Oportun Unveils New App and Brand Identity

March 08 2023 - 8:05AM

Oportun Financial Corporation (Nasdaq: OPRT) today revealed its new

brand identity and the launch of a new product experience.

Together, they mark the seamless unification of Oportun and Digit

as a single brand and app that meets Oportun’s members, wherever

they are on their financial journey.

“We are very excited to show our members and partners the new

Oportun,” said Gonzalo Palacio, Oportun’s Chief Marketing Officer.

“We are now one brand and one experience designed to help our

members effortlessly improve their financial health and

resilience.”

The new look and feel of the brand represent Oportun’s promise

to make every member feel more confident, supported and in control

of their finances. The new Oportun brand identity represents a

journey towards financial health and a commitment to helping

members reach their money goals. At its center is a new logo whose

three elements represent Oportun’s members, their money and their

unique financial journey coming together in a full circle.

Available for anyone to download now, Oportun has proven itself

particularly adept at helping people who have been poorly served by

the financial mainstream. Since inception, Oportun has extended

more than $14.7 billion in responsible and affordable loans,

primarily in low- and moderate-income communities, and helped its

members set aside more than $8 billion in savings.

Oportun’s credit-building lending products have helped more than

1 million people to begin establishing a credit history, and in a

time when most Americans do not have enough savings to cover an

unexpected expense of $1,000 or more1 according to Bankrate.com,

Oportun’s neobanking members are proving to be more financially

resilient. Using Oportun’s intelligent savings product, which

understands members’ cash flows and knows how much can be set aside

today, without impacting daily and future spending needs, Oportun

members are setting aside an average of more than $1,800 annually

in savings.

To learn more about the new Oportun brand please visit

oportun.com. The new Oportun mobile app is available in the Apple

App and Google Play stores.

About OportunOportun (Nasdaq: OPRT) is a

digital banking platform that puts its 1.9 million members’

financial goals within reach. With intelligent borrowing, savings,

budgeting, and spending capabilities, Oportun empowers members with

the confidence to build a better financial future. Since inception,

Oportun has provided more than $14.7 billion in responsible and

affordable credit, saved its members more than $2.3 billion in

interest and fees, and helped our neobanking members save an

average of more than $1,800 annually. For more information, visit

Oportun.com.

Investor Contact Dorian Hare(650)

590-4323ir@oportun.com

Media ContactUsher Lieberman(650)

769-9414usher.lieberman@oportun.com

1

https://www.bankrate.com/f/102997/x/fca64133d1/2023-january-fsp-emergency-savings-press-release.pdf

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/e2659f5d-7d6f-46e4-8944-be76a1e70926

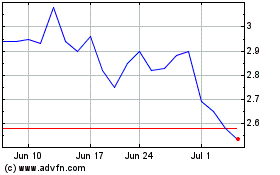

Oportun Financial (NASDAQ:OPRT)

Historical Stock Chart

From Mar 2024 to Apr 2024

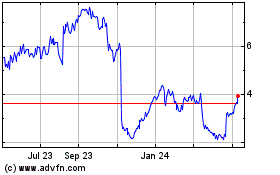

Oportun Financial (NASDAQ:OPRT)

Historical Stock Chart

From Apr 2023 to Apr 2024