Nano Dimension Reports 2020 Second Quarter Financial Results

August 13 2020 - 7:00AM

Nano Dimension’s USA HQ --

Nano

Dimension Ltd. (Nasdaq: NNDM), a leading Additively Manufactured

Electronics (AME)/PE (Printed Electronics) provider, today

announced financial results for the second quarter ended June 30,

2020.

Nano Dimension reported revenues of $288,000 for

the second quarter of 2020. The Company ended the quarter with a

cash and deposits balance of $49,525,000, while total operating

loss for the second quarter was $3,812,000.

“As projected by our President & CEO in our

last investors conference call in mid-May, the global effects of

the Covid-19 pandemic have caused a material decrease to our

revenues, since companies and organizations around the world are

not releasing budgets for purchases of capital equipment,” said

Yael Sandler, Chief Financial Officer of Nano Dimension. “Yet, we

are already witnessing electronic companies considering ways to

shorten their supply chains by looking to reduce dependency in the

Far East by buffering part of their manufacturing on the ground in

America and Europe, rather than only in China. Our DragonFly LDM

Additive Manufacturing Electronic system allows exactly this:

Short-cycled and cost-efficient prototyping and eventually

fabrication of functional high-performance electronic devices

('Hi-PEDs') with minimal ecological disruptions. In the meanwhile,

rather than over spending on marketing and sales while the market

is irresponsive as capital expenses budgets are Corona-stagnated,

we are directing the resources received from the successful equity

offerings in the second quarter of 2020 to product and technology

development. As a result, we expect to be better positioned once

the electronics landscape is revitalized in a post-Covid-19

resurgence,” concluded Ms. Sandler.

Second Quarter 2020 Financial Results

- Total revenues for the second

quarter of 2020 were $288,000, compared to $702,000 in the first

quarter of 2020, and $1,161,000 in the second quarter of 2019. The

decrease is attributed to continuing delays in identified

transactions of DragonFly systems, which the Company primarily

attributes to Covid-19.

- Research and development (R&D)

expenses for the second quarter of 2020 were $1,895,000, compared

to $1,702,000 in the first quarter of 2020, and $2,322,000 in the

second quarter of 2019. The increase compared to the first quarter

of 2020 is attributed to an increase in payroll and related

expenses, as the Company is temporarily mobilizes resources from

marketing and sales to product enhancements. The decrease compared

to the second quarter of 2019 is mainly attributed to a decrease in

payroll and related expenses and materials expenses. The Company

intends to allocate more funds to R&D, in order to be ready

with new technology as Covid-19 subsides.

- Sales and marketing (S&M)

expenses for the second quarter of 2020 were $930,000, compared to

$819,000 in the first quarter of 2020, and $1,507,000 in the second

quarter of 2019. The increase compared to the first quarter of 2020

is attributed to an increase in payroll and related expenses,

before the eruption of the Covid-19 pandemic. The decrease compared

to the second quarter of 2019 was mainly attributed to a decrease

in payroll and related expenses and marketing and advertising

expenses.

- General and administrative

(G&A) expenses for the second quarter of 2020 were $908,000,

compared to $1,035,000 in the first quarter of 2020, and $1,023,000

in the second quarter of 2019. The decrease compared to the first

quarter of 2020 is attributed to a decrease in share-based payments

expenses. The decrease compared to the second quarter of 2019 is

attributed to a decrease in professional services expenses and the

results of cost cutting of salaries and other expenses in the early

stage of Covid-19 related slow down.

- Net loss for the second quarter of

2020 was $8,265,000, or $0.27 per share, compared to $2,074,000, or

$0.32 per share, in the first quarter of 2020, and $1,188,000, or

$0.30 per share, in the second quarter of 2019. The increase

compared to both the first quarter of 2020 and the second quarter

of 2019 is mainly attributed to finance expenses of approximately

$4,322,000 that were recognized in the second quarter of 2020, as a

result of the change in the fair value of warrants, which are

non-cash expenses.

Six Months Ended June 30, 2020 Financial

Results

- Total revenues for the six months

ended June 30, 2020 were $990,000, compared to $2,850,000 in the

six months ended June 30, 2019. The decrease is attributed to less

sales of DragonFly systems in the first half of 2020, which the

Company primarily attributes to Covid-19.

- R&D expenses for the six months

ended June 30, 2020 were $3,597,000, compared to $4,474,000 in the

six months ended June 30, 2019. The decrease resulted primarily

from a decrease in payroll and related expenses and materials

expenses.

