|

|

|

|

|

|

|

|

|

|

Net revenue |

$ |

766,956 |

|

|

$ |

12,737 |

|

|

$ |

2,851 |

|

|

$ |

— |

|

|

$ |

782,544 |

|

| Cost of goods sold |

589,044 |

|

|

10,769 |

|

|

2,849 |

|

|

— |

|

|

602,662 |

|

| Gross profit |

177,912 |

|

|

1,968 |

|

|

2 |

|

|

— |

|

|

179,882 |

|

| Operating expenses |

124,991 |

|

|

11,216 |

|

|

2,543 |

|

|

2,089 |

|

|

140,839 |

|

| Interest and other expense,

net |

(117 |

) |

|

(1,268 |

) |

|

(2,760 |

) |

|

— |

|

|

(4,145 |

) |

| Income (loss) before income

taxes |

$ |

52,804 |

|

|

$ |

(10,516 |

) |

|

$ |

(5,301 |

) |

|

$ |

(2,089 |

) |

|

34,898 |

|

| Provision for income

taxes |

|

|

|

|

|

|

|

|

517 |

|

| Net income |

|

|

|

|

|

|

|

|

$ |

34,381 |

|

| |

|

|

|

|

|

|

|

|

|

| 2019 |

|

|

|

|

|

|

|

|

|

| Net revenue |

$ |

367,475 |

|

|

$ |

5,551 |

|

|

$ |

683 |

|

|

$ |

— |

|

|

$ |

373,709 |

|

| Cost of goods sold |

294,984 |

|

|

4,143 |

|

|

683 |

|

|

— |

|

|

299,810 |

|

| Gross profit |

72,491 |

|

|

1,408 |

|

|

— |

|

|

— |

|

|

73,899 |

|

| Operating expenses |

81,596 |

|

|

11,743 |

|

|

2,903 |

|

|

3,435 |

|

|

99,677 |

|

| Interest and other income

(expense), net |

40 |

|

|

340 |

|

|

(2,847 |

) |

|

(3 |

) |

|

(2,470 |

) |

| Loss before income taxes |

$ |

(9,065 |

) |

|

$ |

(9,995 |

) |

|

$ |

(5,750 |

) |

|

$ |

(3,438 |

) |

|

(28,248 |

) |

| Benefit for income taxes |

|

|

|

|

|

|

|

|

(622 |

) |

| Net loss |

|

|

|

|

|

|

|

|

$ |

(27,626 |

) |

| |

| |

Six months ended June 30, |

| |

Retail |

|

tZERO |

|

MVI |

|

Other |

|

Total |

| 2020 |

|

|

|

|

|

|

|

|

|

| Net revenue |

$ |

1,106,554 |

|

|

$ |

22,976 |

|

|

$ |

4,425 |

|

|

$ |

162 |

|

|

$ |

1,134,117 |

|

| Cost of goods sold |

854,436 |

|

|

19,536 |

|

|

4,423 |

|

|

— |

|

|

878,395 |

|

| Gross profit |

252,118 |

|

|

3,440 |

|

|

2 |

|

|

162 |

|

|

255,722 |

|

| Operating expenses |

207,826 |

|

|

23,474 |

|

|

5,451 |

|

|

6,072 |

|

|

242,823 |

|

| Interest and other income

(expense), net |

(416 |

) |

|

(3,050 |

) |

|

6,073 |

|

|

3 |

|

|

2,610 |

|

| Income (loss) before income

taxes |

$ |

43,876 |

|

|

$ |

(23,084 |

) |

|

$ |

624 |

|

|

$ |

(5,907 |

) |

|

15,509 |

|

| Provision for income

taxes |

|

|

|

|

|

|

|

|

693 |

|

| Net income |

|

|

|

|

|

|

|

|

$ |

14,816 |

|

| |

|

|

|

|

|

|

|

|

|

| 2019 |

|

|

|

|

|

|

|

|

|

| Net revenue |

$ |

730,100 |

|

|

$ |

10,047 |

|

|

$ |

1,291 |

|

|

$ |

— |

|

|

$ |

741,438 |

|

| Cost of goods sold |

585,624 |

|

|

7,500 |

|

|

1,291 |

|

|

— |

|

|

594,415 |

|

| Gross profit |

144,476 |

|

|

2,547 |

|

|

— |

|

|

— |

|

|

147,023 |

|

| Operating expenses |

166,929 |

|

|

27,297 |

|

|

7,157 |

|

|

7,436 |

|

|

208,819 |

|

| Interest and other income

(expense), net |

175 |

|

|

(623 |

) |

|

(8,011 |

) |

|

(7 |

) |

|

(8,466 |

) |

| Loss before income taxes |

$ |

(22,278 |

) |

|

$ |

(25,373 |

) |

|

$ |

