As Filed Pursuant to Rule 424(b)(5)

Registration No. 333-230535

The information in this

preliminary prospectus supplement is not complete and may be changed. A registration statement relating to these securities has

been filed with the Securities and Exchange Commission and is effective. This preliminary prospectus supplement and the accompanying

prospectus are not an offer to sell these securities and they are not soliciting an offer to buy these securities in any jurisdiction

where the offer or sale is not permitted.

SUBJECT TO COMPLETION,

DATED JULY 27, 2020

PROSPECTUS SUPPLEMENT

(To Prospectus Dated April 8, 2019)

NEMAURA MEDICAL INC.

Shares

of Common Stock

Warrants to Purchase up to Shares

of Common Stock

We are offering shares

of our common stock, par value $0.001 per share, and warrants to purchase up to shares

of our common stock (each a “Warrant”). Each share of our common stock is being sold together with of

a Warrant, each whole Warrant to purchase one share of our common stock. The Warrants will have an exercise price of $ per share,

will be immediately exercisable and will expire on the five-year anniversary of the original issuance date. The shares of our

common stock and Warrants are immediately separable and will be issued separately, but will be purchased together in this offering.

The shares of our common stock issuable from time to time upon exercise of the Warrants are also being offered pursuant to this

prospectus supplement and the accompanying prospectus.

Our common stock is listed on the Nasdaq

Capital Market under the symbol "NMRD." On July 24, 2020, the last reported sale price of our common stock on the Nasdaq

Capital Market was $9.47 per share. There is no established public trading market for the Warrants, and we do not expect a market

to develop. We do not intend to apply for listing of the Warrants on any securities exchange or other nationally recognized trading

system. Without an active trading market, the liquidity of the Warrants will be limited.

Investing

in our securities involves risks. See "Risk Factors" beginning on page S-9 of this prospectus supplement and the

risk factors incorporated by reference into this prospectus supplement and the accompanying prospectus.

|

|

|

Per Share and

Warrant

|

|

Total

|

|

|

Public offering price

|

|

$

|

|

|

$

|

|

|

|

Underwriting discount (1)

|

|

$

|

|

|

$

|

|

|

|

Proceeds to us (before expenses)

|

|

$

|

|

|

$

|

|

|

|

|

(1)

|

See section entitled “Underwriting” beginning on page S-23 for additional information regarding the compensation payable to the underwriters.

|

Neither the Securities and Exchange

Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy

of this prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

The securities offered

hereby are expected to be ready for delivery on or about ,

2020 against payment in immediately available funds.

Sole Book-Running Manager

Kingswood Capital Markets

a division of Benchmark Investments, Inc.

The date

of this prospectus supplement is ,

2020

TABLE OF CONTENTS

PROSPECTUS SUPPLEMENT

|

|

|

|

Page

|

|

|

ABOUT THIS PROSPECTUS SUPPLEMENT

|

|

|

S-1

|

|

|

PROSPECTUS SUPPLEMENT SUMMARY

|

|

|

S-2

|

|

|

THE OFFERING

|

|

|

S-8

|

|

|

RISK FACTORS

|

|

|

S-9

|

|

|

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

|

|

|

S-13

|

|

|

USE OF PROCEEDS

|

|

|

S-14

|

|

|

DILUTION

|

|

|

S-14

|

|

|

DESCRIPTION OF SECURITIES BEING OFFERED

|

|

|

S-15

|

|

|

CAPITALIZATION

|

|

|

S-17

|

|

|

MATERIAL U.S. FEDERAL TAX CONSIDERATIONS FOR NON-U.S. HOLDERS OF OUR COMMON STOCK

|

|

|

S-18

|

|

|

UNDERWRITING

|

|

|

S-24

|

|

|

INCORPORATION BY REFERENCE OF CERTAIN DOCUMENTS

|

|

|

S-29

|

|

|

WHERE YOU CAN FIND MORE INFORMATION

|

|

|

S-30

|

|

|

LEGAL MATTERS

|

|

|

S-30

|

|

|

EXPERTS

|

|

|

S-30

|

|

PROSPECTUS

|

ABOUT THIS PROSPECTUS

|

|

|

2

|

|

|

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

|

|

|

2

|

|

|

PROSPECTUS SUMMARY

|

|

|

3

|

|

|

THE OFFERING

|

|

|

3

|

|

|

OUR COMPANY

|

|

|

4

|

|

|

RISK FACTORS

|

|

|

6

|

|

|

USE OF PROCEEDS

|

|

|

6

|

|

|

RATIO OF EARNINGS TO FIXED CHARGES

|

|

|

7

|

|

|

DESCRIPTIONS OF THE SECURITIES WE MAY OFFER

|

|

|

7

|

|

|

PLAN OF DISTRIBUTION

|

|

|

19

|

|

|

LEGAL MATTERS

|

|

|

21

|

|

|

EXPERTS

|

|

|

21

|

|

|

LIMITATION ON LIABILITY AND DISCLOSURE OF COMMISSION POSITION ON INDEMNIFICATION FOR SECURITIES ACT LIABILITIES

|

|

|

21

|

|

|

WHERE YOU CAN FIND MORE INFORMATION

|

|

|

21

|

|

|

INCORPORATION BY REFERENCE OF CERTAIN DOCUMENTS

|

|

|

22

|

|

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement

and the accompanying base prospectus form part of a registration statement on Form S-3 that we filed with the Securities and Exchange

Commission, which we refer to as the SEC, using a "shelf" registration process. This document contains two parts. The

first part consists of this prospectus supplement, which provides you with specific information about this offering. The second

part, the accompanying base prospectus, provides more general information, some of which may not apply to this offering. Generally,

when we refer only to the "prospectus," we are referring to both parts combined. This prospectus supplement may add,

update or change information contained in the accompanying base prospectus. To the extent that any statement we make in this prospectus

supplement is inconsistent with statements made in the accompanying base prospectus or any documents incorporated by reference

herein or therein, the statements made in this prospectus supplement will be deemed to modify or supersede those made in the accompanying

base prospectus and such documents incorporated by reference herein and therein.

In this prospectus

supplement, "Nemaura," the "Company," "we," "us," "our" and similar terms refer

to Nemaura Medical Inc., a Nevada corporation and its consolidated subsidiaries. References to our "common stock" refer

to the common stock, par value $0.001 per share, of Nemaura Medical Inc.

All references in this

prospectus supplement to our consolidated financial statements include, unless the context indicates otherwise, the related notes.

The industry and market

data and other statistical information contained in the documents we incorporate by reference in the prospectus are based on management's

own estimates, independent publications, government publications, reports by market research firms or other published independent

sources, and, in each case, are believed by management to be reasonable estimates. Although we believe these sources are reliable,

we have not independently verified the information.

You should rely only

on the information contained in or incorporated by reference in this prospectus supplement, the accompanying base prospectus and

in any free writing prospectus that we have authorized for use in connection with this offering. We have not, and the underwriters

have not, authorized anyone to provide you with different information. If anyone provides you with different or inconsistent information,

you should not rely on it. You should assume that the information in this prospectus supplement, the accompanying base prospectus,

the documents incorporated by reference in the accompanying base prospectus, and in any free writing prospectus that we have authorized

for use in connection with this offering, is accurate only as of the date of those respective documents. Our business, financial

condition, results of operations and prospects may have changed since those dates. You should read this prospectus supplement,

the accompanying base prospectus, the documents incorporated by reference in the accompanying base prospectus, and any free writing

prospectus that we have authorized for use in connection with this offering, in their entirety before making an investment decision.

