Current Report Filing (8-k)

August 03 2022 - 9:35AM

Edgar (US Regulatory)

0001500198

false

0001500198

2022-08-02

2022-08-02

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 2, 2022

NeuroOne

Medical Technologies Corporation

(Exact name of Registrant as Specified in Its

Charter)

| Delaware |

|

001-40439 |

|

27-0863354 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

7599 Anagram Dr., Eden Prairie, Minnesota 55344

(Address of principal executive offices, including

Zip Code)

Registrant’s Telephone Number, Including

Area Code: 952-426-1383

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.001 per share |

|

NMTC |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

Third Amendment to Exclusive Development

and Distribution Agreement with Zimmer, Inc.

On August 2, 2022, NeuroOne Medical

Technologies Corporation (the “Company”) entered into a Third Amendment to Exclusive Development and

Distribution Agreement (the “Third Amendment”) with Zimmer, Inc., a Delaware corporation

(“Zimmer”). Pursuant to the terms and conditions of the Third Amendment, Zimmer agreed to make a $3,500,000

payment (the “Payment”) to the Company within 10 business days of the execution of the Third Amendment.

The Payment to be made by Zimmer to the Company is non-refundable.

In addition, the Third Amendment extended the

term of the license granted to Zimmer under the Strip/Grid Distribution License (as defined in the Exclusive Development and Distribution

Agreement dated July 20, 2020 (the “Distribution Agreement”), and the SEEG Distribution License through the term

of the Distribution Agreement.

The foregoing description of the Third Amendment

is not complete and is qualified in its entirety by reference to the Third Amendment, which is attached hereto as Exhibit 10.1 and incorporated

herein by reference.

Private Placement

On August 2, 2022, in connection with the Third

Amendment, the Company issued Zimmer a Warrant to Purchase Common Stock (the “Warrant”).

The Warrant will be exercisable for up to an aggregate

of 350,000 shares of the Company’s common stock, par value $0.001 (the “Common Stock”). The Warrant will

have an exercise price of $3.00 per share, will be exercisable commencing six months from the issuance date (the “Initial

Exercise Date”), and will expire on August 2, 2027 (the “Initial Exercise Date”). Subject to limited

exceptions, Zimmer will not have the right to exercise any portion of the Warrant if Zimmer, together with its affiliates, would beneficially

own in excess of 4.99% of the number of shares of the Common Stock outstanding immediately after giving effect to such exercise (the “Beneficial

Ownership Limitation”); provided, however, that upon prior notice to the Company, the holder may increase or decrease the

Beneficial Ownership Limitation, provided further that in no event shall the Beneficial Ownership Limitation exceed 19.99% and any increase

in the beneficial ownership limitation will not be effective until 61 days following notice to the Company. After the Initial Exercise

Date and prior to expiration, subject to the terms and conditions set forth in the Warrant, Zimmer may exercise the Warrant for the shares

of the Common Stock issuable pursuant to the Warrant by providing notice to the Company and paying the exercise price per share for each

share so exercised or by utilizing the “cashless exercise” feature contained in the Warrant.

The foregoing description of the Warrant is not

complete and is qualified in its entirety by reference to the Warrant, which is attached hereto as Exhibit 4.1 and incorporated herein

by reference.

Item 3.02. Unregistered Sales of Equity Securities.

As described more fully in Item 1.01 above, which

description is hereby incorporated by reference into this Item 3.02, the Company issued the Warrant to Zimmer, who is an accredited investor,

in reliance on the exemption from registration provided by Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities

Act”). The Company will rely on this exemption from registration based in part on representations made by Zimmer. Neither

the Warrant nor the shares of the Common Stock issuable upon the exercise of the Warrant been registered under the Securities Act or applicable

state securities laws and may not be offered or sold in the United States absent registration under the Securities Act or an exemption

from such registration requirements. Neither this Current Report on Form 8-K nor any exhibit attached hereto shall constitute an offer

to sell or the solicitation of an offer to buy the Warrant, shares of the Common Stock or any other securities of the Company.

Item 8.01 Other Events.

On August 3, 2022, NeuroOne Medical Technologies

Corporation issued a press release announcing entry into the Third Amendment. A copy of this press release is filed herewith as Exhibit

99.1 to this Current Report and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange

Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

NeuroOne Medical Technologies Corporation |

|

Date:

August 3, 2022 |

By: |

/s/ David Rosa |

| |

|

David Rosa |

| |

|

President and Chief Executive Officer |

3

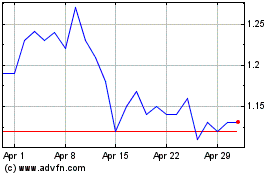

NeuroOne Medical Technol... (NASDAQ:NMTC)

Historical Stock Chart

From Mar 2024 to Apr 2024

NeuroOne Medical Technol... (NASDAQ:NMTC)

Historical Stock Chart

From Apr 2023 to Apr 2024