By Inti Pacheco

Executives and directors at Pfizer Inc., Moderna Inc. and other

companies developing Covid-19 vaccines sold approximately $496

million of stock last year, reaping rewards of positive vaccine

developments that drove up the value of the drugmakers' shares.

Executives and directors at the same 13 companies sold about

$132 million of stock in 2019, according to insider transaction

data from research firm Kaleidoscope. More than 8.5 million shares

were sold last year by insiders at these companies, compared with

4.7 million shares in 2019.

In dollar terms, much of the sales came at a single company,

Moderna, maker of one of two Covid-19 vaccines authorized for use

in the U.S. Executives and a director there sold more than $321

million of their stock in more than 700 transactions. Merck &

Co. insiders sold $58 million of their shares. At Novavax Inc.,

executives sold more than $40 million of their shares after the

company's vaccine hit milestones in August and September.

Merck, which last May said it was pursuing two vaccines,

scrapped those efforts last month after data showed disappointing

immune responses. Novavax announced positive results of its

clinical trials last month.

Some of the sales toward the end of last year have drawn the

attention of government officials, with the then-head of the

Securities and Exchange Commission calling for new restrictions on

the trading plans under which many of the sales were made.

Corporate compensation experts say these kinds of sales are the

natural consequence of a long-term shift to using stock for a

greater share of executive pay, with the goal being to tie pay to

performance -- in this case the development of life-saving

vaccines. Top company officials, like other investors, may be

disinclined to leave profits on the table, as long as they adhere

to insider-trading rules, some consultants say.

"This is behavior that I would expect to see in most of these

companies, " said Ben Silverman, director of research at

InsiderScore, which analyzes transactions by corporate insiders.

While Mr. Silverman described some of the selling as aggressive, he

said it isn't unusual, particularly for young companies like

Moderna whose executives have seen the value of their holdings jump

dramatically.

Some of the selling was part of preset trading plans that were

established before the pandemic. The rest was mostly part of preset

trading plans that were changed or adopted after vaccine

development was under way. Those changes allowed for more selling

in the second half of the year when positive news about the

vaccines was coming out.

Preset trading plans often are set up to allow officers who

might have access to nonpublic information to sell shares without

exposing themselves to charges of insider trading. The so-called

10b5-1 plans can set prices or other thresholds that trigger

automatic sales when reached. Some plans require a "cooling-off

period" between the time the plan is implemented and the first

trade.

Novavax said its executives adhere to the laws of company stock

sales and have sold a fraction of their overall holdings in the

company. Pfizer didn't respond to requests for comment. Merck

didn't provide any comment.

Companies aren't required to disclose these plans, though they

often disclose when a transaction is tied to a plan in the interest

of providing legal protection for the seller, said Mr.

Silverman.

"As an investor, what you want to look out for is that

opportunistic behavior where people are targeting specific prices,

increasing the pace of selling at a higher price or these examples

where there are significant changes in behavior," he said.

Executives sell stock for a variety of reasons that can be

unrelated to developments at their companies, including

diversification, estate planning and setting aside money for

college tuition.

At Moderna, 17% of the dollar amount of the transactions, or

about $56 million, was part of 10b5-1 trading plans established

before 2020 that weren't updated last year, according to a Wall

Street Journal analysis of securities filings. Some Moderna

executives amended their 10b5-1 trading plans or established new

ones in March, May and June of last year, after trials for the

vaccine started and after the company received government funding

to speed up its development.

A spokesman for Moderna said all executive sales are made under

10b5-1 trading plans. In August, executives and directors agreed

not to enter into new plans, add shares to existing plans or engage

in additional unscheduled sales, the spokesman said. In December,

the company once again allowed trading through new or modified

preset trading plans, following the disclosure of efficacy numbers

for its Covid-19 vaccine.

Chief Executive Stéphane Bancel sold $98 million of his shares

last year. He had been selling an average 86,000 shares a month

last year until June, after which the pace of share sales doubled.

Mr. Bancel's sales represented less than 10% of his holdings, the

company said.

In November, Pfizer CEO Albert Bourla sold about $5.6 million in

company shares -- about 60% of his holdings at the time -- on the

same day the company announced positive results from its Covid-19

vaccine, which the FDA authorized for emergency use in the U.S. in

December. Pfizer said at the time that the sale was part of Mr.

Bourla's personal financial planning and relied on a 10b5-1 plan.

Mr. Bourla authorized the sale in February 2020 and renewed the

authorization in August with identical price and volume terms, the

company said.

Big-ticket stock sales at Pfizer, Moderna and elsewhere have

come under scrutiny from some investors and government officials.

In November, the head of the SEC called for new restrictions on

trading under these plans. "For senior executive officers using

10b5-1 plans to sell stock, I do believe that a cooling-off period

from the time that the plan is put in place or is materially

changed, until the first transaction, is appropriate," then-SEC

Chairman Jay Clayton said at a Senate hearing.

Merck Chairman and CEO Kenneth Frazier sold $23 million in stock

in November, while the company's vaccine candidate was in clinical

trial. His trades weren't attributed to a trading plan, unlike all

of his other transactions since October 2015. The selloff

represented 40% of his vested stock at the time.

Novavax executives sold $23 million of shares in August a day

after the company announced the beginning of the second phase of

its clinical trial. The August sales weren't attributed to a

trading plan in securities filings.

In late September, executives at Novavax sold another $19

million in shares days after entering phase three of the clinical

trial for its vaccine candidate. Securities filings from the last

week of September tied the sales to a trading plan but didn't

disclose when the plan was set up.

Moderna and Pfizer insiders who set up preset trading plans last

year all had cooling-off periods of less than three months. Novavax

insiders didn't disclose dates for the adoption of their preset

trading plans. Most of Merck insiders' sales weren't tied to such

trading plans, and the ones that were didn't include dates for the

plans.

Moderna's spokesman said the company requires that any new or

revised 10b5-1 plans are subject to a significant cooling-off

period before any transactions under those plans can be triggered,

but didn't say how long.

Theo Francis contributed to this article.

Write to Inti Pacheco at inti.pacheco@wsj.com

(END) Dow Jones Newswires

February 17, 2021 05:44 ET (10:44 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

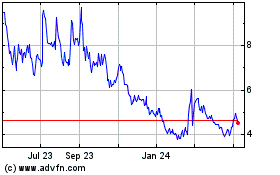

Novavax (NASDAQ:NVAX)

Historical Stock Chart

From Mar 2024 to Apr 2024

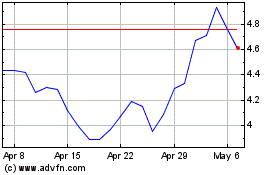

Novavax (NASDAQ:NVAX)

Historical Stock Chart

From Apr 2023 to Apr 2024