You should also read and consider the information in the documents to which we have referred you in the sections of the accompanying

base prospectus entitled "Where You Can Find More Information" and "Incorporation by Reference of Certain Documents."

We are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where the offer or sale

is not permitted.

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights

selected information contained elsewhere in this prospectus supplement, the accompanying prospectus and in the documents we incorporate

by reference. This summary does not contain all of the information you should consider before investing in our common stock. You

should read this entire prospectus supplement and the accompanying prospectus carefully, especially the risks of investing in our

common stock discussed under “Risk Factors” beginning on page S-8 of this prospectus supplement, page 5 of the accompanying

prospectus and page __ of our Annual Report on Form 10-K for the year ended March 31, 2020, which is incorporated by reference

in this prospectus supplement, along with our consolidated financial statements and notes to those consolidated financial statements

and the other information incorporated by reference in this prospectus supplement and the accompanying prospectus, before making

an investment decision.

About Nemaura

Overview

We are a medical technology company

developing sugarBEAT®, a non-invasive, affordable and flexible continuous glucose monitoring system for adjunctive use by persons

with diabetes. SugarBEAT consists of a disposable adhesive skin-patch connected to a rechargeable wireless transmitter that displays

glucose readings at regular five minute intervals via a mobile app. SugarBEAT works by extracting glucose from the skin into a

chamber in the patch that is in direct contact with an electrode-based sensor. The transmitter sends the raw data to a mobile app

where it is processed by an algorithm and displayed as a glucose reading, with the ability to track and trend the data over days,

weeks and months. While sugarBEAT requires once per day calibration by the patient using a blood sample obtained by a

finger stick, we believe sugarBEAT will be adopted by non-insulin dependent persons with diabetes alongside insulin-injecting

persons with diabetes who all perform multiple daily finger sticks to manage their disease.

CE approval was granted by the European

Notified Body BSI in May 2019, allowing the product to be made available for commercial sale. The company commenced a phase 1 launch

whereby devices were made available to limited cohorts of users to gauge their feedback so that any fine-tuning could be completed

prior to a mass market launch. A mass-market launch is due to commence in the UK in the coming months via its UK licensee DB Ethitronix,

whereby the sugarBEAT will be available via a number of subscription models that are yet to be determined. In July 2020, Nemaura

filed a PMA application with the FDA to use sugarBEAT as an adjunct to finger prick testing for blood glucose trending. In addition

it has been pursuing the possibility of launching the sugarBEAT under the FDA Wellness guidance which would preclude it from an

FDA assessment and allow the product to be launched in the US for Wellness use, to provide prompts and educate users on factors

affecting their blood sugar profiles. Further to discussions with the FDA Nemaura established that sugarBEAT can be classified

under the Wellness guidance when it is used according to the FDA Wellness guidance notes. Nemaura is now expediting a commercial

launch in the US under the Wellness guidance. Nemaura is now expediting its planning of a commercial launch in the US.

We believe there are additional applications

for sugarBEAT and the underlying BEAT technology platform, which may include:

|

|

–

|

a web-server accessible by physicians and diabetes professionals to track the condition remotely, thereby reducing healthcare costs and managing the condition more effectively;

|

|

|

–

|

a complete virtual doctor that monitors a person's vital signs and transmits results via the web;

|

|

|

–

|

other patches using the BEAT technology platform to measure alternative analytes, including lactate, uric acid, lithium and drugs. This would be a step-change in the monitoring of conditions, particularly in the hospital setting. Lactate monitoring is currently used to determine the relative fitness of professional athletes and we completed preliminary studies demonstrating the application of the BEAT technology for continuous lactate monitoring;

|

|

|

–

|

a continuous temperature monitoring system which could have various applications, including use for individuals to monitor their temperature in connection with diagnosis and monitoring of symptoms of novel coronavirus (COVID-19); and

|

|

|

–

|

monitoring disease progression in COVID-19 patients using continuous lactate monitoring (CLM).

|

Our Business Strategy

We intend to lead in the discovery,

development and commercialization of innovative and targeted diagnostic medical devices that improve disease monitoring, management

and overall patient care. Specifically, we intend to focus on the monitoring of molecules that can be drawn out through the skin

non-invasively using our technology platform. In addition to glucose, such molecules may include lactic acid monitoring and the

monitoring of prescription drugs and blood biomarkers that may help in the diagnosis, prevention or management of diseases, such

as diabetes. We plan to take the following steps to implement our broad business strategy. Our key commercial strategies post-approval

will first be implemented in Europe and then in parts of the Middle East and Asia, and then the U.S., as follows:

|

|

–

|

Commercialize sugarBEAT in the United Kingdom and Republic of Ireland with Dallas Burston Pharma (Jersey) Limited, with whom we have an exclusive marketing rights agreement for these two countries.

|

We have also signed a full commercial

agreement with Dallas Burston Ethitronix (Europe) Limited in May 2018 for all other European territories as part of an equal joint

venture agreement. The joint venture intends to seek sub-license rights opportunities to one or more leading companies

in the diabetes monitoring space, to leverage their network, infrastructure and resources.

Dallas Burston (Jersey) Limited

was founded by Dr. Dallas Burston, MBBS, an entrepreneur who has founded and sold several companies specializing in marketing pharmaceuticals.

For example, in 1999, he sold 49% of Ashbourne Pharmaceuticals to HSBC Private Equity for £32 million and Bartholomew-Rhodes

to Galen Ltd. for £19.8 million. More recently, in 2015, he sold DB Ashbourne Limited, a provider of off-patent branded pharmaceuticals

for the UK market, to Ethypharm. At the time of the sale, DB Ashbourne Limited was estimated to have annual revenue of approximately

£90 million.

|

|

–

|

Establish licensing or joint venture agreements with other parties to market sugarBEAT in other geographies. We are in detailed discussions and negotiations with several other parties worldwide for licensing or joint venture agreements for the sale of the sugarBEAT device and have signed commercial agreements with TP MENA for the Gulf Cooperation Council, and Al-Danah Medical for Qatar.

|

|

|

–

|

Submit FDA application for approval of sugarBEAT. The application is currently in progress and expected to be submitted by June 30, 2020.

|

|

|

–

|

Expand the indications for which the sugarBEAT device may be used. We believe that the sugarBEAT device may offer significant benefits as compared to those found in the non-acute setting for the monitoring of other diseases. This includes monitoring of lactic acid for performance athletics, and the monitoring of drugs. We have completed initial proof of concept for lactate monitoring and now plan to explore the route to commercialization for well-being applications in athletic performance training, and plan to undertake further clinical programs to support clinical use of the device for lactate monitoring.

|

|

|

–

|

Expand our product pipeline through our proprietary platform technologies, acquisitions and strategic licensing arrangements. We intend to leverage our proprietary platform technologies to grow our portfolio of product candidates for the diagnosis of diabetes and other diseases. In addition, we intend to license our product and acquire products and technologies that are consistent with our research and development and business focus and strategies. This may include drug delivery products for the improved management of diabetes, for example improved insulin injector systems, and/or combination drug products for diabetes related drugs.

|

Product Development

Management has extensive experience

in regulatory and clinical development of diagnostic medical devices. We intend to take advantage of this experience in the field

of diagnostic medical devices in an attempt to increase the probability of product approval. The overall regulatory process

for diagnostic medical devices for diabetes is currently similar to those governing other diagnostic devices. The timelines are

shorter than, for example, when new drugs or completely invasive diagnostic devices are trialed in clinics. We have successfully

tested and evaluated the device for its clinical output, in this case the accuracy and safety with which it can trend blood glucose

levels, based on which CE approval was granted by the Notified Body BSI, and we are currently in the process of preparing a submission

to the U.S. FDA. As we continue to raise funds for marketing the device in some European Union territories, we also intend to seek

collaborations with future licensees and marketing partners to achieve our product development and meet our projected milestones.