(15,168 |

) |

|

$ |

(7,443 |

) |

|

(70,262 |

) |

| Provision for income

taxes |

|

|

|

|

|

|

|

|

256 |

|

| Net loss |

|

|

|

|

|

|

|

|

$ |

(70,518 |

) |

Supplemental Operational Data

Retail gross merchandise sales (“Retail GMS” or “Retail gross

sales”) is calculated as the amount paid by customers for products

and shipping, measured at the time of order, before coupons and

discounts, without reductions for estimated returns. We believe

that GMS provides a useful measure of the overall volume of sales

transactions that flow through our online platform in a given

period.

| |

Three months ended June 30, |

| |

2020 |

|

2019 |

|

Retail Gross Merchandise Sales |

$ |

1,009,146 |

|

|

$ |

471,354 |

|

Non-GAAP Financial Measures and

Reconciliations

We are providing certain non-GAAP financial measures in this

release and related earnings conference call, including Adjusted

EBITDA, Adjusted EBITDA as a percentage of total net revenue

(“Adjusted EBITDA margin”), Free cash flow, Contribution and

Contribution as a percentage of total net revenue (“Contribution

margin”). We use these non-GAAP measures internally in analyzing

our financial results at both the consolidated and segment level

and we believe they are useful to investors, as a supplement to

GAAP measures, in evaluating our ongoing operational performance in

the same manner as our management and board of directors. We have

provided reconciliations of these non-GAAP financial measures to

the most directly comparable GAAP measures in this earnings

release. These Non-GAAP financial measures should be used in

addition to and in conjunction with the results presented in

accordance with GAAP and should not be relied upon to the exclusion

of GAAP financial measures.

Adjusted EBITDA and Adjusted EBITDA margin are non-GAAP

financial measures that are calculated as net income (loss) before

depreciation and amortization, stock-based compensation, interest

and other income (expense), provision (benefit) for income taxes,

and special items. We believe the exclusion of certain expenses in

calculating Adjusted EBITDA and Adjusted EBITDA margin facilitates

operating performance comparisons on a period-to-period basis.

Exclusion of items in the non-GAAP presentation should not be

construed as an inference that these items are unusual, infrequent

or non-recurring.

Free cash flow is a non-GAAP financial measure that is

calculated as net cash provided by or used in operating activities

reduced by expenditures for property and equipment. We believe free

cash flow is a useful measure to evaluate the cash impact of the

continuing operations of the business including purchases of

property and equipment which are a necessary component of our

ongoing operations.

Contribution and Contribution margin are non-GAAP financial

measures that are calculated as gross profit less sales and

marketing expense. We believe contribution and contribution margin

provide information relevant to our Retail business about our

ability to cover our Retail operating costs, such as technology and

general and administrative expenses, while reflecting the selling

costs we incurred to generate our Retail revenues.

