Current Report Filing (8-k)

January 24 2020 - 4:32PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

January 21, 2020

Date of Report (Date of earliest event reported)

INVIVO THERAPEUTICS HOLDINGS CORP.

(Exact Name of Registrant as Specified in

Charter)

|

Nevada

|

|

001-37350

|

|

36-4528166

|

|

(State or Other

|

|

(Commission File Number)

|

|

(IRS Employer

|

|

Jurisdiction of Incorporation)

|

|

|

|

Identification No.)

|

One Kendall Square, Suite B14402

Cambridge, Massachusetts 02139

(Address of Principal Executive Offices)

(Zip Code)

(617) 863-5500

(Registrant’s telephone number, including

area code)

N/A

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

Title of each class

|

Trading symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $0.00001 par value per share

|

NVIV

|

The Nasdaq Capital Market

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 3.02 Unregistered Sales of Equity Securities.

As consideration for the services provided to InVivo Therapeutics

Holdings Corp. (the “Company”) by H.C. Wainwright & Co., LLC (“Wainwright”) as placement agent for

its November 2019 public offering (the “2019 Offering”) of Common Stock, $0.00001 par value per share (the “Common

Stock”), the Company agreed, subject to the approval by its stockholders of an increase to the authorized number of shares

of Common Stock, to issue to Wainwright, or its designees, placement agent warrants (the “Placement Agent Warrants”)

to purchase an aggregate of 455,000 shares of Common Stock. On January 21, 2020, the Company’s stockholders approved an increase

to the Company’s authorized shares of Common Stock and subsequently issued the Placement Agent Warrants. The Placement Agent

Warrants have an exercise price of $0.15 per share, are immediately exercisable and expire 5 years from the date of the 2019 Offering.

The Company’s agreement to issue the Placement Agent Warrants was made, and the Placement Agent Warrants were issued,

in reliance on the exemption provided by Section 4(a)(2) of the Securities Act of 1933, as amended, relative to transactions by

an issuer not involving any public offering, to the extent an exemption from such registration was required. No underwriters were

involved in such transaction. This description of the Placement Agent Warrants is qualified in its entirety by reference to the

complete text of the Form of Placement Agent Warrant, a copy of which is filed as Exhibit 4.1 to this Current Report on Form 8-K

and is incorporated herein by reference.

Item 5.02. Departure of Directors or Certain Officers;

Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On January 21, 2020, the Company held its 2019 Annual Meeting

of Stockholders (the “Annual Meeting”). At the Annual Meeting, the Company’s stockholders approved an amendment

to the Company’s 2015 Equity Incentive Plan (as so amended, the “Incentive Plan”) to increase the number of shares

available for issuance thereunder by 800,000 to a total of 960,000 shares plus (i) the number of shares that remained available

for issuance under the Company’s 2010 Equity Incentive Plan, as amended (the “Prior Plan”) as of the date that

the Incentive Plan became effective and (ii) the number of shares that were subject to outstanding awards under the Prior

Plan the date the Incentive Plan became effective that become available in the future due to cancellation, forfeiture or expiration

of such outstanding awards and corresponding adjustments that will be reflected in various share limitations. This description

of the Incentive Plan is qualified in its entirety by reference to the complete text of the Incentive Plan, a copy of which is

filed as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 5.03. Amendments to Articles of Incorporation or

Bylaws; Change in Fiscal Year.

At the Annual Meeting, the Company’s

stockholders approved an amendment to the Company’s Articles of Incorporation to increase the number of shares of authorized

common stock from 25,000,000 to 500,000,000 shares (the “Common Stock Amendment”). Following stockholder approval of

the Common Stock Amendment, a Certificate of Amendment to the Company’s Articles of Incorporation was filed with the

Secretary of State of Nevada on January 21, 2020, at which time the Common Stock Amendment became effective. This description of

the Certificate of Amendment is qualified in its entirety by reference to the complete text of the Certificate of Amendment, a

copy of which is filed as Exhibit 3.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 5.07. Submission of Matters to a Vote of Security

Holders.