The table below provides our current estimate of our timeline:

Product Development and Commercialization

Timelines

|

|

|

|

|

Milestone

|

Target Start Date

|

Target Completion Date

|

|

Completion of clinical studies in Type 1 and Type 2 diabetic subjects to define final device claims and for submission for CE Mark approval with final device claims.

|

July 2017

|

Completed

|

|

Scale up of commercial sensor/patch manufacturing

(Scale up means we have started looking at larger scales

- sufficient for product launch in the UK. It refers to the manufacturing process for sensors.)

|

January 2017

|

Ongoing

|

|

Scale up of device (transmitter) manufacturing

|

January 2017

|

Ongoing

|

|

CE Mark for body worn transmitter device

|

August 2018

|

Completed

|

|

Commercial launch in the UK, followed by major territories in Europe

|

July - September 2020

|

Staggered launch

|

|

U.S. FDA PMA Submission

|

June 2020

|

June 2020

|

|

Commercial launch of proBEATÔ in the U.S.

|

October - December 2020

|

October - December 2020

|

Intellectual Property

Our trade secrets, trademarks, and patents filed, granted

and pending are as follows

|

IP: Patent (Core Claim), Know-how,7 Trademark Pending

|

|

Expiration Date

|

|

Jurisdictions in which Granted/ Issued

|

|

Jurisdictions in which

|

|

Ongoing Royalty or Milestone Payments

|

|

|

|

|

|

|

|

|

|

|

|

Patent: Cumulative Measurement of an Analyte (1)

|

|

May 20, 2032

|

|

Australia, France, Germany, Italy, Poland, Spain, Netherlands, UK, Brazil, China, India, Japan, U.S.

|

|

Canada, Qatar, UAE

|

|

None. Internal development

|

|

Skin prep Patch (2)

|

|

December 2, 2038

|

|

PCT Filed

|

|

To be determined at national stages

|

|

None. Internal development

|

|

Membrane Anchor sensor (3)

|

|

December 9, 2038

|

|

PCT Filed

|

|

To be determined at national stages

|

|

None. Internal development

|

|

Sensor Calibration algorithm (4)

|

|

October 27, 2039

|

|

UK Application filed, PCT due Oct 2020

|

|

To be determined at national stages

|

|

None. Internal development

|

|

Sample extraction (5)

|

|

March 9, 2040

|

|

UK Application filed, PCT due March 2021

|

|

To be determined at national stages

|

|

None. Internal development

|

|

Know-how: Sensor Formulation

|

|

N/A

|

|

Trade Secret

|

|

N/A

|

|

None. Internal development

|

|

Trademark: BEAT

|

|

Renewal due in 2026

|

|

UK, China, EU, India, Japan

|

|

Canada

|

|

None. Internal development

|

|

Trademark: sugarBEAT

|

|

Renewal due in 2025

|

|

UK, Australia, Switzerland, China, Egypt, EU, Israel, India, Iran, Japan, North Korea, Morocco, Mexico, Norway, New Zealand, Russia, Singapore, Tunisia, Turkey, U.S.

|

|

Canada

|

|

None. Internal development

|

(1) This patent provides a formula

for calculating the amount of glucose extracted over a defined period of time by deducting the difference between two readings

to allow rapid sensing without needing to deplete the analyte being measured.

(2) This patent describes a device

and method for preparing the skin for extraction of glucose.

(3) This patent provides a device

and method for interfacing a solid substrate to the sensor electrode to reduce background noise signals.

(4) This patent describes an algorithm

for calibrating the raw data to provide glucose readings.

(5) This patent describes a device

and method for extracting glucose from the skin.

RECENT DEVELOPMENT

Continuous glucose monitoring

(CGM) device

In February 2020,

Nemaura announced that following discussions with the FDA, Nemaura had established that it may sell its CGM product with a digital

service offering in the U.S. without FDA approval as a non-medical wellbeing application. Nemaura further announced that it intends

to commence sales of this product under the brand proBEAT in the U.S. in Q4 2020. The product offering will enable users to wear

the CGM device from which data will be sent to Nemaura’s servers in the cloud, from where the big data will be processed

to provide users with educational material and insights into factors that can affect their sugar levels and tips for healthy lifestyle

and diet, with a view to helping pre-diabetics and diabetics alike live healthier lives.

Note Purchase

Note Purchase Agreement

On April 15, 2020, the Company entered

into a note purchase agreement (the “Note Purchase Agreement”) by and among the Company, DDL, TCL and Chicago Venture

Partners, L.P. (the “Investor”).

Pursuant to the terms of the Note

Purchase Agreement, the Company agreed to issue and sell to the Investor and the Investor agreed to purchase from the Company a

secured promissory note (the “Secured Note”) in the original principal amount of $6,015,000. In consideration thereof,

on April 15, 2020 (the closing date), (i) the Investor (a) paid $1,000,000 in cash, (b) issued to the Company (1) Investor Note

#1 in the principal amount of $2,000,000 (“Investor Note #1”), and (2) Investor Note #2 in the principal amount of

$2,000,000 (“Investor Note #2” and together with Investor Note #1, the “Investor Notes”), and (ii) the

Company delivered the Secured Note on behalf of the Company, to the Investor, against delivery of the Purchase Price. For these

purposes, the “Purchase Price” means the Investor’s initial cash purchase price, together with the sum of the

initial principal amounts of the Investor Notes.

The Secured Note is secured by the

Collateral (as hereinafter defined). The Secured Note carries an original issue discount (“OID”) of $1,000,000. In

addition, the Company agreed to pay $15,000 to the Investor to cover the Investor’s legal fees, accounting costs, due diligence,

monitoring and other transaction costs incurred in connection with the purchase and sale of the Secured Note (the “Transaction

Expense Amount”), all of which amount is included in the initial principal balance of the Secured Note. The Purchase Price

for the Secured Note is $5,000,000, computed as follows: $6,015,000 original principal balance, less the OID, less the Transaction

Expense Amount.

The borrowing period is 24 months

and the Company shall pay the outstanding balance and all fees on maturity. A monitoring fee equal to 0.833% of the outstanding

balance will automatically be added to the outstanding balance on the first day of each month. The debt less the discount will

be accreted over the term of the Note using the effective interest method.

Security Agreement

On April 15, 2020, the Company entered

into the Security Agreement by the Company, DDL and TCL, in favor of the Investor (the “Security Agreement”). Pursuant

to the terms of the Security Agreement, the Company entered into the Security Agreement and granted the Investor a first-priority

security interest in all rights, title, interest, claims and demands of the Company in and to all of the Company’s patents

and all other proprietary rights, and all rights corresponding to the Company’s patents throughout the world, now owned and

existing, and all replacements, proceeds, products and accessions thereof.

