Oil Rallies on Hopes for Economic Recovery -- Update

May 26 2020 - 3:48PM

Dow Jones News

By Amrith Ramkumar

Oil prices climbed Tuesday, rising alongside stocks with more

states and countries easing lockdown measures and boosting demand

for fuel.

U.S. crude futures for delivery in July advanced 3.3% to $34.35

a barrel, continuing a recent recovery. Prices have rebounded from

a collapse in March and April that sent front-month futures below

$0 for the first time ever on April 20. The negative pricing meant

holders of the futures had to pay buyers to take the contracts due

to a lack of available storage.

A global glut of crude has eased in recent weeks, supporting

prices. The recovery comes with drivers in much of the world

returning to roads and avoiding public transportation to stop the

spread of the coronavirus. More states and countries are expected

to relax lockdowns in the weeks ahead, fueling optimism about a

continued recovery in demand.

Hopes for the development of a vaccine are also boosting oil and

other investments like stocks. Novavax Inc. on Monday said it

started the first human study of its experimental vaccine. Other

companies such as Pfizer Inc. and Moderna Inc. have efforts in

human testing, prompting bets that successful development will

allow life to return to normal more quickly than expected.

Signs of a recovery in oil demand also come with supply

plunging. Companies around the world have responded to ultralow

prices by shutting in productive wells and curtailing output,

lifting crude prices.

"The oil market is finally coming to a balance soon" with supply

expected to match demand, Bjørnar Tonhaugen, head of oil markets at

consulting firm Rystad Energy, said in a note.

Brent crude futures, the global gauge of oil prices, advanced

1.8% to $36.17 a barrel Tuesday.

Adding to the optimism: Russian Energy Minister Alexander Novak

said during a recent videoconference that the energy ministry

expects higher demand to balance the market in the next few months.

Russia is part of a historic deal reached last month through which

many large producers are lowering supply.

Earlier in the year, a production feud between Russia and Saudi

Arabia raised global output as demand crashed, causing the

oil-price slide. U.S. crude started the year above $60.

Producers are now slashing supply, with Saudi Arabia pledging to

cut production to its lowest level since 2002 next month. Investors

are looking ahead to a June meeting of the Organization of the

Petroleum Exporting Countries and allies like Russia to gauge how

long supply cuts might last. If prices continue rising, analysts

expect producers to respond by gradually increasing output.

Elsewhere in commodities Tuesday, most-actively traded copper

futures for July delivery rose 1.3% to $2.4185 a pound. Hopes for a

quick economic rebound have also lifted the industrial metal

recently, as have data points showing a pickup in Chinese

manufacturing activity. China is the world's largest commodity

consumer, and growth there is returning to normal after an

early-year shutdown.

Write to Amrith Ramkumar at amrith.ramkumar@wsj.com

(END) Dow Jones Newswires

May 26, 2020 15:33 ET (19:33 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

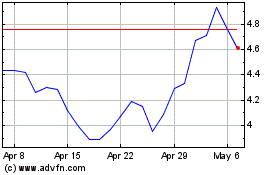

Novavax (NASDAQ:NVAX)

Historical Stock Chart

From Mar 2024 to Apr 2024

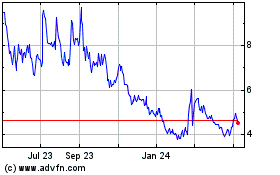

Novavax (NASDAQ:NVAX)

Historical Stock Chart

From Apr 2023 to Apr 2024