Oportun Completes $300 Million Asset-Backed Securitization

November 03 2022 - 4:05PM

Oportun (Nasdaq: OPRT), a mission-driven fintech and digital

banking platform, today announced the issuance of $300 million of

Series 2022-3 fixed rate asset-backed notes (the “Notes”) in a

private asset-backed securitization transaction secured by a pool

of unsecured and secured installment loans.

“Amidst a challenging economic backdrop, Oportun’s access to the

capital markets remains quite strong, as evidenced by the

completion of our fifth major financing this year” said Jonathan

Coblentz, Chief Financial Officer at Oportun. “These notes support

our ability to tactically grow in the current environment, while

advancing our mission by providing our members with responsible and

affordable financial services that help hardworking people build a

better future.”

The offering included four classes of the Notes: Class A, Class

B, Class C and Class D. DBRS, Inc. rated all classes of the Notes,

assigning ratings of AA (low) (sf), A (low) (sf), BBB (low) (sf)

and BB (sf), respectively. The Class A, Class B, Class C and Class

D Notes were placed with a diversified mix of institutional

investors in a private offering pursuant to Rule 144A under the

Securities Act of 1933, as amended. Jefferies acted as the lead

book runner with J.P. Morgan Securities LLC and Goldman Sachs &

Co. LLC as joint book-runners.

This press release does not constitute an offer to sell or the

solicitation of an offer to buy nor shall there be any sale of

these securities in any jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of such jurisdiction.

About Oportun Oportun (Nasdaq: OPRT) is an

A.I.-powered digital banking platform that seeks to make financial

health effortless for anyone. Driven by a mission to provide

inclusive and affordable financial services, Oportun helps its over

1.8 million hardworking members meet their daily borrowing,

savings, banking, and investing needs. Since inception, Oportun has

provided more than $14 billion in responsible and affordable

credit, saved its members more than $2.3 billion in interest and

fees, and automatically helped members set aside more than $8.1

billion for rainy days and other needs. In recognition of its

responsibly designed products, Oportun has been certified as a

Community Development Financial Institution (CDFI) since

2009. For more information about Oportun, visit

https://oportun.com.

Investor ContactDorian

Hare650-590-4323ir@oportun.com

Media ContactUsher

Lieberman650-769-9414usher.lieberman@oportun.com

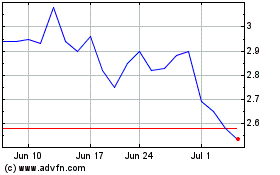

Oportun Financial (NASDAQ:OPRT)

Historical Stock Chart

From Mar 2024 to Apr 2024

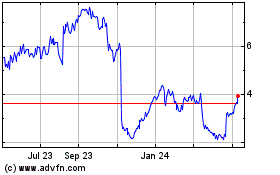

Oportun Financial (NASDAQ:OPRT)

Historical Stock Chart

From Apr 2023 to Apr 2024