ATM Offering

On October 19, 2018, the Company

entered into an Equity Distribution Agreement (the “Agreement”) with Maxim Group LLC as sales agent (“Maxim”),

pursuant to which the Company may offer and sell, from time to time, through Maxim up to $20,000,000 in shares of its common stock,

par value $0.001 per share.

On March 4, 2020, the Company and

Maxim entered into an amendment (the “Amendment”) to the Agreement, pursuant to which the parties agreed, that notwithstanding

anything in the Agreement to the contrary, the Agreement will remain in full force and effect without a specific time-period term,

provided that either the Company or Maxim may terminate the Agreement upon ten (10) days’ prior written notice to the other

party. No other changes to the Agreement were made by the Amendment.

Subsequent to March 31, 2020, and

through July 24, 2020, the Company raised gross proceeds of $4,174,090 for the issuance of 401,230 shares of common stock through

Maxim.

Exercise of Warrants

Subsequent to March 31, 2020 and

through July 24, 2020, the Company raised gross proceeds of $394,503 from the exercise of warrants and the issuance of 37,933 shares

at $10.40 per share.

Impact of COVID-19

Since

the outbreak of COVID-19 in March 2020 resulting in national social distancing and people working from home, COVID-19 resulted

in delays in our product development, manufacturing and commercialization of our innovative and targeted diagnostic medical

devices that improve disease monitoring, management and overall patient care.

As

a medical device manufacturer, public health crises, such as the widespread outbreaks of infectious diseases like the COVID-19

pandemic, may negatively impact our operations. Health concerns and significant changes in political or economic conditions caused

by such outbreaks can cause significant reductions in demand for routine diagnostic testing and medical device procedures or increased

difficulty in serving customers, disrupt manufacturing and supply chains, and negatively affect our operations as well as the operations

of our suppliers, distributors and other third-party partners. Furthermore, such widespread outbreaks may impact the broader economies

of affected countries, including negatively impacting economic growth, the proper functioning of financial and capital markets,

foreign currency exchange rates, and interest rates. Due to uncertainties regarding the duration and impact of the current COVID-19

pandemic, we are unable to predict the extent to which the COVID-19 pandemic may have a material effect on our business, financial

condition or results of operations.

Notwithstanding,

the Company does not anticipate that COVID-19 will have any long-term detrimental effect on the Company’s success. While

key suppliers have not been accessible throughout the whole period of the outbreak, we have been able to be flexible in our priorities

and respond favorably to the challenges faced during the outbreak. We

have also seen a surge in the uptake of technologies for remote and patient self- monitoring, which therefore potentially enhances

the prospects for the likes of the Company and its CGM product and planned digital healthcare offering.

Employee equity compensation plan

The Company adopted the Nemaura Medical

Inc., Omnibus Incentive Plan (the “Plan”) effective May 15, 2020. The Plan authorized 1,000,000 shares of common stock

for issuance under the Plan for future grants.

Submission of PMA Application

for sugarBeat®

In July 2020, the Company submitted

its PMA application for sugarBEAT® to the United States Food and Drug Administration (FDA).

Recent announcements

of two potential applications of the BEAT technology platform in the management of COVID-19.

Continuous

Temperature Monitoring

Several diseases

including COVID-19 are characterized by fever (an increase in body temperature) meaning that temperature monitoring is a vital

tool in detection/ diagnosis and consequently in preventing the spread of such diseases. Measuring body temperature can also be

used to track the course of a disease so as to allow doctors to analyse the effectiveness of treatments and thus proactively adapt

to improve outcomes. Monitoring body temperature can also assist in other areas not related to diseases such as helping a woman

track her ovulation cycle and hence can be a powerful ally in helping couples understand the fertility cycle and giving them the

best chance of conception.

In order to monitor

temperature at the standard that is fit for clinical use requires electronic components and circuitry that are of a very high quality,

precision, and accuracy. The Company’s platform has all of these features by default given it measures electrical currents

from a sensor that are as small as a billionth of an ampere. The Company is adapting the device for continuous temperature monitoring

for all of the above applications. It anticipates a product launch in early to mid-2021 (in Europe initially) pending regulatory

approvals.

Continuous

Lactate Monitoring

Increased lactate

levels have been consistently associated with morbidity and mortality in a wide range of disease states for many years. The Company

recently issued a presentation summarizing several independently published articles indicating that there is an increase in lactic

acid levels in patients with COVID-19, (https://nemauramedical.com/wp-content/uploads/2020/07/BEAT-CLM-in-Covid19-July-2020-1.pdf).

The measurement of blood lactic acid levels therefore serves to potentially provide a means of tracking disease progression, including

progression and severity of COVID-19 infections. The Company’s existing CE mark approved device sugarBEAT for glucose monitoring

has already been demonstrated as being suited for lactic acid monitoring, within changes only to the sensor chemistry and the algorithm

and the information depicted on a smart device app. The Company is working towards regulatory approval of this device in 2021 for

continuous lactic acid monitoring in critical care setting including the monitoring of disease progression in COVID-19.

License from Healthimation

As indicated above

under “-Continuous glucose monitoring (CGM) device”, the Company intends to be launching by the end of 2020 a subscription

based digital wellness program incorporating its non-invasive continuous glucose monitor in the USA under the brand proBEATTM.

The Company has recently been in

discussions with and entered into a letter of intent to acquire key assets from Healthimation Inc., which possesses technology

developed at the Joslin Institute, which is affiliated to Harvard University. The key assets include and relate to a behavioural

change program that has been clinically validated over a 12 year period to demonstrate that it can lead to clinically significant

outcomes in diabetic patients through a series of programs intended to help with diet and weight loss. The key assets also include

several on-going contracts of Healthimation Inc. with third party licensees. The Company believes the acquisition of the key assets

of Healthimation Inc. to be a valuable addition to its existing assets, and will allow the Company to provide a compelling digital

subscription offering, which the Company anticipates will also lead to reimbursement from employers as well as healthcare insurers.

The acquisition is intended to be completed by the end of August 2020, and proBEATTM launched in the USA by the end of 2020.

CORPORATE INFORMATION

Our principal executive offices are

located at 57 West 57th Street New York, NY 10019. Our website is located at www.nemauramedical.com and our telephone

number is + 1 646-416-8000. Information found on, or accessible through, our website is not a part of, and is not incorporated

into, this prospectus supplement, and you should not consider it part of the prospectus supplement.

THE OFFERING

|

|

|

|

Common Stock offered by us

|

shares of our common stock.

|

|

|

|

|

Total common stock outstanding after the offering (1)

|

shares of common stock.

|

|

|

|

|

Warrants offered by us

|

Warrants to purchase up to shares

of common stock. Each share of our common stock is being sold together with

of a Warrant, each whole Warrant to purchase one share of our common stock. Each of the Warrants will have an exercise price of

$ per share, will be immediately exercisable and will expire on the fifth anniversary of the original issue date.

