New York Mortgage Trust Announces Tax Treatment of 2019 Dividend Distributions

January 30 2020 - 4:05PM

New York Mortgage Trust, Inc. (Nasdaq: NYMT) (“NYMT” or the

“Company”) today announced the following tax treatment of common

and preferred stock dividends declared in 2019. This

information is provided to assist stockholders with tax reporting

requirements related to dividend distributions of taxable income by

the Company.

Stockholders should review the 2019 tax

statements received from their brokerage firms or other

institutions to ensure that the statements agree with the

information provided below. Also, as each stockholder's tax

situation may be different, stockholders are encouraged to consult

with their own professional tax advisor with respect to their

specific tax treatment of the Company's dividend distributions.

The Company's dividend distributions per share

of common stock (CUSIP #649604501) are to be classified for income

tax purposes as follows:

|

DeclarationDate |

RecordDate |

PaymentDate |

2019 Distribution Per Share |

Box 1a |

Box 1b |

Box 2a |

Box 2b |

Box 3 |

Box 5 |

|

2019

OrdinaryDividend |

2019QualifiedDividend |

2019Capital Gain

Distribution |

2019 Unrecaptured Section 1250 Gain |

2019 NonDividend

Distributions |

2019199A Dividends1 |

|

3/19/2019 |

3/29/2019 |

4/25/2019 |

$0.200000 |

$0.105952 |

- |

$0.032279 |

$0.002418 |

$0.061769 |

$0.105952 |

|

6/14/2019 |

6/24/2019 |

7/25/2019 |

$0.200000 |

$0.105952 |

- |

$0.032279 |

$0.002418 |

$0.061769 |

$0.105952 |

|

9/09/2019 |

9/19/2019 |

10/25/2019 |

$0.200000 |

$0.105952 |

- |

$0.032279 |

$0.002418 |

$0.061769 |

$0.105952 |

|

12/10/2019 |

12/20/2019 |

1/27/2020 |

$0.200000 |

$0.105952 |

- |

$0.032279 |

$0.002418 |

$0.061769 |

$0.105952 |

|

Totals |

$0.800000 |

$0.423808 |

- |

$0.129116 |

$0.009672 |

$0.247076 |

$0.423808 |

The Company's dividend distributions per share

of 7.750% Series B Cumulative Redeemable Preferred Stock (CUSIP

#649604709) are to be classified for income tax purposes as

follows:

|

|

|

|

|

Box 1a |

Box 1b |

Box 2a |

Box 2b |

Box 3 |

Box 5 |

|

Declaration Date |

Record Date |

Payment Date |

2019 Distribution Per Share |

2019

OrdinaryDividend |

2019QualifiedDividend |

2019Capital Gain

Distribution |

2019 Unrecaptured Section 1250 Gain |

2019 NonDividend

Distributions |

2019199A Dividends 1 |

|

12/4/2018 |

1/1/2019 |

1/15/2019 |

$0.484375 |

$0.406198 |

- |

$0.078177 |

$0.005857 |

- |

$0.406198 |

|

3/19/2019 |

4/1/2019 |

4/15/2019 |

$0.484375 |

$0.406198 |

- |

$0.078177 |

$0.005857 |

- |

$0.406198 |

|

6/14/2019 |

7/1/2019 |

7/15/2019 |

$0.484375 |

$0.406198 |

- |

$0.078177 |

$0.005857 |

- |

$0.406198 |

|

9/09/2019 |

10/1/2019 |

10/15/2019 |

$0.484375 |

$0.406198 |

- |

$0.078177 |

$0.005857 |

- |

$0.406198 |

|

Totals |

$1.937500 |

$1.624792 |

- |

$0.312708 |

$0.023428 |

- |

$1.624792 |

The Company's dividend distributions per share

of 7.875% Series C Cumulative Redeemable Preferred Stock (CUSIP

#649604808) are to be classified for income tax purposes as

follows:

|

DeclarationDate |

RecordDate |

PaymentDate |

2019 Distribution Per Share |

Box 1a |

Box 1b |

Box 2a |

Box 2b |

Box 3 |

Box 5 |

|

2019

OrdinaryDividend |

2019QualifiedDividend |

2019Capital Gain

Distribution |

2019 Unrecaptured Section 1250 Gain |

2019 NonDividend

Distributions |

2019199A

Dividends 1 |

|

12/4/2018 |

1/1/2019 |

1/15/2019 |

$0.492188 |

$0.412750 |

- |

$0.079438 |

$0.005952 |

- |

$0.412750 |

|

3/19/2019 |

4/1/2019 |

4/15/2019 |

$0.492188 |

$0.412750 |

- |

$0.079438 |

$0.005952 |

- |

$0.412750 |

|

6/14/2019 |

7/1/2019 |

7/15/2019 |

$0.492188 |

$0.412750 |

- |

$0.079438 |

$0.005952 |

- |

$0.412750 |

|

9/09/2019 |

10/1/2019 |

10/15/2019 |

$0.492188 |

$0.412750 |

- |

$0.079436 |

$0.005951 |

- |

$0.412750 |

|

Totals |

$1.968750 |

$1.651000 |

- |

$0.317750 |

$0.023807 |

- |

$1.651000 |

The Company's dividend distributions per share

of 8.000% Series D Fixed-to-Floating Rate Cumulative Redeemable

Preferred Stock (CUSIP #649604881) are to be classified for income

tax purposes as follows:

|

DeclarationDate |

RecordDate |

PaymentDate |

2019 Distribution Per Share |

Box 1a |

Box 1b |

Box 2a |

Box 2b |

Box 3 |

Box 5 |

|

2019

OrdinaryDividend |

2019QualifiedDividend |

2019Capital Gain

Distribution |

2019 Unrecaptured Section 1250 Gain |

2019 NonDividend

Distributions |

2019199A

Dividends 1 |

|

12/4/2018 |

1/1/2019 |

1/15/2019 |

$0.500000 |

$0.419301 |

- |

$0.080699 |

$0.006046 |

- |

$0.419301 |

|

3/19/2019 |

4/1/2019 |

4/15/2019 |

$0.500000 |

$0.419301 |

- |

$0.080699 |

$0.006046 |

- |

$0.419301 |

|

6/14/2019 |

7/1/2019 |

7/15/2019 |

$0.500000 |

$0.419301 |

- |

$0.080699 |

$0.006046 |

- |

$0.419301 |

|

9/09/2019 |

10/1/2019 |

10/15/2019 |

$0.500000 |

$0.419301 |

- |

$0.080699 |

$0.006046 |

- |

$0.419301 |

|

Totals |

$2.000000 |

$1.677204 |

- |

$0.322796 |

$0.024184 |

- |

$1.677204 |

(1) Section 199A Dividends are reported in

Box 5 of Form 1099-DIV. Section 199A Dividends are a subset of, and

included in, Ordinary Dividends, which are reported in Box 1a of

Form 1099-DIV. Section 199A Dividends shows the portion of the

Ordinary Dividends in Box 1a that may be eligible for the 20%

qualified business income deduction under Section 199A.

New York Mortgage Trust does not provide tax,

accounting or legal advice. Any tax statements contained herein

were not intended or written to be used, and cannot be used for the

purpose of avoiding U.S., federal, state or local tax penalties.

Stockholders are encouraged to consult with their personal tax

advisors as to their specific tax treatment of the Company’s

dividend distributions and the information contained herein.

About New York Mortgage

Trust

New York Mortgage Trust, Inc. is a Maryland

corporation that has elected to be taxed as a real estate

investment trust for federal income tax purposes (“REIT”). NYMT is

an internally managed REIT in the business of acquiring, investing

in, financing and managing mortgage-related and residential

housing-related assets and targets structured multi-family property

investments such as multi-family CMBS and preferred equity in, and

mezzanine loans to, owners of multi-family properties, residential

mortgage loans (including distressed residential mortgage loans,

non-QM loans, second mortgage loans and other residential mortgage

loans), non-Agency RMBS, Agency RMBS and other mortgage-related and

residential housing-related assets.

CONTACT: AT THE COMPANYKristine R. Nario-EngChief Financial

OfficerPhone: (646) 216-2363Email: knario@nymtrust.com

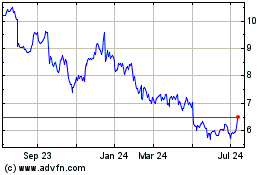

New York Mortgage (NASDAQ:NYMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

New York Mortgage (NASDAQ:NYMT)

Historical Stock Chart

From Apr 2023 to Apr 2024