Additional Proxy Soliciting Materials (definitive) (defa14a)

March 11 2021 - 5:26PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of

the Securities Exchange Act of 1934

|

Filed by the Registrant x

|

|

Filed by a Party other than the Registrant ¨

|

|

Check the appropriate box:

|

|

¨

|

Preliminary Proxy Statement

|

|

¨

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

¨

|

Definitive Proxy Statement

|

|

x

|

Definitive Additional Materials

|

|

¨

|

Soliciting Material under §240.14a-12

|

|

ONCONOVA THERAPEUTICS, INC.

|

(Name of Registrant as Specified In Its Charter)

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

|

Payment of Filing Fee (Check the appropriate box):

|

|

x

|

No fee required.

|

|

¨

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities

to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities

to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying

value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and

state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate

value of transaction:

|

|

|

(5)

|

Total fee paid:

|

|

¨

|

Fee paid previously with preliminary materials.

|

|

¨

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

(2)

|

Form, Schedule or Registration

Statement No.:

|

|

|

(3)

|

Filing Party:

|

|

|

(4)

|

Date Filed:

|

Onconova

Therapeutics, Inc., a Delaware corporation (“Onconova” or the “Company”), is filing materials contained

in this Schedule 14A with the U.S. Securities and Exchange Commission (the “SEC”) as definitive additional materials

pursuant to Rule 14a-6(b) under the Securities Exchange Act of 1934, as amended, in connection with the solicitation of proxies

by the Board of Directors for the Company’s Special Meeting of Stockholders adjourned to April 1, 2021 (the “Reconvened

Special Meeting”). On January 13, 2021, Onconova filed a definitive proxy statement and a definitive form of proxy card with

the SEC in connection with the Company’s Special Meeting of Stockholders held on March 4, 2021 (the “Special Meeting”).

These definitive

additional materials were first sent or made available to stockholders on or about March 11, 2021.

Conference Call on March 11, 2021 at 4:30 p.m. E.T.

On March 11, 2021, the Company hosted a conference call at 4:30

p.m. ET to discuss its corporate and financial results from fiscal year 2020 and certain matters relating to the Company’s

Reconvened Special Meeting.

During the call, the Company asked its stockholders of record

as of January 12, 2021 that have not yet voted to vote today in the Reconvened Special Meeting.

The Company announced on the call that the Board of Directors

firmly believes that the stockholder proposals to change the Company’s capital structure by a reverse stock split are in

the best interest of stockholders. The Company indicated that turning out the vote is imperative for the Company to execute its

strategic plan from a strengthened position. The Company believes the approval of these proposals will:

1. ensure we maintain our NASDAQ listing;

2. a higher stock price will increase the Company’s

appeal and permit institutional and fundamental biotech investors to invest in Onconova; and

3. support in-licensing programs under evaluation.

The Company believes approval of the proposals is needed to

continue to progress new and existing programs and create long-term value for stockholders. On the call, the Company urged all

stockholders who have not yet voted to please vote today.

The Company announced on the call that at the Special Meeting,

which was adjourned to April 1st, more than 70% of the shares which had voted, voted in favor of the two proposals 1. for a reverse

stock split and 2. decrease the number of our authorized shares. The Company indicated on the call that it did not meet the required

threshold for approval of more than 50% of the outstanding shares for the two proposals. The Company also indicated on the call

that in addition to the support of the Company’s stockholders who voted, all 3 independent proxy advisory firms: ISS, Glass Lewis, and Egan-Jones; have recommended stockholders vote FOR the proposals. The Company indicated their support

is based on their view that a yes vote is in the best interest of stockholders.

The Company indicated on the call that the stockholder meeting

process is also costly to the Company, and to stockholders. If any stockholders of record have not voted, the Company urged them

to please do so today to avoid the need for additional meetings.

If stockholders have voted Against the proposals, the Company

asked them to please reconsider their vote.

The Company requested the stockholders to reach out to speak

with any member of management or the Company’s proxy solicitor, MacKenzie Partners, if the stockholders have any questions

regarding the proposals or email the Company at ir@onconova.us.

The Company announced that it will make a $50,000 donation to

the American Cancer Society if it can achieve 70% or more voting participation by stockholders of record on January 12th, regardless

of how these stockholders vote. The Company indicated that as its focus is on studying cancer indications with its novel compounds,

the Company believes that supporting the American Cancer Society to thank its stockholders for voting is worthwhile and fitting.

The Company thanked the stockholders for their consideration

and asked them to please vote their shares today.

The Company thanked the stockholders for participating on today’s

update call. The Company reiterated it has several near-term milestones and value drivers ahead of them. The Company reminded the

stockholders to take action today and vote For the proposals in the Reconvened Special Meeting.

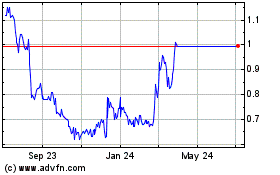

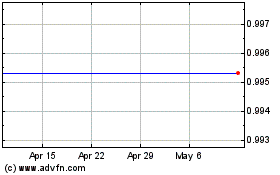

Onconova Therapeutics (NASDAQ:ONTX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Onconova Therapeutics (NASDAQ:ONTX)

Historical Stock Chart

From Apr 2023 to Apr 2024