This prospectus supplement also related to

the offering of the shares of common stock issuable upon exercise of the Warrants. The exercise price of the Warrants and the number

of shares into which the Warrants may be exercised are subject to adjustment in certain circumstances. See “Description of

Securities Being Offered” on page S-15.

|

|

|

|

|

Use of proceeds

|

We intend to use the net proceeds from this offering for general corporate purposes, which include, but are not limited to, the commercial launch of a subscription based service for the US under the Wellness category, Lactate monitor development for launch, glucose monitoring product launch in Europe and the development of a second generation of sugarBeat. See "Use of Proceeds" on page S-14.

|

|

|

|

|

Risk factors

|

An investment in our shares of common stock is highly speculative and involves a number of risks. You should carefully consider the information contained in the "Risk Factors" section beginning on page S-9 of this prospectus supplement, and elsewhere in this prospectus supplement and the base prospectus, and the information we incorporate by reference, before making your investment decision.

|

|

|

|

|

Nasdaq Capital Market symbol

|

Our common stock is listed on the Nasdaq Capital Market under the symbol "NMRD." There is no established public trading market for the Warrants, and we do not expect a market to develop. We do not intend to apply for listing of the Warrants on any securities exchange or other nationally recognized trading system. Without an active trading market, the liquidity of the Warrants will be limited.

|

__________________________________

|

(1)

|

The number of shares of common stock

to be outstanding after this offering is based on 21,299,711 shares of common stock outstanding on July 24, 2020. The

number of shares of common stock excludes:

|

|

|

●

|

|

147,637 shares of common stock issuable upon the exercise of warrants outstanding with a weighted average exercise price of $10.40 per share;

|

|

|

●

|

|

240,000 units, each consisting of one share of common stock, par value $0.001 per share, together with one warrant to purchase one share of common stock at an exercise price equal to $10.40, per share, in a public offering;

|

|

|

●

|

|

9,710 shares of common stock issuable upon the exercise of options outstanding with a weighted average exercise price of $13.00 per share; and

|

|

|

●

|

|

______ shares of common stock issuable upon the exercise of the Warrants offered hereby.

|

RISK FACTORS

An investment

in our securities involves a high degree of risk. Before deciding whether to invest in our securities, you should consider carefully

the risks described below and discussed under the sections captioned "Risk Factors" contained in our Annual Report on

Form 10-K for the year ended March 31, 2020, which are incorporated by reference into this prospectus supplement and the accompanying

base prospectus in their entirety, together with other information in this prospectus supplement, the accompanying base prospectus,

the information and documents incorporated by reference herein and therein, and in any free writing prospectus that we have authorized

for use in connection with this offering. If any of these risks actually occurs, our business, financial condition, results of

operations or cash flow could be seriously harmed. This could cause the trading price of our common stock to decline, resulting

in a loss of all or part of your investment.

Risks Related to our Business

Our business, financial condition and

results of operations may be materially adversely affected by global health epidemics, including the recent COVID-19 outbreak.

Outbreaks of epidemic,

pandemic, or contagious diseases such as COVID-19, could have an adverse effect on our business, financial condition, and results

of operations. The spread of COVID-19 from China to other countries has resulted in the World Health Organization declaring the

outbreak of COVID-19 as a global pandemic. Any resulting financial impact cannot be reasonably estimated at this time. The extent

to which the COVID-19 impacts our results will depend on future developments, which are highly uncertain and cannot be predicted,

including new information which may emerge concerning the severity of the coronavirus and the actions taken globally to contain

the coronavirus or treat its impact, among others. Existing insurance coverage may not provide protection for all costs that may

arise from all such possible events. We are still assessing our business operations and the impact COVID-19 may have on our results

and financial condition, but there can be no assurance that this analysis will enable us to avoid part or all of any impact from

the spread of COVID-19 or its consequences, including downturns in business sentiment generally or in our sector in particular.

The

impact of COVID-19 is not expected to have any long-term detrimental effect on the Company’s success. While key suppliers

have not been accessible throughout the whole period of the outbreak, we have been able to be flexible in our priorities and respond

favorably to the challenges faced during the outbreak. We

have also seen a surge in the uptake of technologies for remote and patient self- monitoring, which therefore potentially enhances

the prospects for the likes of Nemaura Medical and its CGM product and planned digital healthcare offering.

There can be no

assurances that we will be able to successfully launch our continuous temperature monitoring system to assist with diagnosis and

monitor disease progression in COVID-19 patients using continuous lactate monitoring (CLM).

Although

we believe we will be able to do so, there can be no assurances that we will be able to launch our continuous temperature monitoring

system to assist with diagnosis or monitor disease progression in COVID-19 patients using continuous lactate monitoring (CLM).

If we are unable to successfully launch our continuous temperature monitoring system to assist with diagnosis or monitor disease

progression in COVID-19 patients, we will not be able to move forward our planned short term business transition of launching our

continuous temperature monitoring system to assist with diagnosis and using our applications for monitoring disease progression

in COVID-19 patients using CLM. Additionally, time spent attempting to launch our continuous temperature monitoring system to assist

with diagnosis and monitor disease progression in COVID-19 would affect our ability to perform testing and upgrades for our other

products and could have an adverse impact on business operations.

Even if the Company

is able to successfully launch our continuous temperature monitoring system to assist with diagnosis or monitor disease progression

in COVID-19 patients using continuous lactate monitoring (CLM), there can be no assurances that we will generate revenue.

The

Company has not had any material conversations or entered into any agreements with a third party regarding launching our continuous

temperature monitoring system to assist with diagnosis or the performance of COVID-19 monitoring and there is no guarantee that

we will ever enter into any such agreements. As a result, despite our potential ability to launch our continuous temperature monitoring

system to assist with diagnosis or monitor disease progression in COVID-19, there can be no assurances that we will be able to

commercialize such ability to generate any revenue.

The public may

not ultimately adopt our continuous temperature monitoring system to assist with the diagnosis and monitoring of symptoms of COVID-19

or adopt our continuous lactate monitoring system (CLM) to monitor disease progression in COVID -19 patients.

There

are currently no vaccines or drugs approved to treat or prevent COVID-19. Although there are investigational COVID-19 vaccines

and treatments under development, these investigational products are in the early stages of product development and have not yet

been fully tested for safety or effectiveness.

The

U.S. Food and Drug Administration (FDA) and the Federal Trade Commission (FTC) issued warning letters to a number of companies

for selling fraudulent COVID-19 products. These products are unapproved drugs that pose significant risks to patient health and

violate federal law. The FDA and FTC are taking this action as part of their response in protecting consumers during the global

COVID-19 outbreak from companies preying on such consumers by promoting products with fraudulent prevention and treatment claims.

The FDA is particularly concerned that products that claim to cure, treat or prevent serious diseases like COVID-19 may cause consumers

to delay or stop appropriate medical treatment, leading to serious and life-threatening harm.

In light of potential

distrust of the public and regulatory enforcement agencies regarding the effectiveness of products that claim to cure, treat or

prevent COVID-19, the public may not ultimately adopt our continuous temperature monitoring system to assist with the diagnosis

and monitoring of symptoms of COVID-19 or adopt our continuous lactate monitoring system (CLM) to monitor disease progression in

COVID -19 patients, which could significantly impact our business and prospects.

Risks Related to this Offering

Our management will have broad

discretion over the use of the net proceeds from this offering, you may not agree with how we use the proceeds and the proceeds

may not be invested successfully.