- S&M expenses for the six months

ended June 30, 2020 were $1,749,000, compared to $2,871,000 in the

six months ended June 30, 2019. The decrease is mainly attributed

to a decrease in payroll and related expenses and marketing and

advertising expenses.

- G&A expenses for the six months

ended June 30, 2020 were $1,943,000, compared to $1,590,000 in the

six months ended June 30, 2019. The increase is mainly attributed

to an increase in share-based payments expenses.

- Net loss for the six months ended

June 30, 2020 was $10,339,000, or $0.55 per share, compared to

$2,664,000, or $0.80 per share, in the six months ended June 30,

2019. The increase is mainly attributed to finance expenses of

approximately $3,023,000 that were recognized in the first half of

2020 as a result of the change in the fair value of warrants and

convertible notes, compared to finance income of approximately

$7,316,000 in the first half of 2019 as a result of the change in

the fair value of warrants and convertible notes.

Balance Sheet Highlights

- Cash and cash equivalents, together

with short-term bank deposits totaled $49,525,000 as of June 30,

2020, compared to $3,925,000 as of December 31, 2019. The increase

compared to December 31, 2019, mainly reflects proceeds received

from the sale of American Depositary Shares representing the

Company’s ordinary shares in the first half of 2020, less cash used

in operations during the six months ended June 30, 2020.

- Shareholders’ equity totaled

$57,604,000 as of June 30, 2020, compared to $11,602,000 as of

December 31, 2019.

Conference call information

The Company will host a conference call to

discuss these financial results today, August 13, 2019,

at 9:00 a.m. EDT (4:00 p.m. IDT). Investors interested in

participating are invited to register for the conference call here:

http://dpregister.com/10146541. Dial-in numbers, including a local

Israeli number and instructions, will be provided upon

registration. U.S. Dial-in Number: 1-844-695-5517, International

Dial-in Number: 1-412-902-6751, Israel Toll Free Dial-in Number:

1-80-9212373. Please request the “Nano Dimension NNDM call” when

prompted by the conference call operator. The conference call will

also be webcast live from the Investor Relations section of Nano

Dimension’s website at

http://investors.nano-di.com/events-and-presentations.

For those unable to participate in the

conference call, there will be a replay available from a link on

Nano Dimension’s website at

http://investors.nano-di.com/events-and-presentations.

About Nano DimensionNano Dimension (Nasdaq:

NNDM) is a provider of intelligent machines for the

fabrication of Additively Manufactured Electronics (AME). High

fidelity active electronic and electromechanical subassemblies are

integral enablers of autonomous intelligent drones, cars,

satellites, smartphones, and in vivo medical devices. They

necessitate iterative development, IP safety, fast time-to-market

and device performance gains, thereby mandating AME for in-house,

rapid prototyping and production. Nano Dimension machines

serve cross-industry needs by depositing proprietary consumable

conductive and dielectric materials simultaneously, while

concurrently integrating in-situ capacitors, antennas, coils,

transformers and electromechanical components, to function at

unprecedented performance. Nano Dimension bridges the gap between

PCB and semiconductor integrated circuits. A revolution at the

click of a button: From CAD to a functional high-performance AME

device in hours, solely at the cost of the consumable

materials. For more information, please visit

www.nano-di.com.

Forward-Looking StatementsThis press release

contains forward-looking statements within the meaning of the “safe

harbor” provisions of the Private Securities Litigation Reform Act

of 1995 and other Federal securities laws. Words such as “expects,”

“anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates”

and similar expressions or variations of such words are intended to

identify forward-looking statements. Because such statements deal

with future events and are based on Nano Dimension’s current

expectations, they are subject to various risks and uncertainties,

and actual results, performance or achievements of Nano Dimension

could differ materially from those described in or implied by the

statements in this press release. For example, Nano Dimension is

using forward-looking statements when it discusses the potential of

its products and directing resources to product and technology

development, its expectation to be better positioned as the

electronics landscape is revitalized in a post-Covid-19 resurgence,

and the Company’s intention to allocate more funds to R&D, in

order to be ready with new technology as Covid-19 subsides. The

forward-looking statements contained or implied in this press

release are subject to other risks and uncertainties, including

those discussed under the heading “Risk Factors” in Nano

Dimension’s Annual Report on Form 20-F filed with the Securities

and Exchange Commission (“SEC”) on March 10, 2020, and in any

subsequent filings with the SEC. The following factors, among

others, could cause actual results to differ materially from those

described in the forward-looking statements: Nano Dimension’s

ability to increase sales and revenue, its burn rate, and its

ability to continue as a going concern. Except as otherwise

required by law, Nano Dimension undertakes no obligation to

publicly release any revisions to these forward-looking statements

to reflect events or circumstances after the date hereof or to

reflect the occurrence of unanticipated events. References and

links to websites have been provided as a convenience, and the

information contained on such websites is not incorporated by

reference into this press release. Nano Dimension is not

responsible for the contents of third party websites.

