Additional Proxy Soliciting Materials (definitive) (defa14a)

December 02 2020 - 6:02AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE

14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

x

Filed by the Registrant ¨ Filed by a Party other than the Registrant

|

Check the appropriate box:

|

|

¨ Preliminary Proxy Statement

|

|

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

¨

Definitive Proxy Statement

|

|

x Definitive Additional Materials

|

|

¨

Soliciting Material under §240.14a-12

|

OCUGEN,

INC.

(Name of Registrant as Specified In Its

Charter)

|

|

|

|

|

|

|

Payment of Filing Fee (Check

the appropriate box):

|

|

x

|

|

No fee required.

|

|

¨

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

(1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

(2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

(3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

(5)

|

|

Total fee paid:

|

|

¨

|

|

Fee paid previously with preliminary materials.

|

|

¨

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

(1)

|

|

Amount Previously Paid:

|

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

(3)

|

|

Filing Party:

|

|

|

|

(4)

|

|

Date Filed:

|

Leading

Independent Proxy Firms ISS and Glass Lewis Recommend Ocugen Stockholders Vote “FOR” Reverse Stock Split and Authorized

Shares Amendment Proposals

MALVERN, PA, December 1, 2020 (GLOBE NEWSWIRE)- Ocugen,

Inc. (NASDAQ: OCGN), a biopharmaceutical company focused on discovering, developing, and commercializing transformative therapies

to cure blindness diseases, today announced that Institutional Shareholder Services Inc. (“ISS”) and Glass, Lewis

& Co., LLC (“Glass Lewis”), the nation’s leading independent proxy advisory firms, have recommended that

Ocugen stockholders vote “FOR” both Proposals 1 and 2 at the Company’s Annual Meeting of Stockholders to be

held on December 11, 2020.

|

|

·

|

Proposal 1 – Approval of an Amendment to Certificate of Incorporation to effect a reverse stock split at a ratio of not

less than 1-for-4 and not greater than 1-for-20 (“The Reverse Stock Split Proposal”).

|

|

|

·

|

Proposal 2 – Approval of an Amendment to Certificate of Incorporation to increase the Number of Authorized Shares of

Common Stock from 200,000,000 to 500,000,00 (“The Authorized Shares Amendment Proposal”).

|

Consummation of the Reverse Stock Split is conditioned upon

stockholder approval of the Reverse Stock Split Proposal. The Board authorized the reverse split of Ocugen’s common stock

with the primary intent of increasing the per share trading price of common stock in order to ensure that Ocugen continues to satisfy

the listing requirements for its common stock on Nasdaq.

The Company believes its listing on Nasdaq supports and maintains

stock liquidity and Company recognition for Ocugen stockholders. Accordingly, Ocugen believes that effecting the Reverse Stock

Split is advisable and in Ocugen’s and its stockholders’ best interests. The Board may effect only one Reverse Stock

Split as a result of this authorization. The Board also may determine in its discretion not to effect the Reverse Stock Split and

not to file the Certificate of Amendment. Ocugen has until March 8, 2021 to regain compliance with the Nasdaq $1.00 minimum

closing bid requirement. If Ocugen has not regained compliance with the closing bid price requirement by that time, its common

stock will be subject to delisting from Nasdaq.

The implementation of the Authorized Shares Amendment Proposal

is expressly conditioned upon the failure to obtain approval or implementation of the Reverse Stock Split; if the Reverse

Stock Split is approved and implemented, then the Authorized Shares Amendment will not be implemented.

A copy of the Definitive Proxy Statement is available to stockholders

on the Company’s website and at the website maintained by the U.S. Securities and Exchange Commission (the “SEC”)

at https://www.sec.gov.

Voting on the Proposals will be open through the conclusion

of Ocugen's 2020 Annual Meeting of Stockholders on December 11, 2020 at 8:00 a.m. Eastern time. Ocugen stockholders

as of October 28, 2020, the record date for the Annual Meeting, are invited to attend the virtual Annual Meeting by visiting

www.virtualshareholdermeeting.com/OCGN2020. Stockholders can vote prior to the Annual Meeting online at www.proxyvote.com

or by telephone at 1-800-690-6903. Stockholders that need assistance voting or have questions may contact Ocugen’s proxy

solicitation firm, Okapi Partners, at info@okapipartners.com or (855) 208-8902.

Stockholders who have already voted and want to change

their vote can update their vote at any time – the most recently cast votes become what is recorded.

About Ocugen, Inc.

Ocugen, Inc. is a biopharmaceutical company focused on discovering,

developing, and commercializing transformative therapies to cure blindness diseases. Our breakthrough modifier gene therapy platform

has the potential to treat multiple retinal diseases with one drug – “one to many” and our novel biologic product

candidate aims to offer better therapy to patients with underserved diseases such as wet age-related macular degeneration, diabetic

macular edema, and diabetic retinopathy. For more information, please visit www.ocugen.com.

Cautionary Note on Forward-Looking Statements

This press release contains

forward-looking statements within the meaning of The Private Securities Litigation Reform Act of 1995, which are subject to risks

and uncertainties. We may, in some cases, use terms such as “predicts,” “believes,” “potential,”

“proposed,” “continue,” “estimates,” “anticipates,” “expects,” “plans,”

“intends,” “may,” “could,” “might,” “will,” “should” or

other words that convey uncertainty of future events or outcomes to identify these forward-looking statements. Such statements

are subject to numerous important factors, risks and uncertainties that may cause actual events or results to differ materially

from our current expectations. These and other risks and uncertainties are more fully described in our periodic filings with the

Securities and Exchange Commission (the “SEC”), including the risk factors described in the section entitled “Risk

Factors” in the quarterly and annual reports that we file with the SEC. Any forward-looking statements that we make in this

press release speak only as of the date of this press release. Except as required by law, we assume no obligation to update forward-looking

statements contained in this press release whether as a result of new information, future events or otherwise, after the date of

this press release.

Corporate Contact:

Ocugen, Inc.

Sanjay Subramanian

Chief Financial Officer

IR@Ocugen.com

Media Contact:

LaVoieHealthScience

Lisa DeScenza

ldescenza@lavoiehealthscience.com

+1 978-395-5970

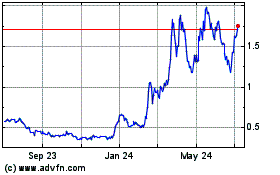

Ocugen (NASDAQ:OCGN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ocugen (NASDAQ:OCGN)

Historical Stock Chart

From Apr 2023 to Apr 2024