The following table reflects the reconciliation of Adjusted

EBITDA to net income (loss) (in thousands):

| |

Three months ended June 30, |

|

Six months ended June 30, |

| |

2020 |

|

2019 |

|

2020 |

|

2019 |

| |

|

|

|

|

|

|

|

|

Net income (loss) |

$ |

34,381 |

|

|

$ |

(27,626 |

) |

|

$ |

14,816 |

|

|

$ |

(70,518 |

) |

|

Depreciation and amortization (1) |

7,548 |

|

|

7,464 |

|

|

15,117 |

|

|

14,078 |

|

|

Stock-based compensation |

2,465 |

|

|

5,171 |

|

|

5,733 |

|

|

9,156 |

|

|

Interest income, net |

(26 |

) |

|

(525 |

) |

|

(98 |

) |

|

(801 |

) |

|

Other expense, net |

4,171 |

|

|

2,995 |

|

|

(2,512 |

) |

|

9,267 |

|

|

Provision (benefit) for income taxes |

517 |

|

|

(622 |

) |

|

693 |

|

|

256 |

|

|

Special items (see table below) |

(7,272 |

) |

|

— |

|

|

(8,375 |

) |

|

1,757 |

|

| Adjusted

EBITDA |

$ |

41,784 |

|

|

$ |

(13,143 |

) |

|

$ |

25,374 |

|

|

$ |

(36,805 |

) |

| |

|

|

|

|

|

|

|

| Segment Adjusted

EBITDA |

|

|

|

|

|

|

|

| Retail |

$ |

53,011 |

|

|

$ |

1,581 |

|

|

$ |

51,146 |

|

|

$ |

(876 |

) |

| tZERO |

(7,052 |

) |

|

(8,729 |

) |

|

(15,302 |

) |

|

(21,937 |

) |

| MVI |

(2,085 |

) |

|

(2,586 |

) |

|

(4,583 |

) |

|

(6,595 |

) |

| Other |

(2,090 |

) |

|

(3,409 |

) |

|

(5,887 |

) |

|

(7,397 |

) |

| Adjusted

EBITDA |

$ |

41,784 |

|

|

$ |

(13,143 |

) |

|

$ |

25,374 |

|

|

$ |

(36,805 |

) |

| |

|

|

|

|

|

|

|

| Special items: |

|

|

|

|

|

|

|

|

Special legal charges (2) |

$ |

(7,272 |

) |

|

$ |

— |

|

|

$ |

(9,773 |

) |

|

$ |

— |

|

|

Severance |

— |

|

|

— |

|

|

1,398 |

|

|

1,757 |

|

| |

$ |

(7,272 |

) |

|

$ |

— |

|

|

$ |

(8,375 |

) |

|

$ |

1,757 |

|

__________________________________________

(1) — Depreciation and amortization for the six months ended June

30, 2019 includes a $1.4 million adjustment related to finalizing

our preliminary purchase price accounting for Mac

Warehouse.

(2) — Includes amounts associated with the resolution for and

adjustments to various legal contingencies.

The following table reflects the reconciliation of Free cash

flow to Net cash provided by or used in operating activities (in

thousands):

| |

Six months ended June 30, |

| |

2020 |

|

2019 |

|

Net cash provided by (used in) operating activities |

$ |

170,443 |

|

|

$ |

(65,852 |

) |

| Expenditures for property and

equipment |

(9,399 |

) |

|

(10,586 |

) |

| Free cash flow |

$ |

161,044 |

|

|

$ |

(76,438 |

) |

The following table reflects the reconciliation of Retail

Contribution to Retail Gross profit (in thousands):

| |

Three months ended June 30, |

| |

2020 |

|

2019 |

| Retail: |

|

|

|

|

Net revenue |

$ |

766,956 |

|

|

$ |

367,475 |

|

| Cost of goods sold |

589,044 |

|

|

294,984 |

|

| Gross profit |

177,912 |

|

|

72,491 |

|

| Less: Sales and marketing

expense |

79,158 |

|

|

33,947 |

|

| Contribution |

$ |

98,754 |

|

|

$ |

38,544 |

|

| Contribution margin |

12.9 |

% |

|

10.5 |

% |

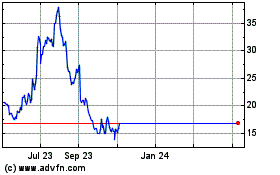

Overstock com (NASDAQ:OSTK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Overstock com (NASDAQ:OSTK)

Historical Stock Chart

From Apr 2023 to Apr 2024