NANO DIMENSION INVESTOR RELATIONS CONTACTYael

Sandler, CFO | ir@nano-di.com

|

|

|

Consolidated Statements of Financial Position as

at |

|

|

| |

June 30, |

|

|

December 31, |

|

|

|

2019 |

|

2020 |

|

|

2019 |

|

| (In thousands of

USD) |

(Unaudited) |

|

(Unaudited) |

|

|

|

|

| |

|

|

|

|

|

|

|

| Assets |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

5,290 |

|

|

39,665 |

|

|

3,894 |

|

|

Bank deposits |

31 |

|

|

9,860 |

|

|

31 |

|

|

Trade receivables |

1,174 |

|

|

541 |

|

|

1,816 |

|

|

Other receivables |

573 |

|

|

503 |

|

|

570 |

|

|

Inventory |

3,967 |

|

|

3,956 |

|

|

3,543 |

|

| Total current

assets |

11,035 |

|

|

54,525 |

|

|

9,854 |

|

| |

|

|

|

|

|

|

|

|

|

Restricted deposits |

351 |

|

|

376 |

|

|

377 |

|

|

Property plant and equipment, net |

5,350 |

|

|

4,391 |

|

|

4,743 |

|

|

Right of use asset |

1,640 |

|

|

2,258 |

|

|

2,673 |

|

|

Intangible assets |

5,597 |

|

|

4,826 |

|

|

5,211 |

|

| Total non-current

assets |

12,938 |

|

|

11,851 |

|

|

13,004 |

|

| Total

assets |

23,973 |

|

|

66,376 |

|

|

22,858 |

|

| |

|

|

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

|

|

|

Trade payables |

819 |

|

|

669 |

|

|

850 |

|

|

Other payables |

3,153 |

|

|

3,678 |

|

|

3,575 |

|

| Total current

liabilities |

3,972 |

|

|

4,347 |

|

|

4,425 |

|

| |

|

|

|

|

|

|

|

|

|

Liability in respect of government grants |

867 |

|

|

892 |

|

|

1,044 |

|

|

Lease liability |

1,273 |

|

|

1,699 |

|

|

2,089 |

|

|

Liability in respect of warrants and rights of purchase |

2,804 |

|

|

1,834 |

|

|

3,698 |

|

| Total non-current

liabilities |

4,944 |

|

|

4,425 |

|

|

6,831 |

|

| Total

liabilities |

8,916 |

|

|

8,772 |

|

|

11,256 |

|

| |

|

|

|

|

|

|

|

|

| Equity |

|

|

|

|

|

|

|

|

|

Share capital |

5,559 |

|

|

66,236 |

|

|

6,441 |

|

|

Share premium and capital reserves |

63,850 |

|

|

61,748 |

|

|

65,202 |

|

|

Treasury shares |

(1,509 |

) |

|

(1,509 |

) |

|

(1,509 |

) |

|

Presentation currency translation reserve |

1,431 |

|

|

1,431 |

|

|

1,431 |

|

|

Accumulated loss |

(54,274 |

) |

|

(70,302 |

) |

|

(59,963 |

) |

| Total

equity |

15,057 |

|

|

57,604 |

|

|

11,602 |

|

| Total liabilities and

equity |

23,973 |

|

|

66,376 |

|

|

22,858 |

|

| |

|

|

|

|

|

|

|

|

|

Consolidated Statements of Profit or Loss and Other

Comprehensive Income |

|

(In thousands of USD, except per share amounts) |

|

|

|

|

For the Six-Month Period Ended June 30, |

|

For the Three-Month Period Ended June 30, |

|

|

|

For the Year ended December 31, |

|

|

2019 |

|

2020 |

|

2019 |

|

|

|

2020 |

|

|

|

2019 |

|

|

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

|

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues |

2,850 |

|

|

990 |

|

|

1,161 |

|

|

288 |

|

|

|

7,070 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenues |

1,959 |

|

|

589 |

|

|

841 |

|

|

174 |

|

|

|

4,312 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenues - amortization of intangible |

386 |

|

|

386 |

|

|

193 |

|

|

193 |

|

|

|

772 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total cost of revenues |

2,345 |

|

|

975 |

|

|

1,034 |

|

|

367 |

|

|

|

5,084 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit (loss) |

505 |

|

|

15 |

|

|

127 |

|

|

(79 |

) |

|

|

1,986 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development expenses, net |