Our management will

have broad discretion over the use of proceeds from this offering, and we could spend the proceeds from this offering in ways with

which you may not agree or that do not yield a favorable return. We intend to use the net proceeds from this offering for general

corporate purposes, which include, but are not limited to, the commercial launch of a subscription based service for the US under

the Wellness category, Lactate monitor development for launch, glucose monitoring product launch in Europe and the development

of a second generation of sugarBeat. As of the date of this prospectus supplement, we cannot specify with certainty all of the

particular uses of the proceeds from this offering. Accordingly, our management will have broad discretion as to the use of the

net proceeds from this offering and could use them for purposes other than those contemplated at the time of commencement of this

offering. Accordingly, you will be relying on the judgment of our management with regard to the use of these net proceeds, and

you will not have the opportunity, as part of your investment decision, to assess whether the proceeds are being used appropriately.

It is possible that, pending their use, we may invest the net proceeds in a way that does not yield a favorable, or any, return

for our company.

If you purchase shares of common

stock in this offering, you will suffer immediate and substantial dilution in the book value of your investment.

The price per share

of our common stock in this offering may exceed the net tangible book value per share of our common stock outstanding prior to

this offering. Therefore, if you purchase shares of our common stock in this offering, you may pay a price per share that substantially

exceeds our net tangible book value per share after this offering. See "Dilution" for a more detailed discussion of the

dilution you may incur in connection with this offering.

There may be future sales or other

dilution of our equity, which may adversely affect the market price of our common stock.

We are not

generally restricted from issuing additional common stock, or any securities that are convertible into or exchangeable for,

or that represent the right to receive, common stock. The issuance of any additional common stock or preferred stock or

securities convertible into, exchangeable for, or that represent the right to receive, common stock, or the exercise of such

securities, could be substantially dilutive to holders of our common stock. After this offering, we will

have shares

of common stock outstanding based on 21,299,711 shares of common stock outstanding on July 24, 2020. The market price of our

common stock could decline as a result of this offering, sales of our common stock made after this offering or the perception

that such sales could occur. Because our decision to issue securities in any future offering will depend on market conditions

and other factors beyond our control, we cannot predict or estimate the amount, timing or nature of future offerings. Thus,

our stockholders bear the risk of future offerings reducing the market price of our common stock and diluting their

shareholdings in us.

A large number of shares may be

sold in the market following this offering, which may depress the market price of our common stock.

Sales of a substantial

number of shares of our common stock in the public market following this offering could cause the market price of our common stock

to decline. If there are more shares of common stock offered for sale than buyers are willing to purchase, then the market price

of our common stock may decline to a market price at which buyers are willing to purchase the offered shares of common stock and

sellers remain willing to sell the shares. All of the shares sold in this offering will be freely tradable without restriction

or further registration under the Securities Act.

Because we do not intend to declare

cash dividends on our shares of common stock in the foreseeable future, stockholders must rely on appreciation of the value of

our common stock for any return on their investment.

We have never declared

or paid cash dividends on our common stock. We currently anticipate that we will retain future earnings for the development, operation

and expansion of our business and do not anticipate declaring or paying any cash dividends in the foreseeable future. In addition,

the terms of any future debt agreements may preclude us from paying dividends. As a result, we expect that only appreciation of

the price of our common stock, if any, will provide a return to investors in this offering for the foreseeable future.

Our common stock may be delisted

from The Nasdaq Capital Market if we cannot maintain compliance with Nasdaq’s continued listing requirements.

Our common stock

is listed on the Nasdaq Capital Market. There are a number of continued listing requirements that we must satisfy in order

to maintain our listing on the Nasdaq Capital Market.

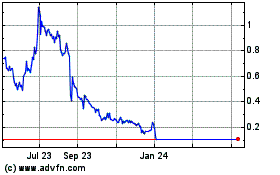

On July 15, 2019, we received

a deficiency letter from the Listing Qualifications Department of The Nasdaq Stock Market stating that, for the preceding 30 consecutive

business days, the closing bid price for our common stock was below the minimum $1.00 per share requirement (“Minimum Bid

Price Rule”) for continued inclusion on The Nasdaq Capital Market pursuant to Nasdaq Listing Rule 5550(a)(2). In accordance

with Nasdaq Rule 5810(c)(3)(A), we were provided a period of 180 calendar days, or until January 11, 2020, to regain compliance

with the Minimum Bid Price Rule. On November 27, 2019, our Board of Directors approved (i) a reverse stock split of the issued

and outstanding shares of our common stock, at a ratio of 1-for-10 shares (“Reverse Stock Split), and (ii) a decrease of

our authorized number of shares of common stock on the same basis from 420,000,000 shares of common stock to 42,000,000 shares

of common stock (“Decrease in Authorized Common Stock”). On November 27, 2019, we filed a Certificate of Change with

the Secretary of State of Nevada to effect the Reverse Stock Split and Decrease in Authorized Common Stock. The Reverse Stock Split

became effective on the Nasdaq Capital Market at the open of market on December 5, 2019. On December 19, 2019, we received a letter

from the Nasdaq Stock Market stating that because our common stock maintained a closing bid price at or above $1.00 per share

for a minimum of ten (10) consecutive business days, we regained compliance with the Minimum Bid Price Rule for continued listing

on the Nasdaq Capital Market, as set forth in Nasdaq Listing Rule 5550(a)(2), and that the matter is now closed.

On April 2, 2020, the Company

received a written notice (the “Notice”) from staff of Listing Qualifications of The Nasdaq Stock Market LLC (“Nasdaq”)

indicating that the Company has not complied with the requirements of Nasdaq Listing Rule 5620(a) of Nasdaq’s listing rules

due to its failure to hold an annual meeting of stockholders within 12 months of the end of the Company’s fiscal year ended

December 31, 2018. The Company had 45 calendar days to submit a plan to regain compliance and, if Nasdaq accepted the plan, Nasdaq

could grant an exception of up to 180 calendar days from the fiscal year end, or until September 28, 2020, to regain compliance.

As discussed with Nasdaq, the Company filed and mailed its proxy materials relating to its annual meeting on April 10, 2020 and

held such annual meeting on May 15, 2020. As a result, the Company regained compliance with Nasdaq Listing Rule 5620(a), and that

matter is now closed.

We cannot assure you our

securities will meet the continued listing requirements to be listed on Nasdaq in the future. If Nasdaq delists our common stock

from trading on its exchange, we could face significant material adverse consequences including:

|

|

·

|

a limited availability of market quotations for our securities;

|

|

|

·

|

a determination that our common stock is a “penny stock” which will require brokers trading in our common stock to adhere to more stringent rules and possibly resulting in a reduced level of trading activity in the secondary trading market for our common stock;

|

|

|

·

|

a limited amount of news and analyst coverage for our company; and

|

|

|

·

|

a decreased ability to issue additional securities or obtain additional financing in the future.

|

If we fail to maintain

compliance with all applicable continued listing requirements for the Nasdaq Capital Market and Nasdaq determines to delist our

common stock, the delisting could adversely affect the market liquidity of our common stock, our ability to obtain financing to

repay debt and fund our operations.

If our common stock is delisted from

the Nasdaq and the price of our common stock declines below $5.00 per share, our common stock would come within the definition

of “penny stock”.