Set forth below is a summary of the matters voted on at the

Annual Meeting.

Election of Directors

The Company’s stockholders elected Christina Morrison

and Daniel Marshak as Class II directors, each to serve for a three-year term expiring at the 2022 Annual Meeting of Stockholders

or until his or her successor is duly elected and qualified. The results of the stockholders’ vote with respect to the election

of such Class II directors were as follows:

|

|

For

|

Withheld

|

Broker Non-Votes

|

|

Christina Morrison

|

7,354,915

|

978,798

|

2,335,809

|

|

Daniel Marshak

|

7,337,222

|

996,491

|

2,335,809

|

Approval of Common Stock Amendment

The Company’s stockholders approved the Common Stock Amendment.

The results of the stockholders’ vote with respect to such amendment were as follows:

|

For:

|

9,937,169

|

|

Against:

|

671,009

|

|

Abstain:

|

61,344

|

Approval of Preferred Stock Amendment

The Company’s stockholders did not approve the Preferred

Stock Amendment. The results of the stockholders’ vote with respect to such amendment were as follows:

|

For:

|

6,714,933

|

|

Against:

|

788,843

|

|

Abstain:

|

829,937

|

|

Broker Non-Votes

|

2,335,809

|

Approval of Amendment to 2015 Equity Incentive Plan

The Company’s stockholders approved an amendment to the

Company’s 2015 Equity Incentive Plan to increase the shares available for issuance thereunder by 800,000 shares. The results

of the stockholders’ vote with respect to such amendment were as follows:

|

For:

|

7,086,697

|

|

Against:

|

418,990

|

|

Abstain:

|

828,026

|

|

Broker Non-Votes:

|

2,335,809

|

Advisory Vote on Named Executive Officer Compensation

The Company’s stockholders approved, on an advisory basis,

the compensation paid by the Company to its named executive officers. The results of the stockholders’ vote with respect

to such advisory vote were as follows:

|

For:

|

7,182,064

|

|

Against:

|

313,601

|

|

Abstain:

|

838,048

|

|

Broker Non-Votes:

|

2,335,809

|

Advisory Vote on Frequency of Future Advisory Votes on Named

Executive Officer Compensation

The Company’s stockholders approved, on an advisory basis,

to hold future advisory votes on named executive officer compensation three years. The results of the stockholders’ vote

with respect to such advisory vote were as follows:

|

One Year:

|

951,186

|

|

Two Years:

|

359,301

|

|

Three Years:

|

6,153,455

|

|

Abstain:

|

869,771

|

|

Broker Non-Votes:

|

2,335,809

|

Ratification of the Appointment of RSM US, LLP as the Company’s

Independent Registered Public Accounting Firm for the Fiscal Year Ending December 31, 2019

The Company’s stockholders ratified the appointment of

RSM US, LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2019.

The results of the stockholders’ vote with respect to such ratification were as follows:

|

For:

|

9,183,432

|

|

Against:

|

134,844

|

|

Abstain:

|

1,351,246

|

Item 9.01. Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act

of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

INVIVO THERAPEUTICS HOLDINGS CORP.

|

|

|

|

|

|

|

|

Date: January 24, 2019

|

By:

|

/s/ Richard Toselli

|

|

|

Name:

|

Richard Toselli

|

|

|

Title:

|

President and Chief Executive Officer

|

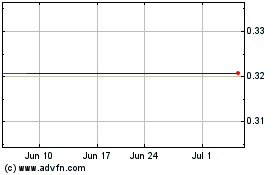

InVivo Therapeutics (NASDAQ:NVIV)

Historical Stock Chart

From Mar 2024 to Apr 2024

InVivo Therapeutics (NASDAQ:NVIV)

Historical Stock Chart

From Apr 2023 to Apr 2024