4,474 |

|

|

3,597 |

|

|

2,322 |

|

|

1,895 |

|

|

|

8,082 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales and marketing expenses |

2,871 |

|

|

1,749 |

|

|

1,507 |

|

|

930 |

|

|

|

5,469 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative expenses |

1,590 |

|

|

1,943 |

|

|

1,023 |

|

|

908 |

|

|

|

3,270 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating loss |

(8,430 |

) |

|

(7,274 |

) |

|

(4,725 |

) |

|

(3,812 |

) |

|

|

(14,835 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Finance income |

7,317 |

|

|

130 |

|

|

3,796 |

|

|

-- |

|

|

|

8,765 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Finance expense |

1,551 |

|

|

3,195 |

(*) |

|

259 |

|

|

4,453 |

(*) |

|

|

2,283 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total comprehensive loss |

(2,664 |

) |

|

(10,339 |

) |

|

(1,188 |

) |

|

(8,265 |

) |

|

|

(8,353 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic loss per share (after 1:50 reverse split effective June 29,

2020) |

(0.82 |

) |

|

(0.55 |

) |

|

(0.33 |

) |

|

(0.27 |

) |

|

|

(2.38 |

) |

(*) The Finance expenses are mainly attributed to finance

expenses due to changes in the fair value of warrants of

approximately $3,023,000 in the six months ended June 30, 2020, and

approximately $4,322,000 in the second quarter of 2020.

|

|

|

Consolidated Statements of Changes in Equity

(Unaudited) |

|

(In thousands of USD) |

|

|

|

|

Share capital |

|

|

Share premium and capital reserves |

|

Treasury shares |

|

Presentation currency translation reserve |

|

|

Accumulated loss |

|

Total equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the six months ended June 30, 2020: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance as of January 1, 2020 |

6,441 |

|

|

65,202 |

|

|

(1,509 |

) |

|

1,431 |

|

|

(59,963 |

) |

|

11,602 |

|

|

Issuance of ordinary shares, net |

55,512 |

|

|

(9,743 |

) |

|

-- |

|

|

-- |

|

|

-- |

|

|

45,769 |

|

|

Conversion of convertible notes |

2,013 |

|

|

(78 |

) |

|

-- |

|

|

-- |

|

|

-- |

|

|

1,935 |

|

|

Exercise of warrants and options |

2,270 |

|

|

2,883 |

|

|

-- |

|

|

-- |

|

|

-- |

|

|

5,153 |

|

|

Share-based payments |

-- |

|

|

3,484 |

|

|

-- |

|

|

-- |

|

|

-- |

|

|

3,484 |

|

|

Net loss |

-- |

|

|

-- |

|

|

-- |

|

|

-- |

|

|

(10,339 |

) |

|

(10,339 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance as of June 30, 2020 |

66,236 |

|

|

61,748 |

|

|

(1,509 |

) |

|

1,431 |

|

|

(70,302 |

) |

|

57,604 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the three months ended June 30,

2020: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance as of April 1, 2020 |

12,219 |

|

|

65,216 |

|

|

(1,509 |

) |

|

1,431 |

|

|

(62,037 |

) |

|

15,320 |

|

|

Issuance of ordinary shares, net |

51,747 |

|

|

(9,325 |

) |

|

-- |

|

|

-- |

|

|

-- |

|

|

42,422 |

|

|

Exercise of warrants and options |

2,270 |

|

|

2,883 |

|

|

-- |

|

|

-- |

|

|

-- |

|

|

5,153 |

|

|

Share-based payments |

-- |

|

|

2,974 |

|

|

-- |

|

|

-- |

|

|

-- |

|

|

2,974 |

|

|

Net loss |

-- |

|

|

-- |

|

|

-- |

|

|

-- |

|

|

(8,265 |

) |

|

(8,265 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance as of June 30, 2020 |

66,236 |

|

|

61,748 |

|

|

(1,509 |

) |

|

1,431 |

|

|

(70,302 |

) |

|

57,604 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

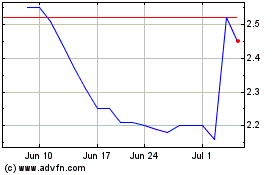

Nano Dimension (NASDAQ:NNDM)

Historical Stock Chart

From Mar 2024 to Apr 2024

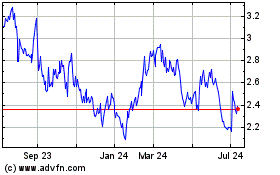

Nano Dimension (NASDAQ:NNDM)

Historical Stock Chart

From Apr 2023 to Apr 2024