Transactions in securities

that are traded in the United States that are not traded on Nasdaq or on other securities exchange by companies, with net tangible

assets of $5,000,000 or less and a market price per share of less than $5.00, may be subject to the “penny stock”

rules. The market price of our common stock is currently more than $5.00 per share. If our common stock is delisted from the Nasdaq

and the price of our common stock declines below $5.00 per share and our net tangible assets remain $5,000,000 or less, our common

stock would come within the definition of “penny stock”.

Under these penny stock rules, broker-dealers

that recommend such securities to persons other than institutional accredited investors:

|

|

·

|

must make a special written suitability determination for the purchaser;

|

|

|

·

|

receive the purchaser’s written agreement to a transaction prior to sale;

|

|

|

·

|

provide the purchaser with risk disclosure documents which identify risks associated with investing in “penny stocks” and which describe the market for these “penny stocks” as well as a purchaser’s legal remedies; and

|

|

|

·

|

obtain a signed and dated acknowledgment from the purchaser demonstrating that the purchaser has actually received the required risk disclosure document before a transaction in a “penny stock” can be completed.

|

As a result of these requirements,

if our common stock is at such time subject to the “penny stock” rules, broker-dealers may find it difficult to effectuate

customer transactions and trading activity in these shares in the United States may be significantly limited. Accordingly, the

market price of the shares may be depressed, and investors may find it more difficult to sell the shares.

Our common stock may be affected

by limited trading volume and may fluctuate significantly.

Our common stock

is traded on the Nasdaq Capital Market. Although an active trading market has developed for our common stock, there can be no assurance

that an active trading market for our common stock will be sustained. Failure to maintain an active trading market for our common

stock may adversely affect our shareholders’ ability to sell our common stock in short time periods, or at all. Our common

stock has experienced, and may experience in the future, significant price and volume fluctuations, which could adversely affect

the market price of our common stock.

There is no public market for the warrants.

There is no established

public trading market for the warrants being offered in this offering and we do not expect a market to develop. In addition, we

do not intend to apply for listing of the warrants on any securities exchange or automated quotation system. Without an active

market, investors in this offering may be unable to readily sell the warrants.

The warrants may be dilutive to

holders of our common stock.

The ownership interest

of the existing holders of our common stock will be diluted to the extent the warrants offered in this offering or other outstanding

warrants are exercised. Prior to this offering, 147,637 shares of common stock are issuable upon the exercise of warrants outstanding

with a weighted average exercise price of $10.40 (aggregate amount of $1,535,425). The shares of our common stock underlying our

outstanding warrants represented approximately 0.69% of our common stock outstanding as of July 24, 2020.

Holders of warrants purchased in

this offering will have no rights as common stockholders until such holders exercise their warrants and acquire our common stock.

Until holders of

warrants acquire shares of our common stock upon exercise of the warrants, such holders will have no rights with respect to the

shares of our common stock underlying such warrants. Upon exercise of the warrants, the holders thereof will be entitled to exercise

the rights of common stockholders only as to matters for which the record date occurs after the exercise date.

SPECIAL NOTE REGARDING FORWARD-LOOKING

STATEMENTS

This prospectus supplement and our SEC

filings that are incorporated by reference into this prospectus supplement contain or incorporate by reference forward-looking

statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities

Exchange Act of 1934, as amended (the "Exchange Act"). All statements, other than statements of historical fact, included

or incorporated by reference in this prospectus supplement regarding our development of our strategy, future operations, future

financial position, projected costs, prospects, plans and objectives of management are forward-looking statements. Forward-looking

statements may include, but are not limited to, statements about:

|

|

•

|

|

any statements of the plans, strategies and objectives of management for future operations;

|

|

|

•

|

|

any statements concerning proposed new products, services or developments;

|

|

|

•

|

|

any statements regarding future economic conditions or performance;

|

|

|

•

|

|

our ability to protect our intellectual property and operate our business without infringing upon the intellectual property rights of others;

|

|

|

•

|

|

our estimates regarding the sufficiency of our cash resources and our need for additional funding;

|

|

|

•

|

|

our intended use of the net proceeds from the offerings of shares of common stock under this prospectus supplement;

|

|

|

•

|

|

any statement that our business, financial condition and results of operations may be materially adversely affected by global health epidemics, including the recent COVID-19; and

|

|

|

•

|

|

any statement regarding the effectiveness of our continuous temperature monitoring system to assist with the diagnosis and monitoring of symptoms of COVID-19 or the effectiveness of our continuous lactate monitoring system (CLM) to monitor disease progression in COVID -19 patients.

|

The words "believe,"

"anticipate," "design," "estimate," "plan," "predict," "seek," "expect,"

"intend," "may," "could," "should," "potential," "likely," "projects,"

"continue," "will," and "would" and similar expressions are intended to identify forward-looking

statements, although not all forward-looking statements contain these identifying words. Forward-looking statements reflect our

current views with respect to future events, are based on assumptions and are subject to risks and uncertainties. We cannot guarantee

that we actually will achieve the plans, intentions or expectations expressed in our forward-looking statements and you should

not place undue reliance on these statements. There are a number of important factors that could cause our actual results to differ

materially from those indicated or implied by forward-looking statements. These important factors include those discussed under

the heading "Risk Factors" contained or incorporated in this prospectus supplement and the accompanying prospectus and

any free writing prospectus we may authorize for use in connection with a specific offering. These factors and the other cautionary

statements made in this prospectus supplement and the accompanying prospectus should be read as being applicable to all related

forward-looking statements whenever they appear in this prospectus supplement and the accompanying prospectus. Except as required

by law, we do not assume any obligation to update any forward-looking statement. We disclaim any intention or obligation to update

or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

USE OF PROCEEDS

We estimate that the net

proceeds we will receive from this offering will be approximately $ million (or approximately $ million if

the underwriter exercises its option to purchase additional shares in full), in each case, after deducting the estimated underwriting

discount and estimated offering expenses payable by us.

We intend to use

the net proceeds from this offering for general corporate purposes, which include, but are not limited to, the commercial launch

of a subscription based service for the US under the Wellness category, Lactate monitor development for launch, glucose monitoring

product launch in Europe and the development of a second generation of sugarBeat.

We have not determined

the amount of net proceeds to be used specifically for such purposes and, as a result, management will retain broad discretion

over the allocation of net proceeds. The occurrence of unforeseen events or changed business conditions could result in the application

of the net proceeds from this offering in a manner other than as described in this prospectus supplement. Pending the use of any

net proceeds, we expect to invest the net proceeds in interest-bearing, marketable securities.

DILUTION

If you invest in

our securities in this offering, your interest in our common stock will be diluted immediately to the extent of the difference

between the combined public offering price per share and related Warrant and the as adjusted net tangible book value per share

of our common stock immediately after this offering.

The net tangible

book value of our common stock as of March 31, 2020, was approximately $(2,264,796) or approximately (0.11) per share. Net tangible

book value per share represents the amount of our total tangible assets, excluding goodwill and intangible assets, less total liabilities,

divided by the total number of shares of our common stock outstanding. Dilution per share to new investors represents the difference

between the combined offering price per share and related warrant paid by purchasers in this offering and the net tangible book

value per share of our common stock immediately following the completion of this offering.

