Global Stocks Drift as Virus Fears Fade Again

February 14 2020 - 9:16AM

Dow Jones News

By Avantika Chilkoti

Global stocks drifted higher Friday as investors' concerns about

a sharp rise in coronavirus cases from earlier in the week

faded.

Futures tied to the Dow Jones Industrial Average wavered between

gains and losses, while the Stoxx Europe 600 index ticked up almost

0.1%. Over in Asia, the Shanghai Composite Index closed 0.4%

higher.

Investors had briefly grown concerned this week about when the

coronavirus outbreak might peak after Chinese authorities changed

the criteria for diagnosis, leading to a dramatic increase in the

new cases. But stocks in the U.S. and in Europe have largely

continued their rally from last year on speculation that central

banks and governments will take steps to shield the global economy

from the impact of the outbreak.

"The market wants to believe this is a one-quarter blip and

we're back to the races," said Neil Dwane, global strategist at

Allianz Global Investors.

Investors also largely shrugged off the signs of fresh tensions

between Washington and Beijing that emerged overnight after the

U.S. charged Chinese telecommunications giant Huawei and two of its

U.S. subsidiaries with racketeering conspiracy and conspiracy to

steal trade secrets. Tensions between the two nations had roiled

markets for large parts of last year, and eased only briefly after

they sealed an initial trade accord that failed to address a number

of crucial issues.

"We always thought the 'phase one' trade deal would not actually

resolve tensions between the U.S. and China," said Simona

Gambarini, markets economist at Capital Economics in London. "The

two economies are based on totally different foundations."

Ahead of the opening bell in New York, Nvidia advanced around

6.2% after the graphics-chip maker's fourth-quarter earnings topped

Wall Street's expectations.

Expedia Group gained over 12% in offhours trading after the

online travel company projected cost savings and growth in a

measure of profit for this year. Shares in Arista Networks dropped

over 7% after the cloud-networking provider reported a drop in

fourth-quarter revenue.

Among European equities, Royal Bank of Scotland Group was among

the biggest losers. The stock declined 6.4% after the U.K. bank

reduced the size of its investment banking business and projected

as much as GBP1 billion ($1.3 billion) in costs this year, stemming

from strategic changes it plans to make.

Write to Avantika Chilkoti at Avantika.Chilkoti@wsj.com

(END) Dow Jones Newswires

February 14, 2020 09:01 ET (14:01 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

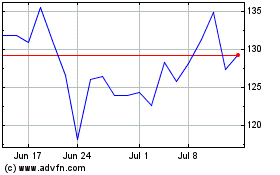

NVIDIA (NASDAQ:NVDA)

Historical Stock Chart

From Mar 2024 to Apr 2024

NVIDIA (NASDAQ:NVDA)

Historical Stock Chart

From Apr 2023 to Apr 2024