Current Report Filing (8-k)

June 10 2020 - 5:28PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

June 10, 2020

Onconova Therapeutics, Inc.

(Exact name of Registrant as specified in

its charter)

|

Delaware

|

|

001-36020

|

|

22-3627252

|

(State or Other Jurisdiction

of Incorporation or Organization)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

375 Pheasant Run

Newtown, PA 18940

(267) 759-3680

(Address, Including Zip Code, and Telephone

Number, Including Area Code, of Registrant’s Principal Executive

Offices)

Not Applicable

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

¨

|

Written communications pursuant to Rule 425 under

the Securities Act (17 CFR 230.425)

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under

the Exchange Act (17CFR 240.14a-12)

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of

the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, par value $.01 per share

|

|

ONTX

|

|

The Nasdaq Stock Market LLC

|

|

Common Stock Warrants

|

|

ONTXW

|

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

Item 8.01 Other Events.

Onconova Therapeutics, Inc. (the “Company”)

previously announced that it adjourned its 2020 Annual Meeting of Stockholders held on May 27, 2020 (the “Annual Meeting”)

to June 26, 2020 (the “Reconvened Annual Meeting”) to give the Company’s stockholders additional time to consider and

vote on Proposal 2. Proposal 2 sought stockholder approval for an amendment to the Company’s Tenth Amended and Restated Certificate

of Incorporation, as amended, to combine outstanding shares of the Company’s common stock into a lesser number of outstanding

shares, or a “reverse stock split”, by a ratio of not less than one-for-five and not more than one-for-twenty-five,

with the exact ratio to be set within this range by the Company’s Board of Directors in its sole discretion.

On June 10, 2020, the Company’s Board of Directors determined

that the Company intends to withdraw Proposal 2 from consideration by the Company’s stockholders at the Reconvened Annual

Meeting. Based on feedback from the Company’s stockholders, the Company intends to defer any reverse stock split until topline

data from its pivotal Phase 3 “INSPIRE” trial are announced (expected during the second half of 2020), or as required

by the Nasdaq Stock Market (“Nasdaq”). If the Company has not achieved compliance with Nasdaq’s minimum bid price

rules by August 17, 2020, the Company expects to request a six-month extension from Nasdaq in order to regain compliance with these

rules.

In addition, at the Reconvened Annual Meeting, the Company

expects to ask its stockholders to consider and vote upon a new proposal regarding an amendment to the Company’s 2018

Omnibus Incentive Compensation Plan (the “2018 Plan”). At the time of the closing of the polls at the Annual

Meeting, votes in favor of Proposal 3, the proposal to add 25 million shares to the 2018 Plan, exceeded votes against.

However, the Company subsequently learned from the Inspector of Election that additional votes had been cast but not

tabulated, resulting in Proposal 3 not passing. After considering feedback from stockholders, the Company’s Board

of Directors approved a new proposal to add 12.5 million shares to the 2018 Plan. This new proposal represents a 50% decrease

in the size of the requested increase in authorized shares at the Annual Meeting. The Company’s Board of Directors

believes that this amendment to the 2018 Plan is needed to enable the Company’s compensation program to remain

competitive and enable the Company to attract and retain experienced, highly-qualified directors, employees, consultants and

advisors who will contribute to the Company's success; including leadership of a new commercial organization.

Forward-Looking Statements

Some of the statements contained in this report are forward-looking

statements within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange

Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995, and involve risks and uncertainties. These statements

relate to Onconova’s expectations regarding its intention to withdraw Proposal 2 from consideration by its stockholders at

the Reconvened Annual Meeting, its clinical trials, its compliance with Nasdaq rules and a reverse stock split. Although Onconova

believes that the expectations reflected in the forward-looking statements are reasonable as of the date made, expectations may

prove to have been materially different from the results expressed or implied by such forward-looking statements. These statements

are only predictions and involve known and unknown risks, uncertainties, and other factors, including Onconova's ability to continue

as a going concern, maintain its Nasdaq listing, the need for additional financing, the success and timing of Onconova's clinical

trials, and those discussed under the heading “Risk Factors” in Onconova's most recent Annual Report on Form 10-K and

quarterly reports on Form 10-Q. Any forward-looking statements contained in this release speak only as of its date. Onconova undertakes

no obligation to update any forward-looking statements contained in this release to reflect events or circumstances occurring after

its date or to reflect the occurrence of unanticipated event.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

|

Dated: June 10, 2020

|

Onconova Therapeutics, Inc.

|

|

|

|

|

|

By:

|

/s/ MARK GUERIN

|

|

|

|

Name: Mark Guerin

|

|

|

|

Title: Chief Financial Officer

|

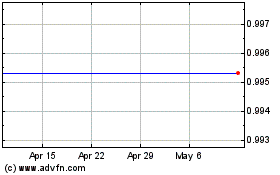

Onconova Therapeutics (NASDAQ:ONTX)

Historical Stock Chart

From Mar 2024 to Apr 2024

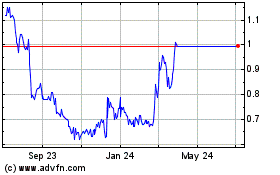

Onconova Therapeutics (NASDAQ:ONTX)

Historical Stock Chart

From Apr 2023 to Apr 2024