After giving effect

to the sale of shares of

our common stock and Warrants to purchase shares

of common stock in this offering at the combined public offering price of $ per

share and related Warrant, assuming no exercise of the Warrants offered hereby, no value is attributed to such Warrants and such

Warrants are classified as and accounted for as equity, and after deducting the underwriting discount and estimated offering

expenses, our as-adjusted net tangible book value as of March 31, 2020 would have been approximately $ or

approximately $ per share. This represents an immediate

increase in net tangible book value of approximately $ per

share to our existing stockholders and an immediate dilution in as-adjusted net tangible book value of approximately $ per

share new investors participating in this offering, as illustrated by the following table:

|

|

|

|

|

|

|

|

|

Public offering price per share and related Warrant

|

|

|

|

|

$

|

|

|

|

Net tangible book

value per share as of March 31, 2020

|

|

$

|

(0.11)

|

|

|

|

|

|

|

Increase in net tangible book value per share attributable to this offering

|

|

|

|

|

|

$

|

|

|

|

As-adjusted net tangible book value per share as of March 31, 2020, after giving effect to this offering

|

|

|

|

|

|

$

|

|

|

|

Dilution per share to new investors participating in this offering

|

|

|

|

|

|

$

|

|

|

The table above is

based on 20,850,848 shares of common stock outstanding as of March 31, 2020, and excludes, as of March 31, 2020, the following:

|

|

●

|

|

147,637 shares of common stock issuable upon the exercise of warrants outstanding with a weighted average exercise price of $10.40 per share;

|

|

|

●

|

|

240,000 units, each consisting of one share of common stock, par value $0.001 per share, together with one warrant to purchase one share of common stock at an exercise price equal to $10.40, per share, in a public offering;

|

|

|

●

|

|

9,710 shares of common stock issuable upon the exercise of options outstanding with a weighted average exercise price of $13.00 per share; and

|

|

|

●

|

|

______ shares of common stock issuable upon the exercise of the Warrants offered hereby.

|

To the extent that

after March 31, 2020, any outstanding warrants were or are exercised, or we otherwise issued or issue additional shares of common

stock in the future at prices per share below the price per share for any shares sold in this offering, there will be further dilution

to new investors.

DESCRIPTION OF SECURITIES BEING OFFERED

Common Stock

The material terms and

provisions of our common stock are described under the caption “Description of Securities We May Offer” starting on

page 9 of the accompanying prospectus.

Warrants

The following summary of

certain terms and provisions of the Warrants is not complete and is subject to, and qualified in its entirety by, the provisions

of the Warrants. Prospective investors should carefully review the terms and provisions of the form of Warrant for a complete description

of the terms and conditions of the Warrants.

Duration and Exercise

Price

Each Warrant will have

an initial exercise price of $ per share. The Warrants are exercisable

immediately upon issuance and will expire on the fifth anniversary of the date they first become exercisable. The exercise price

and number of shares of common stock issuable upon exercise is subject to appropriate adjustment in the event of stock dividends,

stock splits, reorganizations or similar events affecting our common stock and the exercise price. The Warrants will be issued

separately from the common stock included in this offering. of a Warrant to purchase one share of our common stock will be sold

with each share of common stock purchased in this offering.

Cashless Exercise

If, at the time a holder

exercises its Warrants, a registration statement registering the issuance of the shares of common stock underlying the Warrants

under the Securities Act is not then effective or available for the issuance of such shares, then in lieu of making the cash payment

otherwise contemplated to be made to us upon such exercise in payment of the aggregate exercise price, the holder will be permitted

to receive upon such exercise (either in whole or in part) the net number of shares of common stock determined according to a formula

set forth in the Warrants.

Exercisability

The Warrants will be exercisable,

at the option of each holder, in whole or in part, by delivering to us a duly executed exercise notice accompanied by payment in

full for the number of shares of our common stock purchased upon such exercise (except in the case of a cashless exercise as discussed

above). A holder (together with its affiliates) may not exercise any portion of a Warrant to the extent that the holder would own

more than 4.99% of the outstanding common stock immediately after exercise, except that upon at least 61 days' prior notice from

the holder to us, the holder may increase the amount of ownership of outstanding stock after exercising the holder's Warrants up

to 9.99% of the number of shares of our common stock outstanding immediately after giving effect to the exercise, as such percentage

ownership is determined in accordance with the terms of the Warrants. Purchasers of Warrants in this offering may also elect prior

to the issuance of Warrants to have the initial exercise limitation set at 9.99% of our outstanding common stock.

Fractional Shares

No fractional shares of

common stock will be issued upon the exercise of the Warrants. Rather, the number of shares of common stock to be issued will be

rounded to the nearest whole number.

Transferability

Subject to applicable laws,

the warrants may be offered for sale, sold, transferred or assigned without our consent.

Exchange Listing

There is no established

public trading market for the Warrants being issued in this offering and we do not intend to list the Warrants on any securities

exchange or nationally recognized trading system. The common stock issuable upon exercise of the Warrants is currently listed on

the Nasdaq Capital Market.

Right as a Stockholder

Except as otherwise provided

in the Warrants or by virtue of such holder’s ownership of shares of our common stock, the holders of the Warrants do not

have the rights or privileges of holders of our common stock, including any voting rights, until they exercise their Warrants.

Fundamental Transaction

If

a fundamental transaction occurs, then the successor entity will succeed to, and be substituted for us, and may exercise every

right and power that we may exercise and will assume all of our obligations under the Warrants with the same effect as if such

successor entity had been named in the Warrant itself. If holders of our common stock are given a choice as to the securities,

cash or property to be received in a fundamental transaction, then the holder shall be given the same choice as to the consideration

it receives upon any exercise of the Warrant following such fundamental transaction. In addition, in certain circumstances, upon

a fundamental transaction, the holder will have the right to require us to repurchase its Warrant at its fair value using the Black

Scholes option pricing formula; provided, however, that, if the fundamental transaction is not within our control, including not

approved by our board of directors, then the holder shall only be entitled to receive the same type or form of consideration (and

in the same proportion), at the Black Scholes value of the unexercised portion of the Warrant, that is being offered and paid to

the holders of our common stock in connection with the fundamental transaction.

Rights

as a Stockholder

Except

as otherwise provided in the Warrants or by virtue of such holder’s ownership of our common stock, the holder of a Warrant

does not have the rights or privileges of a holder of our common stock, including any voting rights, until the holder exercises

the warrant.

Amendment

and Waiver

The

Warrants may be modified or amended or the provisions thereof waived with the written consent of our company and the holders of

at least a majority of the common stock issuable upon the exercise of the then-outstanding Warrants (determined without giving

effect to the exercise limitation provisions of the Warrants); provided such modification, amendment or waiver applies to all of

the then-outstanding warrants.

CAPITALIZATION

The following

table sets forth our audited consolidated capitalization as of March 31, 2020 and our capitalization as of March 31, 2020 on an

as-adjusted basis, based on a public offering price of $ per share of common stock

and accompanying Warrant (excluding any proceeds that may be received, and shares of common stock that may be issued, upon exercise

of the Warrants). You should read the following table in conjunction with “Use of Proceeds” in this prospectus supplement

and our consolidated financial statements and the notes thereto incorporated by reference in this prospectus supplement and the

accompanying prospectus.

|

|

|

As of March 31, 2020

|

|

|

|

|

Actual

|

|

|

As Adjusted (1)

|

|

|

|

|

(audited)

|

|

|

|

|

|

Cash

|

|